introduction

In this first article in this series, a preliminary review ofReview the technical solutions of CP (Cosmos Polkadot) and Layer 2 StacksAfter that, we were able to understand the network architecture and core technology of CP and Layer 2 Stacks solutions. As of now, CP’s technology far exceeds Layer 2 Stacks, so what about the community and ecological status?

Next, this article will describe the respective token economic models and ecological development levels. By sorting out the token value capture scenarios and comparing the various dimensions of their respective solutions. Help readers understand the possible development trends of their respective tokens and the characteristics of the solutions.

1. Token value

As CP and Layer 2 develop hyperlink networks one after another, what role will their ecological tokens play in this, or what more possibilities does the development of hyperlink networks bring to these tokens?

In order to discuss the future development trend of tokens, this article first sorts out the respective token models and analyzes the similarities and differences; then discusses in depth the potential impact that each scheme may have on the tokens, and explores the corresponding investment value, etc. So next, let us take a look at how their token economic models can fully unleash their respective potentials.

1.1 Cosmos

In fact, if you can understand the Cosmos framework, you can know that under its advocacy of sovereignty and free chain customization, Cosmos Hub’s $ATOM token has little demand in actual application scenarios, because each chain has its own native token, $ATOM. Not required. However, at the Cosmos 2.0 conference, the team formulated the ATOM 2.0 plan, which is dedicated to bringing additional utility and value to the $ATOM token.

1.1.1 Token distribution

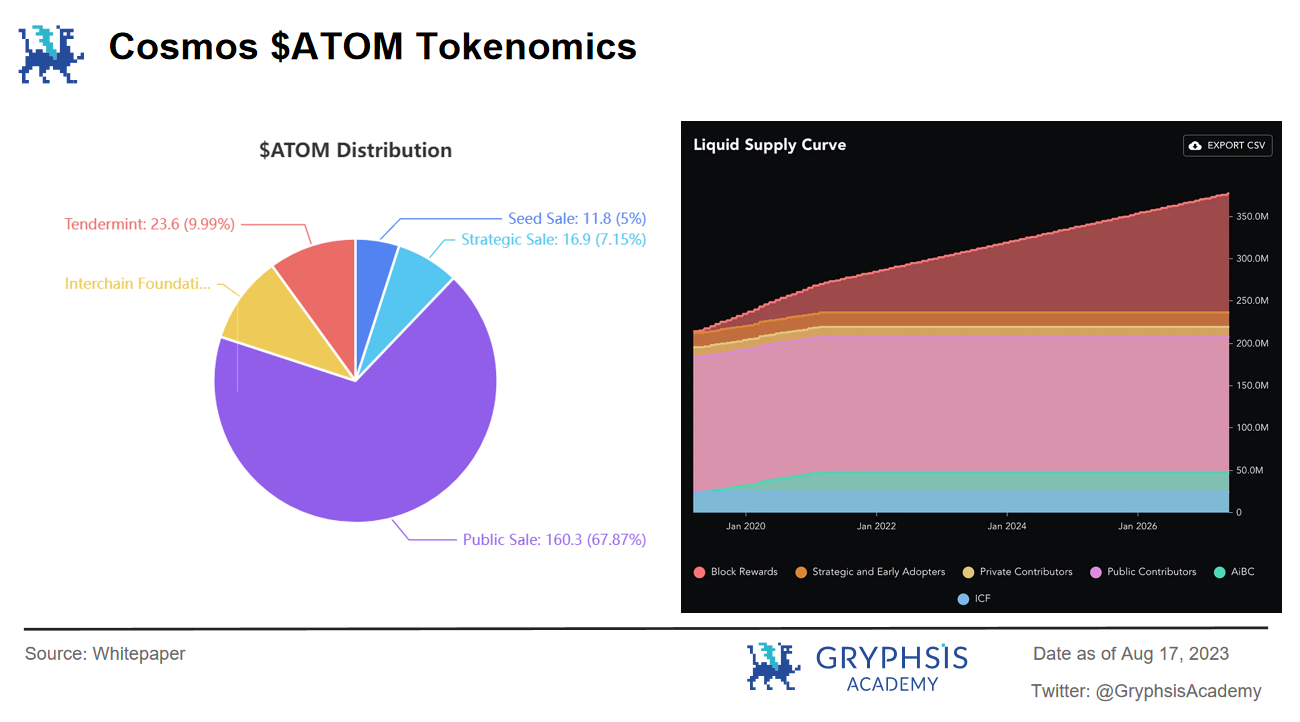

There is no limit to the supply of $ATOM, and there are currently 290 million $ATOM issued on the market. in:

Seed Sale: 11.8 million ATOM at $ 0.025 per token

Strategic Sale: 16.9 million ATOM at $ 0.079 per token

Public Sale: 160.3 million ATOM at $ 0.10 per token

Interchain Foundation: 23.6 million ATOM

Tendermint: 23.6 million ATOM

1.1.2 Token value

( 1) Validators Staking

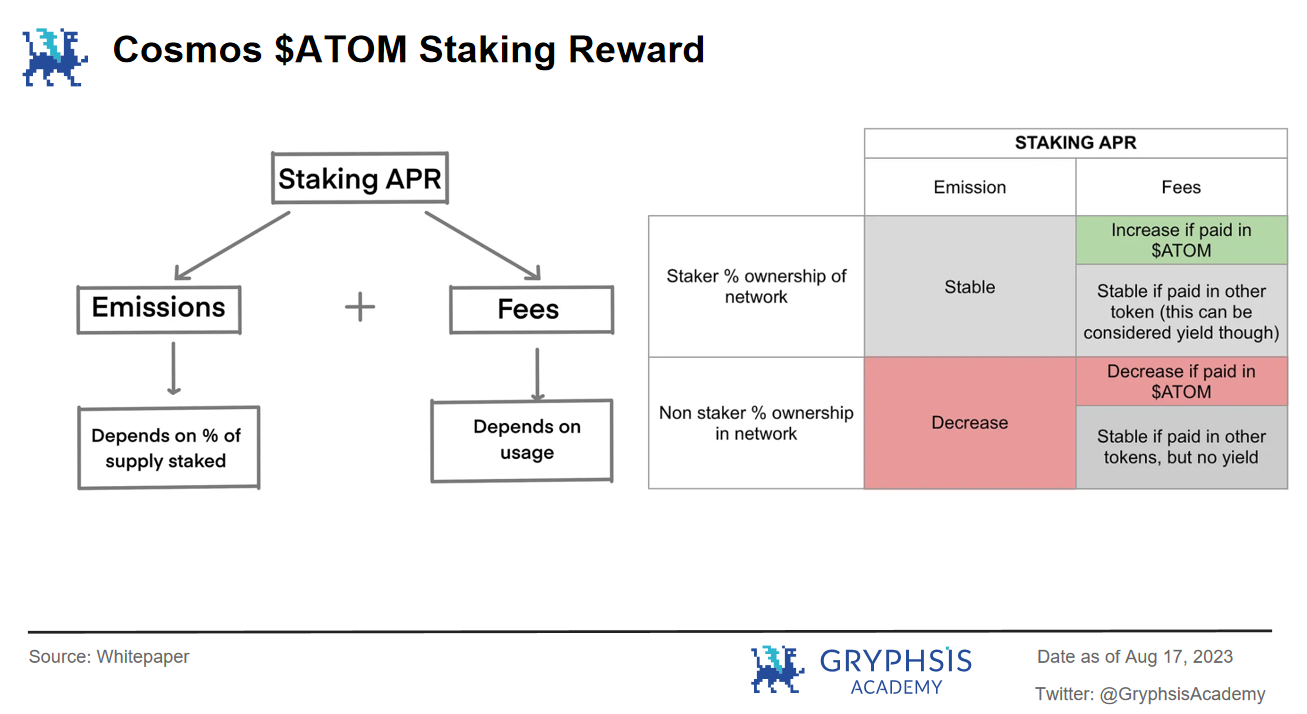

Since the Cosmos ecosystem is a POS chain, the tokens pledged by nodes reflect their contribution to the network. Cosmos has also formulated relevant measures for the Staking mechanism, mainly by adjusting the network pledge rate and the token inflation rate to coordinate.

