Written by:@yutsingkuh

Tutor: @CryptoScott_ETH , @HaywarZhu

1. Background

On January 10, 2024, the SEC approved the listing of Bitcoin spot ETF for the first time. A total of 11 Bitcoin ETFs have been approved this time, with a total size of US$27 billion as of January 19 (the vast majority are Grayscales GBTC shares, converted from their original trust funds). However, this is not the world’s first BTC spot ETF. In 2021, the Purpose Bitcoin ETF was listed on the Toronto Exchange. However, the United States is the worlds largest capital market, and SEC approval will have a far greater impact on the market than Canada.

The listing of the BTC spot ETF is an important milestone in the development of Bitcoin. It will make Bitcoin investment more convenient and will further increase the adoption rate of Bitcoin. Regular investors can invest in Bitcoin through a securities account and no longer need to open a cryptocurrency account. The risk control and compliance issues faced by investing in Bitcoin will also be alleviated.

2. Current market conditions

BTC price has risen significantly in the past three months, rising from $25,889 on September 10 to $46,106 on January 10, a 78% increase. The market generally believes that the adoption of BTC ETF expectations is one of the main reasons for the rise in BTC prices. After the BTC ETF was passed, the market performance was relatively calm, possibly because the market had already digested this expectation in advance. When the BTC ETF first started trading, BTC briefly shot up to $48,500, but then quickly fell back. As of January 17, BTC price was $42,800, down approximately 8% from before the BTC ETF passed.

