Original title:The Holy Grail of DeFi Lending: Undercollateralized Loans

Original title:

first level title

introduce

introduce

In this article, we will first understand what credit is and why it is important to the economy and business. Then, research popular DeFi credit protocols, and their pros and cons compared to TradFi/CeFi lending. We will summarize a few points that we believe are critical to the next phase of growth in the DeFi credit market.

first level title

Credit: The Modern Way of Borrowing

Borrowing and borrowing is one of the oldest socioeconomic behaviors in human society, dating back to ancient Mesopotamia. Ancient loans started as pawnbrokers, which were simply loans secured by items believed to be of value. Early forms of credit arose because resource owners lent production materials to labor workers with the expectation of repaying the goods. If the borrower did not repay, his family risked being held as slaves.

Today, credit is important to businesses and entire economies because it allows economic units to raise working capital without diluting equity. This leverage leads to increased investment, capital spending, and consumption, which leads to rapid economic growth.

In contrast, in DeFi, most existing lending protocols are based on over-collateralization, similar to pawn shop lending, and do not involve the creation of credit. If Elon Musk had to put down $1 billion worth of Tesla stock to borrow $500 million to buy a house, it would be the equivalent of an over-collateralized mortgage in DeFi - not very attractive to someone who already has $1 billion power because he can easily find a bank willing to lend him US$ 10 B.

first level title

Credit as a Business Financing Channel

To raise working capital while maintaining majority control over their operations and business decisions, businesses opt for debt financing. Debt financing creates credit because the lender provides cash or other working capital in exchange for future repayments of principal plus interest, rather than a controlling interest. Lenders also avoid taking equity risk because they have a claim on the borrower's assets while equity holders do not. This form of financing or loan is usually offered after a business or company has managed to clear all the claims made by financial institutions.

first level title

What prevents credit creation in DeFi?As mentioned earlier,DeFi lending

It still largely follows the old pawn shop model — borrowers put down something of value as collateral, then take out cash for less than or equal to the value of the collateral. This is ultimately because DeFi lending protocols are permissionless, which is procedurally efficient and does not bias against any borrower. However, this hinders the pre-loan credit checks and know-your-customer (KYC) procedures that typically precede credit origination in the TradFi world. Since mainstream DeFi lending protocols cannot know the real identity of borrowers and assess their credit risk, they can only ensure that lenders remain intact through over-collateralization.The core DeFi principle of being permissionless has prevented the growth of the DeFi lending market.

first level title

Undercollateralized Lending: The Next Holy Grail of DeFi LendingTVLCurrently, as of December 5, 2022, the cumulative

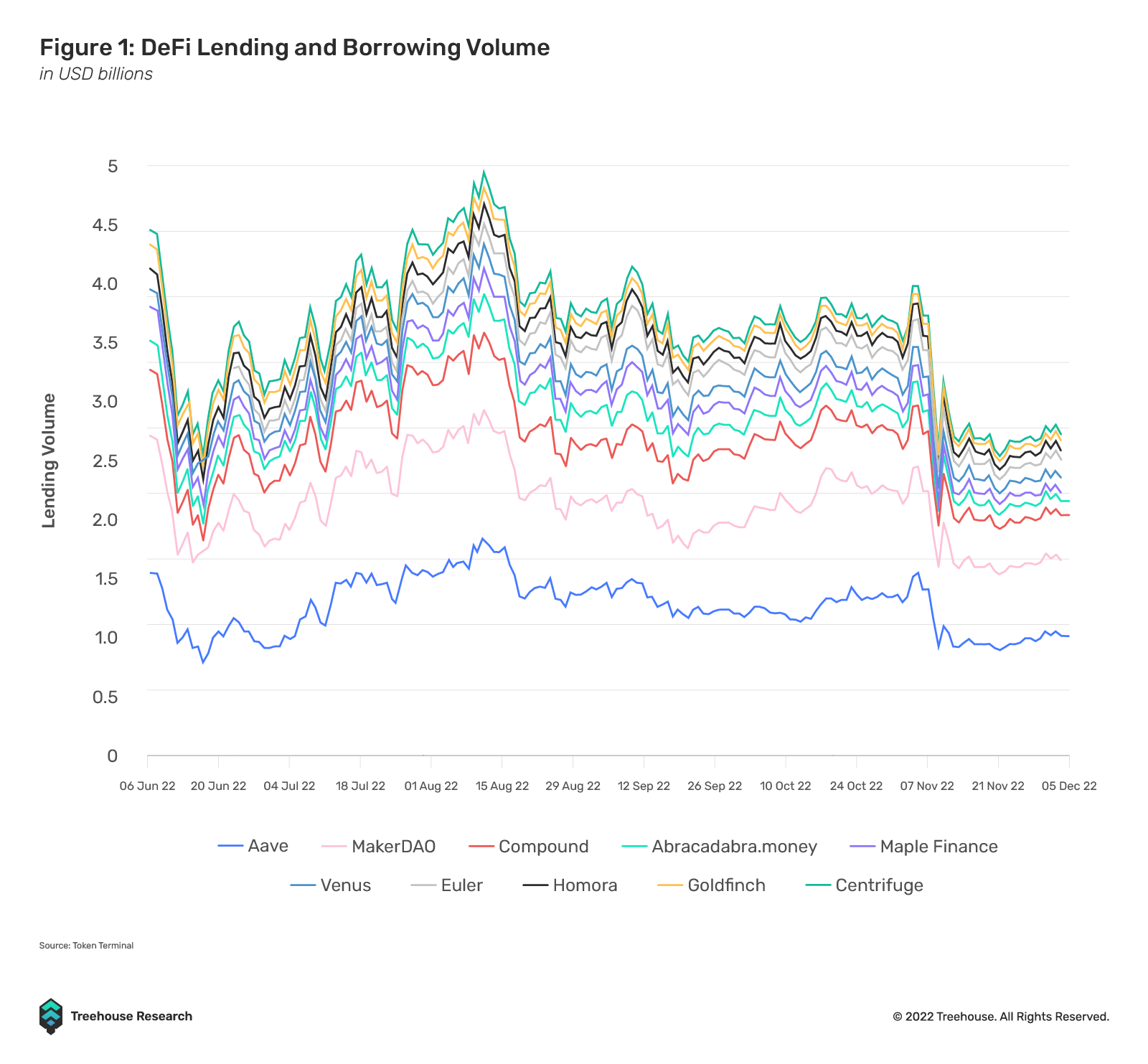

At US$ 13.96 B, the monthly borrowing volume in the past year has ranged from US$ 9.37 B to US$ 32.46 B. While this number has remained steady even during the recent market contraction, the size of this currency market still pales in comparison to the TradFi market.