For stakers, Cosmos gives two parts of rewards: Emission (block reward) + Fee (network fee). When the network pledge rate exceeds 66%, the system will reduce the inflation rate (as low as 7%); when the network pledge rate is lower than At 66%, the system increases the inflation rate (up to 20%). In short, the system uses algorithms to balance the network pledge rate and the stakers income. Those users who do not pledge will suffer losses caused by inflation, which indirectly prompts them to participate in staking.

Why increase the pledge rate? Because the economic security of Cosmos Hub depends on the amount of $ATOM pledged, the more $ATOM is pledged, the higher the cost of attacking the network. Therefore, the more $ATOM is locked, the greater the economic security of the network.

( 2)Validators Rewards

The rewards for validators mainly come from block rewards. Since it is a POS mechanism, the reward share received by validators is related to the amount of $ATOM they pledge.

A concept is introduced here: Delegators refer to users who hold $ATOM but do not have the ability/will to become verifiers. They can entrust their tokens to verifiers of their choice for pledge. After receiving the reward, the verifier will return part of the reward to the delegator in proportion to the investment. Of course, the validator can collect commission from the delegator’s income.

Then the verifier’s income comes from: block reward + client commission

( 3) Transaction Fees

Inter-chain accounts open up the entire Cosmos ecosystem and improve the usage scenarios of $ATOM. As the native token of Cosmos Hub, $ATOM can be used as a relay chain to realize the seamless conversion of assets between different chains, allowing assets on different chains in the ecosystem to be directly traded, providing a platform for the interaction between different assets on different sovereign chains and $ATOM. convenience.

( 4) Governance

Users holding $ATOM have governance voting rights and can participate in the governance of Cosmos Hub, initiate proposals and vote on the future direction of the ecosystem. In addition, $ATOM will also be used in community management, giving it to the community through one-time subsidies, or setting up incentives such as developer funding streams, so that the community can better provide suggestions for the Cosmos ecosystem.

The token mechanism of $ATOM allows most users to choose to stake, which to a certain extent increases the security of the network and prevents attacks. However, this also leads to low liquidity of the token and its inability to circulate in the ecosystem, which especially plays a positive role in its ecological features of mostly Defi products.

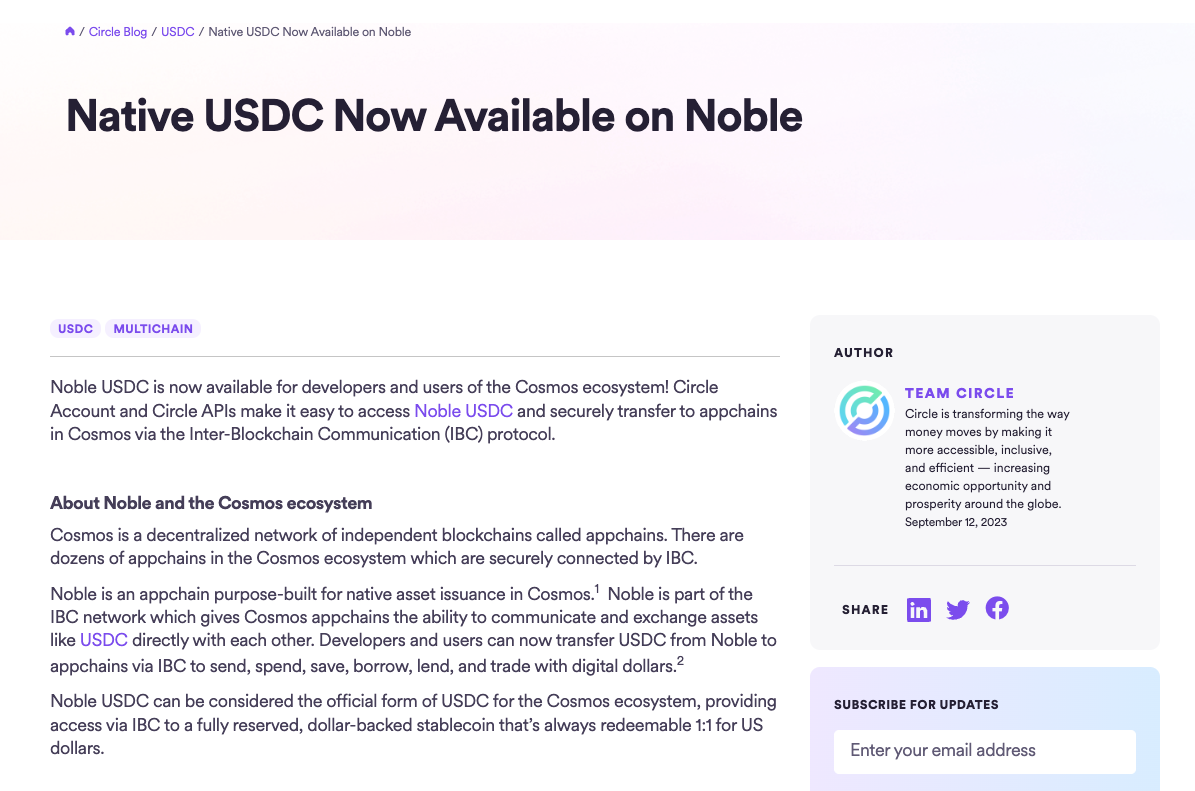

However, it is worth noting that dydx chose to deploy to Cosmos, and Cosmos now supports CCTP’s native USDC. In addition, in a recent community proposal, a $ATOM liquidity staking solution was added, giving the pledged $ATOM Same liquidity as spot $ATOM. These updates and optimizations have undoubtedly given its token more demand scenarios, and I believe that the development of $ATOM will be better in the future than it is now.

1.2 Polkadot

1.2.1 Token distribution

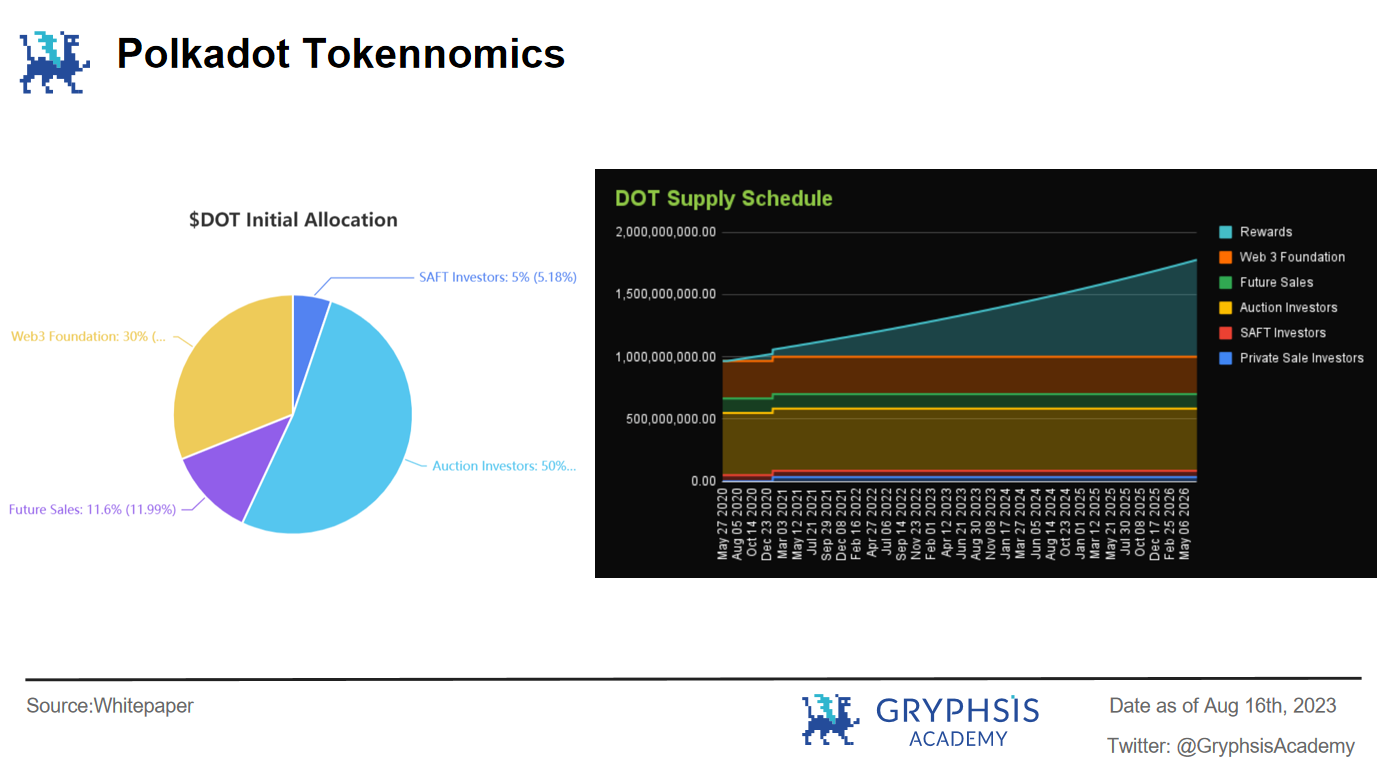

Polkadot’s token $DOT has no supply online, and its token distribution is:

3.42% private equity investors

5.00% SAFT Investors

50.00% Auction Investors

11.58% Future Sales

30.00% Web 3 Foundation

1.2.2 Token value

( 1) Validators Staking

If you want to become a Validator, you must first pledge a certain amount of $DOT. Because the Polkadot network adopts the NPoS (Nominated Proof of Stake) consensus mechanism, similar to Cosmos, the validators pledge can maintain the security and decentralization of the network.

