This article comes from a16z CryptoThis article comes from

, Original author: Jason Rosenthal & Maggie Hsu, compiled by Odaily translator Katie Ku.

Pricing a new product or service is one of the key challenges founders need to address early in the product development life cycle. In a relatively new market, like cryptocurrencies, pricing can be difficult to “shop around”.

Pricing strategies depend on market conditions. Fully decentralized projects have their own tokens (like many de-Dapps and Web3 protocols), often with their own unique logic and design considerations. But for founders of other crypto-related businesses (such as infrastructure providers, service-based startups, etc.), some fundamental principles provide a template for product pricing.

When determining the right price for a new product in a new market, here are six questions every founder should ask themselves that can make the entrepreneurial process more manageable.

secondary title

1. What are the different pricing methods? Which method is best for my market?

The first step is to identify options for all pricing methods. By weighing each option, you can better find what works best for you. This allows finding a hybrid pricing approach that matches customer needs or market conditions.

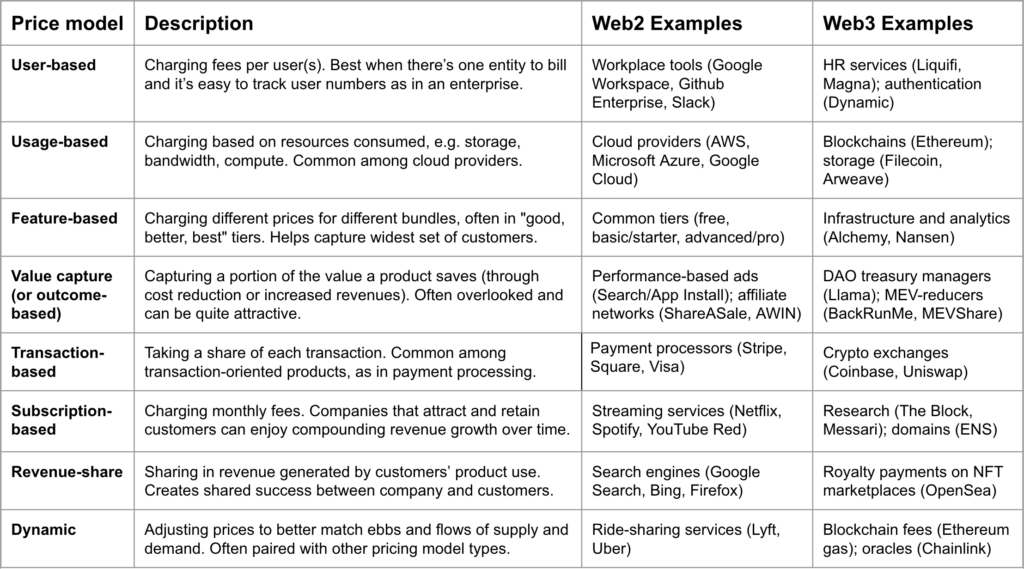

Below are some common pricing models, along with a brief description of how they apply, as well as some traditional and cryptocurrency-specific examples of each. (Note that these pricing frameworks are mainly applicable to Web3 projects that do not have tokens and are not fully decentralized.)

Now that you've seen the most common pricing methods, here's how to apply this framework in practice.

The examples above, while in the same category, cover multiple pricing models, with a mix and match approach to pricing. For example, Alchemy uses both usage-based and feature-based approaches, while The Block uses both usage-based and subscription-based approaches. You simply choose the pricing combination that works best for you.

