The United States last night (17 Aug 08: 30 pm UTC+ 8) announced the number of initial jobless claims for the week, recording 239,000, slightly lower than the expected 240,000, and the previous value was 248,000.Labor market remains tight. U.S. Treasuries also suffered a sixth consecutive day of selling, with the 30-year U.S. Treasury yield rising to nearly 4.40%, surpassing the panic highs of 2022 and approaching 2010/11 levels. In the current market environment, next Thursday (25 Aug 10:00 pm UTC+8) Federal Reserve Chairman Powell willJackson Hole Global Central Bank ConferenceThe speech on the Internet will attract more attention, and it may be expected to bring some guidance for the next monetary policy and measures.

Source: SignalPlus, important financial events next week

In the early hours of this morning, digital currencies plummeted. BTC fell by US$1,700 (-8%) in the short term. The intraday decline once expanded to 14.5%, with the lowest falling to 24,600 (Binance-BTC-USDT-Perp).Erases Most of Gains Realized After BlackRock Filed for Bitcoin Spot ETF on June 15. In fact, there has been no news that can arouse bullish sentiment in cryptocurrency recently, and the rise in U.S. interest rates and the rise in risk aversion have invisibly pushed investors to transfer risky assets. This may be why digital currency prices are prone to weakening in the near future. One of the main reasons, coupled with the stable trend in the past month, has resulted in the accumulation of positions on major support lines. These positions have intensified the short-term mutual trampling during the market decline and were liquidated, resulting in temporary losses. overreaction. Regarding todays slump, sources said,SpaceX has reduced its $373 million BTC position this year, although it is not clear when it will be sold, this news undoubtedly adds to the pessimistic environment for the market.

Source: Binance Tradingview, BTC broke several support points in a row and only rebounded near the high point before the first quarter of 2023

This round of decline triggered large-scale liquidation of positions on various exchanges. According to data from CoinGlass, as the price fell, 855.215 M worth of contracts were liquidated in the past day on BTC alone.

Source: Coinglass

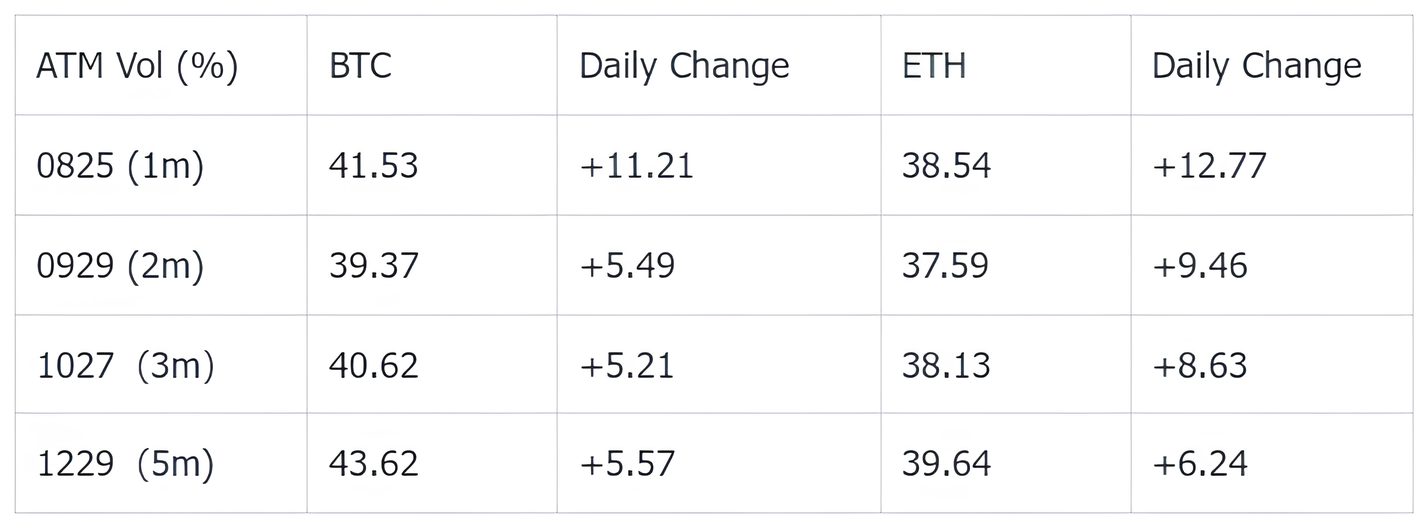

Affected by the plunge, the implied volatility of options rose rapidly in the early morning, and the ATM IV of BTC/ETH once exceeded 50% at the end of the month. After the price rebounded and gradually stabilized around BTC 26500/ETH 1680, the market began to become more rational and liquidity gradually returned, giving back about half of the IV increase, but the current IV is still at a recent high.

