Welcome, dear reader, to Gryphsis Academy’s weekly cryptocurrency digest. We bring you key market trends, in-depth insights on emerging protocols, and new industry dynamics, all designed to enhance your expertise on cryptocurrency and Web3. Happy reading! Follow ourTwitterandMedium, for deeper research and insights.

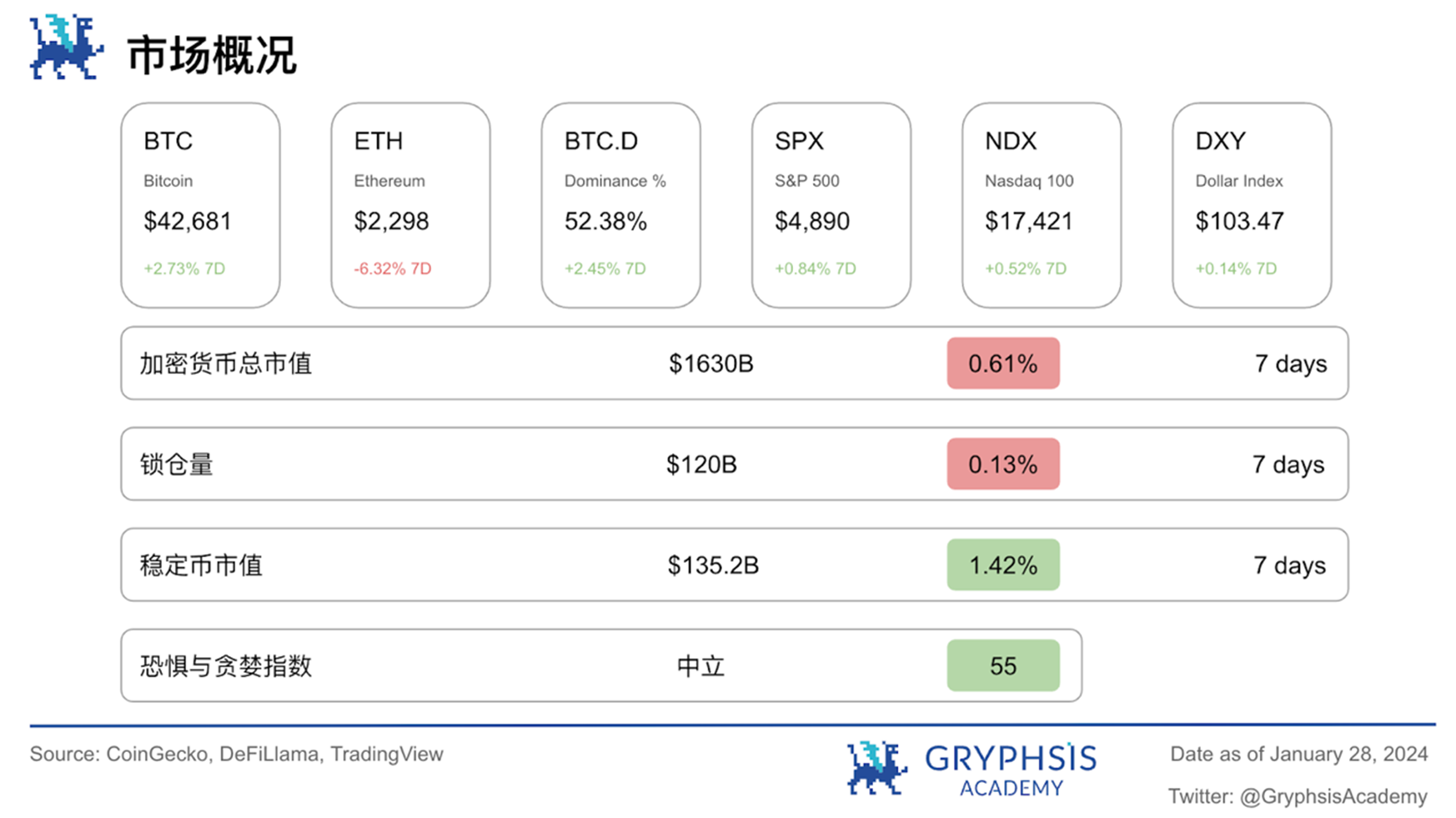

Market and industry snapshots