However, in the Polkadot network, there are three types of validators: Parachain Validator; Relaychain Validator; Other Validators. The role of each validator can be understood literally:

Parachain validators not only verify the status of this chain but also submit candidate receipts to Polkadots relay chain so that more blocks can be added.

Relay chain validators participate in the relay chains consensus to review validity claims from other Polkadot validators, allowing blocks to be added.

Other validators work together to form distributed network validation, like a double verification process to ensure correct distribution of quasi-validators for higher throughput and less latency.

( 2) Validators Rewards

In Polkadot, validators will obtain corresponding Era Points through block production or other activities in an epoch (Era), and the reward $DOT will be distributed according to the score.

Rewards will be sent after the end of each epoch, but the specific amount is unclear, taking into account the points earned by all validators in the current epoch and the inflation model of $DOT.

In addition, there is also a Nominator role, which can be understood as the Delgator in Cosmos. Only this token can nominate its $DOT to the verifier to obtain rewards, and the two can share part of the revenue.

( 3) Transaction Fees

Polkadot has launched a Weight-Based Fee Model, which takes into account limited block resources and has developed a series of standards for the overall fee model.

For example, each relay chain must process transactions efficiently to prevent block congestion; each block must reserve a certain amount of space for some high-priority, poorly processed transactions; fees must change slowly to prevent traders from accurately estimating fees. etc.

( 4) Governance

Polkadot launched a new governance plan this year. Let’s first understand Go v1 and PolkadotOpenGov (new plan) and the differences and improvements between the two.

In traditional Go v1, the roles involved in governance include:

Parliament: performs governance and is responsible for managing parameters, proposals, etc.

Technical committee: manages upgrade schedules, etc.

Holder: $DOT holder, participate in the referendum

In the newly issued governance scheme, the roles involved in governance include: holders and technical associations (Fellowship). From the perspective of governance roles, the new solution is more decentralized than the original governance solution, and Polkadot’s governance has also become more closely related to holders.

a. Network governance

In Go v1, before any changes were to be made to the network, the idea was to bring together active token holders and a council to manage network upgrade decisions. Regardless of whether the proposal is proposed by the public (token holders) or by parliament, it must ultimately go through a referendum, allowing all holders to make a decision weighted by their stake.

For proposal elections, each proposal has the same weight, Holder can only vote on one proposal at a time (except emergency proposals), and the voting period may last several weeks. In addition, Go v1 also supports an alternating voting schedule, allowing voting every 28 days. However, in the new upgraded version of OpenGov, it has changed the voting mechanism to make proposal voting wider and more flexible.

Transfer all responsibilities of Parliament to the public through a direct democratic voting system.

dissolve parliament

Allow users more ways to delegate voting rights to community members

Disbanded Technical Committee and established Polkadot Technical Scholarship

The centralized parliament was eliminated and decentralized governance was truly realized.

b.Treasury mechanism

The Treasury, as the name suggests, is the public treasury of Polkadot network governance. When the proposal is passed, part of the funds will be allocated to implement the proposal to better develop the network.

The main sources of revenue for the state treasury are:

Transaction fees: 80% of transaction fee income is submitted to the treasury, 20% is given to the validator

Staking Yield: The Polkadot network generates an ideal staking rate. When the actual pledge rate of the network does not reach the ideal pledge rate, the APY income of the pledgers will decrease. To keep the inflation rate at 10%, the system does not reduce the number of tokens, but transfers a portion of investors’ total returns to the treasury. (Polkadot will regularly burn part of the funds in the treasury, so the actual inflation rate is less than 10%)

Validators: When the number of validators or proposers decreases, part of their tokens will be transferred to the treasury.

Transfers: Anyone can transfer funds to the treasury, but typically recipients repay the funds they received for some reason.

Treasury funds are held in an account that is inaccessible to anyone, and when a proposal is accepted, a waiting period for allocation begins on that day. Because when funding is proposed immediately, there may be treasury funds required to maintain a deposit of at least 5% of the proposed expenditure. This deposit will be partially reduced if the proposal is rejected and refunded if accepted.

Proposals may include (but are not limited to): infrastructure deployment and ongoing operations, cybersecurity operations (monitoring services, ongoing audits), ecosystem provision (collaborations), marketing campaigns (advertising, paid features, partnerships), community events and outreach (party, pizza party, hackathon)…

The treasury is now managed through OpenGov, and how the funds are spent depends on the referendum.

c. Slot AuctionCore Time

The parachain needs to lock $DOT to obtain the slot. It will continue to be locked during the lease period of the slot and will be automatically returned after the parachain exits. And users holding $DOT have the right to vote, govern parachains, and even directly allow a parachain to run for free on the network.

The original slot mechanism is actually not very flexible because it is designed for long-term single chains. Although liquidity is eased by parallel threads, for those technology-focused teams, they may need to raise funds and market, obtain $DOT and then lock up to participate in this ecological network.

However, Polkadot recently proposed version 2.0, which may cancel the slot auction mechanism and adopt the core time (Core Time) allocation method.

The biggest difference between the core time mechanism and the current slot auction is that the slot auction locks $DOT for a period of time; while core time requires paying $DOT to purchase time, and $DOT will not be unlocked and returned.

Currently, the sales mechanism is divided into two types: bulk purchase immediate purchase

Bulk Purchases: Made once a month, 4 weeks of core time, non-fungible assets are sold at a fixed price.

Instant purchase: Similar to the pay-as-you-go model of parallel threads, you can buy it when you need it.

Polkadot’s token governance mechanism is very complete, and the parallel slot auction mechanism has been updated. Abandoning the pledge unlocking mechanism and adopting a purchasing mechanism brings new value capture to $DOT. As more and more project parties choose to deploy on Polkadot, I believe the importance of $DOT will become more prominent.

1.3 Optimism

1.3.1 Token distribution

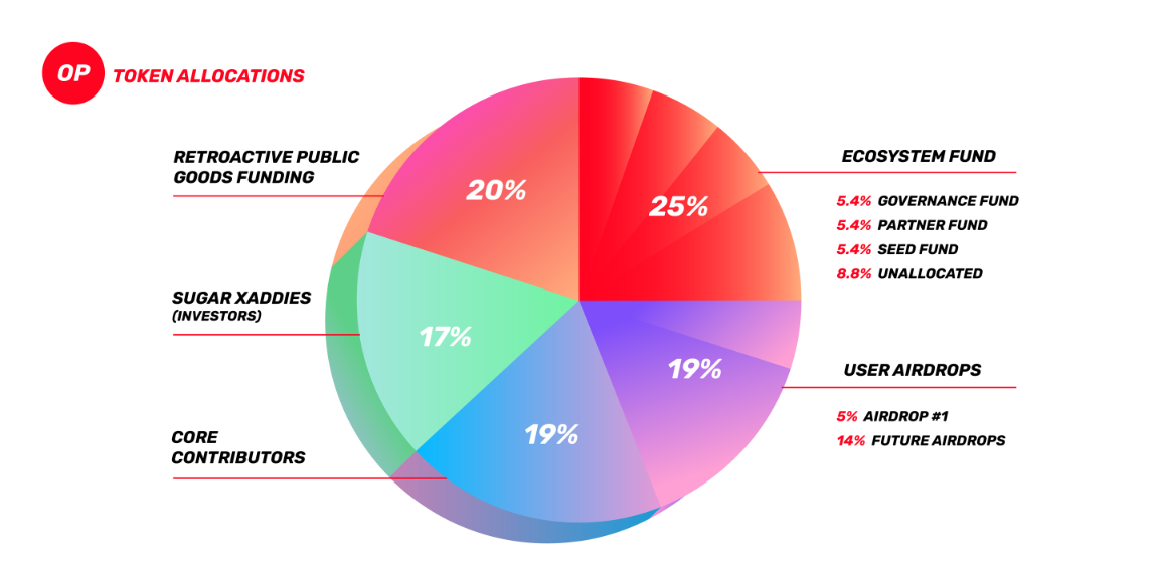

The initial supply of $OP is 4.3 Billion, roughly divided among:

25% Ecological Fund

19% airdrop users

19% core contributors

17% investors

20% RPGF (Retrospective Public Service Fund)

Source: Whitepaper

1.3.2 Token value

At present, there is no clear definition of $OP’s demand scenario in the hyperlink network, but OP Stack will be unified managed by OP Collective.

