Original Author: Liao Wang, lawyer of Beijing DeHeng (Hangzhou) Law Firm; Gu Jiening, senior legal advisor of Shanghai Mankiw Law Firm

* This article was co-authored by lawyers Liao Wang and Gu Jiening, invited by Beosin.

In order to actively respond to the "Policy Declaration on the Development of Virtual Assets in Hong Kong" in October 2022, in order to promote Hong Kong's development into an international virtual asset center, the Hong Kong Legislative Council passed the "2022 Anti-Money Laundering and Terrorist Funds" on December 7, 2022. The latest amendment to the Raising Ordinance ("Anti-Money Laundering Ordinance") means that Hong Kong's new virtual asset service provider licensing system (VASP system) will be officially implemented on June 1, 2023.

On February 20, 2023, the Hong Kong Securities Regulatory Commission (SFC) issued the "VASP Consultation Document", and released the "VASP Consultation Summary" on May 23, clarifying the "Guidelines Applicable to Virtual Asset Trading Platform Operators" (VASP Guidelines) will come into effect on June 1, 2023. This marks that the Hong Kong government has actively embraced the new VASP system with an open attitude towards the virtual asset market through more than half a year of planning. At that time:

All centralized virtual asset exchanges operating in Hong Kong or actively promoting their services to Hong Kong investors, regardless of whether they provide security token trading services, must be licensed and regulated by the SFC.

The SFC will finalize in the second half of the year to allow licensed virtual asset exchanges to offer services to retail investors, but only tokens that are not securities and have high liquidity in one of the traditional financial indices can be offered to retail investors.

For stablecoins, regulatory arrangements for stablecoins will be implemented in 2023/24, and a licensing and licensing system for stablecoin-related activities will be established. Until stablecoins are regulated, the SFC believes that stablecoins should not be included for retail trading.

This article will help you better understand the background of the revision of the VASP system, what are virtual assets and virtual asset services, the application requirements for VASP licenses, the compliance requirements of exchanges, the dual license system, and the transition period arrangements. The Hong Kong virtual asset VASP licensing system implemented on the 1st.

1. Background of revision of VASP system

In the "VASP Consultation Document", the SFC clearly elaborated on the revised background of the establishment of a new VASP system: in the ongoing crypto winter, crashes occurred one after another, which intensified the risk of the virtual asset market, especially the collapse of FTX, which made Tens of millions of investors suffered heavy losses. The risks brought about by the current closeness between the virtual asset market and the traditional financial market have highlighted the importance and necessity of effective supervision of the virtual asset industry.Major jurisdictions around the world are changing their regulatory approach from a looser approach (i.e. regulation from the perspective of combating money laundering and payments) to a more comprehensive approach (i.e. regulation from an investor protection perspective).

SFC is ahead of other jurisdictions. As early as 2018, it gradually established a "voluntary licensing" system for security token virtual assets.It is clearly stipulated that the SFC has no right to supervise platforms that only buy and sell non-securities virtual assets or tokens.Under the "voluntary licensing" system, if it is a virtual asset trading platform engaged in non-security tokens, it does not need to be licensed. Only two virtual asset exchanges have obtained licenses for exchange business under the "voluntary licensing" system: OSL Digital Securities Limited under BC Technology Group and Hash Blockchain Limited under HashKey Group have obtained License No. 1 (Securities Trading) and License No. 7 License plate (provides automated trading services).

Today, the virtual asset industry has undergone tremendous changes. The original "voluntary licensing" system can no longer cover the current market dominated by retail investors and non-security tokens as the main trading objects. In order to fully supervise all centralized virtual asset trading platforms in Hong Kong and implement the latest standards of the Financial Action Task Force on Money Laundering (FATF), the Hong Kong government has amended the Anti-Money Laundering Ordinance and established a new VASP "compulsory licensing" system, in order to achieve a more appropriate balance between investor protection and market development.After the formal implementation of the VASP system, all centralized virtual asset exchanges operating in Hong Kong or actively promoting their services to Hong Kong investors, regardless of whether they provide security token trading services, will be required to be licensed by the SFC and subject to its regulations. Supervision.

