If the chat software in the Web 2 world is dominated by WhatsApp and WeChat, then in the Web 3 world, the well-deserved king is Telegram with 700 million active users around the world. Users who have not yet fully legalized encrypted assets are safe and have a large number of Web 3 users. TON (The Open Network), which is backed by Telegram, is the veritable first encrypted chat currency. Its long-term value will be encrypted in 2022 when the scandal broke out. In the cold winter of currency, it is very well reflected.

In 2022, the overall cryptocurrency market value will evaporate by nearly 1.4 trillion US dollars, with an overall decline of 64.5%. The price of Bitcoin, the largest market value and has always been the most resilient, will collapse by more than 60%. In contrast, TON "only" fell by about 33.5% At present, its market value is still ranked among the top 25 in the world on CoinMarketCap. Its stable performance has made TON selected by Cointelegraph as the top 5 projects with the best performance in 2022. Resilience is victory.

In the middle of March 🈷, Telegram further expanded Telegram's encrypted chat attributes, allowing users to send USDT directly in the chat through the @Wallet robot, allowing TON to gain a wave of attention again. This robot was developed by the TON Foundation and allowed Telegram to Users can buy, send, receive, and trade Toncoin (TON) tokens directly in the app without handling fees.

To understand the endogenous value of TON, one has to review the history of TON.

In 2017, Telegram developed a blockchain platform called Telegram Open Network (the original TON), issued the native encrypted asset Gram, and conducted an initial token offering to specific investors the following year, raising a total of 1.7 billion US dollars. It became the project with the second largest ICO fundraising amount in history at that time, and it was a moment of glory.

However, the next development of the story surprised everyone.

In 2019, the US Securities and Exchange Commission (SEC) accused Telegram of issuing Grams without registering with it, violating the US Securities Act (Securities Act), prohibiting Telegram from issuing Grams globally, and even prohibiting it from circulating the currency globally. This forced Telegram to abandon Telegram Open Network, which will be taken over by community developers in 2021 and renamed to its current name - The Open Network.

first level title

Technical features: fast, can achieve millions of transactions per second

The core features of TON are scalability and sharding. TON can verify and process millions of transactions per second by supporting dynamic sharding and work chains. In other words, TON's adaptive architecture allows it to scale infinitely without sacrificing performance. TON is designed to support billions of concurrent users unlike most other blockchain ecosystems. It does this through blockchain sharding, which involves using multiple subnetworks, or shards, on the same blockchain to efficiently accomplish tasks. Each shard serves a specific purpose and helps avoid a large backlog of unvalidated blocks.

In short, TON is scalable and shardable, can handle millions of transactions, has ultra-fast transactions, low fees, and easy-to-use applications.

TON's unique architecture is the key to its high transaction speed and scalability. It consists of a main chain and up to 232 working chains, each of which can be further divided into up to 260 shards. The main chain is responsible for storing general information about validators, work chains and their shards on the chain, while the work chain contains information on events such as smart contract transactions and value transfers. This method of sharding horizontally splits the database on the blockchain, helping to reduce network load.

TON's POS mechanism makes it an efficient way to pay transaction fees, settle payments and verify transactions. TON Token is the key to supporting the operation of the entire system. According to its basic parameters, its current annual inflation rate is about 0.6%.