To put it simply, it adopts a two-house system governance structure, including the Token House and the Citizens House. The two powers check and balance each other to avoid excessive concentration of governance power.

Among them, the Token Institute is composed of OP holders and is responsible for determining business parameters. However, if token holders can completely determine the business, then there is a high probability that the system economy will be tilted towards them and will be unfriendly to other interested parties. The Citizens Chamber adopts a one-person-one-vote mechanism and is responsible for long-term value judgments. Different types of decisions monitor each other and are evaluated with a broader perspective. With this new iteration of this model, Optimism hopes to build a governance system that will stand the test of time and help collectives thrive.

In the near future, Base and OP have launched an economic cooperation agreement. Base provides OP with two revenue models (whichever is higher), one is a 2.5% sorter fee, or 15% of profits; and OP will provide Base with 2.75% of $OP (specific details will be explained in the third article).

OP has already started its tentative income distribution plan, and according to market value calculation, OP actually makes money in this cooperation. In the past, L2 mainly relied on the gas fees generated by transactions (L2 gas + L1 gas) as the main source of income, and OP created a new rent collection model.As a Base deployed using the OP Stack solution, it needs to pay for the benefits it obtains, which is undoubtedly positive for the OP.

But how should the benefits of this model be returned to $OP token holders?? At present, what is certain is ecological governance rights. What subsequent application scenarios will be is very critical to the OP who currently ranks first in the L2 Stack.

1.4 Arbitrum

1.4.1 Token distribution

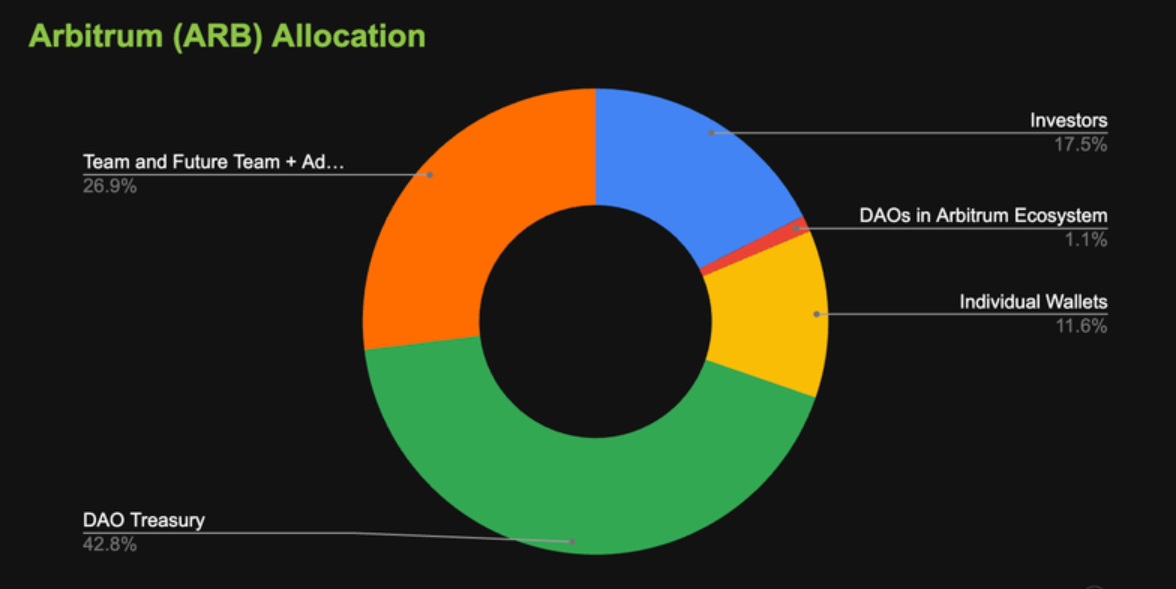

$ARB was first issued on March 23, 2023, with a total supply of 10 billion, and the current circulating supply is 1.2 billion

17.53% Investors

1.13% Arbitrum DAOs

11.62% Individual Wallets

42.78% DAO Treasury

26.94% Team and Advisors

Source: CoinGecko

1.4.2 Token value

For the time being, the official has not released any specific demand scenarios for $ARB in the hyperlink network.However, what is certain is that regardless of whether the hyperlinks have issued local tokens and management mechanisms, Arbitrum DAO will use $ARB to fully manage all hyperlink networks, communities and technology updates.

1.5 Polygon 2.0

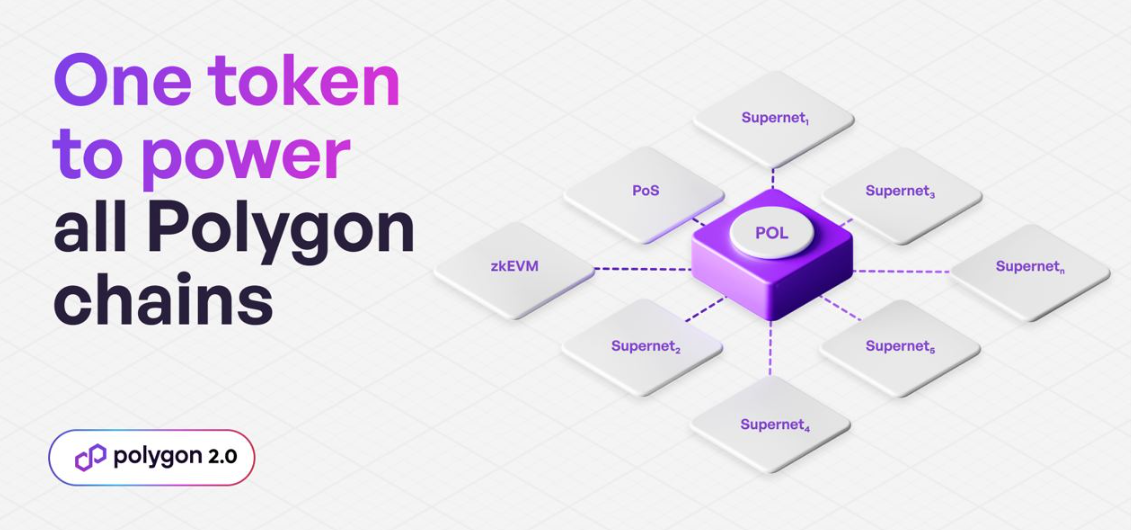

Polygon issued a token economic white paper for the Polygon 2.0 hyperchain network in July this year, hoping to govern the network through the issuance of $POL.

In essence, $POL is an upgrade and rename of $MATIC. The two are exchangeable in equal amounts at a ratio of 1:1 and will not coexist. $POL will completely replace $MATIC in the future. Therefore, we temporarily replace $POL with $MATIC’s token distribution model.