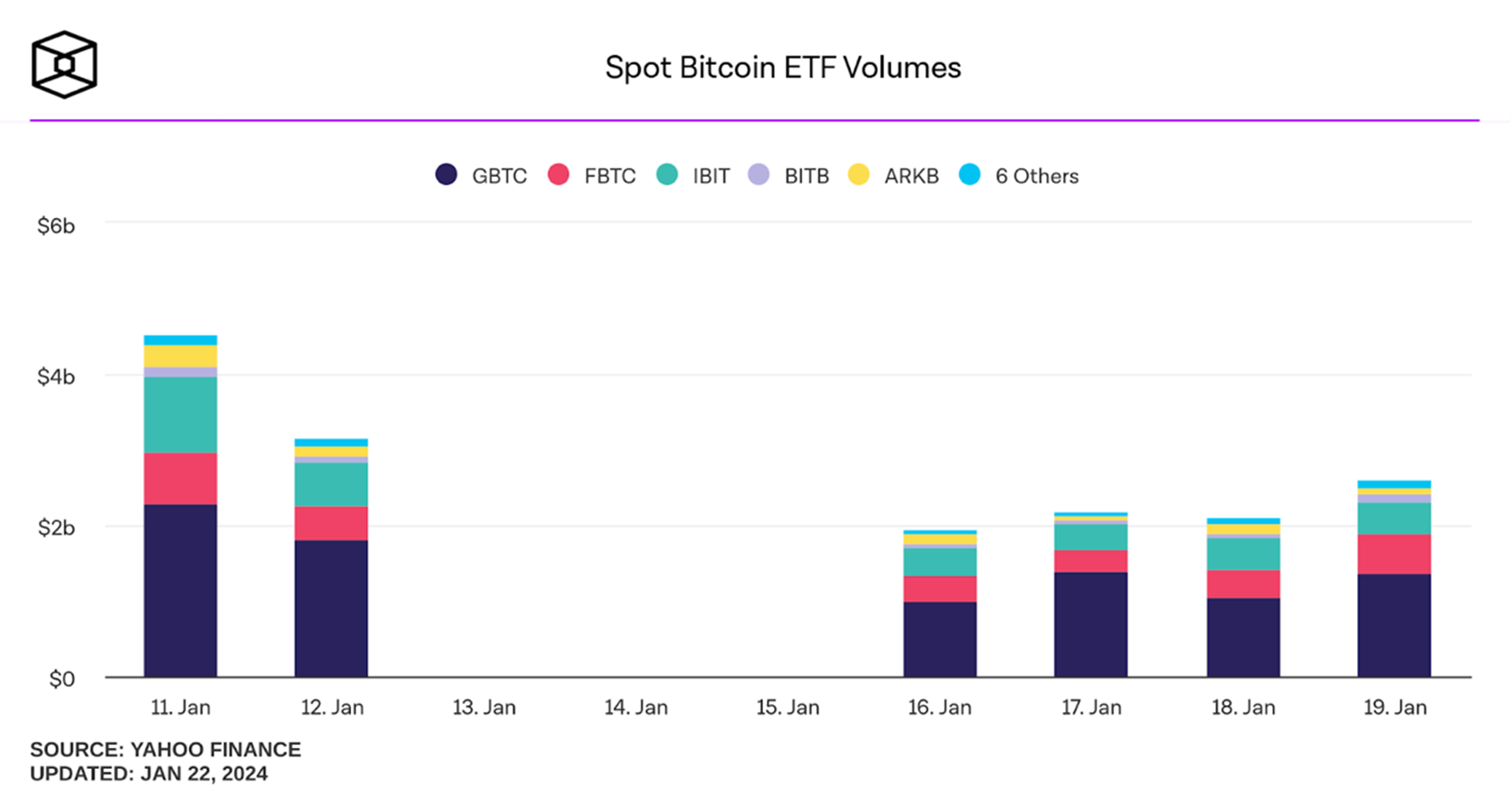

Although BTC price fluctuations are relatively mild, the BTC ETF has had a huge impact on the market in just a few days. The BTC ETF saw huge trading volumes, reaching $4.6 Bn on its first day of listing. In comparison, Binance, the largest cryptocurrency exchange, had spot trading volume of just $4.1 Bn for the day. This may be because competition among market makers is more intense in traditional markets.

3. New trading factors

Due to the huge trading volume of the Bitcoin spot ETF, it is likely to have a significant impact on the trend of Bitcoin.In the long term, Bitcoin spot ETFs may become an important channel for incremental funds to enter, driving the further rise of Bitcoin; in the short term, spot ETFs increase the available information in the market and may bring new trading factors.

The deep liquidity of Bitcoin spot ETFs and traditional centralized exchanges contains huge arbitrage space.On the one hand, there may be a difference between the price of spot ETFs and the spot price of BTC, which will bring arbitrage opportunities; on the other hand, the difference in market structure between the opening and closing periods of US stocks may also bring opportunities for statistical arbitrage. These arbitrage opportunities will attract more funds and institutions to enter the cryptocurrency market.

Trading factors in the U.S. stock market, such as market sentiment, market volatility, market liquidity, etc., may also affect the cryptocurrency market.The adoption of Bitcoin spot ETF will allow trading factors in traditional markets to more directly affect the cryptocurrency market.For example, investor sentiment in traditional markets may affect the short-term price of spot ETFs, which in turn affects the spot price of BTC. The influence of these factors may lead to new trading strategies.