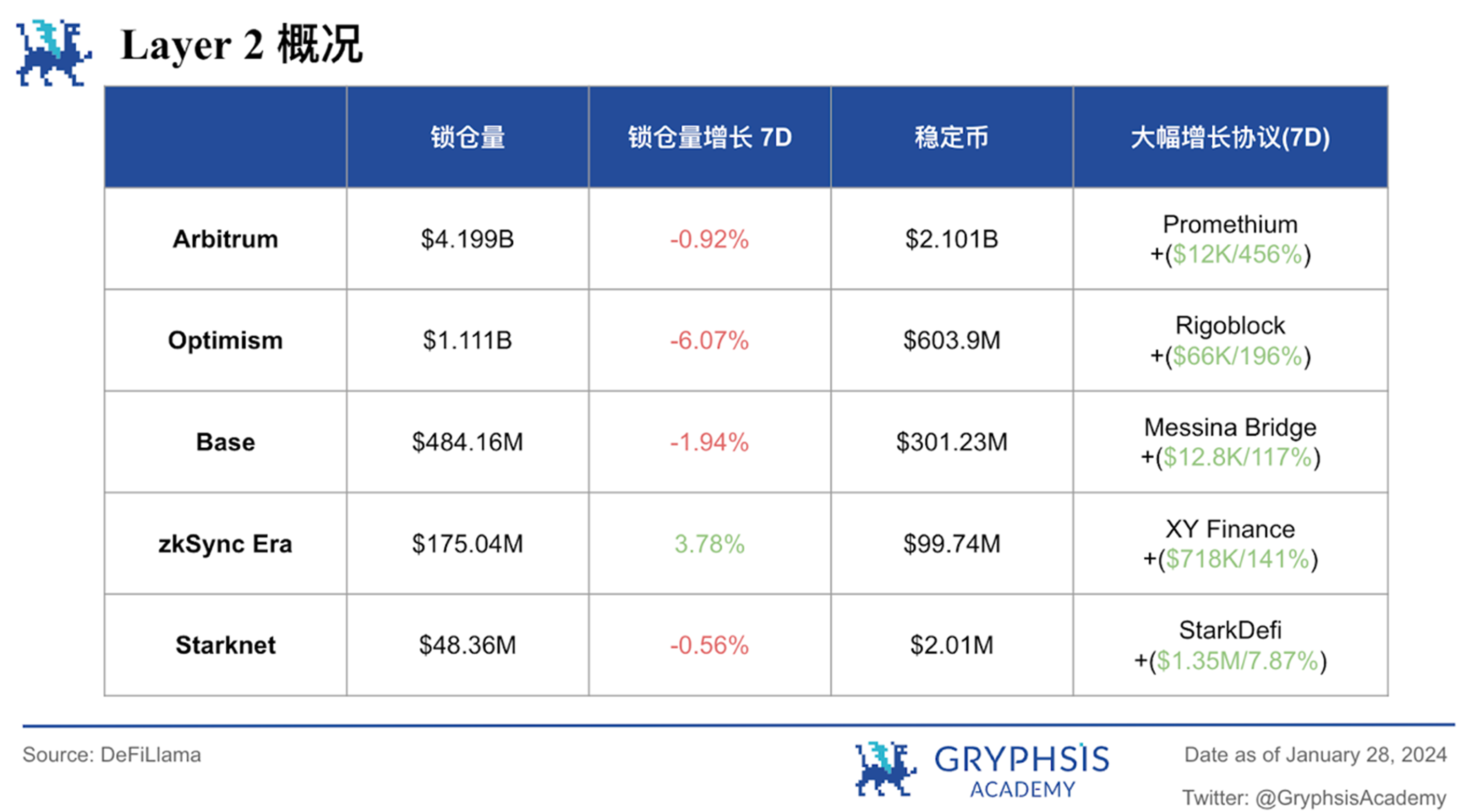

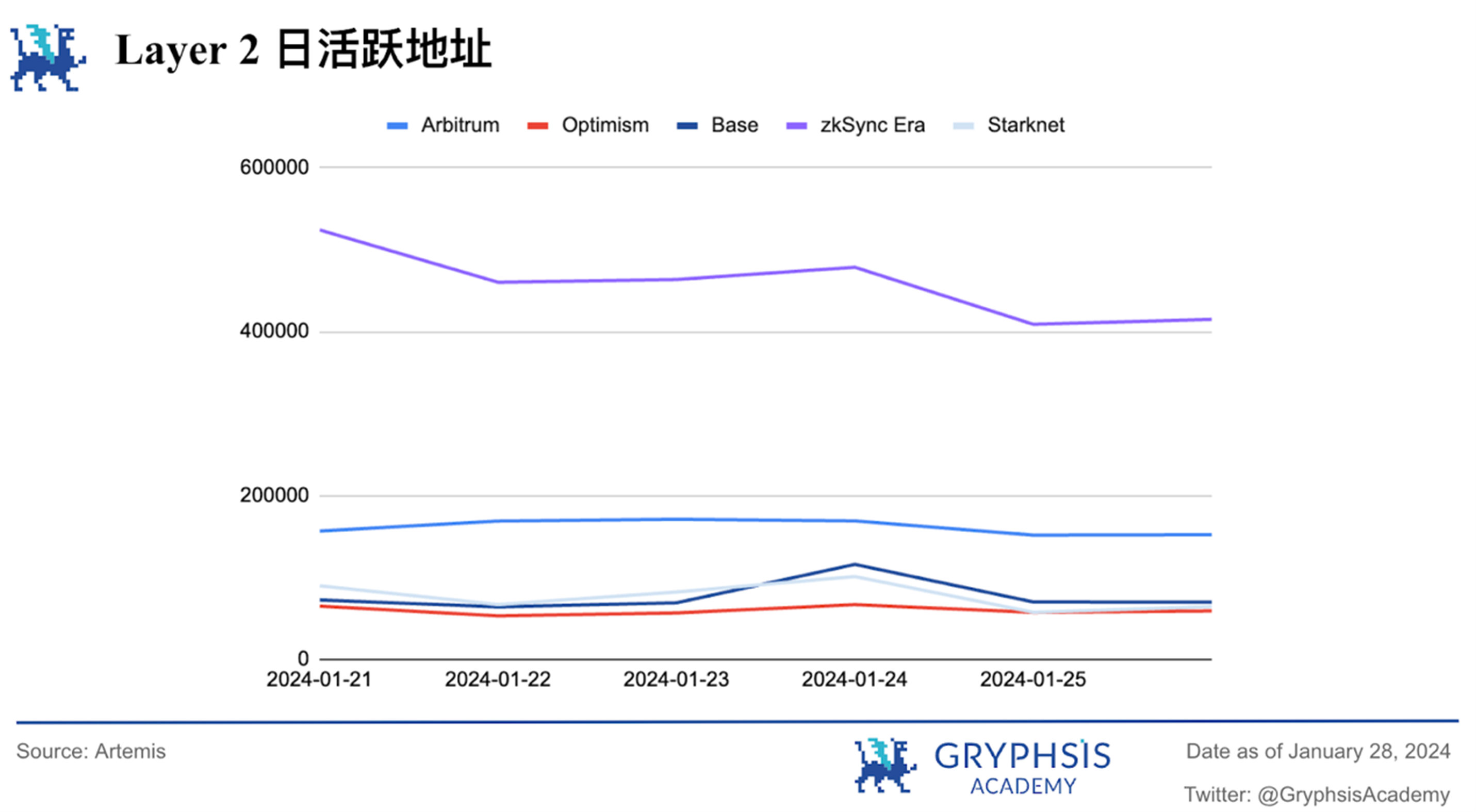

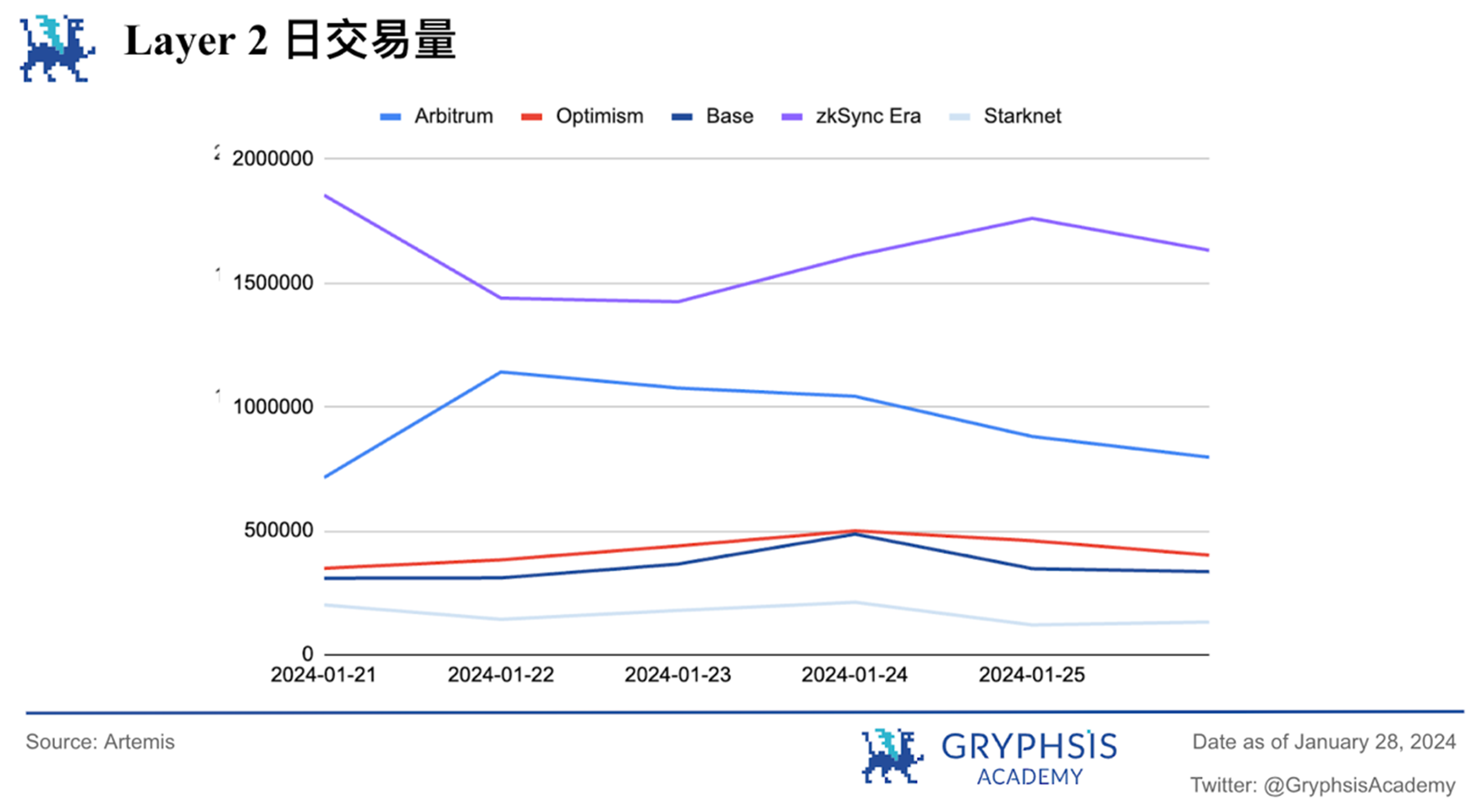

Layer 2 Overview:

Last week, Layer 2 showed a downward trend except for zkSync Era, which increased by 3.78%. Protocols like Promethium, Rigoblock, Messina Bridge, XY Finance, and StarkDefi have demonstrated noteworthy TVL growth rates.

