Welcome, dear reader, to Gryphsis Academy’s weekly cryptocurrency digest. We bring you key market trends, in-depth insights on emerging protocols, and new industry dynamics, all designed to enhance your expertise in cryptocurrency and Web3. Happy reading! Follow ourTwitterandMedium, for deeper research and insights.

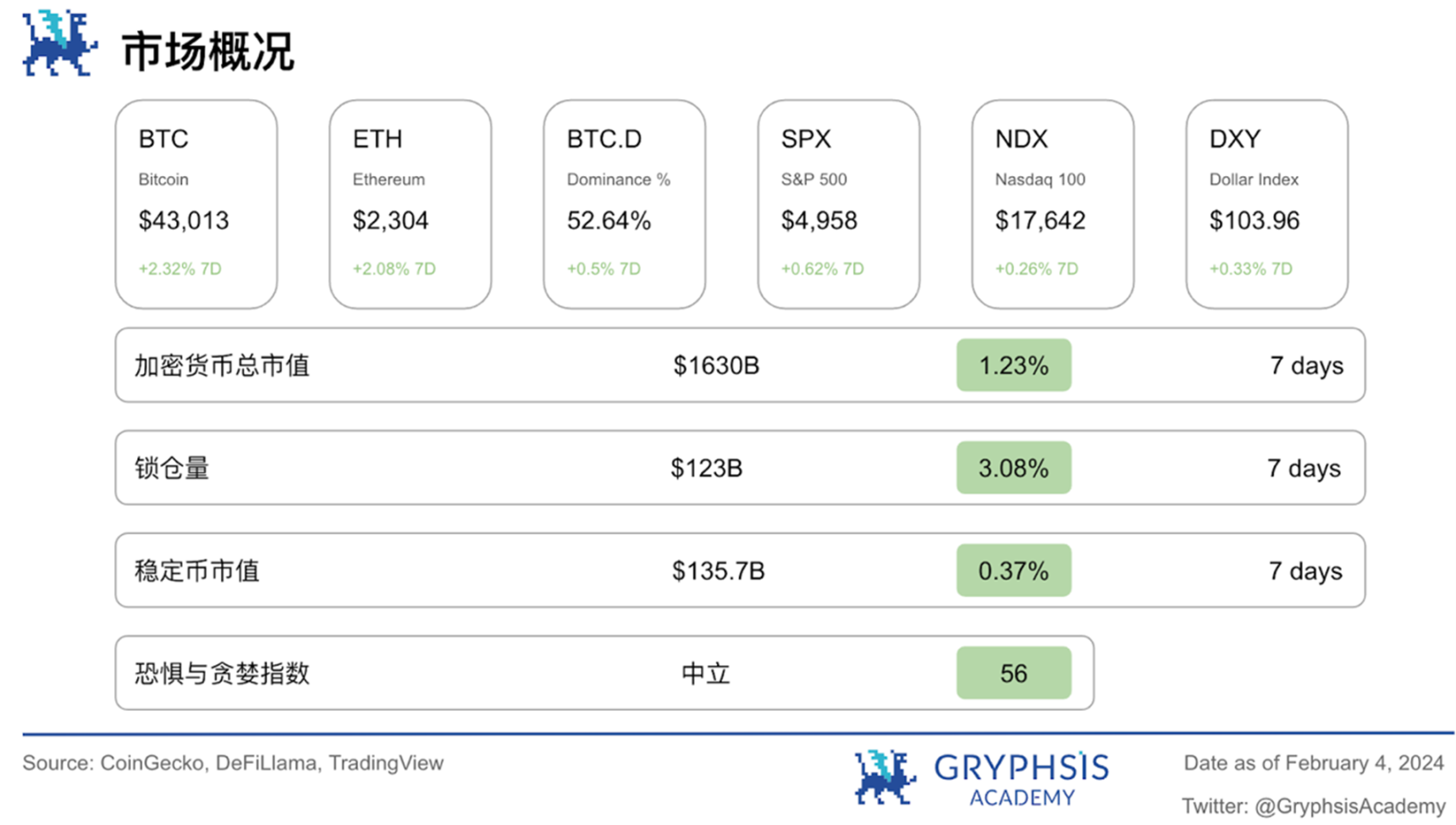

Market and industry snapshots