The cryptocurrency market is highly active and competitive. Inflows into Bitcoin ETFs serve as drivers of long-term trends and may not be correlated with short-term movements in Bitcoin. Public information in some markets, such as ETF inflows on the day, has a lag. Investors should be alert to the volatility risks of the cryptocurrency market and avoid blind trading.

4. Capital inflow

4.1 Other forecast reports

GalaxyThrough the reach rate of BTC ETF on the asset management platform, it is expected that BTC ETF capital inflow will reach $14.4 Bn in the first year, $26.5 Bn in the second year, and $38.6 Bn in the third year.

GlassnodeBy reference to the size of existing ETF products, the BTC ETF is expected to receive inflows of $70.5 Bn.

Standard Charted ResearchThe BTC ETF is expected to receive inflows of $50 ~ 100 Bn in 2024.

4.2 Forecasting based on asset allocation

Many studies have shown that incorporating Bitcoin into asset allocation can help improve portfolio returns and reduce volatility. This is due to Bitcoin’s low correlation with traditional assets. However, for traditional investors, the investment threshold for Bitcoin is relatively high. The passage of the BTC ETF will make it easier for investors to incorporate Bitcoin into their asset allocation. therefore,We can expect that the passage of the BTC ETF will bring a large inflow of asset allocation funds.

