Dear readers, welcome to the weekly cryptocurrency summary of Gryphsis Academy. We bring you key market trends, in-depth insights into emerging protocols, and fresh industry news, all aimed at enhancing your expertise in cryptocurrencies and Web3. Enjoy your reading! Follow us on Twitter and Medium for deeper research and insights.

Market and Industry Snapshot

Layer 2 Overview:

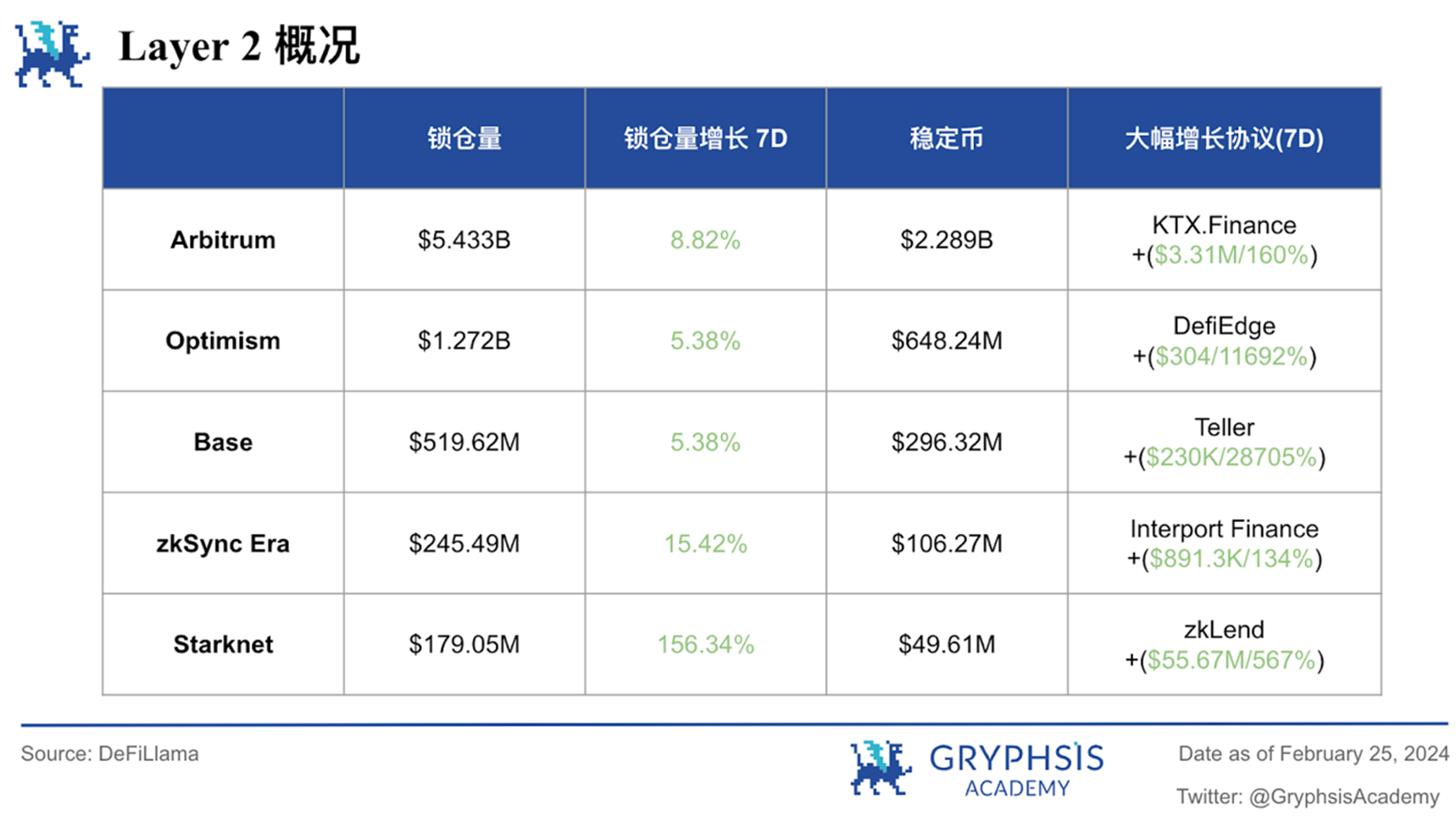

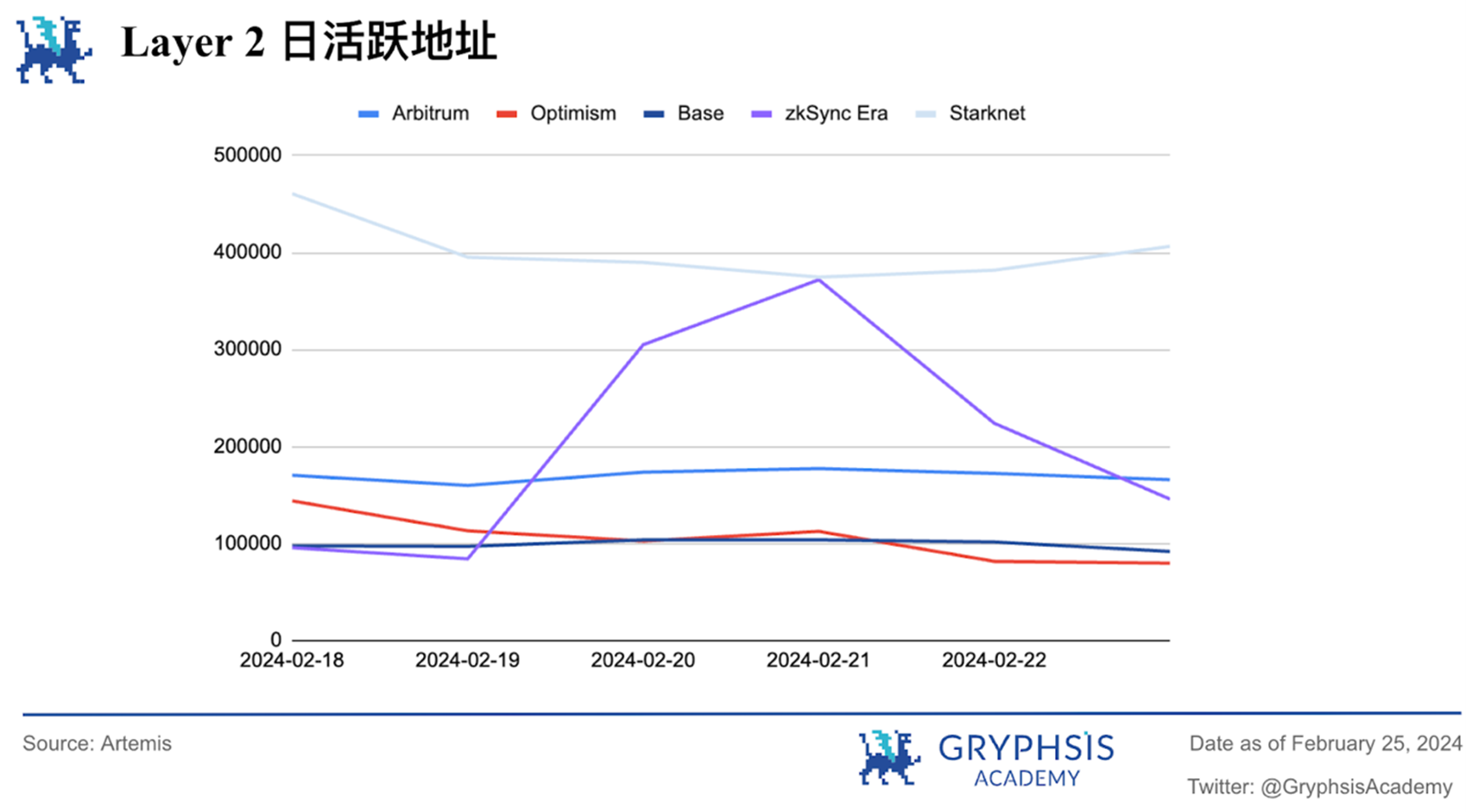

Last week, Layer 2 solutions showed positive growth, with Starknet and zkSync Era experiencing significant increases of 156.34% and 15.42%, respectively. Protocols like KTX.Finance, DefiEdge, Teller, Interport Finance, and zkLend demonstrated notable growth in TVL (Total Value Locked).

