Welcome, dear reader, to Gryphsis Academy’s weekly cryptocurrency digest. We bring you key market trends, in-depth insights on emerging protocols, and new industry dynamics, all designed to enhance your expertise in cryptocurrency and Web3. Happy reading! Follow ourTwitterandMedium,Get deeper research and insights.

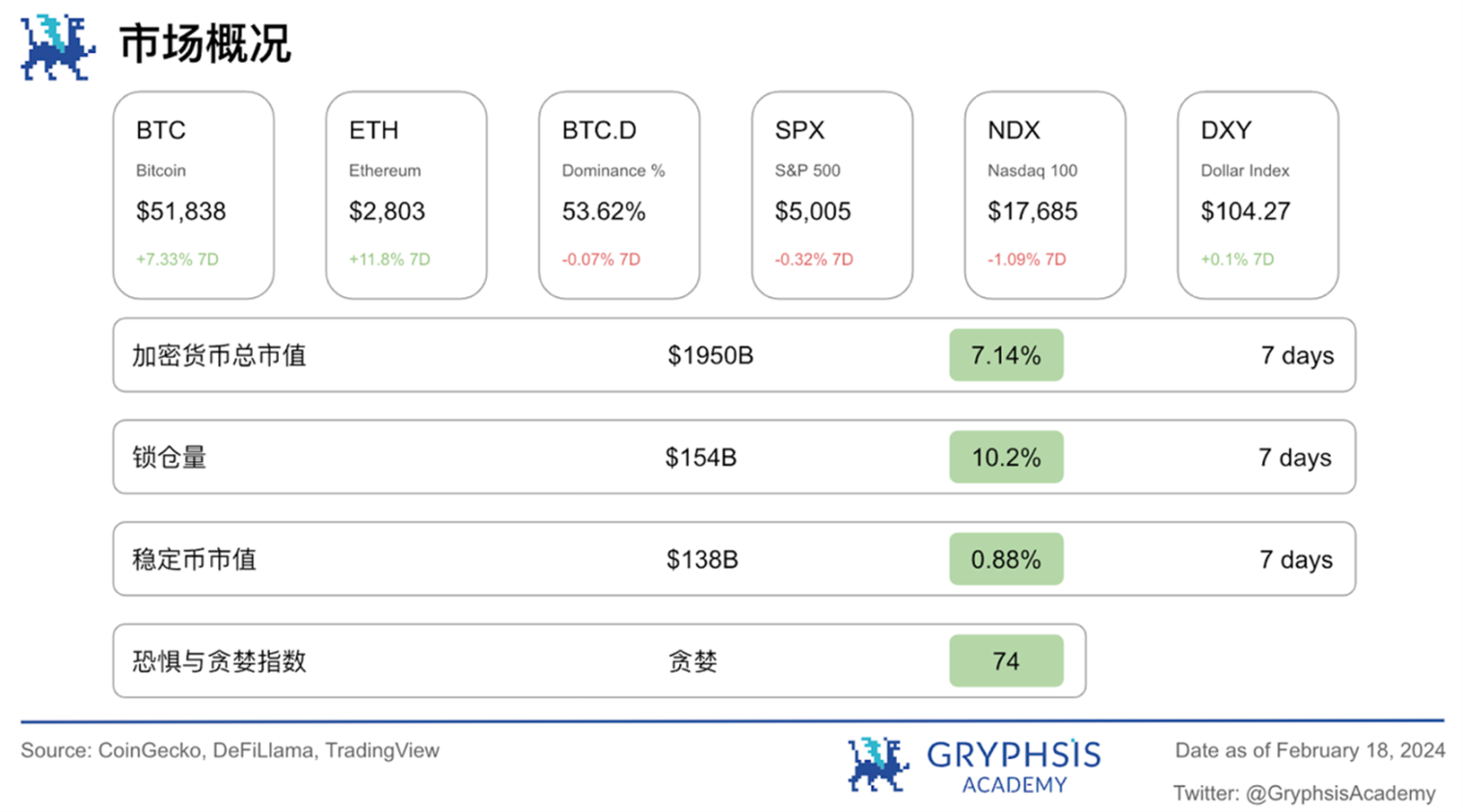

Market and industry snapshots

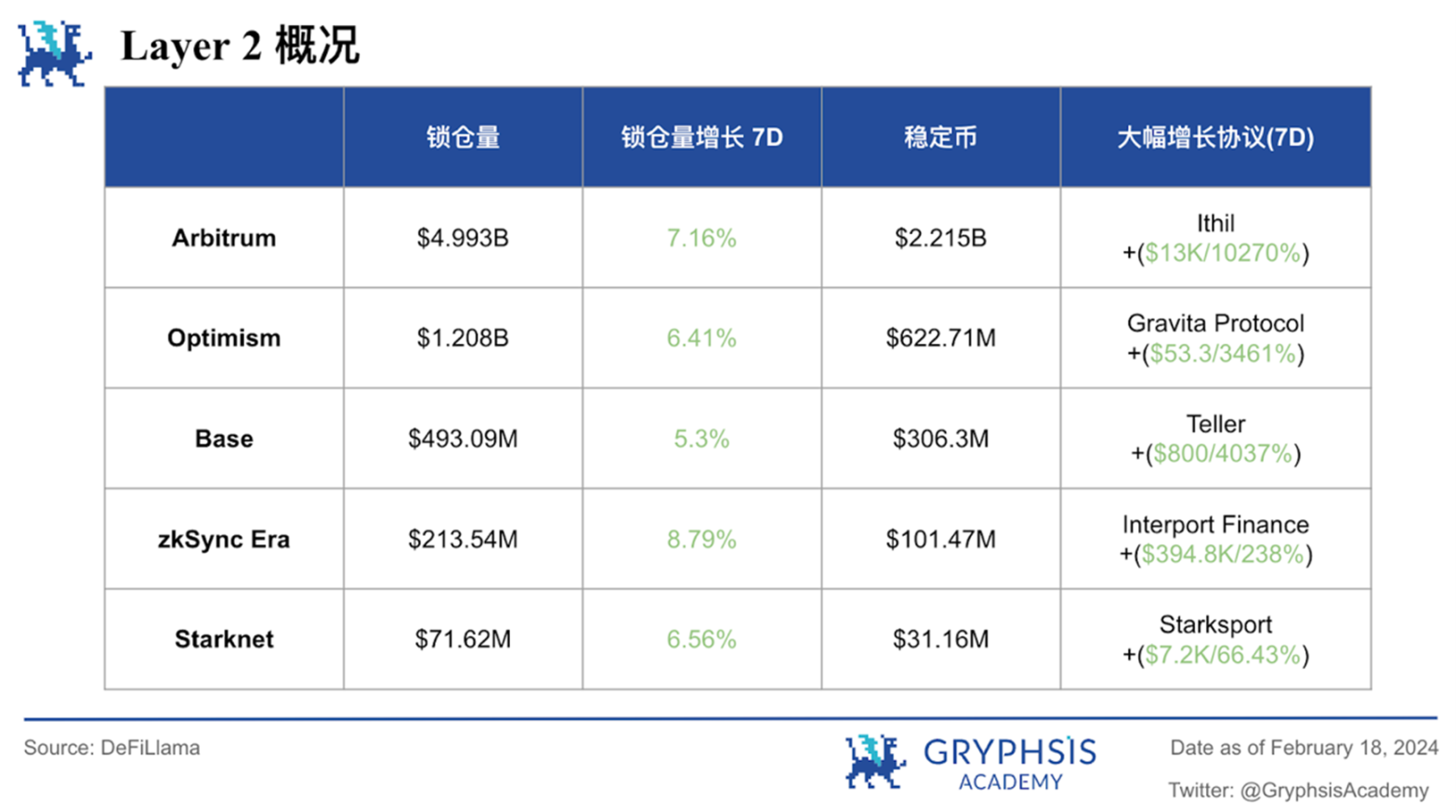

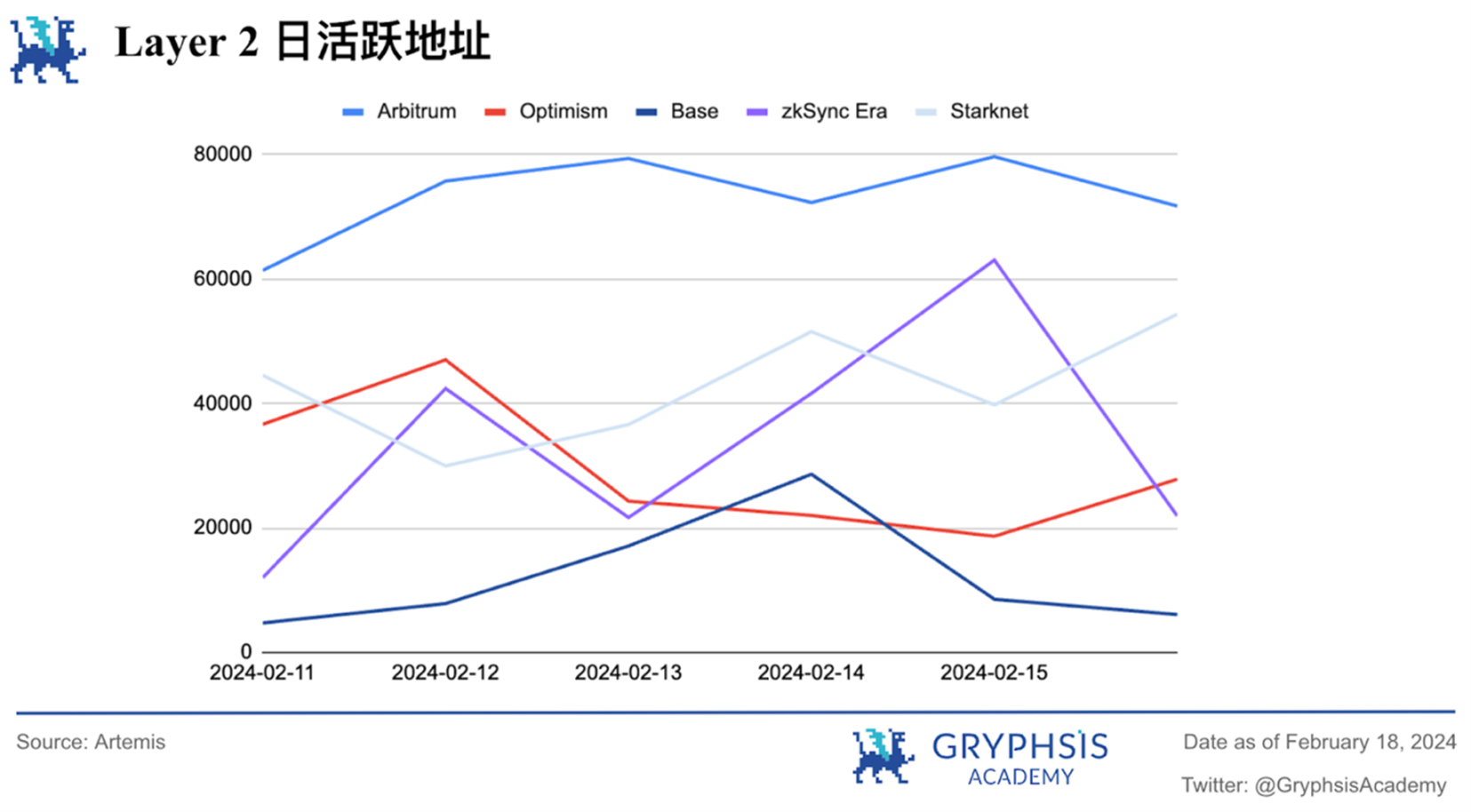

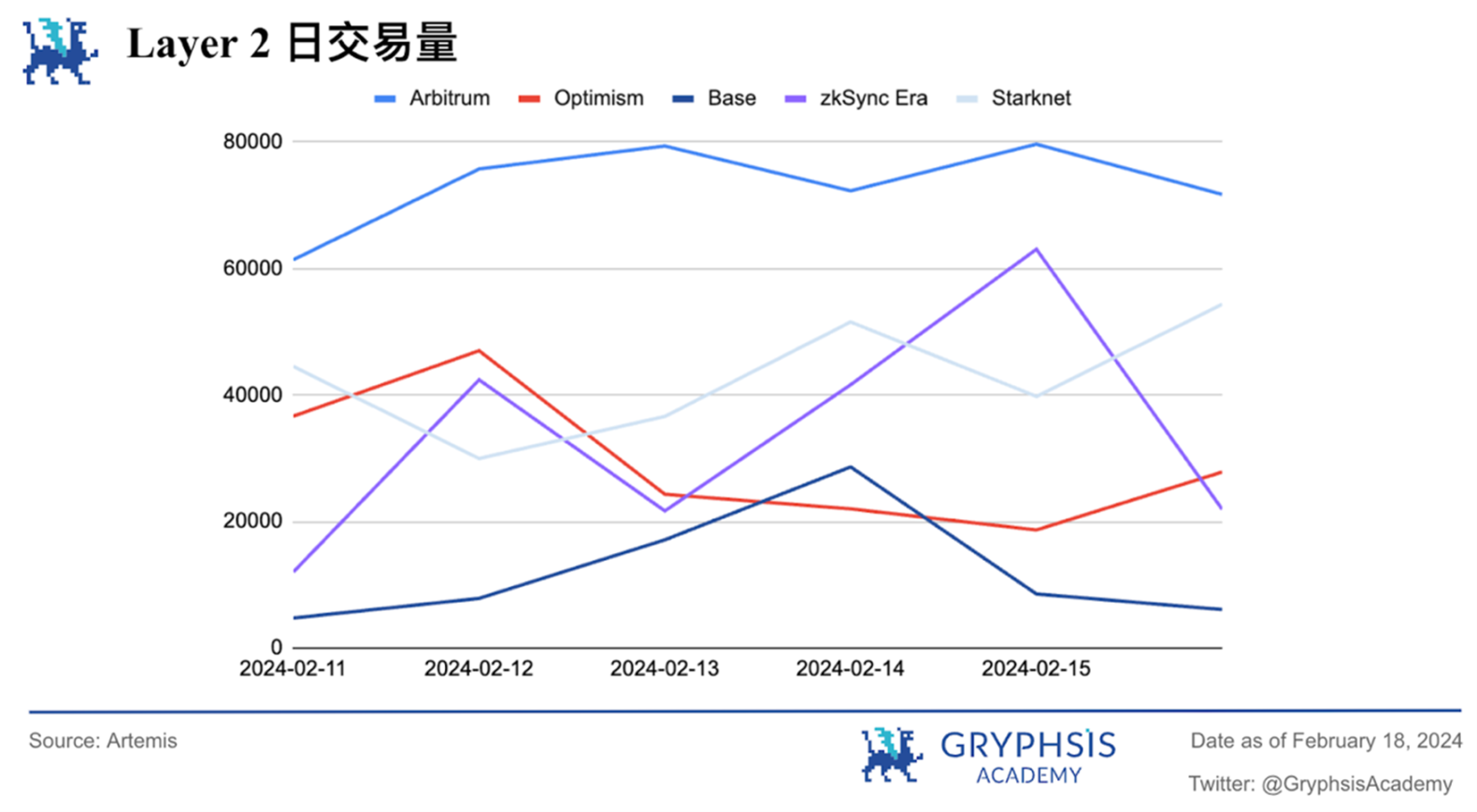

Layer 2 Overview:

Last week, Layer 2 all showed positive growth, with zkSync Era showing the most obvious growth of 8.79%. Protocols like Ithil, Gravita Protocol, Teller, Interport Finance, and Starksport have demonstrated noteworthy TVL growth rates.