first level title

The diverse ecosystem behind TON

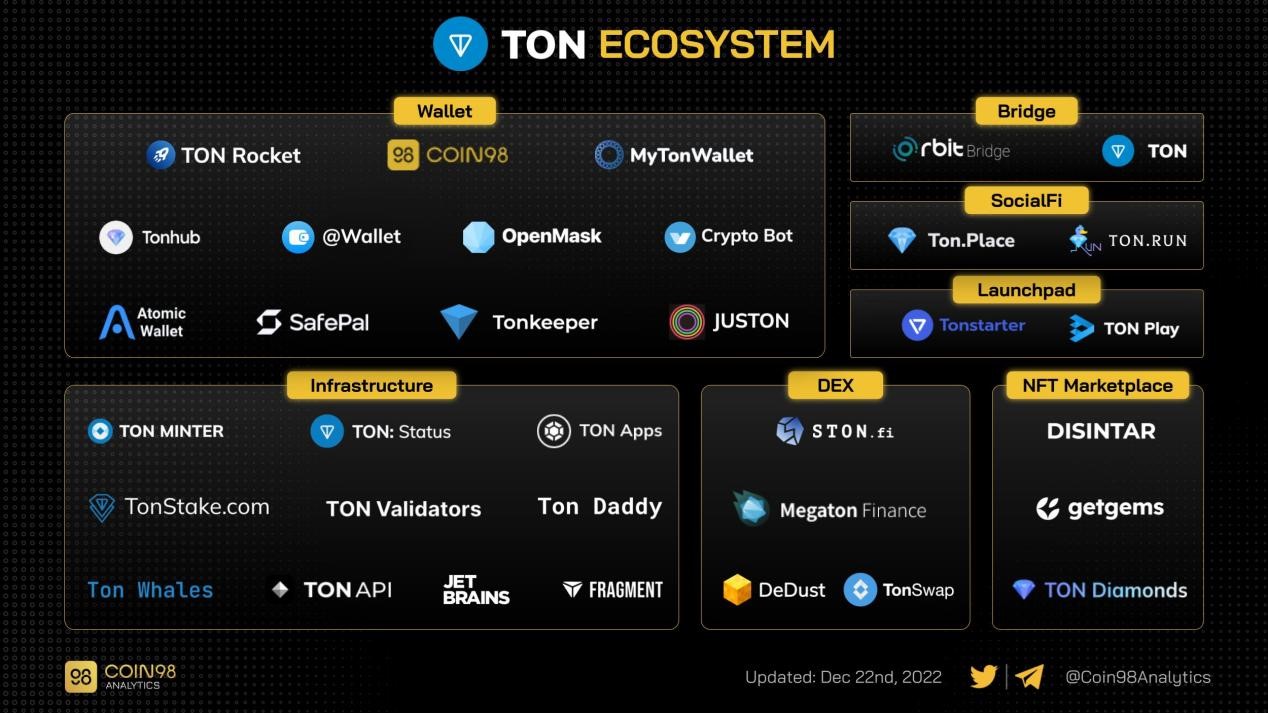

The technical advantages of TON have attracted a large number of developers, creating a thriving and rich TON ecosystem.

In addition to the Telegram payment and wallet applications mentioned above, TON’s development applications also include NFT, De-Fi, DEX, games, etc. At present, more than 100 million transactions have been processed on the TON chain.

In terms of the token model, the initial total amount of TON is 5 billion. The current operating mode is similar to ETH, and POS miners will be given TON as a reward, and the total amount of tokens will increase at a rate of about 0.6% per year. This means TON is an inflationary token, but with a relatively low inflation rate that tends to approach zero over time. The purpose of inflation is to incentivize miners to keep the network safe and active, and to offset the reduction in supply due to token loss. Since TON does not have any kind of lock-up period or release schedule, all holders are free to trade or use their TON. This reduces uncertainty and stress in the market, and also avoids price fluctuations caused by supply and demand imbalances.

In order to encourage the liquidity of TON, in February this year, it announced the launch of a $20 million liquidity incentive plan "The Open Challenge", which aims to increase the TVL on TON. TON stated that the program is open to any DeFi project that helps bring liquidity to the ecosystem.

The TON Foundation also announced the launch of a US$250 million TON fund in April last year. Up to now, more than US$1 billion has been injected successively, which directly reflects TON's determination to create a diverse and rich on-chain ecology.

In general, TON, as the first coin of encrypted chat, has experienced life and death, but can persist. If it is replaced by other projects, it is very likely that it will not be able to persist, but the TON Foundation can still continue to plan for the future and build With a rich and diverse on-chain ecology, coupled with the strong capital and user base behind Telegram, the long-term value of TON is still quite exciting.

Although TON has been listed on many exchanges, in terms of the choice of trading platform, it is recommended that you choose an exchange with a long history, security and stability, such as Biftfinex (commonly known as the Big B Network in China) established in 2012, as the top five in the world. A professional cryptocurrency exchange, Bitfinex has extremely high security and liquidity.

According to Coingecko, Bitfinex's 24-hour trading volume was $339,987,180.32, ranking fifth in CoinGecko's trading platform sector. Bitfinex has opened trading on April 7th.