Compilation of the original text: Bai Ze Research Institute

Compilation of the original text: Bai Ze Research Institute

Arbitrum is on fire lately!

With the $ARB airdrop worth >$1 billion, a lot of money will be poured into its ecosystem projects, making liquidity "rising".

secondary title

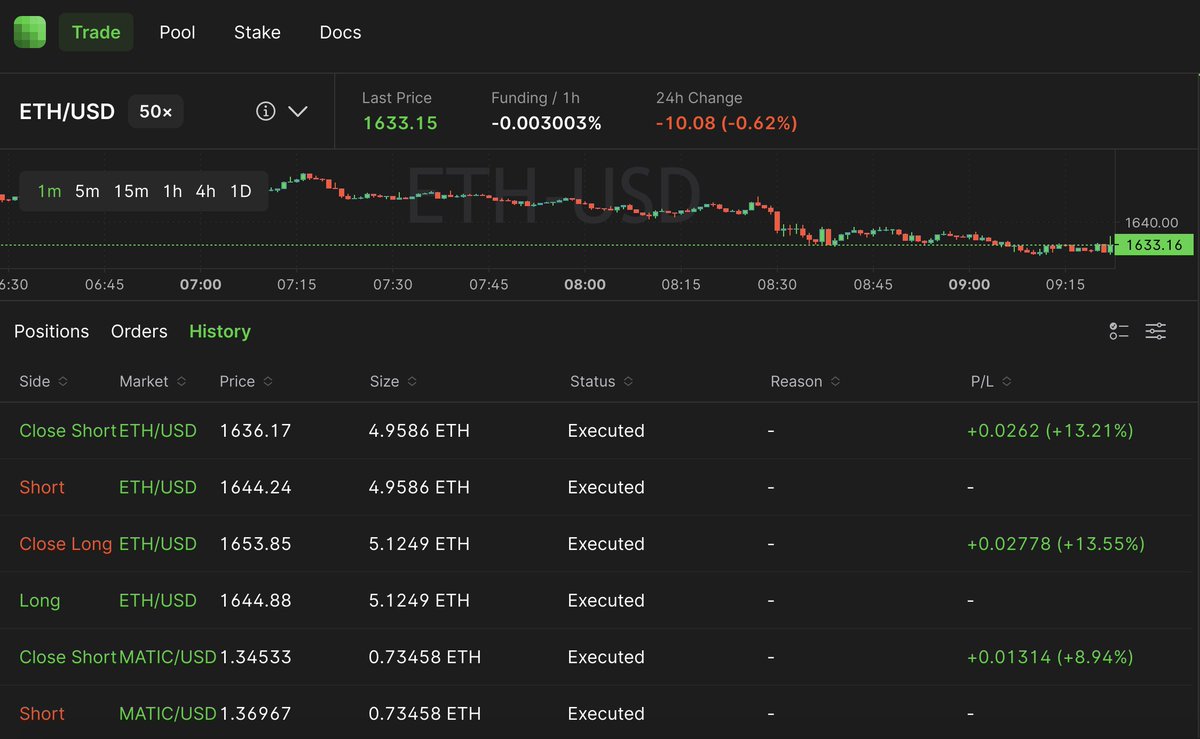

GMX($GMX)

GMX is a decentralized perpetual contract trading platform that allows users to trade BTC, ETH and other cryptocurrencies with up to 50x leverage and no price impact. The adoption of GMX has been incredible, with a total transaction volume of over $110 billion and a total transaction fee of approximately $170 million.

secondary title

Gains Network Analysis($GNS)

Gains Network is a decentralized perpetual contract trading platform that provides leveraged trading of cryptocurrencies, foreign exchange, stocks, commodities and indices. With $32 billion in total transaction volume and $23 million in total fees, it has proven to be a product for the market.

secondary title

TreasureDAO($Magic)

TreasureDAO is a decentralized gaming ecosystem designed to connect games and players. It has been quite successful in providing interoperability for GameFi projects by bootstrapping the community and liquidity.