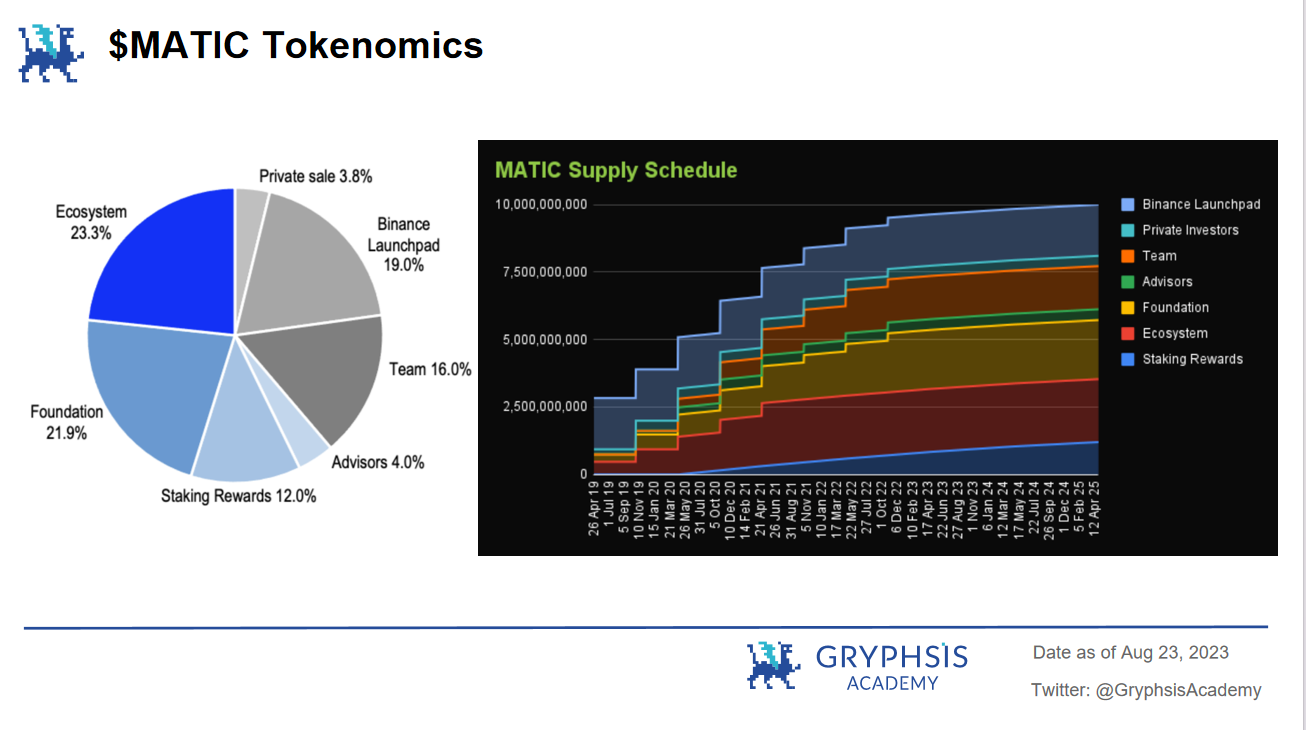

1.5.1 Token distribution

12.00% Staking Rewards

23.33% ecological community

21.86% Foundation

4.00% Advisors

16.00% Team

3.80% Private Investors

19.00% Binance Launchpad

1.5.2 Token value

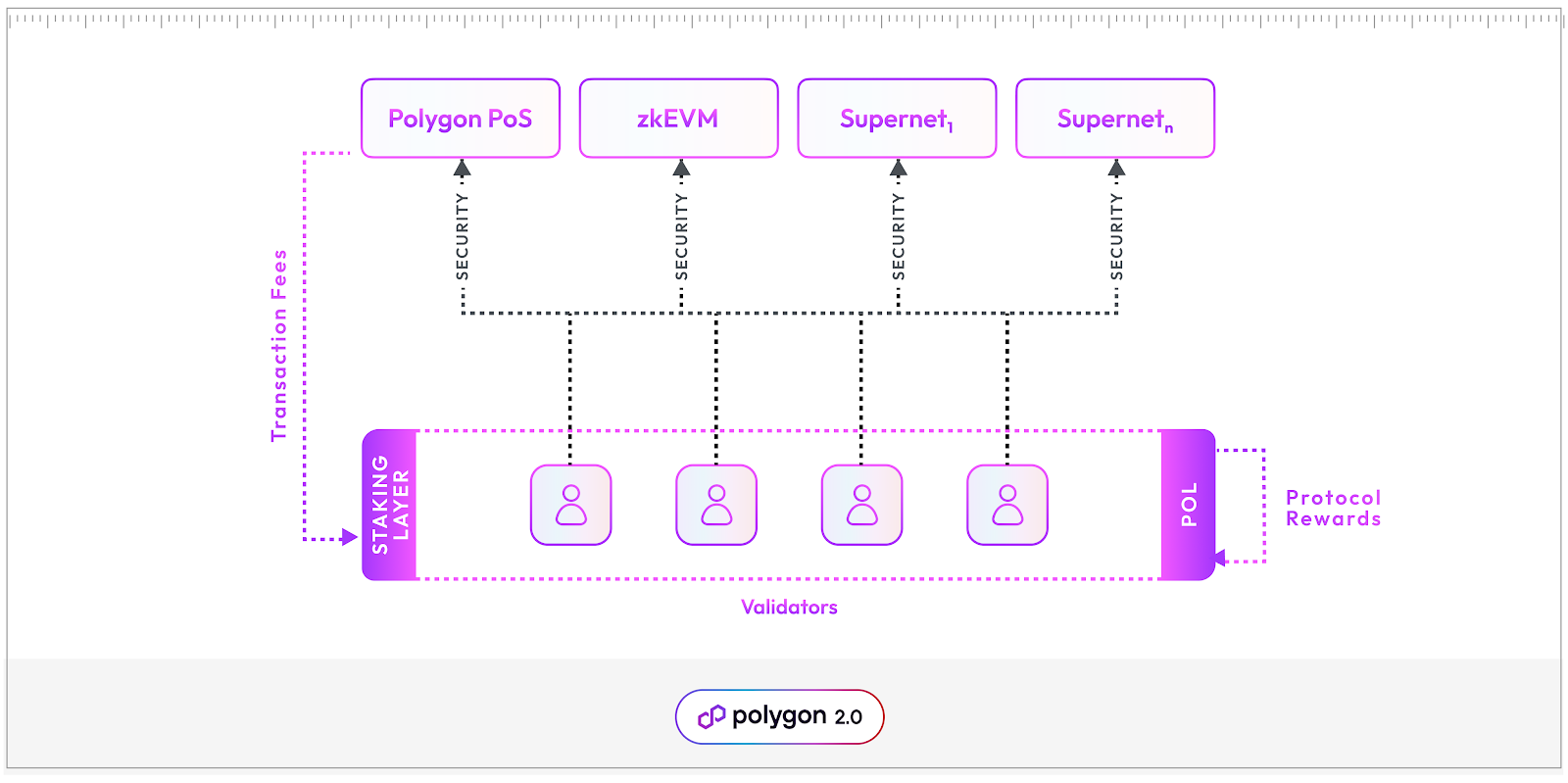

( 1) Validators Staking

Polygon 2.0 is a POS chain. If you want to become a Validator of its network, you must stake $POL tokens. Once staked, they can join the validator pool and are eligible to check any Polygon chain.

( 2)Validators Rewards

In order to motivate Validators, the rewards given to validators by the Polygon network are mainly divided into three parts:

Protocol rewards: The protocol will continue to send $POL to the validator pool as a basic reward, which will be distributed based on the proportion of the validators’ pledge shares.

Transaction fees: Because validators are free to validate any number of chains, transaction fees can be collected from these chains. It is worth noting that Polygon allows each chain to decide for itself which token to use to pay gas, and does not force the use of $POL, so the transaction fees received by validators are also different.

Additional rewards: In order to attract more validators, some Polygon chains can choose to introduce additional rewards, not limited to token types, as a means of incentives.

( 3)Governance

Owners of $POL tokens can have governance rights, but the specific details are not yet listed in the white paper.

Source: Polygon Whitepaper

Polygon 2.0 allows respective hyperchains to use their own tokens as transaction fees, which is a very critical and special move. It fully respects the native autonomy of each hyperchain, but to a certain extent also cuts off an important source of token capture.

Currently, all Layer 2 Gas Fees are settled in ETH. If Polygon 2.0 gives up this part of the revenue source, how should it attract token holders? Even if they have governance rights, can it be fed back to Holder and give them additional benefits?

The author believes that based on the currently officially disclosed token uses, Holder’s incentives may not be as rich as those of CP, but it does not rule out the subsequent update of its development strategy.

