Welcome to the weekly cryptocurrency summary of Gryphsis Academy for the month of July. We bring you key market trends, in-depth insights into emerging protocols, and fresh industry news. All of this is aimed at enhancing your expertise in cryptocurrencies and Web 3. Follow us on Twitter and Medium for more research and insights.

Market and Industry Snapshot:

Layer 2:

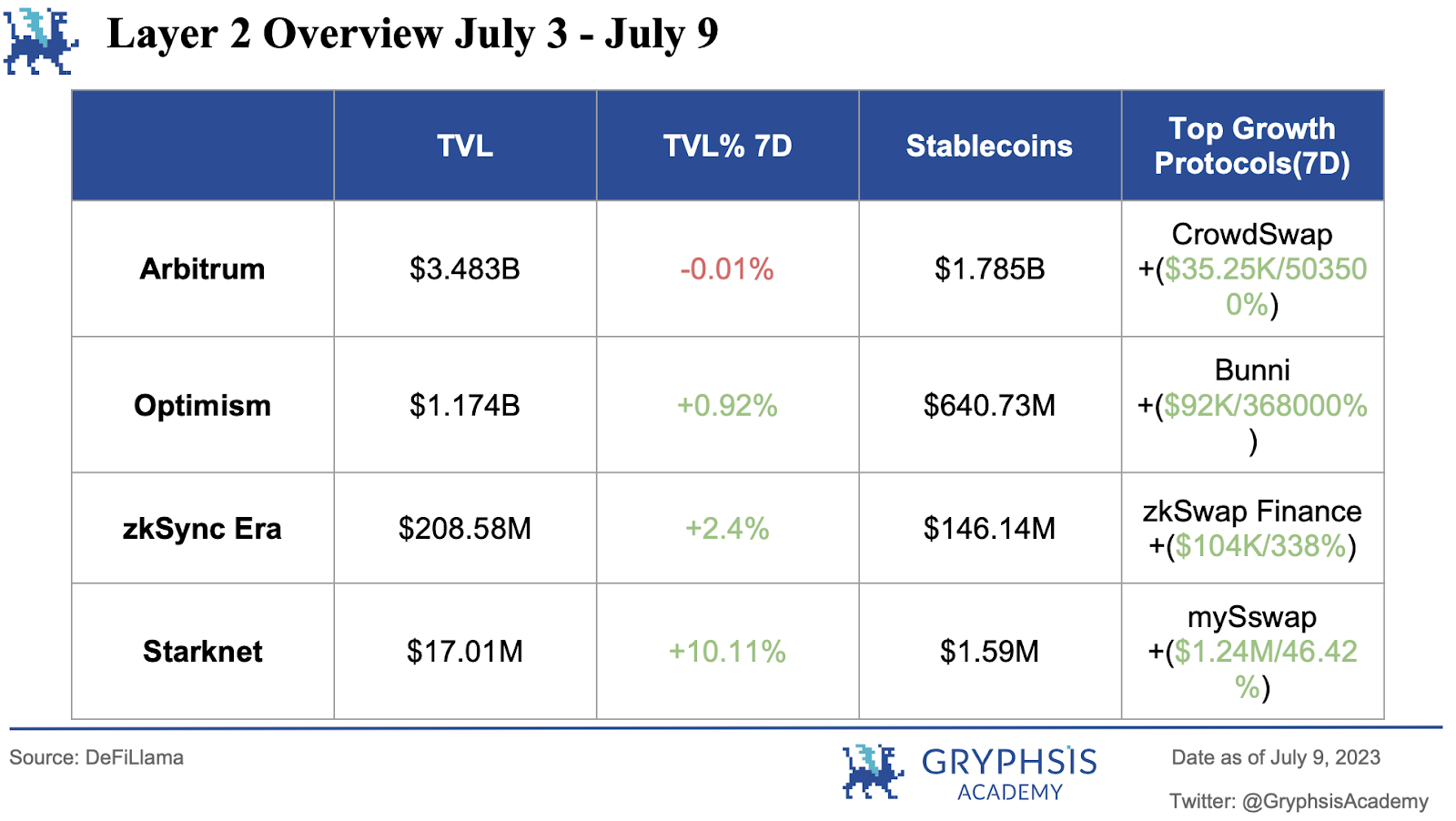

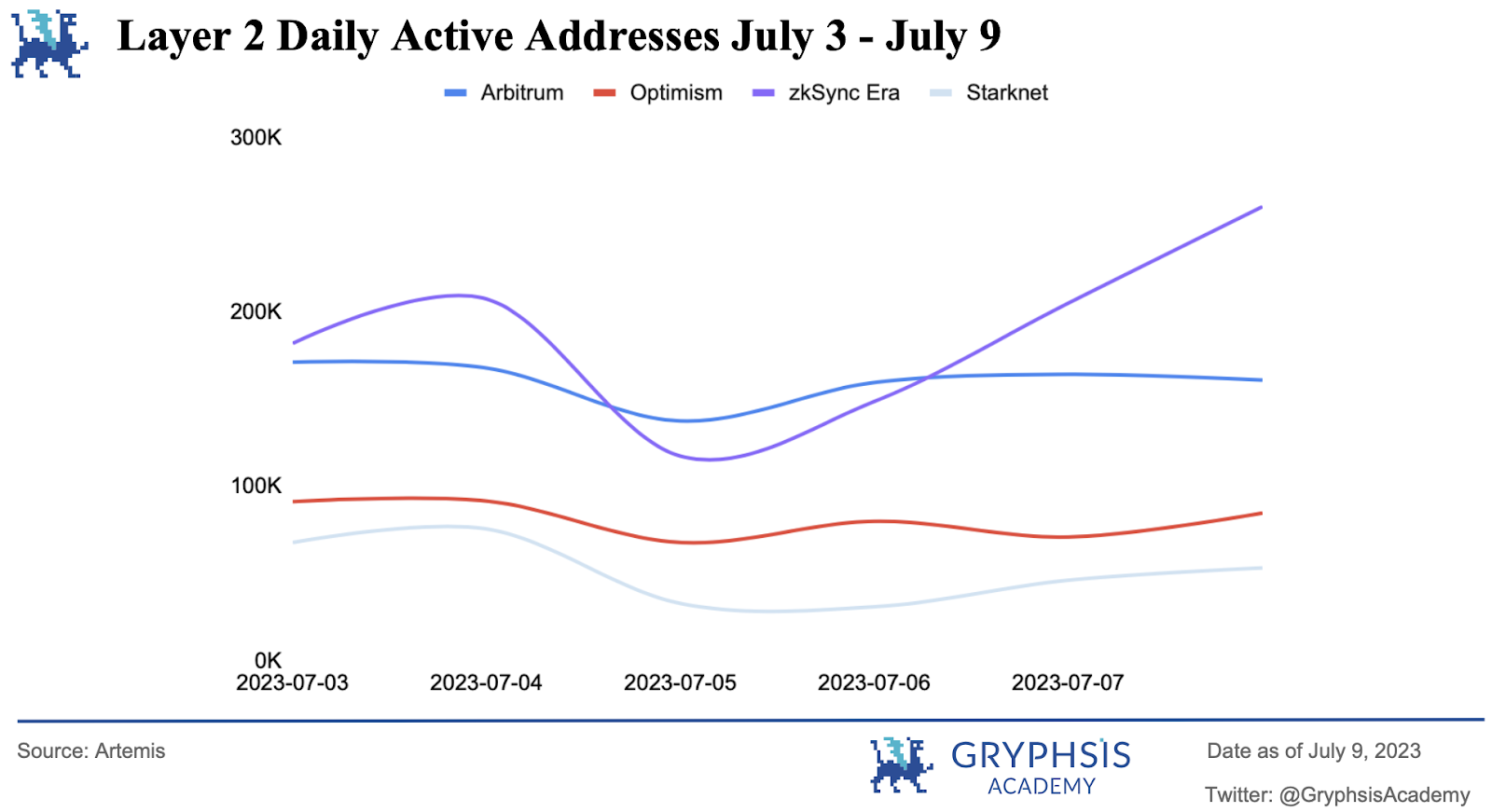

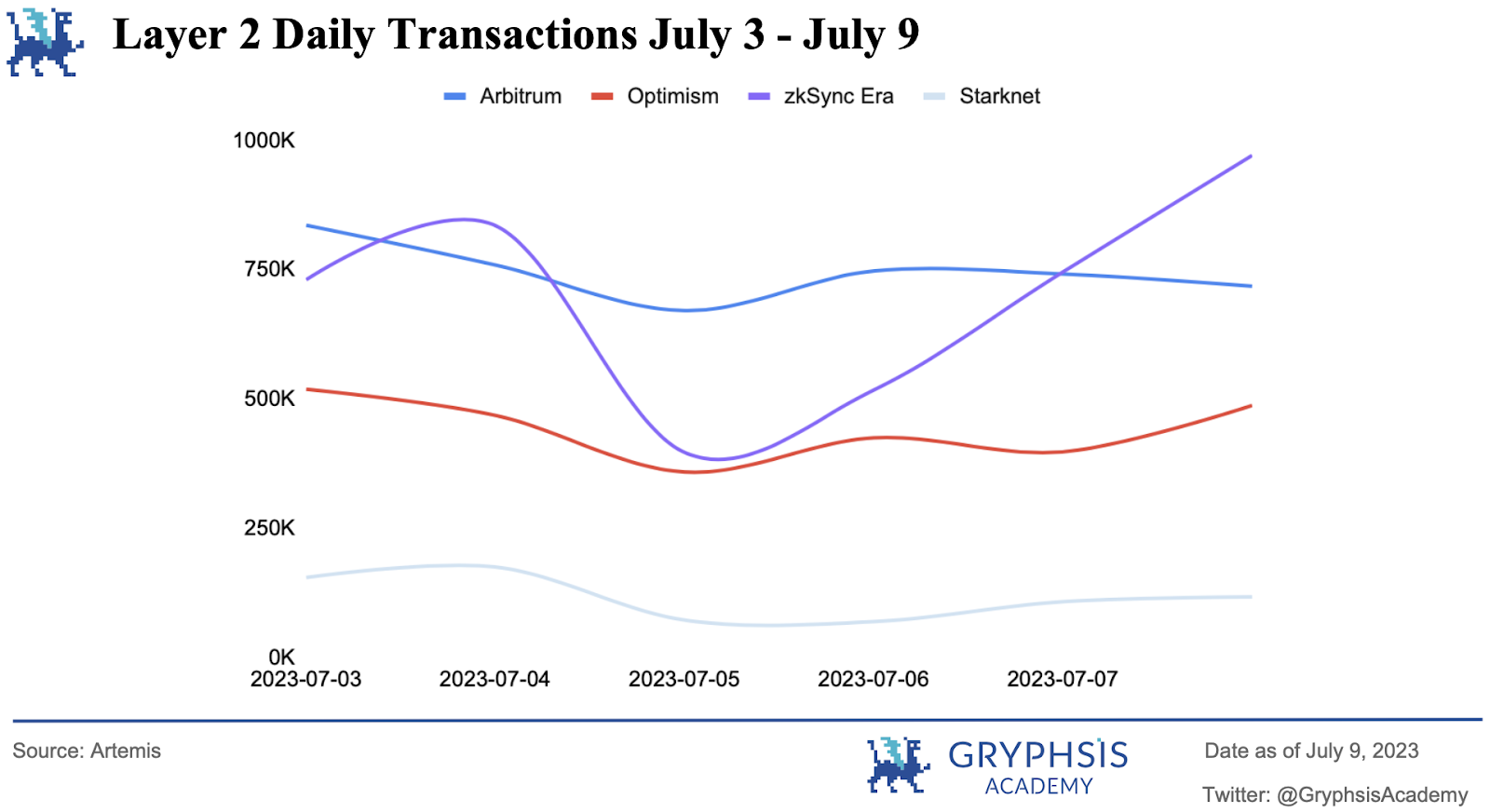

In the Layer 2 space, there was minimal fluctuation in Total Value Locked (TVL) this week, with the exception of Starknet leading with a 10% 7-day TVL growth rate. Specific protocols, including CrowdSwap, Bunni, zkSwap, and mySwap, outperformed other protocols, recording the highest TVL growth over the past week. Additionally, zkSync appears to be gaining momentum, with on-chain activity starting to surpass Arbitrum.