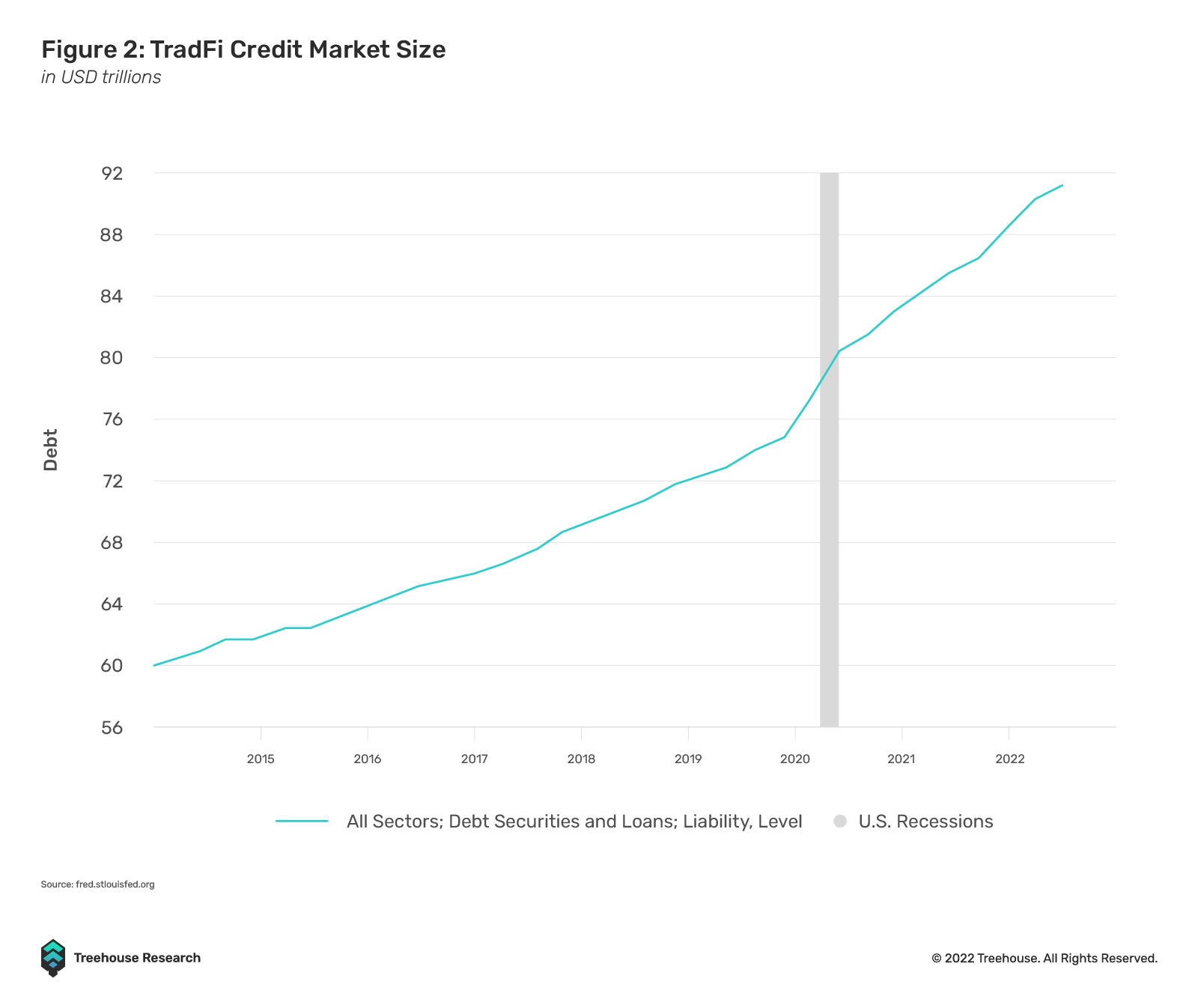

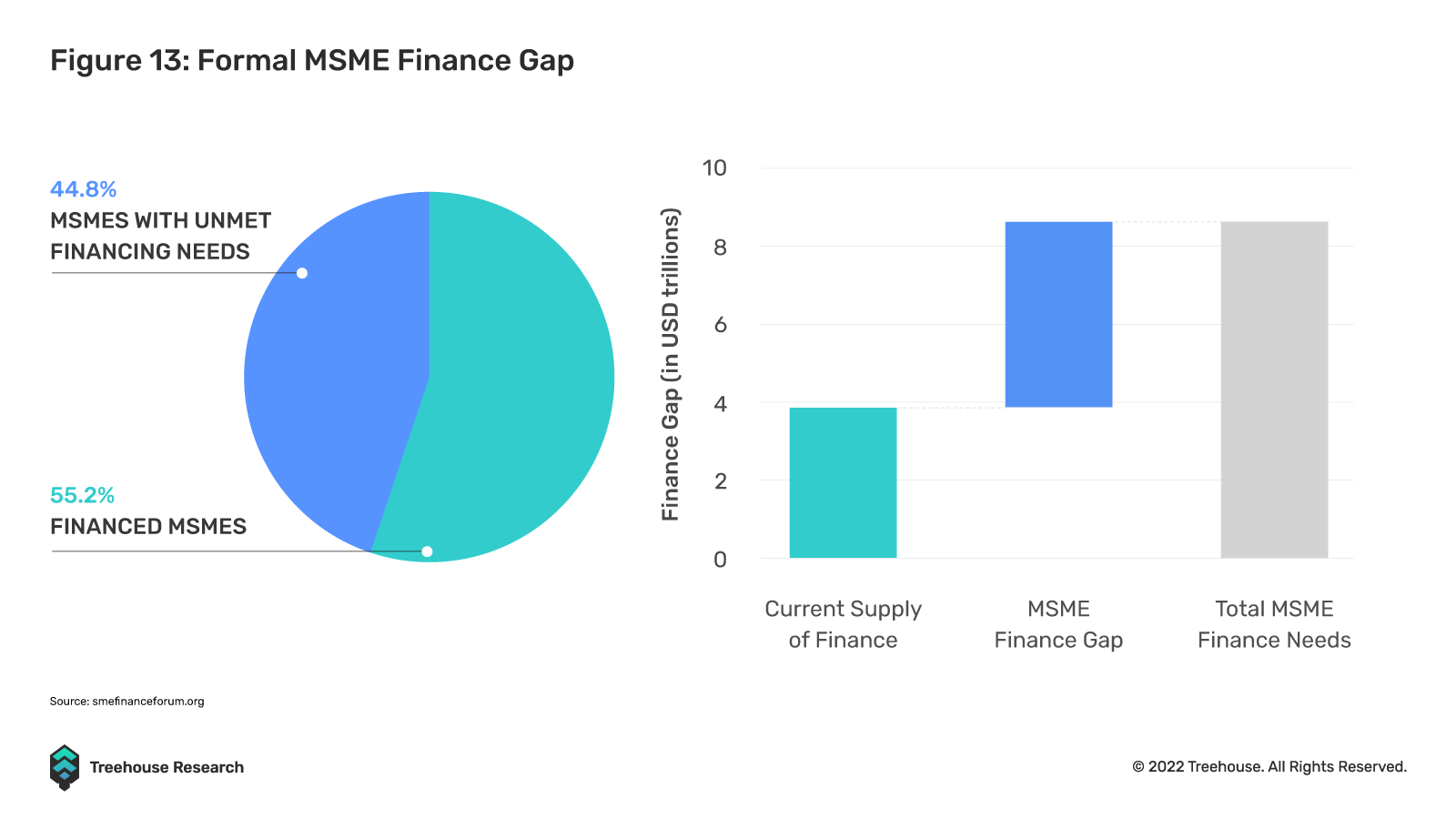

The size of the credit market in TradFi is about $91T, which is larger than the TradFi stock market and the DeFi money market. This is largely due to capital inefficiencies and a lack of means to assess and price DeFi credit risk.

Undercollateralized Lending: The Next Holy Grail of DeFi Lending

The size of the credit market in TradFi is about $91T, which is larger than the TradFi stock market and the DeFi money market. This is largely due to capital inefficiencies and a lack of means to assess and price DeFi credit risk.