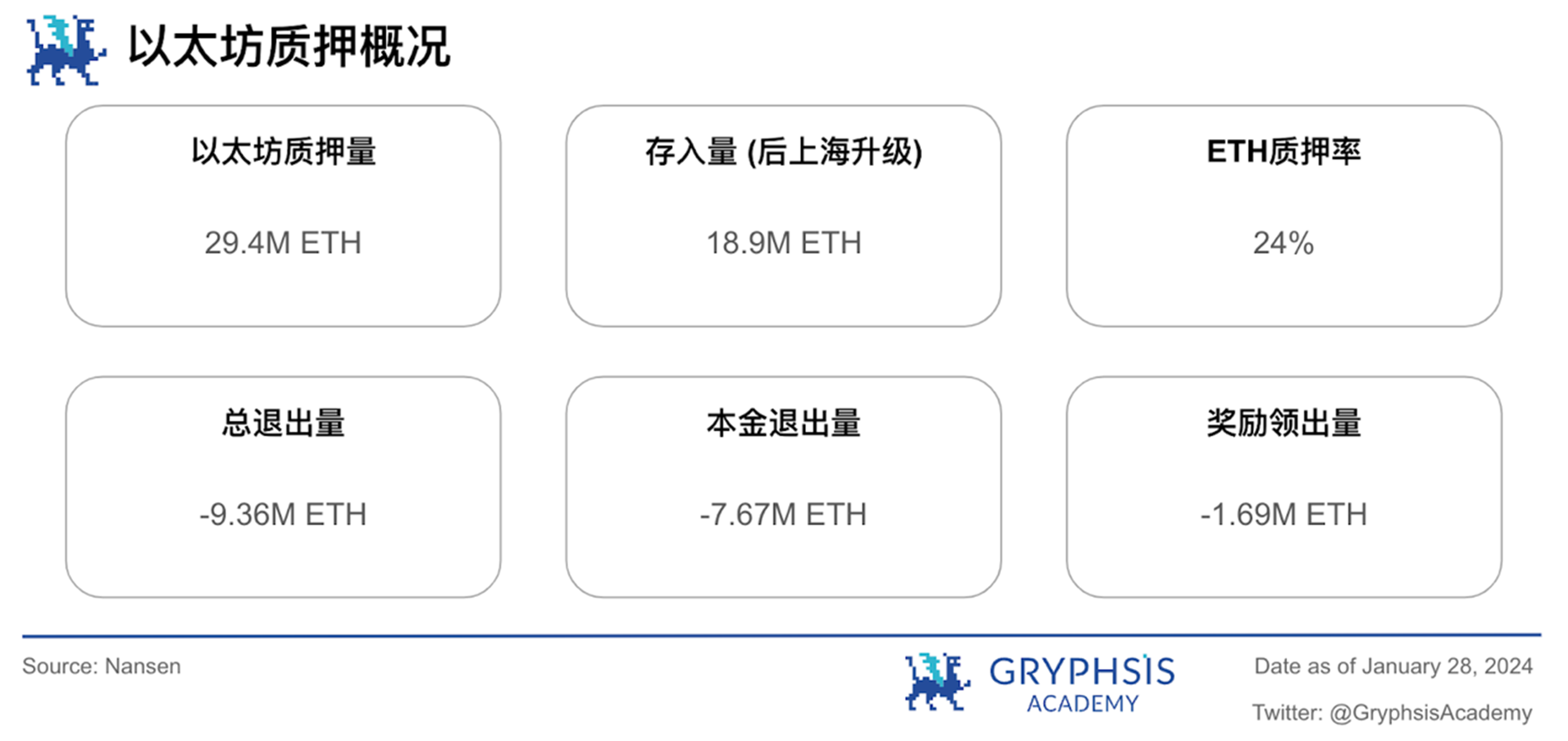

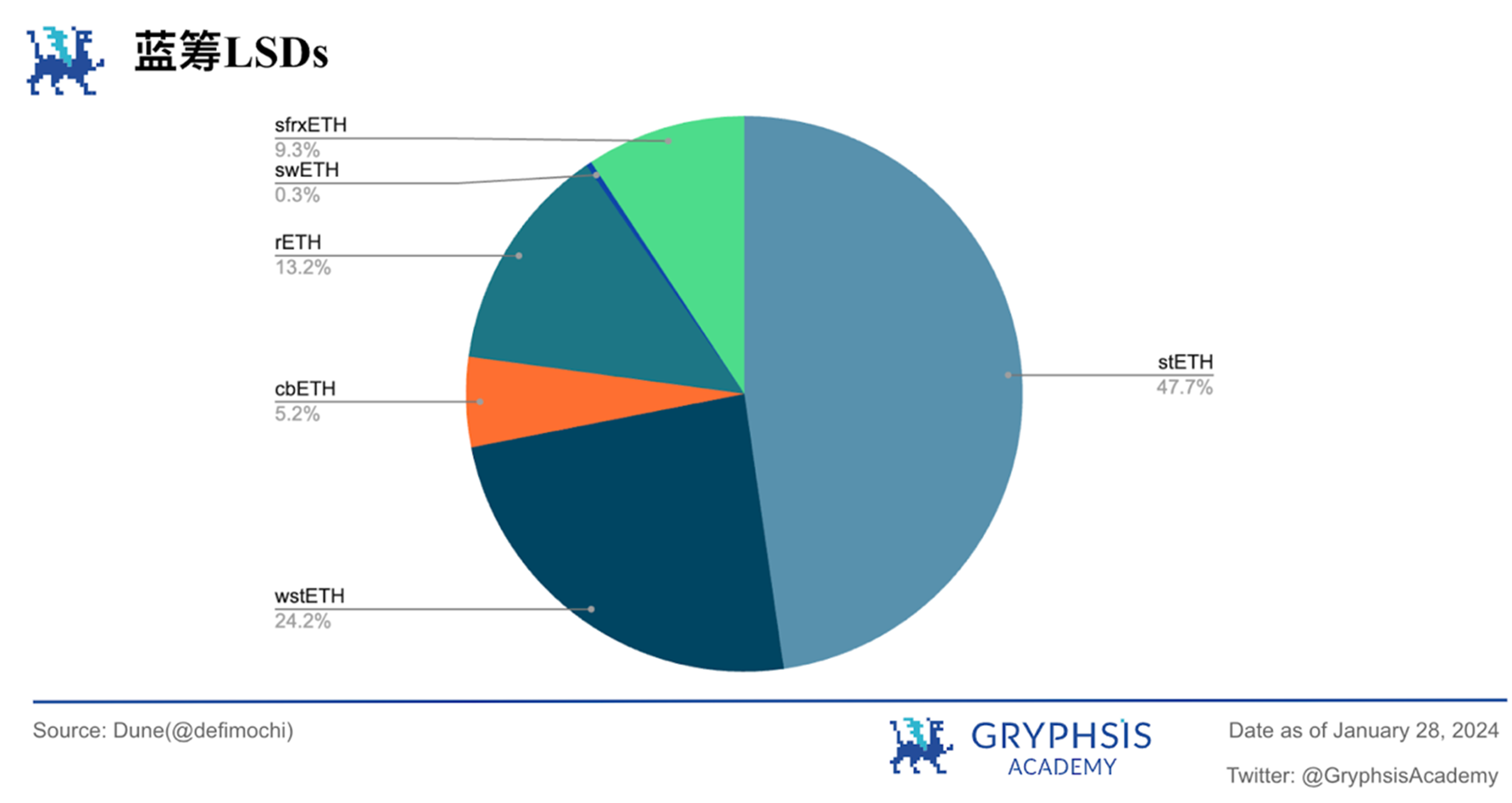

LSD Sector Overview:

In the LSD field, both Ethereum deposits and total withdrawals increased slightly, but the withdrawals were relatively more obvious. In terms of market share, all blue-chip LSDs have declined significantly, with sfrxETH having the most obvious decline of 23.31%.

