Editor's Note: This article comes fromBlockVC(ID:blockvcfund), reprinted by Odaily with authorization.

foreword

Editor's Note: This article comes from

, reprinted by Odaily with authorization.

At the end of 2017, two American exchange giants, CME and CBOE, launched cash-settled (Cash Settled) Bitcoin futures, and the traditional financial market had digital currency derivatives that could be traded publicly for the first time.

first level title

What are options?

Options Product Introduction

secondary title

What are options?

When the option buyer pays the premium (Premium), he has the right to buy or sell a certain amount of underlying objects from the option seller at the strike price (Strike Price) within a specific time or at a specific time. This right is called options.

If this right is to buy the subject matter, it is called a call option (Call Option), referred to as the right to buy; if this right is to sell the subject matter, it is called a put option (Put Option), referred to as the right to sell. Like the futures contract, the option contract also has an expiration date. If the buyer can only choose to exercise the right on the expiration date, the option is called a European option (European Option); if the buyer chooses to exercise the right on the expiration date or any day before If the right can be exercised, the option is called an American Option.

Regardless of whether it is a call option or a put option, their buyers obtain the right to buy and sell at a fixed price by paying a certain premium at one time. The biggest difference from futures contracts is that option buyers do not Obligations only enjoy rights, while option sellers have only obligations but no rights. When you become short or long of a futures contract, you assume the rights and obligations at the same time, that is, you can complete the delivery at the opening price, but you must also complete the delivery at the opening price, so the price curve of the futures contract and the spot is related. It is very high, almost 1, and the price difference withdrawal is a financing time cost. But the option buyer has no obligation, that is, when the price moves in the opposite direction to the expectation, the buyer can choose not to execute the contract, and only loses the option premium spent on buying the option, while the option seller’s all gain is the premium for selling the option , when the buyer exercises the option, he needs to unconditionally fulfill his contractual obligations.

secondary title

History of option development"The embryonic form of modern options appeared in the tulip bubble period in Holland in the 17th century."Due to the limited supply of tulip bulbs, pure spot trading can no longer meet the fanatical speculative demand, so options with high leverage characteristics were born at this time, which magnified the efficiency of capital utilization in the market and derived many transactions that could not have occurred. At the peak of the tulip bubble, the tulip market in the Netherlands had grown to the point where there were no physical transactions because the growth rate of tulip bulbs could not keep up with the demand of the market. At this time, a fully cash-settled contract appears, and the buyer and seller only settle the difference between the spot price and the contract performance price at maturity. When the tulip bubble ended, the price plummeted, and the put buyers (put buyers) demanded to perform their contracts one after another to settle the profits from the plummeting tulip bulbs. However, the put sellers (put sellers) had limited funds and were unable to perform the contracts, and they were actually technically bankrupt. The market crashes.

The option contract in the modern financial market originated from the over-the-counter option market created by Russell Sage in Chicago in 1872, but the option market did not gradually become active until the Chicago Board of Trade (CBOT) launched the overnight option product. 1932 CBOT takes place

, leading to the prohibition of all commodity-related on-exchange and over-the-counter option transactions in the United States in the Commodity Exchange Act of 1936, and the pace of option development slowed down again.

In 1973, under the organization of the Chicago Board of Trade (CBOT), the Chicago Board Options Exchange (CBOE) was established. This marks that options trading has officially entered a stage of comprehensive development of unification, standardization, and normalization. In order to avoid repeating the mistakes of the tulip bubble, the Chicago Board Options Exchange added an independent third-party clearing agency, the Option Clearing Corporation (OCC), which greatly reduces the performance risk of option buyers.

