Original | Odaily Planet Daily ( @OdailyChina )

Author: Golem ( @web3_golem )

Who would have thought that the traditional finance and crypto industries, which were once incompatible, have entered a honeymoon period of mutual interweaving in the past two months. On the one hand, the tokenization process of traditional finance stocks has accelerated, and compliant platforms such as Robinhood and Coinbase have joined in, and on-chain US stock platforms have sprung up like mushrooms after rain. Crypto investors may also have to complete the transformation from "speculating on copycats" to "speculating on US stocks" in the future.

On the other hand, the crypto bull market is also taking place in the U.S. stock market. News such as U.S. listed companies announcing crypto asset treasury strategies, crypto companies going public in the U.S., and traditional companies transforming to crypto can all trigger stock price increases. " The U.S. stock market is willing to pay more than $2 for $1 of crypto assets , " Bloomberg columnist Matt Levine described the madness of U.S. stock investors for crypto concept stocks.

However, there is one thing that is common to both crypto investors and US stock investors, which is to find high-potential crypto stocks. This round of structural bull market in crypto stocks has just begun, and the market is still focusing on topics with short-term popularity such as "well-known US stocks" and "crypto asset treasury listed companies", while those US stock listed companies that truly conduct crypto business in compliance and are on the rise are still little known.

In this article, Odaily Planet Daily will introduce a US-listed company that has transformed from a car service provider to the world's second largest Bitcoin mining company - Cango Inc. As Robinhood CEO Vlad Tenev said at a press conference held in Cannes, the world's film capital, " It's time to move from Bitcoin and Meme coins to real-world assets that have real practical utility."

Cango Inc. is the gold buried under the soil, let us dig it out.

1. Although the transformation span is large, Cangu is serious

Cango Inc. (NYSE: CANG) was founded in 2010 and successfully listed on the New York Stock Exchange in 2018. Cango has been deeply involved in the automotive industry for many years, and has tried everything from auto finance to car trading to new energy car manufacturing, and even made a strategic investment in Ideal Auto. However, this listed company with considerable achievements in the automotive industry announced in November 2024 that it would fully enter the crypto industry to engage in Bitcoin mining business, and only retained the operation of the online international used car export platform AutoCango.com in the past automotive business.

Nowadays, it is not new for Web2 enterprises to enter the crypto industry or announce crypto asset treasury strategies. For most of these companies, it is just a "market value management behavior" to use the market narrative to boost stock prices before bankruptcy. However, when Canggu announced his entry into the crypto industry, the crypto market was still in the Meme coin wealth-making carnival, and crypto-concept US stocks were not as popular with investors as they are today.

"Due to the impact of the epidemic and the deteriorating credit environment under the economic downturn, Cangu has begun to systematically consider the issue of business transformation since 2022 or even earlier. To this end, we have actually investigated many directions, from auto finance to auto trading to new energy vehicle manufacturing, to new energy, and finally into the field of computing power mining. From the outside world, the scale of transformation seems huge, but the road under our feet is still clear, and we are taking one step at a time." Juliet Ye, head of Cangu IR, said when talking about the company's transformation.

Become the world's second largest mining company and aim to become the world's largest mining company by the end of the year

Cangu is "cutting off one's arm" when it comes to entering the Bitcoin mining business, which is the biggest difference between it and those US-listed companies that claim to transform into cryptocurrencies at a small cost. On November 15, 2024, Cangu acquired a rack-mounted Bitcoin mining machine with a total computing power of 32 EH/s from Bitmain for $256 million; on June 27, 2025, Cangu acquired a rack-mounted Bitcoin mining machine with a total computing power of 18 EH/s from Golden TechGen for $144 million in equity. This acquisition has brought Cangu's computing power to 50 EH/s, making it the world's second largest mining company, second only to MARA Holdings (57.4 EH/s).

Before the acquisition was completed, Cangu's computing power ranked fifth in the world (data source: BitcoinMiningStock )

"Our plan is to increase by another 10-15 EH/s by the end of 2025 and become the world's number one." Juliet Ye revealed Cangu's future plans for mining to Odaily.

In order to better integrate into the Web3 industry and lead the company's strategic development, Cangu also "made changes" at the company's management level. On May 27, Cangu announced that it had sold its Chinese business to Ursalpha Digital Limited for approximately US$351.94 million. At the same time, it made a major reorganization of the board of directors, with four of the original seven members leaving and two new directors added, namely Lin Yanjun, founding partner of blockchain and AI investment consulting company IN Capital, and Lu Haitian, professor of accounting and finance at the Hong Kong Polytechnic University.

