El Salvador, as the first country to truly legalize Bitcoin, this blockbuster exploded on the heads of its fans, which made them very excited.

According to the news on June 9, El Salvador’s Congress voted to approve the proposal submitted by the President to use Bitcoin as a legal tender. El Salvador became the first country in the world to recognize Bitcoin as a legal currency.

"Bitcoin is a 'super asset' that many capitals or institutions compete with each other. Now we need to add a 'small country', and in the future we will add a 'big country'." Jiang Zhuoer, the founder of Leibit Mining Pool, commented on his Weibo The news expressed excitement.

In fact, recently, under the influence of high-pressure supervision, the crazy fire of "altcoins" has been extinguished, and the systemic risks of the encryption market have been released. Right now, investor confidence is weak, and Bitcoin has once again become the focus of the currency circle.

Under the favorable blessing of Bitcoin, on June 9, the strong rise of Bitcoin also rekindled hope for the bulls.

"We all speak the same language, that is Bitcoin." On June 11, as one of the world's most influential technology entrepreneurs, Twitter CEO Jack Dorsey (Jack Dorsey) on his personal Twitter Say so.

secondary title

The first country to recognize Bitcoin as "legal" was born

Since mid-May, a sudden regulatory storm is sweeping through the entire encryption industry. Right now, the limelight is in full swing, and everyone is in danger. Clinker, El Salvador opens a window for Bitcoin.

Statistics show that El Salvador is a coastal country located in northern Central America, with a land area of 20,720 square kilometers and a total population of 6.705 million in 2019.

On June 9, El Salvador's Congress finally voted to approve the president's proposal to use Bitcoin as a legal tender, and finally won 62 out of 84 votes. This means that El Salvador has become the first country in the world to recognize Bitcoin as a legal currency.

After El Salvador passed a law accepting Bitcoin as legal tender, it was a major event in currency history, Agence France-Presse tweeted and illustrated. El Salvador's President Nayib Bukele retweeted the tweet and commented that El Salvador became one of the 14 most important events in the 12,000-year "monetary history".

