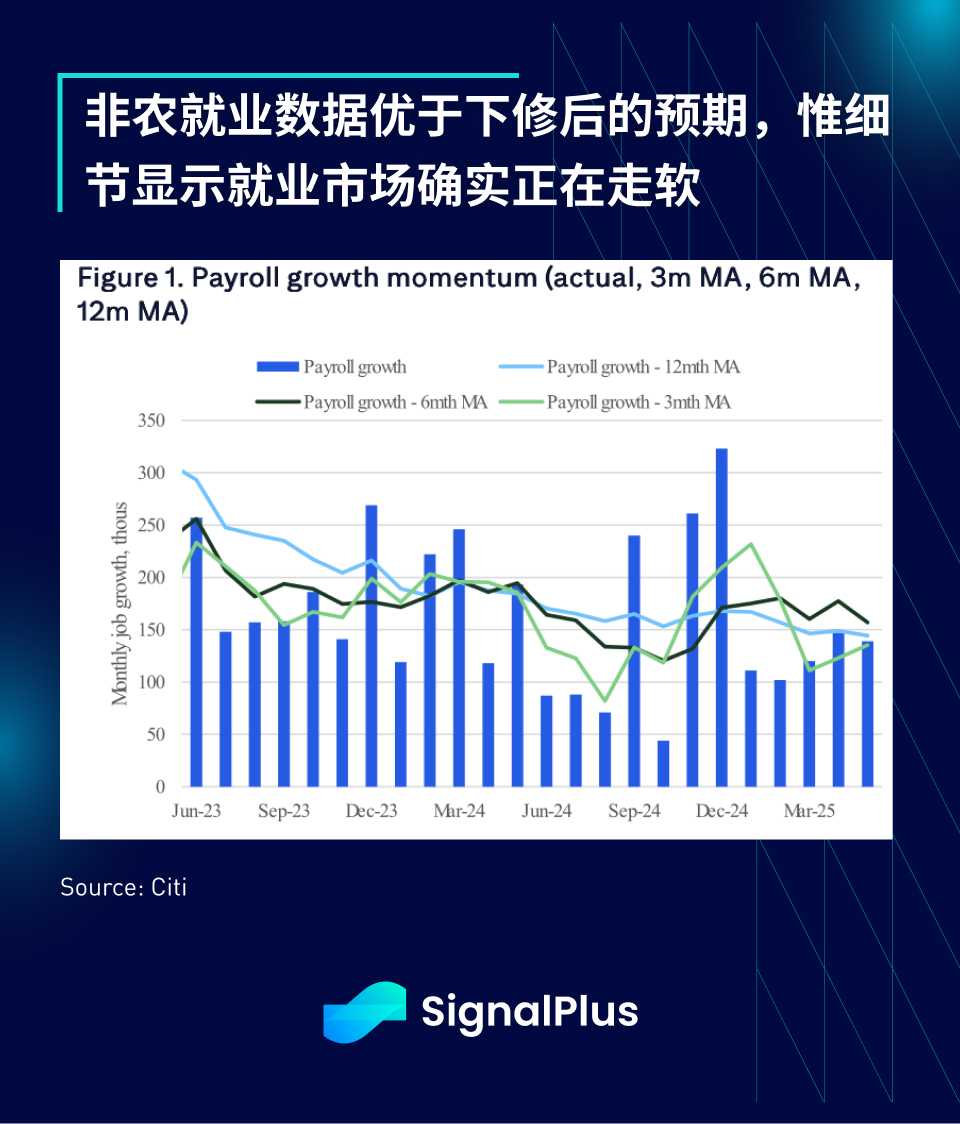

The May nonfarm payrolls report was solid, with 139,000 new jobs added, higher than Wall Street's expectations of 126,000, but the new jobs were mainly concentrated in the leisure and entertainment and healthcare sectors, while there were net losses in the government and manufacturing sectors. The details of the data were slightly weak, with the unemployment rate rising from 4.19% to 4.24%. If the labor force participation rate had not fallen, the unemployment rate would have been close to 4.6%.

Nonfarm payrolls outperformed recent jobless claims data, and stocks and Treasury yields rose in tandem, even as hard data finally began to converge with weak survey data. In addition, with geopolitical risks cooling since "Liberation Day" and tensions within the Trump camp, the market has once again entered "bad news = good news" mode, continuing to seek reasons for the Fed to cut interest rates further.

