Federal Reserve Chairman Powell once again completed a difficult task in Jackson Hole,Delivering a message that blended hawks and doves, his remarks overall were more dovish than hawks had expected before the meeting.

Regarding the Fed Funds Terminal Rate:

Fed ready to raise rates further if circumstances warrant

Sustained above-trend growth may require further policy tightening

Restrictive policy will continue until inflation stabilizes and slows

Watch for signs the economy isnt cooling as expected

On being flexible about the neutral rate:

We cannot determine the neutral rate

Real interest rates are positive and well above most neutral interest rate expectations

Past rate hikes could still create further drag

On job market and housing stress:

If job market doesnt slow, monetary policy will respond

Given the size of the [housing] industry, further progress here is critical to restoring price stability

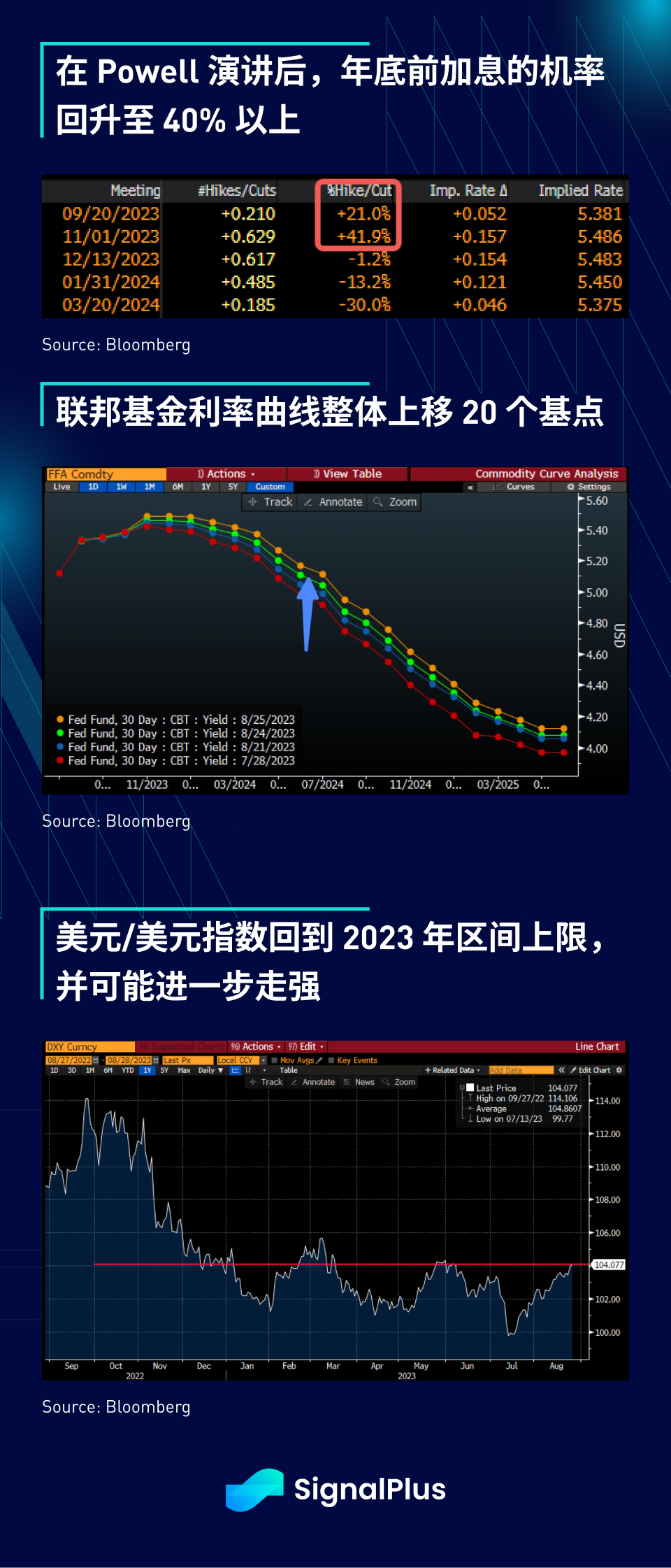

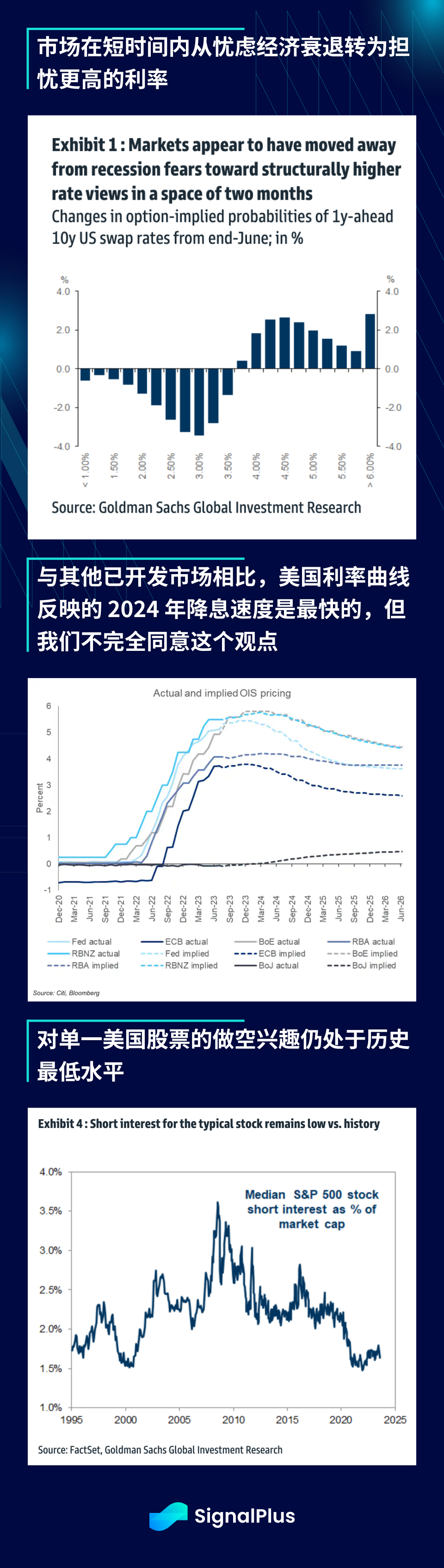

Overall, the speech was not as hawkish as worst-case scenarios might have predicted, but it was certainly not dovish either.In terms of market reaction, the probability of a rate hike by the end of 2023 has risen to 42% from around 20% before the meeting, expectations for the first rate cut have now been pushed back to May-June next year, and the federal funds curve as a whole is about 20% higher base point, bond yields showed a bearish trend, with the 2-year yield closing above 5.05%, helping to push the USD/USD index back to the upper limit of this years range.

