Originally Posted by: Saurabh Deshpande

Original translation: TechFlow

Hello!

Newton is famous for discovering gravity, but in his time, he was more interested in another field: financial alchemy, or the pursuit of turning lead into gold. This pursuit even led him to theology. And modern finance seems to echo his interests - through financial engineering, we are in an era of turning "lead into gold" by simply combining the right elements.

In today's article, Saurabh explains in detail how companies can realize a premium on their actual value by adding cryptocurrencies to their balance sheets. Take MicroStrategy, for example, a company with quarterly revenue of just over $100 million, but holding nearly $10.9 billion worth of Bitcoin. 80 companies around the world are exploring how to include cryptocurrencies in their balance sheets. Traditional financial institutions have shown great interest in this and have paid a premium for the volatility and potential returns of this stock.

Saurabh also analyzes the rise of convertible bonds, a financial instrument that has helped create this thriving ecosystem, while exploring the risks and those companies that are trying to bring other cryptocurrencies onto their balance sheets.

Let’s get down to business!

How did a software/BI company with $111 million in quarterly revenues achieve a market cap of $109 billion? The answer is: it bought Bitcoin with other people’s money. And the market is now valuing its Bitcoin holdings at a 73% premium. What kind of alchemy is this?

MicroStrategy (now called Strategy ) created a financial mechanism that allows it to borrow money at almost zero cost to buy Bitcoin. Taking its $3 billion convertible bond issued in November 2024 as an example, here’s how it works:

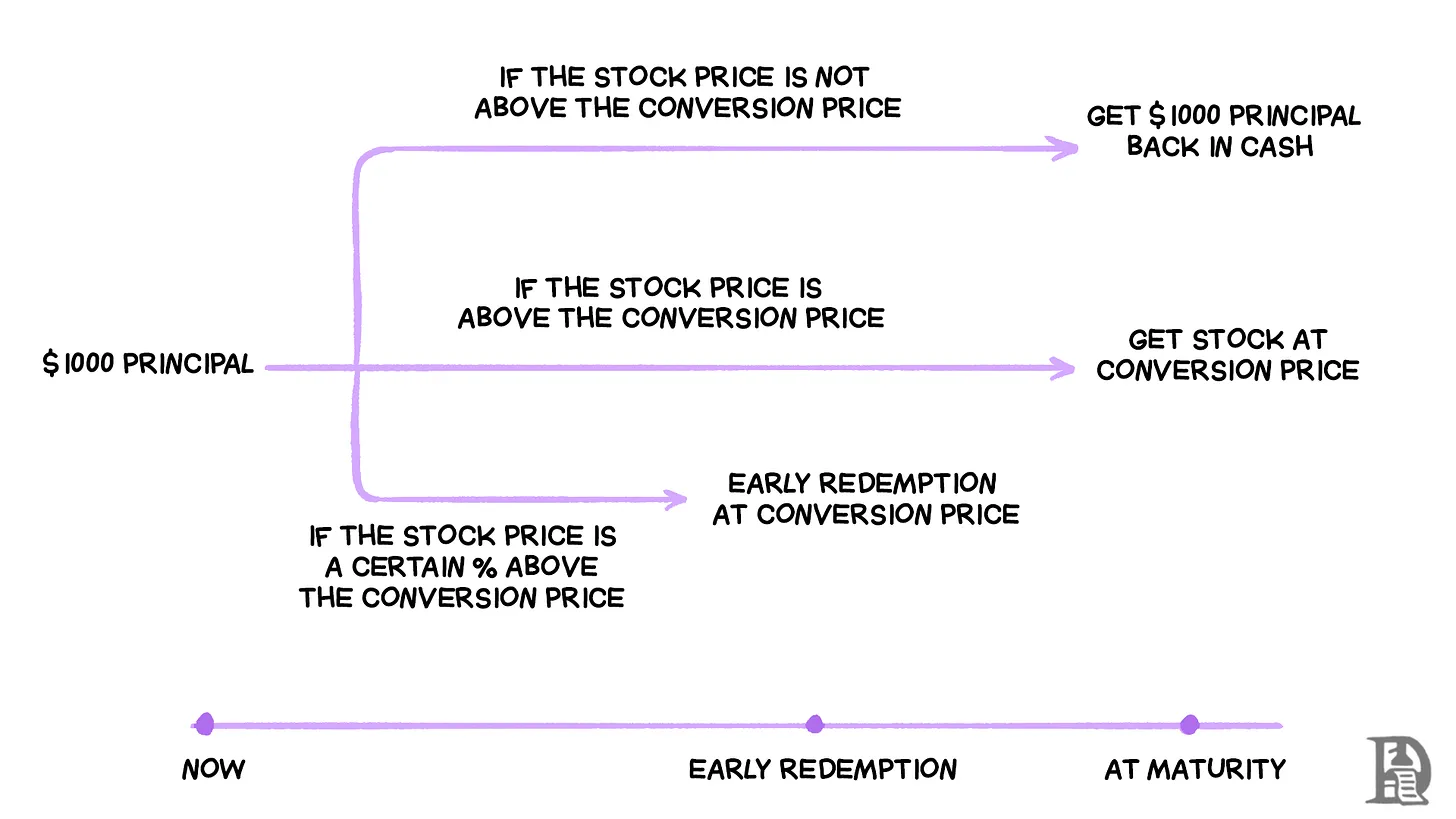

The company issued convertible bonds with a 0% coupon, meaning bondholders will not receive regular interest payments. Instead, each $1,000 bond can be converted into 1.4872 shares of Strategy stock, but only if its stock price rises to $672.40 or more before maturity.