In terms of equity, after the completion of the 18 EH/s equity transaction, the combined shareholding ratio of Cangu founders Zhang Xiaojun and Lin Jiayuan dropped to 18.54%, and the voting rights dropped to 12.07%; Golden GenTech holds 19.85% of Cangu's shares and 12.92% of the voting rights; and another key stakeholder Enduring Wealth holds 2.82% of Cangu's shares, but has up to 36.74% of the voting rights, thus truly controlling the company. Enduring Wealth Capital is a financial planning and investment management service company in Singapore, and its partner Andrea Dal Mas has been deeply involved in blockchain for many years.

From spending high costs to quickly establish advantages in the mining industry to introducing a large number of Web3 practitioners into the company's decision-making level, Cangu completed its comprehensive transformation into a Bitcoin mining company in less than a year. This not only reflects Cangu's determination to transform, but also highlights a sense of urgency.

"We are currently in the halving cycle, and time is money. We hope to acquire as much Bitcoin as possible in this cycle with the lowest possible initial capital investment, in preparation for the next cycle's expansion into the upstream and downstream of the digital economy ecosystem value chain." Juliet Ye explained to Odaily the strategic considerations behind the company's decision not to build its own mines and to rapidly transform.

New Bitcoin Treasury Company: Implementing the Bitcoin "Mine and Hold" Strategy

It is also new to the market that a Bitcoin mining company publicly stated that its goal is to "obtain as much Bitcoin as possible."

Bitcoin mining companies have been in a position of "love and hate" by investors since ancient times. On the one hand, miners play an important role in maintaining the security of the Bitcoin network, but on the other hand, miners are also a greater potential selling pressure in the market. "Mine, withdraw and sell" has always been the strategy of most mining companies to maintain normal operations, especially when Bitcoin is in a downward cycle or the price is close to the "shutdown price" of mining companies, the selling of mining companies will further depress the price of Bitcoin.

But unlike these mining companies that "go with the flow", Cangu has clearly stated that it will implement a Bitcoin "mine and hold strategy" similar to the Bitcoin treasury strategy. That is, Cangu will not choose to sell the Bitcoin mined by mining machines on the market, but will hold it for a long time.

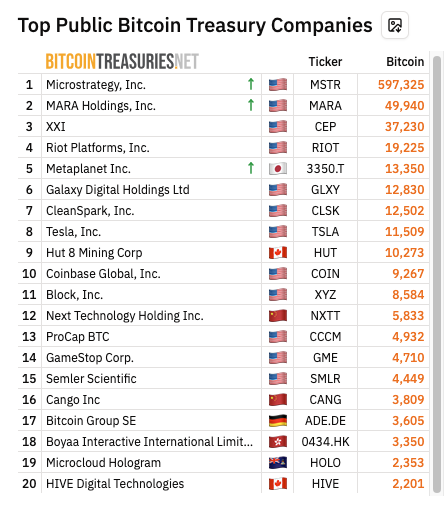

According to the first quarter 2025 earnings report released by Cangu, the total revenue in the first quarter was US$145.2 million, of which the BTC mining business achieved revenue of US$144.2 million. Given that Cangu implemented the "mine and hold" strategy, it also reduced the selling pressure of Bitcoin worth US$144.2 million in the first quarter. According to Cangu's disclosure on June 27, it holds a total of 3,809.1 bitcoins, worth more than US$416 million. According to data from the BitcoinTreasuries.net website , Cangu's Bitcoin holdings also ranked 16th among listed companies.

Listed companies’ ranking of publicly disclosed Bitcoin holdings

The "mine and hold" strategy makes Cangu a new type of Bitcoin treasury company. It is not only supported by actual encryption business, but also continues to increase its holdings of Bitcoin every day. Although Cangu does not create Bitcoin buying orders in the open market, it reduces market selling pressure from the "supply side". Based on Cangu's current computing power of 50 EH/s, if the computing power of the entire network is 900 EH/s, Cangu can produce about 9,125 BTC a year, worth more than US$912 million. It is believed that as Cangu's computing power and industry status increase, this strategy will also be learned by other mining companies.