Undercollateralized Lending: The Next Holy Grail of DeFi Lending

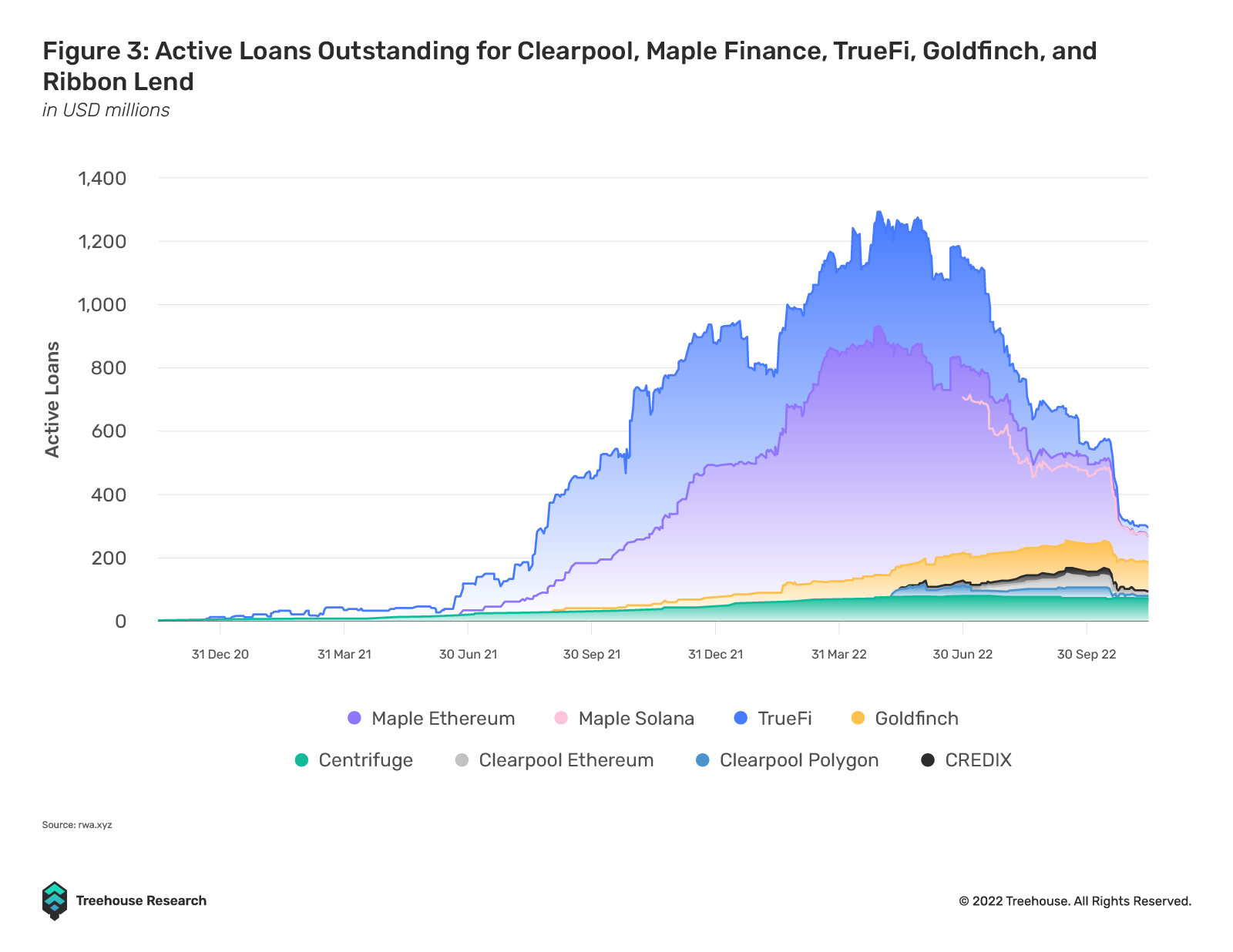

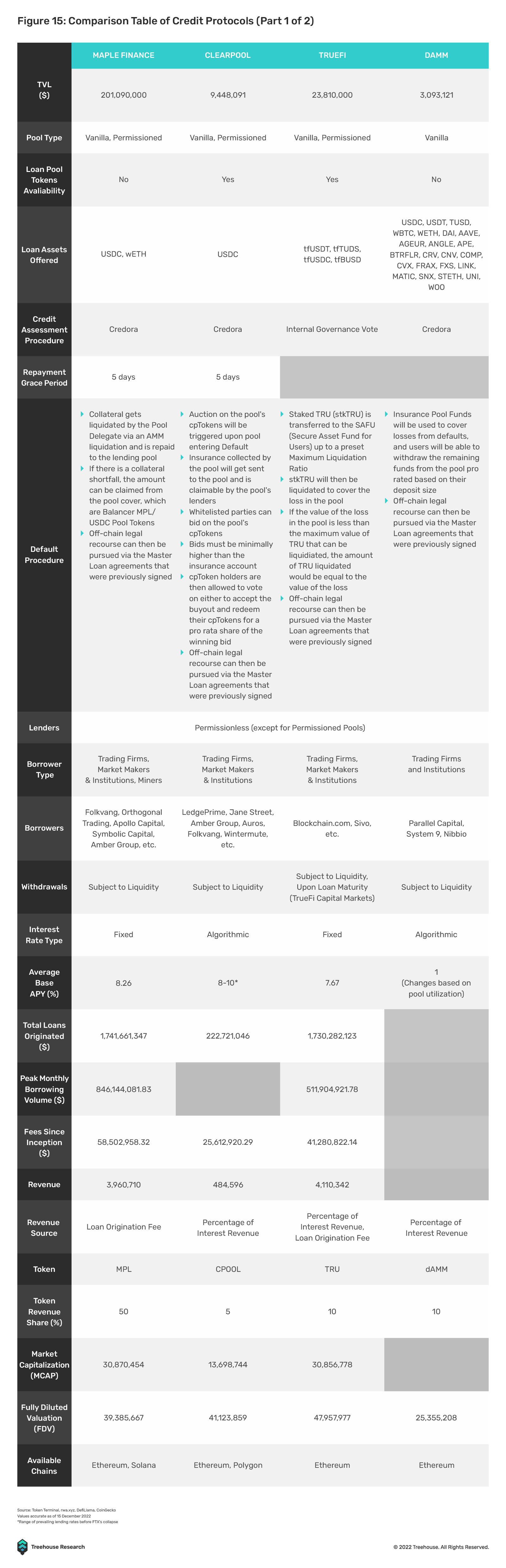

In addition, the default of large CeFi lenders such as Celsius has led to an overall credit contraction in the crypto finance space, as the risk appetite of CeFi lenders has decreased, leaving crypto institutions with fewer options for obtaining credit. As a result, emerging DeFi credit protocols can seize the market share vacuum left. For example, Maple Finance noted in its Q2 report that lender demand remained strong throughout the year, with 23% of lenders increasing their loan positions, increasing demand for borrower capital. Clearpool also reported that the total liquidity it provided peaked at $145 million in September 2022, a 30% month-on-month increase, while DeFi’s total liquidity fell 26.7%. Excessive growth in DeFi credit origination often corresponds to a CeFi credit crisis.