When these bonds were issued, Strategy's stock price was $433.80, so the stock price would need to rise 55% to make conversion profitable. If the stock price never reaches that level, bondholders will get their $1,000 back after five years. But if Strategy's stock price soars (which usually happens when the price of Bitcoin rises), bondholders can convert to stock and capture the entire upside.

The clever thing about this mechanism is that bondholders are actually betting on the performance of Bitcoin while enjoying downside protection that is not available to those who hold Bitcoin directly. If Bitcoin plummets, they can still get their principal back because bonds take precedence over stocks in bankruptcy liquidation. At the same time, Strategy can borrow $3 billion at zero cost and immediately use these funds to buy more Bitcoin.

However, the key trigger for this mechanism is that starting from December 2026 (just two years after issuance), if Strategy's stock price exceeds $874.12 (130% of the conversion price) for a period of time, the company can force an early redemption of these bonds. This "redemption clause" means that if Bitcoin drives the stock price high enough, Strategy can force bondholders to convert to stock or redeem the funds early, thereby refinancing on better terms.

This strategy works because Bitcoin has achieved an average annual growth rate of about 85% over the past 13 years, and an average annual growth rate of 58% over the past five years. The company is betting that Bitcoin will grow much faster than the 55% share price increase required to trigger the bond conversion. They have proven the success of this strategy by successfully redeeming early bonds issued, saving millions of dollars in interest expenses.