2. Virtual assets and virtual asset services

In the context of the "mandatory licensing" of the VASP system, it is very important to clarify what is a virtual asset and what is a virtual asset service.

2.1 What is a virtual asset

According to the "Anti-Money Laundering Ordinance" 53 ZRA and VASP guidelines, virtual assets (Virtual Asset, VA) are broadly defined as:

(a) A cryptographically protected representation of value in digital form that:

(1) Expressed in the form of calculation unit or storage of economic value;

(2) Meet one of the following:

A. Being or intended to be used as a publicly accepted medium of exchange for one or more of the following purposes: (I) payment for goods or services; (II) discharge of debt; (III) investment; or

B. Provide the right, capacity or means to vote on the following matters: the management, operation or governance of any matter related to the cryptographic protection of value in digital form, or any change in the terms of any arrangement applicable to cryptographic protection of value in digital form;

(3) can be transferred, stored or traded electronically; and

(4) Possess other characteristics prescribed by SFC from time to time by notice published in the Gazette;

(b) According to the Hong Kong Financial Services and the Treasury Bureau in the form of a notice published in the Gazette as a digital representation of the value of virtual assets.

(c) any security token means the value in encrypted digital form constituting a "securities" as defined in section 1 of Part 1 of Schedule 1 to the SFO.

Under 53 ZRA of the Anti-Money Laundering Regulations, the following items are excluded from the definition of VA:

(1) Digital currency (CBDC) issued by the central bank, an entity performing central bank functions, or an entity authorized by the central bank on behalf of the central bank;

(2) limited-use digital tokens (non-transferable, non-exchangeable, and non-fungible in nature, such as gift cards, customer loyalty rewards programs, and electronic payment services);

(3) Stored value payment facilities (regulated by the "Payment System and Stored Value Facilities Regulations");

(4) Securities or futures contracts (regulated by the Securities and Futures Ordinance).

The definition of VA in the Anti-Money Laundering Regulations will cover most of the virtual currencies in the market, including BTC, ETH, Stablecoin, Utility Token, and Governance Token. For stablecoins, SFC also made it clear in the Consultation Summary:The Hong Kong Monetary Authority has released the "Consultation Summary of Encrypted Assets and Stablecoin Discussion Documents" in January 2023, stating that it will implement the regulatory arrangements for stablecoins in 2023/24, and will establish licenses and permits for stablecoin-related activities. system. Until stablecoins are regulated, the SFC believes that stablecoins should not be included for retail trading.

The attributes of NFT are linked to the attributes of the assets behind it, and there is no clear definition under the VASP system yet. When SFC issued a reminder to investors on NFT risks on June 6, 2022, it stated that if NFT is a true digital representation of collectibles (art, music or movies), activities related to it are not within the scope of SFC's supervision. However, some NFTs cross the boundary between collectibles and financial assets, and may have the attributes of "securities" regulated by the Securities and Futures Ordinance, so they will be regulated.

2.2 What is virtual asset service

According to Schedule 3 B of the Anti-Money Laundering Ordinance and the VASP guidelines, activities related to virtual asset services (VA Service) are defined as: operating virtual asset exchanges, namely:

(a) by means of electronic means, to provide services that comply with the following descriptions:

(1) The service:

A. Offers to buy or sell virtual assets are frequently made or accepted in a manner in which such offers or acceptances result in, or result in, a binding transaction; or

B. Persons are introduced or recognized to each other on a regular basis with a view to negotiating or consummating a sale or purchase of a virtual asset, or with the reasonable expectation that they will negotiate or complete a sale or purchase of a virtual asset in some manner , and the sale and purchase are negotiated or consummated in such a manner that a binding transaction is formed or results in a binding transaction; and

(2) In the service, client money or client virtual assets are directly or indirectly possessed by the person providing the service; and

(b) Any off-platform virtual asset trading activities and incidental services provided by the platform operator to its customers, and any activities undertaken in relation to off-platform virtual asset trading activities.