first level title

Business Model of DeFi Credit Protocol

Undercollateralized Lending: The Next Holy Grail of DeFi Lending

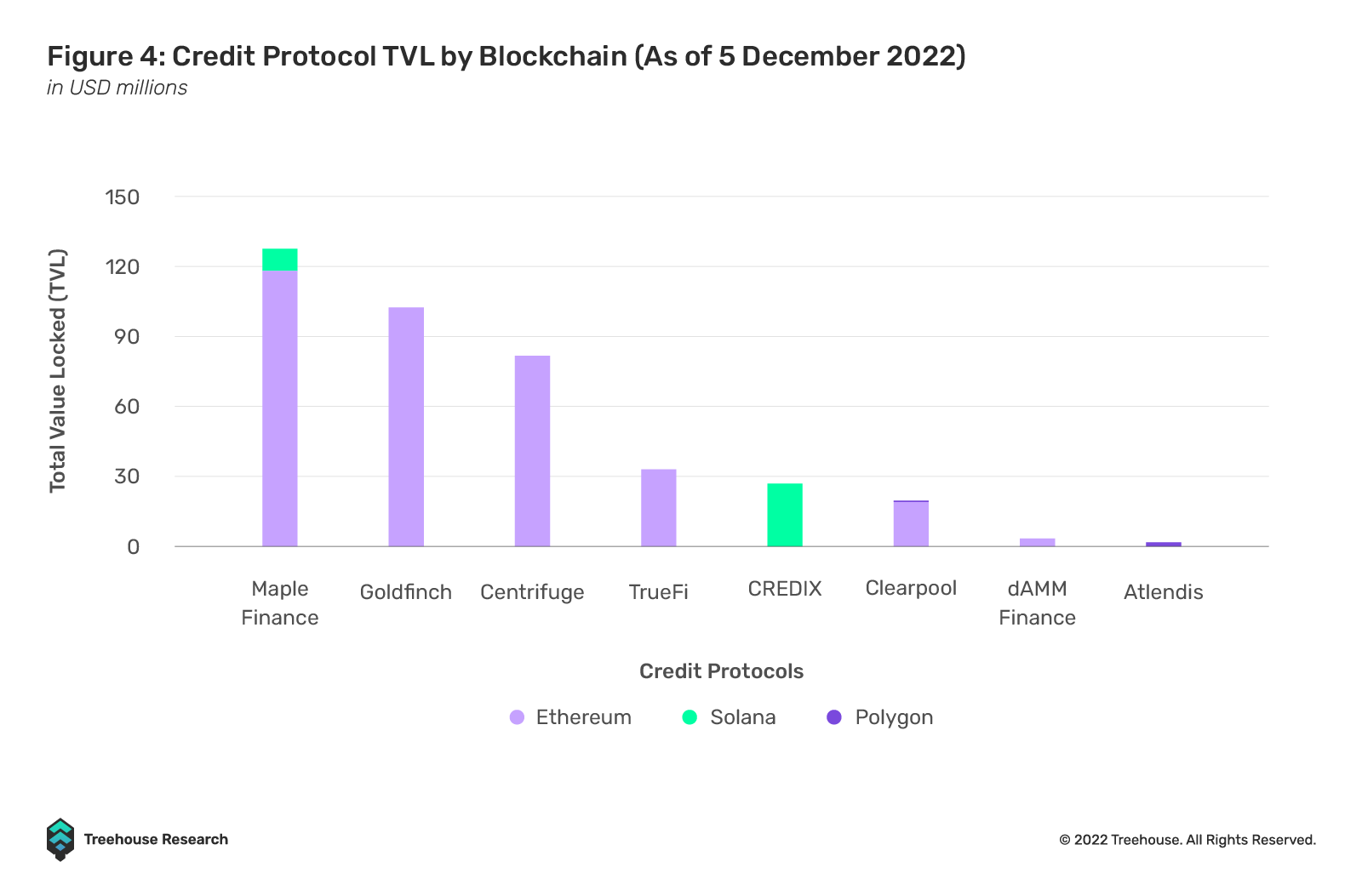

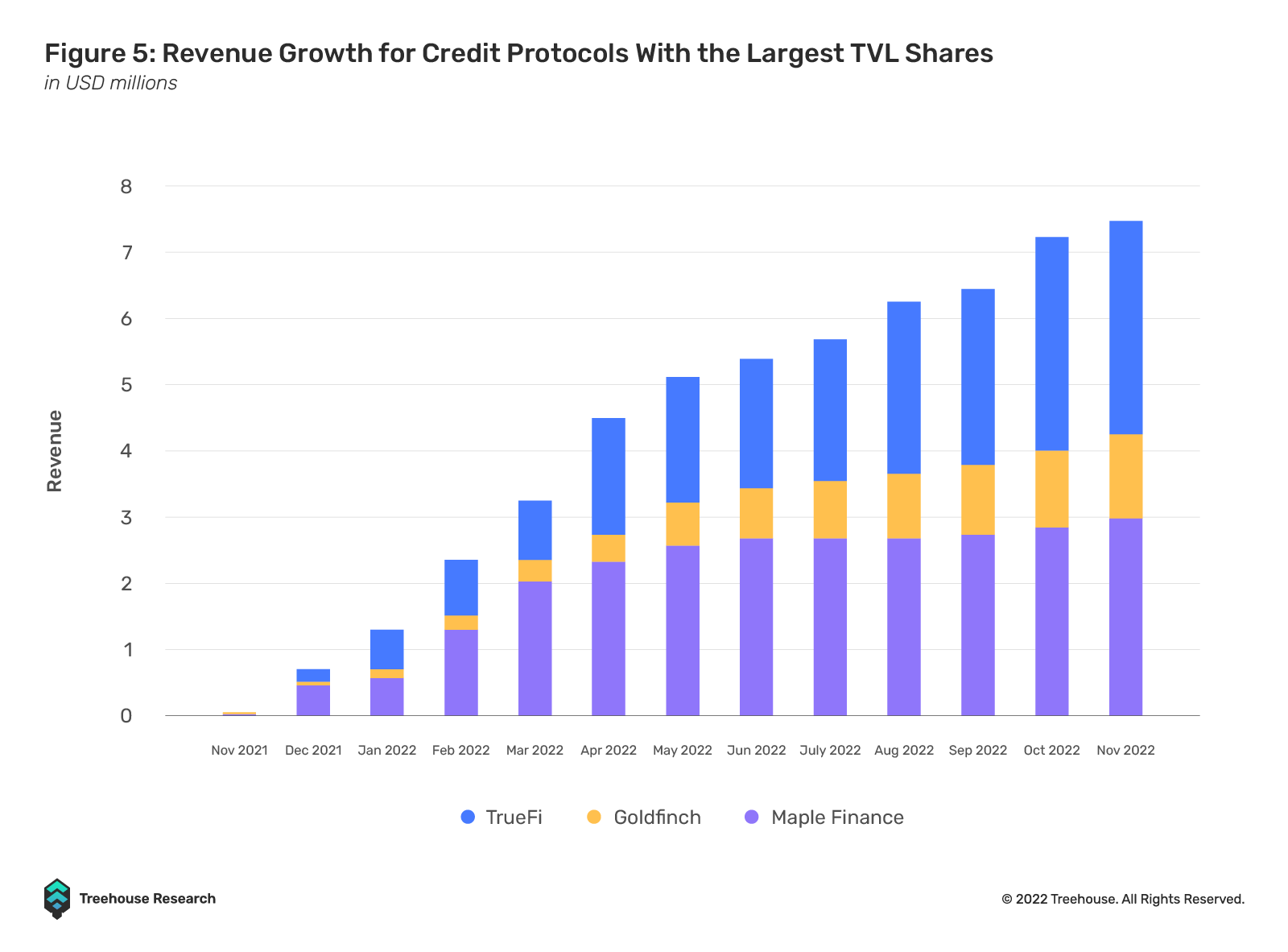

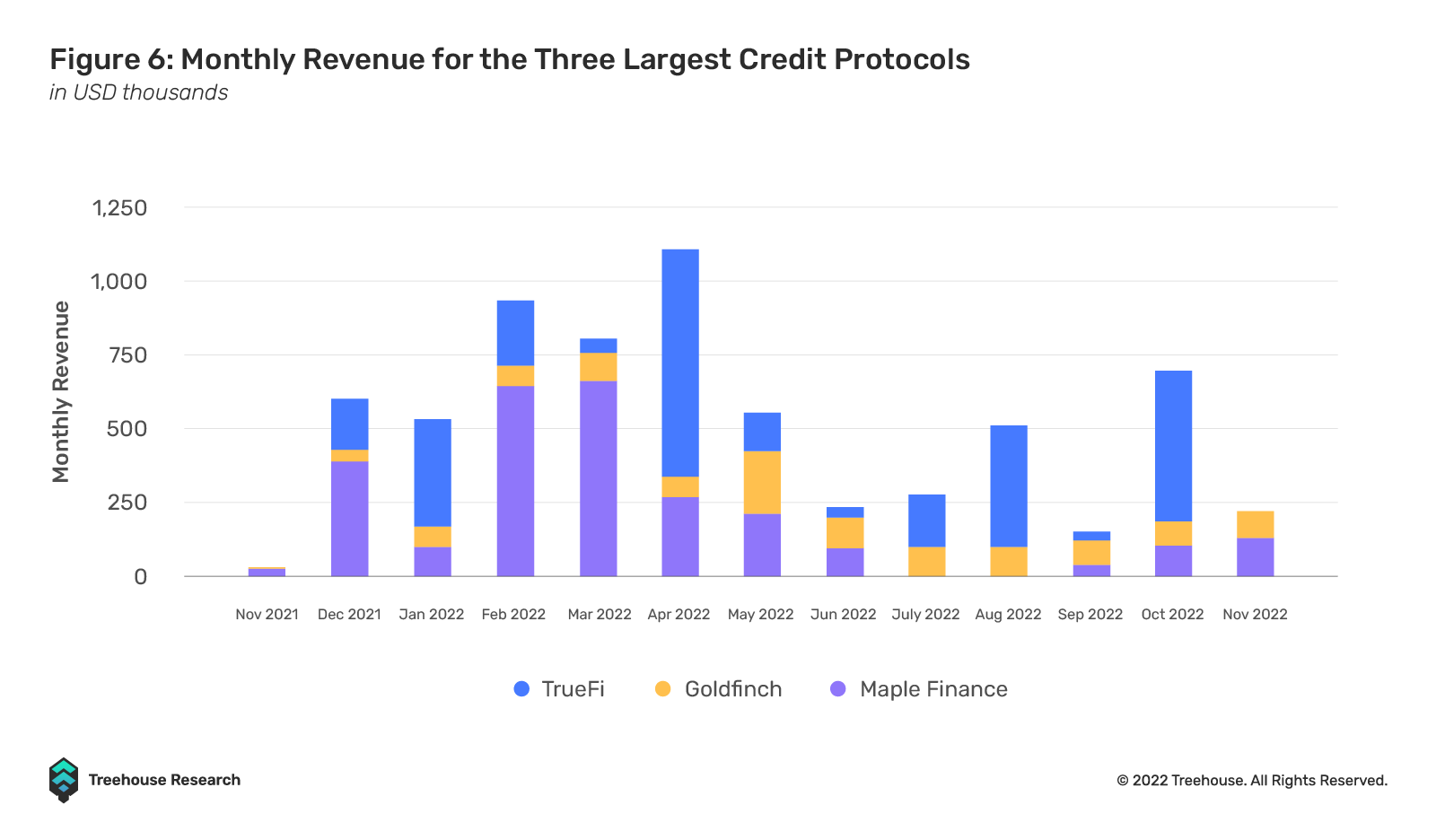

Despite the broader crypto liquidity contraction, the three largest credit protocols by monthly lending volume: Maple Finance,TrueFiandGoldfinchand