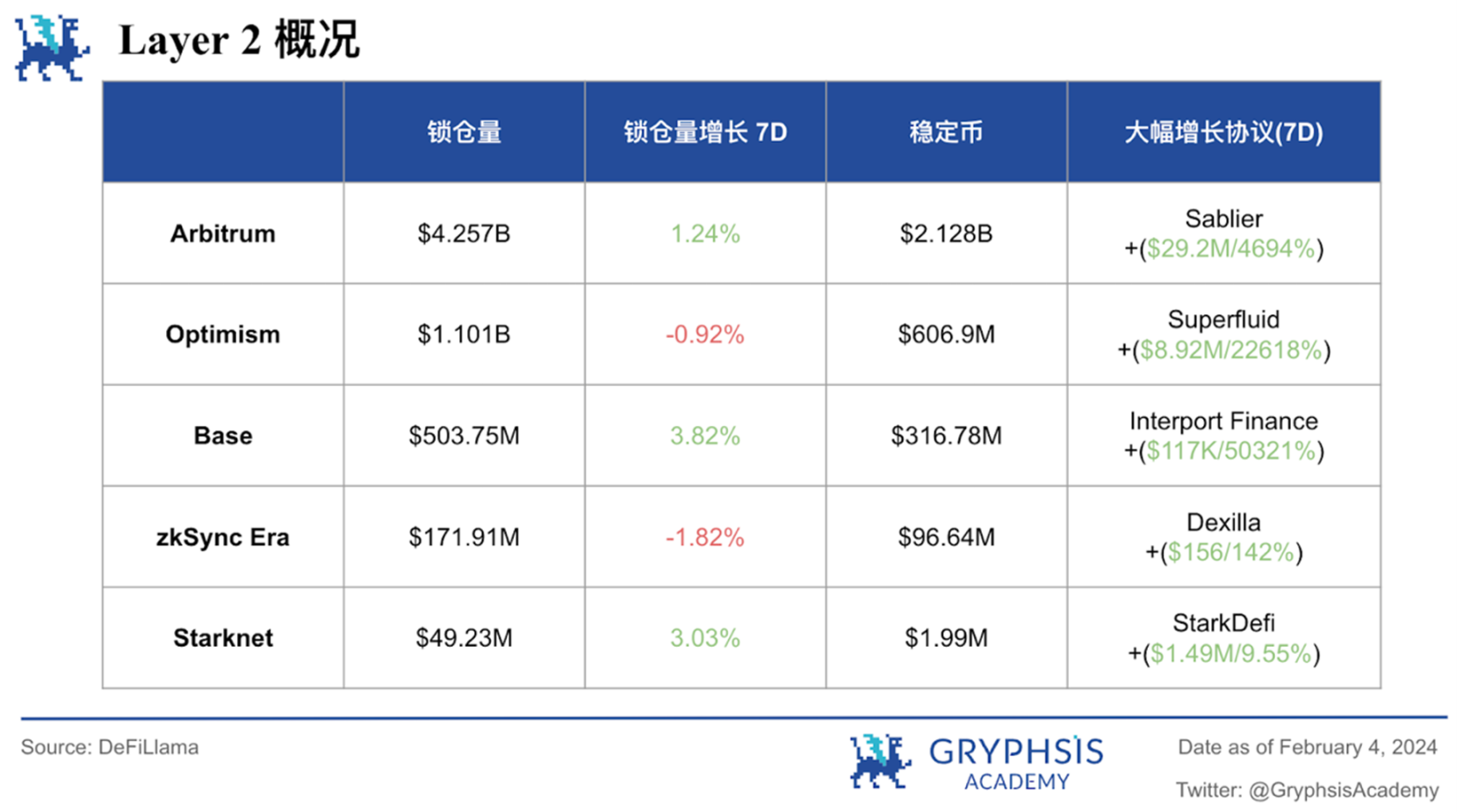

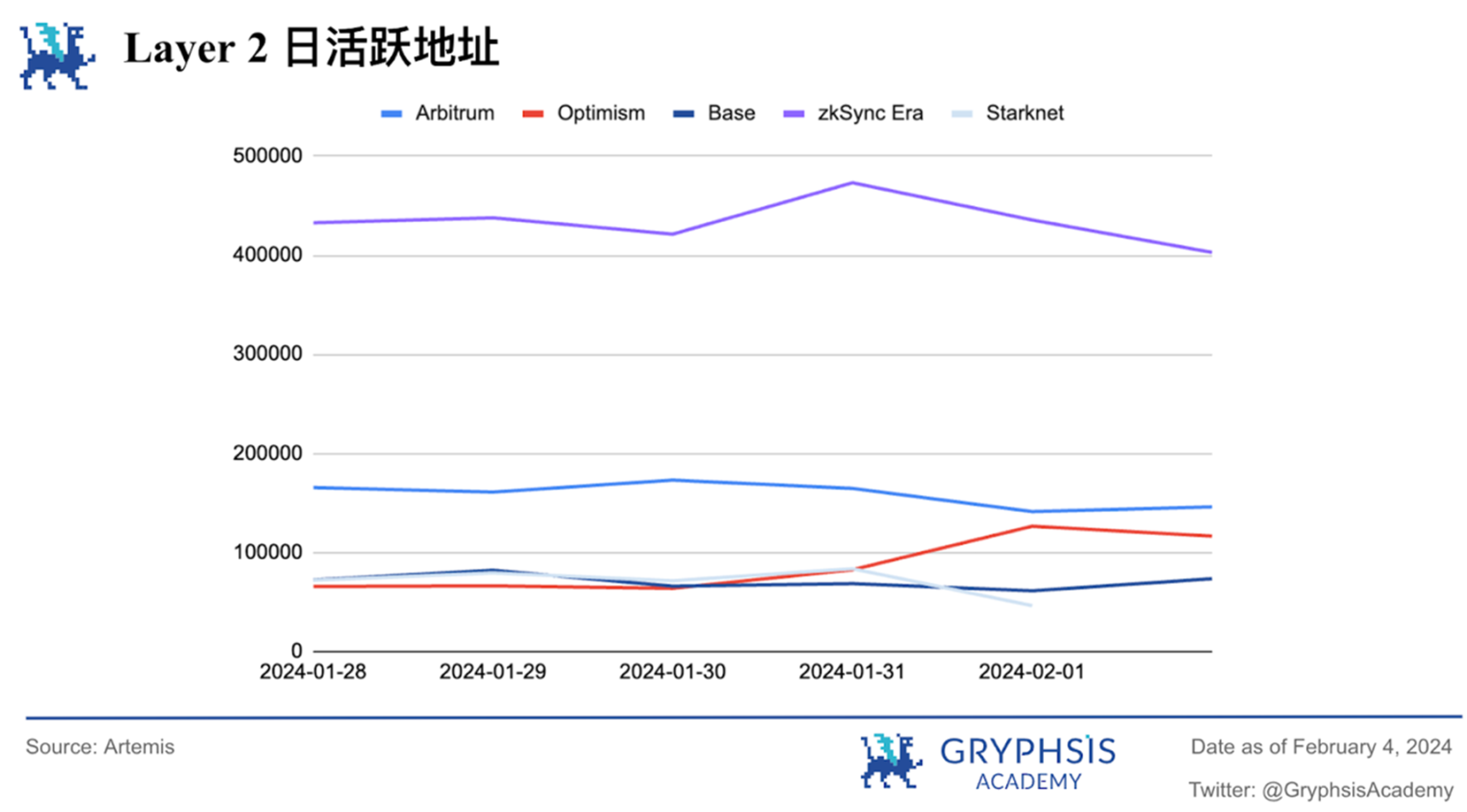

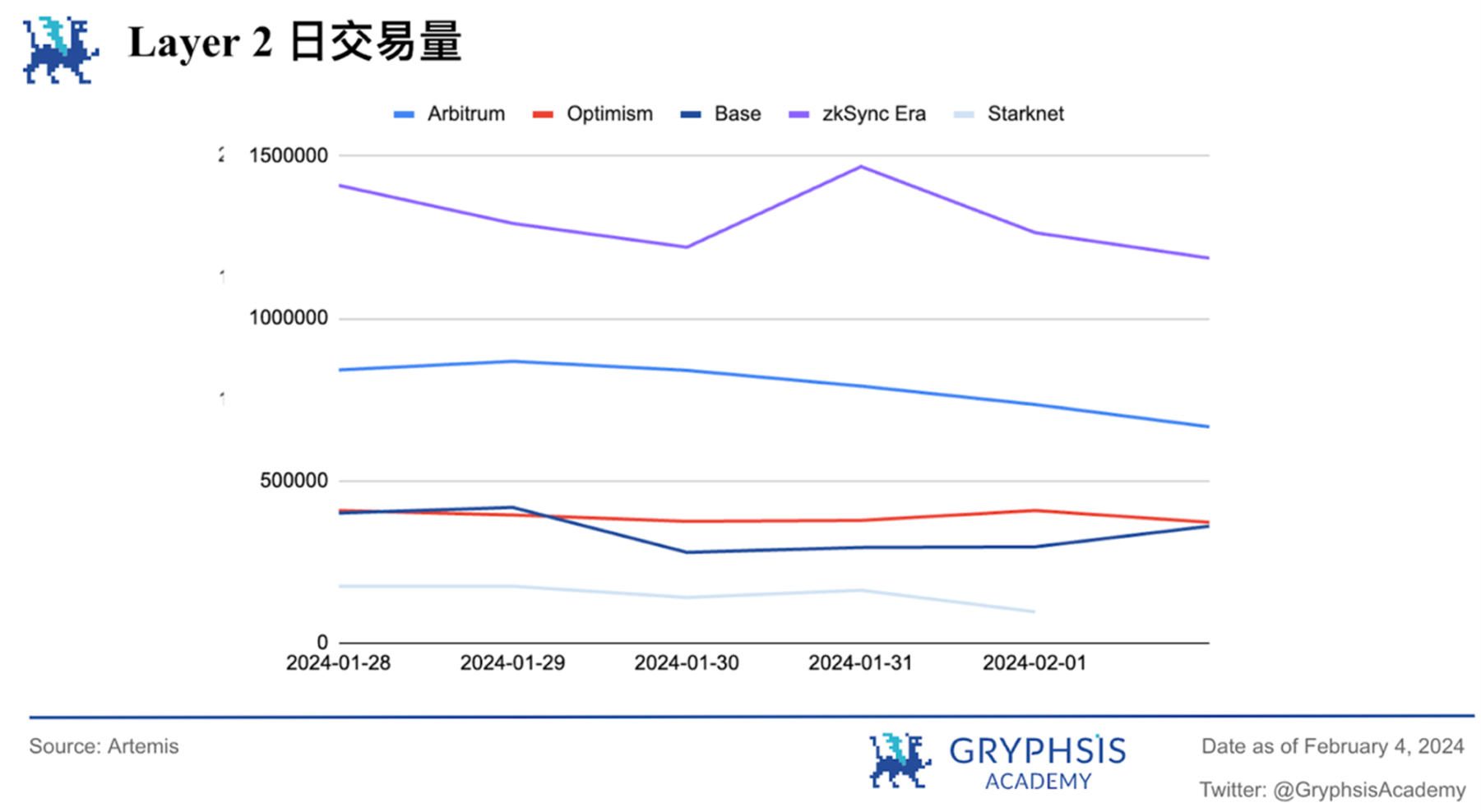

Layer 2 Overview:

Last week, Layer 2 increased except for zkSync Era and Optimism, with Base increasing most significantly by 3.82%. Protocols like Sablier, Superfluid, Interport Finance, Dexilla, and StarkDefi have demonstrated noteworthy TVL growth rates.