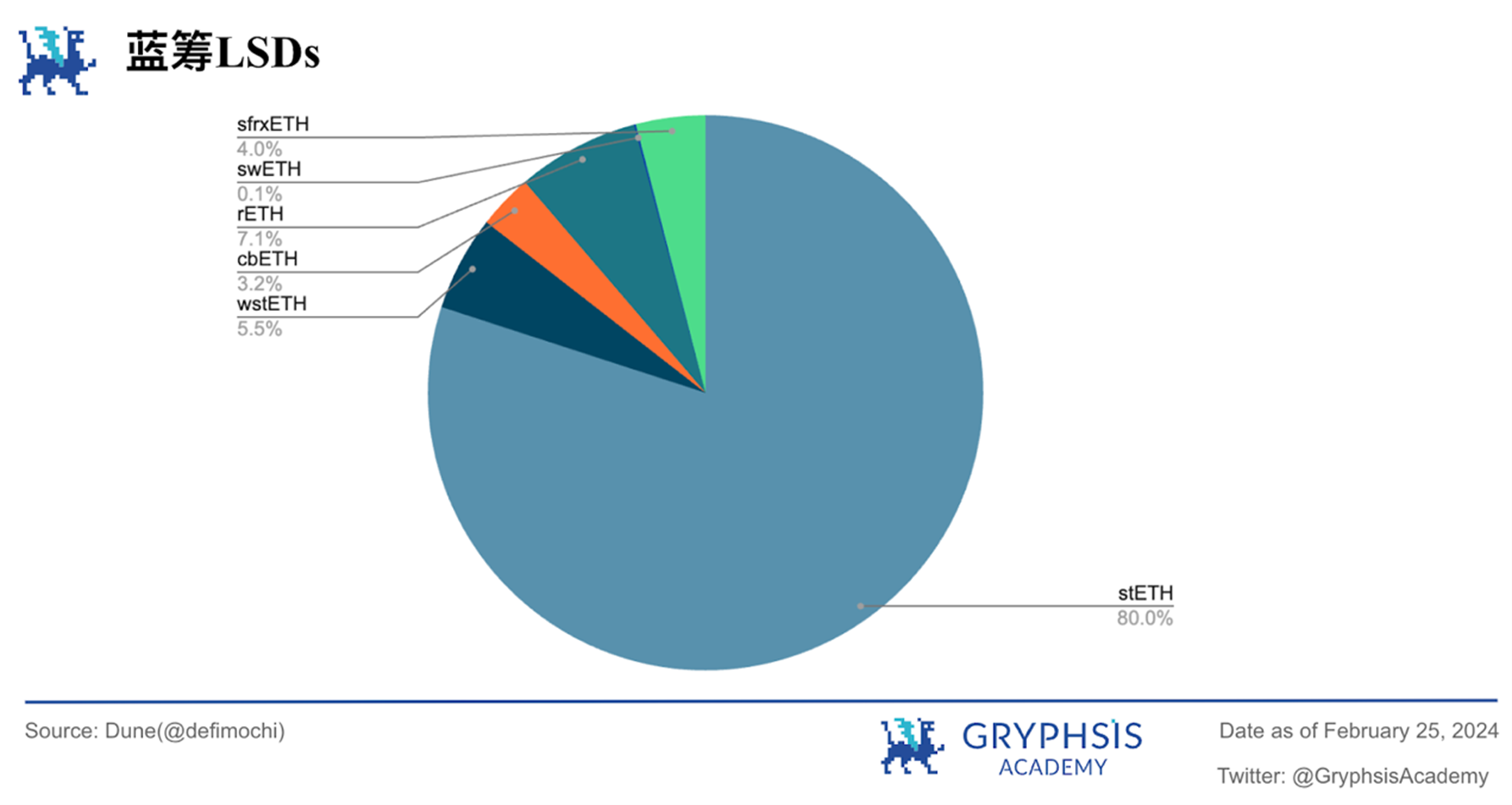

LSD Sector Overview:

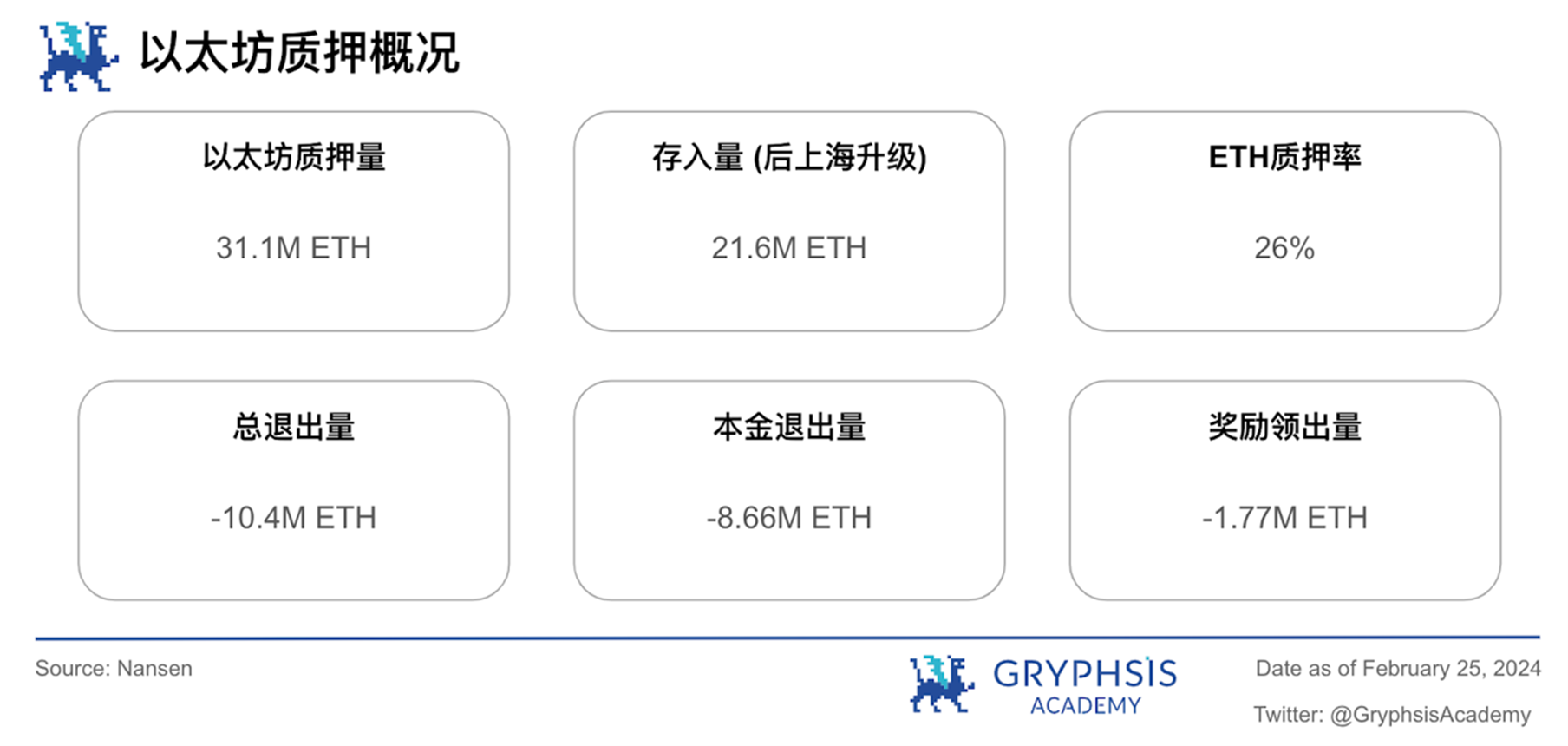

In the LSD sector, Ethereum deposits increased by 0.65%, while total withdrawals decreased by 1.92%. In terms of market share, all major blue-chip LSD tokens experienced growth, with swETH and stETH showing the most significant increases at 25% and 9.42%, respectively.

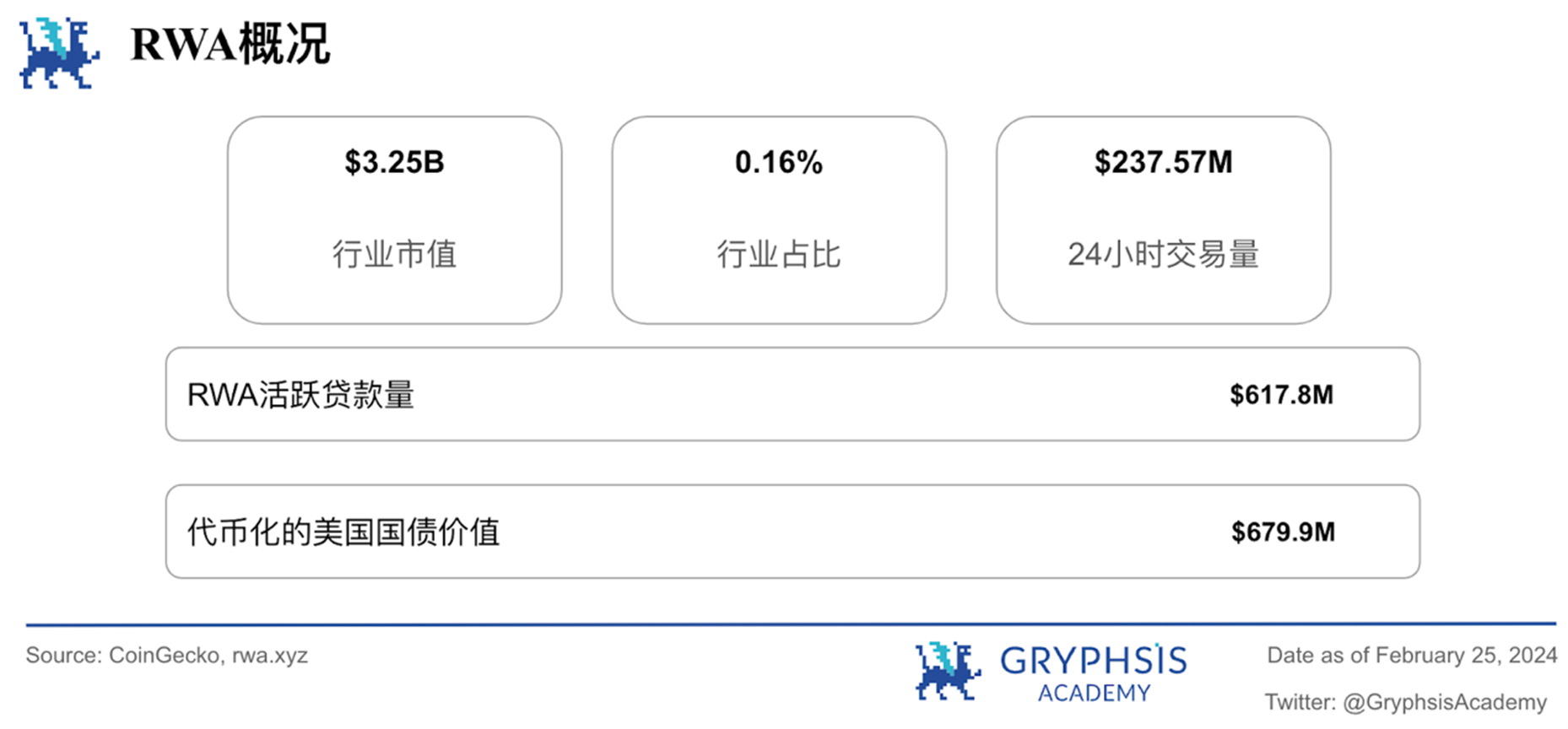

RWA Sector Overview:

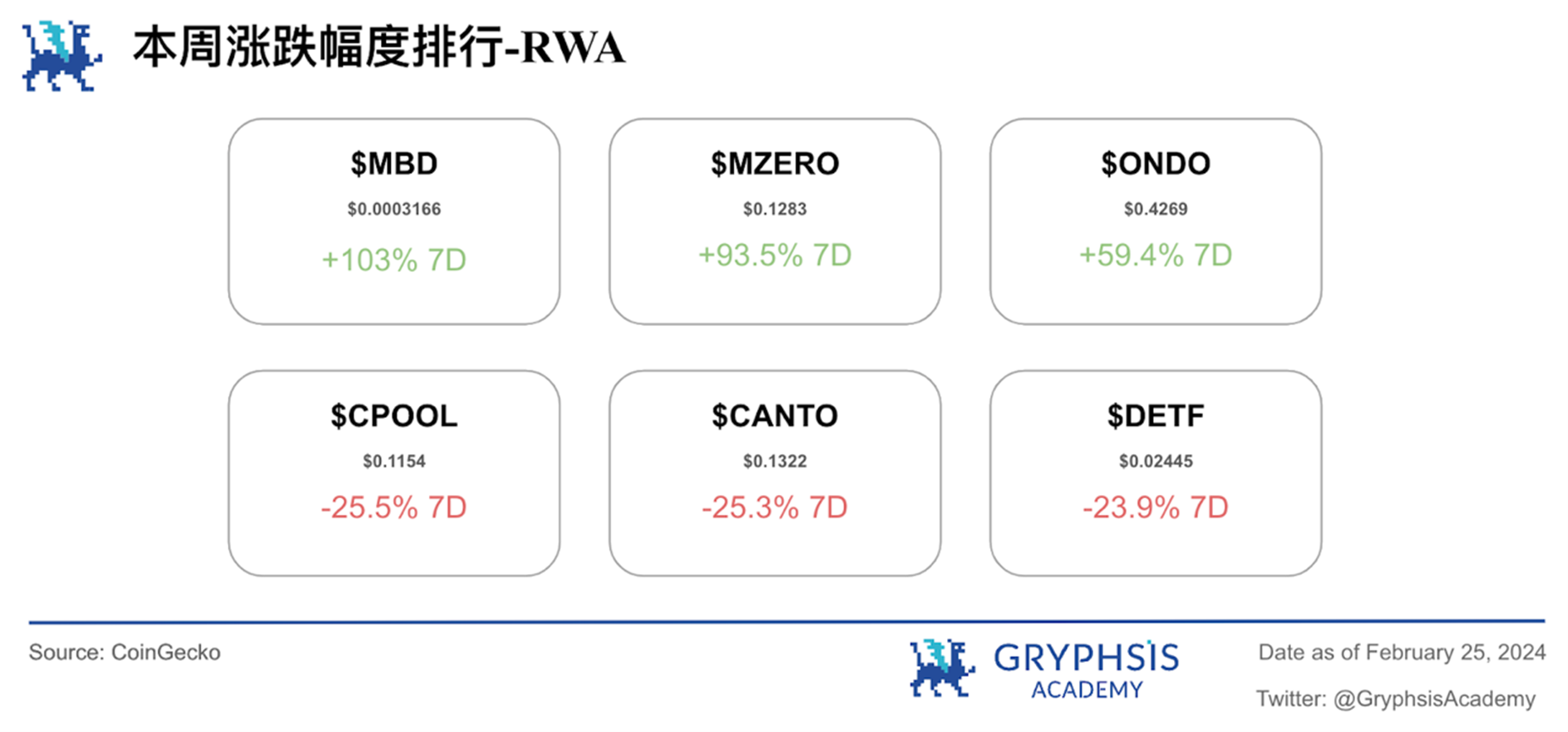

Last week, the global real asset market value increased by 12.07%, and the 24-hour trading volume increased by 24.16%. RWA tokenized treasuries increased by 0.23%, and tokenized US government bond value increased by 0.91%. Notable growth tokens include $MBD, $MZERO, and $ONDO, while tokens such as $CPOOL, $CANTO, and $DETF experienced significant losses.

Main Topics

Macro Overview:

US Stock V.S. Crypto

Key Events This Week:

Nvidia announces earnings beat, AI-related crypto tokens surge

Weekly Protocol Recommendation:

Bluefin

Weekly VC Investment Focus:

Flare ($35M)

OX.FUN ($4M)

Superfluid ($5.1M)

Twitter Alpha:

@DeRonin_ on $STRK

@TheDeFISaint on Near Protocol

@malviya 9 on zkML

@francesco web3 on Frax Finance

@cyrilXBT on AI

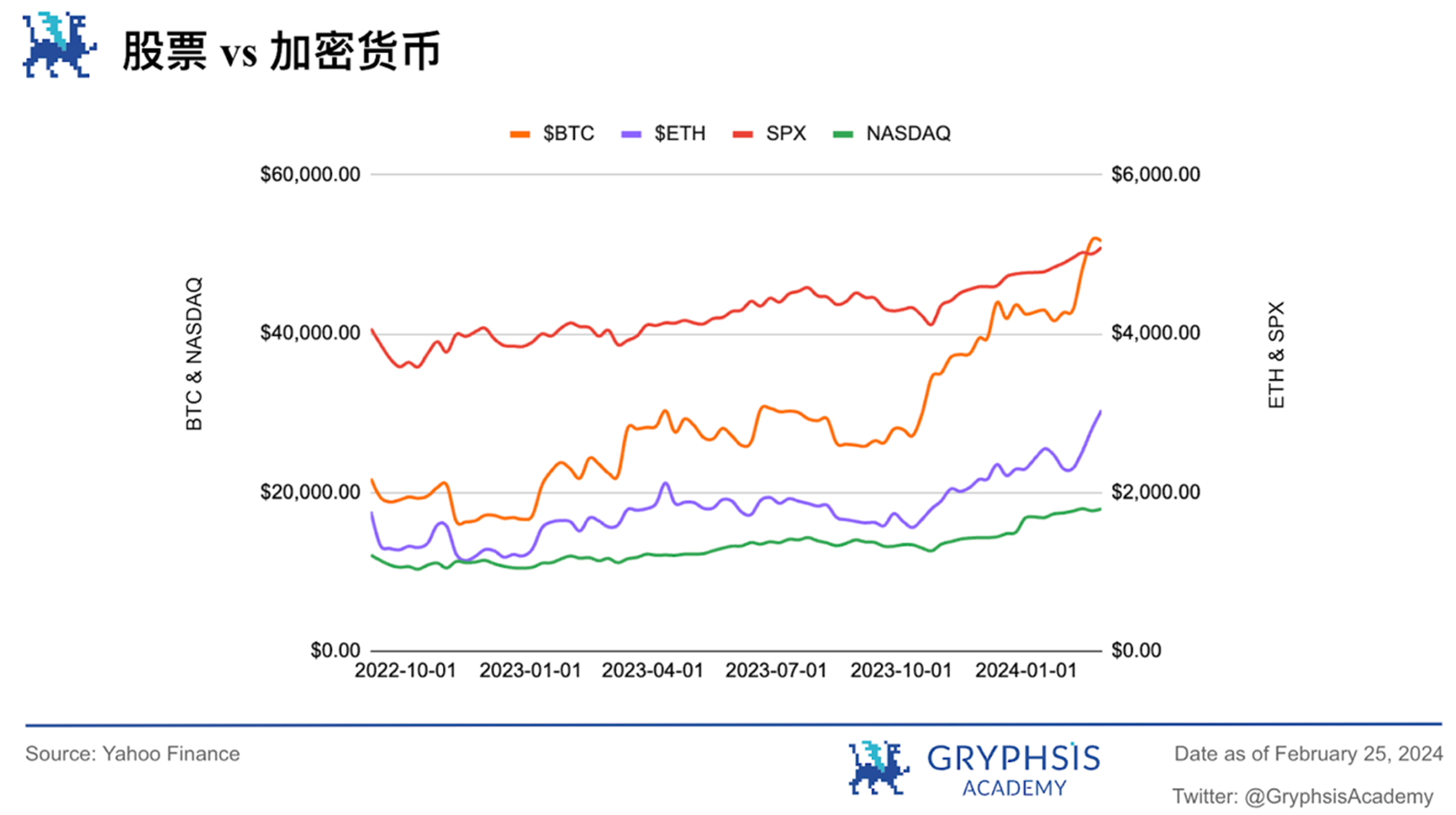

Macro Overview

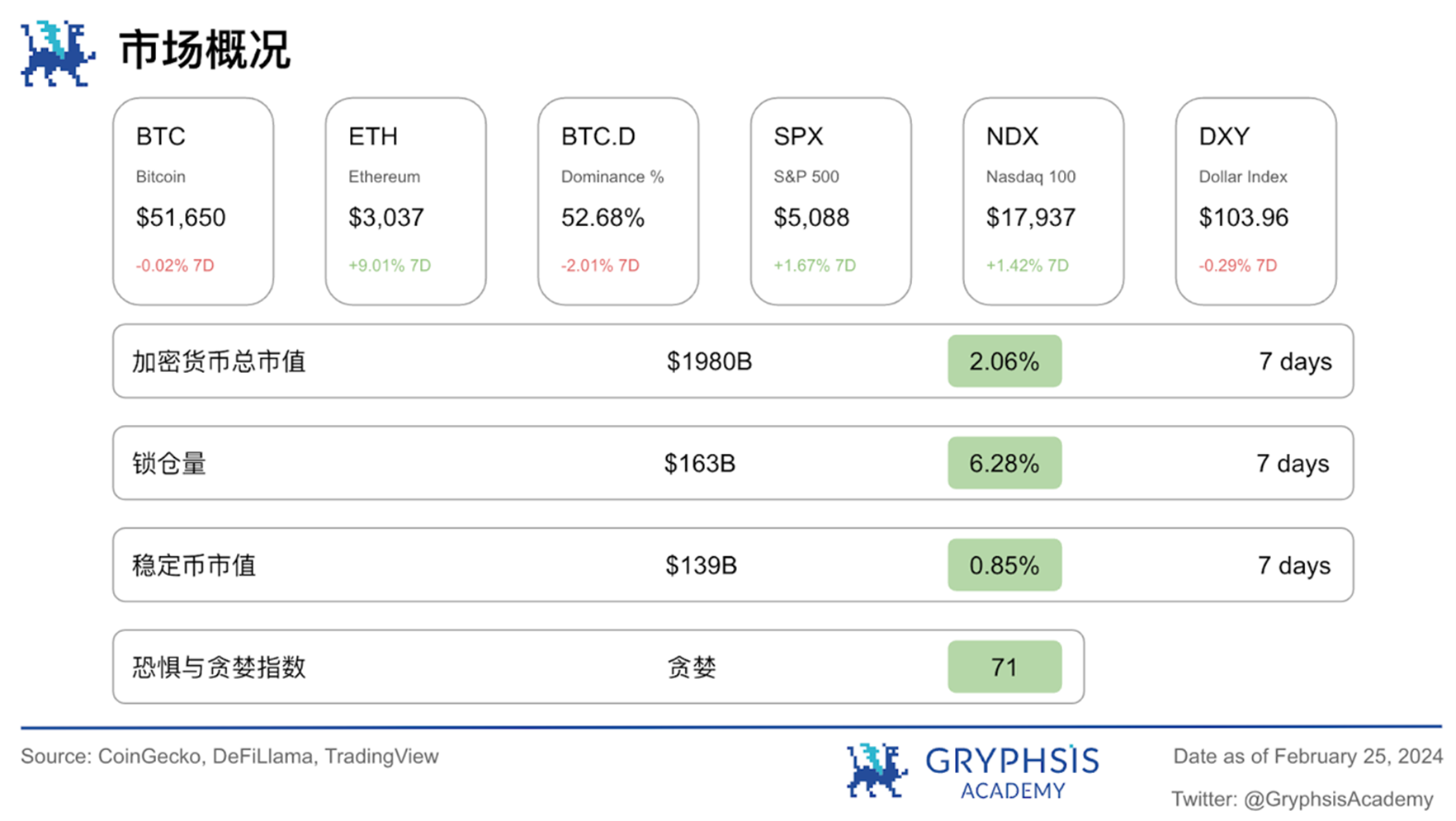

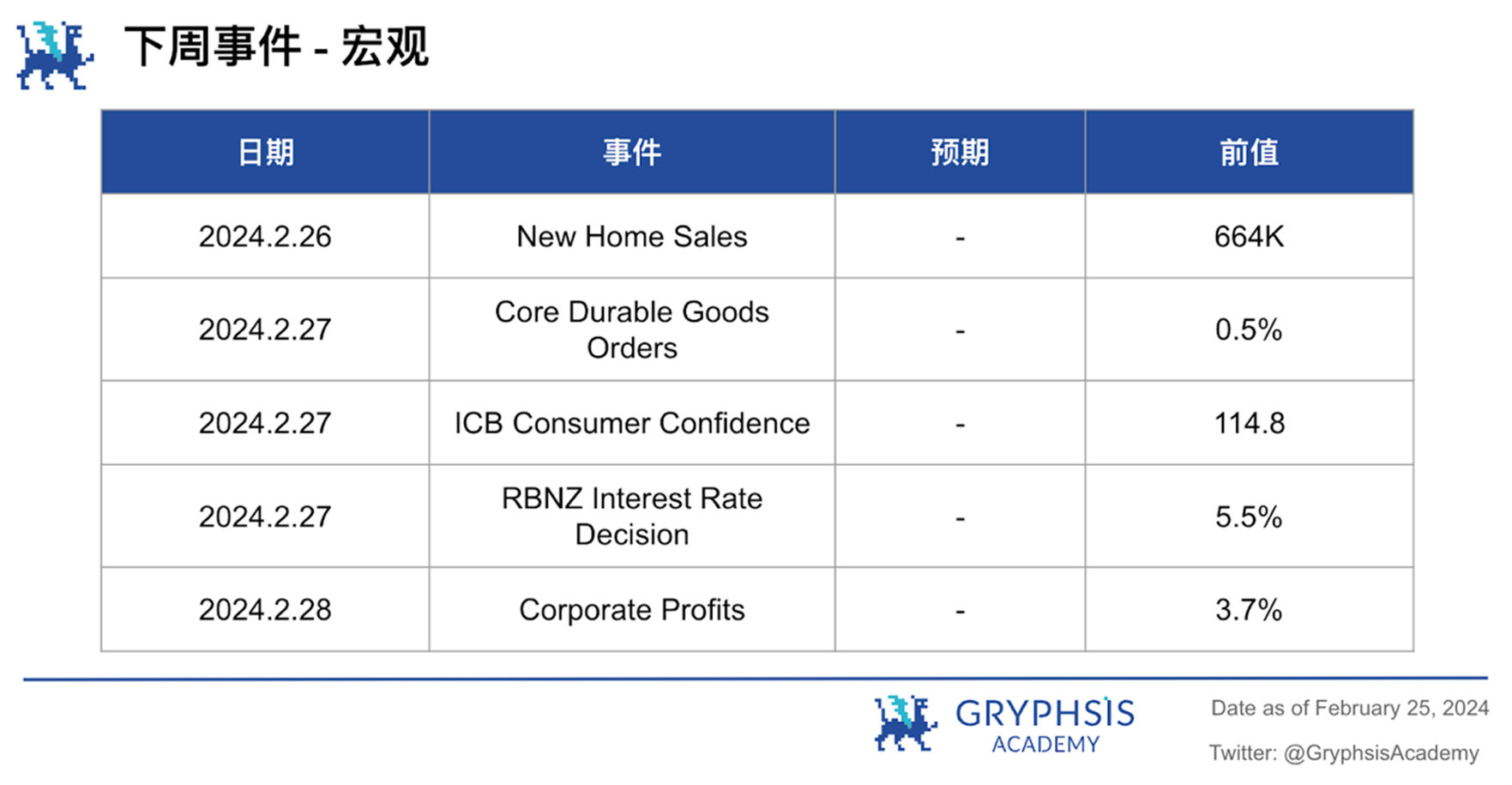

This week, the stock market levels SPX and NASDAQ rose by 1.67% and 1.42% respectively. In the coming week, major events to watch out for include new home sales, core durable goods orders, ICB consumer confidence, Reserve Bank of New Zealand interest rate decision, and corporate profits.

Key Events this Week

Crypto tokens related to AI experience a surge after Nvidia announces earnings beat

Chip-making giant Nvidia (NVDA) announced better-than-expected earnings for the fourth quarter, boosting not only the broader stock market but also tokens related to artificial intelligence (AI).

Nvidia said on Wednesday that its fourth-quarter earnings per share were $5.16, surpassing the average analyst estimate of $4.59 as per FactSet data. The chip manufacturer also reported revenue of $22.1 billion, higher than the Wall Street's expectation of $20.4 billion.

After Nvidia announced its earnings, the price of AI tokens soared. SingularityNet (AGIX) rose more than 20%, FetchAI (FET) rose more than 10%, and Render (RNDR) rose 8%. According to CoinGecko, the overall market value of AI tokens has exceeded $16.5 billion.

In contrast, the CoinDesk 20 (CD 20), which is the benchmark for the largest and most liquid cryptocurrencies, fell 2.7%.

"Accelerated computing and generative AI have reached a turning point. The demand from companies, industries, and countries around the world is surging," said NVIDIA's founder and CEO Jensen Huang.