As early as 2019, a study by Aleh Tsyvinski stated that 4% ~ 6% of cryptocurrency should be allocated in the asset portfolio. As BTC adoption increases, its volatility risk diminishes.Wealth advisors usually recommend allocating 1% ~ 5% to BTC. For a typical investor based on a broad asset allocation, such as investing in 40% stocks + 25% bonds + 10% gold + 25% cash, it would be very reasonable to include 3% in cryptocurrencies in the asset allocation. Compared to the current SP 500 Index Fund AUM of $1.27 Bn, we expect the BTC ETF to reach $95 Bn in two years.

4.3 Forecasting based on product comparison

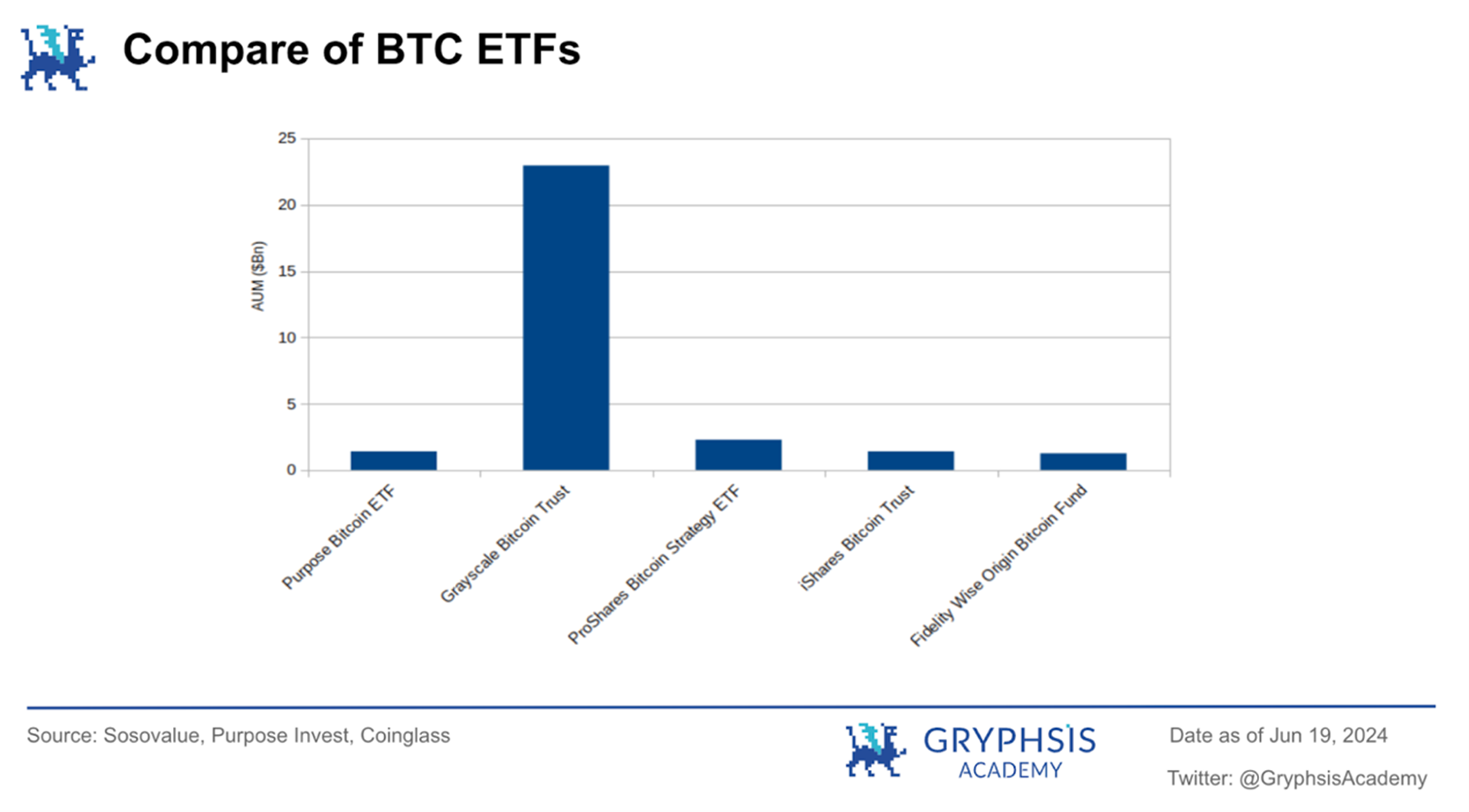

From an investment perspective, the market demand for new products can be estimated by comparing existing products. Previously, the main products of the same type included trust fund Grayscale Bitcoin Trust, futures ETF ProShare Bit ETF, and spot ETF Purpose Bitcoin ETF.

The point of investing in BTC products is to gain position exposure in BTC.Management fees and tracking accuracy are major considerations when investing in this type of product. The management fee determines the holding cost for investors, and the tracking accuracy determines the risk faced by investors. In actual products, management fees are included in the net value. Therefore, this type of product can be regarded as a tool to obtain the risk exposure of BTC by paying the downside risk of the net value relative to BTC as a cost. As long as market conditions remain unchanged, this cost determines investor demand.

We assume that, assuming that market conditions remain unchanged, the market consumption scale of BTC ETP products will increase as the cost level decreases.

The consumption scale is the product of the total position and the cost.

Therefore, when holding costs decrease, the total number of positions held by the market increases at least inversely with the cost level.