LSD:

LSD:

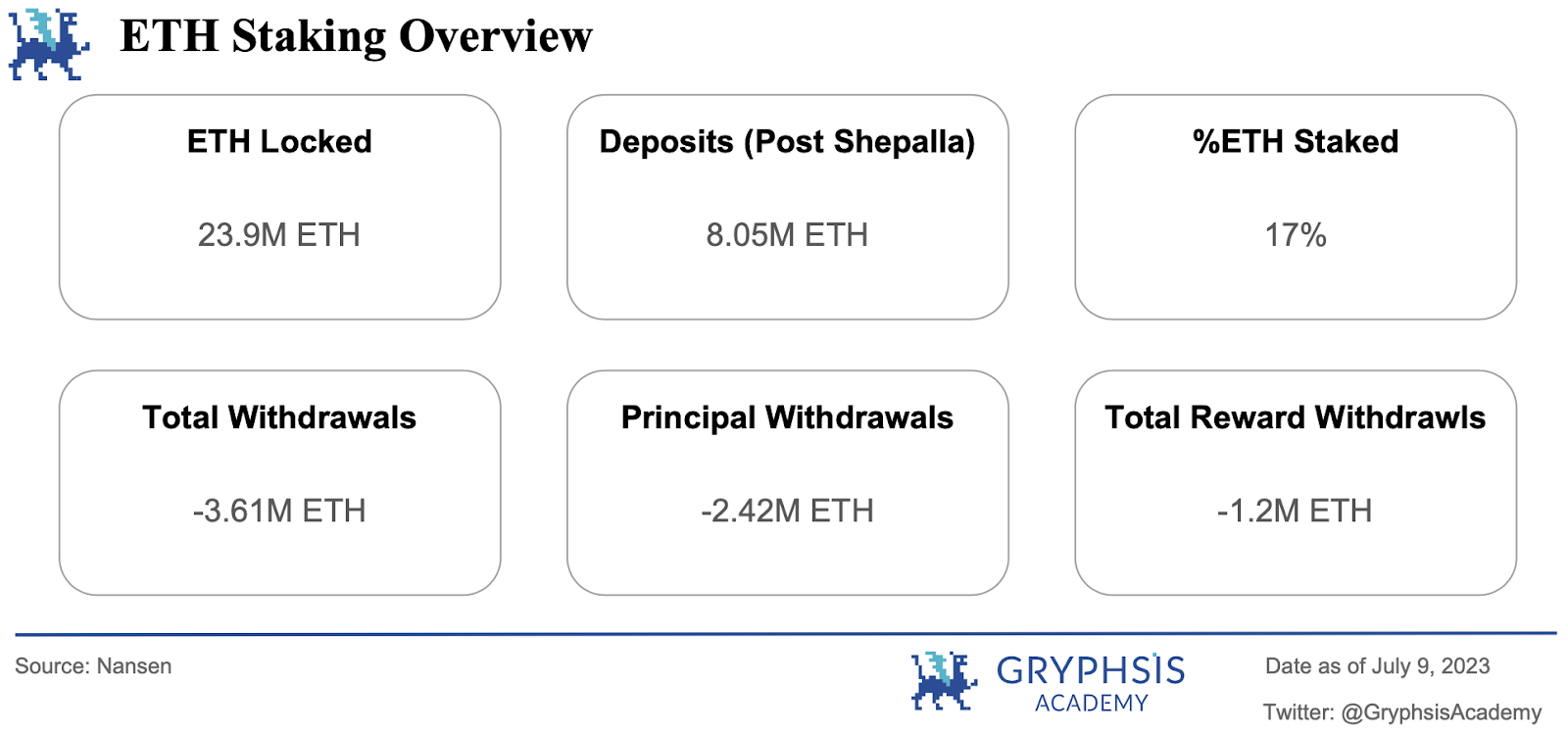

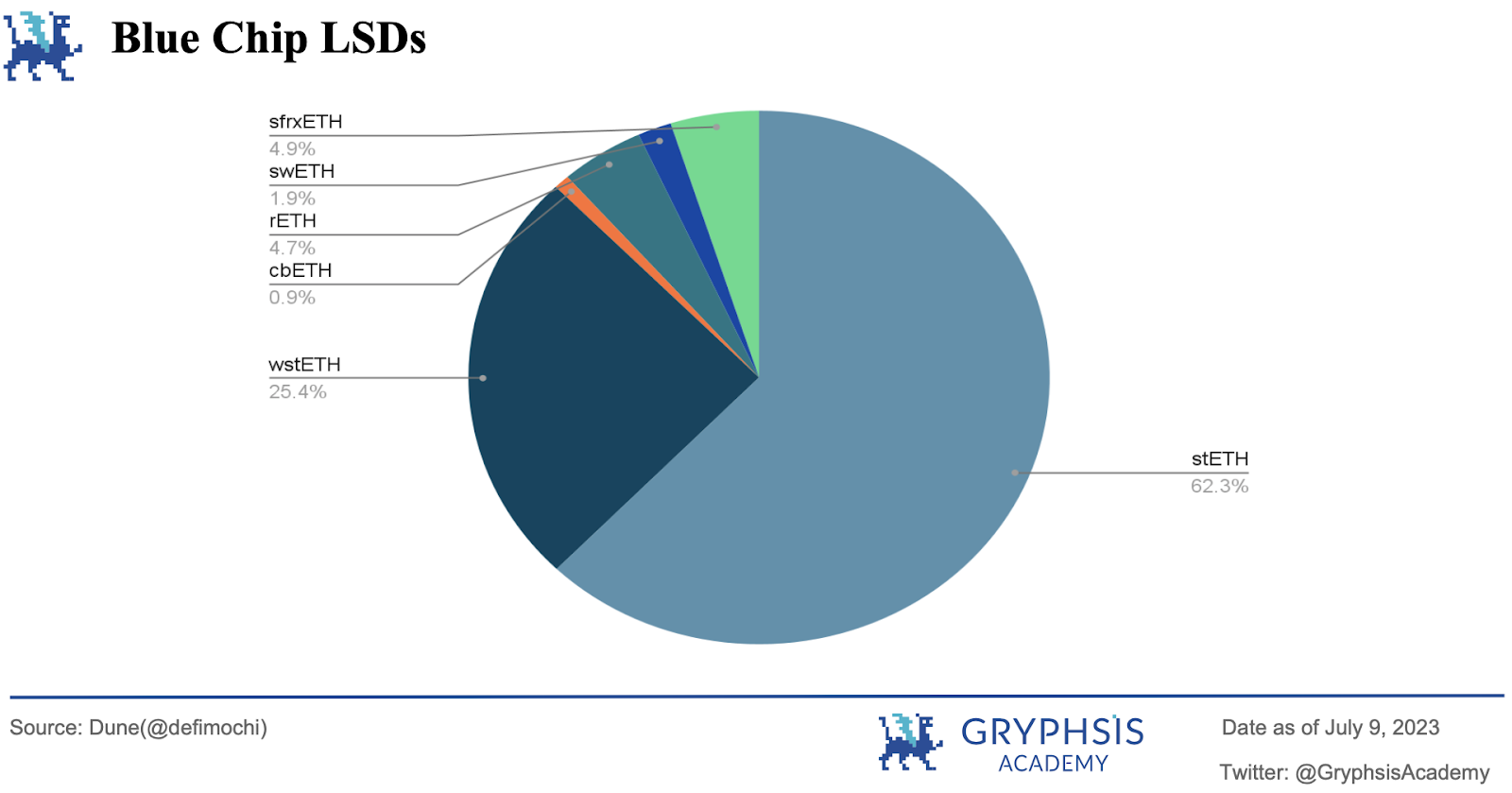

This week, the LSD field continues to show stable growth. It is worth noting that the deposit volume has increased slightly, adding momentum to the expansion of the entire field. The percentage of pledged ETH remains stable at 17%, consistent with last week's figure.

AI:

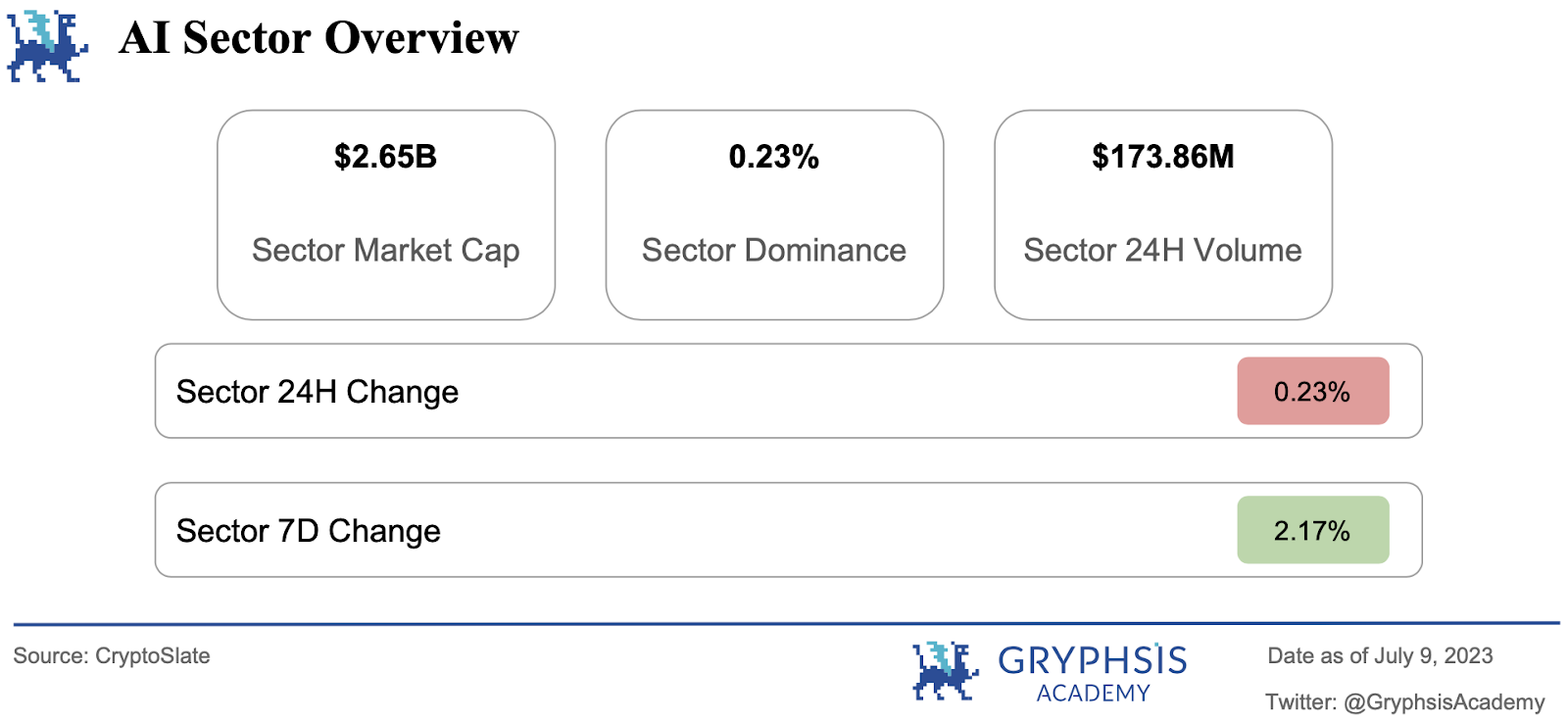

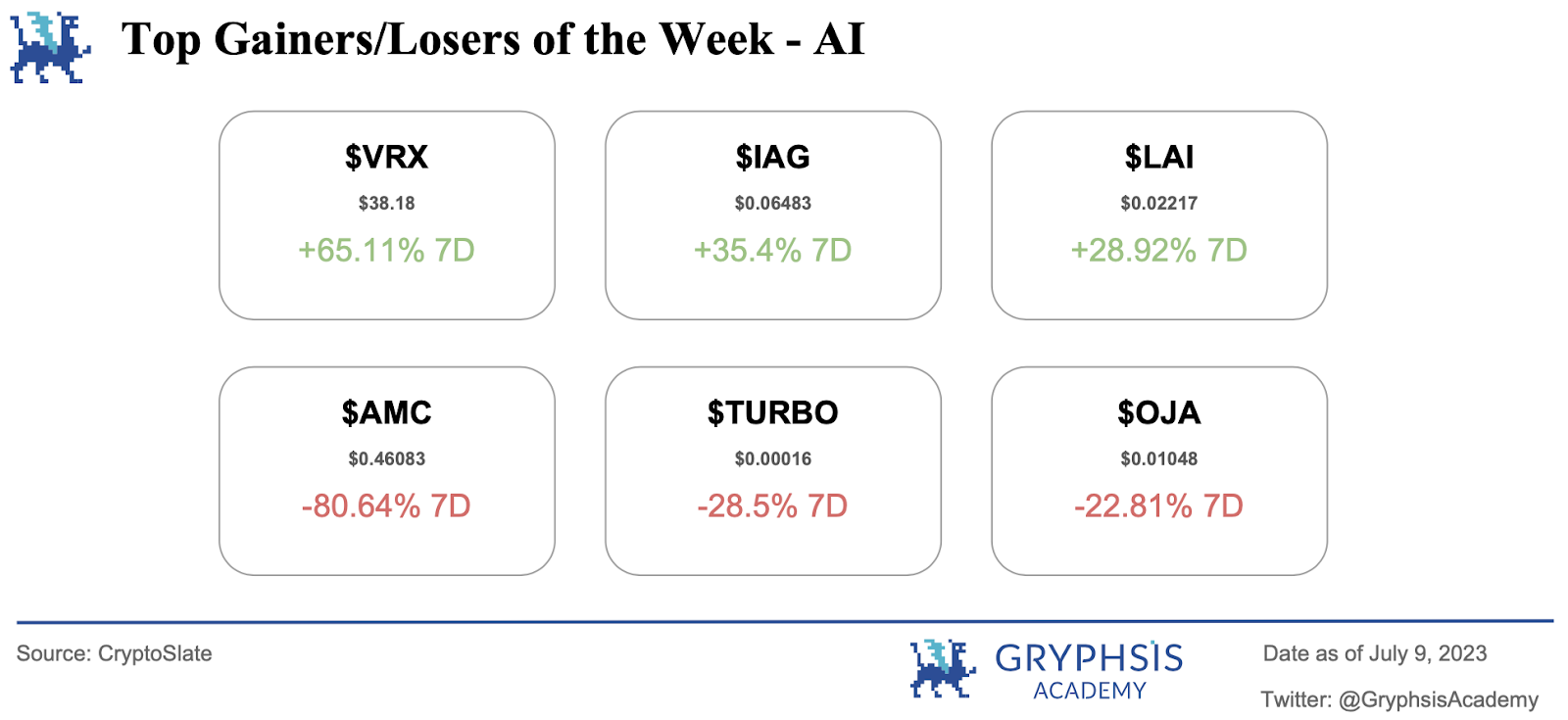

This week, the AI field is relatively stable, reflecting trends in the broader market. The market cap and dominance of this field have changed little, with a 2.17% slight increase in market value over the past 7 days. The top performers in this field are $VRX, IAG, and $LAI. Conversely, the biggest losses were seen in $AMC, $TURBO, and $OJA.