image description

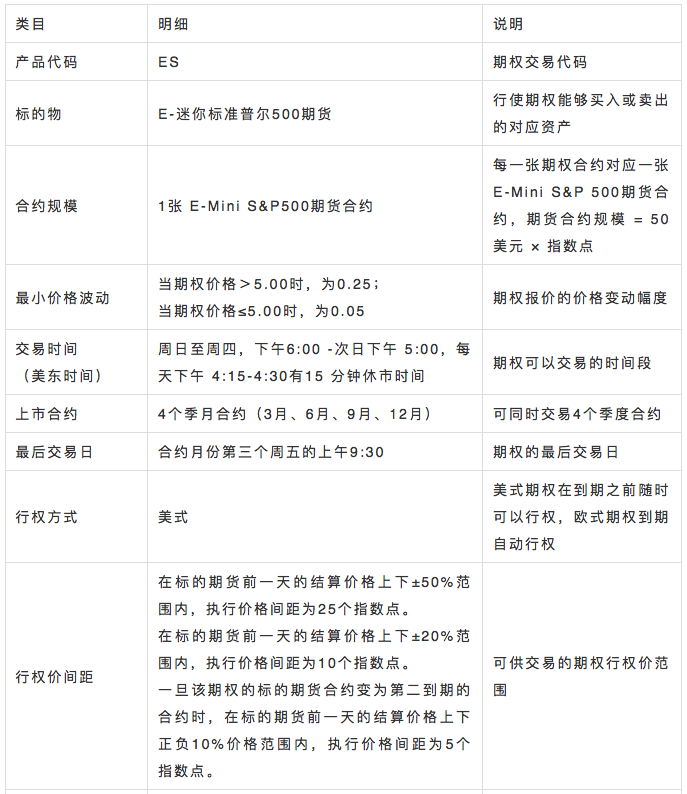

Judging from the proportion of the trading volume of major global option varieties, the head effect of the distribution of option trading volume is more obvious. In 2018, the trading volume of the top four options accounted for 28% of the total global option trading volume. Among them, the largest single option trading volume in the world is the Bank Nifty index option of NSE in India, with a trading volume of 1.587 billion contracts, accounting for 12%. Followed by CME's E-Mini S&P 500 futures and options, the trading volume was 835 million contracts, accounting for 6%.

image description

secondary title

Elements of an Options Contract

secondary title

The options market is a market dominated by institutions. Taking the US options market as an example, the main participants are: exchanges, options clearing company (OCC), options market maker E-Shang, institutional investors, individual investors and market regulators. Institutional investors (including market makers) dominate, accounting for about 57% of the market, and individual investors account for 43%. Among them, the largest trading volume is the market maker, accounting for 46%, and the market maker provides good liquidity for the entire market. In terms of classification, in the stock index option market, there are relatively more institutional investors, accounting for 20%; while in the individual stock option market, the proportion of human investors has increased relatively, accounting for 44%.

image description

first level title

Digital Currency Options

secondary title

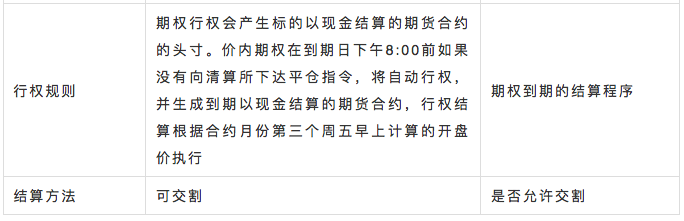

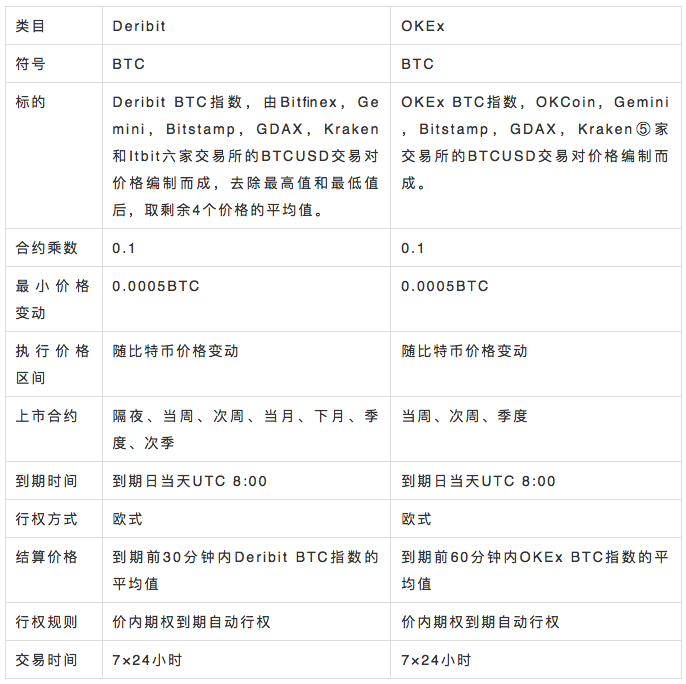

The earliest exchange to launch digital currency options was Deribit. This derivatives exchange in the Netherlands was founded by professional investment bank traders in 2016. It was not until four years later in 2020 that OKEx, the leading player in digital currency derivatives, launched With reference to the options trading products of competitors, it has become the two largest digital currency options exchanges in the market.

image description

secondary title

contract rules

image description

Data source: OKEx official website, Deribit official website

secondary title

image description

transaction rate

Source: OKEx official website, Deribit official website

secondary title

The calculation of the transaction fee rate of options is based on the percentage of the face value of the underlying object of the option contract, and the proportion of the premium to the face value is usually very small, so the ratio of handling fee: premium is often very large.