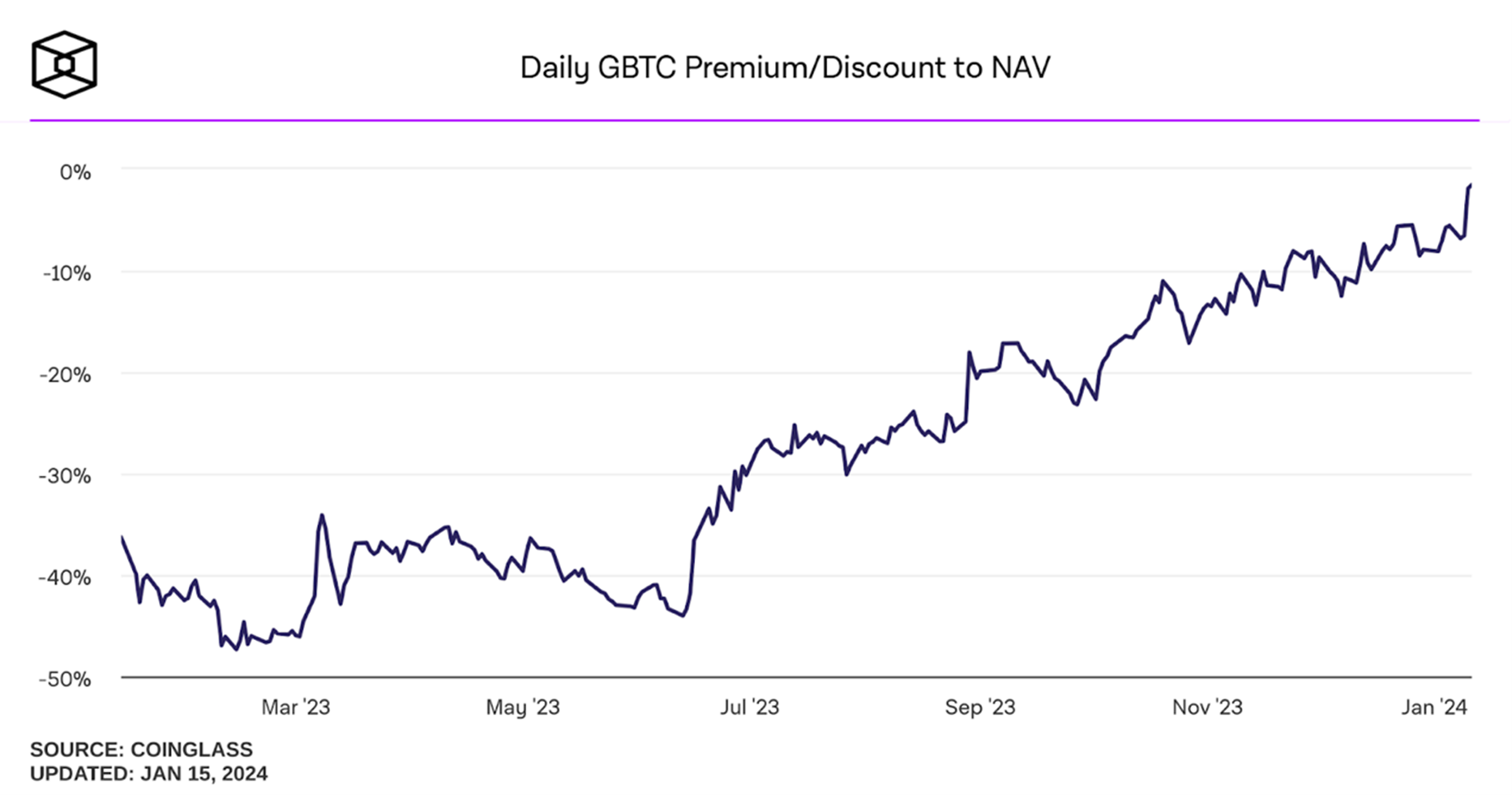

Grayscale Bitcoin Trust is a trust fund whose shares of GBTC are held by Grayscale at a 1:1 ratio and charges an annual management fee of 2%. GBTC shares can be traded on the secondary market, but cannot be redeemed. The GBTC share grew rapidly to 650,000 BTC from June 2020 to February 2021, and then stopped growing. The price of GBTC deviates significantly due to various reasons. Before February 2021, GBTC experienced an extremely high premium. Therefore, the demand for GBTC during this period mainly came from the arbitrage space brought by the premium. After February 2021, GBTC faced a severe negative premium. Since it cannot be redeemed, the share of GBTC has not been significantly reduced. This does not reflect the actual market demand for GBTC. Therefore, GBTC cannot be used as a reference for predicting demand for BTC ETFs.

ProShare Bit ETF is a futures ETF. Its underlying assets are mainly CMEs BTC futures. Its current market value is $1.59 Bn, making it the largest BTC ETP except GBTC. Due to management fees and futures swap costs, its net value lags behind BTC by about 25% from October 2021 to January 2024. We believe BITOs annual holding cost is 13%. For comparison, the newly issued iShares Bitcoin Trust management fee is 0.25% per year, which is also the current common management fee