Therefore, for (1) a centralized virtual asset exchange operating in Hong Kong, and (2) an offshore centralized virtual asset exchange that actively promotes its services to Hong Kong investors, if it engages in the above-mentioned related activities, it is a virtual exchange. The scope of asset services. According to the "Anti-Money Laundering Regulations" 53 ZRD, any entity operating virtual asset services must obtain a VASP license from SFC.

At present, except for the above-mentioned virtual asset services, other businesses such as market makers, proprietary trading, futures contracts and derivatives are not allowed to be carried out, but it is not ruled out that the Hong Kong Financial Services and the Treasury Bureau will issue an announcement in the Gazette Incorporate other virtual asset services.

3. VASP license application

Under the new VASP regime, applicants will be licensed and supervised by the SFC in accordance with the Anti-Money Laundering Regulations and VASP guidelines. Applying for a VASP license has very high requirements for the company and its personnel:

A. Company:1. Have a company established in Hong Kong with a fixed office location; 2. Need to have a registered capital of not less than 5 million Hong Kong dollars, and a working capital of more than 3 million Hong Kong dollars; 3. Subsidiaries or affiliated companies must have Hong Kong Trust TCSP license for virtual asset custody.

B. Personnel:1. Applicants, responsible officers, licensed representatives, directors and ultimate owners of VASP must meet the SFC's fit and proper test; 2. At least 2 responsible officers (ROs) with experience in virtual asset services must be appointed, and the following must be met Conditions: At least one RO must be the executive director of the VASP, at least one RO must reside in Hong Kong, there must always be at least one RO supervising the business; 3. At least one RO licensed representative; 4. Audits with virtual asset business experience are required division.

C. Compliance Requirements:In addition to meeting the company's qualifications and company personnel requirements, it is also necessary to meet the virtual asset transaction business development evaluation report,AML/CTF, customer asset management and a series of compliance systems. According to the VASP guidelines, the detailed requirements of these applications also include: requirements for suitable candidates, requirements for competency, requirements for continuous training, principles of business conduct, financial soundness, operation of virtual assets on the platform, prevention of market manipulation and illegal activities, Transactions with customers, protection of customer assets, management, supervision and internal control, network security, avoidance of conflicts of interest, record keeping, auditor audit, continuous reporting and notification responsibilities, etc.

4. Compliance requirements of exchanges

secondary title

A. Secure custody of client assets

The platform operator should hold client monies and client virtual assets on trust (TCSP trust licence) through a wholly-owned subsidiary (i.e. "associated entity"). Platform operators should ensure that no more than 2% of customers' virtual assets are stored in online wallets.

In addition, since access to virtual assets can only be done through the use of private keys, the custody of virtual assets basically requires the safe management of the relevant private keys. Platform Operators should establish and implement written internal policies and governance procedures for private key management to ensure that all encryption seeds and keys are securely generated, stored and backed up.

secondary title

B. Know Your Customer (KYC)

secondary title

C. Anti-Money Laundering/Terrorist Financing

secondary title

D. Prevention of conflicts of interest

secondary title

E. Incorporation of virtual assets for sale and purchase

The platform operator should set up a function responsible for establishing, implementing and enforcing the criteria for the inclusion of virtual assets, the criteria for suspending, suspending and canceling the trading of virtual assets, together with the options exercisable by customers.

secondary title

F. Prevention of Market Manipulation and Illegal Activities

secondary title

G. Accounting and Auditing

secondary title

H. Risk management

Platform Operators should establish a robust risk management framework to enable them to identify, measure, monitor and manage all risks arising from their business and operations. Platform operators should also require customers to deposit funds into their accounts in advance, and must not provide customers with any financial accommodation to purchase virtual assets.

5. Dual license system

According to different regulatory authorizations, SFC will supervise the security token transactions conducted by virtual asset exchanges in accordance with the Securities and Futures Ordinance (No. 1 license + No. 7 license); Regulation of non-security token transactions on virtual asset exchanges (VASP license).