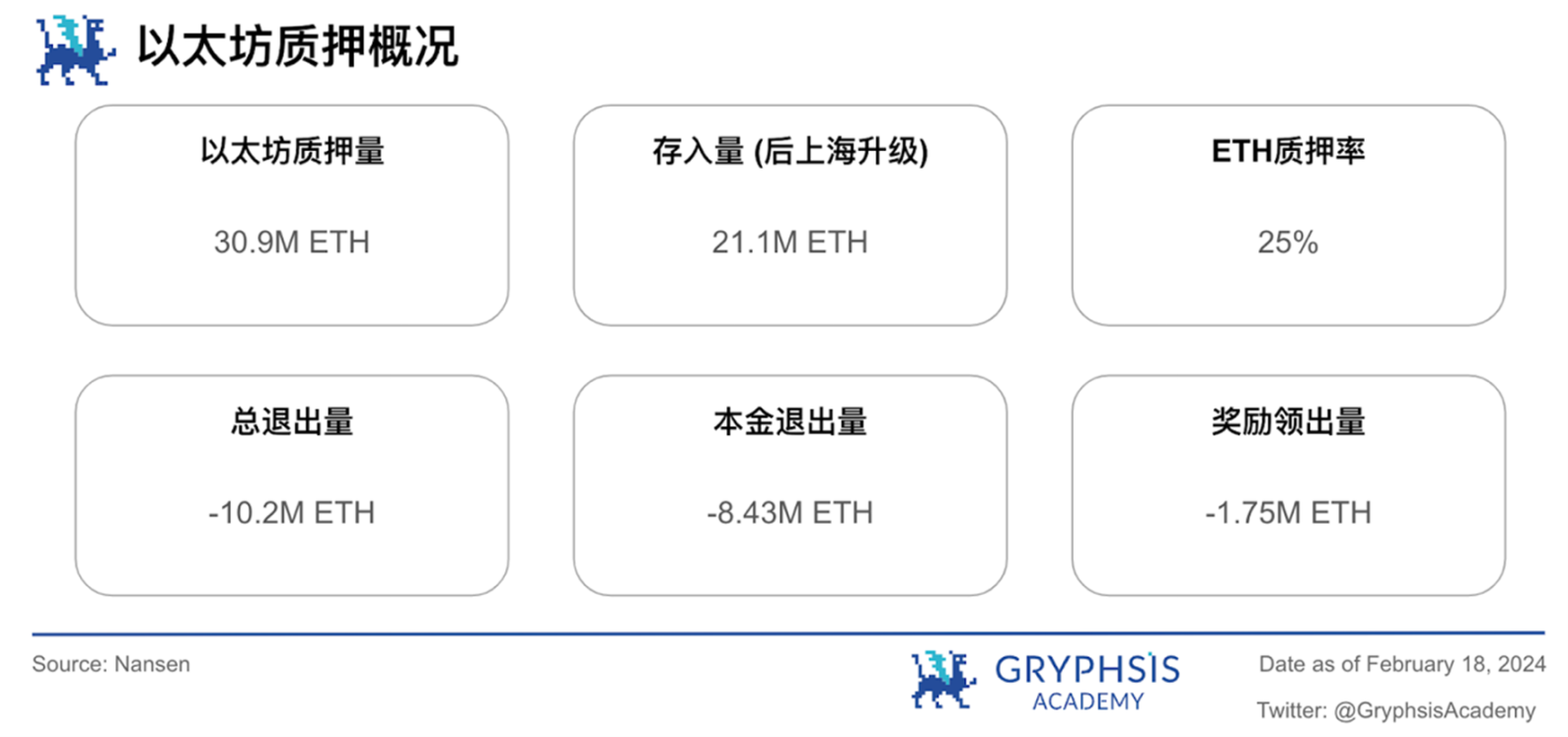

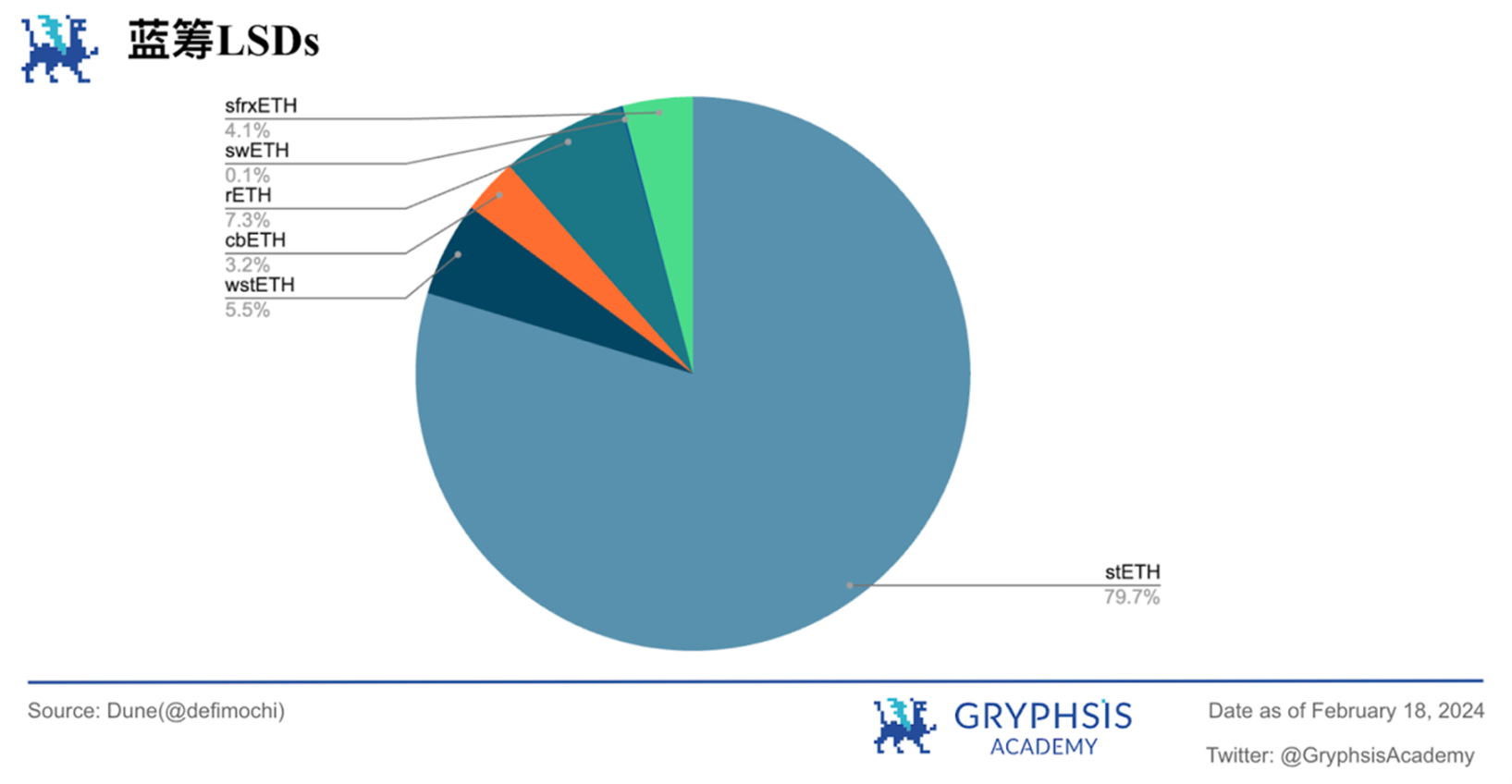

LSD Sector Overview:

In the LSD field, both Ethereum deposits and total withdrawals increased, but the withdrawal volume was more obvious at 2.51%. In terms of market share, stETH achieved explosive growth of 3-4 times, accounting for nearly 80% of the total share. swETH and wstETH fell by 20.36% and 40.77% respectively.