Undercollateralized Lending: The Next Holy Grail of DeFi Lending

Undercollateralized Lending: The Next Holy Grail of DeFi Lending

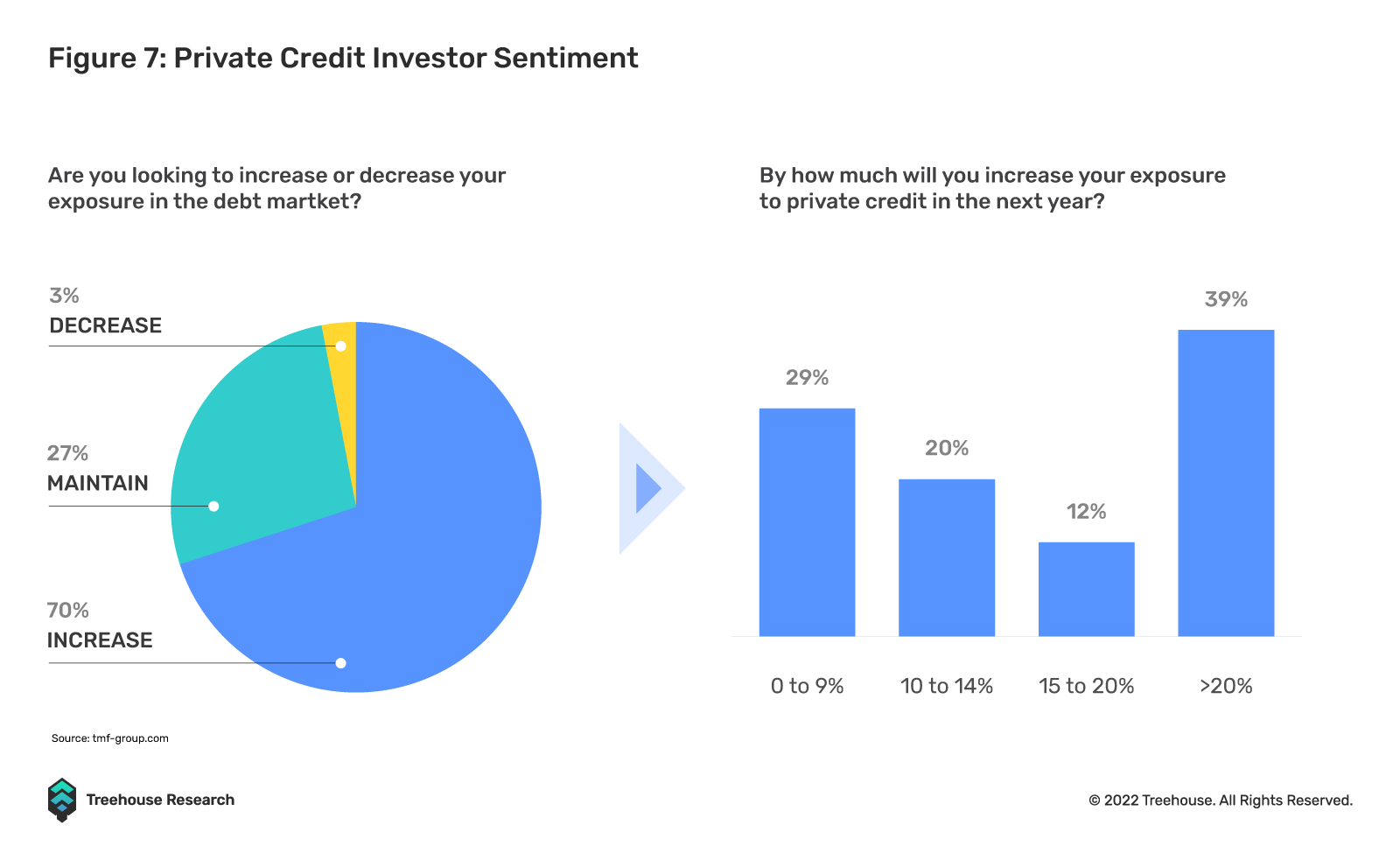

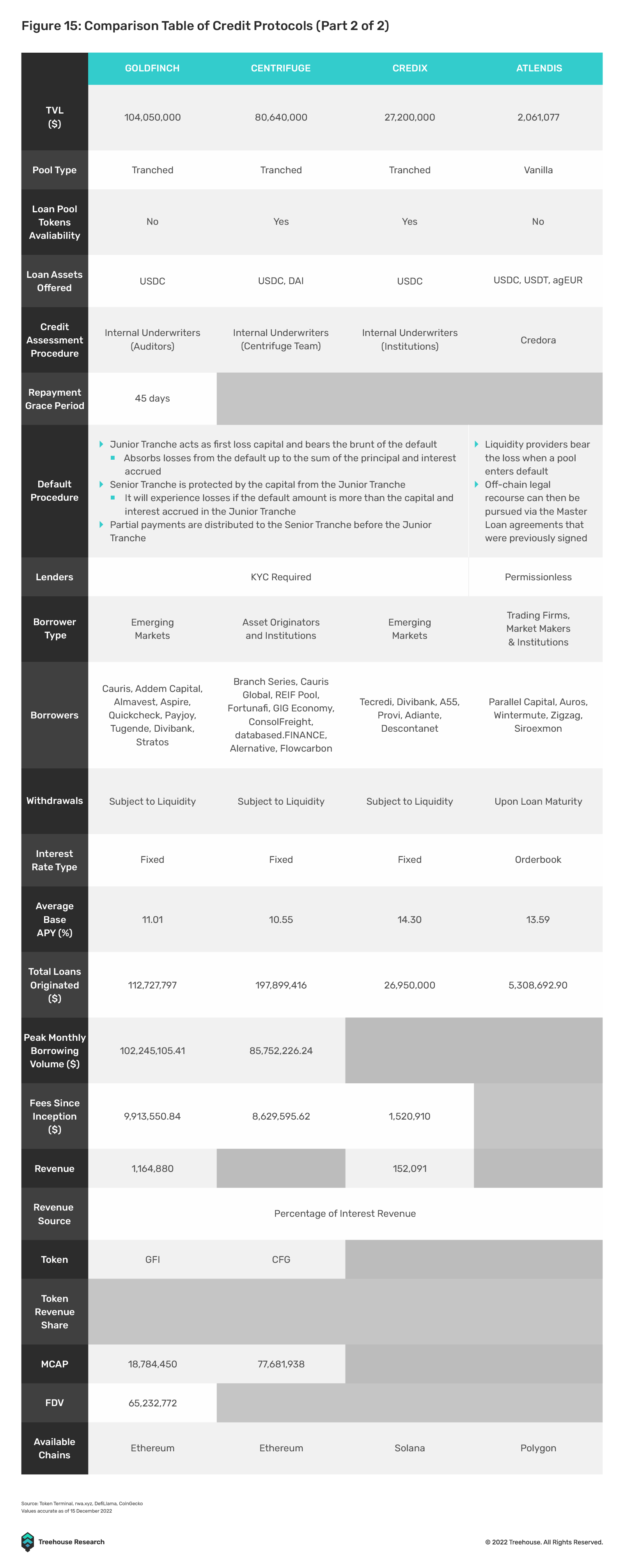

Emerging debt markets offer investors favorable risk-reward portfolios, creating demand for exposure to such debt instruments. However, investors may find it difficult to access debt markets in emerging economies. So, to solve this problem, certain credit protocols provide access and benefits by connecting potential lenders and borrowers. Goldfinch, an agreement currently serving emerging market borrowers, states that in order to minimize the risk and uncertainty of providing credit to industries that are still in the growth phase, they only provide loans to established credit funds and fintech organizations with historically stable financial performance. Also, ensuring that borrowers meet satisfactory standards vs. Goldfinch and Credix, as the overall default rate has been 0% since inception.

first level title

Credit Agreement Infrastructure

secondary title

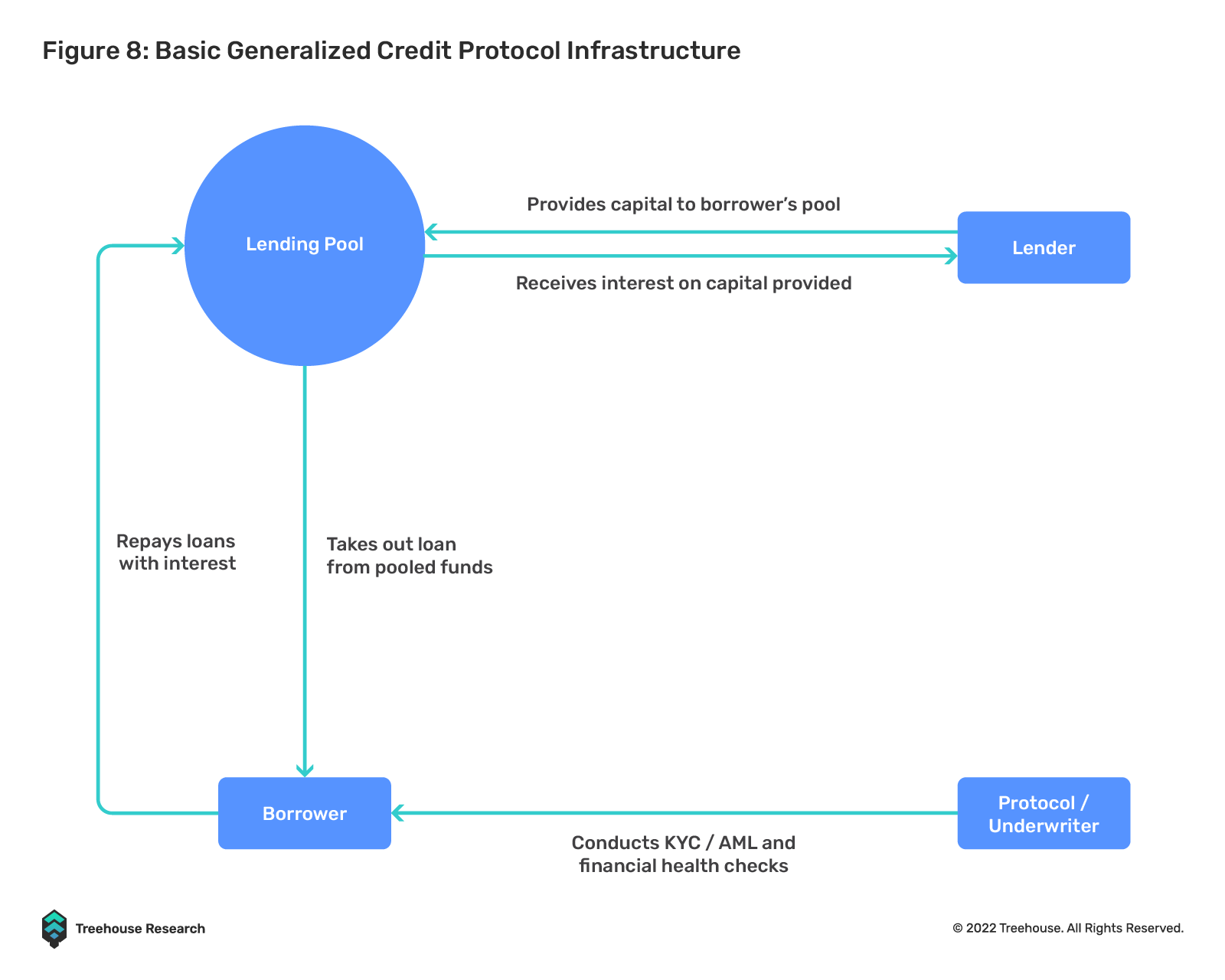

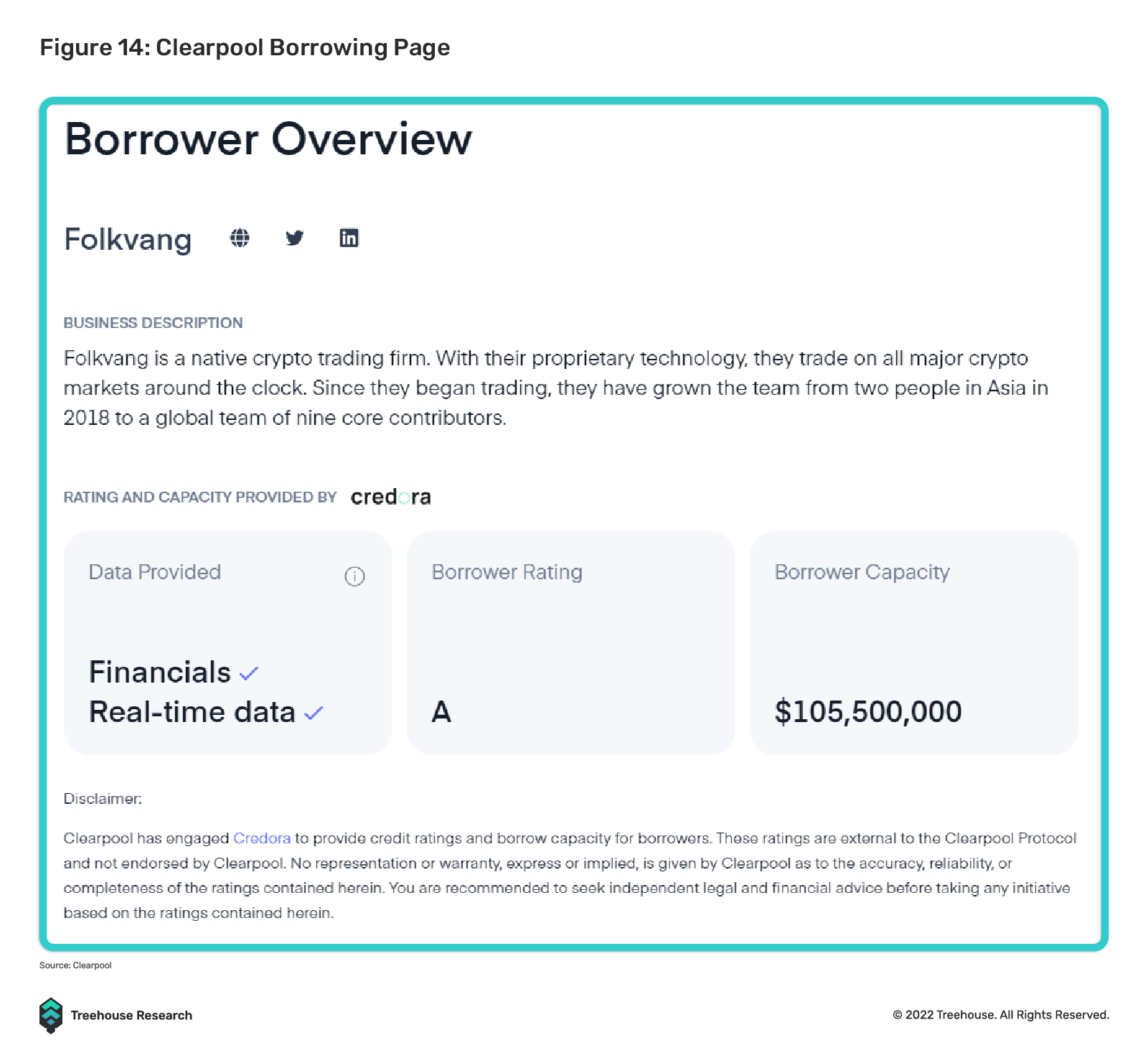

protocol levelA credit agreement typically acts as an infrastructure layer, providingNecessary risk assessment and credit scoring expertise required, as well as protocol-level decisions such as setting interest rate mechanisms. While such credit risk assessment decisions may centralize some aspects of these protocols compared to other DeFi money markets, they are critical to ensuring that the quality of borrowers on the platform meets certain standards to minimize credit risk. important.Protocols either have teams with years of credit experience, or use something like Credora

Such centralized credit rating providers assess the financial health of each potential borrower.dAMMin such an agreement.