Of course, the "mine and hold" strategy does not mean never selling. "We do not mechanically implement 'never sell', but have established a triple selling trigger mechanism. First, when the price of Bitcoin exceeds $150,000, we may lock in part of the profits to return to shareholders and investors through step-by-step reduction; second, to deal with liquidity needs, such as computing power expansion or debt repayment, but we will give priority to solving it through currency mortgage financing; third, when encountering black swan events. All plans have been incorporated into the dynamic risk control model." Juliet Ye said when talking about whether Cangu will sell Bitcoin.

At the same time, because of the increase in Bitcoin holdings through mining, Cangu's Bitcoin cost is low enough. According to Cangu's first quarter 2025 earnings report, its Bitcoin mining cost is an average of $70,602.1, which is lower than Strategy (average $70,982 per coin). Coupled with Cangu's current $347 million in cash and equivalent reserves and $351.94 million in proceeds from the divestiture of traditional businesses, it is enough to provide the company with sufficient cash flow without having to maintain operations by selling coins like other mining companies.

2. Competitive mining business and entry into green energy

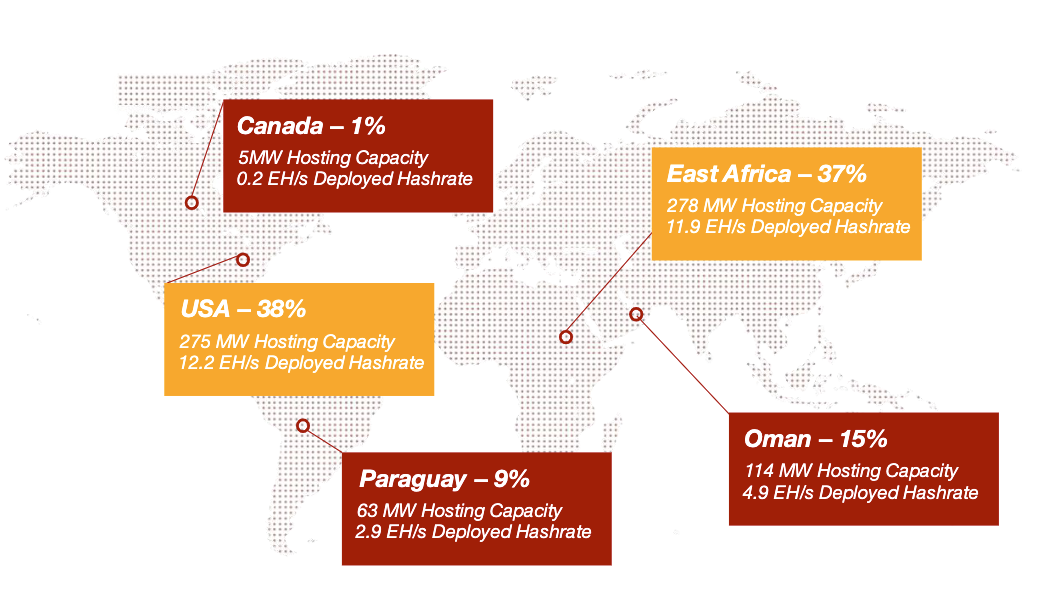

As a Web2 company, Cangu is no longer young, but as a Bitcoin mining company, Cangu, which just entered the industry in November 2024, is like a newborn compared to other listed mining companies. At present, Cangu mainly deploys its mining business in North America, the Middle East, South America and East Africa. Although Cangu has just started its Bitcoin mining business, in addition to its computing power becoming the second in the world, other aspects are not inferior to well-known mining companies.

In terms of Bitcoin holdings, Cangu's holdings (3,809.1 Bitcoins) ranked sixth, and MARA Holdings ranked first with 49,940 Bitcoins. However, given that Cangu only started mining in November 2024, it is not reasonable to compare only the total holdings. Before the acquisition of 18 EH/s computing power was completed in the first quarter of 2025, Cangu had more than 136,000 rack-mounted mining machines with a total computing power of 32 EH/s, ranking behind MARA Holding (54.3 EH/s), CleanSpark (42.4 EH/s) and Riot Platforms (33.7 EH/s), and before Core Scientific (18 EH/s).

