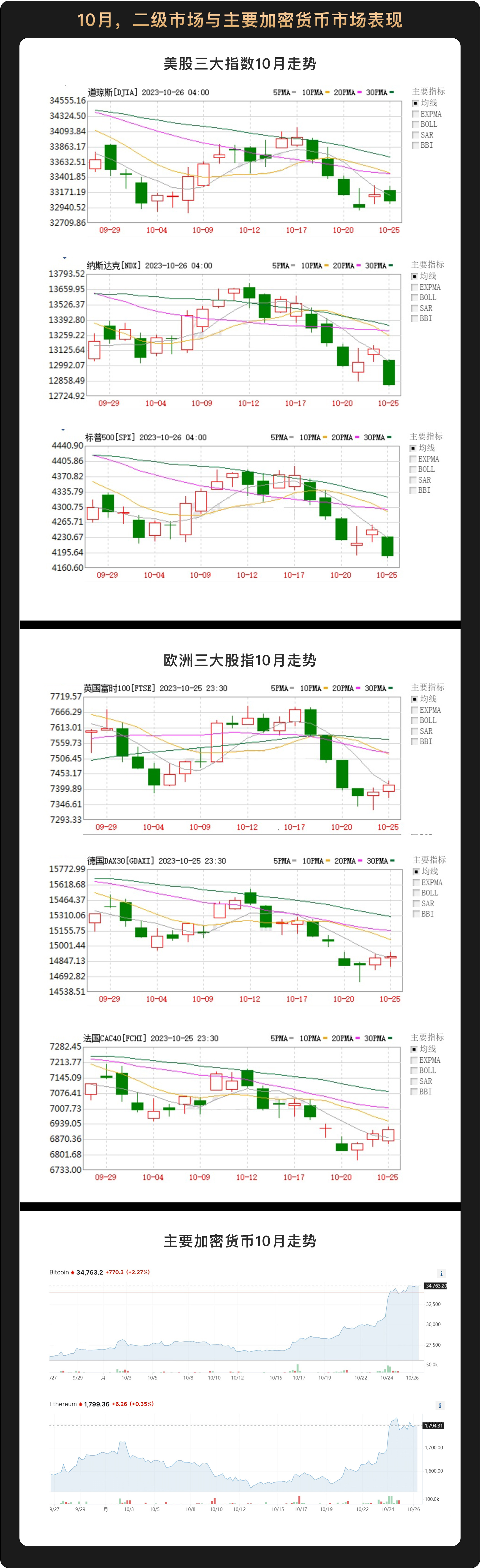

In October, the three major U.S. stock indexes, Europe, Asia-Pacific and other major global securities markets generally showed fluctuations and adjustments. Among them, after experiencing a decline in the index in early October, the worlds major stock indexes rebounded quickly. After reaching a peak around October 16, the index fell again. In the meantime, due to the impact of the Mid-Autumn Festival and National Day holiday, no trading was opened in domestic A-shares in the first half of this month. After trading sideways for a period of time in the middle of the month, the three major A-share indexes showed a unidirectional downward trend.

In terms of cryptocurrency, after a period of low sideways trading, cryptocurrency prices have risen rapidly since mid-October. In particular, the issuance of Bitcoin spot ETFs is expected to heat up, U.S. debt is bearish, and the fourth halving is approaching. The price of Bitcoin once rose above US$35,000 for the first time since 2022. Some cryptocurrency industry analysts believe that a new round of cryptocurrency bull market has begun to brew, and the peak price of Bitcoin is expected to exceed US$138,000 in the next few years.

Data from the U.S. Department of Labor showed that in September, the year-on-year growth rate of the U.S. Consumer Price Index (CPI) was the same as in August; the month-on-month increase was 0.4%, which was slightly slower than the 0.6% increase in August. During the same period, other relevant price indicators have been close to pre-epidemic levels, and inflationary pressures have continued to weaken, gradually approaching the Federal Reserves 2% target. Wealthbee believes that the de-inflation trend in the United States will continue in the fourth quarter, but it has achieved relatively obvious results.

In view of the continued easing of inflationary pressure in the United States, the market generally expects that the Federal Reserves current round of interest rate hikes is nearing its end. In the past few weeks, many Federal Reserve officials and Federal Open Market Committee members have stated that U.S. bond yields have risen, the downward trend in U.S. core inflation is expected to continue, and the need for the Federal Reserve to further raise interest rates has weakened. On October 25, the Federal Reserve’s federal funds interest rate swap market showed that the probability of the Federal Reserve raising interest rates by 25 basis points in November has dropped to less than 1%.

It is worth noting that despite the obvious results of de-inflation, the U.S. economy remains unabated. Data from the U.S. Department of Commerce disclosed that in September, U.S. retail sales increased by 0.7% month-on-month, exceeding market expectations of 0.3%. In a report in October, Morgan Stanley also raised its U.S. Q3 GDP growth forecast to 4.9%. Affected by this, while inflation continues to decline, U.S. energy and labor prices may remain high and volatile in the fourth quarter.

Affected by the Federal Reserves interest rate hike cycle, U.S. bond yields will continue to rise in 2023. In September, despite the Federal Reserve suspending interest rate hikes, the yield on the 10-year U.S. Treasury bond continued to rise, with the increase far exceeding the yield on short-term U.S. Treasury bonds, leading to a bear steep phenomenon in the bond market.