Source: Deribit (as of 18 Aug 16:00 UTC+ 8)

Source: SignalPlus, IV surge

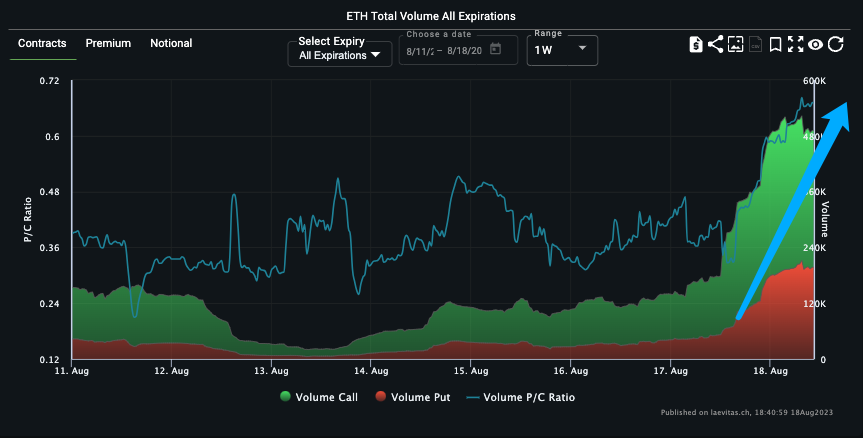

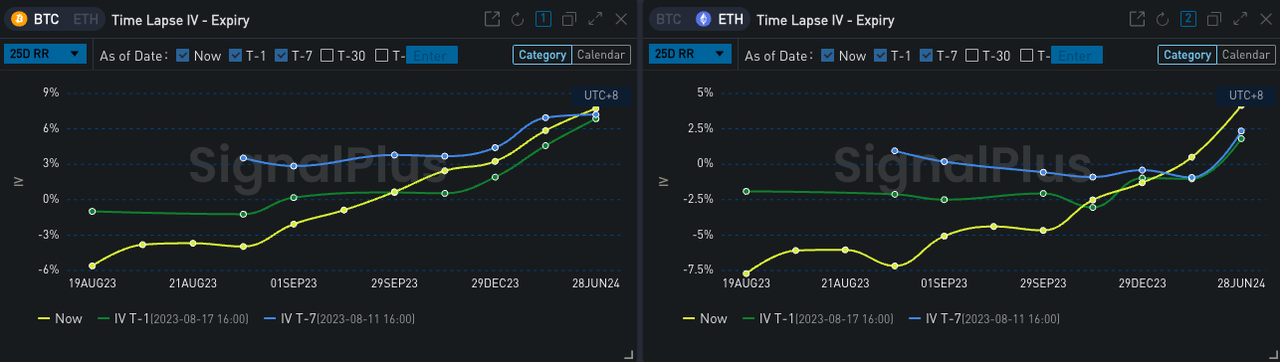

As digital currency prices continue to weaken, the P/C Ratio of ETH transactions in the past 24 H has risen to a high of 0.67. There has been an obvious reduction in positions/opening of short call options in the Deribit retail market, and the purchase of short-term Put as a protective transaction. The trend has caused significant declines in BTC/ETH IV Skew.

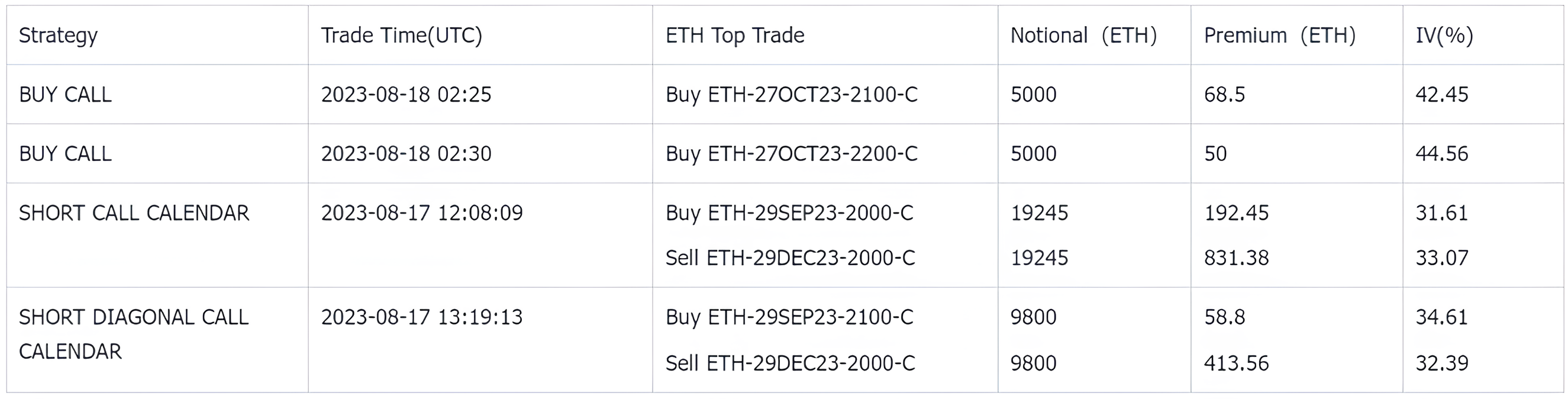

In terms of bulk trading, the drop in prices has reduced the cost for traders to place forward calls. About 2,600 reverse calendar spread strategies have appeared on BTC, including buying 29 SEP 23-33000-C and selling 29 DEC 23-33000- C, betting on the subsequent development of the BTC ETF application results; on ETH, there are similar transactions of buying 29 SEP 23-2000-C and selling 29 DEC 23-2000-C (nearly 40,000 ETH), in addition to ten There were also two large purchases of Outright Call at the end of the month, namely 5,000 contracts of 2100-C and another 5,000 contracts of 2200-C.

Source: Laevitas,ETH P/C Ratio hits weekly high

Source: SignalPlus,BTC/ETH 25 dRR down

Source: Deribit Block Trade

Source: Deribit Block Trade

You can search for SignalPlus in the Plugin Store of ChatGPT 4.0 to get real-time encryption information. If you want to receive our updates immediately, please follow our Twitter account @SignalPlus_Web 3, or join our WeChat group (add assistant WeChat: chillywzq), Telegram group and Discord community to communicate and interact with more friends.

SignalPlus Official Website:https://www.signalplus.com