Considering that the nature of virtual assets may evolve over time, such as from non-security tokens to security tokens, in order to avoid violations of any licensing regime, virtual asset exchanges should also comply with the Securities and Futures Ordinance " and "Anti-Money Laundering Regulations" to obtain dual licensing and approval from SFC (that is, apply for VASP license and No. 1 license and No. 7 license at the same time).

To simplify the application procedure for dual licenses, applicants who want to apply for a license under both the current regime under the Securities and Futures Ordinance and the virtual asset service provider regime under the Anti-Money Laundering Ordinance need only submit a comprehensive online Application form, and indicate that the two licenses should be applied for at the same time.

The SFC expects that only one notification by a dual-licensed platform operator will be sufficient to comply with the licensing or notification requirements of the existing regime under the SFO and the virtual asset service provider regime under the AMLO .

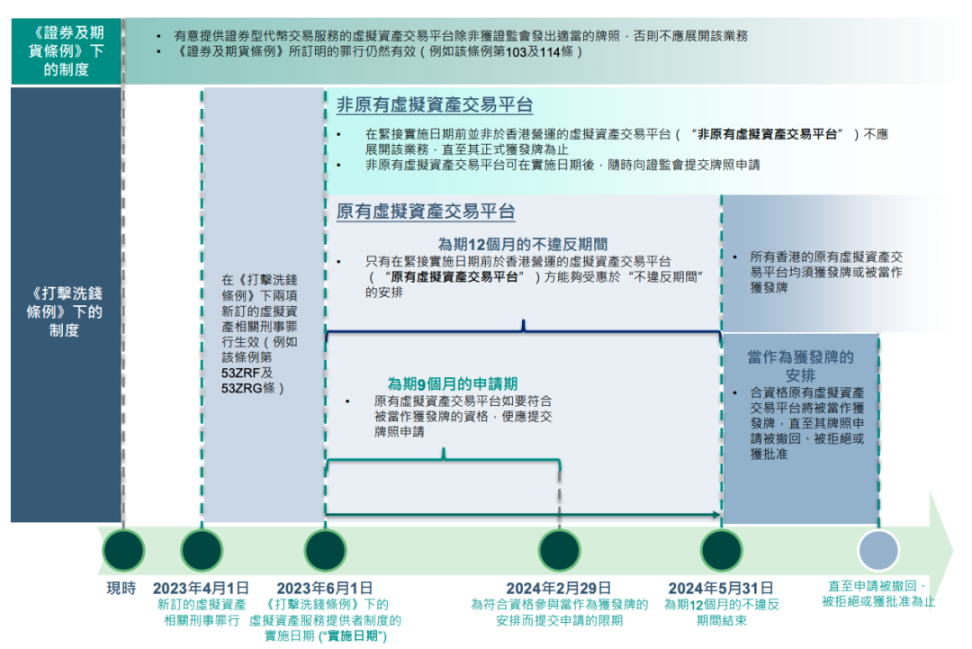

6. Arrangements for the transitional period

The "Anti-Money Laundering Regulations" provides transitional arrangements for "original virtual asset exchanges", and stipulates that the transition period will be before June 1, 2024. For exchanges that have operated in Hong Kong and established meaningful and substantive businesses before June 1, 2023, including (1) exchanges that have or are applying for licenses under the Securities and Futures Ordinance, including (2) ) are unlicensed exchanges that carry on business in non-security tokens under the SFO to be eligible to participate in the transitional arrangements.

Exchanges eligible to participate in the transitional arrangement must meet the conditions set out in Schedule 3G of the AMLO in order to continue operating in Hong Kong from 1 June 2023 to 31 May 2024, and will continue to do so from June 2024 It will be subject to the licensing system of VASP from January 1st.