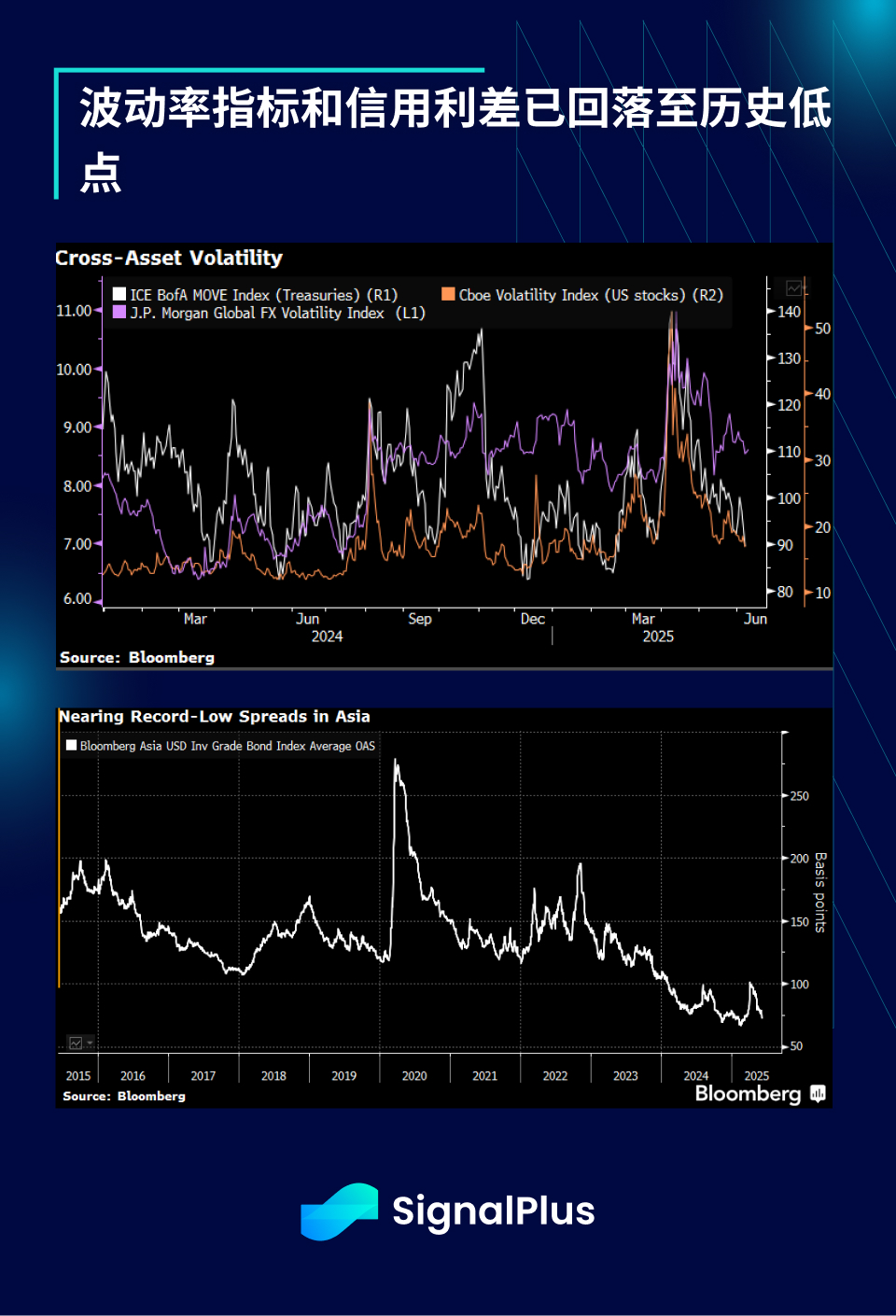

Although the passage of the "Big Beautiful Bill" still poses risks, market sentiment has rebounded to a high point, with both the volatility index and credit spreads falling to historic lows. The VIX plunge was one of the fastest in history, even exceeding that during the pandemic, and the main victim was the US dollar, which weakened significantly due to policy changes after the liberation.

Speaking of the dollar, we are entering a new correlation mechanism, where stock prices are beginning to move in a positive relationship with the dollar, which is extremely rare and the first sustained structural change since the pandemic. This reflects the market's focus on the potential implications of Trump's policy reversals on US assets, making the current price performance of US stocks more affected by international capital flows rather than expectations of Fed interest rate changes.