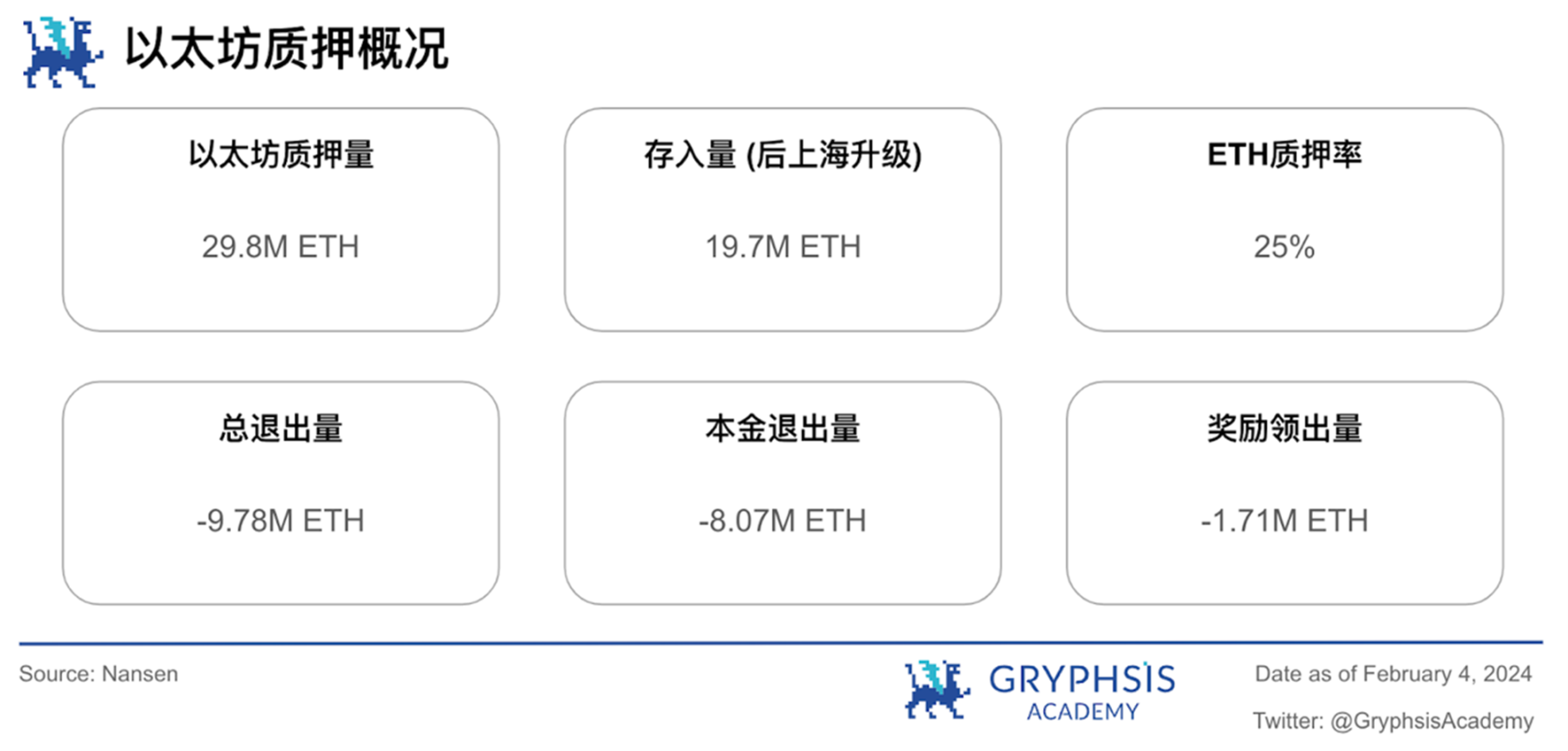

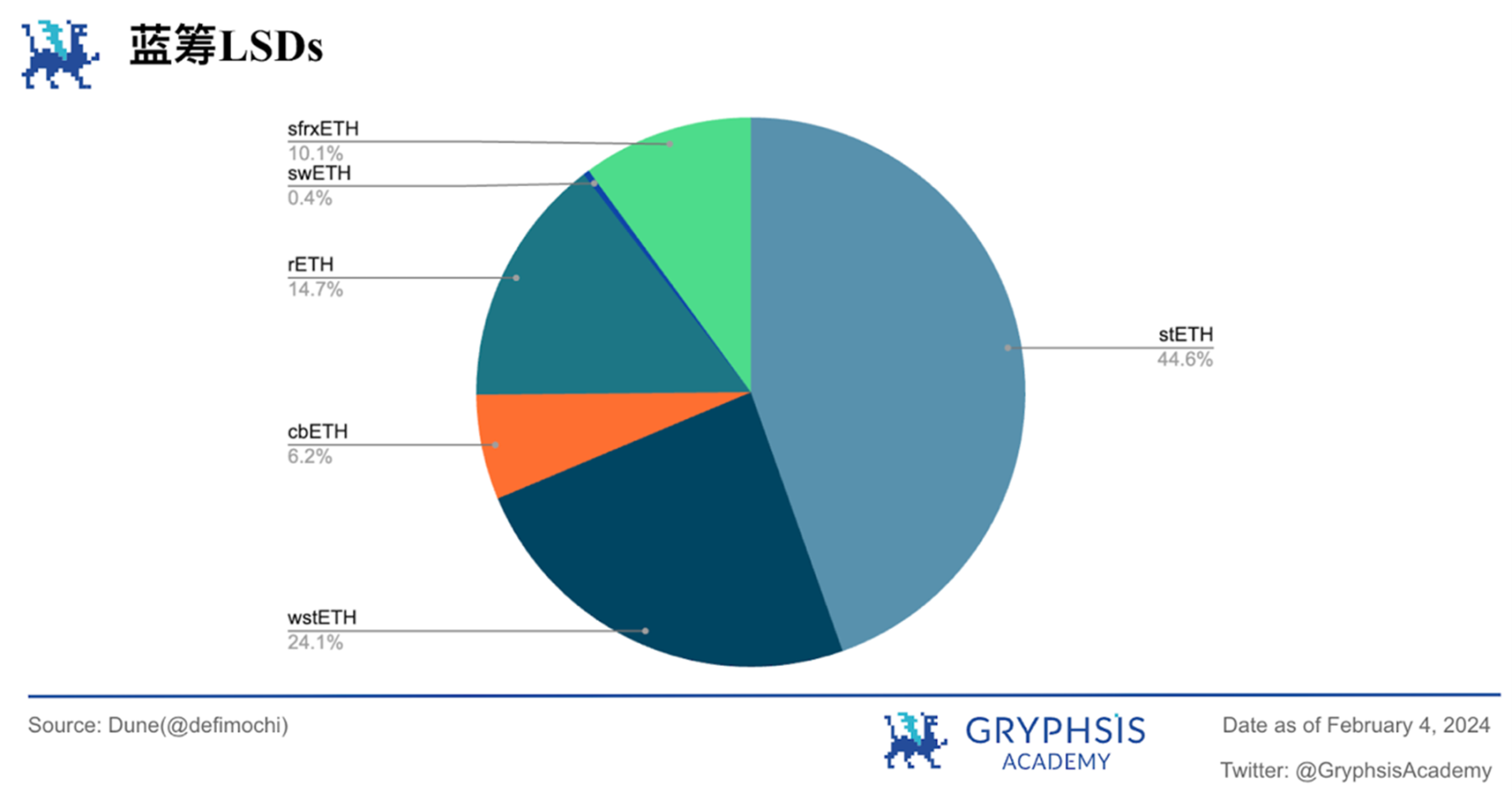

LSD Sector Overview:

In the LSD field, both Ethereum deposits and total withdrawals increased slightly, but relatively speaking, the withdrawal