secondary title

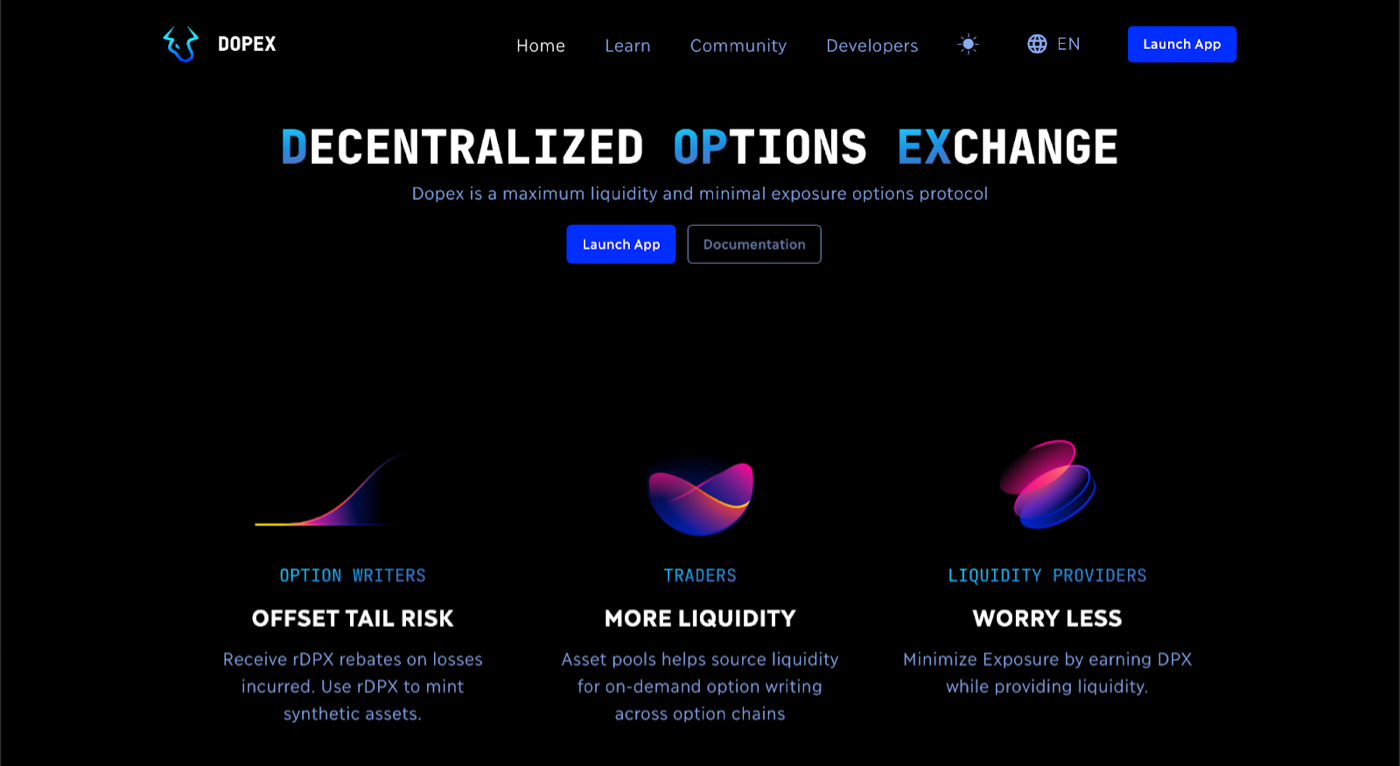

Dopex($DPX)

Dopex is a decentralized option protocol that provides option trading through the concept of "option vault". Aims to compete for options market share by providing fair prices, deep liquidity, and minimizing losses for option sellers.

