When many investors are planning their Bitcoin investment, they may have questions about "BTC Snowball" and "Accumulator (AQ). These two structured products sound similar in logic, so which one is more suitable for me? If you have USDT and want to allocate Bitcoin, but don't know how to choose between these structured products. Don't worry, this article will use easy and popular language to help you understand the structural logic of these two common BTC structured wealth management products, the people they are suitable for, and their performance under different market conditions.

1. What is BTC Snowball?

"Snowball" is a non-principal-protected structured financial product. Its name figuratively implies that the returns will grow like a snowball. Simply put, buying BTC Snowball is like saving a "long-term interest" USDT. When the BTC price fluctuates within the agreed range, you can continue to "earn interest"; if the price reaches the preset knock-out price (stop profit price), the product will automatically end in advance and settle the income, which is equivalent to helping you "knock out the stop profit" to lock in the income. On the other hand, in order to control risks, Snowball also sets a knock-in price (protection price): if the BTC price falls below this level, the product will trigger a knock-in event, and your principal will be converted into BTC at the initial agreed price, thereby "passively buying" Bitcoin at a low point. In a popular analogy, Snowball is a bit like a high-interest deposit with conditions attached: you usually get interest, and when the market falls too hard, you buy at a low point and the principal is converted to BTC; when the market rises too sharply, you stop profit in advance to lock in the income.