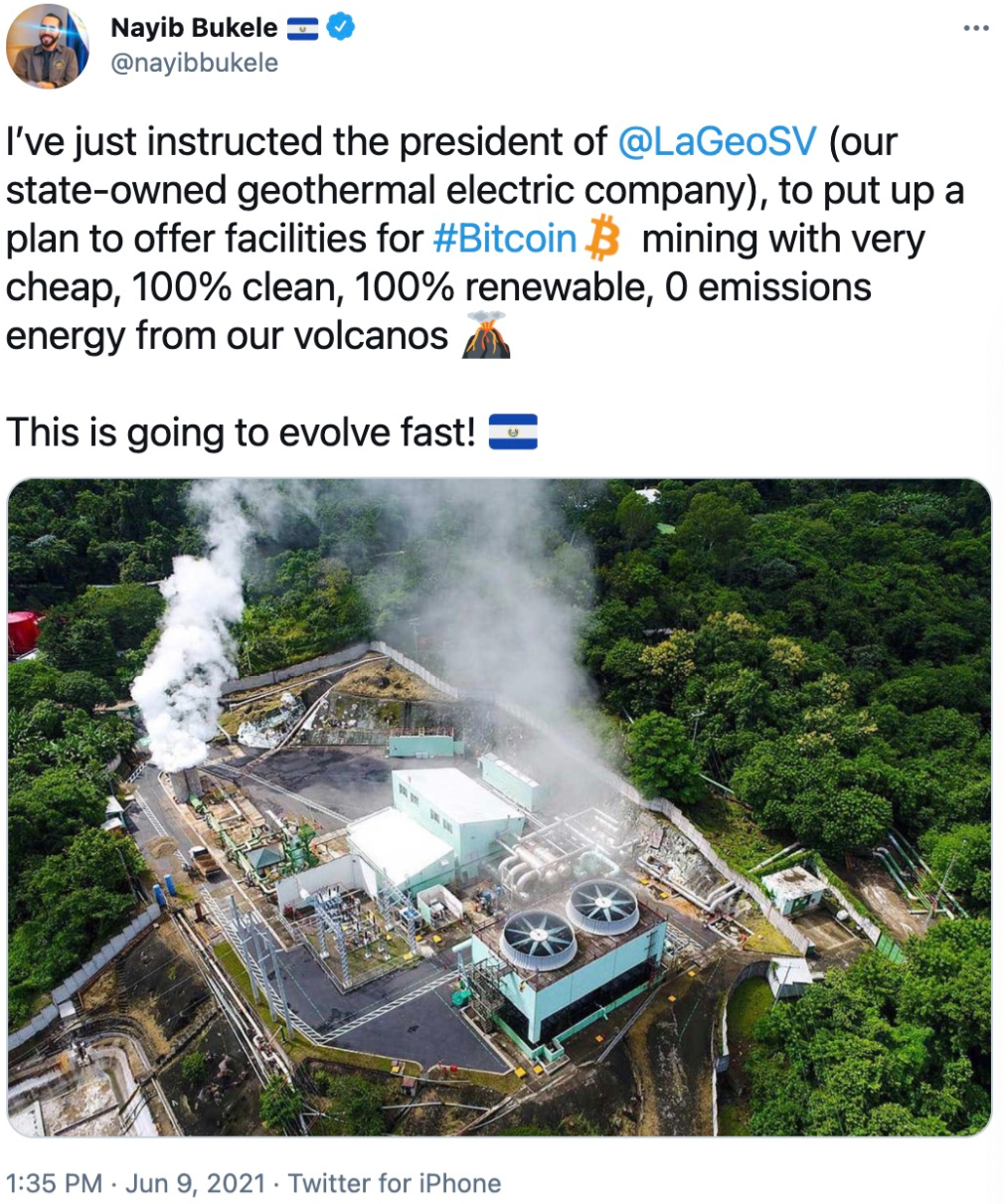

At the same time, President Nayib Bukele of El Salvador also tweeted that I just instructed the president of LaGeoSV (state-owned geothermal power company) to develop a plan to provide very cheap, 100% clean, 100% renewable, Energy from volcanoes with zero emissions.

F2Pool co-founder Shenyu commented on the use of clean volcanic energy for Bitcoin mining in El Salvador. He said that when he investigated hydropower from 2014 to 2015, he learned that the cost of geothermal power generation is extremely low and the degree of stability is high. The main cost is to dig geothermal wells. Cost, volcanic areas are especially suitable.

"Today is a historic day." Jiang Zhuoer said, don't think that El Salvador is just a small country, and a small country is also a complete sovereign country. Compared with the same period last year, the Cayman Islands had only 60,000 people, but the number of companies registered in the Cayman Islands exceeded 100,000, including more than 700 banks, more than 800 insurance companies and nearly 10,000 hedge fund institutions. Among them, there are many subsidiaries of large multinational companies such as Coca-Cola, Procter & Gamble, Intel, and Oracle, as well as various large Chinese companies such as Tencent, Baidu, Alibaba, Sina.com, New Oriental, Evergrande Real Estate, Country Garden, and Mengniu.

secondary title

After El Salvador is there anyone else?

Being used as a legal tender by sovereign countries, this application experiment has undoubtedly played a positive role in the current Bitcoin.

On June 11, the Securities Times published the article "Bitcoin's Perfect Controlled Experiment". The article stated that the full legalization of Bitcoin in El Salvador is a perfectly controlled experiment. El Salvador does not have its own currency, and both the U.S. dollar and Bitcoin are foreign objects, so there is no ideological obstacle for the two to "compete on the same stage".

Cryptocurrency analyst Lark Davis tweeted that 70% of El Salvador's population is unbanked, but mobile phone penetration is 146%, and they rely on the U.S. dollar instead of their own currency. This means it is a country well suited for the rapid adoption of Bitcoin.