Main Topics

Macroeconomic Overview:

US Stock V.S. Crypto

Major Events This Week:

Multichain Exploited

SEGA Quitting GameFi

Weekly Protocol Recommendations:

Rodeo Finance

Gryphsis Research Focus (Ordinals):

In-depth Research on the BTC Ecosystem

Weekly VC Investment Focus:

CryptoQuant ($ 6.5 M)

Twitter Alpha:

@ArbiAlpha's Arbitrum recommendation protocol

@alpha_pls conversation with Pendle co-founder

@TheDeFinvestor's weekly Alpha

@Flowslikeosmo talks about Coinbase Venture's investment

@DamiDefi's trader wallet analysis

Macro Overview

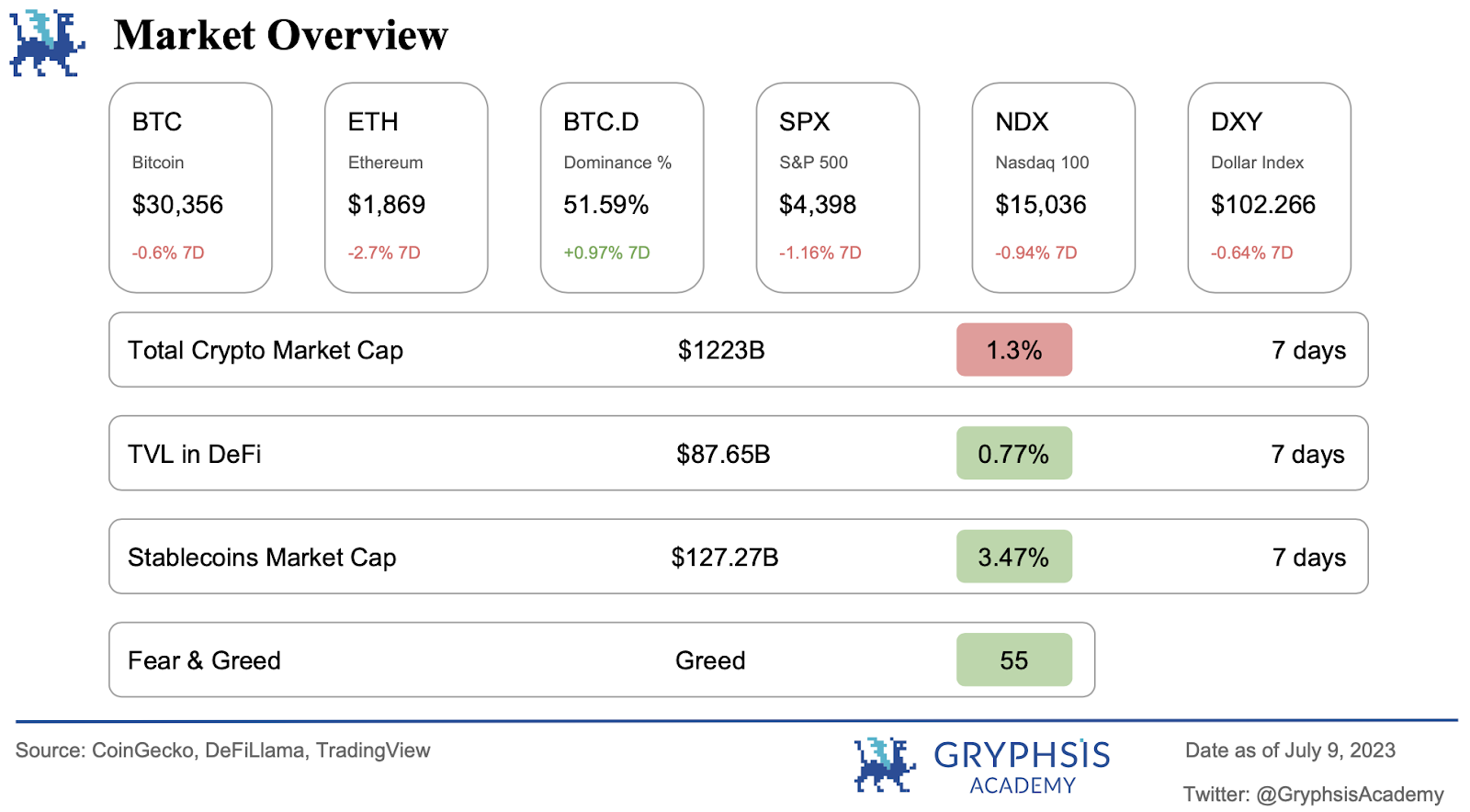

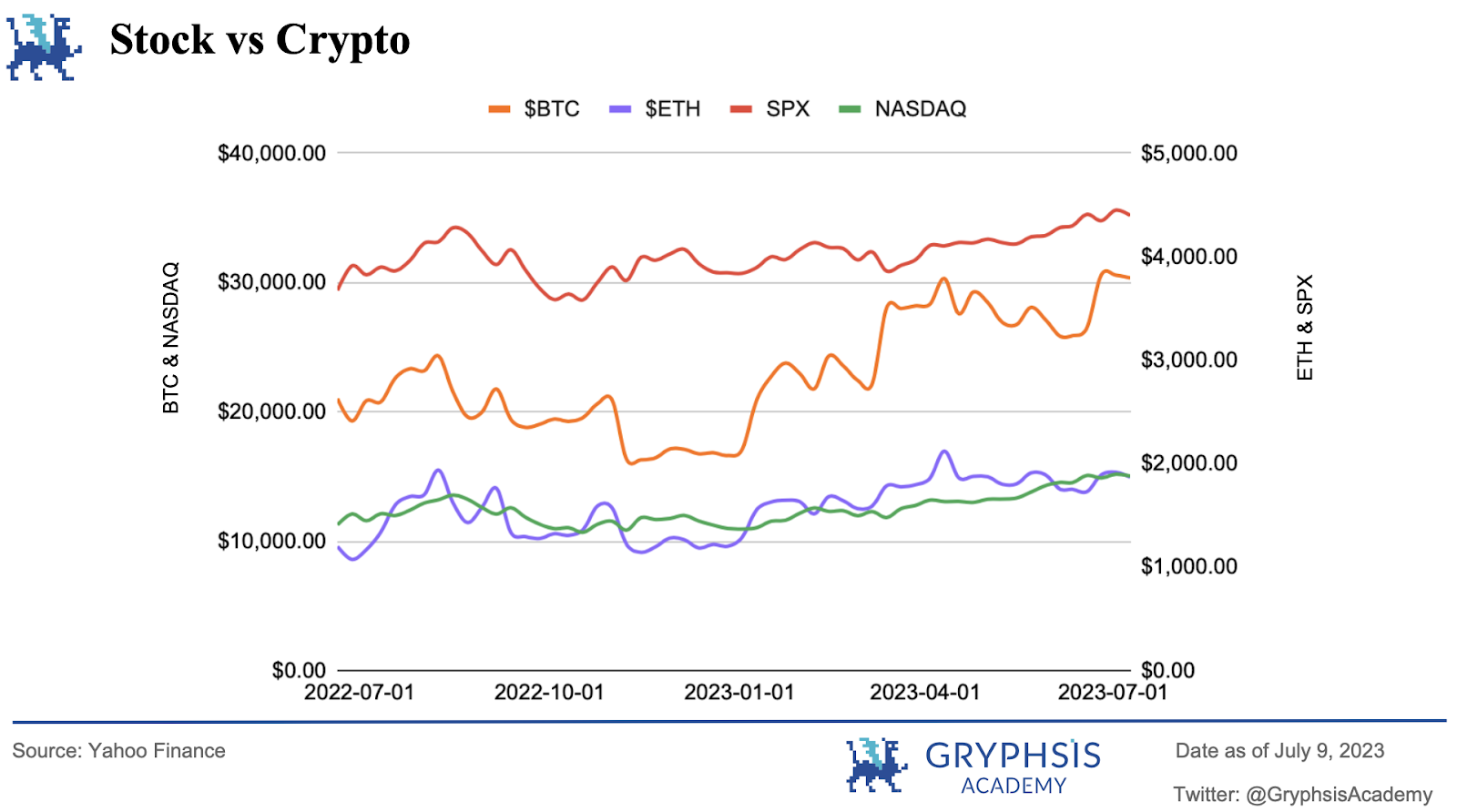

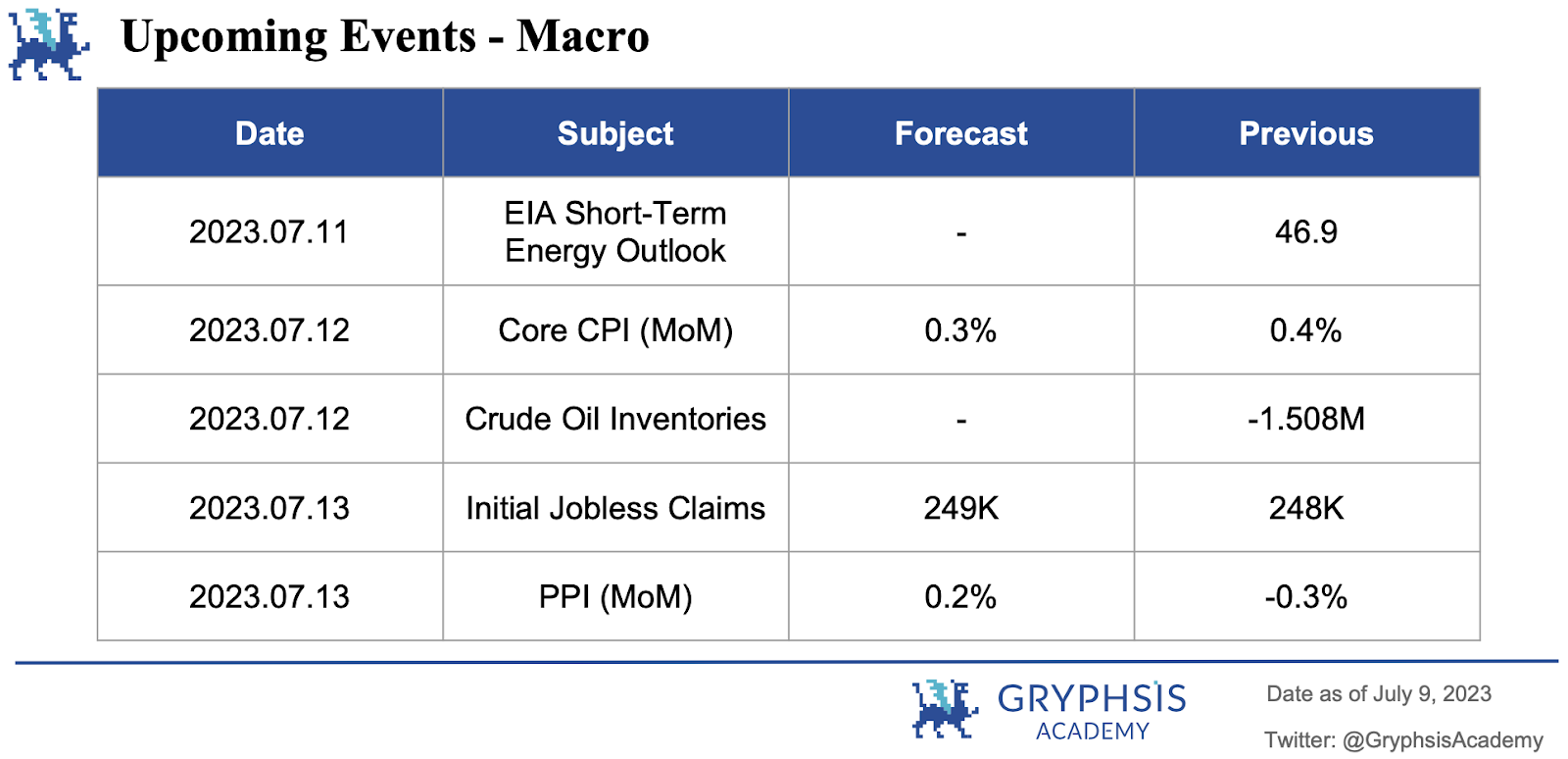

This week, both the SPX and Nasdaq indexes experienced slight declines, with low volatility in both markets. Looking ahead, key events to watch include the EIA Short-Term Energy Outlook, Core CPI, Crude Oil Inventories, Initial Jobless Claims, and PPI.

In the cryptocurrency field, volatility is also relatively low. The prices of $BTC and $ETH are roughly in line with the opening prices of this week. It is worth noting that BTC's dominance has slightly increased and is currently about 51.59%.