secondary title

Borrower

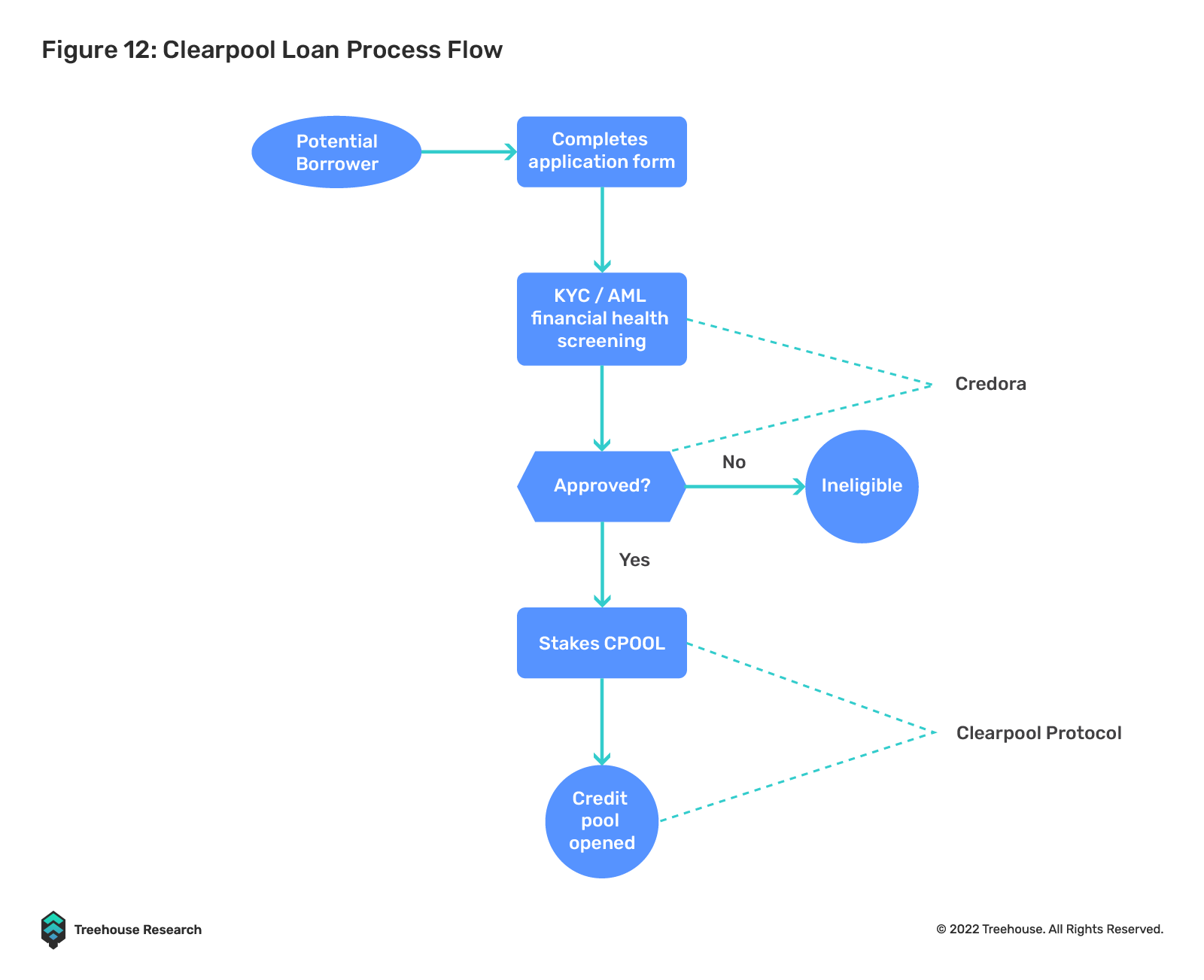

How to borrow?The process for borrowers in most credit agreements is relatively standardized,They must complete the KYC and anti-money laundering (AML) procedures stipulated in the agreement, as well as analyze their financial situation before opening the loan pool.

After completing the necessary procedures, the borrower can open a loan pool, usually similar to a revolving credit line, in which funds can be borrowed up to a certain amount and can be borrowed at any time. Because there are enough funds available. These processes apply to most protocols that allow institutions to build their own pools and borrow directly from them, such as dAMM and Clearpool.

However, for agreements using a business model that allows an institution to set up a credit facility, the borrower typically must go through an additional third party in the set up process. This additional party acts as a pool manager, interacting directly with borrowers and negotiating credit terms with them. These mining pool managers usually have to pass KYC checks by agreement when the pool is set up by them. Becoming a pool manager is similar to running a credit business, borrowers have to interact with them to get a loan. Borrowers can also start borrowing from these pools once these loans are approved by administrators. Protocols that follow this structure include Maple Finance and TrueFi's Capital Markets, where each pool is run by an institution that pools funds and approves each borrower itself.

With most agreements, interest is automatically compounded each period, giving borrowers the flexibility to choose to repay the loan as they see fit. However, there are some agreements, such as TrueFi, that only require interest repayments at the end of the loan term, which leaves the borrower under no obligation to pay interest until the repayment date arrives.

secondary title

lender

How to lend?

Currently, most credit protocols run permissionless pools, meaning that lenders can choose to deposit funds in any pool they choose. As long as users have a compatible Web3 wallet and asset pool to deposit into, they can provide funds to the lender of their choice to start earning interest. However, for some protocols and licensed pools, lenders need to complete a KYC/AML process before depositing funds into these pools. Currently, the three protocols that require lenders to complete KYC before being able to deposit funds are Goldfinch, Centrifuge, and Credix.

vanilla lending pool

Most current protocols employ a model in which lenders simply select the institution they wish to lend funds to and deposit funds into the corresponding pool. This is similar to funding on AAVE, except that the borrower is an institution that has gone through the KYC process and joined through a credit agreement.

Tiered Loan Pools

There are several protocols that split their loan pools into different tranches, enabling lenders to choose the amount of risk they are willing to take in order to earn interest. Centrifuge is an example of a protocol that offers segmented loans in the form of different tokens representing junior or senior loans. Lenders who choose to lend their funds to the junior tranche will typically earn higher yields because they will provide first loss capital in the event of any default. Lenders in the senior tranche, on the other hand, get lower yields, but are saved from default because of the liquidity in the junior tranche.

For most protocols, once a lender deposits funds, he cannot withdraw them until the loan term ends or there are sufficient funds in the pool. This may mean that the funds provided are illiquid over the life of the loan. If a lender deposits funds into a pool at which point their funds are fully utilized, the lender will not be able to withdraw funds until the next interest payment or until the loan is fully repaid.

secondary title

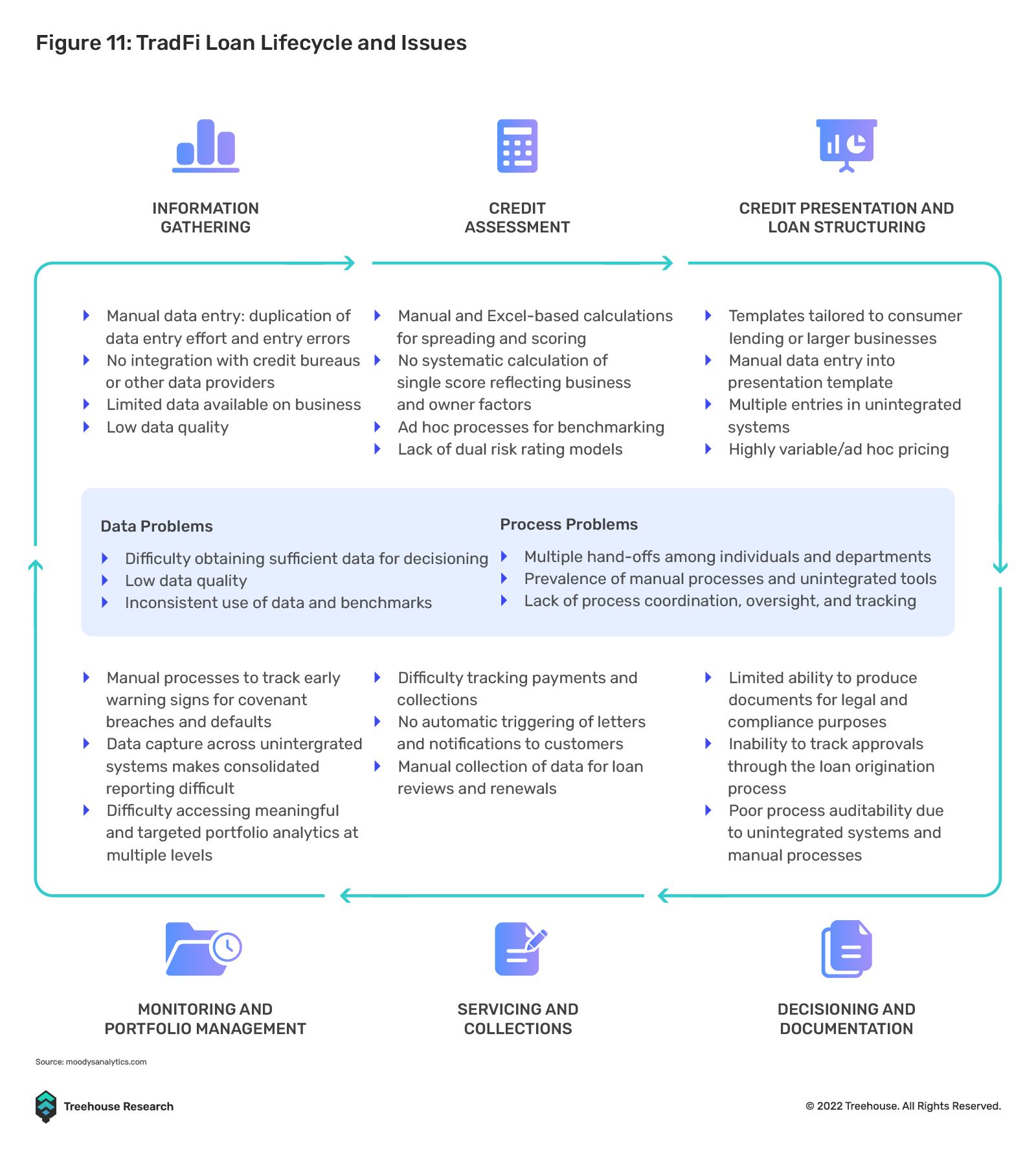

DeFi credit protocols appear to be just on-chain iterations of traditional banks or lenders due to their centralized nature compared to their over-collateralized counterparts. However, DeFi credit protocols have advantages throughout the loan process and lifecycle that TradFi cannot replicate.