secondary title

2. Are there opportunities for me to price differentiate within my product line?

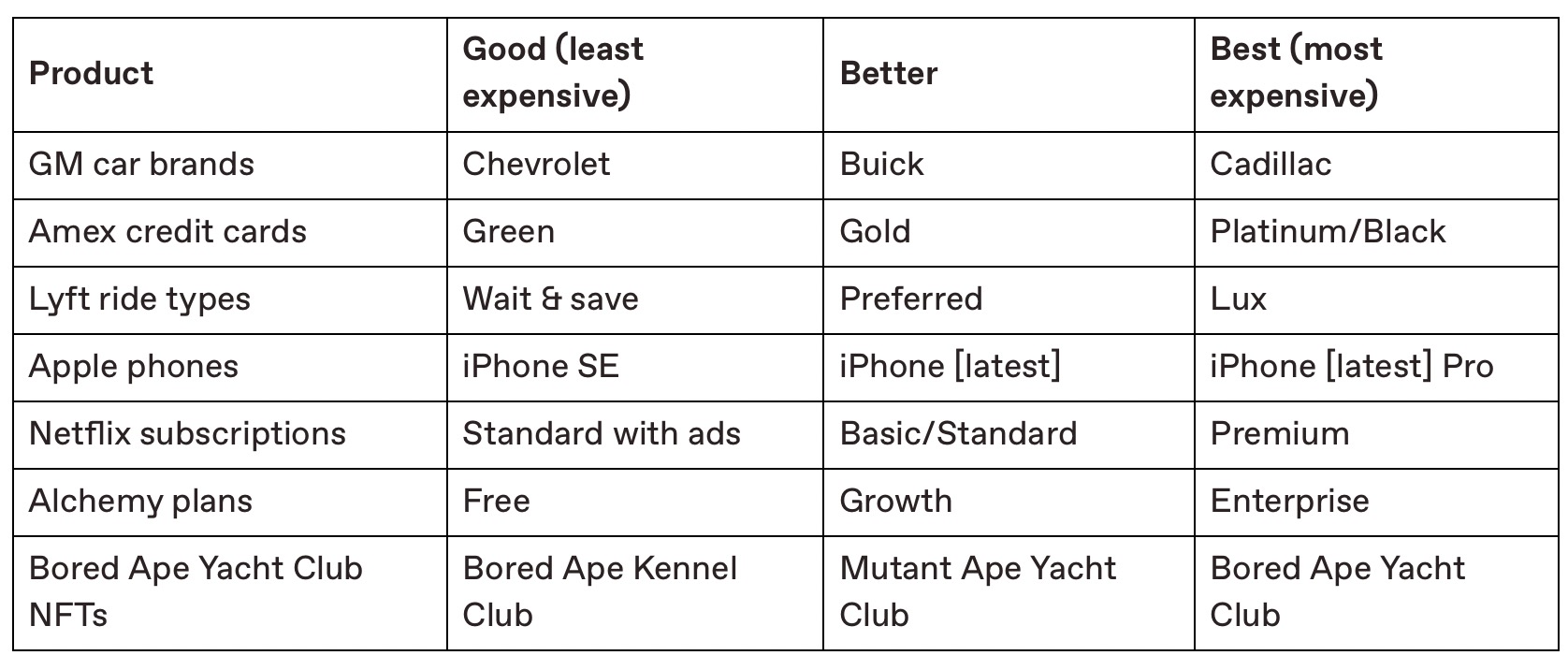

Most tech products appeal to different categories of customers. Users range from novices with basic needs, to professionals looking for more advanced features, to enterprise customers who want the highest level of service and functionality the company has to offer. This set of needs and desires creates an opportunity to tailor products to different customer groups through the principle of "Good, Better, Best".

Here are some examples of this framework:

Good-as-standard product: A complete set of features at an attractive price point. This is usually the cheapest option and will serve the majority of the customer base. Better builds on Good, often adding some additional core functionality to meet the needs of customers who view the product as a critical tool in their daily workflow. Best attracts clients who require specialized feature sets to achieve their goals. Within this framework, founders will typically want to experiment and iterate on product features in each category.

Pro tip: When selling to the enterprise, making sure your best-of-breed offering includes the right level of support, security, ease of onboarding, and deployment assistance is key to attracting customers.Don’t just focus on the interests of a single stakeholder, but on the differentiating selling points for all types of stakeholders.

secondary title

3. Is my pricing right?

While founders often worry about overpricing their product, a more common mistake is underpricing.