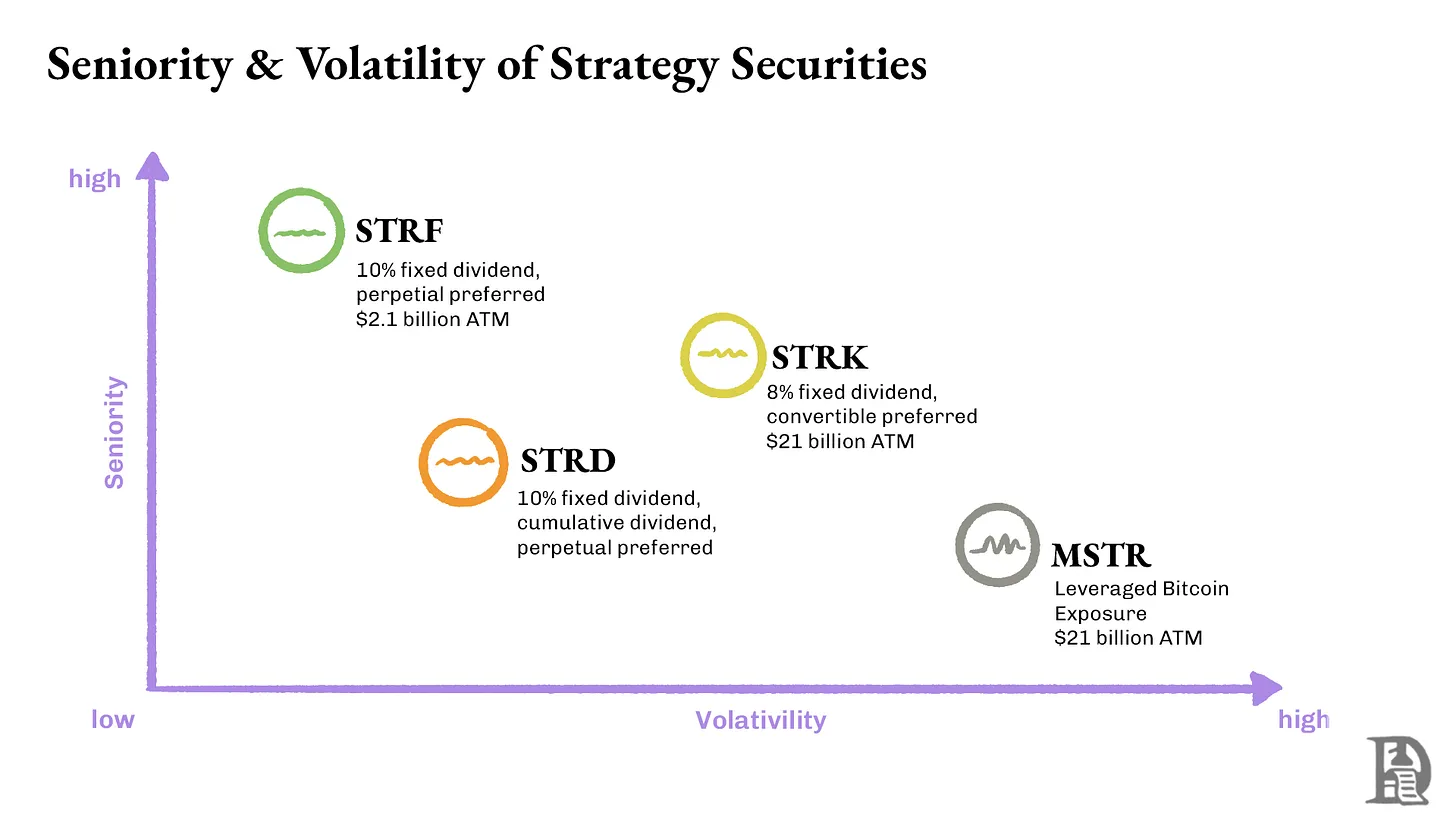

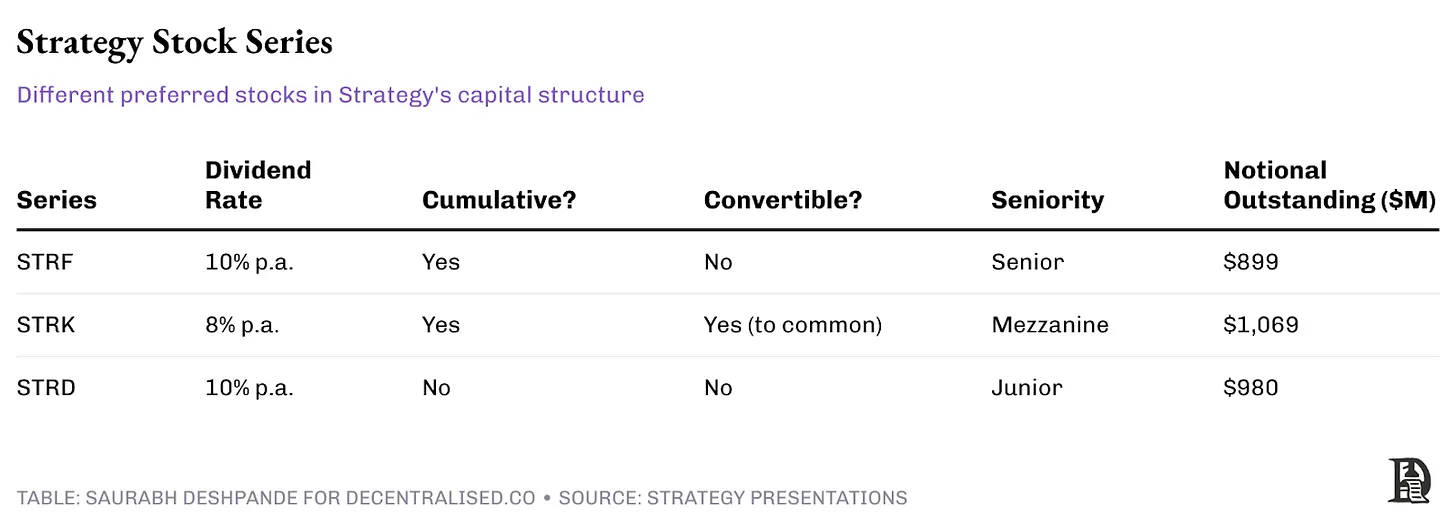

At the core of this structure are three different perpetual preferred stock series: STRF, STRK and STRD, each tailored for a different investor type.

STRF: Perpetual preferred stock, providing 10% cumulative dividends and having the highest priority. If Strategy fails to pay dividends, the company must pay all unpaid STRF dividends before paying other shareholders. In addition, as a penalty, the dividend rate will increase accordingly.

STRK: Perpetual preferred stock that provides 8% cumulative dividends and is ranked middle priority. Unpaid dividends accumulate and must be paid in full before common stockholders receive any proceeds. In addition, STRK includes the right to convert into common stock.

STRD: Perpetual preferred stock, offering a 10% non-cumulative dividend, lowest priority. The higher dividend rate is compensation for higher risk - if Strategy skips a payment, these dividends will be lost forever and no compensation is required.

Perpetual preferred shares enable Strategy to raise equity-like capital while paying perpetual dividends similar to bonds. Each series is custom designed based on the investor's risk appetite. The cumulative dividend feature protects STRF and STRK holders by ensuring that all unpaid dividends will eventually be received, while STRD provides a higher current yield but without a protection mechanism for unpaid dividends.