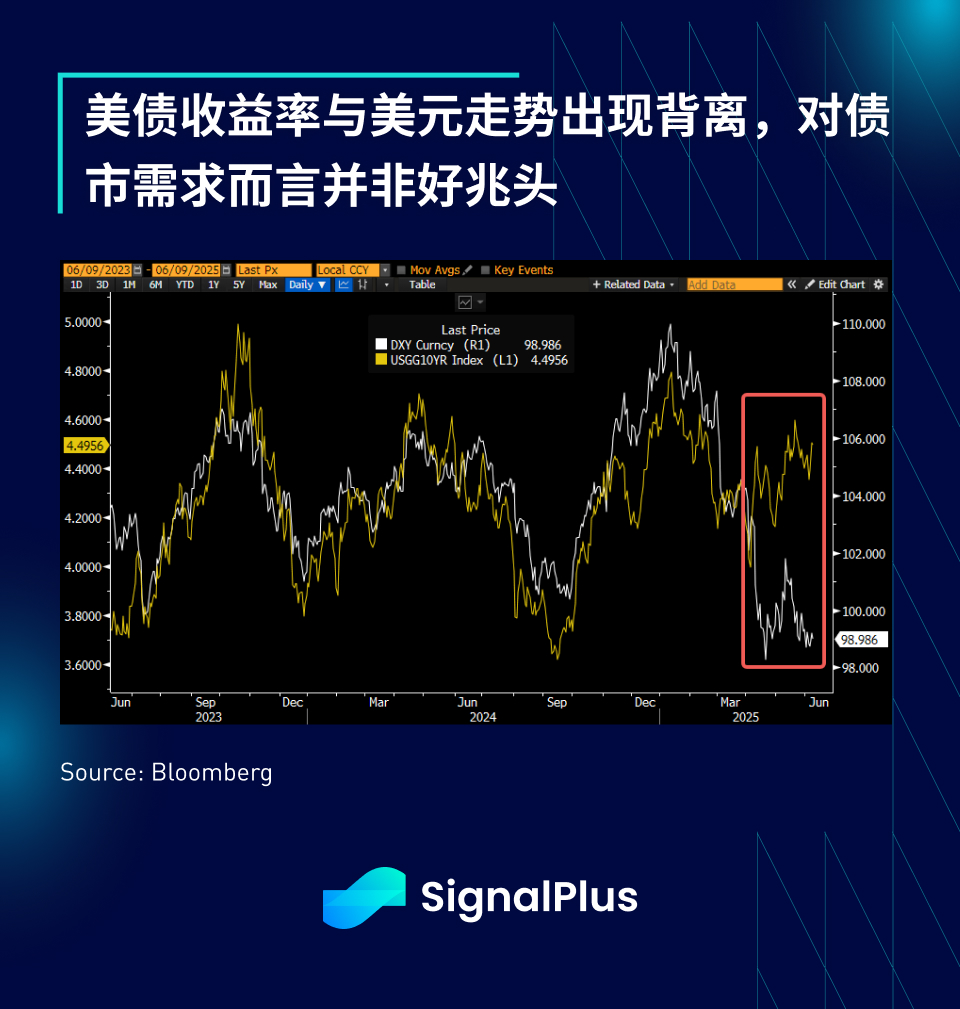

In the bond market, yields usually move in sync with the dollar in a non-crisis environment, but since Liberation Day, this correlation has been broken, with yields continuing to rise amid a weaker dollar, which has historically meant lower interest rates from the Federal Reserve in the future. This divergence may continue until there is more clarity on the budget spending bill and whether the Trump administration can reach a trade deal in the coming months.