2. Ecological comparison

2.1 Cosmos & Polkadot

1) Ecological data

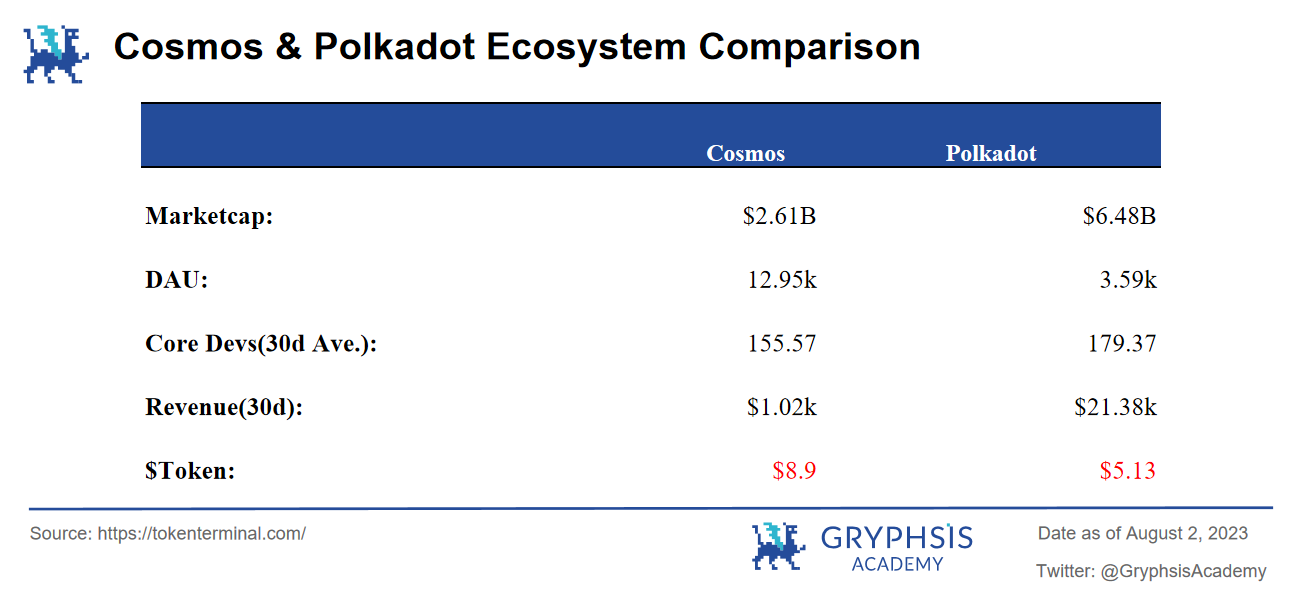

As can be seen from the chart, the market value of Polkadot is about three times that of Cosmos, but the ecological stickiness of Cosmos is higher, with 12.95 K daily active users; the core developers of the two are similar, but the network revenue of Polkadot is far higher Higher than Cosmos.

2) Ecological projects:

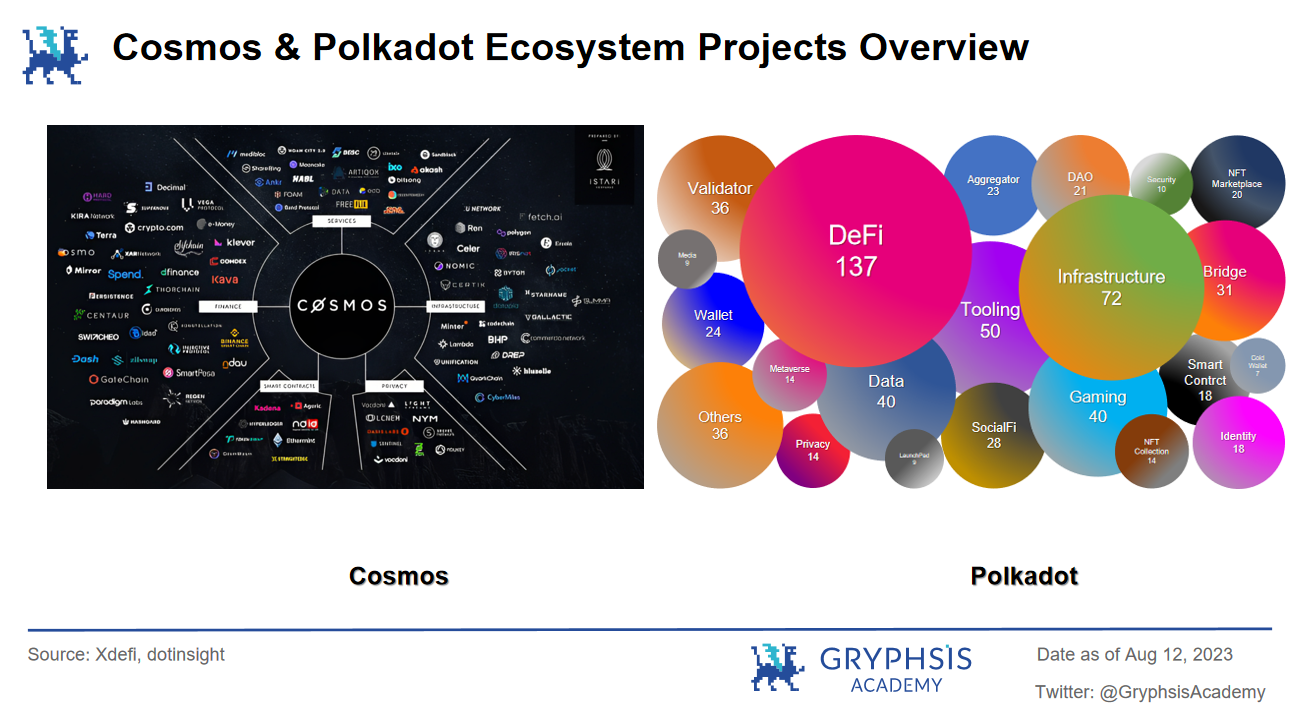

It can be seen from the distribution of ecological projects between the two:

In addition to the well-known Sei network, financial projects in Cosmos account for a relatively high proportion and cover a wide range of areas, including decentralized exchanges (DEX), lending and stablecoins. Examples include derivatives exchange dydx, DEX such as Osmosis, and Kava lending platform. In addition, the stablecoin Terra is also one of them, but after the collapse of UST, Cosmos’s stablecoin has no particularly outstanding projects.

However, it is worth noting that CCTP USDC has been deployed in Cosmos, which has greatly solved the liquidity problem of Cosmos and developed the ecological community faster.

Polkadots ecological projects mainly focus on infrastructure projects, such as network and blockchain development tools. Among them, the more well-known Acala Network, MoonbeamEVM-compatible smart contract platform... Polkadots Substrate framework makes it easier for developers to create their own independent consensus blockchain, thus attracting more infrastructure projects.

In summary,From the perspective of ecological project distribution, the Cosmos ecosystem mainly focuses on financial projects, while the Polkadot ecosystem has more infrastructure projects, and the ecological diversity will be slightly stronger.The different features of the two different development tools, Cosmos SDK and Substrate framework, have attracted different projects, leading to the current situation.

3) Version 2.0 update

CP has released its own version 2.0 to conduct more comprehensive improvements and optimizations for ecological governance and token empowerment.

In Cosmos 2.0, most of the new mechanisms introduced focus on how $ATOM is reallocated. Including inter-chain scheduler, inter-chain allocator, inter-chain security and liquidity staking, etc., deeply integrating $ATOM into these aspects. The specific performance is:

The liquidity pledge chain joins the Hub consumption chain, and $stATOM and $qATOM are obtained by pledging $ATOM, which can be used for transactions and other inter-chain activities; the $ATOM issuance policy is modified to reduce the issuance amount based on 36 months. After 36 months, part of the transaction fees generated by the Hub consumption chain will be redistributed to stakers, nodes and community pools. The $ATOM issuance, inter-chain scheduler and inter-chain allocator will distribute the proceeds to the treasury to support ecological growth and the development of $ATOM public assets.

In addition, Cosmos Hub’s latest community proposal will optimize $ATOM’s Liquidity Staking Model (LSM) on September 13, allowing pledged $ATOM to enjoy the same liquidity as spot $ATOM. This move allows $ATOM, with an original staking rate of 68%, to be released into the Defi scene, accelerating the overall development of the ecosystem. In addition, management measures such as liquidity staking limit, validator guaranteed staking, and instant liquidity staking have also been added.