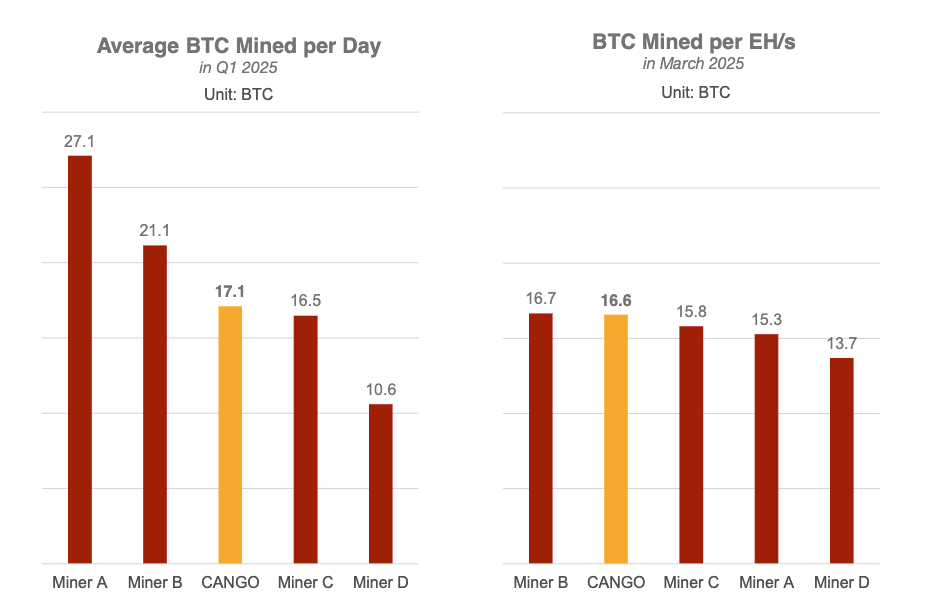

However, as shown in the figure below, in the first quarter of 2025, Canggu's daily average Bitcoin mining volume ranked third, and Bitcoin mined per EH/s ranked second, with efficiency ranking among the top Bitcoin mining companies. As Canggu completes the acquisition of 18 EH/s computing power and improves its infrastructure, its various indicators will also improve in Q2 2025.

Comparison of average daily Bitcoin mining volume and Bitcoin mined per EH/s in Q1 2025 (A, B, C, D are MARA Holding, CleanSpark, Riot Platforms, and Core Scientific, respectively)

In terms of mining, in addition to the improvement in efficiency and computing power, Cangu has greater ambitions. " In fact, 'energy + computing power' is our real transformation direction . On the one hand, we strive to become the world's number one computing power mining company; on the other hand, from the energy perspective, Cangu will deepen the green energy transformation and promote the upgrade of Bitcoin mining from a high-energy consumption model to a sustainable paradigm. Through self-built green electricity and energy storage integrated projects, the company plans to achieve 100% green electricity mining and 'zero cost' mining in the future." Juliet Ye explained to Odaily Cangu's core competitiveness in mining business and energy in the future.

One of the reasons why China stopped all Bitcoin mining business in 2021 is that the energy consumption is huge and it is inconsistent with the carbon emission reduction target. In the future, if Cangu successfully achieves pure green electricity mining, it may be possible to restart this core Bitcoin industry in China in the context of the current global regulatory acceleration of the acceptance of the crypto industry.