level for BTC ETFs. Therefore, the cost level of BITO is 52 times that of BTC ETF. According to the above assumption,The expected size of the BTC ETF is approximately 52 times that of BITO, which is $83 Bn. Given that market equilibrium takes time, we expect this to occur within two years.

Purpose Bitcoin ETF is a BTC spot ETF listed on the Toronto Exchange in Canada. It was also the largest BTC spot ETF. It was founded in February 2021 and currently has $1.5 Bn under management.Considering that the total Canadian wealth management market in 2023 is $1933 Bn,andThe US wealth management market totals $58,446 Bn. If the BTC spot ETF had the same participation in the US market as the Canadian market, it is expected to reach $45 Bn. In addition, Statista predicts that the US wealth management market will grow by 10% in 2024, reaching $64,700 Bn. Based on this calculation, the size of the BTC spot ETF will reach $50 Bn by the end of 2024.

4.4 Comparison of Gold ETF and Bitcoin ETF

Gold ETF is the earliest commodity ETF and one of the most successful ETFs. Its scale has exceeded 10% of the gold market. Bitcoin is called digital gold. Its anti-inflation value and store-of-value functions are similar to gold. The successful experience of gold ETF has certain reference value for predicting the scale of Bitcoin ETF, which is also a commodity ETF.