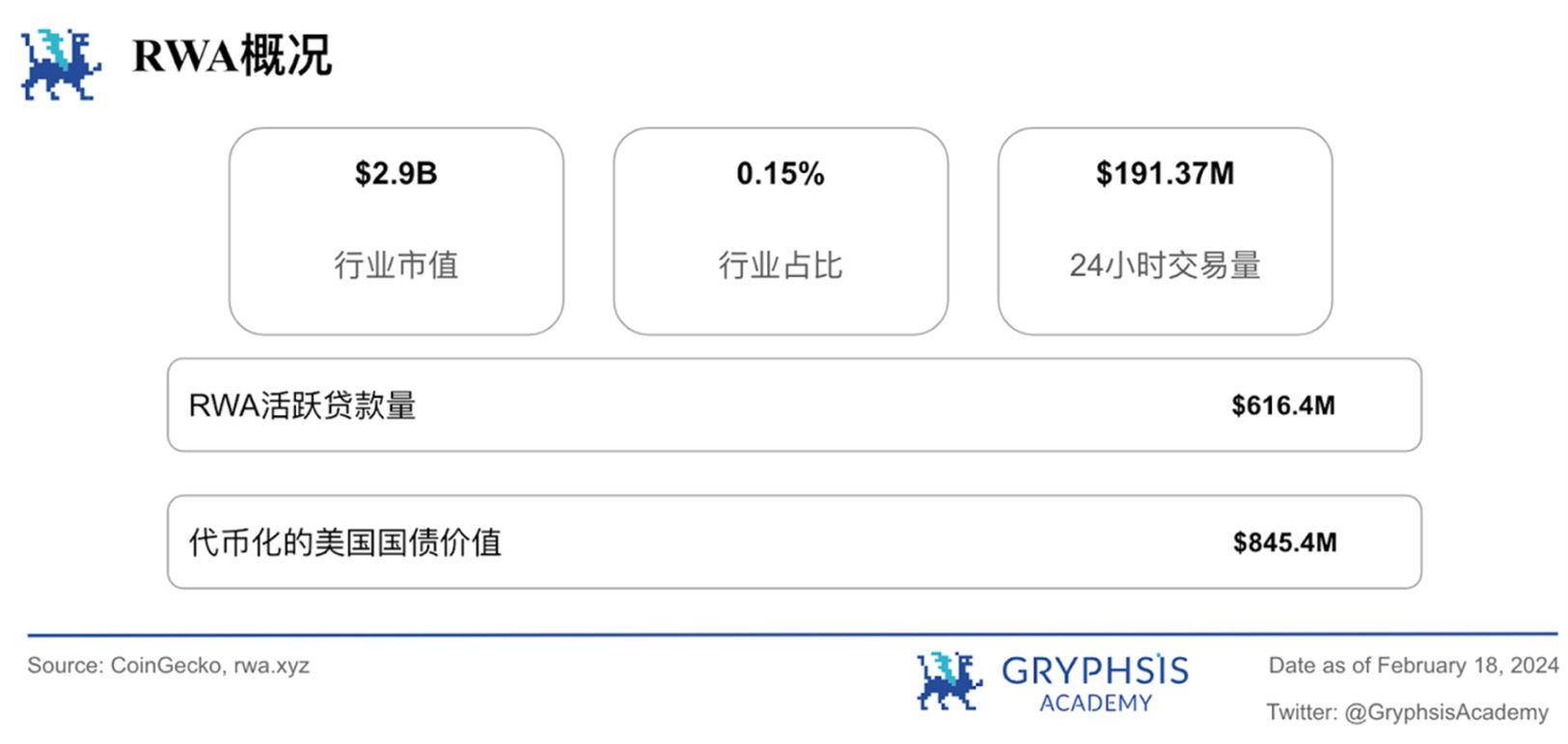

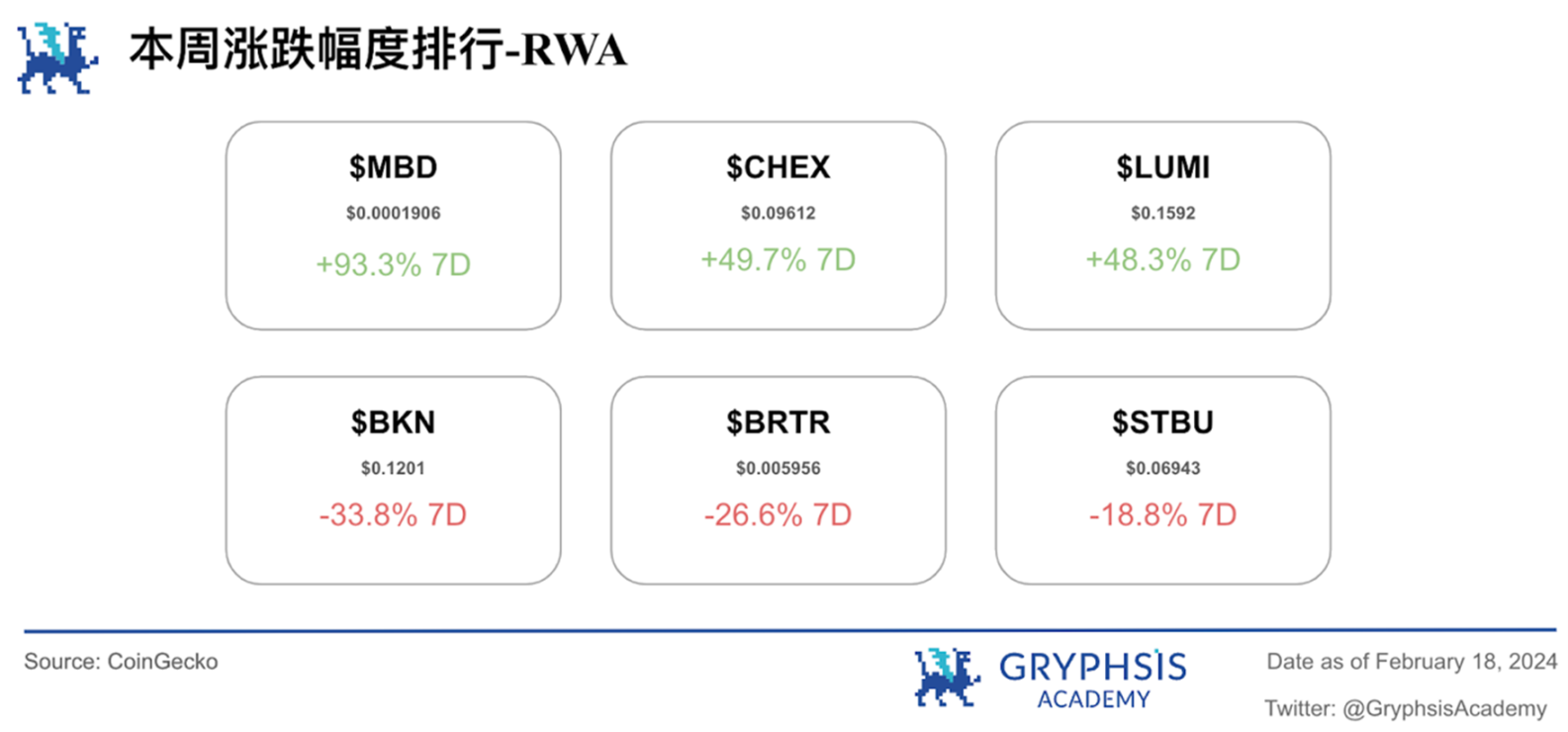

RWA Sector Overview:

Last week, the worlds real asset market value increased by 5.45%, and the 24-hour trading volume fell by 2.92%. RWA Tokenized Treasuries rose by 1.88% and tokenized U.S. Treasury bonds decreased in value by -0.92%. Notable growth tokens include $MBD, $CHEX and $LUMI, with tokens like $BKN, $BRTR and $STBU experiencing larger losses.

Main Topics

Macro overview:

US Stock V.S. Crypto

Big news this week:

Bitcoin price tops $52,000 for first time

Weekly Agreement Recommendations:

Paal AI

Weekly VC Investment Focus:

Ultiverse ( 4 M)

Lava Network ( 15 M)

Exverse ( 3 M)

Twitter Alpha:

@0x AndrewMoh on Instadapp

@stacy_muur on Metahorse Unity

@defi_blackjoker on ERC 4337

@wist_defi on AI

@DamiDefi on Soil Protocol

Macro overview

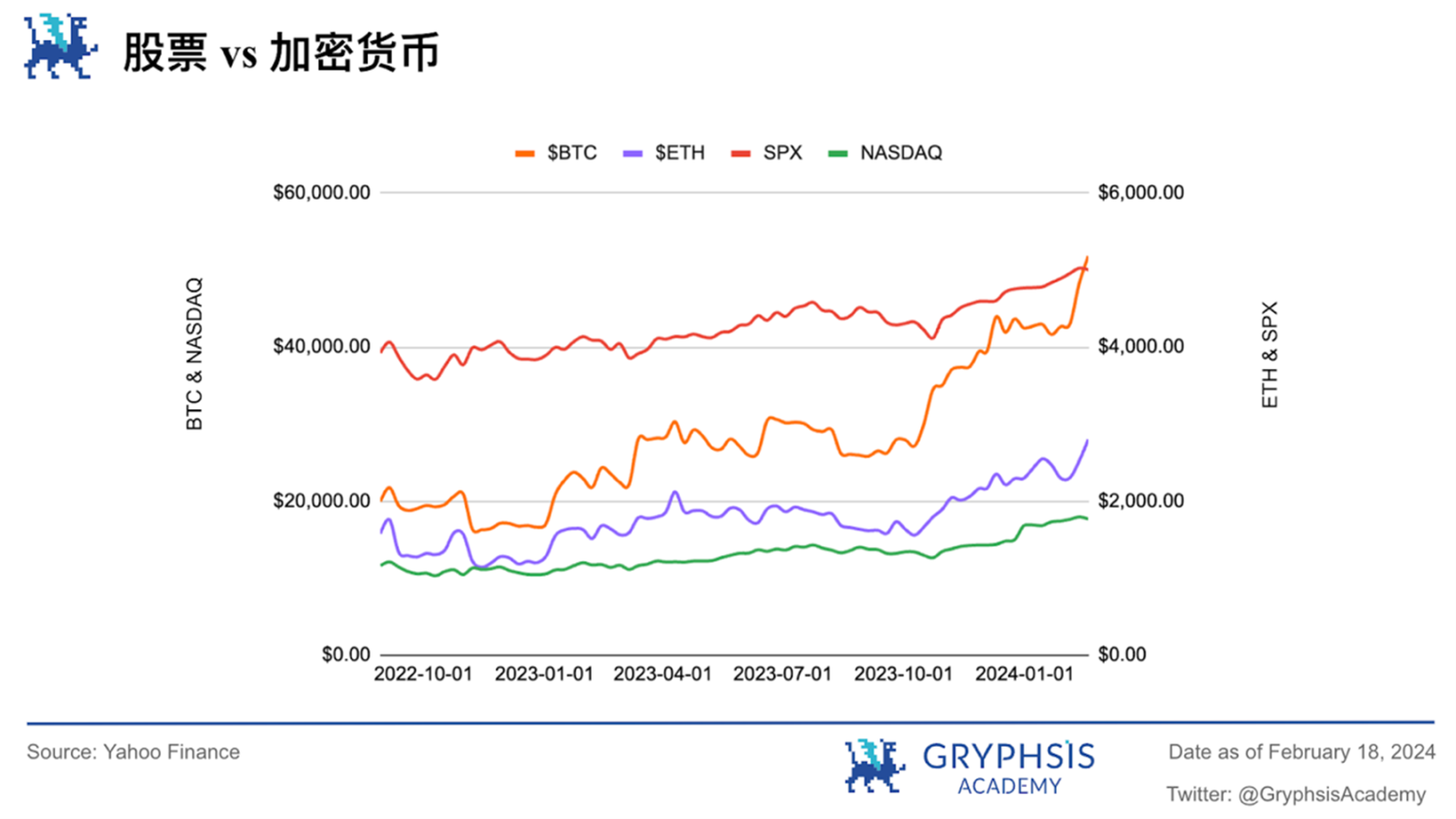

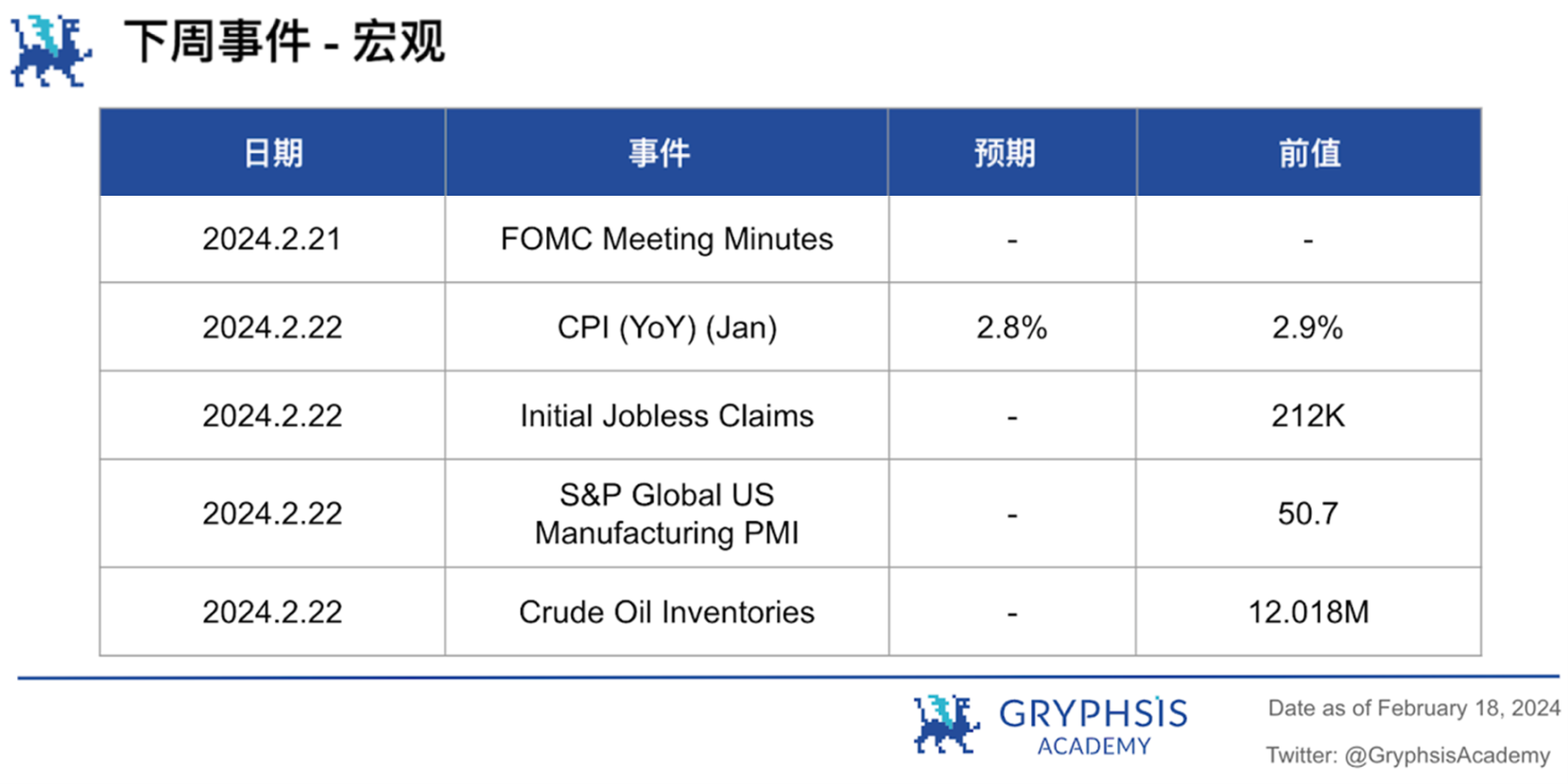

This week, at the stock market level, SPX and NASDAQ fell 0.42% and 1.54% respectively. In the coming week, pay attention to the Federal Open Market Committee meeting minutes, CPI, initial jobless claims, SP Global U.S. Manufacturing Purchasing Managers Index, crude oil inventories and other major events.

Big news this week

Bitcoin price tops $52,000 for first time

Bitcoin (BTC) topped $52,000 this week for the first time in 26 months, but its stalled momentum could signal an “imminent” pullback before further price gains. The largest cryptocurrency by market capitalization has gained 10% in a week, outpacing the 8% gain in the CoinDesk 20 index (CD 20), and has continued its upward momentum since a low of $38,500 in late January. The rally comes as inflows into U.S. spot Bitcoin exchange-traded funds (ETFs) accelerate, with BlackRock’s IBIT taking in more than 28,000 bitcoin this week.