The option commission rate of OKEx is similar to other derivatives on the platform, and supports tiered commissions.

image description

secondary title

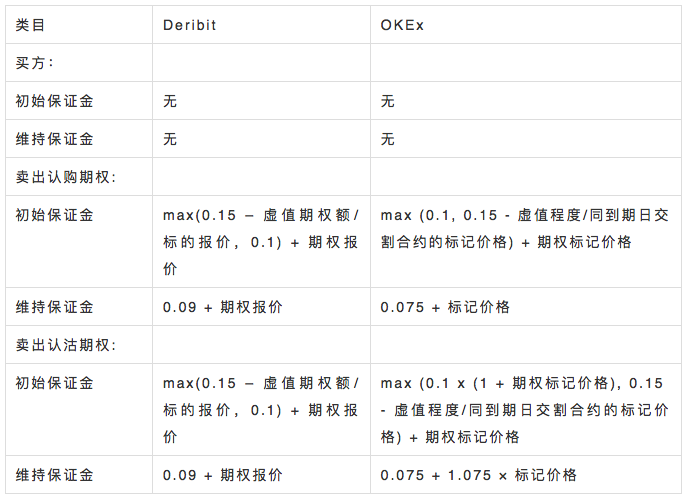

Bakkt, a digital currency exchange with Intercontinental Exchange ICE as its major shareholder, is the first fiat currency exchange in the world to launch publicly traded Bitcoin option products, followed by CME, which also released its options trading products. Although CME’s option products were released later, But currently, it is far ahead of its competitor Bakkt in terms of volume and open interest.

image description

secondary title

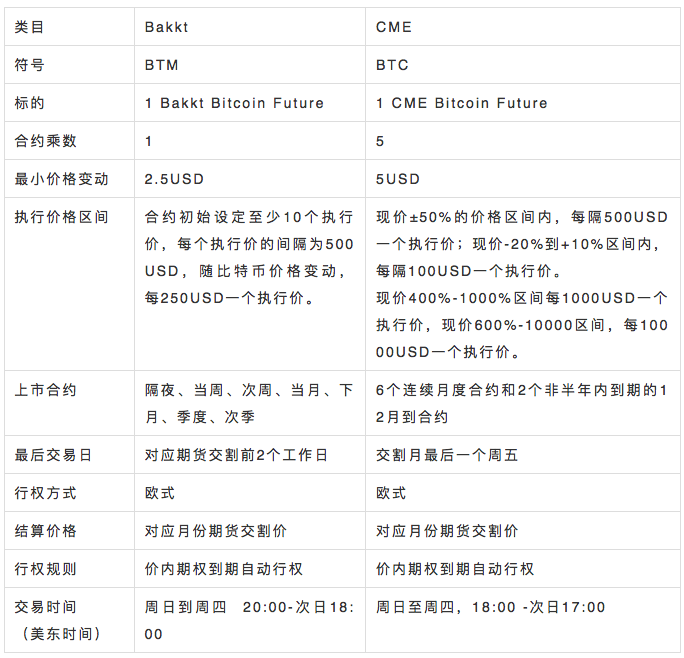

Both Bakkt and CME released USD-denominated Bitcoin option products, and the contract rules are similar to traditional commodity futures products.

image description

Data source: ICE official website, CME official website

Risk Control Rules & Transaction Rates

first level title

option pricing

Options Trading Strategies

option pricing

At present, the most influential option pricing model in the industry is the Black-Scholes model (referred to as BS model) proposed by Black and Scholes. They summarized several factors that affect option prices and constructed a stochastic differential equation to calculate the theoretical price of options. The following is a simple example based on the BS model calculated by the theoretical value of European options

image description

BS Model of Calculating Theoretical Value of European Call Option

image description

BS Model for Calculating Theoretical Value of European Put Option

Refers to the probability distribution function in the standard normal distribution

is the remaining expiration time of the option from the exercise date

is the spot price of the option underlying

is the strike price of the option

is the risk-free lending rate for cash lending

is the annualized volatility of the option underlying price

In actual operation, the main factors that will have a greater impact on option prices are

2) The difference between the current price and the exercise price;

3) The remaining expiration time of the option;

secondary title

buyer strategy

As a pure buyer of options, the main strategy is to predict the price fluctuation direction of the underlying object, so as to obtain the income from the price difference between the current price and the strike price. When the remaining expiration time of the option is very short, the option The premium is very low, and the leverage denominated in nominal value may be as high as tens or even hundreds of times. When the market fluctuates violently, it is easy to generate several times the income in a short period of time. The following figure is an example

Data source: OptionCreator

This is a Bitcoin European call option maturity return chart with a remaining expiration time of 1 day. The current price and strike price are both 10300, and the volatility σ=50%. The theoretical option premium is about 107 ≈ 0.0104 BTC. If When the Bitcoin price expires one day later, the price of Bitcoin will rise by 10%, and the value of the option will reach 921≈0.0818 BTC. The standard income of fiat currency is about 750%, and the income of BTC standard is about 690%. The high leverage of options can well amplify the income of short-term transactions. At the same time, the premium of short-term options is very low. Even if there is an extreme market that exceeds expectations, only a limited amount of principal will be lost.