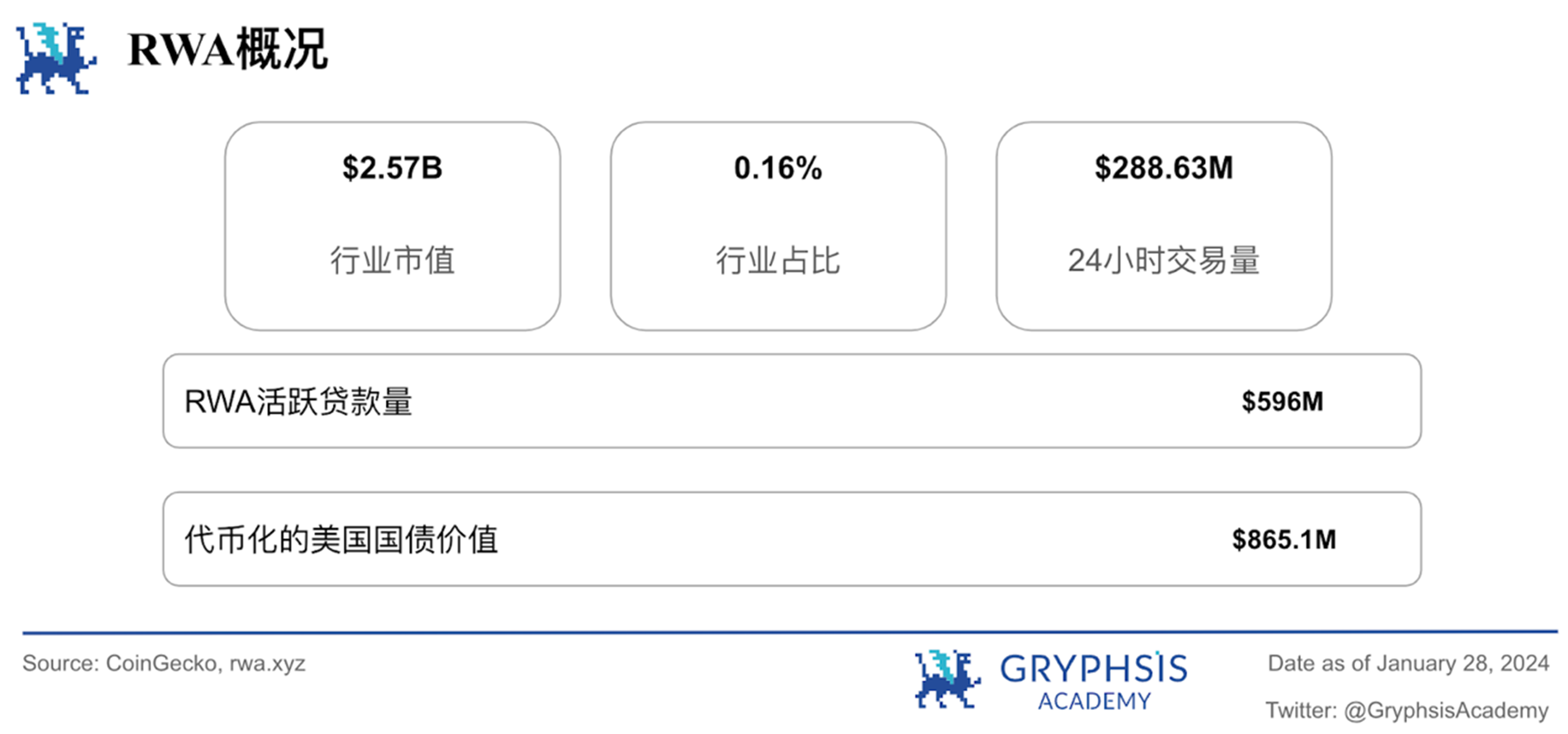

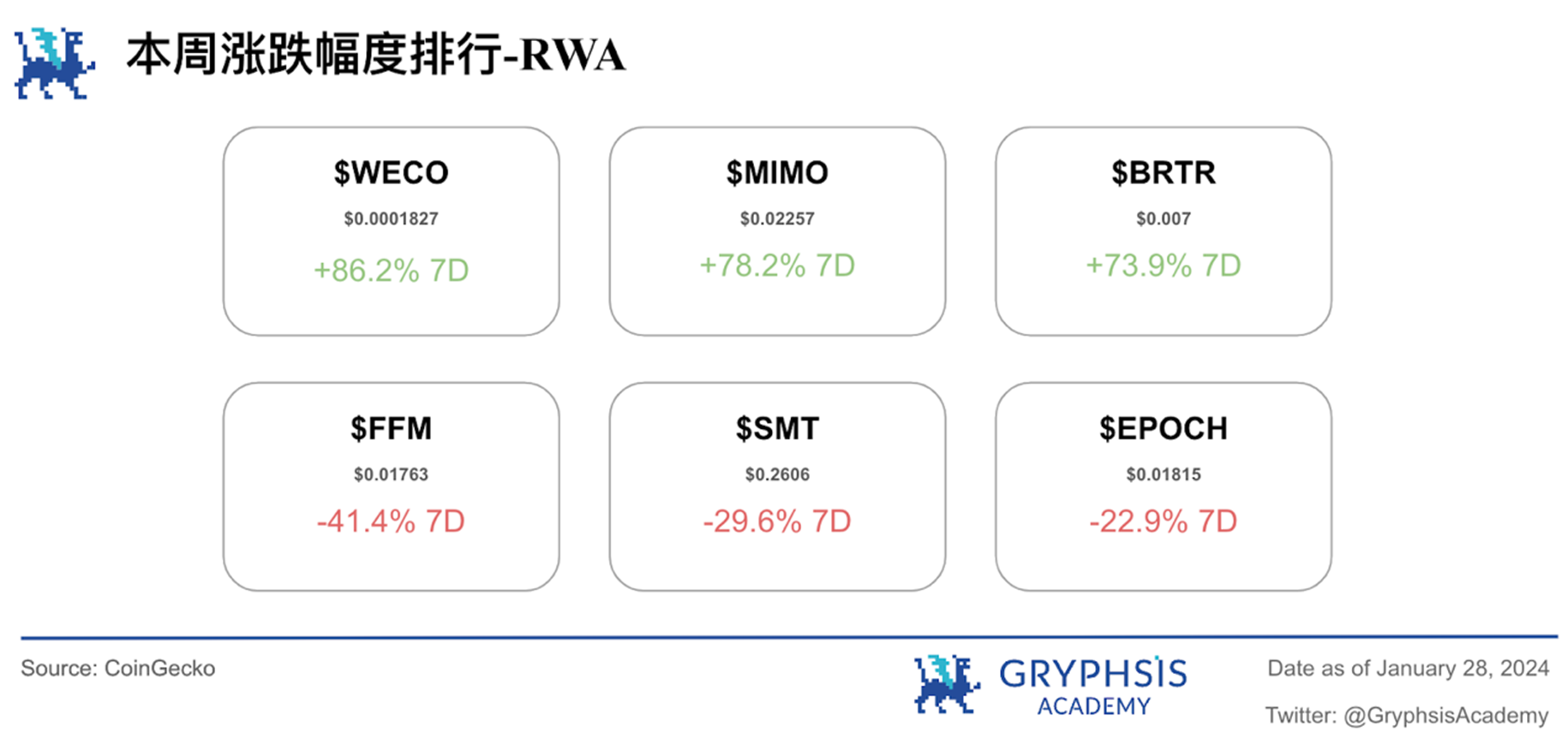

RWA Sector Overview:

Last week, the worlds real asset market capitalization changed little, but the 24-hour trading volume increased significantly by 18.02%. RWA tokenized treasury gains and tokenized U.S. Treasury bond values both fell slightly. Notable growth tokens include $WECO, $MIMO and $BRTR, with tokens like $FFM, $SMT and $EPOCH experiencing larger losses.

Main Topics

Macro overview:

US Stock V.S. Crypto

Big news this week:

SEC Delayed Ethereum Spot ETF Application

Weekly Agreement Recommendations:

Peapods

Weekly VC Investing Spotlight:

Axiom($ 20 M)

Dopamine($ 4.5 M)

Synonym($ 1.5 M)

Twitter Alpha:

@poopmandefi on Celestia

@MoonKing___ on Surfboard

@stacy_muur on Flare Network

@DeRonin_ on LBPs

@KingWilliamDefi on DePIN

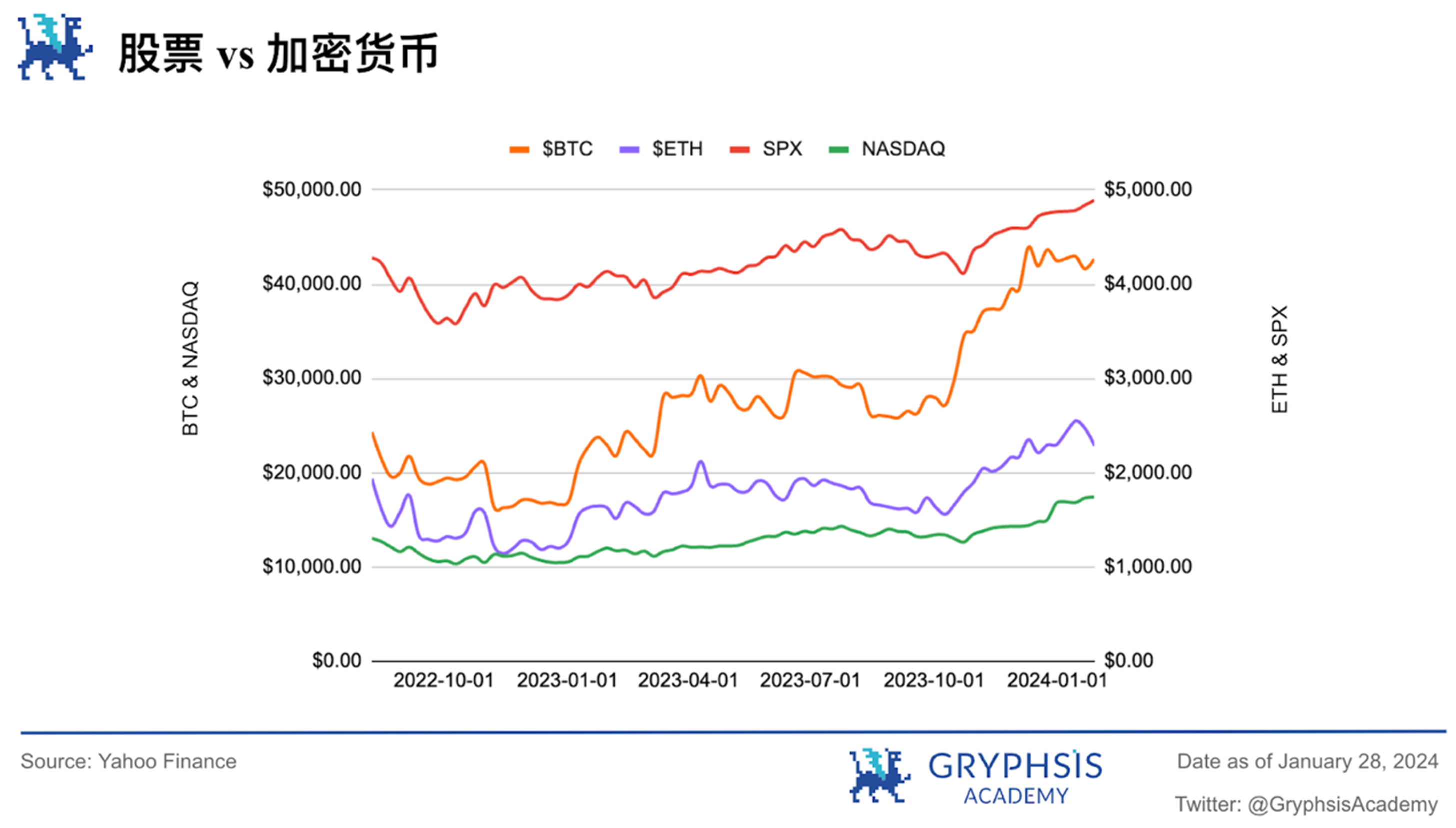

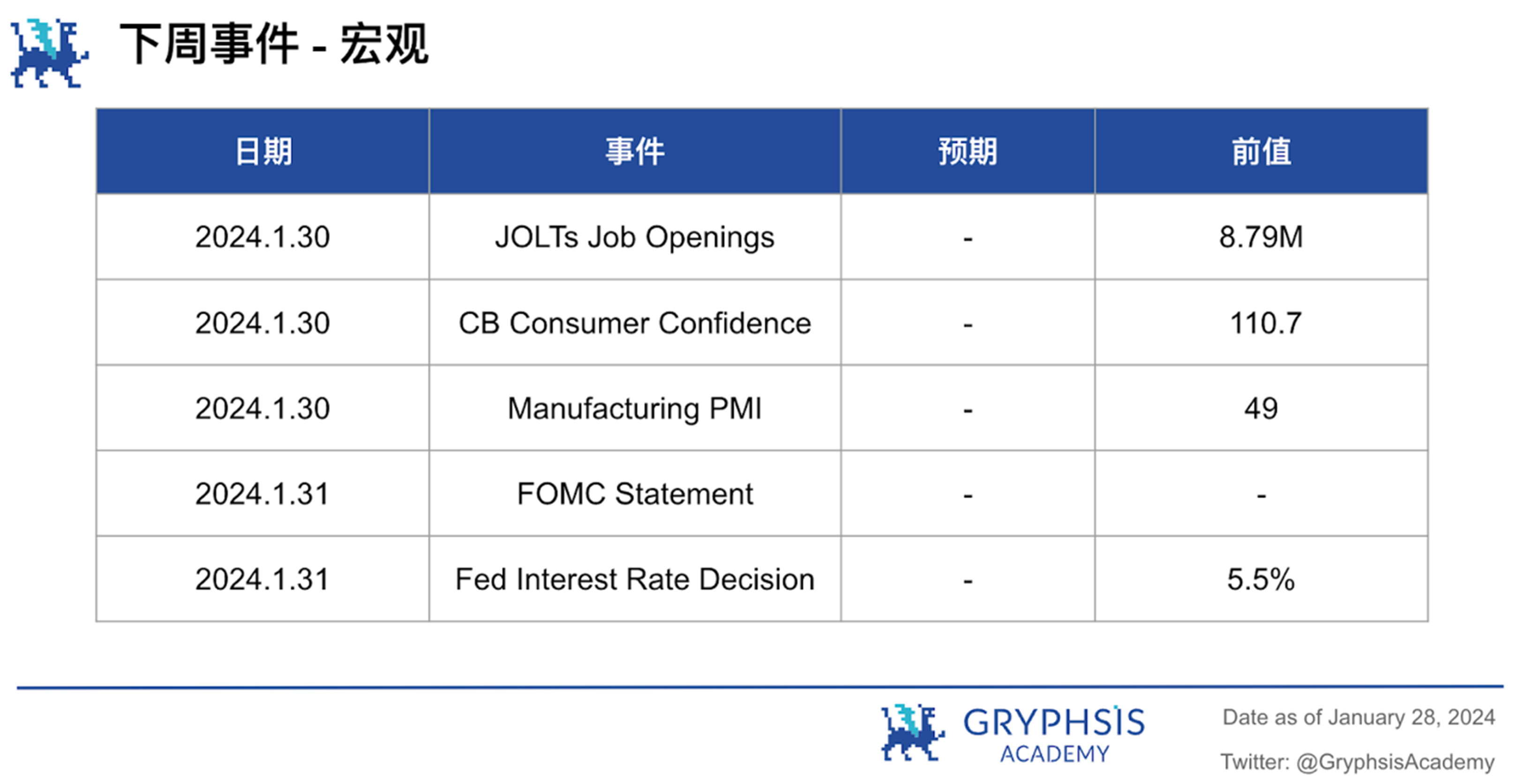

Macro overview

This week, at the stock market level, SPX and NASDAQ increased by 1.05% and 0.62% respectively. In the coming week, pay attention to JOLTs job vacancies, CB consumer confidence index, manufacturing PMI, FOMC statement, Federal Reserve interest rate decision and other major events.

Big news this week

SEC delays spot Ethereum ETF application

Grayscale and BlackRock are among the companies currently trying to launch spot Ethereum ETFs, but the U.S. Securities and Exchange Commission (SEC) has delayed Grayscale Investments’ application to convert its Ethereum Trust Product (ETHE) into an exchange-traded fund (ETF); a day earlier, BlackRocks application was also delayed.

The SEC has traditionally opposed spot cryptocurrency ETF products and only allowed a series of spot Bitcoin ETF products to be listed in the United States for the first time in January. The delay in any decision on Grayscales application on Thursday was not surprising, as was BlackRocks application.

Before the SEC approves a spot Bitcoin ETF application, issuers and exchanges need to start submitting updated documents answering a variety of questions from the regulator. This week’s filing raised the question of whether a spot Ethereum ETF would be similar to a spot Bitcoin ETF.

“Do commenters believe that the arguments supporting the listing of Bitcoin ETPs apply equally to Shares?” “Do specific characteristics associated with ETH and its ecosystem, including its proof-of-stake consensus mechanism and centralization under the control or influence of a few individuals or entities, exist? Issues that raise unique concerns about ETH’s vulnerability to fraud and manipulation?”

There are other issues focusing on market manipulation, whether the spot market and futures market are related and whether the CME futures market is of significant size, etc. These are similar issues raised by the SEC when reviewing the Bitcoin application.

https://www.coindesk.com/policy/2024/01/25/spot-ether-etf-applications-decisions-delayed-by-sec/

Weekly Agreement Recommendations

Welcome to our Protocols of the Week segment – where we spotlight protocols making waves in the crypto space. This week, we selected Peapods, an on-chain index fund product that can help users manage multi-chain crypto assets and achieve arbitrage.