And in Polkadot 2.0, the parachain slot auction mechanism is modified to the core time, thereby lowering the entry barrier and optimizing flexibility. It can be circulated in the primary and secondary markets through bulk purchases and instant purchases. The original slot auction method of unlocking $DOT is no longer provided, which optimizes the liquidity of $DOT.

And in 2.0, Polkadot hopes to transform the previous paradigm centered on the relay chain. Users may use an application on chain A and also want to use the application on chain B. This involves seamless cross-chain deployment of applications. . For the paradigm of cross-chain deployment, Polkadot developed the XCM cross-chain communication protocol, a descriptive language framework that helps you describe what you want to do. However, it is difficult to guarantee that the recipient will honestly translate this message. Thus the Accord was created to ensure fidelity of behavior. In addition, Polkadot is also creating other mechanisms such as Hermit Relay, Project CAPI, etc. to help the relay chain free up space and transfer the functional application layer to the parallel chain.

Generally speaking, Cosmos 2.0 is mainly aimed at redistributing the value of $ATOM tokens through inter-chain scheduling and distribution, etc., while Polkadot 2.0 mainly modifies the usage scenarios of $DOT, adds new empowerment methods, and will be aimed at creating Cross-chain applications realize a completely decentralized cross-chain network.

2.2 L2s Comparison

1) Development status:

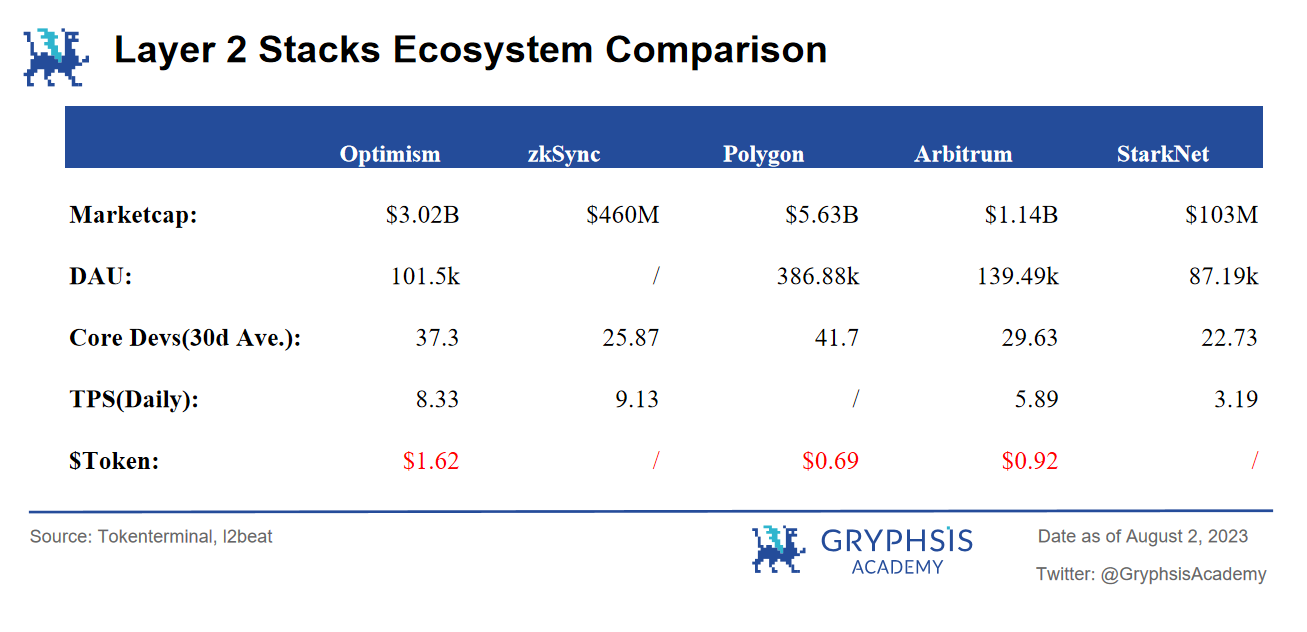

From the chart, it can be seen that Polygon has the highest market value, daily active users, and core developers; zkSync has the highest TPS; except for Starknet and zkSync, which do not issue coins, only under the current circumstances, $OP price is the highest.

2) Ecological resources

Looking back on the public chain war in 2021, Solana was appreciated by SBF for its innovative PoH (Proof of Work History) technology. The FTX platform created its own DEX, and the funder behind it, Multichain, also used its own resources to help Solana vigorously expand the ecosystem. The price of $SOL has skyrocketed; BSC is endorsed by the top exchange Binance, and has held multiple hackathons to launch top DEXs, quickly importing Binance traffic; Avalanche created the Avalanche consensus to improve chain performance, and is used by top exchanges such as A16Z, Polychain, and Three Arrows Capital. With the foundations investment, TVL surged 10 times in half a month....

If L2s wants to grow the network, it must inevitably escape from the three levels of developer-project-user, and behind this, ecological resources are extremely important. If there is strong support from top exchanges/VCs behind it, it will attract more developers and projects, thereby attracting more users, forming a positive cycle. So do these L2s currently launching Stack solutions have core ecological resource barriers?

Polygon ($450 million):

The founding team comes from Matic Network, and the core members include high-end RD talents from well-known companies such as PayPal, Google, 0x, and Coinbase.

Completed several rounds of financing, investors include well-known institutions and angel investors such as Coinbase Ventures, Binance Labs, Mark Cuban, etc., and received support from ETH and Financial Grants from the Ethereum Foundation, as well as support from the Polkadot Ecological Foundation.

Active cooperation with traditional web3 industry leaders, such as joining Disneys accelerator program, cooperating with Meta to develop Instagram NFT, releasing NFT on the Polygon chain with well-known brands such as Adidas and Prada, and having a large number of member NFTs from web2 companies, becoming a member of the web3 industry The leader’s role as a guide.

Optimism ($179 million):

Originally developed by Plasma Group, core member Karl Floersch is also one of the founding team members of Uniswap and has close ties with Ethereum.

Completed seed round and Series A financing, investors include Coinbase Ventures, Binance Labs, Paradigm, etc., and received support from Ethereum Fund

Synthetix, a well-known synthetic asset Defi, was the first to support Optimistic Rollup

zkSyncMatter Labs ($258 million):

zkSync was founded by the Matter Labs team. The core members come from world-class universities and scientific research institutions such as Stanford, MIT, and the Technion-Israel Institute of Technology, and have strong technical strength.

It has completed multiple rounds of financing, with investors including Coinbase Ventures, Paradigm, Framework Ventures, Three Arrows Capital and other well-known Crypto VCs and institutions, and has received multiple development and research grants from the Ethereum Foundation.

Arbitrum ($140 million)

Arbitrums founding team, Offchain Labs, is composed of technical experts such as Princeton University professor Ed Felten.

It has completed multiple rounds of financing, with investors including Pantera Capital, Coinbase Ventures, Ribbit Capital, Naspers Ventures and other well-known institutions.

It has been deployed in multiple leading projects, such as Reddit, dydx, and Chainlink. Its most important sustainable trading platform, GMX, has also added a lot to its ecology.

Starknet (no financing yet, Starkware $261 million)

Starkware, as the core RD team of Starknet, is composed of many cryptography and blockchain experts.

Starkware team receives multiple research and development grants from Ethereum Foundation

Starknet has cooperated with companies such as NVIDIA to use GPUs to increase computing speed; it has also cooperated with other well-known entity companies to jointly explore applications such as supply chain finance.

It can be seen that among these L2s, Polygon has the strongest strength at the financial level; the Optimism team has a close relationship with the Ethereum team and has higher community recognition; zkSync, as the first team to use zk technology, pioneered ZK Rollup; Arbitrum Although it has the least financing, it accounts for half of L2s TVL and has many projects out of the circle; Starknet has taken a different approach. Although it is based on ZK Rollup to implement expansion solutions, it uses the native technology StarkEx mechanism to implement Rollup that can be calculated in parallel.

3. To Be Layer 1 or Layer 2?

Cosmos and Polkadot have continuously improved their development ecosystems in the past few years and have successively launched versions 2.0. So facing the development of L2s, can their 2.0 have some features to maintain their own advantages without being too affected?