secondary title

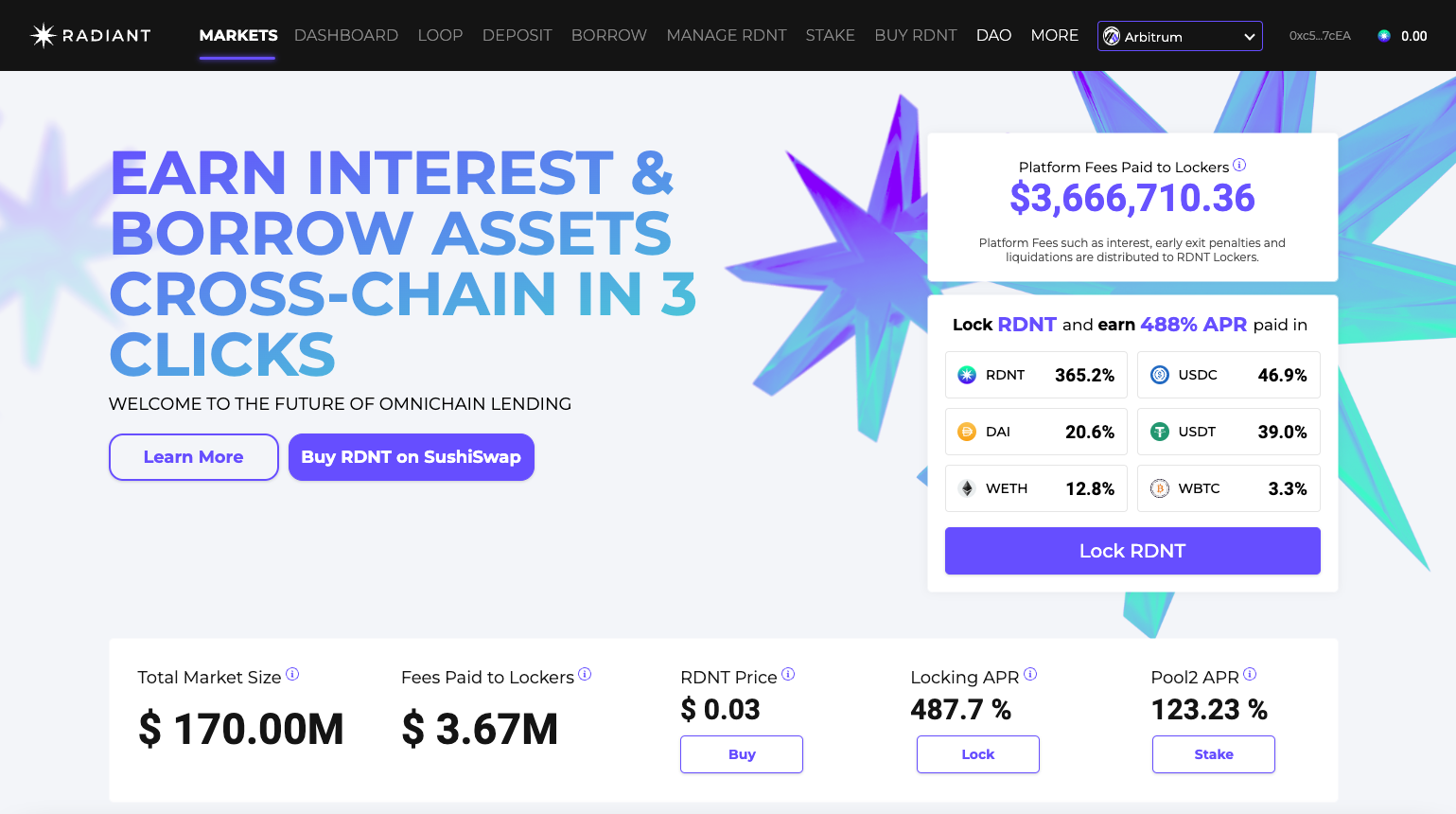

Radiant Capital($RDNT)

Radiant Capital is a lending protocol with full-chain liquidity. This means you can deposit assets on one chain while borrowing and lending on another. With cross-chain expansion, the introduction of new assets, and improvements to token economics, a V2 version of the protocol is coming soon.