Peapods is a decentralized, permissionless, trustless on-chain volatility mining protocol that does not rely on oracles or external price sources, allowing users to take advantage of the endless volatility of the crypto market to unlock income opportunities for any liquid asset. Simply put, users can obtain liquidity mining incentives of $PEAS by creating/joining a liquidity pool. When users deposit multiple assets, the platform will unify and wrap them into a single ERC-20 token. These tokens are called pods in the Peapods ecosystem.

$PEAS is the native token of the protocol, with an issuance limit of 10 M. 88% of the tokens are deposited by users into Uniswap to provide $PEAS/$DAI liquidity, and the remaining 12% is used for team unlocking.

In traditional farming protocols, the revenue from mining comes from minting new coins, and the revenue may be offset by the issuance. In Peapods, tokens have no inflation mechanism or can be minted. They are minted when the contract is deployed.

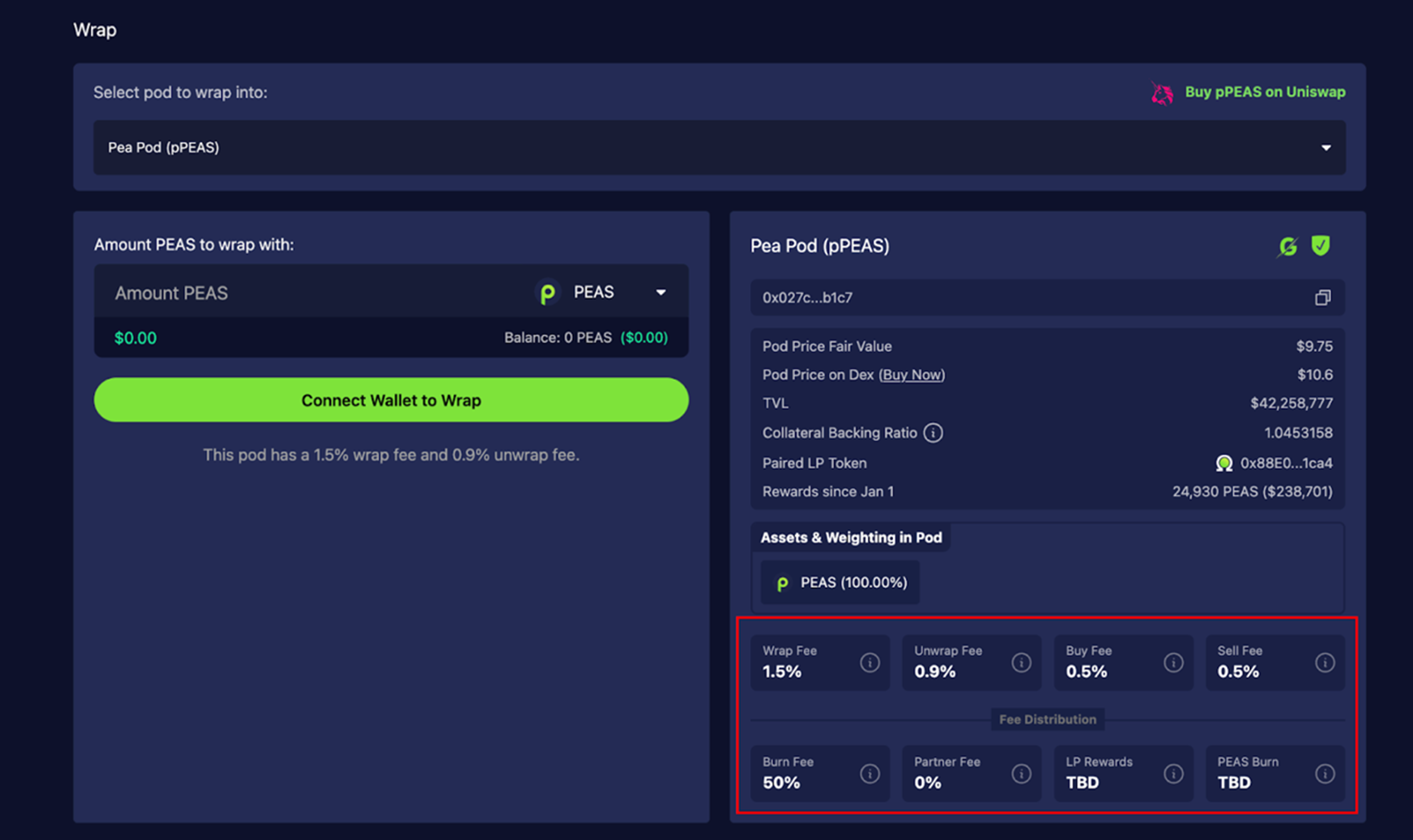

The main fee of the protocol comes from the warpped fee. Users will pay a certain fee when they (un)wrap, and this part of the protocol income will be used to purchase $PEAS in the market, and the rest will be used to burn and reward to LP or Token holder and so on.

Source: Website

For example, in the pPEAS pod, users must first hold $PEAS, and the platform will wearp it into $pPEAS and then deposit it. During this process, the platform will charge a 1.5% warp fee; of course, users can also directly purchase $pPEAS from other dexes, but they still need to pay a 0.5% purchase fee. In this pool, for example, 50% of the burning fee will be used to purchase $PEAS, creating purchase demand so that $PEAS holders can enjoy token appreciation, but it is not friendly to users who directly hold $pPEAS, indirectly prompting users to purchase $PEAS.

The fee mechanism of Peapods can not only bring appreciation benefits to holders, but more importantly, it serves as a key trigger of the arbitrage mechanism in the entire system.

Source: Official Doc

The users original asset is TKN, and the asset after the platform wrap is pTKN. However, since part of the pTKN fee will be charged when (un)wrap, the actual number of pTKN obtained will be reduced. However, since the total value of the pTKN held must be equal to the value of the original assets, but the quantity will inevitably lead to The prices of pTKN and TKN are different, creating room for arbitrage.

our insights

Peapods is affiliated to the Yield track. It currently ranks among the top 5 in terms of single-day growth rate and ranks in the top 10 in terms of TVL. Around January 26, TVL achieved a 5-fold increase. At present, the product has generated 2.5 M in expenses and a total revenue of 2.2 M.

Source: Defilama

The most important thing about Peapods is the arbitrage opportunity that arises from the price deviation of TKN and pTKN caused by the wrap mechanism. This arbitrage volume drives protocol revenue through (un)wrap fees, with all participants profiting in the process.

Arbitrageurs get the spread

The $pPEAS collected for encapsulation or unblocking is destroyed, increasing the value of $pPEAS and benefiting the holders;

The remaining fees are used to purchase $PEAS tokens in the market, benefiting all $PEAS holders;

10% of $PEAS purchased in the market is destroyed, which helps reduce the total amount;

90% of market-purchased $PEAS is distributed as rewards to users who stake liquidity;

Since the market prices of all assets are perpetually fluctuating, users and MEV bots are constantly looking for arbitrage opportunities, and the Peapods protocol takes advantage of this to increase liquidity by creating arbitrage opportunities. Thanks to the existence of Pods, arbitrageurs now have the necessary secondary market where price differences can occur between the same assets, giving them arbitrage opportunities.