The 2.0 versions of Cosmos and Polkadot have been optimized through consensus mechanisms, cross-chain interoperability, and token value distribution. It can be said that CP has more mature experience in creating hyperlink networks than L2s. And the current market value of CP is nearly 10 Billion. L2s needs to put in more energy to surpass them. However, since L2s itself relies on Ethereum, Ethereums strong consensus and large community will also help the development of L2s Stack.

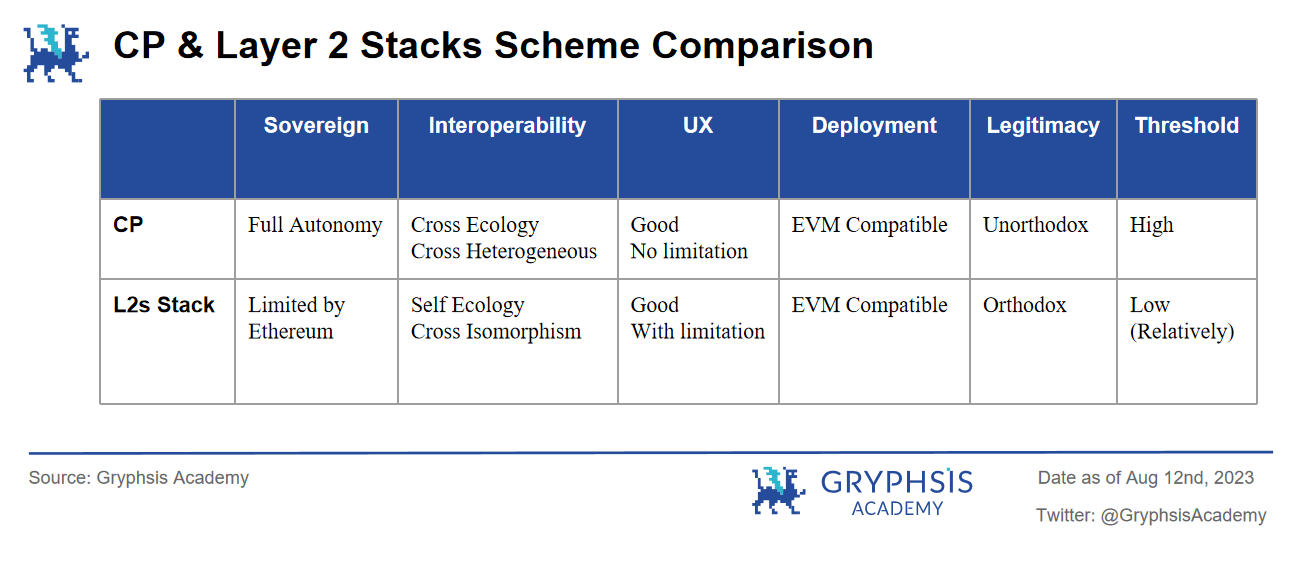

Here we roughly summarize the features of CP and L2s that will attract project parties to deploy:

Sovereignty: CP allows application chains to have completely autonomous rights such as selecting validators, issuing tokens, self-governance, etc., although L2s Stack allows developers to modify stack modules and customize their own chains. However, they are not given the right to autonomous governance. The consensus of transactions ultimately relies on L1 such as Ethereum, and governance is completely controlled by L2.Therefore, for those who need to highly customize their own public chain or application chain and have control over parameters, governance, etc., CP is the first choice.For example, the founder of dydx recently chose to deploy the V4 version on Cosmos. It believes that Ethereum has several problems based on L2: the performance is not powerful enough; Ethereum L2 currently operates through centralized sequencers (Sequencers), and these sequencers have the ability to review and block transactions. While it is possible to avoid censorship by bypassing the sequencer and accessing L1 directly, Ethereum L1 is too slow and expensive to support the needs of dydxs core product. So even though Ethereum currently seems to be more decentralized, its L2 least decentralized components such as the sequencer cannot meet application needs, so Cosmos was chosen.

Cross-chain interoperability: CP supports communication and asset transfer between heterogeneous chains, not only limited to this ecosystem, but also compatible with the Ethereum ecosystem. For example, the current Cosmos ecosystem relies on Axelar Network and Gravity Bridge to bridge assets from the ETH ecosystem, and security relies on third-party bridges, so TVL is less.Although cross-EVM bridge compatibility is not ideal for the time being, it still provides broader cross-chain possibilities.Project parties can implement communication with other public chains such as Ethereum and even L2s hyperchains on CP. In contrast, the interoperability protocol of L2s is slightly single. Shared cross-chain bridges alone can only achieve internal ecological communication and cannot interact with other non-EVM public chains.Therefore, for those full-chain interactive platforms, CP may be more preferred.

User experience: CP, as an independent blockchain, is not limited to Ethereum and achieves higher throughput and transaction speed through communication protocols; while L2s uses Rollup technology to transfer most of the transaction processing work to this chain, Stack will also use Rollup recursive compression to greatly reduce costs, but the final security and consensus are still limited by Ethereum.If you pursue transaction speed and user experience projects, you can choose to deploy them on CP; for those projects that require a large amount of off-chain storage space and place transaction processing off-chain, it will be more convenient to choose L2s, as CP on-chain space limited.

Deployment difficulty: Currently both CP and L2s are compatible with Ethereum EVM, but in comparison, the compatibility of L2s may be more mature than that of CP. L2 itself has already taken over the extremely rich Dapps of Ethereum and guided these projects to migrate and deploy. The difficulty and willingness of deployment are easier than putting them on CP.

Legitimacy: It is difficult to undertake deployment. Users have higher recognition of Ethereum in terms of deployment willingness and community consensus. Therefore, for projects that are developing in the Ethereum ecosystem, it is difficult for CP to attract them to join the ecosystem.Therefore, for those who need to quickly utilize various tools and protocols on Ethereum, deploying on L2 can obtain the richest ecological resources and is also very safe.

Entry threshold: If a node wants to be deployed on CP, it needs to pledge $ATOM / mortgage $DOT auction slot, and the screening threshold is high. In contrast, L2s such as Optimism only need to mortgage a certain amount of ETH, and zkSync does not even have special requirements. As long as you have certain technical capabilities, you can become a node. Therefore, compared with CP, Ethereum L2 has a lower threshold, but it is also more convenient for node deployment.

Generally speaking, Cosmos and Polkadot have more advantages in interoperability, performance, scalability and governance, but Ethereums second layer has higher security and mature ecology.

Conclusion

This article further deepens the discussion of CP and Layer 2 Stack solutions from the perspective of token economic model and ecological development, and summarizes the points that need to be considered whether the project becomes Layer 1 or Layer 2. We analyzed the role of its ecological tokens in the network as CP and Layer 2 develop, and how the development of the hyperlink network brings more possibilities to these tokens. These analyzes provide strong evidence for our understanding of the long-term impact and value of these technology solutions.

Although these L2s each have corresponding resources, how to make good use of these resources to build their own ecology raises a new question: how L2s develops its own hyperlink network, which we will explain in detail in Series 3.

References:

https://medium.com/@eternal1 997 L

https://tokeneconomy.co/the-state-of-crypto-interoperability-explained-in-pictures-654cfe4cc167

https://research.web3.foundation/Polkadot/overview

https://foresightnews.pro/article/detail/16271

https://messari.io/report/ibc-outside-of-cosmos-the-transport-layer?referrer=all-research

https://stack.optimism.io/docs/understand/explainer/#glossary

https://www.techflowpost.com/article/detail_12231.html

https://gov.optimism.io/t/retroactive-delegate-rewards-season-3/5871

https://wiki.polygon.technology/docs/supernets/get-started/what-are-supernets/

https://polygon.technology/blog/introducing-polygon-2-0-the-value-layer-of-the-internet

https://era.zksync.io/docs/reference/concepts/hyperscaling.html#what-are-hyperchains

https://medium.com/offchainlabs

Disclaimer: This report is produced by@sldhdhs 3 , a student at @GryphsisAcademy, in@Zou_Blockand@artoriatechOriginal work completed under the guidance of . The authors are solely responsible for all content, which does not necessarily reflect the views of Gryphsis Academy, nor the views of the organization that commissioned the report. Editorial content and decisions are not influenced by readers. Please be aware that the author may own the cryptocurrencies mentioned in this report. This document is for informational purposes only and should not be relied upon for investment decisions. It is strongly recommended that you conduct your own research and consult with an unbiased financial, tax or legal advisor before making any investment decisions. Remember, the past performance of any asset does not guarantee future returns.