secondary title

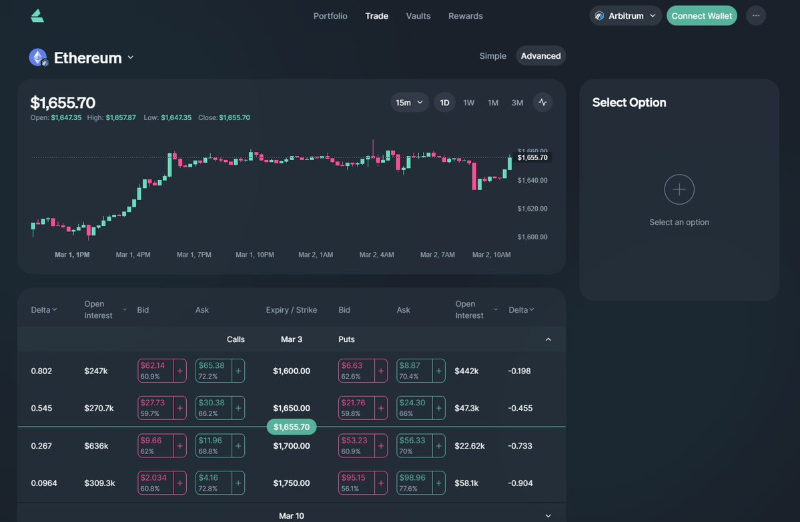

Premia Finance($PREMIA)

Premia Finance is a decentralized options platform with market-driven pricing through AMMs. It is live on multiple chains and differentiates itself from competitors by offering American-style options (options can be exercised at any time).

secondary title

Lyra Finance($LYRA)

Lyra Finance is a decentralized options protocol based on the AMM model. Option traders buy and sell options based on the liquidity pool provided by liquidity providers (LP), and the transaction fees generated by traders are paid to LPs as rewards for providing liquidity. LPs are also protected from the risk of unpaid losses through automatic hedging.

secondary title

Vela Exchange($VELA)

Vela Exchange is a decentralized exchange (DEX) designed to provide traders with an experience comparable to centralized exchanges (CEX). It is growing in popularity and recently reached an impressive total transaction volume, mainly due to an upcoming airdrop.

secondary title

CamelotDEX($GRAIL)

CamelotDEX is Arbitrum's native Dex with some fancy features and token economics. It has established many partnerships and has become the main launching platform for new projects on Arbitrum.

secondary title

Mux Protocol($MUX)

Mux Protocol is a DEX with zero price impact and aggregated liquidity. The protocol unifies liquidity across multiple chains and allows transactions of the same depth on any of them.