secondary title

seller strategy

The seller of the option bears all the risk of the price change of the underlying object, and the income obtained is the limited premium paid by the option buyer. This behavior is similar to that of an insurance company in the real world, which collects limited premiums and pays high compensation. Therefore, under normal circumstances, the option seller's strategy is mainly an option market maker and selling long-term put options.

options market maker

Option market makers conduct market-making transactions by providing bilateral quotations of multiple option contracts. The main source of income comes from market-making spread income, liquidity rebates from exchanges, and the time value of selling options.

At present, market maker strategies are mainly divided into inventory model and information model. The mainstream strategy is to predict the very short-term market trend through the analysis of the market microstructure, and then calculate the optimal quotation strategy based on the current position risk of the market maker and under the constraints of the market-making obligation.

image description

Inventory Model Adjustments to Bid and Bid Quotes

The information model was proposed by Bagehot in 1971. He believed that information cost, that is, the cost of information asymmetry, is the cost paid by uninformed traders to informed traders, and is the main reason for the formation of price differences. At present, the mainstream strategy of major market-making institutions is to predict the short-term market trend through the study of market microstructure, especially the study of order books and volatility.

Traditional information theory believes that informed traders often trade through market orders, so the order book composed of limit orders does not have additional information. With the disclosure of transaction information and electronic transactions promoted by major transactions, more and more investors use limit orders. At the same time, large passive investment managers, including ETFs, also use order books to estimate shock costs. Therefore, it is generally believed in the market that the microstructure of the order book can predict short-term price movements.

Most of the long-term stable profitable market maker systems are multi-strategy, or dynamically adjust the parameters of the strategy according to the characteristics of the market.

text

Compared with selling a call option Call, selling a put option Put is relatively less risky, because the price of the underlying object can only fall to 0 at most, so selling Put is actually a trading behavior with limited income and limited loss. But in reality, due to the existence of inflation, the value of physical objects tends to rise over time, that is to say, the farther in the future, the lower the possibility of the same thing being lower than the current price, so sell A put option whose strike price is close to the current price has a high probability of not being exercised in the future, which also becomes a transaction with an advantage in probability.

The most well-known example of selling Put is Buffett, the stock god. After the global financial crisis in 2008, he sold a large number of Puts of S&P500 Index ETFs that expired a few years later. With the 10-year bull market in the US stock market, his previous transactions All the put options bought by the opponent turned into waste paper, and he earned hundreds of millions of dollars in royalties.

secondary title

Portfolio strategy

In the actual options trading market, the vast majority of transactions exist in the form of option combinations. In view of the current bull market in the digital currency market, there are many options that can obtain stable Alpha.

Buy Bull Spread Bull Spread

Buy 10500Call@290,Sell 11000Call@141

The bull market spread arbitrage combination is an option combination constructed by buying a call option call whose strike price is closer to the current price, and then selling a call option call farther away from the strike price.

image description

If the Bitcoin price ≤ 10500 after 7 days, the option fee of 290-141=149 will be lost; if the Bitcoin price ≥ 11000 after 7 days, the gain will be 11000-10500-141=359, if 10500 after 7 days

Compared with simply buying call options, the bull market spread combination reduces the cost by about 50%, and also limits the income within a certain range, which is suitable for short-term trend trading in the bull market.

Sell Bear Spread Bear Spread

Buy 9500Call@117,Sell 10000Call@277

Corresponding to the bull market spread is the bear market spread. Selling the bear market spread arbitrage combination is to sell a put option Put whose strike price is closer to the current price, and then buy a put option Put farther away from the strike price. to construct option portfolios.

image description

If the Bitcoin price ≥ 10000 after 7 days, the profit will be 277-117=160; if the Bitcoin price ≤ 9500 after 7 days, the loss will be 10000-9500+160=340; if 9500 after 7 days

Because the price trend of the bull market is upward, the possibility of selling the bear market spread is relatively low, and the decline in the bear market is more plummeting. Compared with simply selling Put, the possible loss of the bear market spread is relatively limited.

synthetic futures

Buy 10250Call@398,Sell 10250Put@394

Assuming that the price of the underlying Bitcoin is 10250, the volatility rate is 70%, the interest rate is 2%, and the remaining time is 7 days, the sell option price is 10250Put, and the buy option price is 10250Call. The portfolio maturity yield curve is as follows

Buy 10500Call@290,Sell 10000Putl@277

image description

Summarize

first level title

References:

[1]Black–Scholes model

Summarize