Nvidia also predicted first-quarter revenue of $24 billion, surpassing analyst estimates of $22.2 billion. The company's stock has risen over 200% in the past year, with a market value at one point close to $1.7 trillion, surpassing tech giants like Amazon and Google, due to its chips driving the pace of the artificial intelligence (AI) revolution. This surge has been so hot that Goldman Sachs even called it the "most important stock on Earth."

In after-hours trading on Wednesday, the chip manufacturer's stock rose more than 7%, while S&P 500 futures rose 0.5% and Bitcoin fell 1.2%.

Weekly Protocol Recommendation

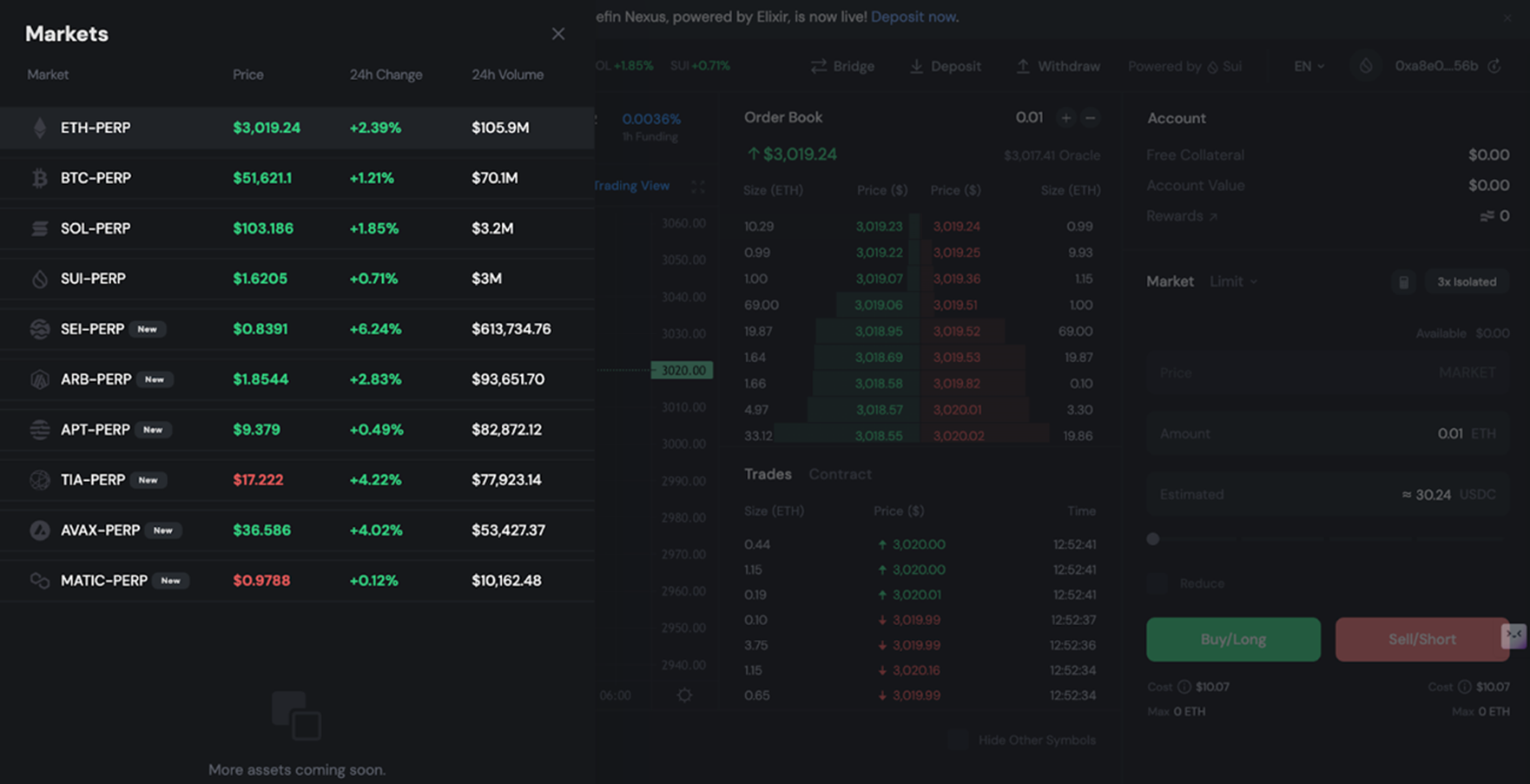

Welcome to our weekly protocol segment, where we will focus on the protocols making waves in the crypto space. This week, we have chosen Bluefin, a decentralized perpetual contract exchange based on the order book model.

Formerly known as Firefly Exchange, Bluefin is currently a perpetual exchange exclusive to the Sui chain. Bluefin utilizes the order book model to provide all users with a low-latency and free order placement experience similar to CEX in DeFi.

The official rebuilt the code repository in 23 years and completed the release of Version 2. Bluefin v2 is built on Sui and provides traders with higher performance, lower costs, and a more Web2-like user experience. Bluefin v2 introduces:

Optimism transaction confirmation + on-chain finality: Because Sui does not require complete sorting of all transactions (only relative sorting of causally related transactions), it supports parallel execution.

Wallet-less transaction experience: Allows users to log in with social accounts like Google, Apple, etc.

Spot trading using Sui's on-chain order book

New margin engine with cross-asset margining capability

High TPS: Peak throughput on the mainnet reached 5,400 TPS and in a series of tests, throughput peak ranged from 10,871 TPS to 297,000 TPS.

To incentivize user participation in the V2 version, the official launched the Initial Trade & Earn Program, where participants can enjoy a 6% allocation of the total supply of $BLUE. The event will end on March 30, 2024, and a long-term incentive plan will be launched afterwards. Users can start trading by depositing USDC.e, and all users who use the product for the first time will receive 0.2 $SUI as GAS support for depositing/withdrawing, opening/closing positions, adjusting leverage, and other transaction actions.

Source: Official Website

Users can also participate in the referral program and provide additional rewards to users through mutual recommendations. It serves as an additional reward distribution of $BLUE for trading and earning rewards. The rewards will be distributed after a one-week waiting period following the end of each 14-day epoch. At the end of each epoch, all referred users will receive a 10% Boost reward on the rewards they have accumulated through the trading and earning program. Additionally, referrers will also receive a 10% Boost reward from the trading and earning rewards of their referred users.