Key Events This Week

Multichain Collapse: Massive Attack Worth $130 Million

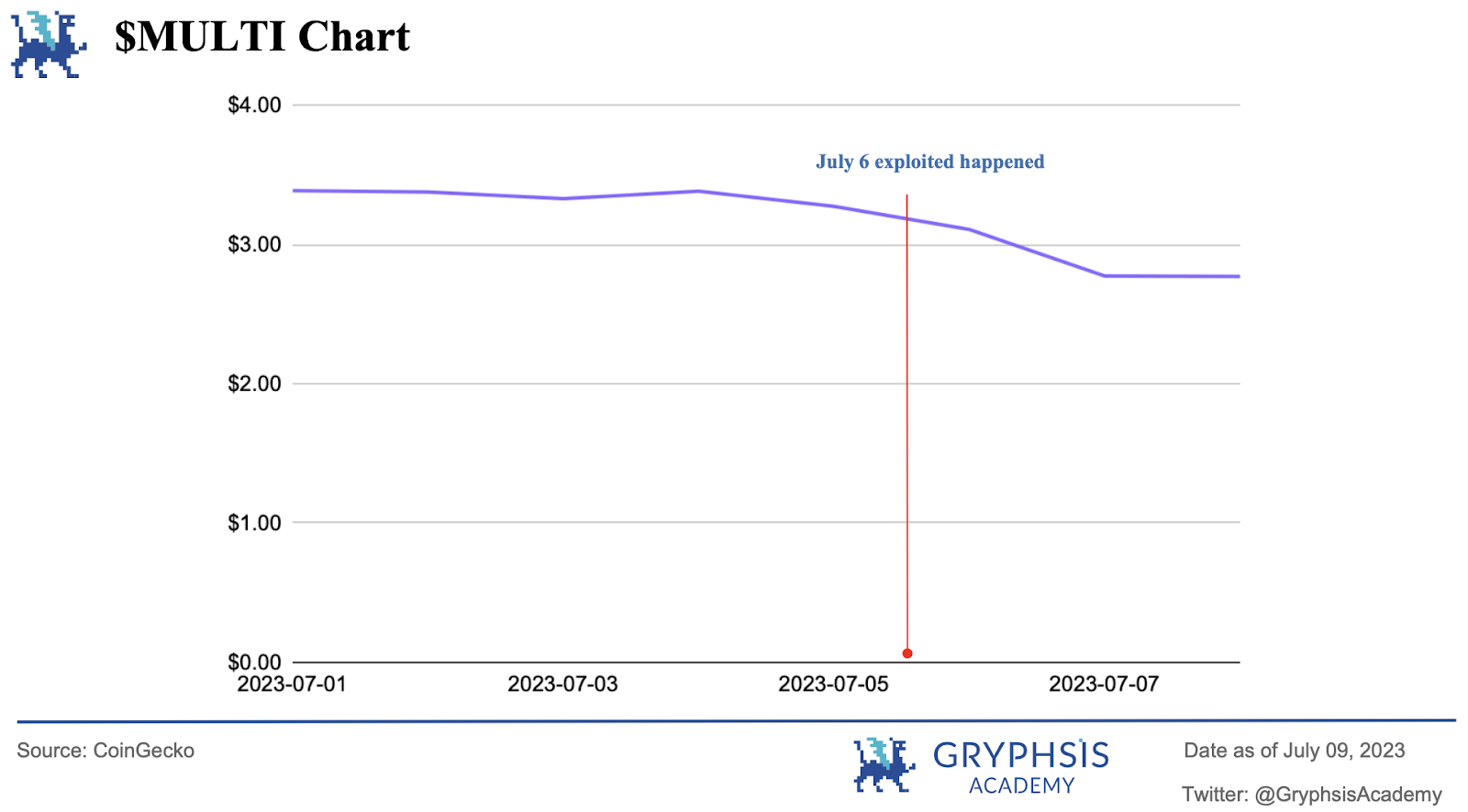

Multichain, a renowned Multi-Party Computation (MPC) bridging network supporting token movement across chains, has experienced a significant exploit. This event resulted in an astonishing outflow of over $130 million in crypto assets, delivering a blow to the crypto space. The abnormal activity primarily targeted Multichain's Fantom bridge, effectively depriving it of holding wBTC, USDC, USDT, and various altcoins.

Reportedly, on the Ethereum side of the Fantom bridge alone, approximately $102 million was plundered. Additionally, the Dogechain and Moonriver bridges had $666k and $5 million taken, respectively. These unauthorized withdrawals significantly depleted the Ethereum smart contract of the Fantom bridge, causing a loss of 7214 Wrapped Ether (WETH) tokens, 1024 Wrapped Bitcoin (WBTC) tokens, and $58 million worth of USD++++++++ Coin (USDC). Astonishingly, over 86% of the Ethereum deposits in the Dogechain bridge contract were taken, leaving behind only around $100k in assets.

Multichain's tweet:

https://twitter.com/multichainorg/status/1677180114227056641?s=61&t=mWHvRNex-uA3al_kWD4qFQ

In response to this major security vulnerability, the Multichain team has advised all users to temporarily halt their usage of their services and revoke all contract approvals associated with Multichain. An investigation is currently underway to uncover the details of this incident.

Show the complexity of this attack and identify possible mitigation strategies. However, this incident has not only raised concerns about the security of the encryption bridge, but also had a negative impact on Multichain's native token MULTI, causing it to plummet by 17% to $2.59.

Our View

The vulnerability of cross-chain bridges in DeFi is not a new issue. The high-profile attacks on Ronin ($600M), Wormhole ($300M), and Nomad ($190M) bridges regularly remind the crypto community of these risks. According to Chainalysis data, in 2022, approximately $2 billion was stolen in 13 different cross-chain bridge attacks, accounting for a staggering 69% of the total stolen funds that year. These figures highlight the seriousness of the situation.

Cross-chain bridges are particularly vulnerable to attack because they typically have a centralized point of funds storage to support the bridging of assets on the receiving blockchain. This structure makes them attractive targets for attackers.

However, the recurring vulnerabilities in cross-chain bridges may actually present an opportunity for LayerZero as a bullish point. LayerZero is a cross-chain communication protocol designed to facilitate communication between applications deployed on different chains. Unlike typical cross-chain bridges, LayerZero does not rely on intermediary nodes. It enables applications to have seamless cross-chain communication. In envisioning the future of cryptocurrencies as a fully interconnected ecosystem, LayerZero may present a more secure and efficient pathway.

SEGA Exit: What's Next for GameFi?

On July 7, gaming giant Sega is reportedly abandoning its initial plans to enter the blockchain-based gaming and GameFi market. The company's Co-Chief Operating Officer, Shuji Utsumi, expressed doubts about the potential of this technology in the gaming industry and cited the lack of enthusiasm from players for "earn-to-play" games as a key factor in this decision. Sega had previously expressed intentions to develop its own blockchain games, but now may cancel those plans while still allowing third-party developers to create such games. Despite the reconsideration, Sega will continue its investment in Asian-based crypto fund IVC, known for active involvement in GameFi projects. This development reflects the company's ongoing caution towards blockchain games, as it stated it would abandon this technology if viewed as a mere money-making scheme. The impact of this move on the future of GameFi and how it integrates into the broader gaming landscape remains to be seen.

Our View

Since the last bull market, the GameFi market has been in decline and the focus of the market has shifted. The core issue with GameFi is its heavy reliance on Ponzi economics. During bull markets, rising token prices and new users entering created a prosperous scenario. However, in bear markets, the downward spiral caused by falling token prices is unsustainable for the Ponzi economics. A notable example is Axie Infinity, a GameFi project that once dominated the "earn-to-play" market.

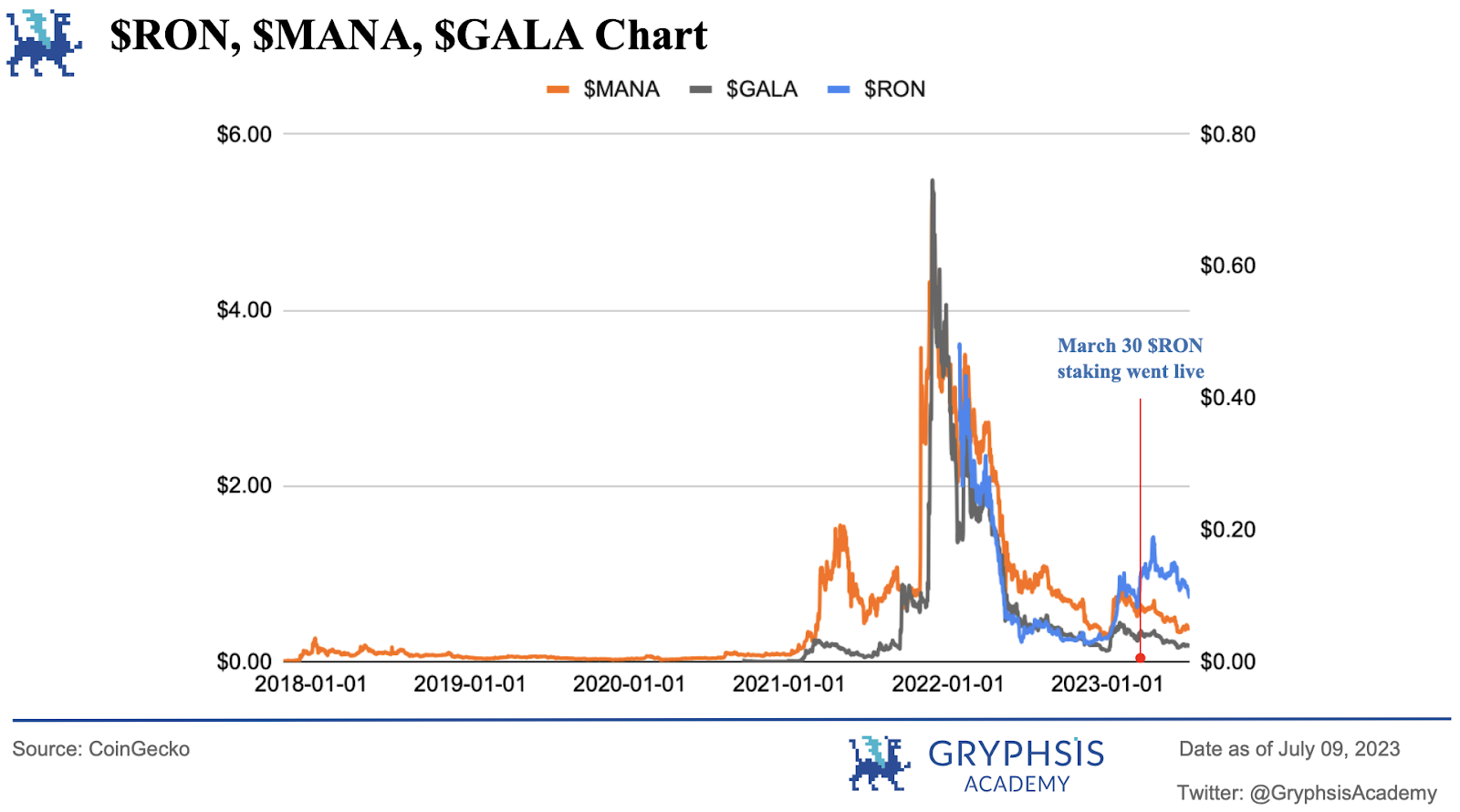

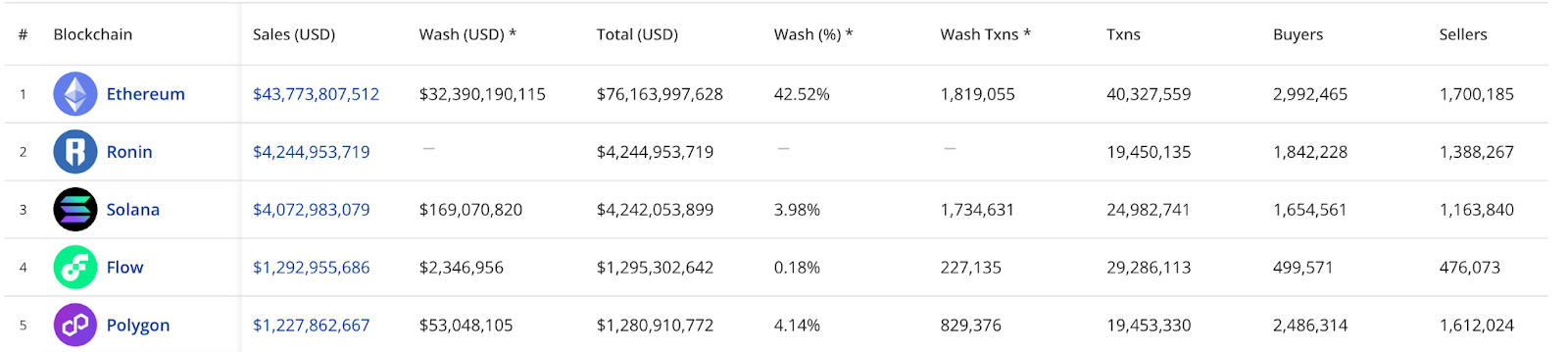

SEGA recently announced its withdrawal from the GameFi industry, which seems to cast a shadow over the future of this industry. However, the withdrawal of one company should not be interpreted as the death knell of this industry. Many factors can influence such decisions, and even large companies may misjudge trends. In the GameFi landscape, there is a project that caught our interest, Ronin Network. Ronin is designed for developers to develop GameFi and is a chain compatible with EVM. Last year, the network suffered a major attack resulting in a loss of $625 million, one of the largest in the industry, severely impacting $RON. However, after fully compensating for the loss and increasing the number of validators, Ronin has persevered in its development. It seems that $RON is gradually recovering its footing.

From the charts, we can clearly see that over the past few months, $RON has outperformed major GameFi tokens like $MANA and $GALA. The network also boasts impressive statistics. For example, Ronin ranks second in total NFT sales volume. Additionally, staked $RON accounts for nearly 40% of the circulating supply. This year, Ronin has established significant partnerships with The Machines Arena developed by SkyVu, Tribesters developed by Tribes Studio, and Bowled.io. Despite the overall underperformance of the GameFi market, Ronin appears to be a promising project that we will closely monitor. However, investing in GameFi tokens may pose risks as the industry as a whole has not performed as well as other industries, indicating that the market's focus is elsewhere. Therefore, investors should proceed with caution.

