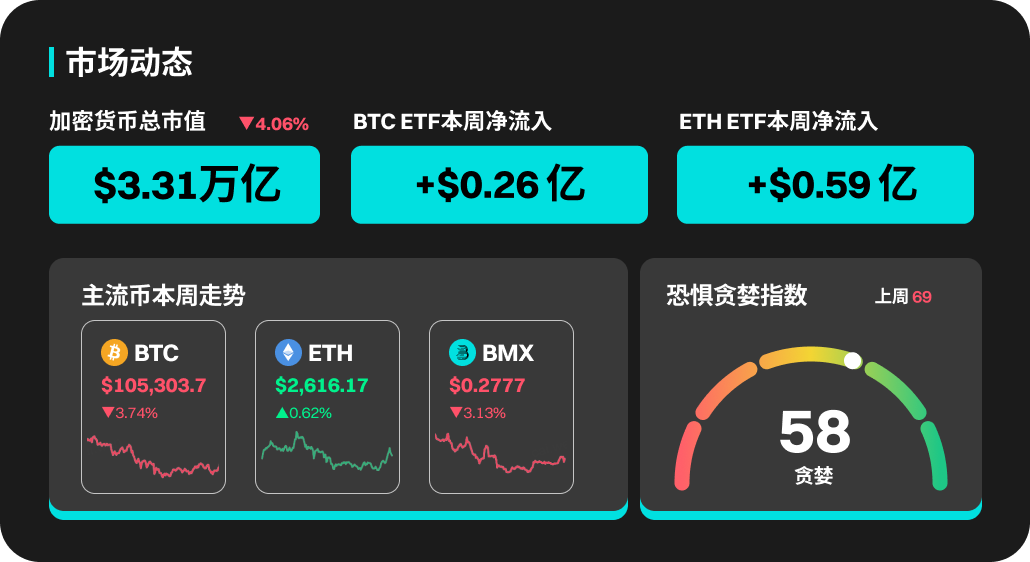

According to BitMart's market report on June 3, the total market value of cryptocurrencies in the past week was 3.31 trillion, down 4.06% from the previous week.

Crypto Market Updates This Week

Last week (2025.05.26-2025.06.01), despite the overall strong performance in May, with a net inflow of approximately US$5.23 billion, ETF fund outflows broke the six-week trend of net inflows this week, with a net outflow of approximately US$157.4 million. The price fell from approximately $109,431 on May 26 to approximately $106,795 on June 1, a weekly decline of approximately -2.91%.

Ethereum ETFs performed strongly last week, with a single-day net inflow of $91.9 million, of which BlackRock's ETHA accounted for $50.4 million and FETH accounted for $38.3 million. Throughout May, ETH ETFs had a cumulative net inflow of $564.18 million, setting a monthly high since 2025.

This week's popular coins

In terms of popular currencies, BOB, POKT, GASS, FLOCK and WHITE all performed well. BOB's price rose 448.29% this week, and its current market value is $41.06 M. POKT's price rose 314.44%, with the highest price being 0.08787 USDT. GASS's price rose 242.63%, and FLOCK and WHITE rose 173.7% and 169.67% respectively.

US market and hot news

The U.S. stock market had a strong week in the week ending May 30, 2025, with all three major indices recording significant gains. The Dow Jones Industrial Average rose 1.6%, the Nasdaq Composite rose 2.0%, and the S&P 500 rose 1.9%. This marked the third consecutive week of gains for stocks, driven primarily by slowing inflation data and improving consumer confidence.

Large technology stocks generally rose, with Apple (AAPL) up 2.5%, Tesla (TSLA) up 3.1%, and Nvidia (NVDA) up 4.2%. The three companies added more than $1.5 trillion in combined market value, reflecting investors' continued confidence in the technology sector.

The U.S. dollar index (DXY) fell 0.8% this week to 98.58, a six-week low, mainly due to growing concerns about slowing U.S. economic growth and trade policy uncertainty. The weakness of the dollar also prompted investors to seek safe-haven investments in other currencies and assets.

Overall, despite the risks of trade tensions and economic slowdown, U.S. stocks showed a strong rebound this week, showing the market's optimism about the future economic outlook.

US SEC postpones decision on physical redemption applications for WisdomTree and VanEck Bitcoin and Ethereum spot ETFs until June 3

South Korea's presidential election will be held on June 3, and 16 million crypto voters may influence key elections

The U.S. House Financial Services Committee will hold a second full hearing on June 4 regarding the structure of the crypto market and stablecoin regulation legislation.

The U.S. SEC Cryptocurrency Working Group will hold a public roundtable on "DeFi and the American Spirit" on June 6

Popular sections and projects unlocked

Ethena (ENA) will unlock approximately 40.63 million tokens at 3:00 pm Beijing time on June 2, accounting for 0.70% of the current circulation and worth approximately US$12.5 million.

Staika (STIK) will unlock approximately 1.57 million tokens at 8:00 am Beijing time on June 2, worth approximately $1.4 million

Cetus Protocol (CETUS) will unlock approximately 8.33 million tokens at 8:00 am Beijing time on June 4, accounting for 1.15% of the current circulation and worth approximately US$1.1 million.

Eigenlayer (EIGEN) will unlock approximately 1.29 million tokens at 3:00 a.m. Beijing time on June 4, accounting for 0.42% of the current circulation and worth approximately $1.7 million.

IOTA (IOTA) will unlock about 8.63 million tokens at 8:00 am Beijing time on June 4, accounting for 0.23% of the current circulation and worth about $1.6 million.

Taiko (TAIKO) will unlock approximately 81.55 million tokens at 8:00 pm Beijing time on June 5, accounting for 69.37% of the current circulation and worth approximately US$46.9 million.

Neon (NEON) will unlock approximately 53.91 million tokens at 8:00 am Beijing time on June 7, accounting for 22.51% of the current circulation and worth approximately US$6.1 million.

The Meme sector rose 5.04%, while Pepe (PEPE), dogwifhat (WIF), and SPX 6900 (SPX) rose 8.20%, 11.43%, and 15.14%, respectively.

Risk Tips:

Use of BitMart services is entirely at your own risk. All cryptocurrency investments (including earnings) are highly speculative in nature and involve substantial risk of loss. Past, hypothetical or simulated performance is not necessarily indicative of future results.

The value of digital currencies may go up or down, and there may be substantial risk in buying, selling, holding or trading digital currencies. You should carefully consider whether trading or holding digital currencies is appropriate for you based on your personal investment objectives, financial situation and risk tolerance. BitMart does not provide any investment, legal or tax advice.