Cangu’s global computing power distribution

Undervalued CANG

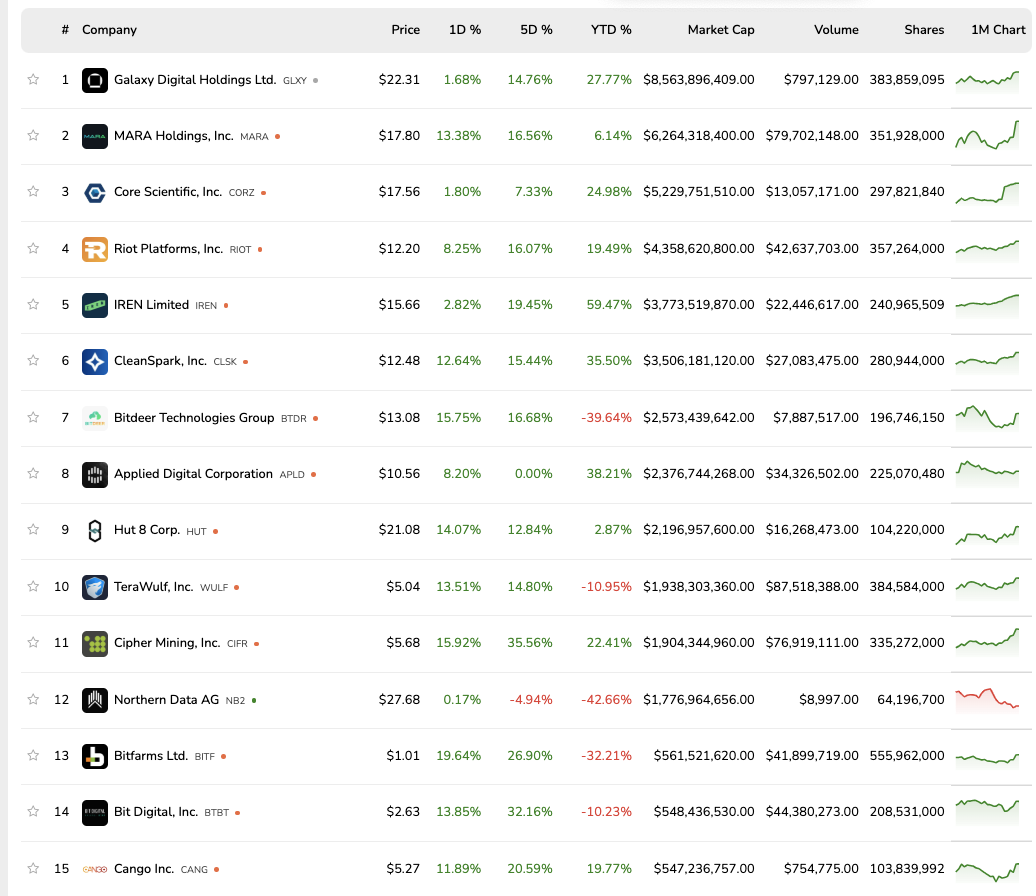

CANG is the stock code of Canggu on the New York Stock Exchange. According to TradingView data, CANG's historical highest price is $14.2, and its current market value is $540 million, ranking 14th among Bitcoin mining companies (excluding Galaxy).

Data source: BitcoinMiningStock

Since Canggu announced its entry into the Bitcoin mining business in November 2024, its stock price has indeed been in a state of fluctuating rise, rising to a maximum of $8 in December 2024, and then the price began to fluctuate. In June, Canggu's stock price rose due to news such as management changes, equity sales, and the acquisition of 18 EH/s computing power. In the past month, CANG has risen by more than 14.32%, but compared with other listed mining companies, CANG is still undervalued.

As shown in the above figure, MARA Holding has a market value of $6.2 billion, and its computing power of 57.4 EH/s ranks first in the world; the listed mining company Core Scientific has a market value of $5.22 billion, but its computing power is only 18.1 EH/s; Riot Platforms has a market value of $4.358 billion and a computing power of 31.5 EH/s. Although the size of computing power has no absolute relationship with the market value of a company, for Cangu, which currently ranks second in computing power and sixth in Bitcoin holdings, the market value of $540 million is already underestimated. Even after completing the stock issuance, the company's total market value is only in the range of $800-900 million.

However, with the continuous increase in Canggu’s mining capacity and the increase in Bitcoin holdings, as well as the return of the concept of “value investment” brought about by this wave of crypto-US stock bull market, CANG may become a dark horse in the stock market.

3. Will Cango become the next Strategy?

Thanks to this round of integration of encryption and US stocks, Bitcoin treasury listed companies and various altcoin treasury listed companies have sprung up like mushrooms after a rain. The market is mixed, and investors who have no time to research are caught in a vicious circle of "looking at what it says instead of what it actually does" and "looking for who is the next strategy". The final result is that it becomes a liquidity exit window for capital.

The noisy market environment has also brought new problems to companies that have truly transformed into crypto businesses, namely how to compete for investors' attention . "If we take November last year as a dividing point, before that, the biggest difficulty facing us was: where to turn? After that, the biggest pain point is: tell you my story." Juliet Ye expressed the concerns that most Web2 companies are facing in their transformation to the crypto industry.

Although the scale of Cangu's transformation is large, it should be noted that before Strategy became the first stock of Bitcoin Treasury, its business was to do business data analysis. Since the announcement of the "Bitcoin Treasury" strategy, its stock price has risen by about 2,600%. So, under the guidance of the "Energy + Computing Power" strategy, how will Cangu, which continues to expand the possibilities of green electricity mining and also realizes the "Bitcoin Treasury" strategy, perform in the future? Let's wait and see.