Weekly Protocol Recommendations

Welcome to our "Weekly Protocol Recommendations" - here, we will focus on protocols that are making waves in the crypto market. This week, we have chosen the lending and leverage trading protocols on Rodeo and Arbitrum.

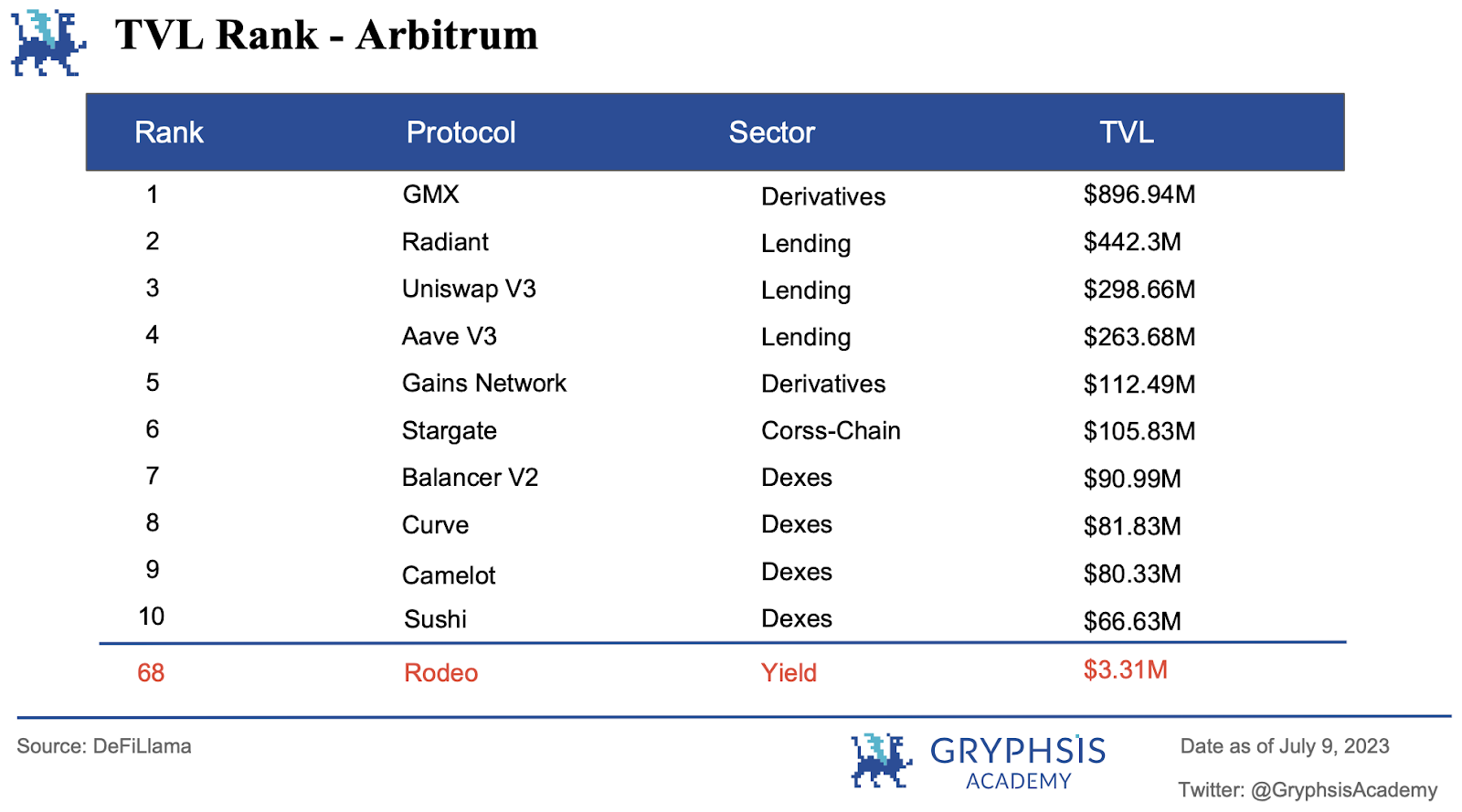

Rodeo Finance is a community-driven decentralized finance protocol that allows users to earn income on various management and passive investment strategies. The protocol is currently running on the Arbitrum mainnet with a Total Value Locked (TVL) of $3.31 million. Rodeo Finance's vision is to provide consistent and stable annualized returns, or "real yield," in a market where yields can vary significantly. The protocol is built on several key values: decentralization, real yield, risk mitigation, automation, and sustainability.

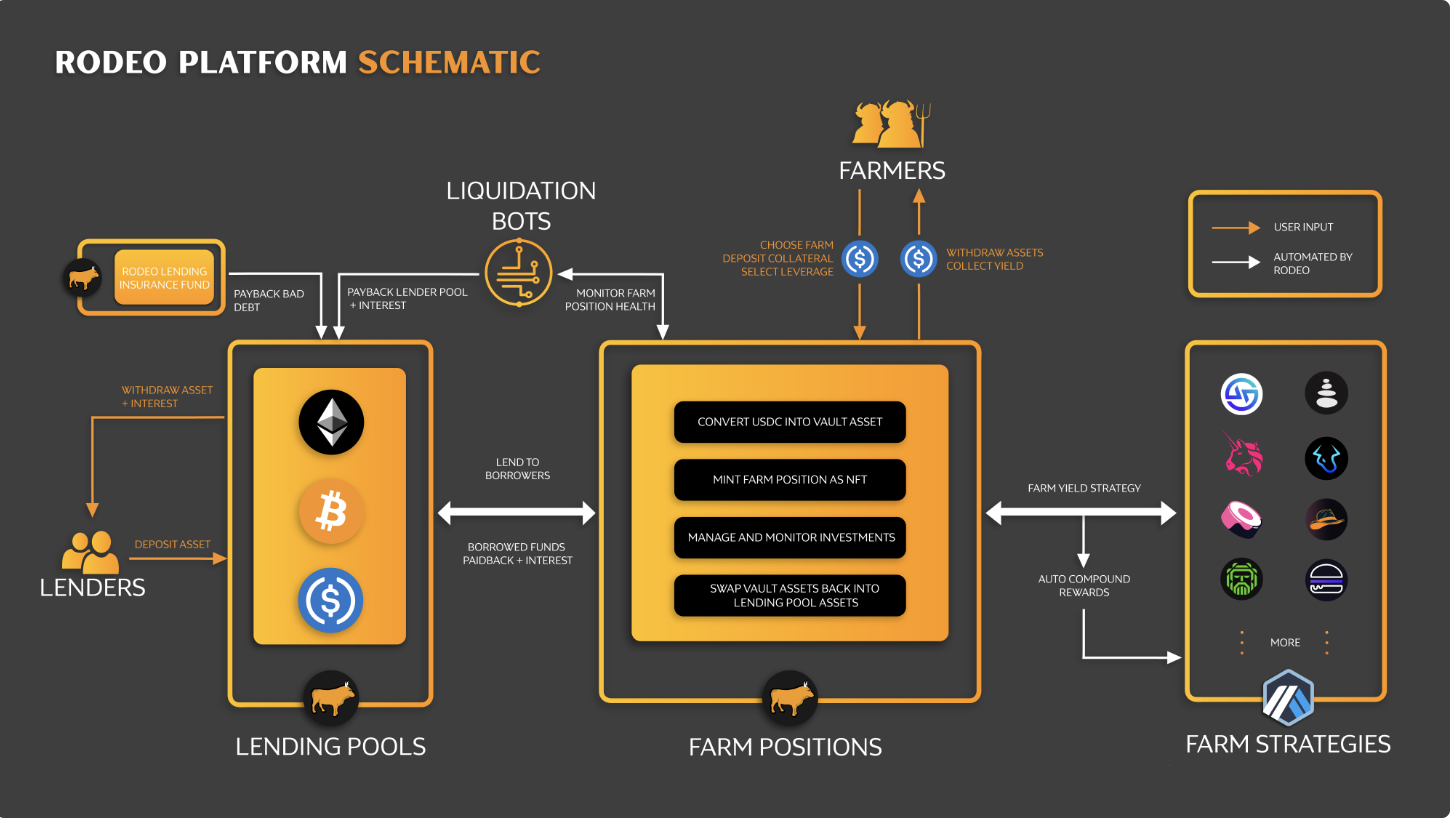

Rodeo mainly consists of two user types: Borrowers and Farmers. Borrowers deposit assets into the lending pool for borrowers to use, while Farmers borrow funds to invest in Rodeo's integrated strategies, surpassing the limits of their own assets.

Compared to standard overcollateralized lending markets like Compound or Aave, Rodeo Finance's uncollateralized lending offers two distinct advantages:

1. Users can access more capital, increasing their positions and potential for earning money.

2. By offering more leveraged assets, the protocol increases its Total Value Locked (TVL).

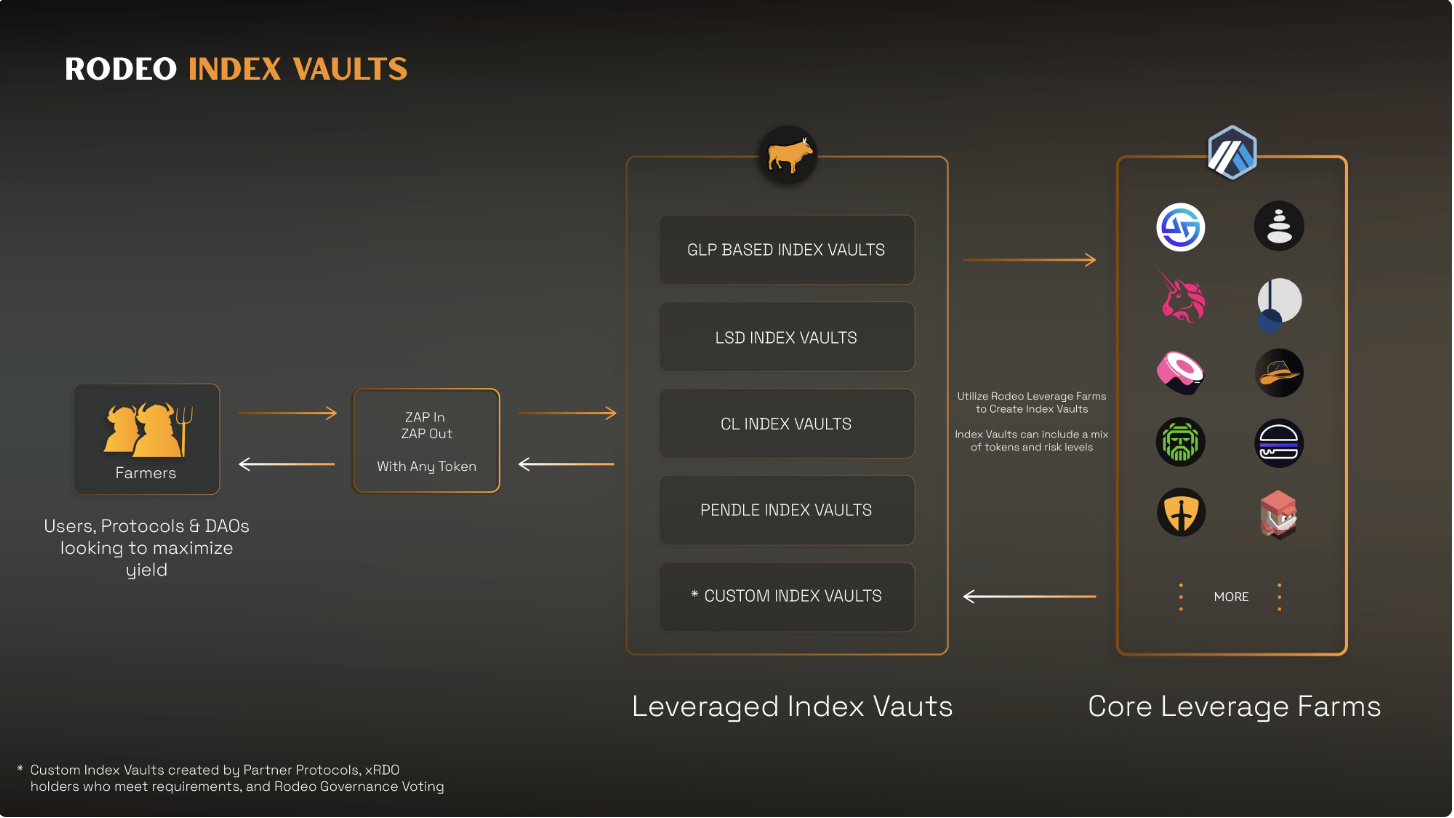

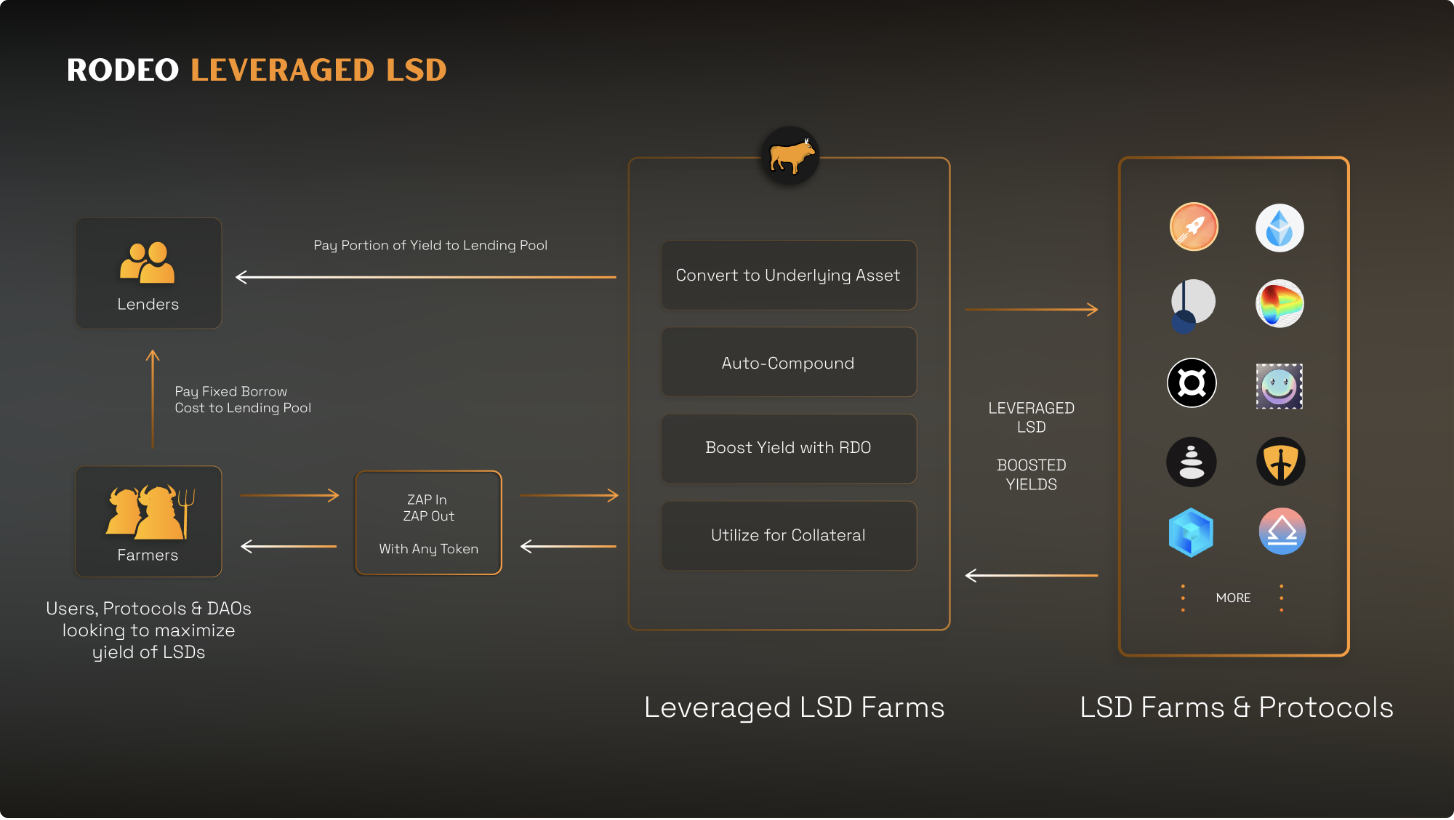

With the vision of becoming the center for maximizing profits in Arbitrum, the protocol is exploring two additional products, Index Vaults and Leveraged LSDs.

Index Vaults are a blend of various tokens, with each token representing a unique profit strategy ranging from regular and leveraged Rodeo farms to stablecoins, interest-bearing assets, and automated treasuries.

An example is the 3x leveraged ETH Index, which is ideal for investors with a bullish position on ETH. Users can enter with USDC, and the leveraged strategy provides ETH exposure between 2.7 to 3.3 through different farms. Additionally, it offers automatic rebalancing, simplifying the investment process.

Leveraged LSDs are a unique LSD leveraged farming system that enhances the returns of LSD assets beyond standard rates through a unique structure, profit sharing, automatic compounding, and increased RDO rewards.

Our Insights

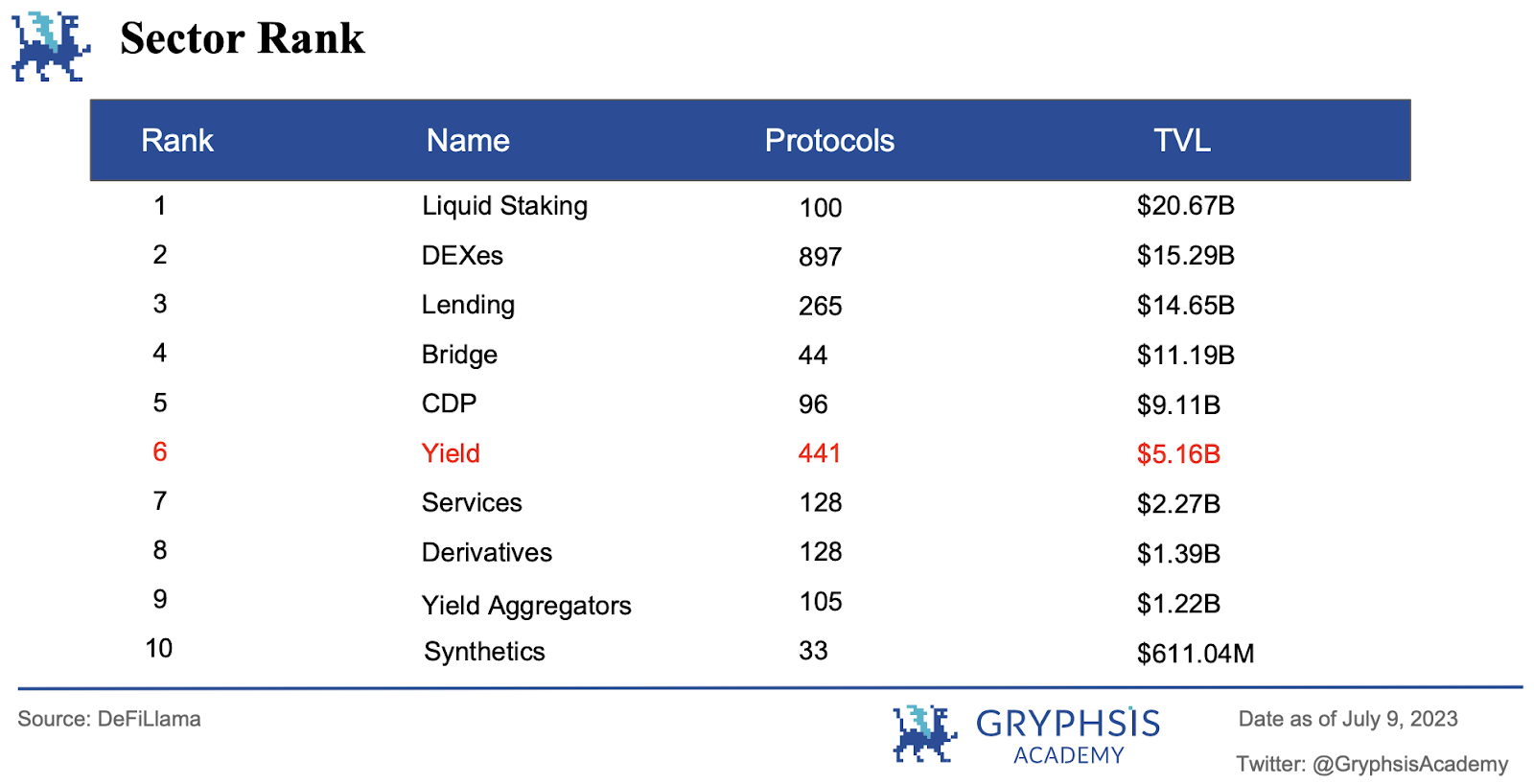

Within the realm of yield products, entities like leveraging farming and strategy vault have proven to be popular choices for users desiring to earn yields but lack the time or inclination to constantly monitor market charts. As evidenced by DeFiLlama's sector ranking, the yield sector's appeal is undeniable, housing over 400 protocols and placing 6th in the hierarchy.

In the field of yield products, entities such as Leveraged Farming and Strategy Treasury have proven to be popular choices for users who want to earn income but lack the time or inclination to constantly monitor market charts. As evidenced by DeFiLlama's industry rankings, the allure of the yield industry is undeniable, with over 400 protocols and ranked sixth.

We believe that Rodeo Finance demonstrates strong potential for success due to its robust product offerings and well-designed token economics. The DeFi user base can be broadly divided into two types: yield-hungry risk investors who are always looking for high leverage, and more conservative users who prefer stable, low-risk returns. Impressively, Rodeo's product suite is able to meet the needs of both of these groups.

The highly anticipated Index Vault stands out as a standout feature as its diversified strategy options have the potential to set Rodeo apart. Additionally, Leveraged LSDs are closely tied to the popular LSD narrative.

Turning our attention to the token economics, this is another key aspect in which Rodeo excels. The $RDO/$xRDO model takes inspiration from Camelot's $GRAIL/$xGRAIL setup. With $RDO as a liquid token and $xRDO as a utility token, Rodeo's token economy facilitates the generation of additional layers of income. Furthermore, holding $xRDO allows participants to engage with the protocol's ecosystem and share in dividends, a feature that may expand with the growth of product offerings and user base.

The $RDO token has shown impressive performance since its initial launch, reflecting the market's confidence in Rodeo's potential. We will continue to closely monitor the ongoing development and operational dynamics of Rodeo to identify opportunities in this exciting protocol and keep you informed of its growth.

Gryphsis Research Focus - Ordinals

Welcome to this week's "Gryphsis Research Focus," where we will share with you the latest findings from our team. Our professional research team is constantly exploring cutting-edge trends, developments, and breakthroughs in the crypto field. This week, we are excited to share our research on Ordinals with you, aiming to deepen your understanding of the evolving crypto world and ignite your curiosity.

Ordinal protocol has carved out an important market share in the Bitcoin ecosystem, with its main applications being BTC NFT and BRC 20. With the initial hype surrounding Ordinals subsiding, continued innovation has nurtured a vibrant ecosystem. Unlike Ethereum, the Bitcoin ecosystem emphasizes values such as on-chain transparency, decentralization, and fairness, reflecting an emerging and unique culture. Despite controversies, BTC NFT and BRC-20 have witnessed sustained growth, offering opportunities for community participation and signaling continued development within the Ordinals ecosystem.

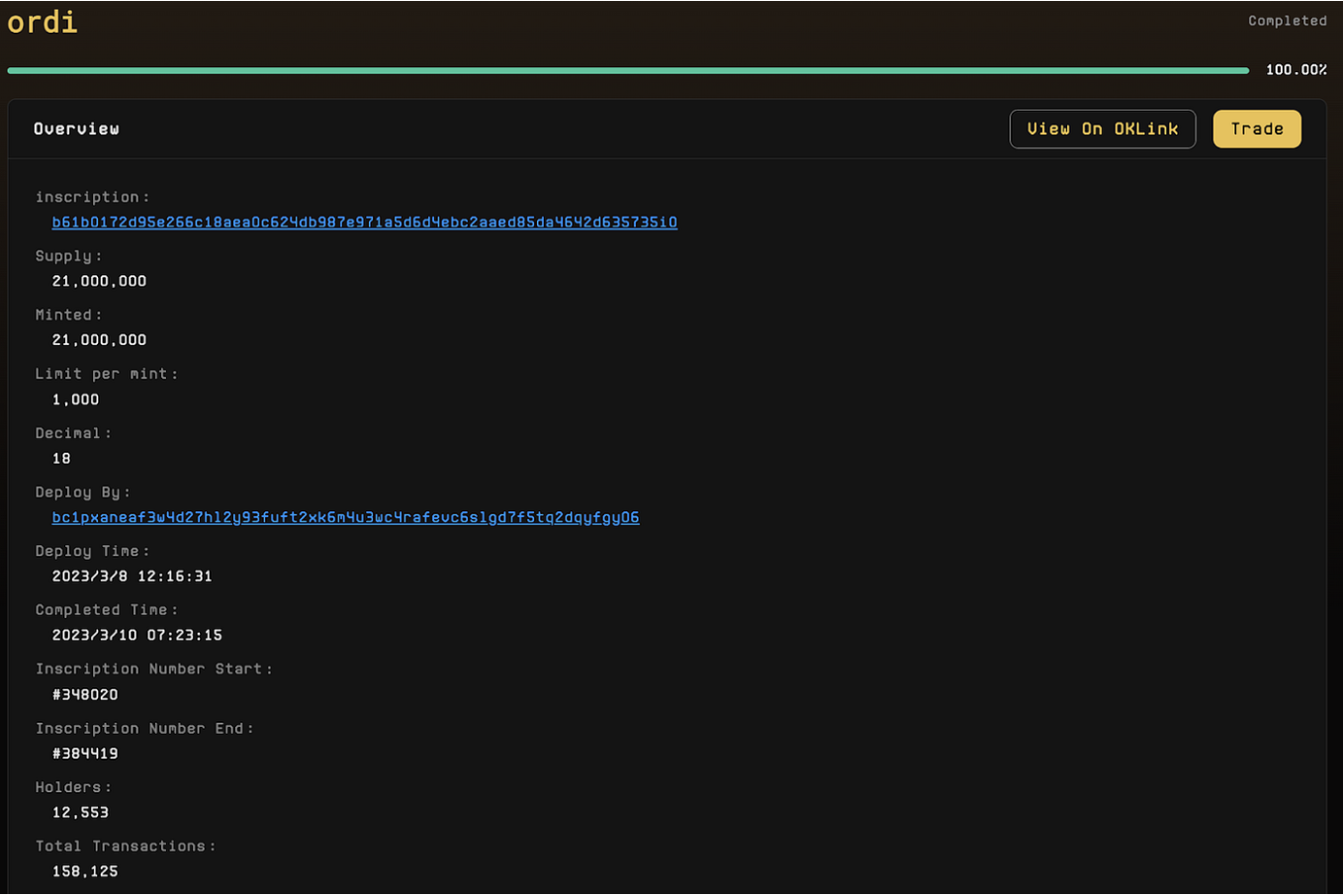

At the core of this ecosystem is $ORDI, the first BRC-20 token, with a narrative comparable to punks. Its unique features have attracted a large number of investors and community base, contributing to its widespread recognition and promotion. With its strong cultural identity, active community, social distribution, and capital drive, $ORDI exhibits significant growth potential compared to other meme coins. This potential is amplified by the narrative surrounding Bitcoin halving cycles and the continued development of BRC 20 and the Ordinals ecosystem. The next section will focus on Gryphsis' study of these complex dynamics.