If the operator applies to the SFC within 9 months after 1 June 2023 and confirms that it will comply with the regulatory requirements set by the SFC, the operator can be deemed to have been licensed until the SFC makes an application for its license. decides that services will be able to continue to be provided during this period until (i) the end of the first 12 months, (ii) the application is withdrawn, (iii) the application is rejected by SFC, and (iv) the license is granted by SFC, whichever is earlier .

If its application for a virtual asset service provider license is rejected by SFC, it must terminate its virtual asset service business within 3 months of receiving the rejection notice or before June 1, 2024, whichever is later. During this period, the operator may only take actions purely aimed at shutting down its services. The operator may apply to the SFC for an extension of the closure period for such period as the SFC deems appropriate, taking into account the operator's business and activities.

For "non-original virtual asset exchanges" that plan to provide virtual asset services in Hong Kong after June 1, 2023, they must apply to SFC in advance and obtain a VASP license.

7. "Regulatory arbitrage" is fading away

Under the Anti-Money Laundering Regulations, relevant sanctions will be imposed for violations and non-compliance, including providing virtual asset services without a license and failing to comply with AML/CTF requirements. In addition, any active marketing of services to the Hong Kong public will be regarded as providing virtual asset services, regardless of where the service is provided or whether the service provider is in Hong Kong.

After June 1, 2023, it will be a crime to operate and provide virtual asset services without a VASP license. On conviction upon indictment, a fine of HK$5 million and 7 years' imprisonment, and in the case of a continuing offence, an additional fine of HK$100,000 for each day during which the offense continues. A fine of HK$5 million and 2 years' imprisonment on summary conviction and, in the case of a continuing offence, an additional fine of HK$10,000 for each day during which the offense continues.

If the statutory AML/CTF regulations are not complied with, the licensed service provider and its responsible personnel are guilty of a crime. Once convicted, each person may be fined HK$1 million and imprisoned for 2 years. In addition to criminal liability, they are subject to disciplinary action by the SFC, including suspension or revocation of licenses, reprimands, orders to take remedial action and fines.

In addition, various "misconduct" in the operation of virtual asset exchanges may also face disciplinary fines from the SFC.

Compared with other jurisdictions, especially other regions in East Asia, Hong Kong's previous regulatory environment for virtual asset transactions can be said to be very loose. That's why there are countless companies, large and small, who have placed their headquarters or operation centers in Hong Kong. However, with the introduction of the "VASP Encryption New Deal", Hong Kong has drifted away from "regulatory arbitrage".

8. Conclusion

The VASP regime is about to be implemented, regardless of any of the following: (1) virtual asset exchanges already operating in Hong Kong; (2) offshore operating virtual asset exchanges actively promoting their services to Hong Kong investors; Operating a virtual asset exchange in Hong Kong; or (4) traditional financial institutions planning to get involved in virtual asset exchanges, VASP license applicants should prepare for business compliance and related license applications in advance.

The VASP system is "draining water into the canal" through licensed exchanges, which is what the Hong Kong government is doing. In this context, KYC and anti-money laundering compliance are the top priorities. After the first step of "draining water into the canal", we will see a series of detailed rules and regulations issued in the second half of the year regarding the opening of retail investors' investment and how to protect investors. If you want to wear the crown, you must bear its weight. Only on the basis of meeting regulatory requirements can exchanges participate in the distribution of this huge cake and promote the long-term development of the market.

References:

References:

https://www.elegislation.gov.hk/hk/cap571!zh-Hant-HK

https://www.sfc.hk/TC/Regulatory-functions/Intermediaries/Licensing/Do-you-need-a-licence-or-registration

https://apps.sfc.hk/edistributionWeb/API/consultation/openFile?lang=TC&refNo=23CP1

https://apps.sfc.hk/publicreg/Terms-and-Conditions-for-VATP_10Dec20.PDF

https://www.hkex.com.hk/-/media/HKEX-Market/News/Research-Reports/HKEx-Research-Papers/2023/CCEO_CryptoETF_202304_c.PDF

https://apps.sfc.hk/edistributionWeb/gateway/TC/news-and-announcements/news/doc?refNo=23PR53