And how to measure the success or failure of this experiment is whether it can replace the dollar. The Securities Times article believes that because of transaction costs, most of the payment currency functions of a country will eventually be borne by one currency, and it is impossible for two currencies to coexist for a long time. El Salvador has given almost the same authority to Bitcoin and the U.S. dollar, and the "exchange rate" between the two is completely free to float. At the same time, neither of them is subject to El Salvador's intervention, so the competition is quite fair. If Bitcoin's stability (anti-inflation properties), anonymity and security are better than traditional currencies as its believers say, there is no reason for Bitcoin not to replace the US dollar.

From this point of view, the world has been suffering for a long time, and there may be many follow-up imitators.

"I am optimistic that Panama will become the next country to support Bitcoin." Jiang Zhuoer said that because the United States has released too much water this time, the Federal Reserve directly doubled the issuance of US dollars. A sum of seigniorage was severely collected. There were also media reports that Panamanian Congressman Gabriel Silva also said he was working on a proposal to bring bitcoin and other cryptocurrencies into the country’s legal tender.

Additionally, Lord Fusitua, a member of Tonga’s House of Representatives, said that he and the Jackmallers want to use the country’s $750 million in reserves to buy bitcoin, or 37% of its GDP.

secondary title

The curtain of supervision is gradually opened

At present, Bitcoin is favored by some small countries, but several major countries in the world still regard it as "heterogeneous" and pursue and intercept Bitcoin. Among them, China's regulatory measures have been implemented one after another, which has attracted widespread attention from people in the global encryption industry.

On May 18, the three associations jointly issued the "Announcement on Preventing Hype Risks in Virtual Currency Transactions", prohibiting financial institutions affiliated to the three associations from conducting virtual currency-related businesses; on May 21, the 51st Financial Stability Development Committee of the State Council The meeting called for "combating bitcoin mining and trading." Since then, the tone has been set for the regulation of the crypto industry at the national level.

Over the past few days, various regions have followed up and implemented supervision, and the rectification of the currency circle and the mining circle has gradually begun.

On May 25th, the Inner Mongolia Development and Reform Commission organized the drafting of the "Inner Mongolia Autonomous Region Development and Reform Commission's Eight Measures on Resolutely Combating and Punishing Virtual Currency "Mining" Behaviors (Draft for Comment)". After entering June, many places have also begun to rectify Bitcoin mining.

On June 9, the Development and Reform Commission of Changji Hui Autonomous Prefecture in Xinjiang issued a notice on immediately suspending production and rectification of virtual currency mining companies, requiring the Xinjiang Zhundong Development Zone Management Committee to immediately order companies engaged in virtual currency mining to Before 14:00 on June 9, all production will be suspended for rectification, and the relevant situation of production suspension and rectification will be reported to the National Development and Reform Commission. On the same day, the Qinghai Provincial Department of Industry and Information Technology issued a notice on the complete shutdown of virtual currency "mining" projects, requiring all regions to clean up and rectify related virtual currency "mining" activities.

In addition, a person from the Yunnan Provincial Energy Bureau confirmed to the reporter of the "Blockchain Daily" that according to the requirements of the notice, it organized various electricity departments to carry out joint inspections in a timely manner, and completed the clean-up and rectification of electricity use by Bitcoin mining companies by the end of June this year.

At the same time, exchanges have also become key regulatory targets. In this context, some small exchanges announced their closure, and most exchanges suspended or restricted some trading services for users in mainland China, and reduced trading business and products to a certain extent.

On June 5, the Weibo accounts of several big Vs in the currency circle were banned. The relevant pages show that the accounts have been complained of violating laws and regulations and the relevant provisions of the "Weibo Community Convention", and are now unable to view.

On June 9, according to media reports, when searching for keywords such as "Binance", "OKEx", and "Huobi" on Weibo and Baidu, no results were displayed. The Weibo page also shows that "according to relevant laws, regulations and policies, the search results are not displayed". After verification, Weibo and Baidu blocked the above keywords.

On June 8, the Securities Daily published an article stating that under strong supervision, encrypted digital currency transactions and mining activities have been further regulated and rectified. Many experts in the industry believe that the heavy regulatory measures that followed in May will not only allow investors to fully understand the nature and risks of encrypted digital currencies such as Bitcoin, but also prevent investors from blindly participating in any form of transactions. Speculation activities, thus better maintaining the stability of the financial order.