Strategy Report Card

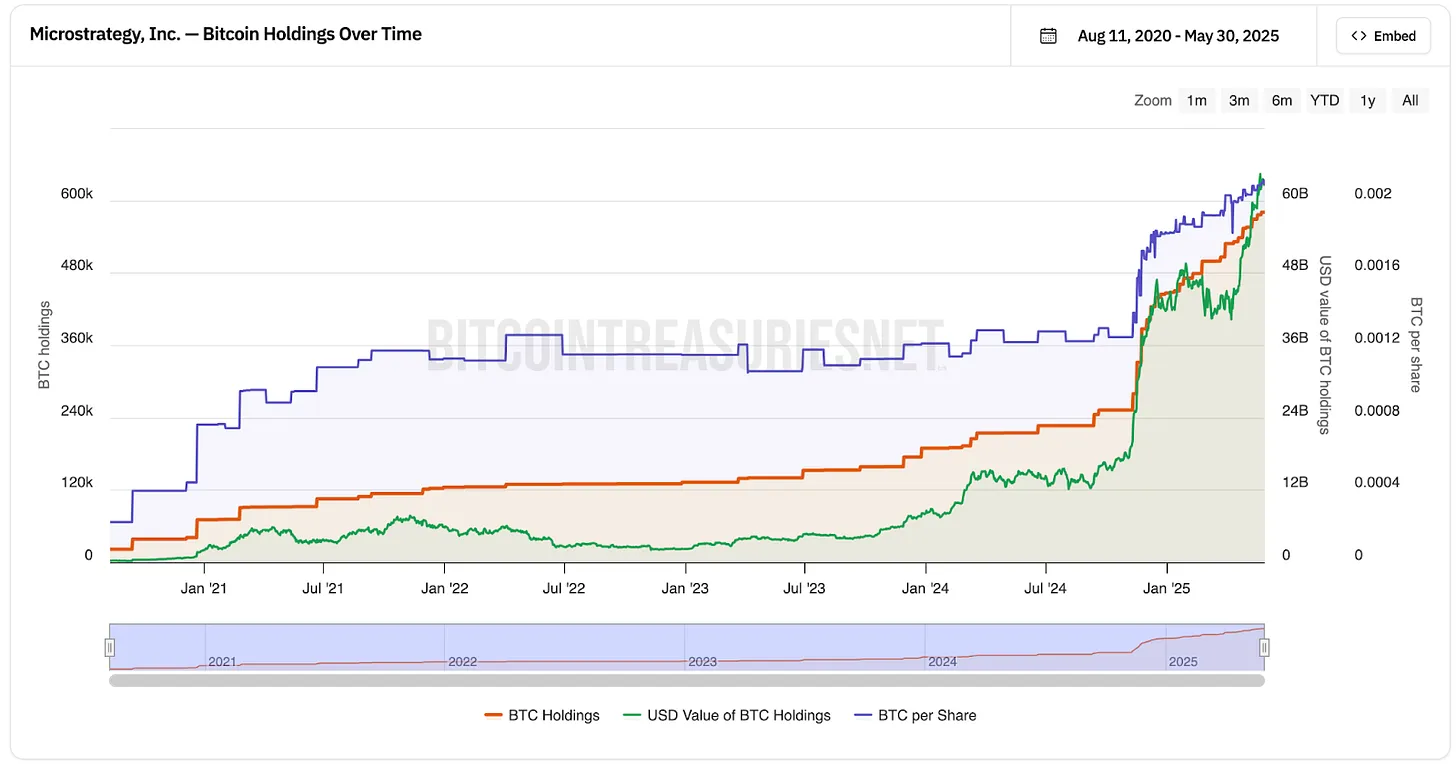

MicroStrategy began raising funds to buy Bitcoin in August 2020. Since then, the price of Bitcoin has soared from $11,500 to $108,000, an increase of about 9 times. At the same time, MicroStrategy's stock price has risen from $13 to $370, almost 30 times.

It’s worth noting that MicroStrategy’s regular business hasn’t grown at all. Their quarterly revenues are still between $100 million and $135 million, exactly the same as they have been in the past. The only change is that they borrowed money to buy Bitcoin. Currently, they hold 582,000 Bitcoins, worth about $63 billion. And their stock market value is about $109 billion, 73% higher than the actual value of their Bitcoin. Investors are willing to pay an extra premium just to indirectly hold Bitcoin through MicroStrategy’s stock.