first level title

Evolution of the credit process

Undercollateralized Lending: The Next Holy Grail of DeFi Lending

Undercollateralized Lending: The Next Holy Grail of DeFi Lending

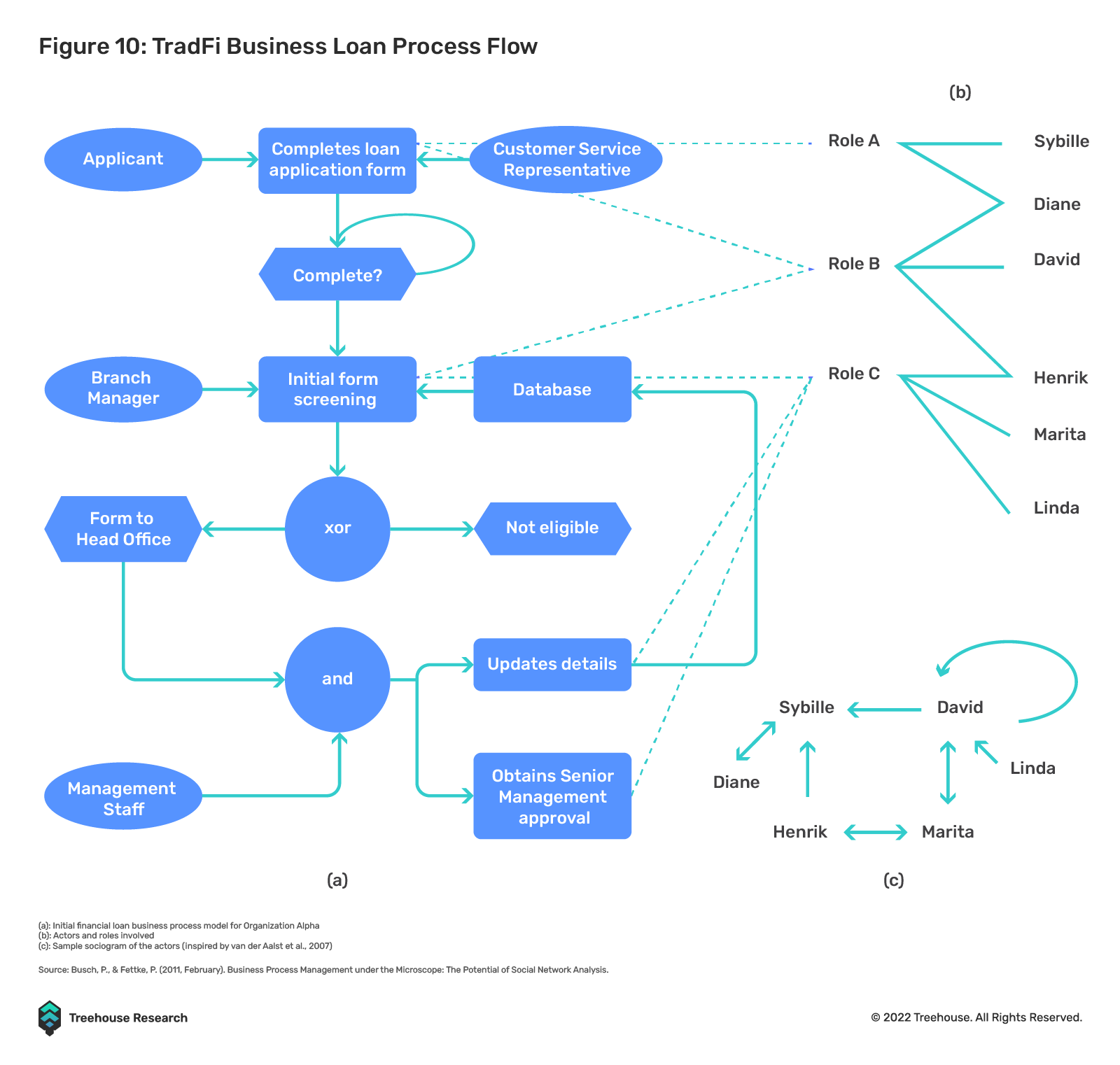

Therefore, getting a TradFi loan is not only expensive but also time-consuming. Data shows that only about 7% of TradFi loans are processed in an average week, and the involvement of multiple parties can lead to a surge in loan costs. In addition, applying for a new line of credit at a financial institution with an existing relationship with the borrower may still need to go through the full 5C review cycle again. The operating costs of all these processes will likely be borne by the borrower in the final loan pricing, as TradFi loans (legal ones at least) are highly monopolized by established financial institutions. Therefore, the cost of the aggregate is likely to be borne by the borrower in the total loan pricing.

Clearpool's loan origination process is an example. With Clearpool, borrowers go through just two intermediaries — the protocol itself and Credora. Additionally, the number of steps and processes required to approve and initiate a loan request is significantly reduced compared to TradFi institutions. The middleman is eliminated so borrowers can earn competitive interest rates from DeFi mortgage protocols. The tedious technical details involved in TradFi borrowing, such as waiting for loan withdrawals to be credited to the borrower's account, or transferring borrowed liquidity to the destination account, can be effectively replaced by blockchain technology.

first level title

Greater credit availability for underserved borrowers

Undercollateralized Lending: The Next Holy Grail of DeFi Lending

While DeFi credit protocols currently only serve a niche market, there are several avenues for greater adoption. One understandable trajectory is the mutual recognition of credit scores/ratings between users and entities in DeFi and TradFi, which would allow borrowers with credit histories on the one hand to access credit on the other. This would benefit not only institutional borrowers but also retail borrowers and potentially make on-chain credit cards a reality. However, mutual recognition of credit scores may require borrowers to reveal their true identities for KYC and compliance purposes. This could undermine maximizing decentralization.

first level title

Transparency, Anti-Fraud and Risk Management

The development of DeFi credit protocols offers a promising cure for several problems in the TradFi and CeFi credit markets.

Undercollateralized Lending: The Next Holy Grail of DeFi Lending

Protocols like Clearpool provide real-time credit scoring by using Credora, where information about borrowers and their respective loan pools is readily available. They also provide users with information on loan sizes and repayment history, as well as transaction hashes, should lenders wish to track where each borrower is going. Although credit terms such as collateral size are not visible to users, they still have a higher level of access to information than lending to CeFi institutions.

Consensus mechanisms in DeFi credit due diligence can also help reduce fraud. The traditional loan approval process of financial institutions often relies on a small number of decision makers, which presents centralization and key personnel risks in fraud prevention. _Netflix fans may remember the heroine Anna Delvey or Anna Sorokin from the true story adaptation of the TV series "Inventing Anna", who faked her identity and managed to trick banks into extending credit lines on false impressions and forged documents . It’s hard to imagine her accomplishing this in the context of DeFi lending, where KYC is conducted by a group of protocol stakeholders (e.g. token stakeholders).

first level title

existing credit agreement

first level title

Despite their achievements, popular DeFi credit protocols still face limitations that, to varying degrees, hinder further adoption.

secondary title

This shortcoming is by no means limited to DeFi credit protocols. Most DeFi money markets operate on a zero-duration basis because due tosmart contractsmart contract

Currently, the lack of duration is less of a concern as the majority of DeFi credit borrowers are financial institutions such as trading companies, as these borrowers are usually content with short-term funding. This allows them to enjoy the flexibility to shrink their balance sheets when market opportunities are not suitable for heavy borrowing. However, for credit investors, some are increasingly comfortable taking smart contract risk and looking for longer-term fixed-rate income. The needs of these investors may be better met with differentiated, long-term offerings.

secondary title

As mentioned above, most DeFi credit borrowers operate in the same sector, which exposes lenders to higher correlations between their loan portfolios, also known as higher joint default probabilities. Goldfinch’s model of bringing in non-financial borrowers helps bridge this gap with diversified on-chain lending.

secondary title

With the advent of on-chain credit rating providers such as Credora, the current lack of a standardized DeFi credit rating framework may soon be resolved. Investors currently have no easy way to assess the creditworthiness of borrowers: they either have to establish bilateral relationships and collect financial statements, or rely on rating providers.

secondary title

There are many unclear legal implications when it comes to DeFi credit. First, a DeFi credit origination does not necessarily provide a prospectus like a TradFi credit bond issuance. Missing prospectuses and legal documents can lead to issues including, but not limited to, illegal solicitation and unclear debt priorities. How do lenders determine if their loan is parity with the borrower's other off-chain unsecured liabilities? On default, do off-chain creditors have the right to accelerate DeFi obligations even if DeFi credit pools pay on time? Are on-chain proofs of loans to borrowers legally binding in court? All of these delicate procedural necessities must be resolved before DeFi credit markets gain greater adoption.

secondary title

Insufficient capital liquidity

Although most DeFi credit pools currently have no clear lock-up period for funds, lenders must not consider their investment principal as liquidity. The amount that can be withdrawn is determined by the utilization rate, which means that if most of the available pool funds are borrowed, the lender needs to wait for repayment or new funds to come in before withdrawing funds.

