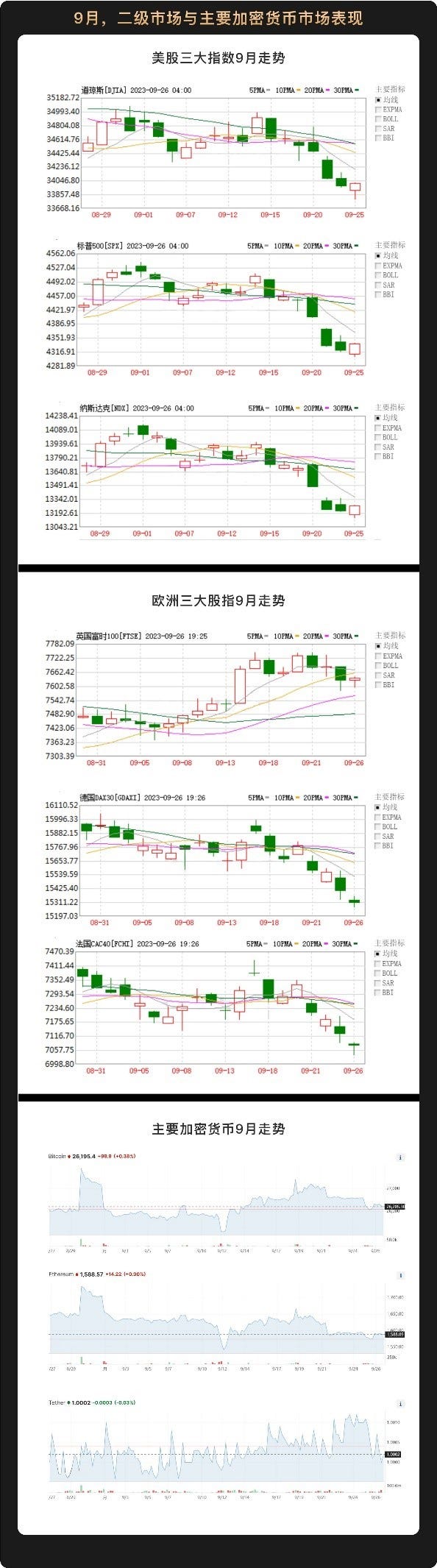

In September, the three major U.S. stock indexes, Europe, Asia-Pacific and other major global securities markets generally showed sideways adjustments. Among them, after reaching a high point on September 1, the three major U.S. stock indexes fell one after another. During the same period, the three major European stock indexes had mixed trends. In September, the British FTSE index first fell and then rose, showing a slight upward trend overall; although the German DAX 30 index and the French CAC 40 index rose in a short period of time, they overall showed a narrow range of consolidation.

In terms of cryptocurrencies, in September, the crypto market continued to consolidate at a low level, with major cryptocurrencies such as Bitcoin and Ethereum performing stably and currency prices fluctuating within a narrow range. During the TOKEN 2049 2023 Singapore Station, some industry veterans pointed out that the low consolidation period is a good time to launch crypto projects, and we should pay attention to new investment opportunities.

On the 20th local time, the Federal Reserve announced that it would keep the federal funds rate target unchanged at a range of 5.25% to 5.50%, a move in line with market expectations. In fact, since the end of July, the credit scale of U.S. commercial banks has experienced negative growth. The year-on-year growth rates of real estate loans and consumer loans have shown a clear downward trend, while the balance of industrial and commercial loans has begun to shrink.

As the scale of commercial bank loans shows negative growth, production demand and consumer demand in the market decline. Analysts generally expect that the U.S. CPI will fall in the second half of the year. In this regard, WealthBee believes that the slowdown in economic growth in Europe and the United States is still a high probability event, and their monetary policies will also maintain high interest rates for a certain period of time. In this case, the probability of price levels running at high levels or continuing to rise is low. As a key factor in de-inflation, rents in the U.S. housing rental market have fallen month-on-month and have returned to the mid-level before the epidemic. In the remaining months of 2023, rent de-inflation will continue, and US CPI will also experience downward volatility.