Source: bitcointreasuries.net

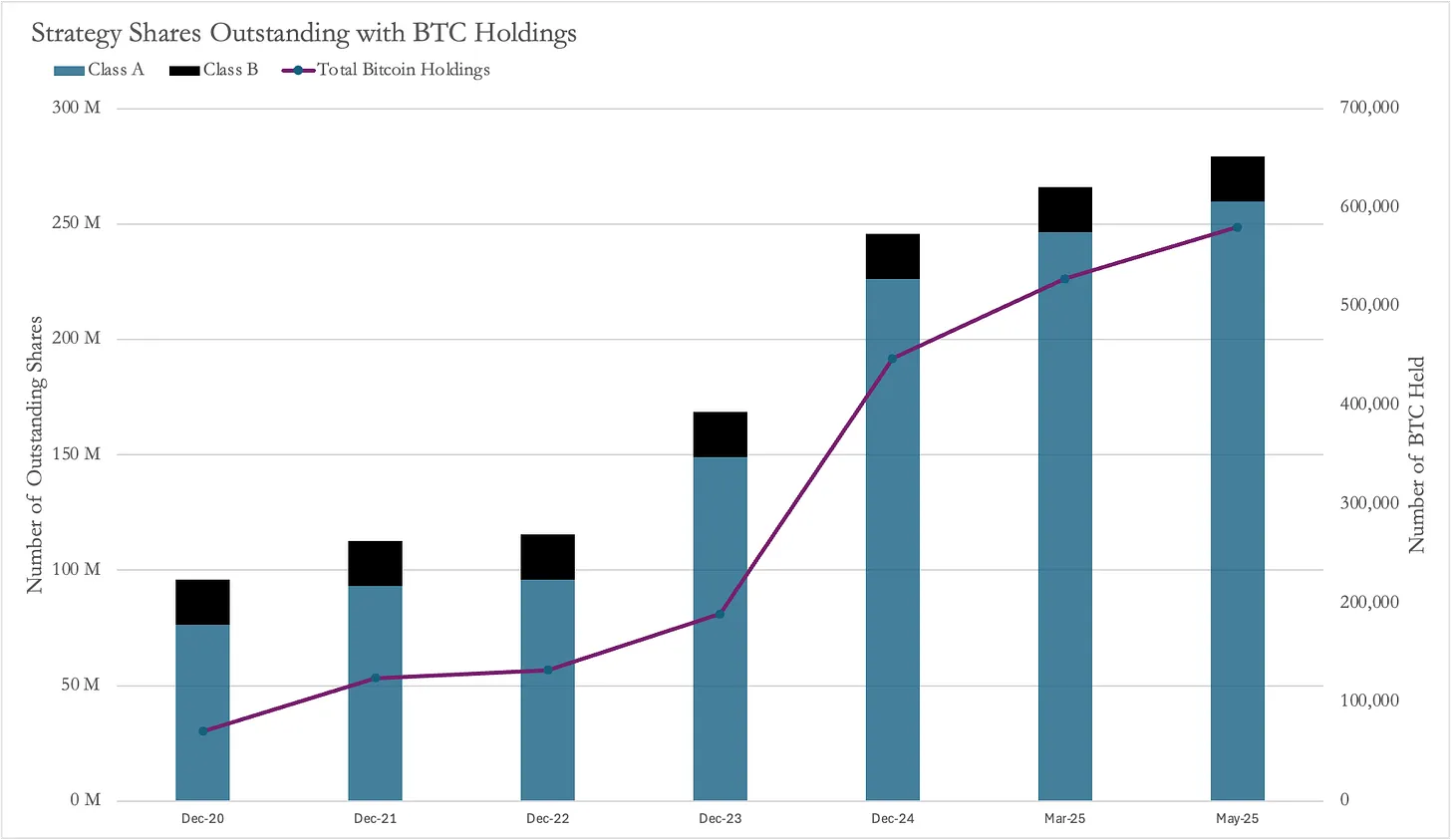

As mentioned before, MicroStrategy financed its Bitcoin purchases by issuing new shares. Since they began buying Bitcoin, the number of shares in the company has nearly tripled from 95.8 million to 279.5 million shares, an increase of 191%.

Source: MicroStrategy Documentation

Normally, issuing so many new shares would hurt existing shareholders, as everyone's share of the company would be diluted. However, even though the number of shares increased by 191%, the share price soared 2,900%. This means that even though shareholders own a smaller percentage of the company, each share is worth significantly more, and overall they still made a profit.

MicroStrategy's success model goes viral

Several companies have begun to follow MicroStrategy's successful model and hold Bitcoin as a company asset. One of the most recent cases is Twenty One (XXI). This is a special purpose acquisition company (SPAC) led by Jack Mallers, backed by Brandon Lutnick's (son of the US Secretary of Commerce) Cantor Fitzgerald, Tether and SoftBank. Unlike MicroStrategy, Twenty One is not listed. The only way to participate through the public market is through Cantor Equity Partners (CEP), which exchanged $100 million for a 2.7% stake in XXI.

Twenty One holds 37,230 Bitcoins. Since CEP owns 2.7% of Twenty One, this effectively means that CEP controls approximately 1,005 Bitcoins (worth approximately $108.5 million at $108,000 per Bitcoin).