The first gold ETF in the United States, SPDR GLD, was launched in November 2004 and is still the largest gold ETF. One, two, and three years after listing, its management scale reached$ 3.2B n,$ 8.3 Bn,$ 15 Bn。Today, the total size of gold ETFs in global markets is approx.$ 235 Bn. Considering that the markets acceptance of ETF products is much higher than in 2004, we expect the BTC ETF to reach its mature scale earlier. Today, the total market capitalization of gold is approximately $12Tn, with gold ETFs accounting for 2% of the total market capitalization. The total Bitcoin market capitalization is approximately $840 Bn. If the Bitcoin ETF accounted for the same proportion of market capitalization, its size would be $17 Bn.

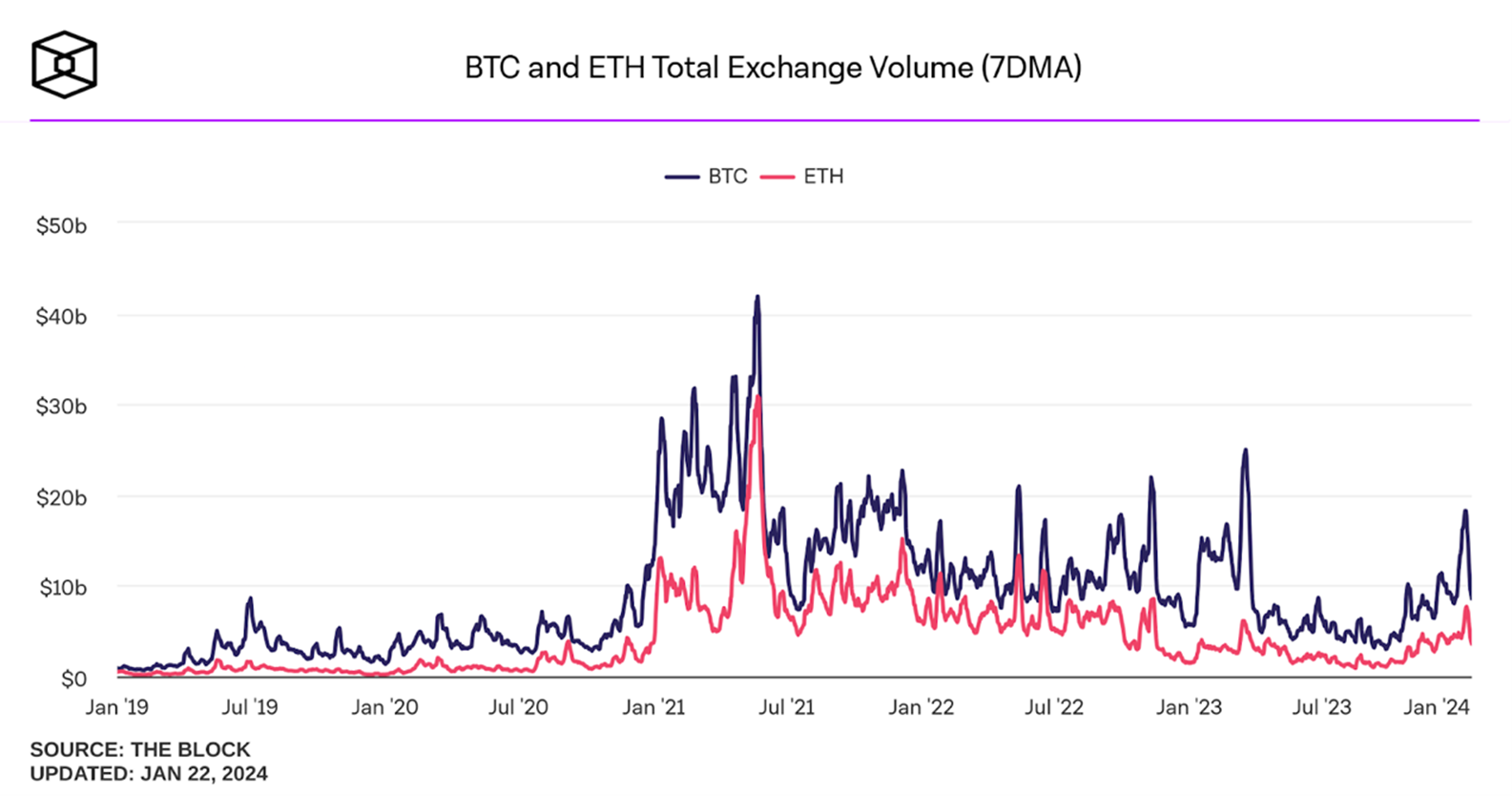

Consider that gold has other uses besides its financial properties.Let’s make another comparison from the perspective of financial transactions. The current trading volume of gold spot is approximately$130 Bn/day, while Bitcoin spot trading volume is around $30 Bn/day. Assuming the Bitcoin ETF size has the same relationship with spot trading volume as the gold ETF, we expect the mature size of the Bitcoin ETF to be approximately $54 Bn.

We assume that the above forecast is reached after 2 years.

4.5 Growth in Bitcoin Adoption

The adoption of the Bitcoin Spot ETF is a major market event. However, in terms of Bitcoin’s long-term development, this is just a small step towards mass adoption. A large number of opinions believe that the adoption of BTC follows the diffusion of innovation theory, and currently BTC is still in the early stages of its development, at the head of the S-shaped curve. In the past few years, there have been many studies using similar models to predict the growth of BTC adoption, and these predictions have been confirmed.The passage of a Bitcoin ETF is the only way for Bitcoin adoption to grow and reach more people. It has significantly lowered the entry barrier for investing in Bitcoin and is expected to become one of the main channels for Bitcoin investment in the next few years and will also be an important driving force for the growth of Bitcoin adoption.

4.6 GBTC possible shrinkage

GBTC is currently the largest BTC spot ETF, converted from the previous trust fund. Between 2022 and 2023, GBTC experienced a large negative premium, which attracted a large number of arbitrageurs. This part of the funds will flow out after the BTC ETF is listed. Considering that the negative premium of GBTC was close to 50% at one time, nearly half of the funds may be outflowed. This money may flow into other Bitcoin ETFs, but it may not. However, it is difficult to estimate the impact this will have on the growth of Bitcoin ETFs.