It is worth noting that in the short term, the U.S. inflation rate has rebounded due to the impact of rising global oil prices, energy commodity prices, and labor prices. However, its core inflation level continued its downward trend year-on-year. In the long term, rising energy prices lack necessary market demand support, especially in an environment where the credit growth rate of U.S. commercial banks has significantly declined.

Continuing the good performance of U.S. Treasuries in August, U.S. Treasuries continued to be strong this month. The yield on the U.S. 10-year Treasury note topped 4.5%, a new high since 2007, and the two-year bond yield has almost stabilized at 5.1%. Even newly issued bonds have very high yields. The U.S. Treasurys winning bid for a $13 billion 20-year Treasury bond extension hit a record high of 4.592%, while the markets pre-issuance trading level was at 4.595% when bids closed at 1 p.m. ET. Bank of America interest rate strategists said the 10-year U.S. Treasury yield could reach 4.75%, continuing to hit new highs.

While Treasury yields continue to be strong, U.S. stocks and major global stock markets are showing a sideways adjustment trend. On September 1, the three major U.S. stock indexes rose to highs, and then fluctuated, showing an overall downward trend. Among them, on September 21, when Powell announced the suspension of interest rate hikes, the three major indexes all recorded their largest declines this month: the Nasdaq fell -1.83%, the SP 500 fell -1.64%, and the Dow Jones fell -1.08%. As the suspension of interest rate hikes has become a common market expectation, the three major U.S. stock indexes have not exceeded expectations, so it is reasonable for the market to move out of shock.

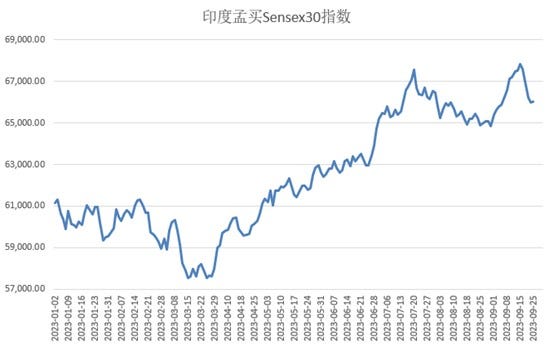

Not only the U.S. stock market, but also the stock markets of other countries around the world that saw huge gains in the first half of the year have experienced shock adjustments recently, and are basically in a high sideways adjustment trend. The Nikkei 225 has fluctuated at highs after hitting a new high in June, Indias SENSEX has gone into a double head, and stock markets in major European countries have been trading sideways for months.

Looking back on the first half of the year, the strong performance of U.S. stocks is obvious to all. Before U.S. stocks reached their highest level of the year on July 19, mainstream investment institutions generally believed that U.S. stocks had entered a calf market. In the process, the market has priced in all expectations. The long-term bullishness of the stock market needs the support of the countrys fundamentals. How major markets such as the United States, Europe, and Asia-Pacific will perform in the second half of the year still needs to wait for the further implementation of policies and measures in various countries.

At present, the worlds major economies are still facing many uncertain factors, especially the European and American markets. New expectations have not yet been formed, nor have the turning points of economic fundamentals emerged. Therefore, the sideways market has become a secondary market, The only option in the cryptocurrency market. Trading sideways or grinding is a very torturous stage. Many investors must control their positions and mentality, seize investment opportunities, and wait for the formation of a new narrative.

Copyright statement: If you need to reprint, you are welcome to communicate with our assistant on WeChat. If you reprint or clean the manuscript without permission, we will reserve the right to pursue legal responsibility.

Disclaimer: The market is risky, so investment needs to be cautious. Readers are requested to strictly abide by local laws and regulations when considering any opinions, views or conclusions in this article. The above content does not constitute any investment advice.