volume was more obvious at 4.49%. In terms of market share, all blue-chip LSDs have declined significantly, with stETH declining most significantly by 17.47%.

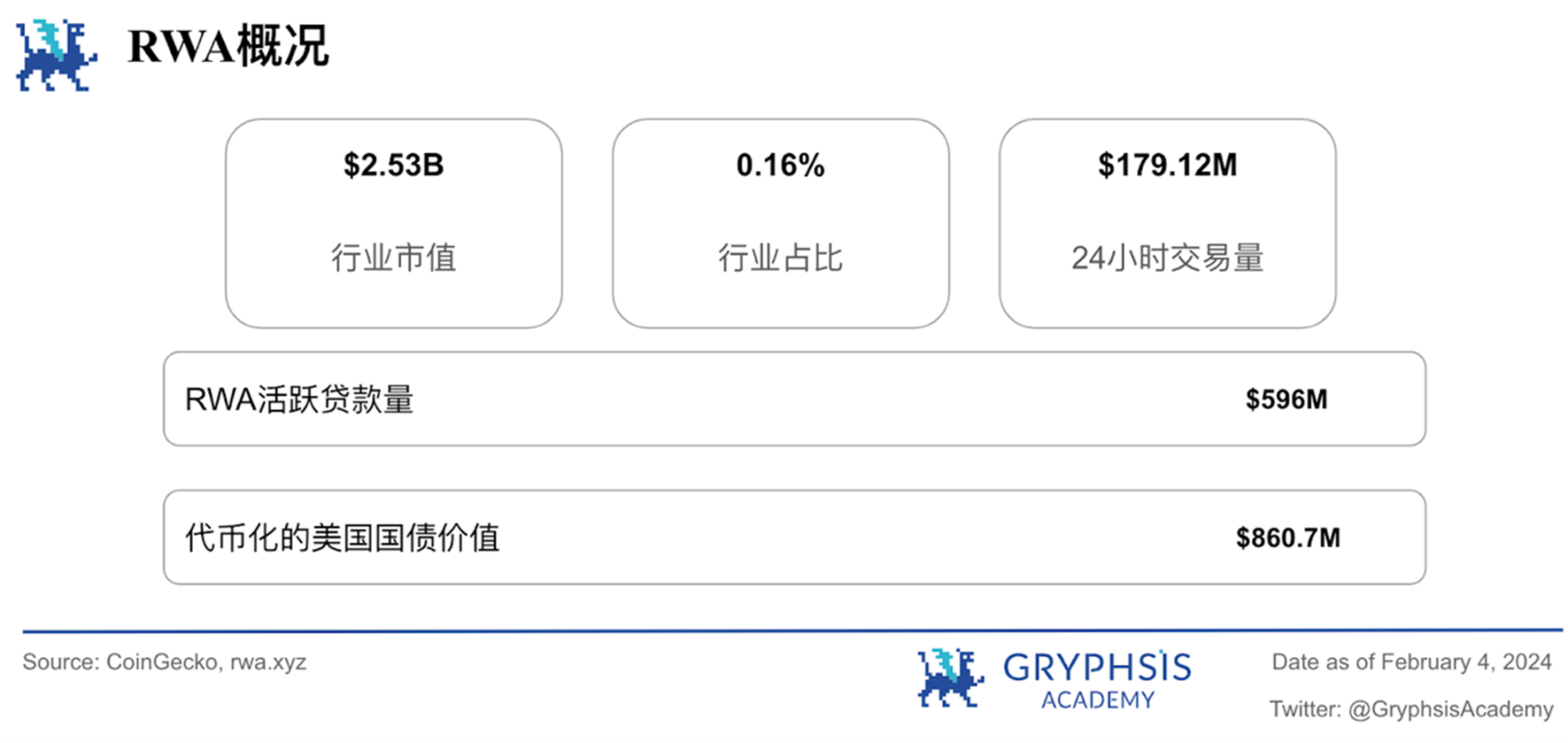

RWA Sector Overview:

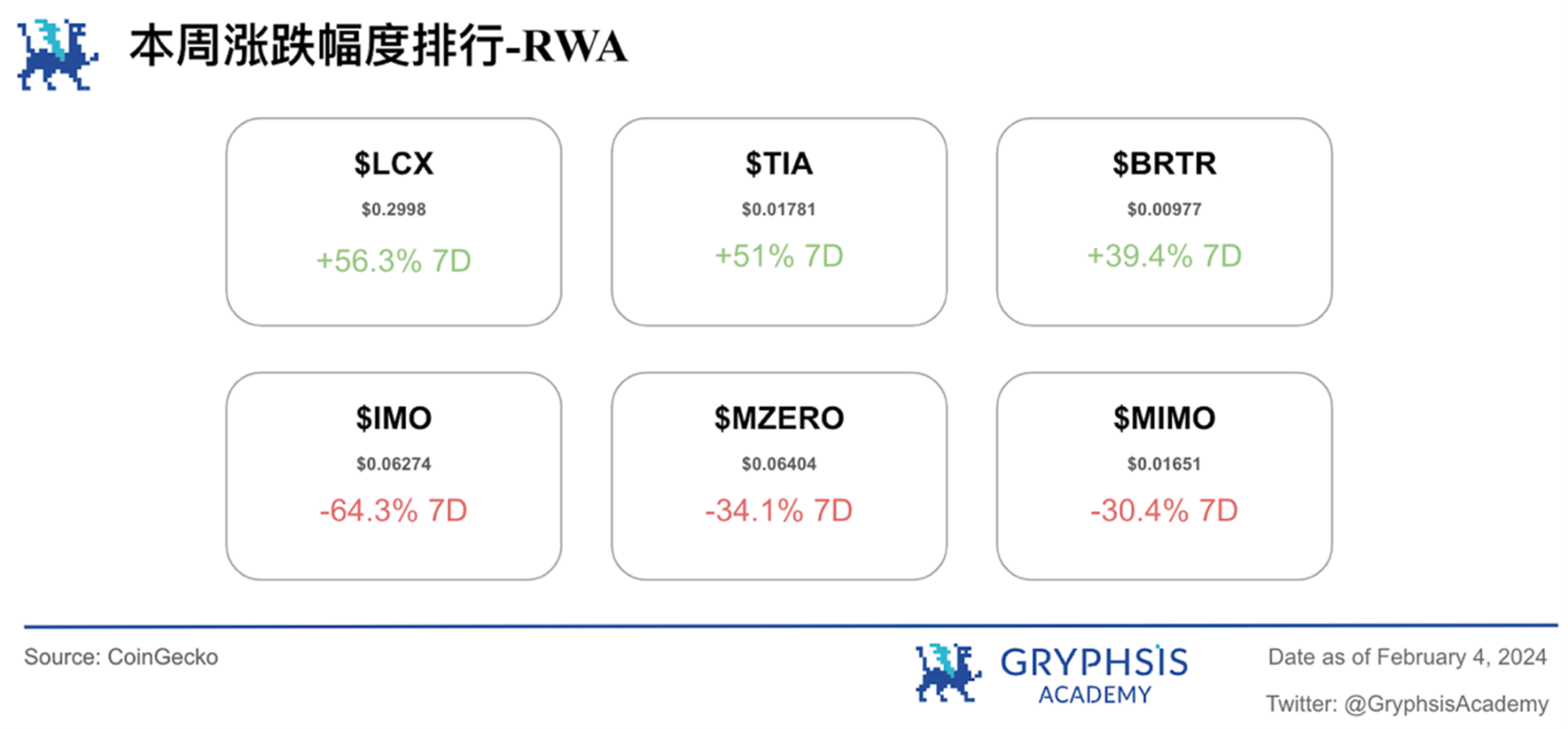

Last week, the worlds real asset market value fell by 1.56%, and the 24-hour trading volume dropped by an even more significant 37.94%. RWA tokenized Treasury gains and tokenized U.S. Treasury bond values were both little changed. Notable growth tokens include $LCX, $TIA and $BRTR, with tokens like $IMO, $MZERO and $MIMO experiencing larger losses.

Main Topics

Macro overview:

US Stock V.S. Crypto

Big news this week:

FTX expects to repay customers in full, BTC price rebounds to $43,000

Weekly Agreement Recommendations:

Puffer Finance

Weekly VC Investment Focus:

BRC-137( 2.5 M)

Stride( 4 M)

Clusters( 9 M)

Twitter Alpha:

@0x Tindorr on Puffer Finance

@Flowslikeosmo on AVAX

@poopmandefi on WhalesMarket

@MoonKing___ on B Squared Network

@the_smart_ape on $ALEO

Macro overview

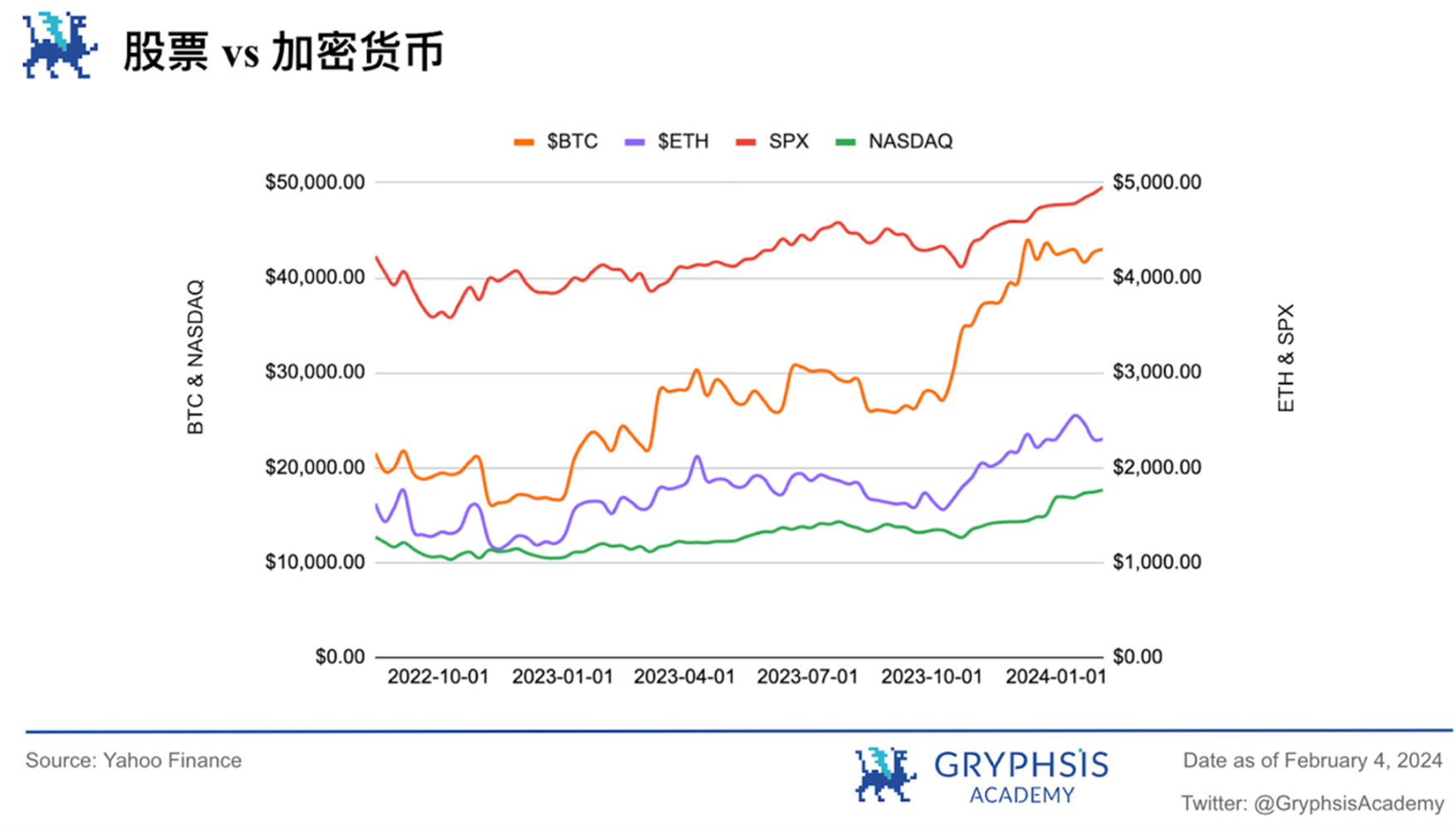

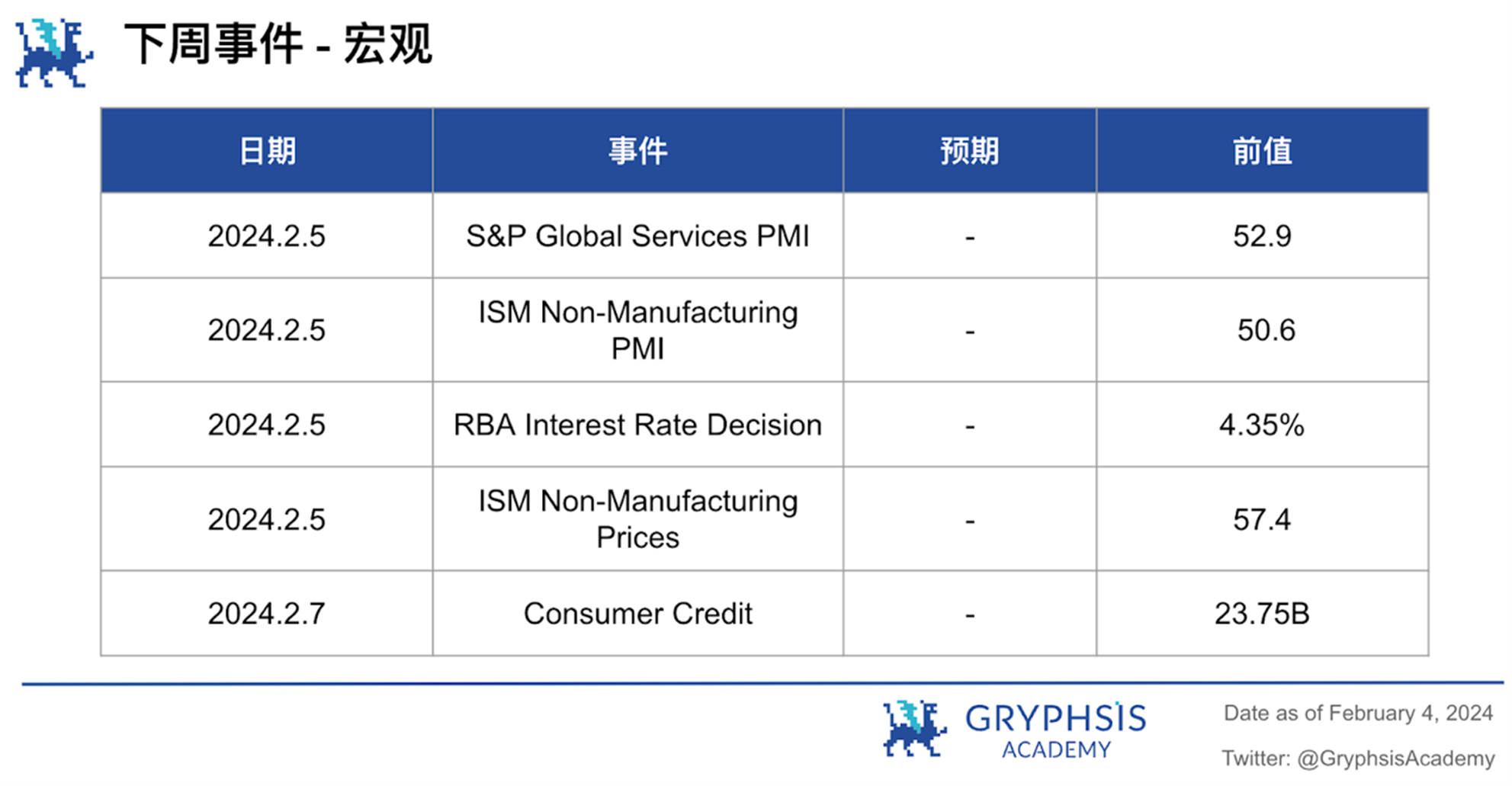

This week, at the stock market level, SPX and NASDAQ increased by 1.39% and 1.27% respectively. In the coming week, pay attention to major events such as the SP Global Services Purchasing Managers Index, ISM Non-Manufacturing Purchasing Managers Index, ISM Non-Manufacturing Price Index, and Consumer Credit.

Big news this week

FTX expects to repay customers in full, BTC price rebounds to $43,000

FTX, the bankrupt cryptocurrency exchange founded by Sam Bankman-Fried, said it expects to repay its customers in full, subject to the timing of FTX’s actual bankruptcy, according to a court hearing. The date has been tentatively approved by U.S. Bankruptcy Judge John Dorsey.