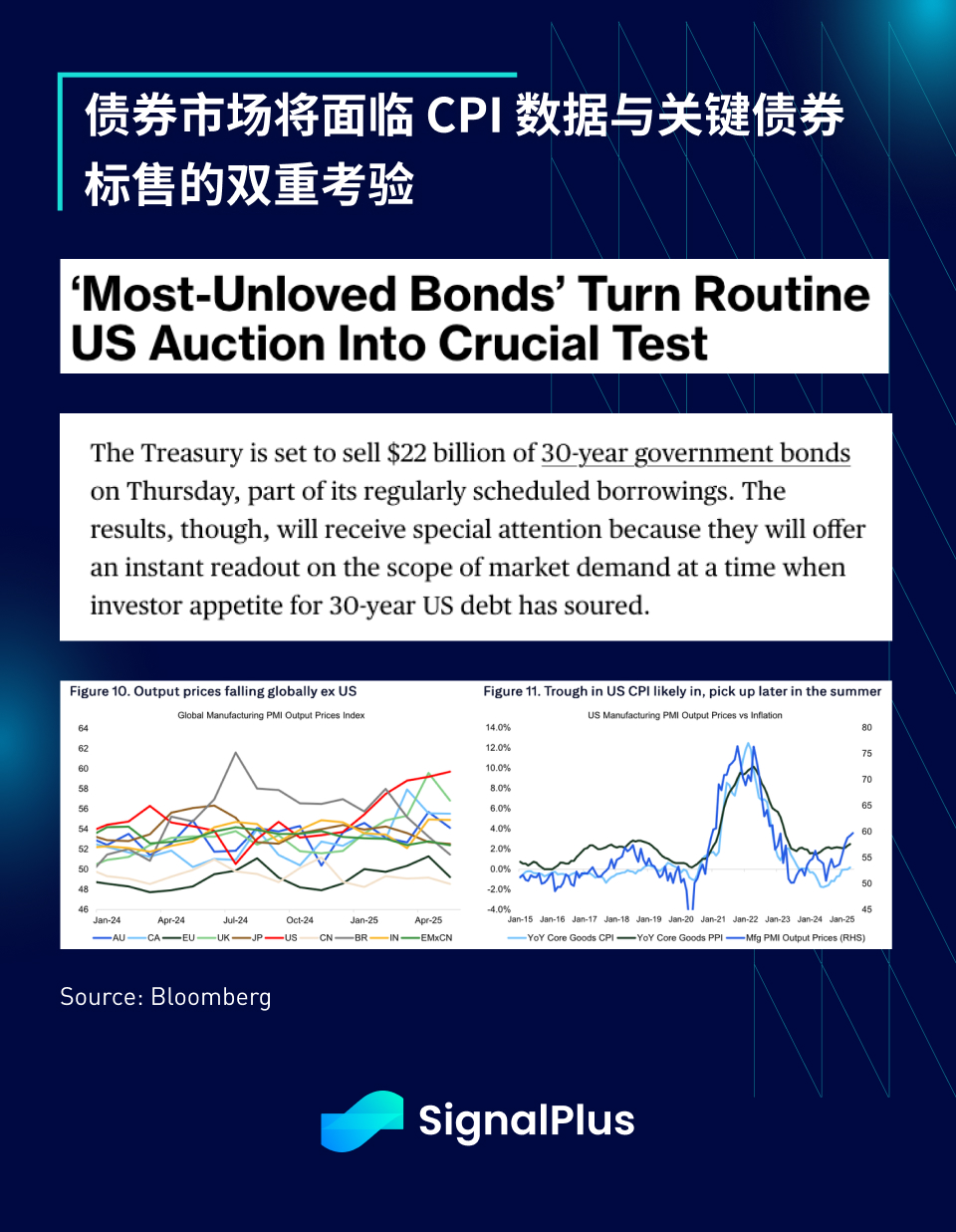

This week will be an important litmus test for market risk. Long-dated US Treasury auctions will be held midweek, along with the resumption of US-China trade talks after the recent escalation. Any progress in the trade talks is expected to focus on breakthroughs related to rare earth supply, while the bond market will have to deal with the upcoming CPI data and supply pressures of 10-year and 30-year bonds.

The market currently expects the core CPI to increase by 0.25% month-on-month, and the cost-push effect brought by tariffs may not be apparent until late summer, which also provides a basis for the Federal Reserve to resume interest rate cuts in the late third quarter and early fourth quarter of this year.