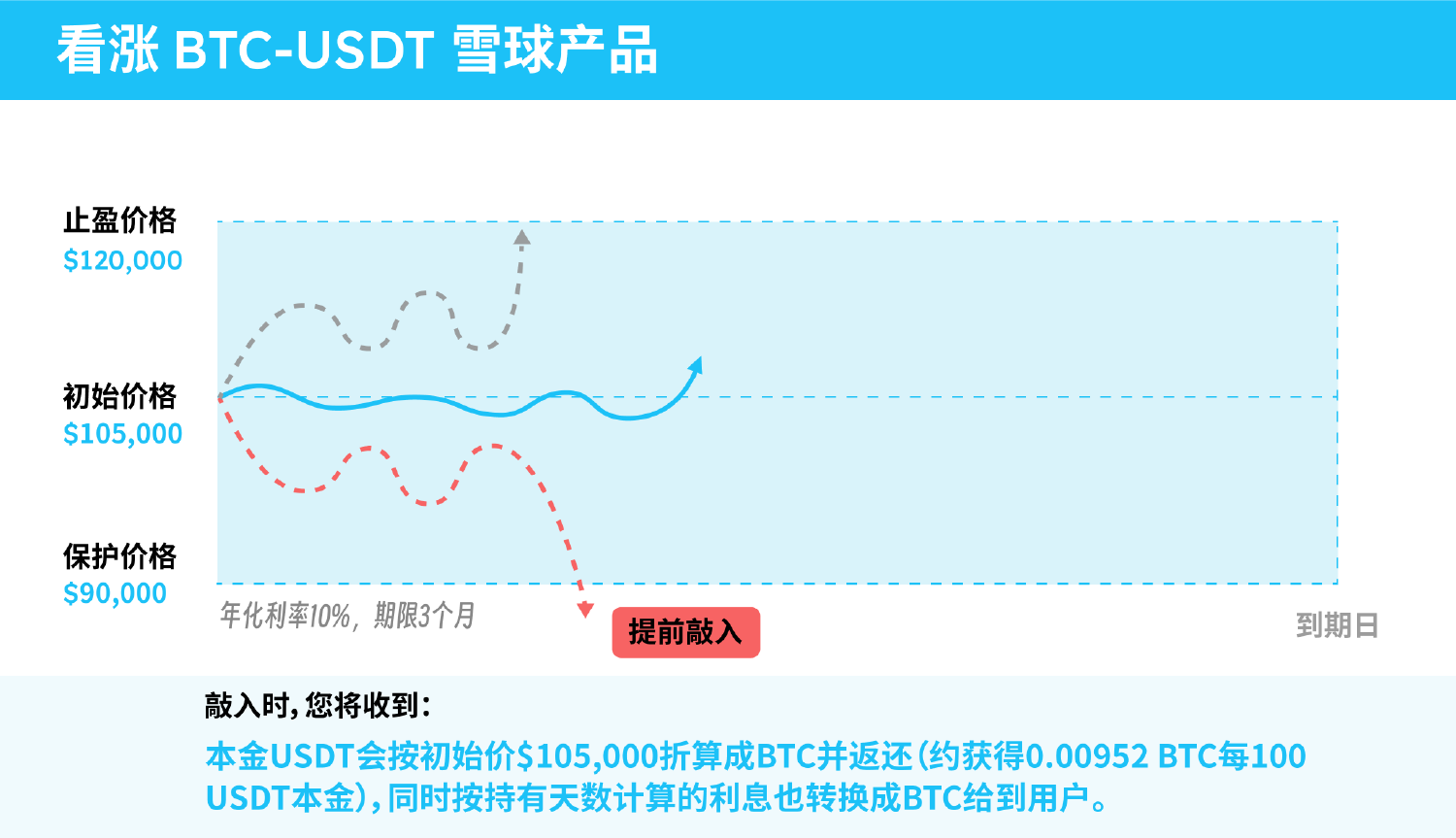

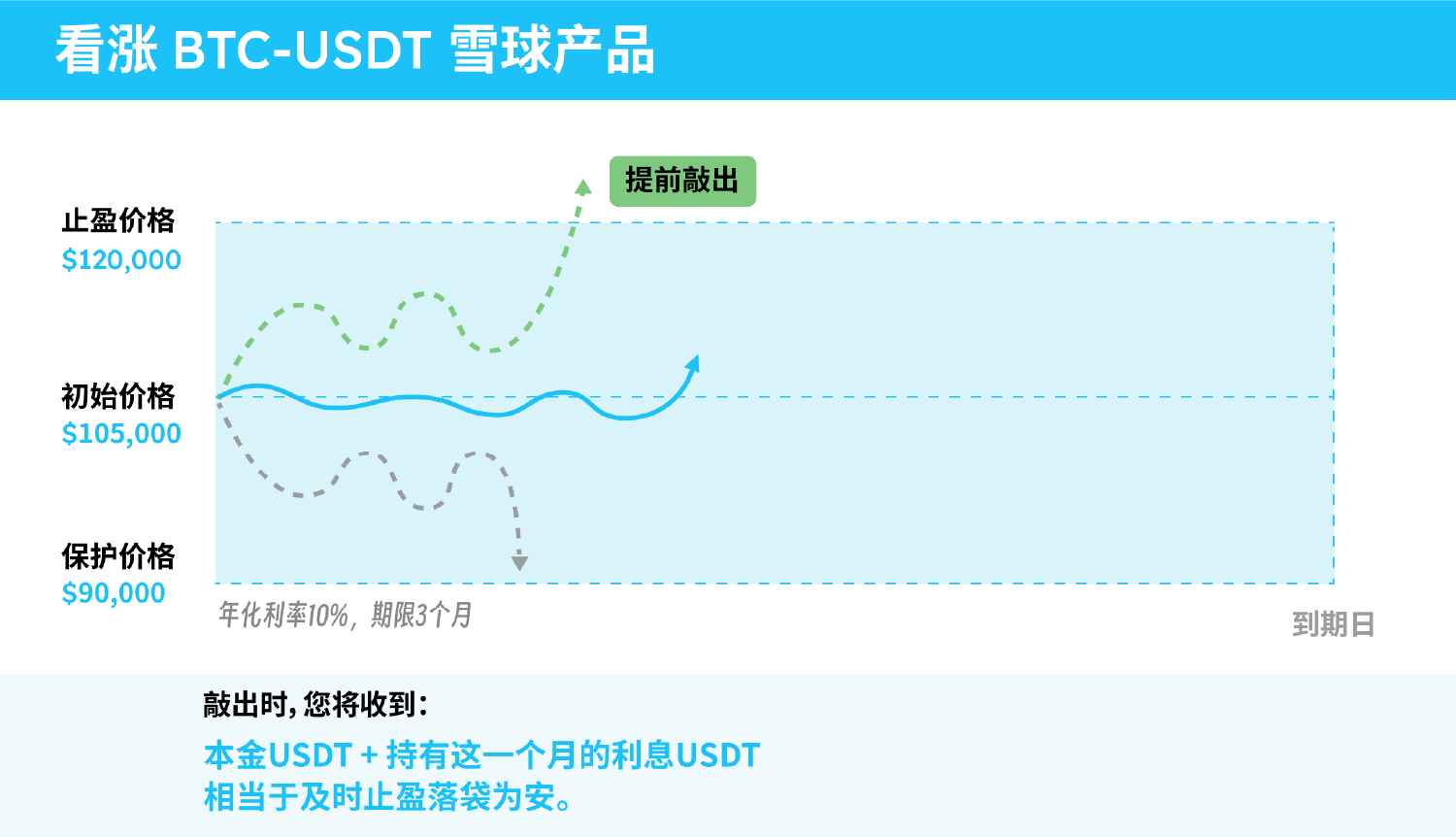

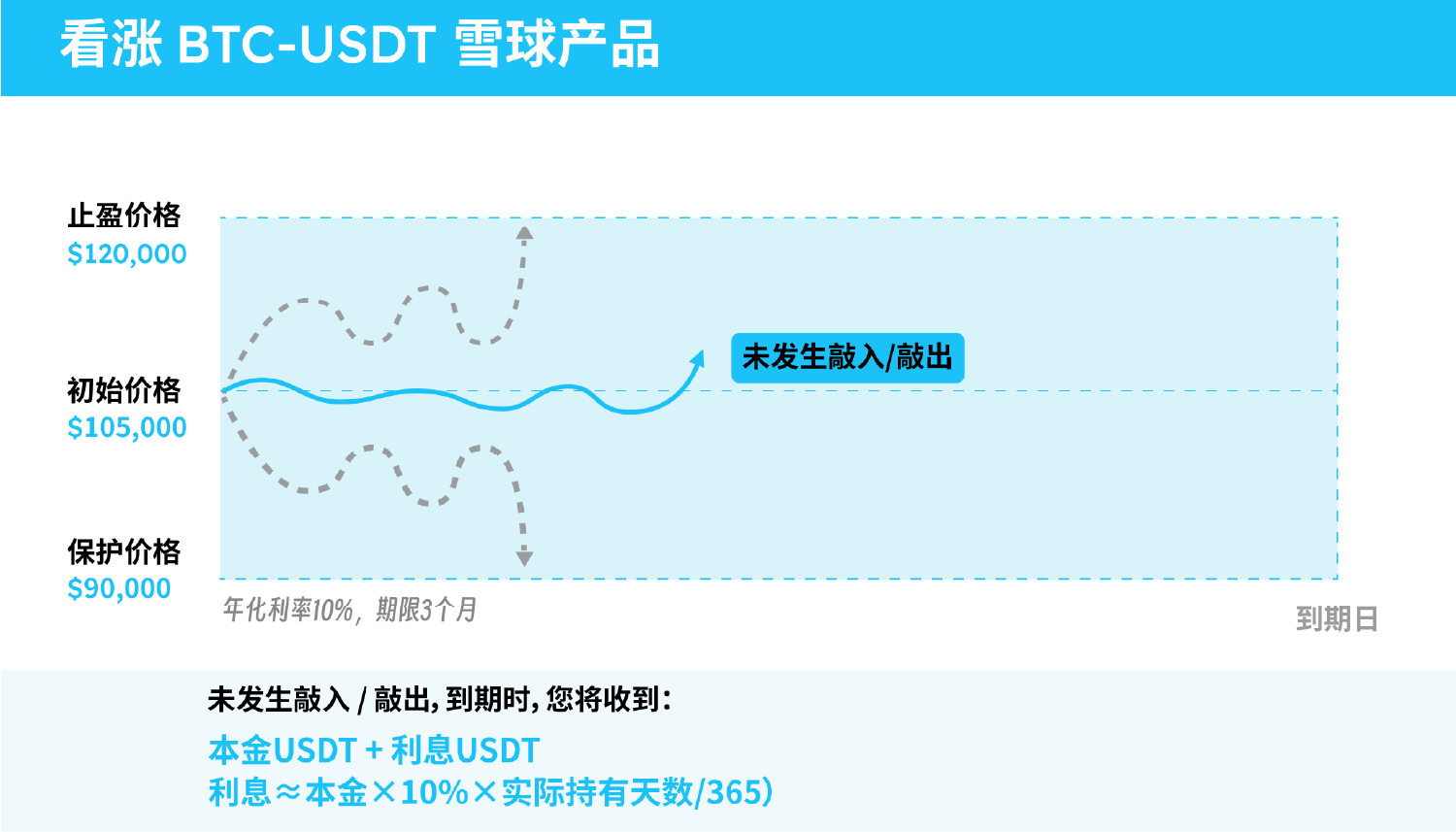

For example, assuming that the current BTC price is $105,000, an investor uses USDT to buy a bullish BTC product on Snowball, setting a take-profit price of $120,000, a protection price of $90,000, an annualized interest rate of 10%, and a term of 3 months. During the following observation period, there may be the following three scenarios:

This is the risk of Snowball: in an extreme unilateral decline, the principal may be converted into BTC at the initial higher price, suffering a certain loss. In general, Snowball is suitable for investors who have a good judgment of the market, want to earn higher interest income, and can accept the worst-case scenario of taking back Bitcoin.

Summary: The core features of Snowball products are "interest income" and "range protection". When the price of BTC is neither rising nor falling, Snowball can provide higher interest returns than ordinary deposits; when the price rises sharply, it automatically stops profit to protect the income; when the price falls sharply, investors passively take the coins, which is equivalent to being trapped at a high position (investors need to be mentally prepared for this part of the risk). Therefore, Snowball is suitable for conservative investors who have medium risks, hope to "earn income" and do not mind taking the coins in the end.

2. What is BTC Accumulator (AQ)?