Many of the claims are based on currencies that have depreciated significantly during the tumultuous period leading up to the filing date, Kris Hansen, an attorney for FTXs committee of creditors, said during Wednesdays hearing.

The U.S. Bankruptcy Court requires applicants to submit proof that they held and subsequently lost assets on FTX for review by restructuring counsel. Due to a lack of buyers, the exchange has abandoned plans to relaunch its platform and is instead focusing on compensating its former customers. According to bankruptcy claims exchange platform Xclaim, approximately 15 million people lost $30 billion to $35 billion worth of various cryptocurrencies after the FTX collapse.

FTXs native token, FTT, rose more than 11% following news of the companys plans, but soon fell sharply, falling about 15% on Wednesday.

At the time of publication, Bitcoin’s price has rebounded to over $43,000, a 110% increase from around $20,500 when FTX crashed in early November.

Weekly Agreement Recommendations

Welcome to our Protocols of the Week segment – where we spotlight protocols making waves in the crypto space. This week, we selected Puffer Finance, a native Ethereum Liquidity Re-pledge Protocol (nLRP) powered by EigenLayer.

Puffer is a decentralized native Liquid Restaking protocol built on EigenLayer. By introducing the native Liquid Restaking Token (nLRT) -pufETH, it lowers the threshold for nodes to participate in Ethereum staking and increases the rate of return through re-staking.

Binance Labs has announced a strategic investment in Puffer Finance. In addition to this round of financing, Puffer has also received a total financing of 6.15 million yuan. It has not only received funding from the Ethereum Foundation, but also received funding from Jump Crypto and Brevan Howard in two rounds of financing. Digital, Bankless Ventures, Animoca Ventures and others, as well as investments from numerous angel investors.

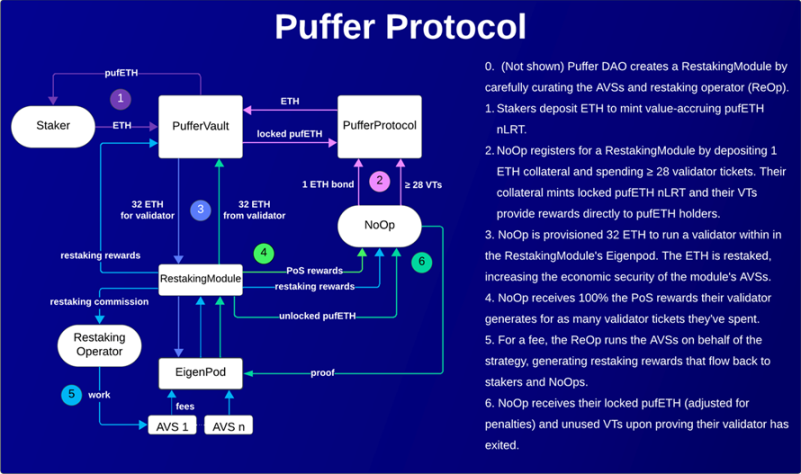

The agreement mainly includes: ordinary pledgers (retail investors), node pledge NoOp, and the RestakingModule contract in the system

The following is its workflow diagram:

Source: Official Doc

Ordinary stakers can deposit ETH and mint pufETH as a pledge certificate, which can provide its holders with more rewards than traditional liquid staking tokens (LST). pufETH not only includes PoS rewards and staking rewards, but its value can quickly accelerate due to the sale of Validator Tickets.

NoOp validators need to deposit a validator ticket (Validator Ticket) and 1 or 2 ETH as collateral for the PufferProtocol contract. In return, pufETH will be minted and kept locked until it is confirmed that its validator has successfully exited.

Each RestakingModule contract contains a queue of pending NoOp registrations. As PufferPool accumulates 32 ETH blocks from deposits and rewards, these blocks will be made available to NoOps pending validators as planned.

Once a NoOp validator is successfully registered, they are eligible to validate their deposited validator tickets for a number of days. During this period, NoOp retains 100% of generated PoS rewards. Their execution rewards are instantly deposited into their wallets, while their consensus rewards accumulate in the module’s EigenPod and can be withdrawn after the NoOp withdrawal process. Since NoOps receive 100% PoS rewards, they are incentivized to maximize validator performance and help protect staker ETH.

our insights

Puffer Finance is part of the Liquid Restaking track. It opened $stETH staking service on February 1st. It has obtained $300M of TVL just two days after it went online, becoming the TOP 2 of the track, and the first place Ether Compared with .fi, it has reached half of its TVL, which shows its strong momentum.

Source: Defilama

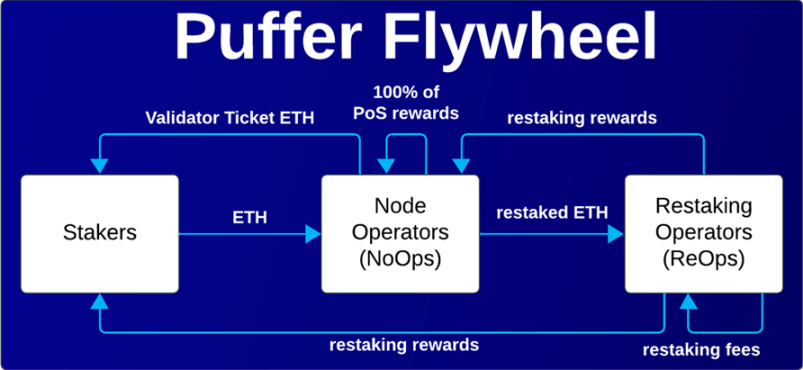

Staker obtains pufETH while staking ETH; NoOp validators need to purchase Validator Tickets (VTs) to operate, and the ETH spent on the purchase will be returned to the stakers to provide additional subsidies for providing funds for the validators; validators need to lock VTs and 1 after purchase ETHs pufETH is used as collateral, and the ETH pledged by Staker is given to ReOps for re-pledge; ReOps returns re-pledge rewards to the verifier and Staker, while the POS rewards obtained in Ethereum are all returned to the verifier, and ReOps will collect a part of Re-pledge fees serve as income.

Source: Official Doc

In addition to multiple benefits, Puffer Finances AVS technology and Secure-Signer remote signature are also project highlights. Among them, Puffers Secure-Signer remote signature has received funding from the Ethereum Foundation, allowing validators to reduce the risk of reduction while improving capital efficiency within the Puffer protocol.

As part of their strategy, Puffer plans to run their upcoming L2 as EigenLayer AVS. The move is expected to create network effects, especially as more AVS come into play and benefit from the economic security provided by Puffer. This integration plays a key role in increasing rewards for Puffer’s permissionless validators. Not only does this incentivize participation, it also helps strengthen Ethereum’s decentralization.

Weekly VC Investment Focus

Welcome to our weekly Investing Spotlight, where we reveal the biggest venture capital developments in the crypto space. Each week, we’ll spotlight the protocols that received the most funding.