Vitalik’s comment on Ordinals:

https://cointelegraph.com/news/vitalik-buterin-ordinals-revived-developers-on-bitcoin

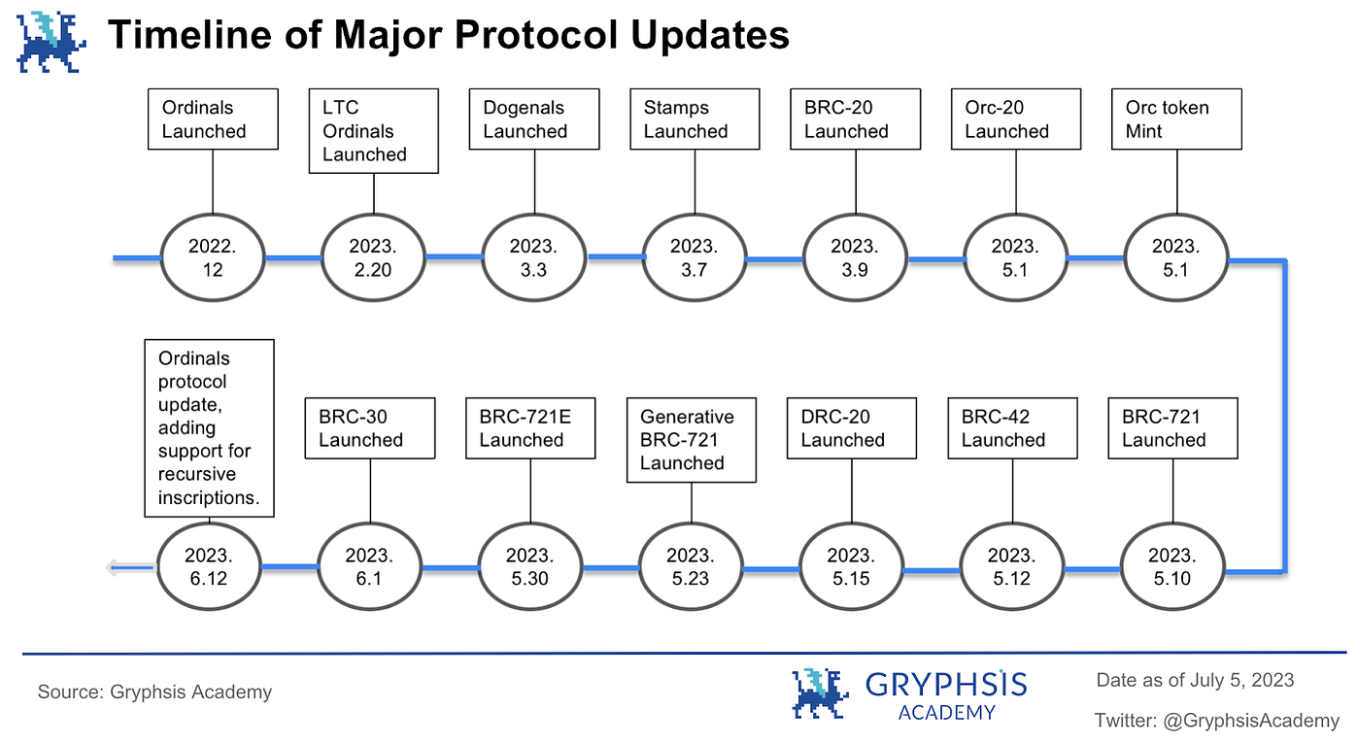

The Ordinal protocol was launched in December 2022 and has made significant progress in the Bitcoin ecosystem. Casey Rodarmor introduced this protocol, leading to the creation of NFTs on the Bitcoin network and the emergence of digital artifacts.

In February 2023, Bitcoin Punks, inspired by CryptoPunks inspired unique NFT project, minted, and traded on platforms like Gamma. In the same month, the largest block of Bitcoin, nearly 4M BTC, was minted by the Bitcoin NFT project Taproot Wizard, sparking extensive discussions.

In March 2023, the BRC-20 protocol was established, launching the "ordi" token, which was the first token to use this protocol for Bitcoin. Later, the protocol was enhanced through ORC-20 by OrcDAO, providing a robust standard for the Ordinal token.

Finally, in a significant event since 2017, the transaction fees of a Bitcoin block exceeded the block reward for the first time, marking an important turning point for miners in the rising Bitcoin transaction fees.

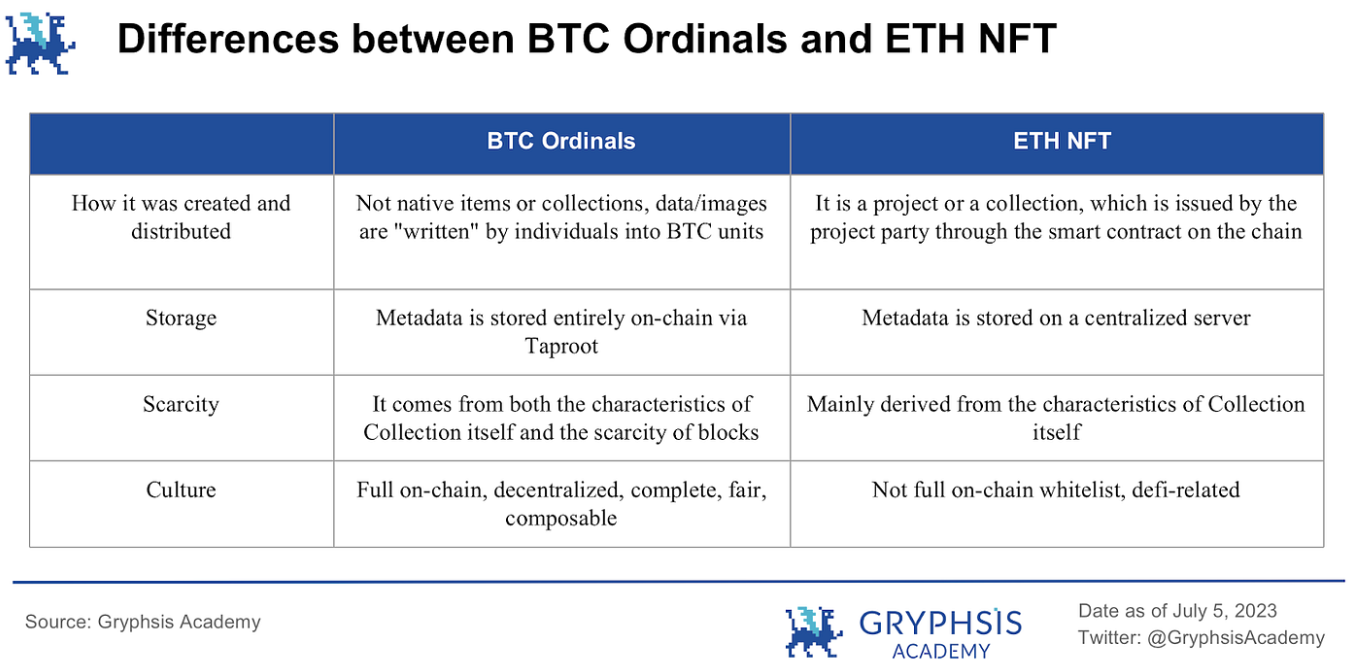

While the value and sustainability of BTC NFT and BRC-20 are debated topics, we must consider the cultural differences between the Bitcoin and Ethereum ecosystems.

BTC NFTs are entirely on-chain, distinguishing them from Ethereum NFTs, which often rely on off-chain custody. Despite higher creation costs, BTC NFTs have gained attention thanks to the Bitcoin culture that insists on complete on-chain existence. This culture is uncompromising and values integrity over cost efficiency.

On the other hand, Ethereum's culture has become accustomed to off-chain storage solutions like Arweave or IPFS. Modifying images or occasional unavailability is accepted because storing only a link is considered sufficient.

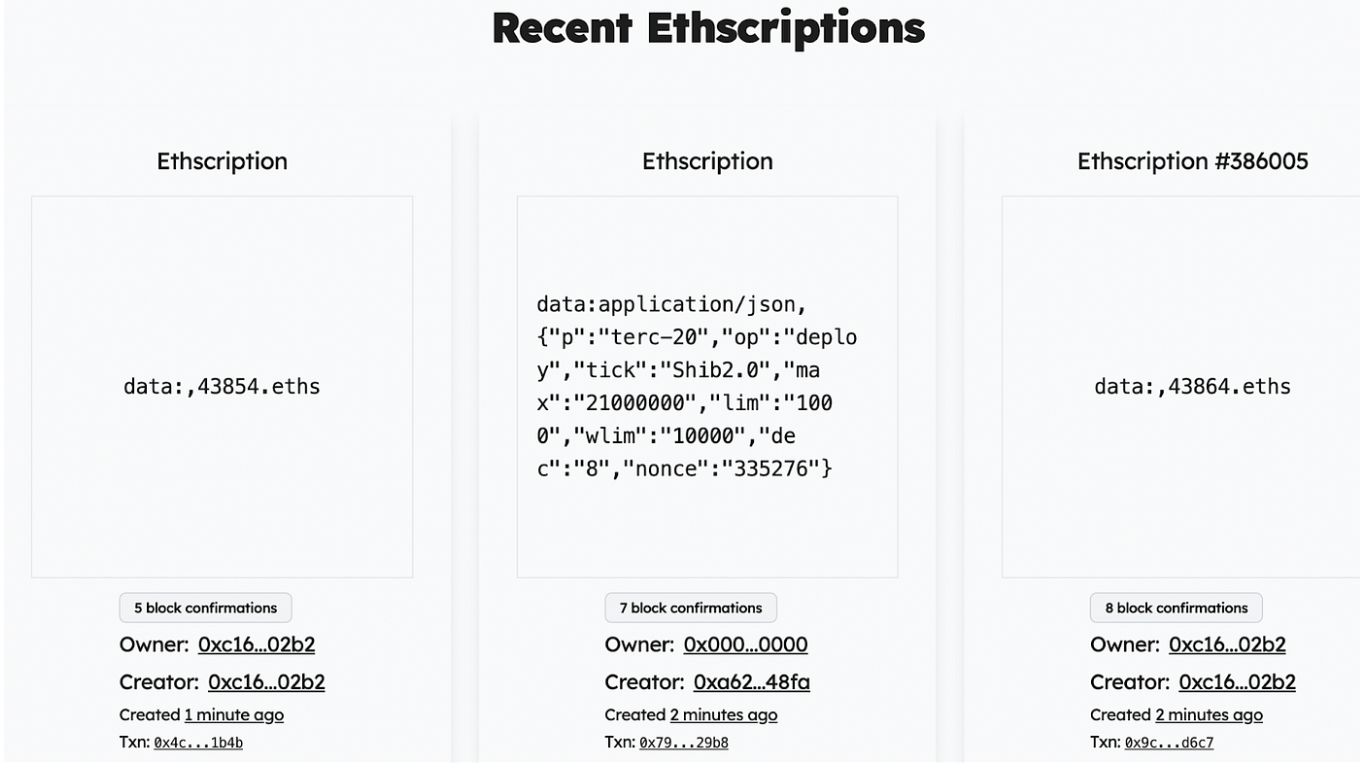

Although BRC 20 and ERC 20 have similar names, their underlying principles are completely different. Once deployed, BRC 20 tokens require minting, providing a fair playing field for all participants, which Ethereum lacks. These differences are not about right or wrong, but about the perception and respect for the different cultures of each platform.