"Accumulator" (AQ) sounds very high-end, but it can be simply understood as a contract for "buying coins in batches at a discount". It allows you to buy BTC regularly at a pre-agreed discounted purchase price (exercise price) within a certain period of time, regardless of the market price at that time. This is a bit like a wholesale stockpiling agreement: you and the counterparty (dealer) agree that "I am willing to buy a certain amount of BTC at $100,000 every day for the next N days", and this $100,000 is a discount price slightly lower than the current market price of $105,000. If the BTC price continues to fluctuate below the knock-out price (for example, $115,000), you can buy cheap BTC at $100,000 every day and slowly accumulate positions. If BTC rises too sharply and the closing price on a certain day is higher than the knock-out price of $115,000, the contract will be automatically cancelled (knocked out), and subsequent purchases will stop - because the market price is higher than the agreed price, and the opportunity to buy cheaply is over. Doesn't it sound a bit like going shopping in a mall and encountering a discount event: if the price is within the discount range, buy a little every day to stock up; if the price rises sharply and exceeds the discount limit, the event will end early.

But there is another important mechanism for cumulative options: multiple buying (also called double buying, etc.). This means that once the BTC price falls below your discount price, not only can you not stop buying, but you can also double your purchase! This sounds crazy, but the logic is actually very straightforward - since you are optimistic about BTC and are willing to buy at $100,000, then when the market falls to a lower $90,000, it is equivalent to a bigger discount, and you "have to buy more at a cheaper price"💰. Therefore, many AQ contracts stipulate that if the market price is lower than the strike price on a certain day, the purchase quantity on that day will double (or increase by an agreed multiple). Back to the previous example: the strike price is $100,000 and the knock-out price is $115,000. If BTC keeps fluctuating around $100k, you buy, for example, 0.01 BTC every day (with $1,000); if BTC falls below $100k to $95k one day, you will have to buy double the amount, 0.02 BTC on the same day (still priced at $100k, you need to pay $2,000). In this way, the lower the price, the more you buy, and you can fully "buy on dips" to accumulate Bitcoin positions📉. Of course, this multiple buying mechanism also buries risks: if BTC plummets all the way, you will continue to buy a large amount at a higher agreed price, which will lose more than buying coins directly at the market price, and you may even invest more money than originally planned. Therefore, AQ is more suitable for investors who are firmly optimistic about the long-term value of BTC and intend to keep hoarding coins - because no matter whether the market goes up or down, they will eventually get a batch of Bitcoin bought at a fixed discount price, and short-term book losses can be compensated by long-term appreciation.