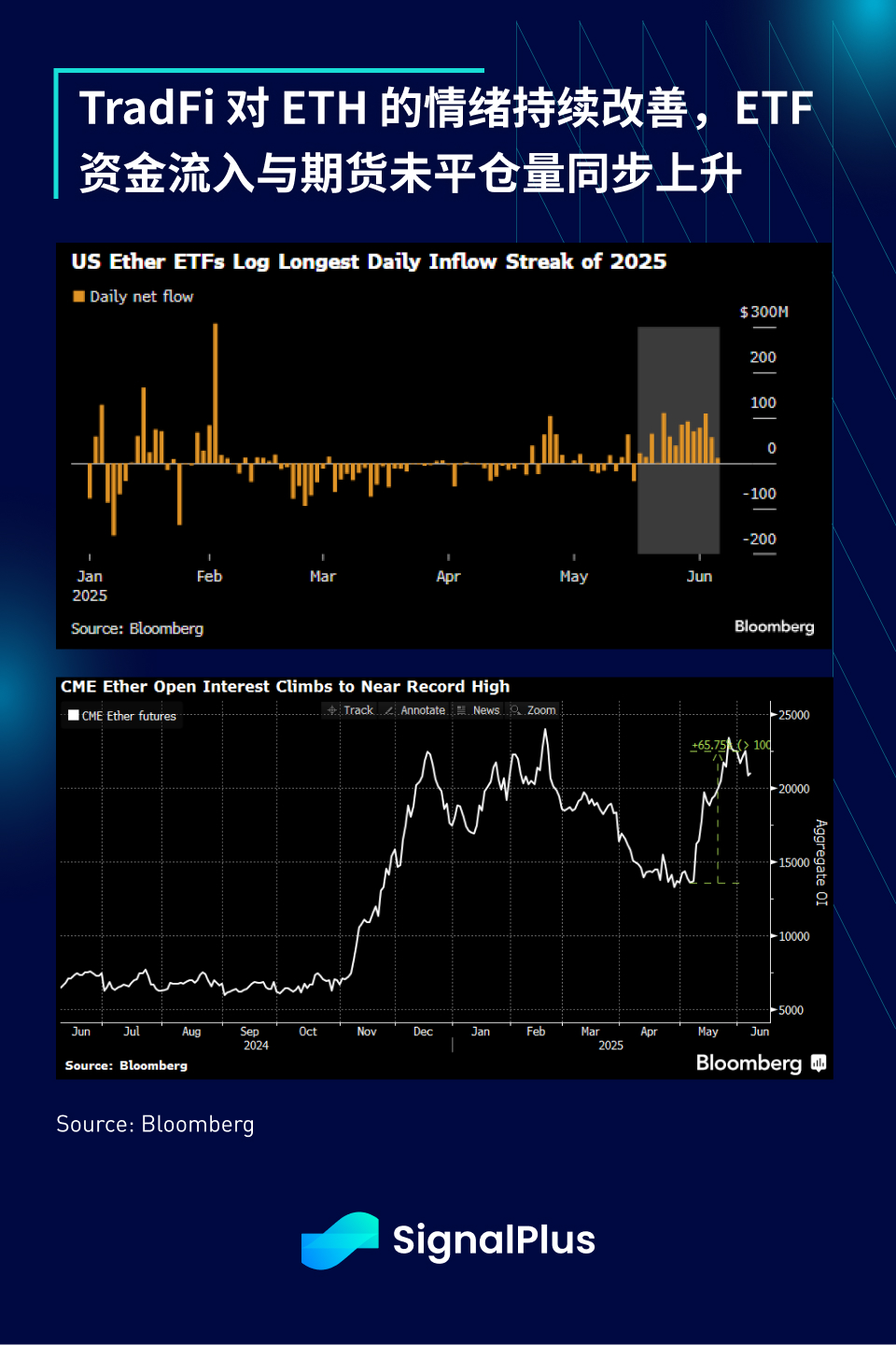

In terms of cryptocurrencies, the overall volatility last week was large. There were not many highlights in the blockchain native field. The main focus was on the traditional financial field, including Circle's IPO and the dynamics of the banking business. ETF fund flows were mixed in BTC, while ETH performed more positively, recording net inflows for 14 consecutive days, totaling more than US$800 million, while CME's ETH futures open interest also climbed to a record high.