BRC-137

The BRC-137 protocol is proposed based on the Ordinals protocol, allowing anyone to create composable DIDs on the Bitcoin blockchain in a completely permissionless and decentralized manner. BRC-137 enables users to monetize their digital identities and facilitates on-chain value exchange and social ecosystem.

https://x.com/brc137io/status/1753704919272685632?s=20

Stride

Stride is the largest liquidity staking protocol in Cosmos today, with 90+% market share and $100 million in TVL on chains such as Cosmos Hub, dYdX, and Osmosis. In just one year, Stride has launched more than 10 LSTs, always focusing on liquidity staking.

https://x.com/stride_zone/status/1753468392428728639?s=20

Clusters

Clusters is a multi-chain domain name service designed to solve problems such as address fragmentation, wallet management complexity, and domain name preemption. It is launched by Delegate in partnership with cross-chain interoperability protocol LayerZero.

https://x.com/clustersxyz/status/1753085068522963012?s=20

protocol event

Ryder Ripps must pay Yuga Labs $ 9 million after lawsuit's final judgment

Genesis asks bankruptcy court to approve $ 1.4 billion sale of GBTC shares

Epic Games is listing Call of Duty-style crypto video game 'Shrapnel'

OPNX a crypto derivatives exchange to shut down in February

Aevo plans airdrop for early adopters of derivatives protocol

Industry updates

BlackRock’s spot bitcoin ETF overtakes Grayscale’s GBTC in daily volume

Hong Kong to release consultation on regulating OTC crypto venues

DOJ charges trio for $ 400 million SIM-swapping hack targeting FTX

Valkyrie adds BitGo as custodian for its spot bitcoin ETF

Bitfinex Securities launches digital asset services in El Salvador

Twitter Alpha

There is a lot of alpha in crypto Twitter, but navigating thousands of Twitter threads can be difficult. Each week, we spend hours doing research, curating threads full of insight, and curating your weekly picks list. Let’s dive in!

https://x.com/0x Tindorr/status/1753794385807114584? s= 20

https://x.com/Flowslikeosmo/status/1753810645718622488?s=20

https://x.com/poopmandefi/status/1751256778044739870?s=20

https://x.com/MoonKing___/status/1753478935801741443?s=20

https://x.com/the_smart_ape/status/1753825705337708963?s=20

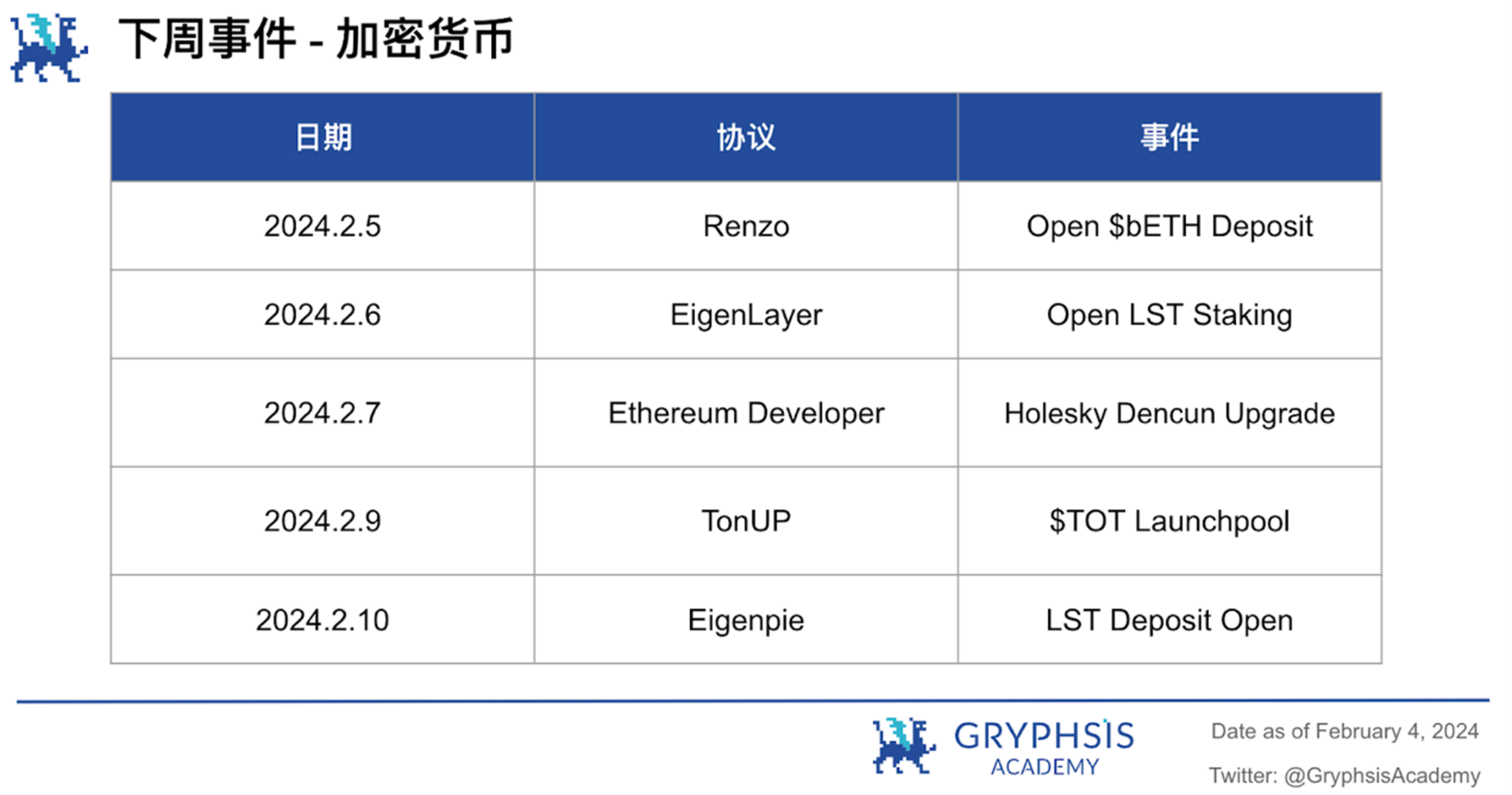

next week events

news source

https://www.theblock.co/post/275735/blackrock-spot-bitcoin-etf-gbtc-daily-volume

https://www.theblock.co/post/275695/crypto-derivatives-exchange-opnx-to-shut-down-in-february

https://www.theblock.co/post/275530/aevo-airdrop-token

That’s all for this week. Thank you for reading this weeks newsletter. We hope you benefit from our insights and observations.

allowableTwitterandMediumFollow us on to get instant updates. See you next time!

This weekly report is provided for informational purposes only. It should not be relied upon as investment advice. You should conduct your own research and consult independent financial, tax or legal advisors before making any investment decisions. And the past performance of any asset is not indicative of future results.