Summary: The core of cumulative options lies in "discounted fixed investment" and "quantity increases and decreases with market conditions". When the BTC price is within a range or falls, you can buy at a predetermined discount price (the lower the price, the more you buy), which is equivalent to automatically executing the fixed investment and low-buy strategy; when the price rises too fast, the contract ends early to prevent you from buying high-priced coins again. AQ is suitable for determined investors with high risk tolerance, who believe that BTC has room for appreciation in the long term and want to hoard more coins on dips, because this product is essentially a structured way to do long-term cumulative holding operations.

3. Which one is more suitable for you: Snowball or AQ?

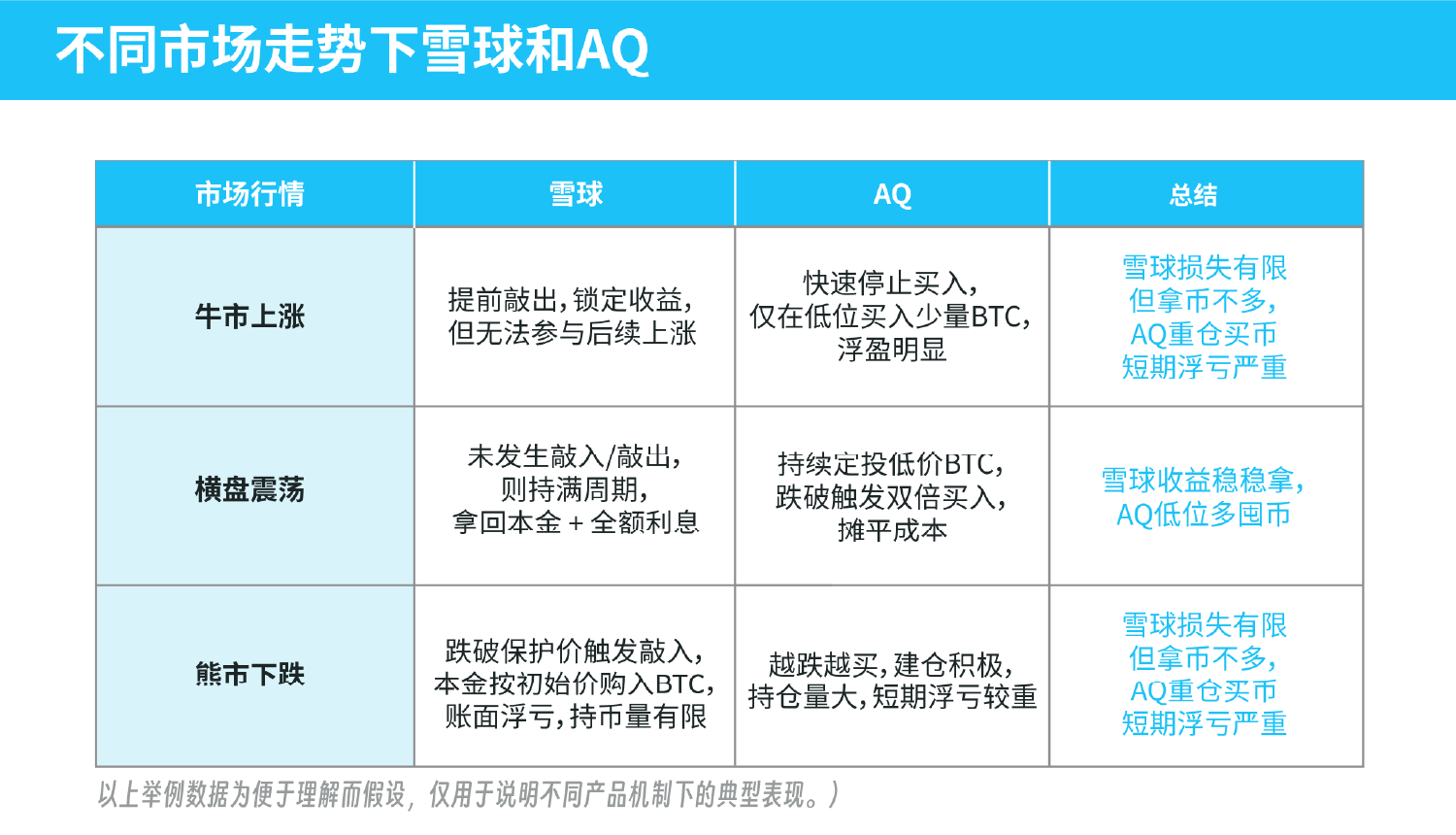

From the above explanation, we can see that although Xueqiu and AQ are both BTC structured products, their positioning and suitable groups are very different:

Snowball: Suitable for conservative investors who are mainly interested in earning income. If you have just bought USDT and want to earn a higher return than depositing stablecoins, but are not sure about the short-term trend of BTC or do not plan to hold a large amount of Bitcoin for a long time, Snowball would be a good choice. Its yield is usually higher than that of ordinary financial management, and the income is considerable when the market is stable or rising slightly; even if you passively take coins when the market plummets, the amount of BTC you get is limited, which is equivalent to being "trapped" to a small extent, and the risk exposure is smaller than holding coins directly. In short, Snowball is more like a financial product that "earns interest as the main purpose and takes coins as the supplement."

Accumulator Options (AQ): Suitable for aggressive investors who are firmly optimistic about the long-term value of BTC. If you originally planned to invest in BTC and are willing to buy more when the price drops, and you are pursuing the accumulation of more BTC at a low price rather than short-term interest, then AQ may be more in line with your needs. It is essentially an automated fixed investment + buy-low mechanism, which helps you buy a large amount of Bitcoin at a discount in a volatile or falling market. It should be noted that AQ has higher requirements for financial strength and risk tolerance: you must have enough funds to cope with potential double purchases and be able to withstand periodic floating losses. Therefore, AQ is more like a "coin hoarding tool" and is suitable for investors who intend to allocate Bitcoin for the long term and have a higher risk appetite.

If these two products sound similar and you don't know how to choose, you might as well consider it from your own investment purpose and risk preference: Do you value steady returns more, or do you want to accumulate coins during volatility? Choose Snowball for the former and AQ for the latter, just like the difference between "saving money to earn interest" and "fixed investment to hoard coins". Of course, any investment is not a choice between two options. You can also flexibly match these two types of products according to market conditions and your own asset allocation needs, using Snowball to earn interest on part of the funds and AQ to buy coins at a low price on the other part of the funds, so as to take advantage of each.

4. Investment tips: Pay attention to risk appetite and choose a compliant platform

Whether you ultimately prefer Snowball or AQ, it is a prerequisite to do what you can and understand the risks of the product. The returns and risks of structured products are often proportional: high returns are accompanied by high risks. Before trying, novices must fully understand the product terms (such as the concepts of knock-out price, knock-in price, discount purchase, multiple purchase, etc. have been explained above) and then decide whether to participate. Clarify your own risk preferences and configuration purposes: if you want steady appreciation, take less coins and earn more interest; if you believe that BTC will rise in the long run, use the discount to save more coins, but you must also be able to withstand short-term fluctuations.

Finally, it is strongly recommended that you participate in this type of BTC structured product investment through a compliant and reliable platform. Matrixport, as the world's leading one-stop cryptocurrency financial service platform, provides crypto asset trading, investment, lending, custody, RWA, investment research and other functions. Its fund management and custody volume reaches 6 billion US dollars. It is committed to providing diversified crypto financial solutions for global users, helping users to maximize fund utilization and continuously increase asset value.

On the Matrixport platform, the investment threshold for Snowball and cumulative option products is relatively low, starting with only a hundred dollars, and the cycle is flexible, which can be as short as a few days, suitable for ordinary investors to try. These products are operated on a compliant platform, with an open and transparent mechanism and professional risk control measures to better protect the rights and interests of investors and the safety of funds.

There is no fixed formula for investment and financial management, and choosing the right tools is crucial. I hope this popular science article can help you better understand the difference between snowball and cumulative options, so that you can make wise choices based on your own situation to achieve stable returns and seize investment opportunities. I wish you all a smooth investment and a bigger wealth snowball!