Our Insight

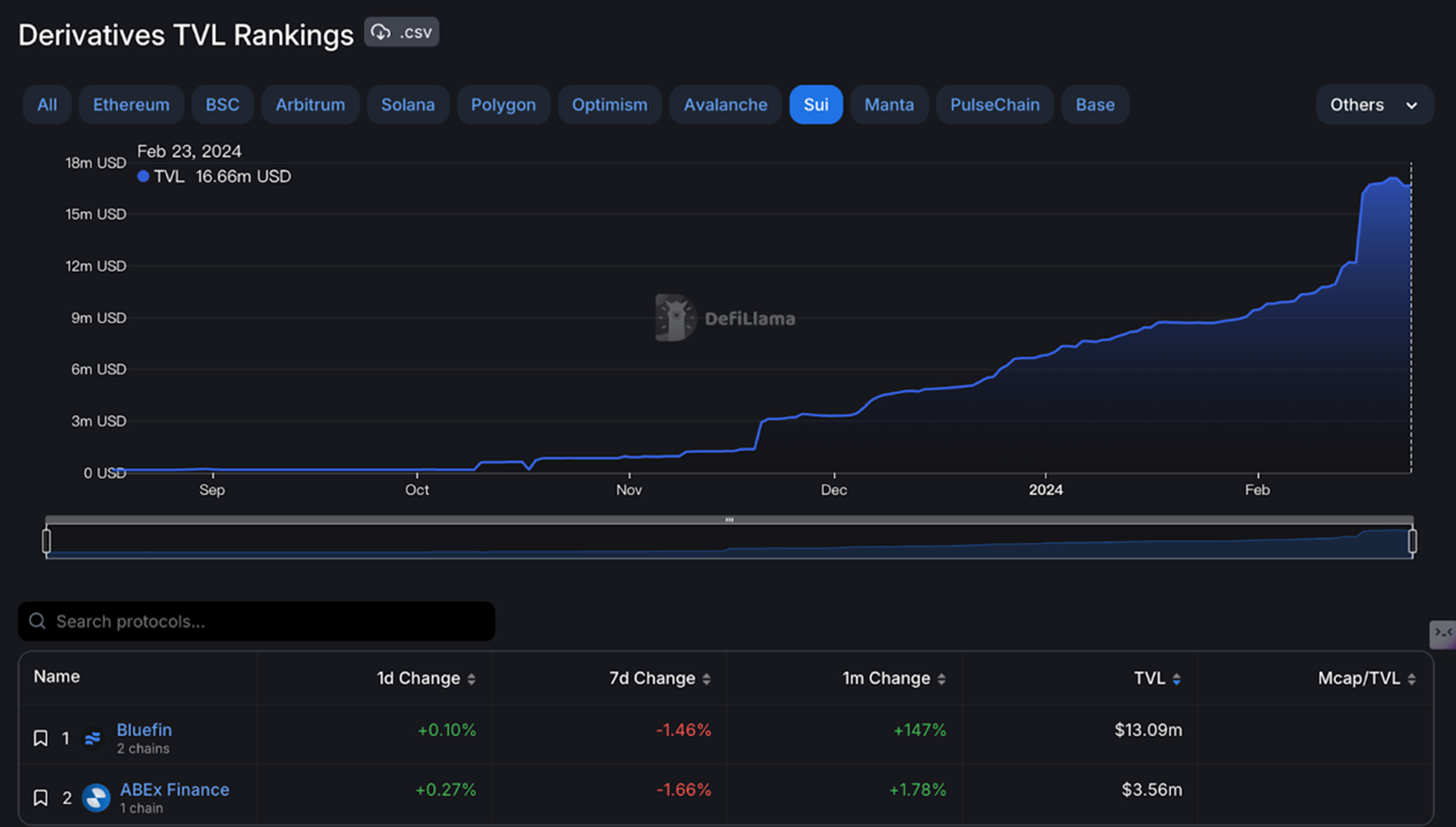

Bluefin had a total trading volume of $5.9B in the past year, with a monthly high of $3.2B and a daily high of $401.4M. The current TVL is 15.29M, and the annual transaction fee is 19.18M. On the Sui network, it currently ranks first in the perpetual track, with its only competitor being ABEx Finance. The track has a large space for improvement, and Bluefin has already established itself as a leader.

Source: Defillama

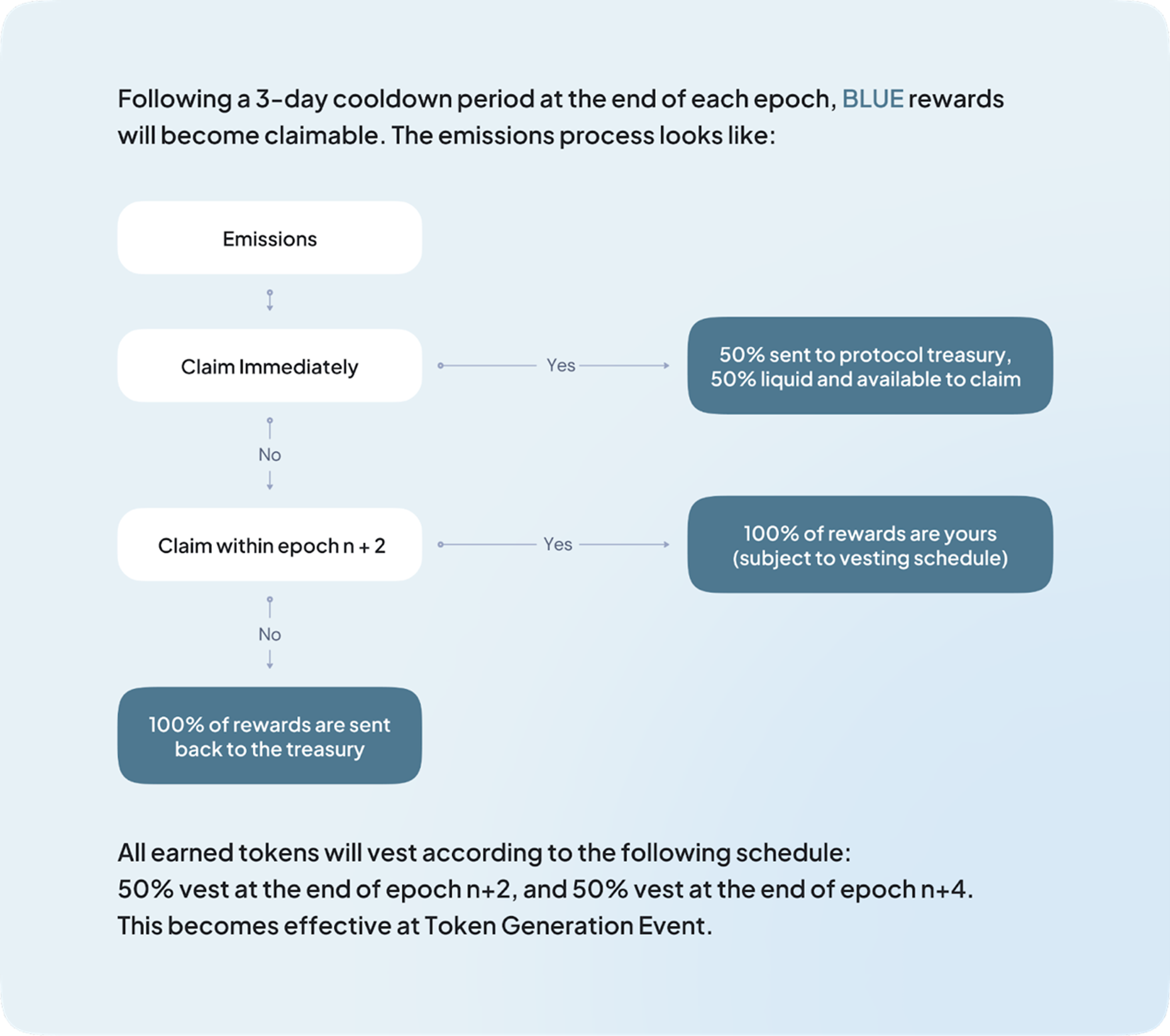

Currently, there are no specific details about its economic model, but its launch of the Initial Trade & Earn program is worth paying attention to. Each Epoch lasts for 14 days, with a reward of 1.79M $BLUE+ 119K $SUI as incentives.

After each Epoch, there will be a three-day cooldown period. Users can immediately claim 50% of the rewards after the cooldown period ends, while the remaining rewards will be locked in the protocol's Vault. If users want to claim the full rewards, they can gradually unlock them within the following 2 Epochs. If not claimed completely, the rewards will be sent to the protocol's treasury.

Source: Documentation

The event will end in one month, and it is speculated that Bluefin's token will be released shortly after. With the rapid growth of Sui, establishing itself as a top-tier public chain, Bluefin, as a leading perpetual exchange, is likely to become one of the most popular trading platforms in the Sui ecosystem.