However, Swissblock noted that the $52,000 area acted as a significant resistance level on the long-term charts, which capped price gains in September and December 2021, and now also poses a substantial obstacle to the continuation of the rally. . “Given the rapid rise of around 33% in recent weeks, a pullback appears imminent and necessary, suggesting that this rally is unsustainable,” Swissblock analysts wrote.

The report also adds that short-term declines aside, the market looks ready for higher prices and any upcoming correction could be a buying opportunity as long as BTC can hold on to support near $47,500. At this point, any pullback should be viewed as a possible buying opportunity.

Institutional-grade cryptocurrency exchange FalconX also noted “abnormal” trading volumes supporting an upward trend in early 2024, last seen since the regional banking crisis in March 2023. Analysts at FalconX wrote on Friday: A drop in trading volume following a price increase has historically been a reliable indicator of a false breakout in cryptocurrencies. The good news at this time is that the liquidity conditions surrounding Januarys rally generally remain healthy.

Analysts at 1 0x Research said in an update on Friday that Bitcoin could make a run towards the $57,500 price target due to strong liquidity and increased demand for Bitcoin futures.

Weekly Agreement Recommendations

Welcome to our Protocols of the Week segment – where we spotlight protocols making waves in the crypto space. This week, we chose PAAL, a customized AI robot solution.

PaaL allows users to customize and generate their own Bot by entering commands, and can enjoy bot services on Discord, Telegram and other platforms. It sounds no different from ChatGPT, but PaaL provides more AI application scenarios, including:

PaaS (Paal As A Service): PaaS focuses on providing a wide range of AI-driven solutions to meet the unique needs of different vertical industries. Our expertise spans a variety of areas, including but not limited to online gambling, financial trading, digital collectibles, and Software-as-a-Service (SaaS) applications with advanced Web AI capabilities and conversational bots.

For example, the customized Twitter Bot will automatically respond according to its training content when a user mentions or tags the bot; the Buy Alert Bot obtains information sources from the exchange to provide real-time trading warnings; the Stake Alert Bot is customized for cryptocurrency An innovative notification tool designed to provide alerts for staking transactions and updates, providing users with important information to effectively manage and oversee their staking portfolio; Sniper Bot to enhance trading automation strategies and optimize trade timing and execution.

MyPaalBot: MyPaal combines the roles of chatbot, mod, researcher and community manager, making it truly a versatile cryptographic assistant.

PaalX: PaalX merges DEX, research platform, social media, and more into an AI-powered toolbox for effortless trading. Filter and analyze large amounts of data through artificial intelligence tools to optimize trading efficiency and research effectiveness to make informed and fast decisions.

The native token of PAAL is $PAAL, and the total supply is capped at 1 B, where:

1% — Marketing and User Acquisition: A more targeted approach that combines marketing efforts with strategies specifically focused on acquiring new users to drive community growth and engagement.

1% — Development Lab: Beyond pure development, this fund is dedicated to innovation, supporting the research and development of new features, and staying at the forefront of technological advancements.

1% — Team: This allocation ensures we attract, retain and adequately compensate top talent, which is critical to our long-term success.

1% — Ecosystem: This is a multifaceted allocation that includes:

Investing in Startups: We now actively invest in promising startups, with profits from these investments used for revenue sharing, which not only diversifies our revenue streams but also supports the broader crypto ecosystem.

RevShare: Continued commitment to sharing revenue with the community.

Buybacks: Buybacked tokens now flow directly into the staking pool, increasing staking rewards and overall token value.

As an AI solution, Paal can be used by companies in various industries through whitelisting artificial intelligence solutions, forming a major source of revenue; cooperation with other companies such as advertising and cross-promotion can bring additional profits; all $PAAL transaction volume 1% as transaction tax; additional subscription service and product commissions, etc.

Source: https://rewards.paalai.io/

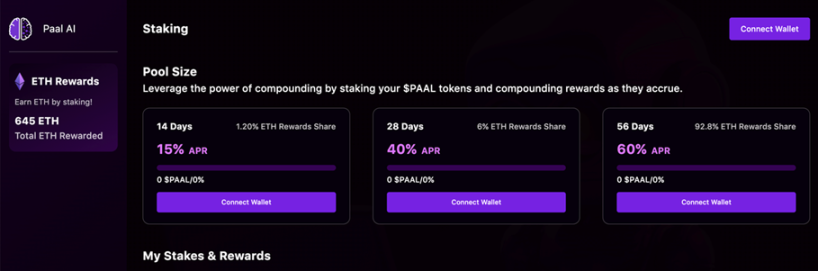

Paal income is mainly distributed to the ecological foundation and pledgers. Staking is the most important part of the Paal economic model. Users can pledge $PAAL. There are Vaults with different time periods and APRs to choose from. Staking can earn $ETH and $ PAAL rewards. As shown in the figure, Paal has provided a total of 645 ETH as rewards, and the $PAAL part of the reward comes from protocol income and repurchase.

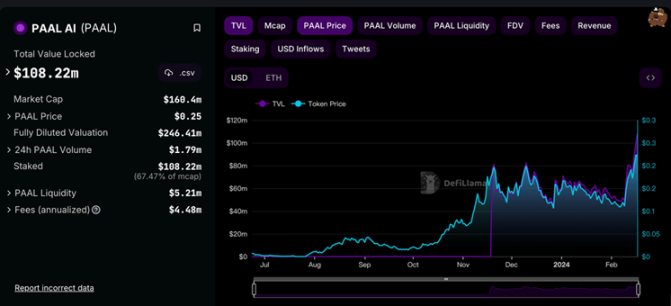

our insights

Since the creation of the Staking mechanism in November 2023, its price has risen and fallen in tandem with TVL. The total number of pledged tokens currently accounts for 67% of the market value, and the price of $PAAL has also exceeded a record high, with an increase of 97.39% in the past seven days.

Source: Defillama

In addition, the official launched a staking incentive event on February 16, giving 140 ETH as a staking reward to users. In addition to the above staking rewards, they can also obtain potential airdrop opportunities from partners, exclusive product features, and team incubation Projects such as AIT Protocol and other investment opportunities. After the event was launched, the TVL of the protocol increased by 10 M in a single day, which shows the strong market response.

Paals current average daily transaction fee revenue is approximately $38K, and Paal AIs revenue sharing model combined with revenue generation methods form a cohesive and dynamic structure. However, the current usage scenarios of the token are weak, and only the value capture of staking is possible. If the use cases of the token can be expanded in the future, Paal may be able to explode innovatively.

Weekly VC Investment Focus

Welcome to our weekly Investing Spotlight, where we reveal the biggest venture capital developments in the crypto space. Each week, we’ll spotlight the protocols that received the most funding.