For a new technology product, in order to gain market appeal, it is necessary to look forward to the market vision after the new product is improved by 10 times. In today's technology market, customers are getting more "savvy", there are too many competing products and services, and traditional suppliers enjoy a huge "moat" and market share. "Improving the product by a factor of 10" may be the threshold for new entrants to break through.

When a team builds a new product of this level or higher, the company gains economic value, leading to increased productivity, faster growth, or cost savings to better serve customers. This "boundary" of "value exchange" (economic cycle: improve product—serve customers better—reap benefits) is a key factor in successfully pricing new products.

An effective and simple approach is to divide potential customers into two groups (Group A and Group B) and share different price points with them. For group A, a startup offers "Good" service for $X per month, "Better" service for $Y per month, and "Best" service for $Z per month. Meanwhile, the startup is offering the same product to the B group, priced at 5 X (Good), 5 Y (Better), and 5 Z (Best). In this example, Group B is actually priced five times as much as Group A.

Another issue to consider is the denomination of pricing. In other words, you need to decide what combination of fiat currencies, stablecoins and/or tokens you accept. While accepting multiple payment methods may be more customer-friendly, it may also increase your exposure to market volatility. Accepting both fiat and stablecoins only makes sense if your spending is primarily in fiat.

secondary title

4. How are other products or services in adjacent markets priced?

One way to think about how to price a new product or service is to look at the approaches taken by peers in similar markets. Researching similar products can provide useful insights into your own pricing strategy.

By looking at the pricing pages of many companies that provide similar services to Web2 consumers and businesses, such as Aura, Bitwarden, and CrowdStrike, founders can quickly identify some potential pricing models that are already prevalent in the market.

secondary title

5. Will my economic strategy work?

Losing money on each customer but making up for it in volume is a strategy that won't last long, especially in an economy where startup capital is slashed, like the one we're in right now. would result in bankruptcy. Founders should understand the economics of the company early in their business. They should also have a rough forecast of what the funding will look like in the future.

In the early days of the Internet, the founders had many ambitious ideas, such as grocery stores and convenience goods delivered in one hour. Many of these startups went bankrupt, but a few years later, businesses like grocery delivery startup Instacart and US food delivery giant Doordash succeeded with strikingly similar models. Four factors make these new businesses stand out:

The number of Internet users has increased by more than 10 times;

The advent of ubiquitous, always-connected smartphones;

Development of complex routing and logistics software;

Vendors such as grocery stores and restaurants are willing to integrate with the software (believing that doing so will drive business growth).Having the vision, tenacity, and ability to change the trajectory of economic returns can lead to long-term, sustainable advantages that are difficult for others to emulate.

For example, the high profit margins that Apple enjoys on the iPhone business are due to three factors:

Huge sales make the business have a superior cost structure;

Positioning is a high-end brand. While gross margin doesn't determine a startup's overall fortunes, it can have a long-lasting impact on how much a company invests in R&D, marketing, and other key areas that determine long-term growth rate and success.

secondary title

6. If my market will grow 10x-100x and gain 100% market share, will I be successful in the end?

As a founder/CEO, it's normal to spend countless hours and sleepless nights obsessing over the company's strategy and details, trying to find product-market fit, overcome countless hurdles, and achieve long-term success. Deep in the brain of every founder (often in the early days of a startup) is the fear of failure.

However, in our experience, some outcomes are more painful than failures. Like spending years building a product and company and getting every decision right under your control, only to discover that the market opportunity isn’t big enough to justify the time, talent, and capital invested by the founders and team.

An easy way to test whether this failure mode is possible is to do a simple top-down calculation early in the company's history. Let’s say the market you’re after grows 10x to 100x and your company captures 100% of this future market.

Next, assume average revenue per customer, and calculate future market size * average revenue per customer * market share (100% in this case). If the market opportunity does not appear large enough to be of interest, then perhaps adjustments to market size or average revenue assumptions are required. As Disney CEO Bob Iger states in his autobiography "The best business advice I've ever received is to avoid entering an industry with 'no market demand.' But the world's annual consumption may be sporadic and small."