On October 20, the 10-year U.S. Treasury yield exceeded 5%, setting a new high in the past 16 years. After U.S. bond yields rose, U.S. credit interest rates rose rapidly, which has had an adverse impact on U.S. economic development, stock and credit market operations. Among them, on October 19, the 30-year residential mortgage interest rate in the United States was close to 8% for the first time since 2000, which greatly affected the consumption desires of potential home buyers.

Considering that the Federal Reserves interest rate hike cycle is coming to an end, although an insurance interest rate hike by the Federal Reserve is not ruled out, investor expectations have begun to shift, with the uncertainty of the global geopolitical background and the possibility of short covering after the surge in yields in previous weeks. Under such circumstances, it is unlikely that the yield on U.S. bonds, especially the 10-year U.S. bond, will reach new highs.

While Treasury yields continue to be strong, U.S. stocks and major global stock markets are showing fluctuations and adjustments. Around October 16, the three major U.S. stock indexes reached their peaks this month. On October 18, the three major stock indexes in the New York stock market fell significantly: the Nasdaq fell -1.62%, the SP 500 fell -1.34%, and the Dow Jones fell -0.98%. In addition to U.S. stocks, major global indexes such as Europe and East Asia also showed fluctuations and adjustments. Affected by the Mid-Autumn Festival and National Day holiday, the domestic A-share market did not open at the beginning of the month. After a period of narrow consolidation in mid-October, the three major A-share indexes showed a downward trend.

Considering that the Federal Reserve will maintain high interest rates for a period of time, as well as the recent continuation of the Russia-Ukraine conflict and the Palestine-Israel conflict, there is still a lot of uncertainty in the capital market, and investors, especially short-term investors, are still mainly waiting and watching.

In October, the cryptocurrency market showed a rebound trend. Among them, the price of Bitcoin rose rapidly in mid-to-late October due to factors such as expectations for the approval of a Bitcoin spot ETF and the steep rise in U.S. bond yields.

In fact, as the U.S. Securities and Exchange Commission has lost successive lawsuits against crypto asset managers, market expectations for the approval of spot ETFs have increased. As far as Bitcoin trading is concerned, the approval of spot ETFs not only means that investors can enter the crypto market in a compliant manner, but also that investors do not need to directly hold and trade Bitcoins. They only need to purchase ETFs and can also obtain investment returns, which is extremely beneficial. Greatly improve transaction efficiency.

Compared with the cryptocurrency market with an overall market value of trillions of dollars, traditional market funds do not need to enter in large quantities, let alone enter the market on the run. Even if there is only 1% of the basic allocation, it will be a huge amount of positive capital inflows. . Data shows that from June to August 2023 alone, a number of asset management institutions, including leading platforms such as BlackRock, have submitted applications for 11 Bitcoin spot ETFs, taking the lead in arranging Bitcoin spot ETF transactions.

On October 16, news broke that the U.S. Securities and Exchange Commission had approved the ISHARES Bitcoin Spot ETF. Although it was later confirmed that this was false news, and the Bitcoin spot ETF listing application is still under review by the U.S. Securities and Exchange Commission, the market’s expectations for the ETF’s listing time have been advanced from November next year to May next year to the end of this year. Affected by this, the price of cryptocurrencies, especially Bitcoin, has experienced rapid rise since mid-to-late October. On October 24, the trading price of Bitcoin once exceeded $35,000 per coin, which was the first time since 2022.

Since mid-October, in view of the intensification of the Palestinian-Israeli conflict and the bearish trend in U.S. bond yields, investors expectations for future economic growth to slow down and the Federal Reserve interest rates to fall have increased, and the investment logic has also shifted from safe-haven trading to multi-asset allocation. Some funds flowed out of long-term U.S. bonds and increased their holdings of assets such as Bitcoin, which also contributed to the strong rise in the crypto market. In addition, the fourth halving in the history of Bitcoin is coming soon, and the number of new Bitcoins recorded on the blockchain will be reduced by 50%. This will also affect the trading mentality of investors to a certain extent and promote this round of Bitcoin trading prices. rise.

Overall, this round of strong gains in the Bitcoin market is the result of rising expectations for the approval of Bitcoin spot ETFs and the sharp rise in U.S. bond yields, the re-pricing of global assets and the resonance of seasonal patterns in the crypto market. The nature of this market is not driven by a single event, but a structural market that will last for a long period of time.

As the Federal Reserves interest rate hike cycle ends and the digital transformation of the global economy continues to advance, a new round of industrial expansion cycle has begun to brew. Under the influence of factors such as rising expectations for the approval of Bitcoin spot ETFs and steepening U.S. bond yields, the cryptocurrency market is expected to start a new round of bull market. However, the outbreak of the Palestinian-Israeli conflict has increased global economic uncertainty and the markets wait-and-see sentiment is still high. Investors should pay close attention to market trends and rationally plan their investment strategies and directions.

Copyright statement: If you need to reprint, you are welcome to communicate with our assistant on WeChat. If you reprint or clean the manuscript without permission, we will reserve the right to pursue legal responsibility.

Disclaimer: The market is risky, so investment needs to be cautious. Readers are requested to strictly abide by local laws and regulations when considering any opinions, views or conclusions in this article. The above content does not constitute any investment advice.