Another way to increase liquidity for DeFi credit borrowing is to introduce market makers into tokenized loans — similar to how TradFi market makers use principal balance sheets to provide secondary liquidity. The obvious obstacle to this route is the lack of credit instruments (credit default swaps, shorting tokenized loans, etc.), which reduces the ability of market makers to hedge risk, thereby reducing market depth.

first level title

In this section, we outline several directions that we foresee the DeFi credit space eventually taking to someday make universal DeFi credit a reality.

secondary title

retail credit

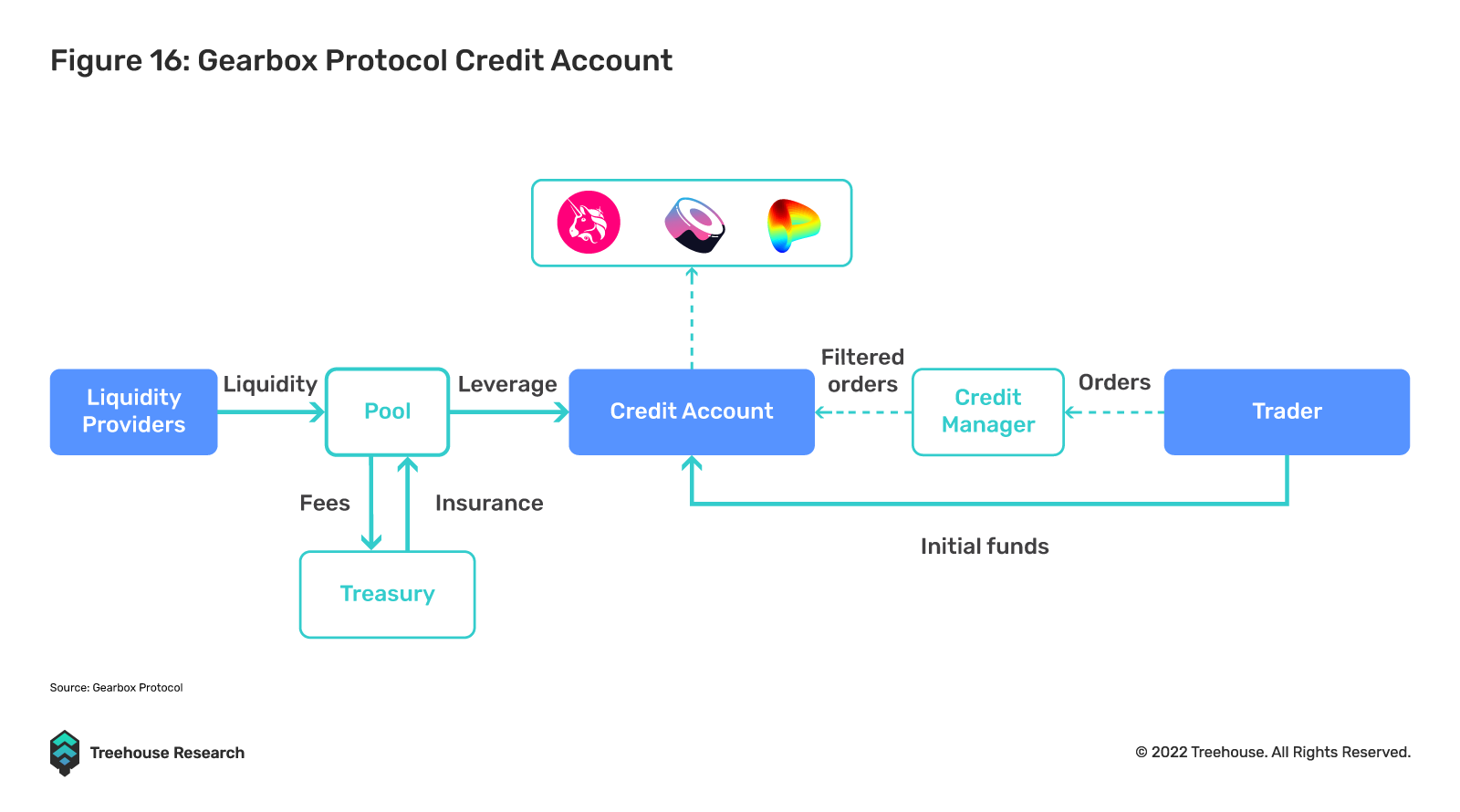

Gearbox ProtocolIn TradFi, credit is heavily used by the retail industry to finance big-ticket purchases like cars or mortgages, and more general use cases like paying for college education. The availability of retail credit in DeFi will be a major value proposition.

For now, retail DeFi credit is still limited to financial use cases, while consumer use cases remain very limited due to the difficulty of determining on-chain identities. In our opinion, one possible solution to the “default incentive” problem is the use of soul-bound tokens (SBT). These non-fungible and non-transferable tokens will ensure that if a user defaults, he will not be able to obtain future loans as his credit history will be linked to his on-chain identity. As the technology stack continues to evolve, we foresee SBTs playing a central role in ensuring retail consumer credit compliance becomes a reality.

secondary title

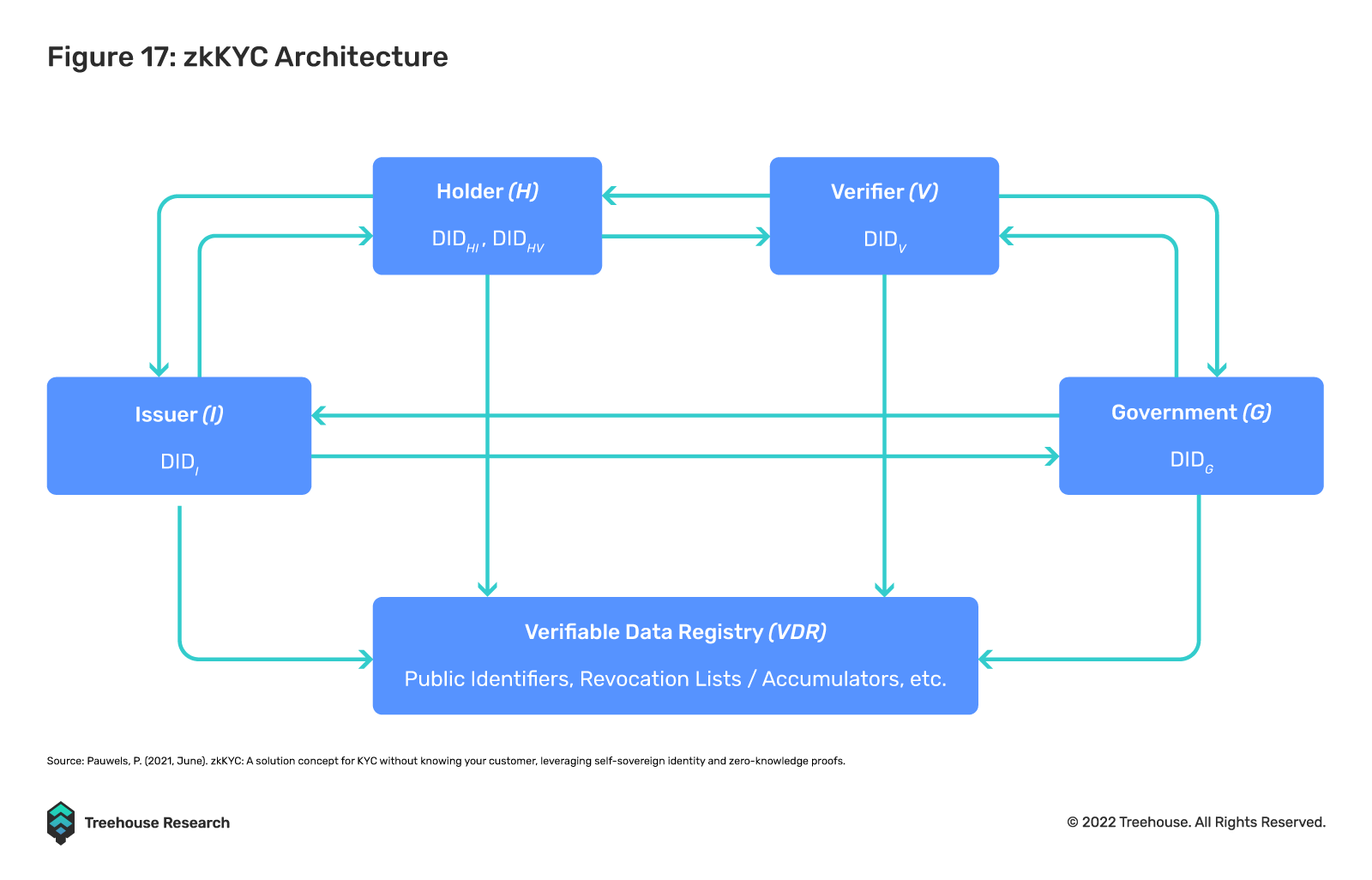

Zero Knowledge KYC (zkKYC)

zkKYC will allow users to prove their identity without fully disclosing all personal data, while still complying with all necessary KYC obligations. This also helps to provide standardized KYC procedures across different credit protocols, potentially increasing the composability of decentralized identities across different protocols while protecting user privacy.

first level title

final thoughtsDespite the many hurdles ahead, the DeFi credit market has demonstrated its momentum and ability to foster innovation.As the most frequently traded risk premium in TradFi

For one, credit risk could become the next heavyweight in the "real yield" narrative.Perhaps the most interesting observation about DeFi credit is that the growth of this market is directly opposed to the decentralization of "DeFi". Both lenders and borrowers voluntarily undergo KYC and whitelisting to participate in these protocols, placing anonymity at a lower priority. This permissioned on-chain market could be a lasting trend that will lead toDegree of institutionalization of on-chain financing and investment activities

Raise as regulators dig deeper into deals and returns they were previously out of reach. The long-term impact of this development is difficult to measure, as DeFi's initial concerns about erosion of privacy and distributed governance may be addressed by future innovations that allow permissionless and algorithmic credit assessment.All things aside, we at Treehouse are optimistic and excited to be a part of the growth of the DeFi credit market as our engineers work hard to integrateCredit Risk Management Tools