secondary title

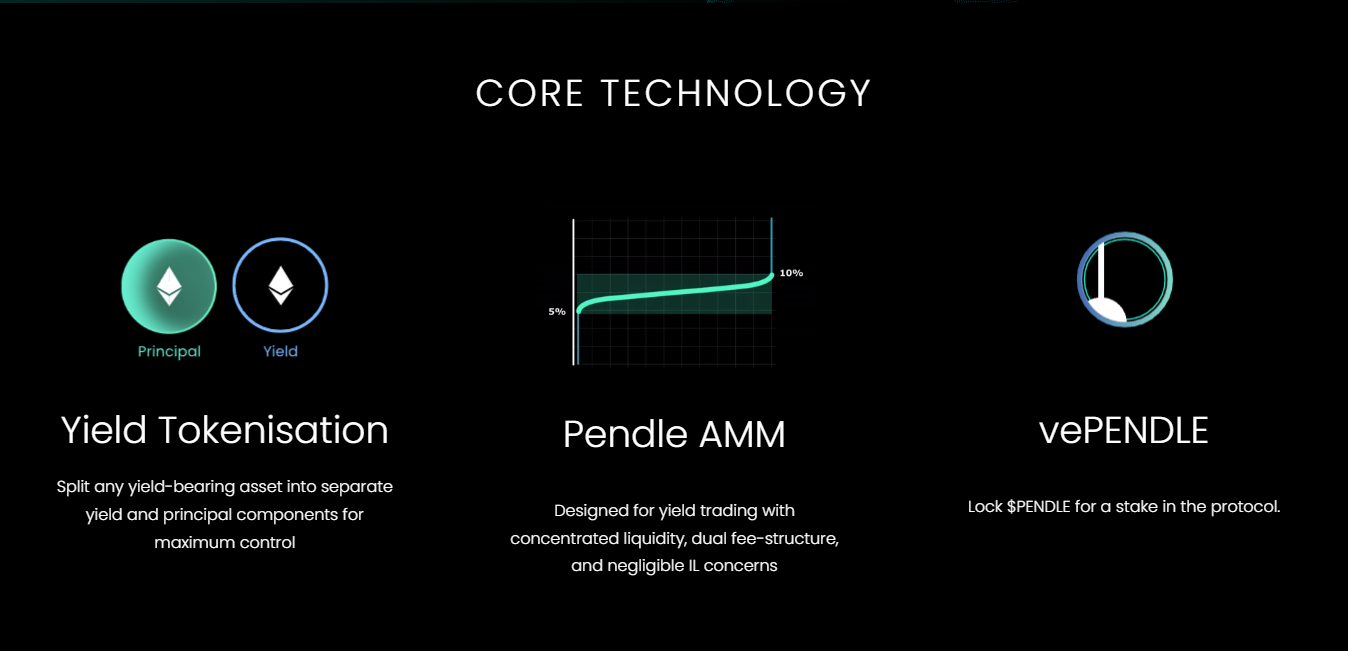

Pendle Finance($PENDLE)

Pendle Finance is a protocol that splits yield assets into principal tokens and yield tokens. It creates a whole new income trading primitive - fixing fluctuating income or buying assets at a discount.

secondary title

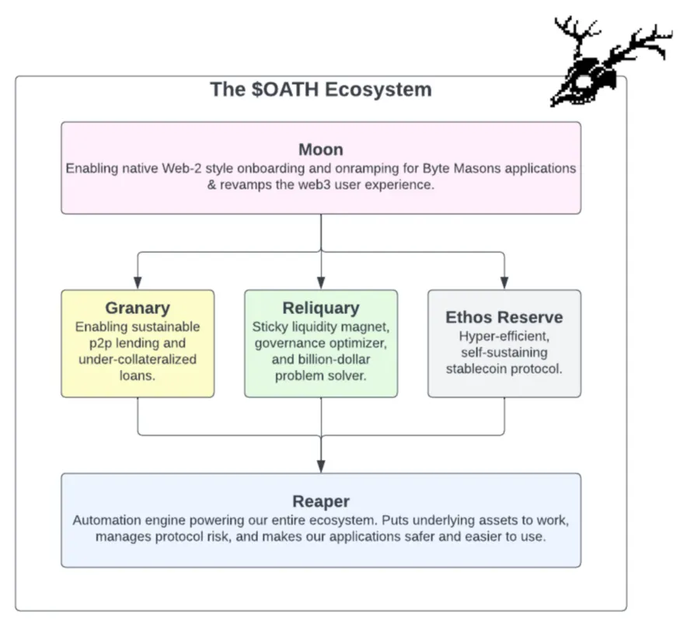

OATH($OATH)

OATH is a product ecosystem built by ByteMasons, a DeFi star development team, including currency markets, treasuries, stablecoins, lending, and more. All elements generate rewards for stakers and protocol users, while generating more demand for the protocol and $OATH.

secondary title

CapDot Finance($CAP)

CapDot Finance is a decentralized perpetual trading platform with up to 100x leverage. It supports cryptocurrency, forex, indices, metals trading and allows traders to set advanced order types.

secondary title

Hegic Options($HEGIC)

Hegic Options is a decentralized options protocol that makes options trading extremely simple. With its one-click trading feature, it provides users with the utmost simplicity and can be easily adjusted to their trading needs.

secondary title

JonesDAO Options($JONES)

JonesDAO Options is a protocol designed to make complex DeFi yield strategies simple. Their treasury and yield tokens unlock liquidity and increase capital efficiency for users.

secondary title

Arcadeum($ARC)

Arcadeum is a GambleFi (combining gambling and financial speculation) protocol, a decentralized casino that provides transparent odds, so players don't have to worry about being hacked. The protocol uses liquidity pools, allowing LPs to become bookmakers and profit from winnings.