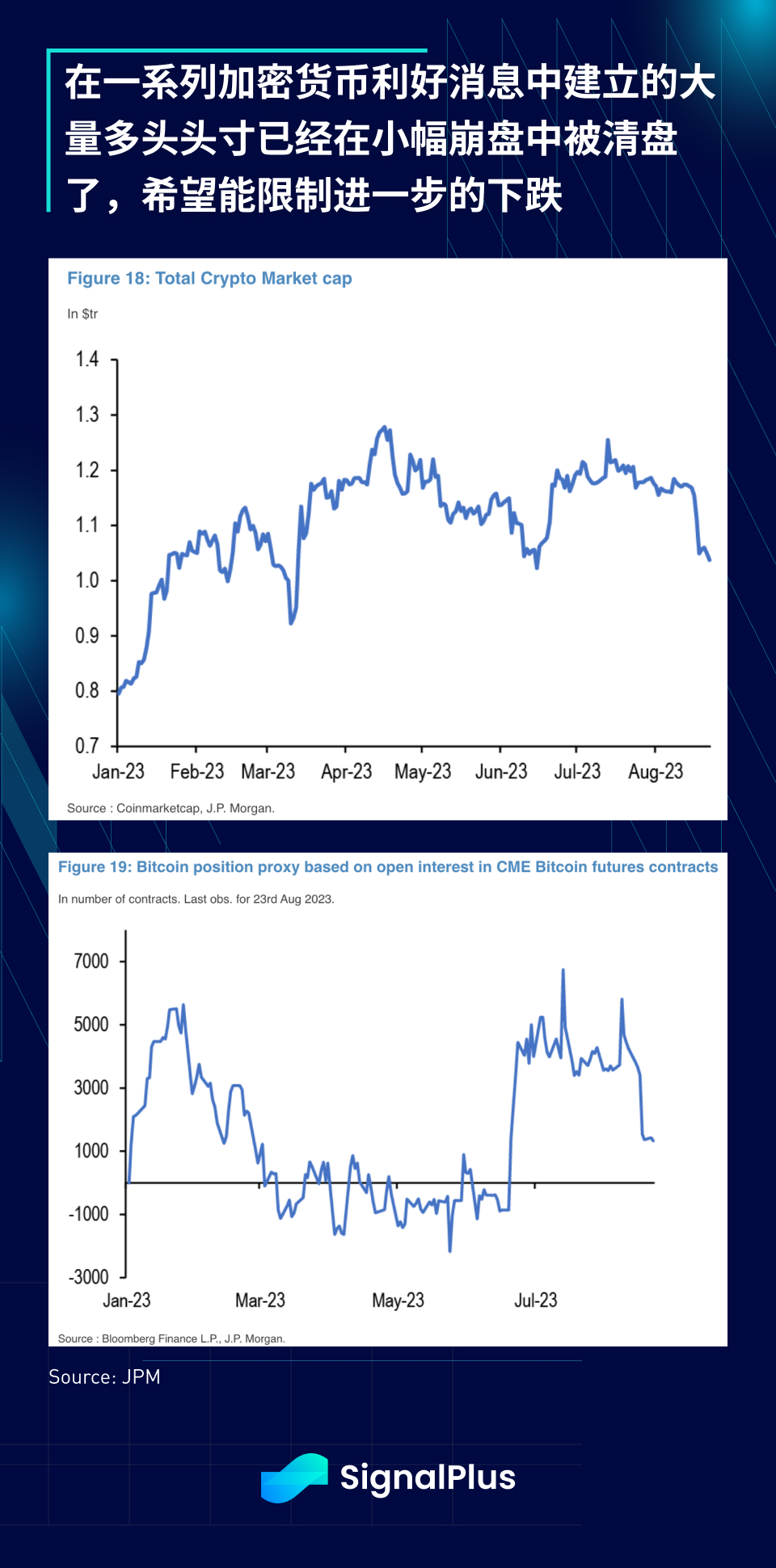

During the quarter, with economic data better than expected,Interest rate traders have shifted from worries about a recession to worries about structurally high interest rates, we also believe that no recession/high interest rates will have a long-term impact on the strengthening of the US dollar, pressure on stock price multiples, and resistance to gold and cryptocurrency prices; yes,Compared with the Bank of England/European Central Bank/Bank of Japan/Bank of Australia/New Zealand, the US interest rate curve reflects the fastest rate of interest rate cuts in 2024, this seems unreasonable, and we still believe that next years U.S. interest rate cut may not be as good as market expectations, and investors will be disappointed.

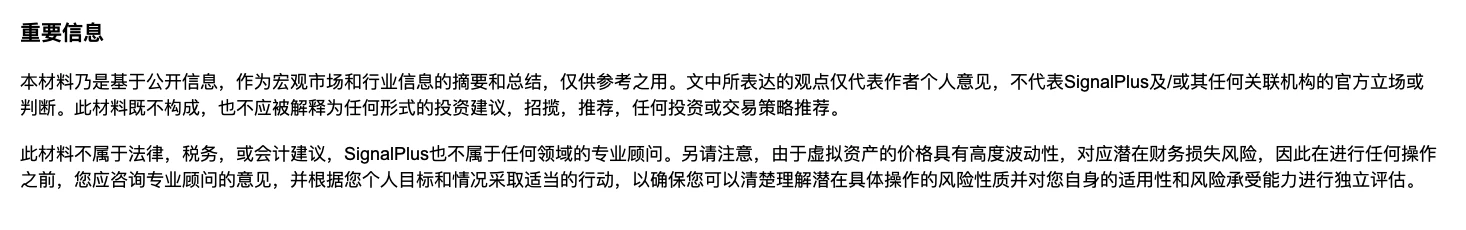

In terms of cryptocurrency,The small price slump earlier coincided with the sharp drop in the CME BTC futures contract, showing that this time the position liquidation was not limited to cryptocurrency native users, but also included mainstream investors; most of the long position was built on a series of positive news, including the SECs initial ruling with Ripple, the launch of Coinbase L2 Base, the Paypal stablecoin, and of course the anticipation of spot BTC ETF approval, so, With current long positions already cleaner than they were a few months ago, we would expect prices to form a floor at current levels, but there is also a chance that prices could turn lower heading into September if real rates rise again before Q4.

Finally, and more worryingly, the IRS released a draft proposal (Form 1099-DA) requiring digital asset brokers to comply with the same disclosure requirements as other financial instrument brokers, which is expected to be implemented over the next decade. The United States brought in $28 billion in tax revenue. The Biden administration’s stance on digital assets has been very clear, and more cryptocurrency development work is expected to shift to the East.

You can search for SignalPlus in the Plugin Store of ChatGPT 4.0 to get real-time encryption information. If you want to receive our updates immediately, please follow our Twitter account @SignalPlus_Web 3, or join our WeChat group (add assistant WeChat: chillywzq), Telegram group and Discord community to communicate and interact with more friends.

SignalPlus Official Website:https://www.signalplus.com