5. Comprehensive analysis

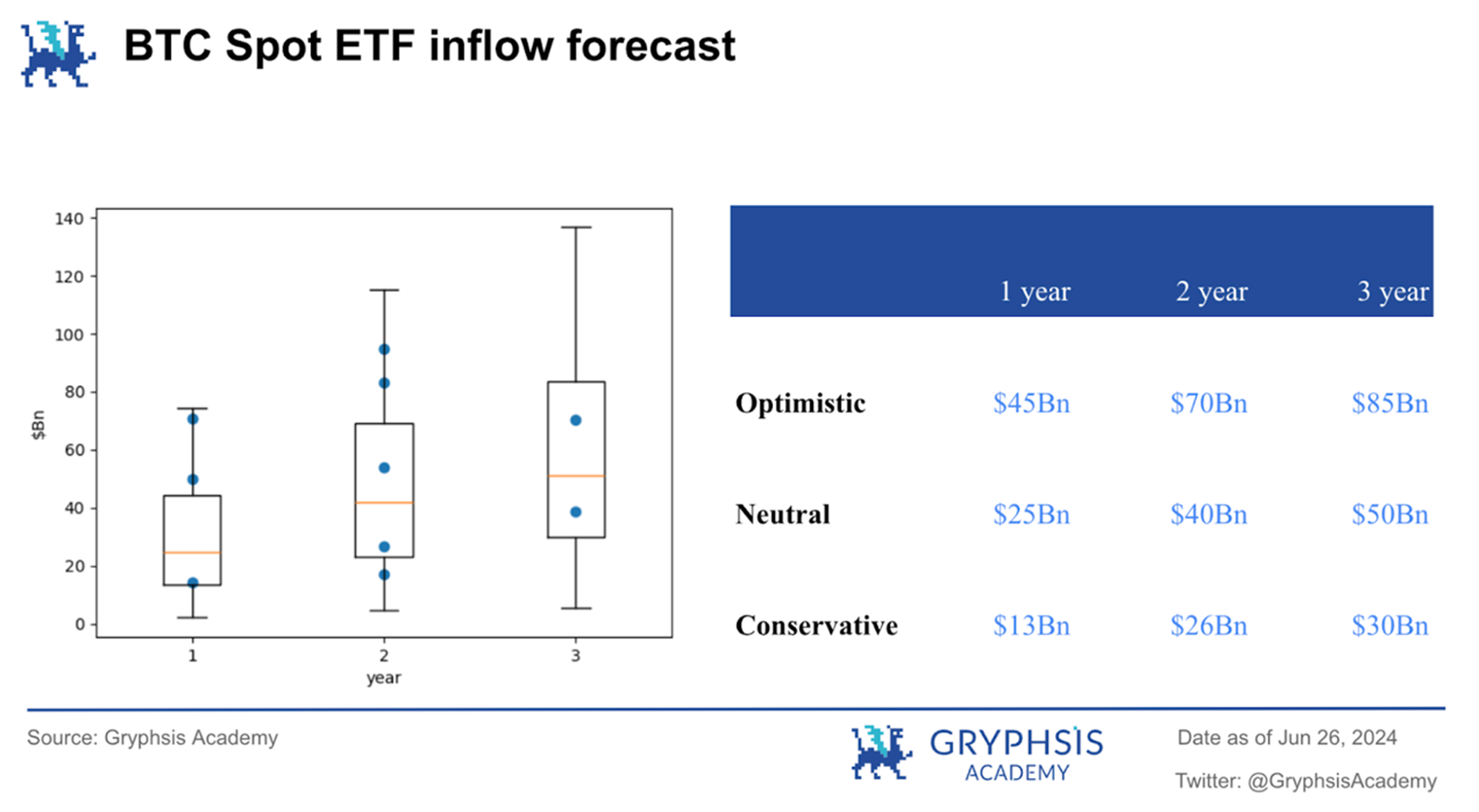

Based on current market conditions, we have forecast the size of Bitcoin spot ETFs from multiple independent angles. Combined with the existing market forecasts, the timing and scale of all forecasts are shown in the figure below. Assume that the inflow rate of Bitcoin ETF spot is log-normally distributed. Kernel density estimation is performed on the known data points to obtain the comprehensive results on the graph. For example, the forecast median and quartiles represent optimistic, neutral and conservative estimates. The final result is shown in the table below,It is expected that within three years, the Bitcoin spot ETF will bring $85 billion in capital inflows to Bitcoin under an optimistic scenario, $50 billion under a neutral scenario, and $30 billion under a pessimistic scenario. Money flows in.

References

[ 1 ] SEC: [Statement on the Approval of Spot Bitcoin Exchange-Traded Products](https://www.sec.gov/news/statement/gensler-statement-spot-bitcoin-011023)

[ 2 ] Liu, Yukun, and Aleh Tsyvinski. "Risks and returns of cryptocurrency." The Review of Financial Studies 34.6 ( 2021): 2689-2727.

[Statement] This report is@GryphsisAcademyContributor@yutsingkuhOriginal work by tutor @CryptoScott_ETHand@HaywarZhuSuggest changes. The authors are solely responsible for all content, which does not necessarily reflect the views of Gryphsis Academy, nor the views of the organization that commissioned the report. Editorial content and decisions are not influenced by readers. Please be aware that the author may own the cryptocurrencies mentioned in this report. This document is for informational purposes only and should not be relied upon for investment decisions. It is strongly recommended that you conduct your own research and consult with an unbiased financial, tax or legal advisor before making any investment decisions. Remember, the past performance of any asset does not guarantee future returns.