secondary title

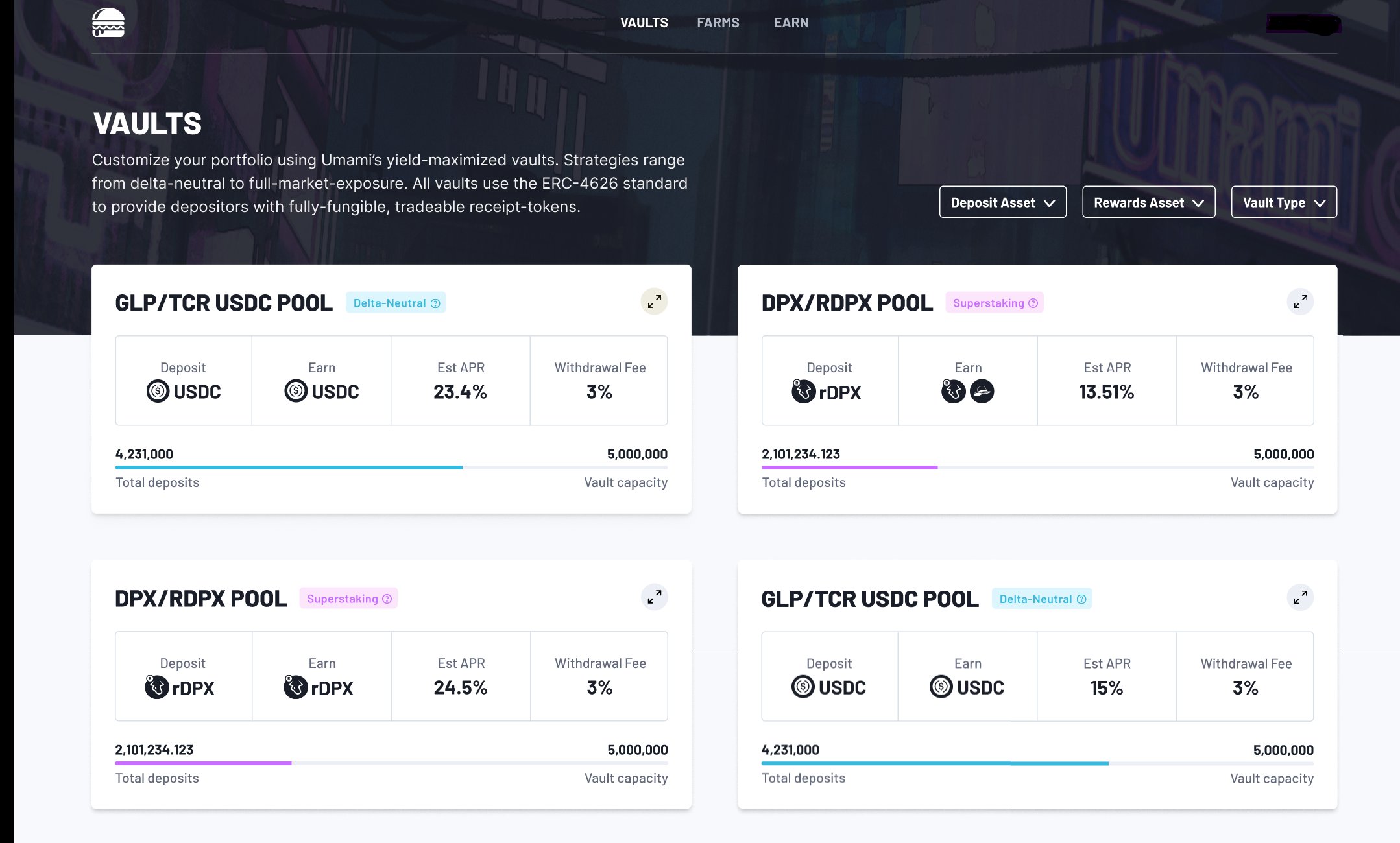

Umami Finance($UMAMI)

Umami Finance is a protocol that aims to bridge the gap between DeFi and TradFi by offering DeFi yield products tailored for institutional investors. There was some founder drama last month (founder dumped $UMAMI, down 52.79% in 24 hours), but the development team is still working on the project.