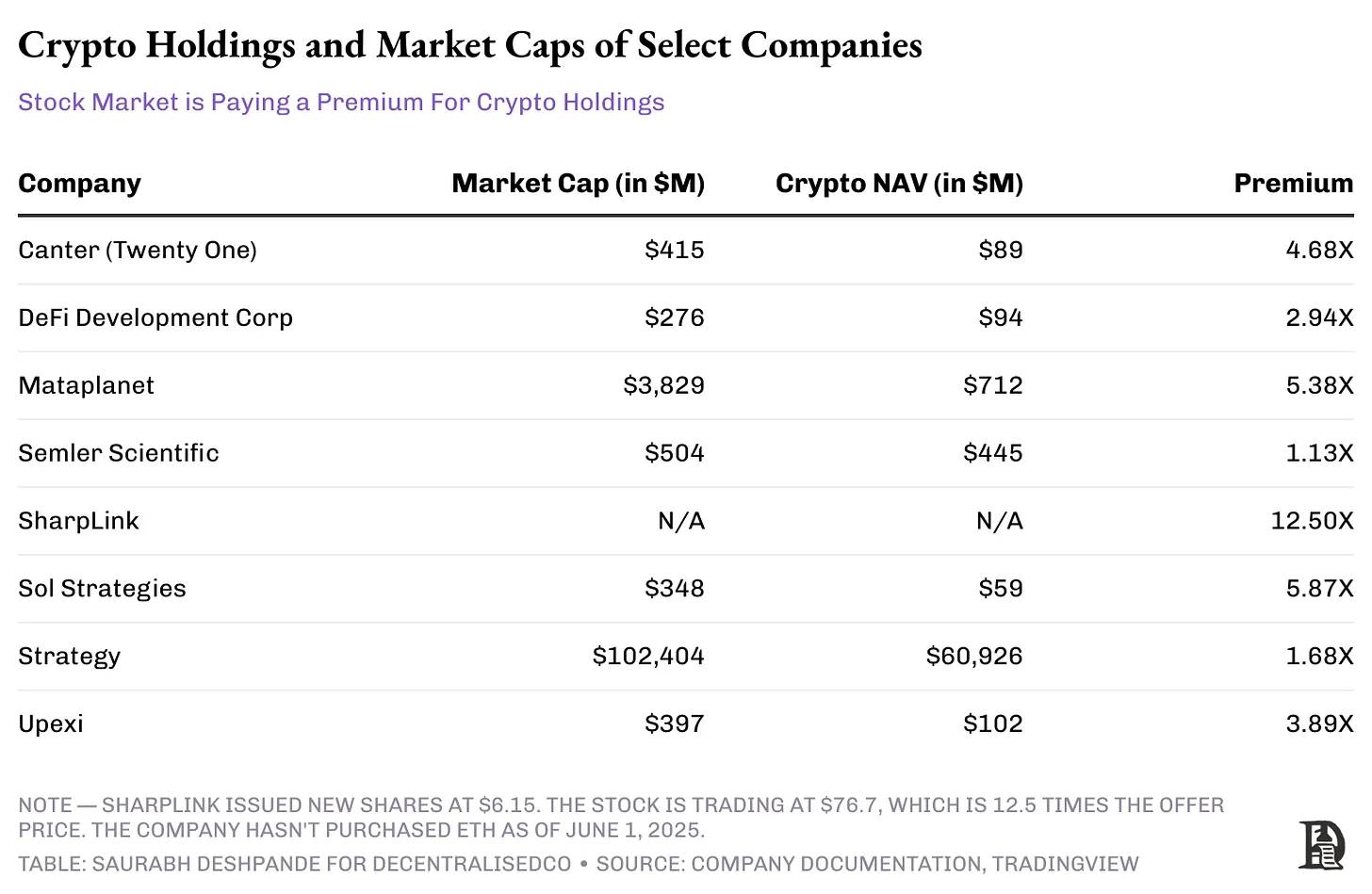

However, CEP’s stock market value is $486 million, 4.8 times the actual value of its Bitcoin! After its Bitcoin correlation was announced, CEP’s stock price soared from $10 to about $60.

This huge premium means that investors paid $433 million for $92 million of Bitcoin exposure. As more similar companies emerge and increase their Bitcoin holdings, market forces will eventually bring these premiums back to more reasonable levels, although no one knows when this will happen or what "reasonable levels" will be.

An obvious question is: Why are these companies trading at a premium? Why are investors willing to pay a premium to buy shares of these companies instead of buying Bitcoin directly from the market to gain exposure? The answer may lie in "optionality." Who is funding MicroStrategy's Bitcoin purchases? Mainly hedge funds that seek "delta-neutral strategies" by trading bonds.

If you think about it, this trade is very similar to Grayscale’s Bitcoin Trust (GBTC), which has also traded at a premium to Bitcoin in the past because it is closed-ended (investors cannot withdraw Bitcoin until it is converted into an ETF).

Therefore, investors will deposit Bitcoin with Grayscale and sell their publicly traded GBTC shares. As mentioned before, MicroStrategy bondholders can enjoy a compound annual growth rate (CAGR) of more than 9%.