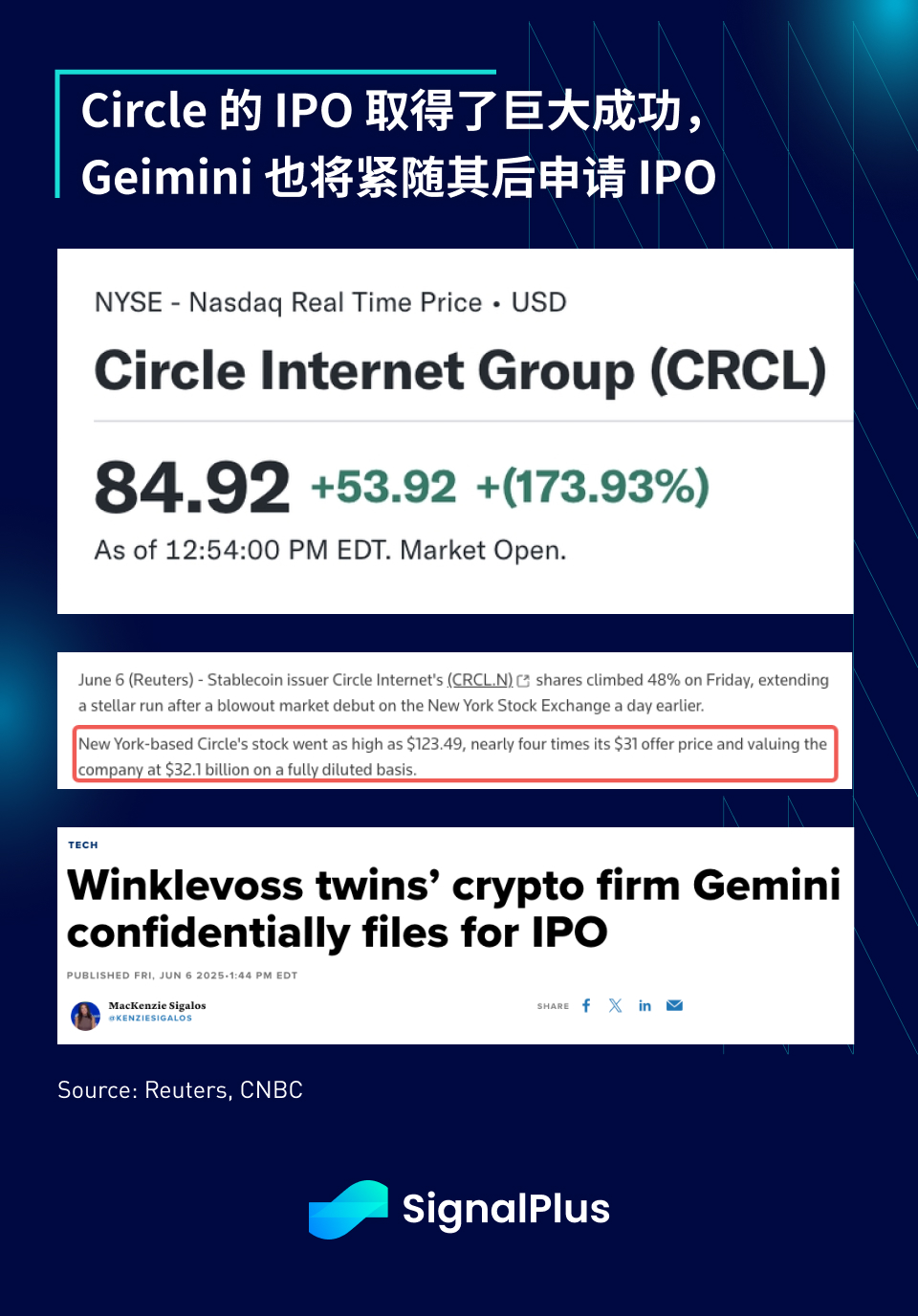

Circle's IPO was a huge success, with its share price soaring nearly 4 times after listing, and its market value reaching about $32 billion. Cryptocurrency banking business is also very active, with Robinhood completing its $200 million acquisition of Bitstamp and Gemini also applying for an IPO in the hot public market atmosphere.

It is worth noting that we do not think this constitutes a unilateral bullish reason for assets such as BTC or ETH, because ordinary investors now have more ways to access cryptocurrency assets, whether through ETFs, MSTR or other BTC proxy tools, and compliant exchanges and regulated stablecoin issuers are about to appear. As cryptocurrency assets gradually mature and become investable macro asset classes, the current cycle will only become more complex and diverse.

I wish you all smooth trading and good luck this week!

You can use the SignalPlus trading vane function for free at t.signalplus.com/crypto-news/all, which integrates market information through AI and makes market sentiment clear at a glance. If you want to receive our updates in real time, please follow our Twitter account @SignalPlusCN, or join our WeChat group (add the assistant WeChat, please delete the space between English and numbers: SignalPlus 666), Telegram group and Discord community to communicate and interact with more friends.

SignalPlus Official Website: https://www.signalplus.com