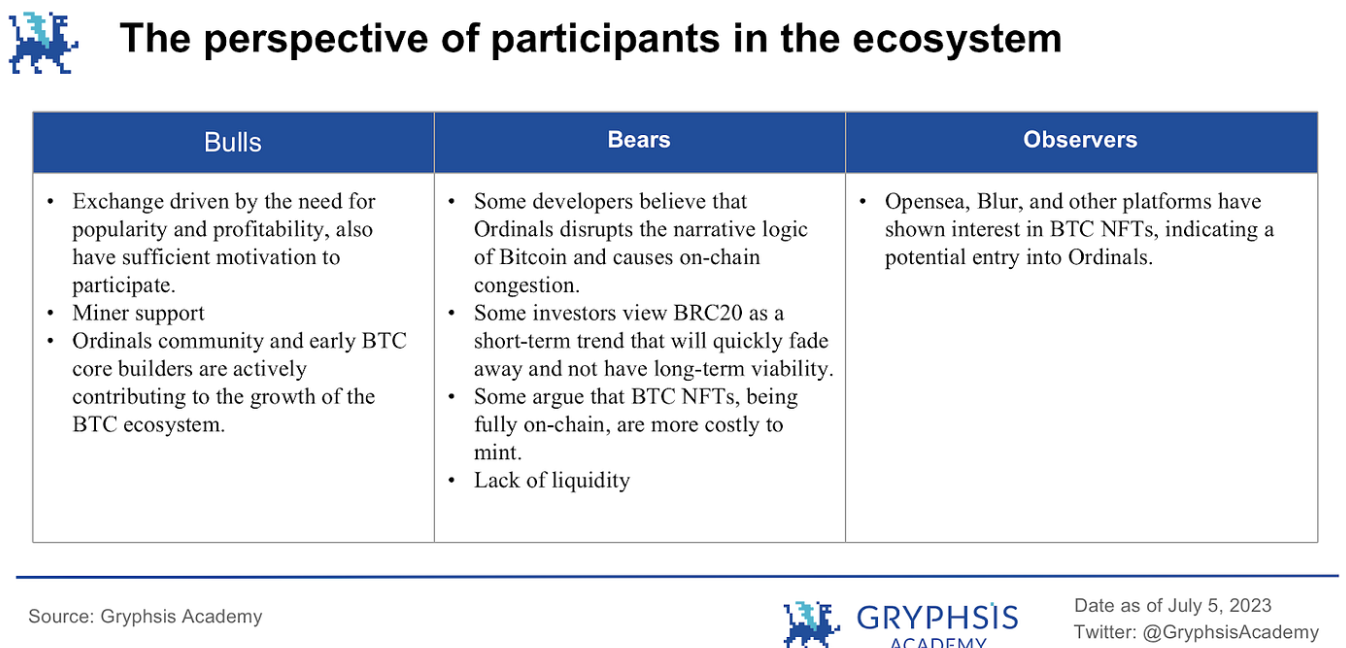

In the landscape of BTC NFT and BRC 20, there are passionate supporters (bulls), skeptical critics (bears), and alert observers. Bulls, including exchanges, miners, and developers, see profit and growth. Bears, including certain Bitcoin developers and investors, express concerns about disruption, temporary trends, and liquidity issues. Observers note the sustained growth in the controversy and see divergence as early consensus and bias as an opportunity for participation. Every disruptive innovation departs from the traditional path and shapes its unique trajectory.

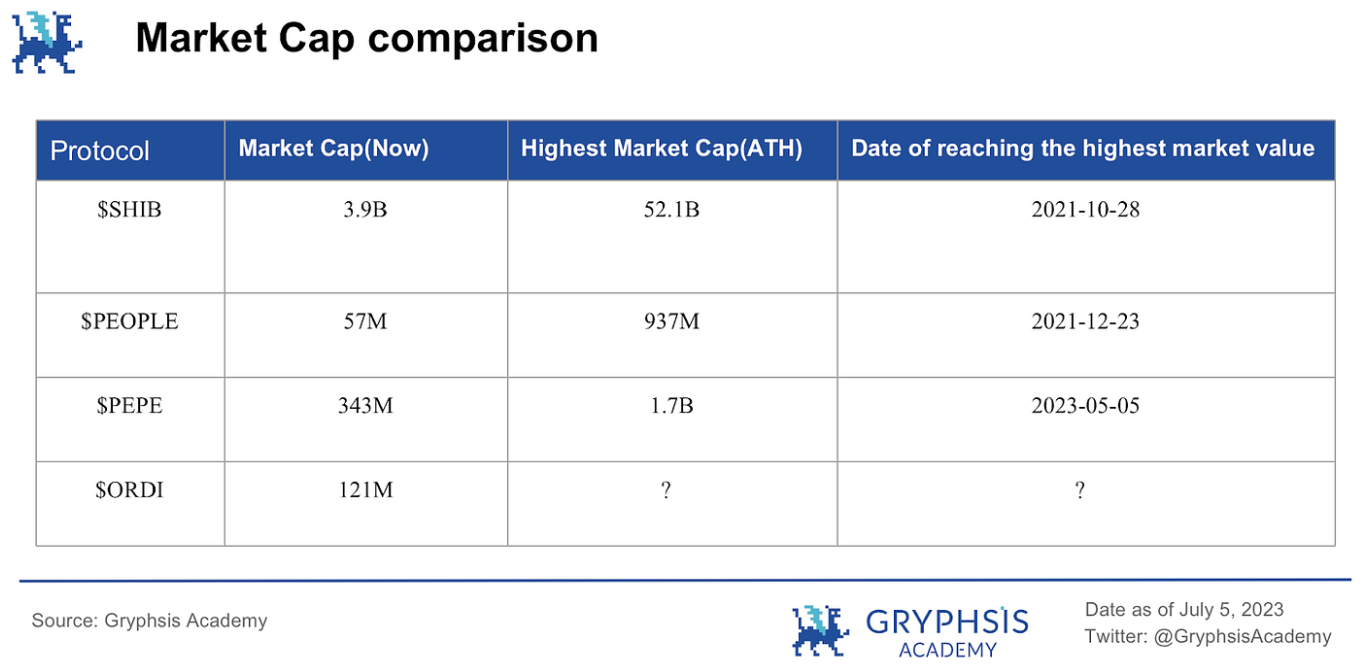

As the first BRC 20 token, $ORDI plays a crucial role in the consensus and confidence of Ordinals and BRC 20. Despite its lack of utility, it is considered a meme token, echoing the success of past meme coins like $SHIB, $PEOPLE, and $PEPE. Its uniqueness lies in its cultural identity, strong community, high social dissemination, and capital driving force. The active participation of centralized exchanges and investment institutions further drives the momentum of $ORDI. Already listed on exchanges such as OKX, its future listing on Binance and potential for further price growth are optimistic. Considering the narrative surrounding the Bitcoin halving cycle and the long-term development of the BRC 20 and Ordinals ecosystem, $ORDI holds enormous potential for the future.

Overall, the innovative narrative of BRC 20 and BTC NFT has garnered significant attention, and $ORDI stands out as a key investment opportunity. In a vibrant ecosystem and the important narrative of the Bitcoin halving, Ordinals is expected to occupy a crucial position in the cryptocurrency ecosystem in the coming years.

The above provides a concise preview of our in-depth research on Ordinals. We encourage readers to delve into the full report for a complete understanding and analysis!

Weekly VC Investment Focus

Welcome to our Weekly Investment Focus, where we reveal the most significant venture capital trends in the crypto space. Each week, we will highlight the agreements that have secured the most funding.

CryptoQuant

CryptoQuant, a well-known on-chain data provider, has raised $6.5 million in a Series A funding led by Atinum Investment, bringing the total funding of the company to $9 million. The platform is used by leading financial institutions and serves over 200 institutional clients, aiming to redefine investment strategies for digital assets through data accuracy. The newly raised funds will be used for business development, team expansion across multiple departments, and nurturing the necessary infrastructure for traditional financial institutions to enter the digital asset market.

https://twitter.com/cryptoquant_com/status/1676890380522991616?s=61&t=i9p5znmUXKtK1q3X4qAzcw

Protocol Event

LayerZero Github reveals $ZRO as gas fees.

Redactedcartel Hidden Hand V 2 live.

Barn Bridge under SEC investigation.

Compound introduces Encumber.

Aave GHO parameter changed.

WooFi launched on Polygon zkEVM.

Aevo launched referral program.

Pendle expanding to BSC.

Industry Updates

Grayscale added $LDO to its DeFi fund.

Gemini files lawsuit against DCG.

Circle launches WaaS developer platform.

DBS starts e-CNY collection platform for China corporation.

Vietnam launches investigation into Pi.

Nasdaq refiles for Blackrock spot BTC ETF.

Bitget launches crypto loan product.

Slovakia lowered-crypto-taxes">crypto taxes.

Twitter Alpha

In encrypted Twitter, there are many Alphas, but it can be difficult to navigate through thousands of Twitter threads. Every week, we spend several hours researching and selecting insightful threads to curate our weekly selection list for you. Let's dive in!

https://twitter.com/arbialpha/status/1676335105764372481?s=61&t= V 1 z 2 bQ 7 cjh 9 guNwi 8 PMJGg

https://twitter.com/alpha_pls/status/1676648967130456070?s=61&t= V 1 z 2 bQ 7 cjh 9 guNwi 8 PMJGg

https://twitter.com/damidefi/status/1677615021923135490?s=61&t= V 1 z 2 bQ 7 cjh 9 guNwi 8 PMJGg

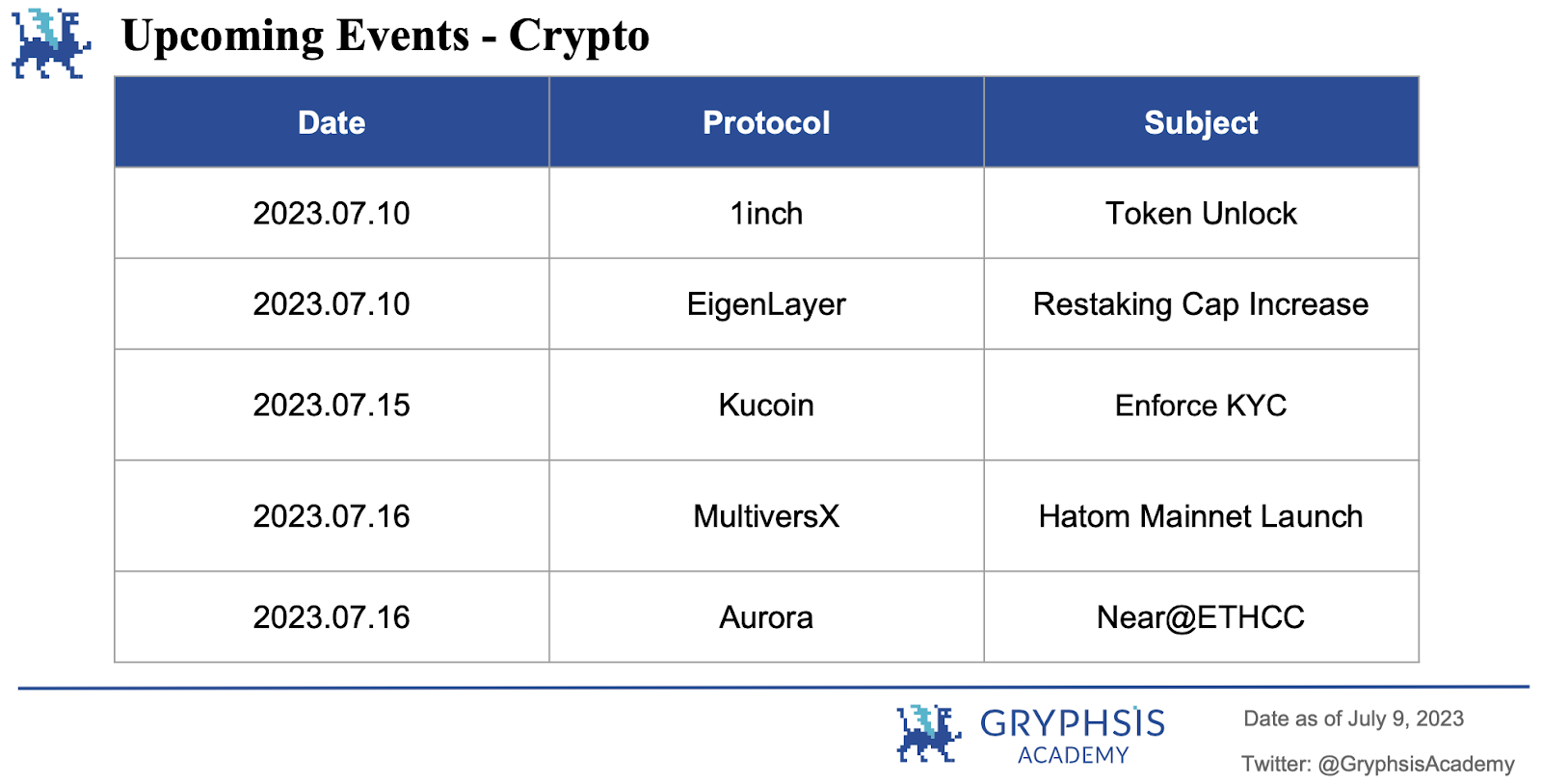

Next Week's Events

News Source:

https://www.coindesk.com/business/2023/07/06/multichain-bridges-experience-unannounced-outflows-of-over-130m-in-crypto/

https://cointelegraph.com/news/multichain-mpc-bridge-sees-millions-in-outflows-exploit-feared

https://coinmarketcap.com/alexandria/article/multichain-bridge-drained-of-over-dollar100m-team-investigating-potential-exploit

https://www.moneyweb.co.za/moneyweb-crypto/bitcoin/mystery-120m-outflow-hits-crypto-bridge-multichain-whose-ceo-is-missing/

https://www.coindesk.com/web3/2023/07/07/sega-rethinks-gamefi-plans-coo-calls-blockchain-gaming-boring-bloomberg/

https://finance.yahoo.com/news/sega-rethinks-gamefi-plans-coo-055214935.html

https://www.cryptotimes.io/sega-quits-blockchain-gaming-as-coo-unsure/

https://www.cryptotimes.io/atinum-investment-leads-6-5m-funding-round-for-cryptoquant-parent/

https://cryptonews.net/news/finance/21282473/

https://bit coinworld.co.in/cryptoquant-raises-another-6-5-million-in-series-a/ The above is all the content for this week. Thank you for reading the weekly report. We hope you benefit from our insights and observations. You can follow us on Twitter and Medium for real-time updates. See you next time! This weekly report is for informational purposes only. It should not be taken as investment advice. Before making any investment decisions, you should conduct your own research and consult with independent financial, tax, or legal advisors. Past performance of any asset is not indicative of future results.