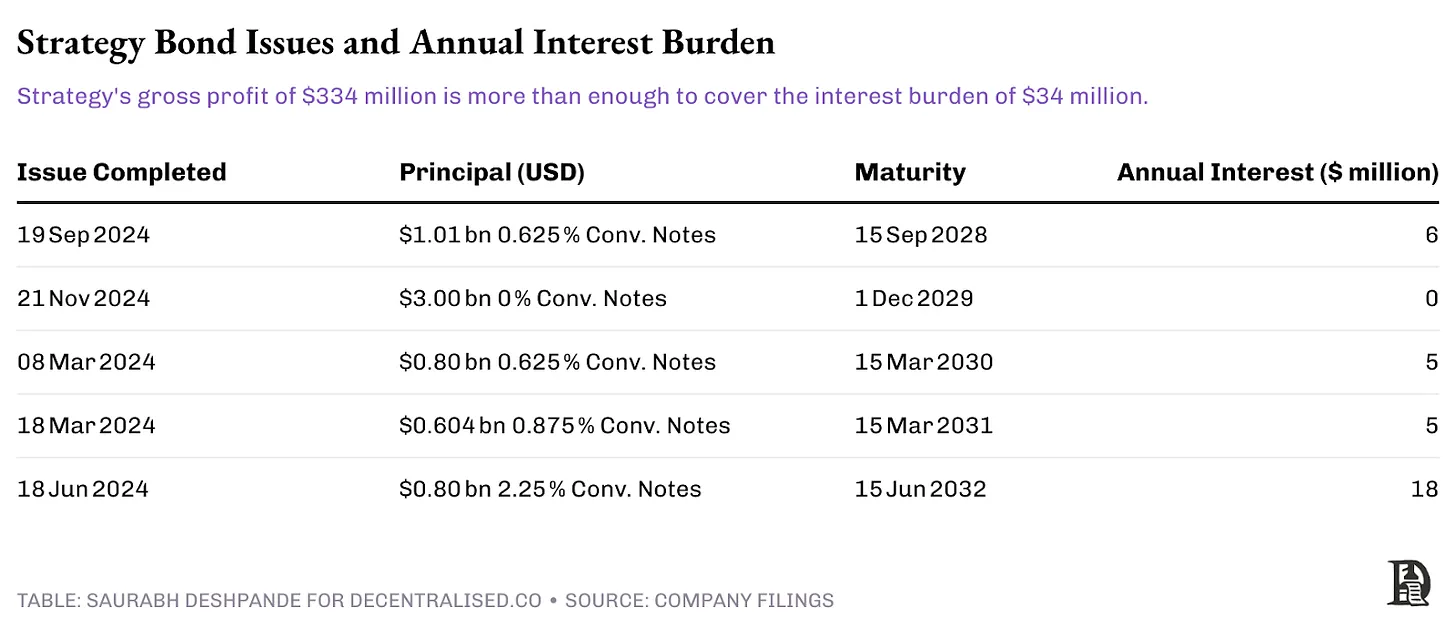

But how big is this risk? MicroStrategy's annual interest burden totals $34 million, and gross profit of $334 million in fiscal 2024 is more than enough to repay the debt. MicroStrategy issued convertible bonds tied to Bitcoin's four-year cycle, with maturities long enough to mitigate price decline risk. Therefore, as long as Bitcoin rises more than 30% in four years, the new stock issuance can easily cover the redemption costs.

When these convertible bonds are redeemed, MicroStrategy can simply issue new shares to bondholders. Bondholders will be paid based on a reference stock price at the time of issuance, which is about 30-50% higher than the stock price at the time the bonds were issued. This will only become a problem if the stock price falls below the conversion price. In this case, MicroStrategy must return cash, either by raising a new round of debt at more favorable terms to repay earlier debt, or by raising cash by selling Bitcoin.

Value Chain

The process apparently began with companies trying to acquire Bitcoin, but they ended up using exchanges and custodial services. For example, MicroStrategy is a Coinbase Prime customer, it purchased Bitcoin through Coinbase, and it stores Bitcoin in Coinbase Custody, Fidelity, and its own multi-signature wallet. While it is difficult to estimate exactly how much Coinbase earns from MicroStrategy's Bitcoin execution and storage, we can make some guesses.

Assuming an exchange like Coinbase charges 5 basis points for OTC executions to buy Bitcoin on MicroStrategy’s behalf, buying 500,000 Bitcoins at an average execution price of $70,000, they earn $17.5 million from executions. Bitcoin custodians charge annual fees of 0.2% to 1%. Assuming the low end of the range, storing 100,000 Bitcoins at $108,000, the custodian earns $21.6 million per year storing Bitcoin for MicroStrategy.