Due to its innovative trading mechanism and user-friendly reward program, Bluefin is expected to attract a large number of traders and liquidity providers. As its user base grows and trading volume increases, the demand for its token's application scenarios expands, making its future actions worth further attention.

Weekly VC Investment Focus

Welcome to our weekly investment focus, where we reveal the most significant venture capital dynamics in the crypto space. Each week, we will focus on protocols that have received the most funding.

Flare

@FlareNetworks is a Layer-1 blockchain that enables secure and interoperable communication between chains, expanding the use of blockchain by allowing free flow of all digital assets and on-chain information. Its consensus protocol for external data allows decentralized applications on Flare to securely and trustlessly access and use information from other blockchains and real-world data sources, solving the oracle problem and ushering in a practical new era.

https://x.com/FlareNetworks/status/1761044910537327092?s=20

OX.FUN

@OXFUNHQ is a platform for trading cryptographic derivatives. OX is the core element of the gamified experience. FUN revolves around the OX farms. Users can also expect leaderboards, competitions, and copy trading vaults to maximize trading adventures.

https://x.com/OXFUNHQ/status/1760960909487624696?s=20

Superfluid

@Superfluid_HQ is a Web3 stream payment protocol for processing subscriptions, wages, rewards, or any other composable value streams on a per-second basis. Its core function is "streaming" payments, where funds flow in real-time from one address to another based on programmable logic and a single on-chain transaction.

https://x.com/Superfluid_HQ/status/1760699706458685942?s=20

Protocol Events

Magic Square, a Binance Labs-backed web3 app store acquires token launchpad TruePNL

Uniswap Foundation proposal suggests turning on rewards for UNI token holders

Uniswap rolls out 'uni.eth' subdomains using ENS infrastructure

Worldcoin surges 40% in 24 hours, leadership hints "major announcements" coming

Lido adds 1inch for faster withdrawals of stETH and wstETH

Industry Update

Ethena captures 5% of ether perpetual futures open interest; founder downplays concerns

Bitcoin miner Riot Platforms generated record $ 281 million total revenue in 2023

Spot Bitcoin ETF cumulative trading volume exceeds $ 50 billion

Kraken seeks to dismiss SEC lawsuit, says claim was 'retaliation' for political remark

FalconX expands into Hong Kong as institutional demand rises

Twitter Alpha

There are many Alphas hidden in CryptoTwitter, but navigating through thousands of tweet threads can be difficult. Every week, we spend hours researching and curating a selected list of insightful threads for you. Let's dive in!

https://x.com/DeRonin_/status/1760370423257034956?s=20

https://x.com/TheDeFISaint/status/1761386296444879033?s=20

https://x.com/hmalviya9/status/1761320769164886096?s=20

https://x.com/francescoweb3/status/1761020707562295773? s= 20

https://x.com/cyrilXBT/status/1761464440233361817?s=20

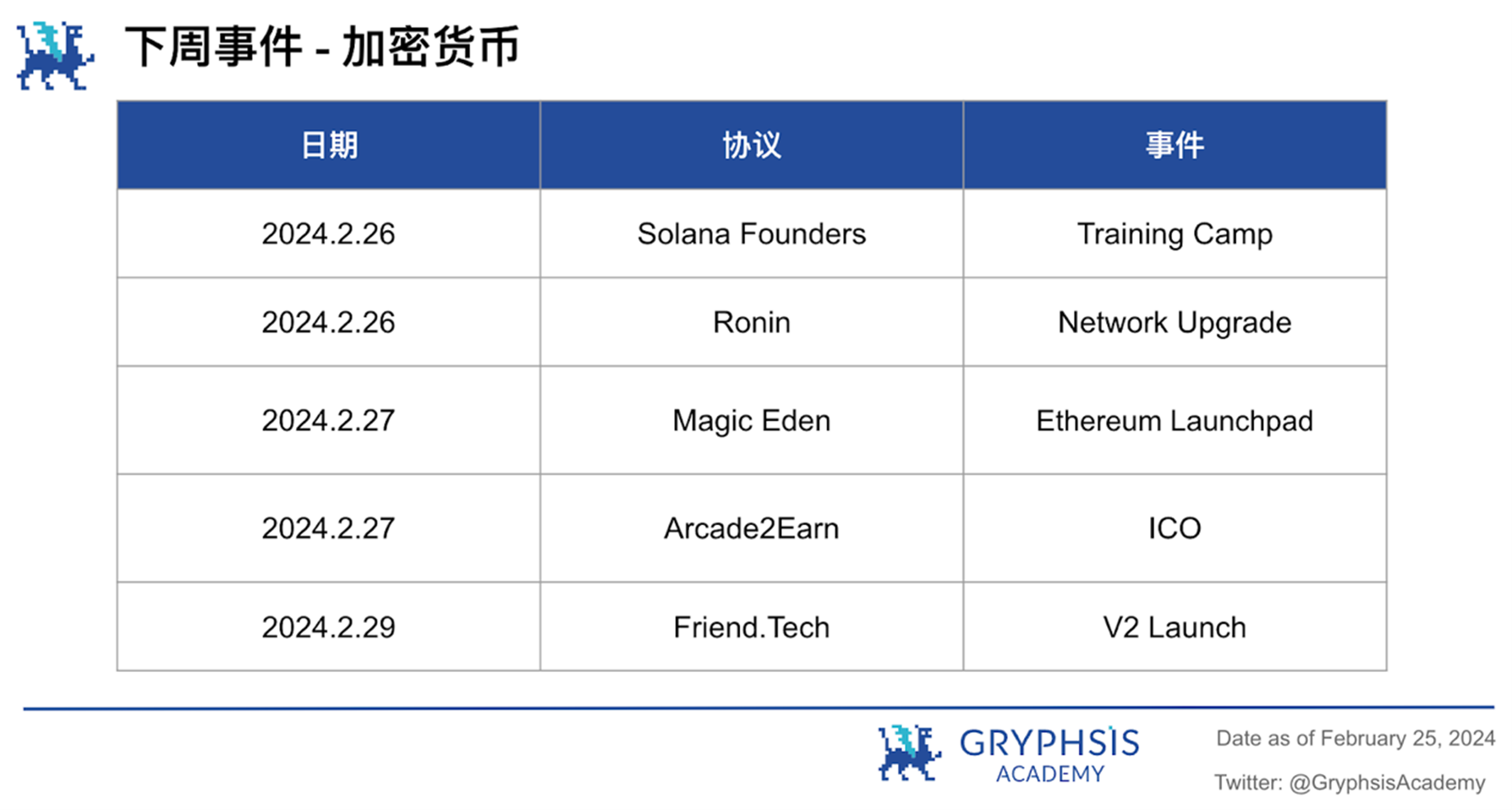

Next Week Events

News Source

https://www.theblock.co/post/278802/ethena-eth-perpetual-futures-open-interest-risk

https://www.theblock.co/post/278868/bitcoin-miner-riot-platforms-2023-report

https://www.theblock.co/post/278843/web3-app-store-magic-square-acquires-token-launchpad-truepnl

https://www.theblock.co/post/278798/spot-bitcoin-etf-cumulative-trading-volume-50-billion

This is the complete content for this week. Thank you for reading this week's newsletter. We hope you benefit from our insights and observations.

You can follow us on Twitter and Medium for real-time updates. See you next time!

This newsletter is for informational purposes only. It should not be considered as investment advice. Before making any investment decisions, you should conduct your own research and consult with independent financial, tax, or legal advisors. Past performance of any assets does not guarantee future results.