Ultiverse

@UltiverseDAO is a social gaming metaverse that connects Web3 with an immersive, fully VR-compatible AAA virtual world. By empowering players of varying financial means to build mutually beneficial relationships, Ultiverse aims to create a first-of-its-kind MetaFi.

https://x.com/UltiverseDAO/status/1757759138959151421?s=20

Lava Network

@lavanetxyz aims to be a marketplace for blockchain data. It incentivizes node providers and decentralized application users to feed market blockchain data into their network, much like Airbnb allows owners to monetize their unused spaces. The protocol enforces data quality and enables node operators to use their bandwidth.

https://x.com/lavanetxyz/status/1758162588381405563?s=20

Exverse

@exverse_io is a free game that brings a new take on AAA first-person shooters to Web3. Exverses three Odailies - Social, Quests and Combat - cater to different play styles while staying connected to each other within a single timeline, with users competing in season cycles lasting eight weeks. The game aims to foster community by allowing players to engage in social activities and even develop user-generated worlds within an ever-expanding universe.

protocol event

Pudgy Penguins briefly flips Bored Ape Yacht Club in floor price

Celsius distributed $ 2 billion of crypto to creditors, court document shows

Ether perpetual futures open interest surges, hits all-time high on Deribit

Uniswap V4 launch, featuring 'hooks,' tentatively set for Q3

Jupiter cancels Ripple XRP ETP investment after self-compliance inspection

Industry updates

Japan's financial regulator encourages stronger monitoring of 'unlawful' crypto transfers

FTX creditors file class action against bankruptcy lawyers over ties to FTX prior to its collapse

House Financial Services panel explores combatting illicit finance in cryptocurrency

FCA issued 450 alerts against illegal crypto promotions in 2023

Court rules Genesis can sell over $ 1.3 billion worth of GBTC shares: Bloomberg

Twitter Alpha

There is a lot of alpha in crypto Twitter, but navigating thousands of Twitter threads can be difficult. Each week, we spend hours doing research, curating threads full of insight, and curating your weekly picks list. Let’s dive in!

https://x.com/0x AndrewMoh/status/1757980672290120157? s= 20

https://x.com/stacy_muur/status/1758311925996499139?s=20

https://x.com/defi_blackjoker/status/1758146366797127721?s=20

https://x.com/wist_defi/status/1758182057534996674?s=20

https://x.com/DamiDefi/status/1758161829778403518?s=20

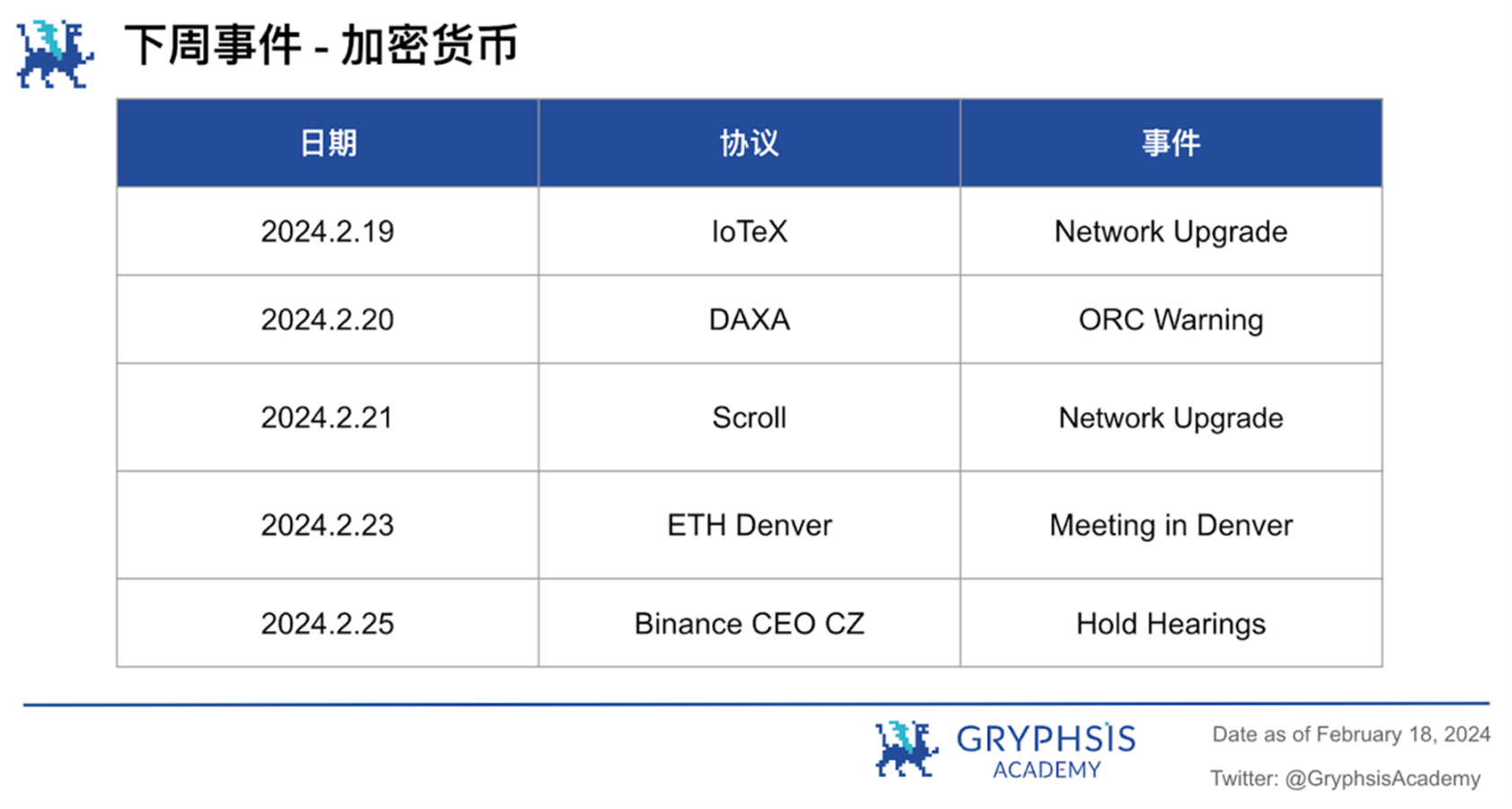

next week events

news source

https://www.theblock.co/post/277947/pudgy-penguins-briefly-flips-bored-ape-yacht-club-in-floor-price

https://www.theblock.co/post/277631/fca-issues-450-alerts-against-illegal-crypto-promotions-in-2023

That’s all for this week. Thank you for reading this weeks newsletter. We hope you benefit from our insights and observations.

allowableTwitterandMediumFollow us on to get instant updates. See you next time!

This weekly report is provided for informational purposes only. It should not be relied upon as investment advice. You should conduct your own research and consult independent financial, tax or legal advisors before making any investment decisions. And the past performance of any asset is not indicative of future results.