Beyond BTC

So far, financial instruments designed to provide exposure to Bitcoin (BTC) in capital markets have performed well. In May 2025, SharpLink raised $425 million in a round of private placement (PIPE) financing led by ConsenSys founder Joe Lubin, who also became the company's executive chairman. The financing issued approximately 69 million new shares at a price of $6.15 per share, and the funds will be used to purchase approximately 120,000 Ethereum (ETH) and may subsequently participate in staking. Currently, ETH exchange-traded funds (ETFs) do not allow staking.

This financial instrument that provides 3%-5% returns is more attractive than ETFs. Before the announcement, SharpLink's share price was $3.99, with a total market value of approximately $2.8 million and only 699,000 shares in circulation. The issue price of this financing is 54% higher than the market price. After the announcement, its share price soared to $124.

Notably, the 69 million new shares issued represent approximately 100 times the current number of shares outstanding.

Another company, Upexi, plans to acquire more than 1 million Solana (SOL) by the fourth quarter of 2025 while remaining cash flow neutral. The plan began with a private round of financing led by GSR, in which Upexi raised $100 million by selling 43.8 million shares. Upexi expects to pay preferred stock dividends through 6%-8% staking income and maximum extractable value (MEV) rebates, and self-fund future SOL purchases. On the day the news was released, its stock price soared from $2.28 to $22, and then closed at around $10.

Upexi had 37.2 million shares outstanding before the financing, so the newly issued shares caused about 54% dilution to old shareholders, but the nearly 400% surge in the stock price more than made up for the loss caused by the dilution.

Sol Strategies is another company that has raised funds through the capital markets to purchase SOL. The company operates a Solana validation node, and more than 90% of its revenue comes from staking rewards. Currently, the company has staked 390,000 SOL, and approximately 3.16 million SOL is entrusted to its nodes by third parties. In April 2025, Sol Strategies reached a convertible bond agreement with ATW Partners and obtained a financing line of up to US$500 million, of which the first US$20 million has been used to purchase 122,524 SOL.

Sol Strategies recently filed a shelf prospectus for an additional $1 billion in common stock (including an “at-the-market offering”), warrants, subscription receipts, units, debt securities, or any combination thereof. This provides the company with diverse financing flexibility.

Unlike MicroStrategy's convertible bond model, SharpLink and Upexi raise funds by directly issuing new shares. Personally, I think MicroStrategy's model is more suitable for investor groups with different goals. Compared with directly purchasing ETH or SOL, investors who gain exposure indirectly by purchasing stocks need to bear additional risks, such as the possibility that middlemen may leverage beyond the investor's risk tolerance. Therefore, unless there is additional service added value, it is more reasonable to adopt a convertible bond model with sufficient operating profit buffer to pay interest.

When the music stops

These convertible bonds are primarily aimed at hedge funds and institutional bond traders seeking asymmetric risk-return opportunities, rather than retail investors or traditional stock funds.

From their perspective, these financial instruments offer the option of "making big money if you win and limited losses if you lose", which fits their risk management framework very well. If Bitcoin achieves the expected 30%-50% increase in two to three years, they can choose to convert the bonds; if the market performs poorly, they can still recover 100% of the principal, although some value may be lost due to inflation.

The advantage of this structure is that it solves a real problem for institutional investors. Many hedge funds and pension funds lack the infrastructure to directly hold cryptocurrencies or cannot directly purchase Bitcoin due to investment restrictions. These convertible bonds provide them with a compliant "backdoor" into the crypto market while maintaining the downside protection required of fixed income assets.

However, this advantage is destined to be temporary. As regulation becomes clearer and more direct crypto investment tools emerge (such as custody solutions, regulated exchanges, and clearer accounting standards), the need for these complex detours will gradually decrease. The 73% premium that investors currently pay for Bitcoin exposure through MicroStrategy may shrink as more direct alternatives emerge.

We have seen similar situations before. In the past, opportunistic managers have taken advantage of the Grayscale Bitcoin Trust (GBTC) premium by buying Bitcoin and depositing it in Grayscale's trust, and then selling GBTC shares in the secondary market at a premium of 20%-50% above net asset value (NAV). However, as more and more people began to follow suit, by the end of 2022, GBTC's premium turned from its peak to a record 50% discount. This cycle shows that if there is no sustainable income to support repeated financing, the stock play backed by cryptocurrencies will eventually be arbitraged away by the market.

The key question is how long this can last and who will be left standing when the premium collapses. Companies with strong business fundamentals and conservative leverage may weather this shift, while those that lack durable revenue streams or competitive barriers and simply chase crypto assets may face a dilution-driven sell-off after the speculative craze subsides.

For now, the music is still playing and everyone is dancing. Institutional capital is pouring in, premiums are widening, and more and more companies are announcing Bitcoin and crypto asset strategies every week. However, smart investors know that this is a trade, not a long-term investment logic. The companies that survive will be those that use this window to create lasting value beyond their crypto holdings.

The transformation of corporate financial management may be permanent, but the extraordinary premiums we are seeing today are not. The question is whether you are ready to profit from this trend or are you just another player hoping to find a seat when the music stops.