Weekly VC Investment Focus

Welcome to our weekly Investing Spotlight, where we reveal the biggest venture capital developments in the crypto space. Each week, we’ll spotlight the protocols that received the most funding.

Axiom

Axiom is a ZK coprocessor that allows smart contracts to access and process all on-chain data trustlessly. This is a protocol that processes data off-chain, then transfers this data to the Ethereum mainnet and verifies it using ZK proofs.

https://x.com/axiom_xyz/status/1750534080842928284?s=20

Dopamine

Dopamine is a crypto investing app for beginners and experts alike, allowing users to access all the information they need (browse all coins, read whitepapers, learn about the team, progress, events, and more), interact with peers, work on DeFi protocols trade and access their favorite crypto tools and projects on.

https://x.com/CoinDesk/status/1750504320880062583?s=20

Synonym

Synonym is the universal cross-chain credit layer for DeFi professionals. Built on Wormhole, Arbitrum and Circle. Synonym allows users to lend, borrow and earn on any chain through a seamless interface.

https://x.com/synonymfinance/status/1750171980803051637?s=20

protocol event

Aleo mainnet set to come within weeks with lofty goal of bringing privacy to crypto

Worldcoin's eyeball scanning Orb is getting an Apple-style makeover

Synthetix deploys first perpetuals protocol on Base blockchain

Polygon aims to launch 'AggLayer' focused on blockchain interoperability in February

Solana Labs releases token extensions for SPL token standard on Solana network

Industry updates

US files intent to dispose $ 117 million in bitcoin seized from Silk Road drug dealer

SEC delays decision timeline for BlackRock's proposed spot Ethereum ETF to March

BIS confirms tokenization project as part of six projects for 2024

Coinbase urges US Treasury to reconsider bulk data reporting in proposed crypto mixing rules

OSL executive says Hong Kong could debut spot crypto ETF by mid-year

Twitter Alpha

Theres a lot of alpha in crypto Twitter, but navigating thousands of Twitter threads can be difficult. Each week, we spend hours doing research, curating threads full of insight, and curating your weekly picks list. Let’s dive in!

https://x.com/poopmandefi/status/1725094175979548991?s=20

https://x.com/MoonKing___/status/1750161835116970374?s=20

https://x.com/stacy_muur/status/1750420288771371489?s=20

https://x.com/DeRonin_/status/1750583770481090836?s=20

https://x.com/KingWilliamDefi/status/1750578494604538283?s=20

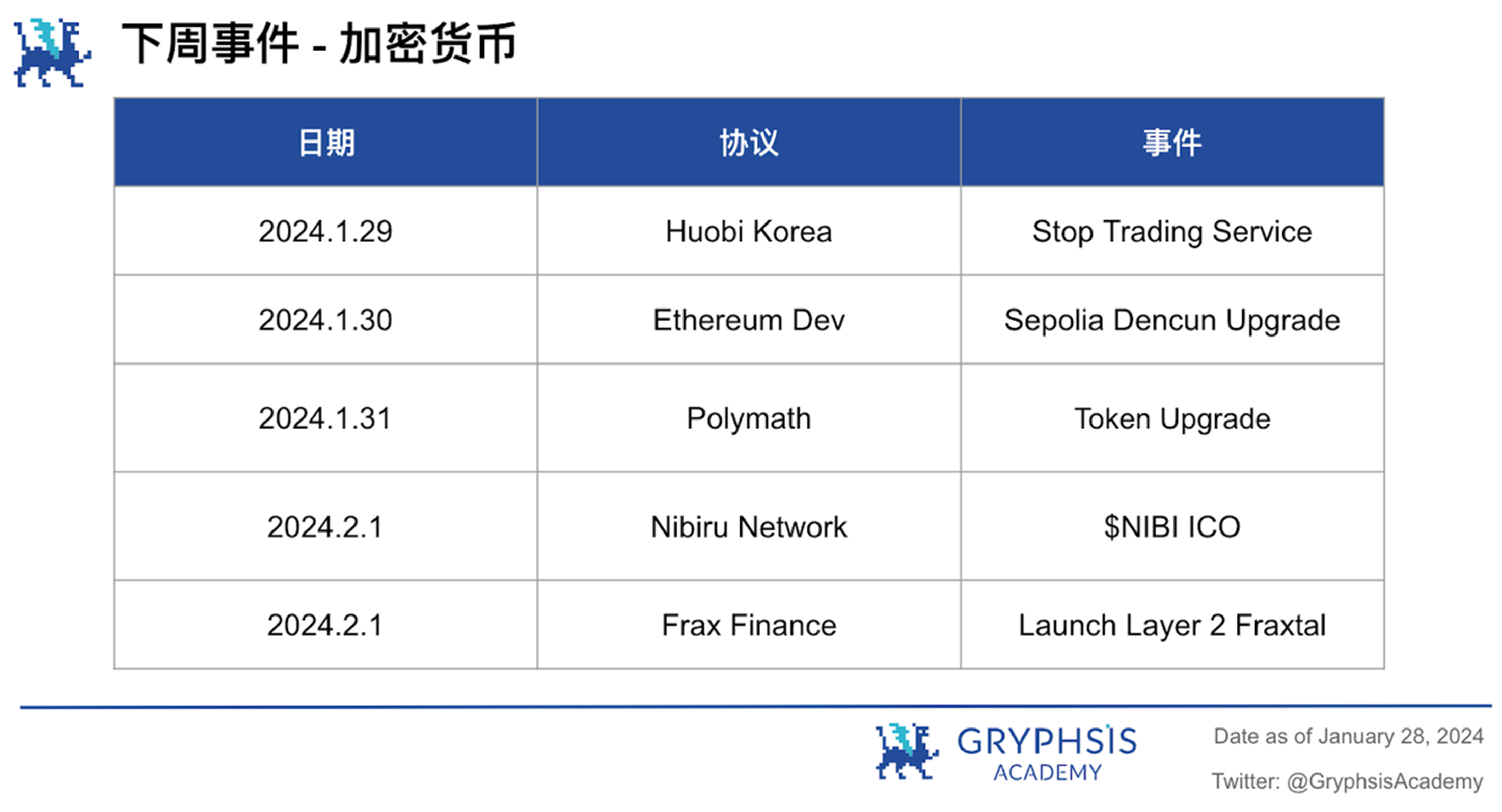

next week events

news source

https://www.theblock.co/post/274350/synthetix-deploys-first-perpetuals-protocol-on-base-blockchain

https://www.theblock.co/post/274296/polygon-agglayer-blockchain

That’s all for this week. Thank you for reading this weeks newsletter. We hope you benefit from our insights and observations.

allowableTwitterandMediumFollow us on to get instant updates. See you next time!

This weekly report is provided for informational purposes only. It should not be relied upon as investment advice. You should conduct your own research and consult independent financial, tax or legal advisors before making any investment decisions. And the past performance of any asset is not indicative of future results.