secondary title

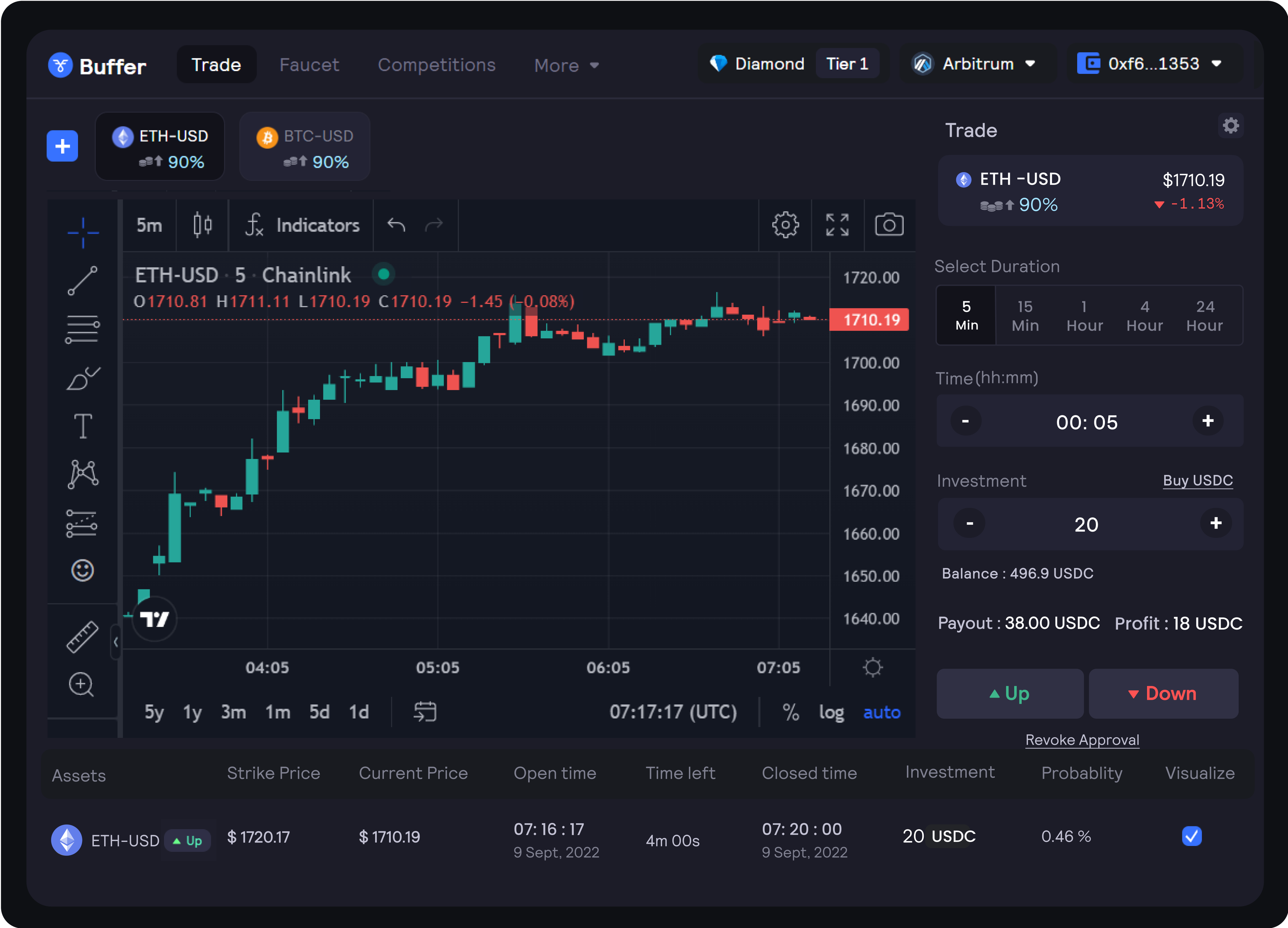

Buffer Finance($BFR)

Buffer Finance is a decentralized binary options trading platform. Binary options differ from perpetual options because traders only bet on rising or falling prices. Traders either earn a fixed return, or nothing.

secondary title

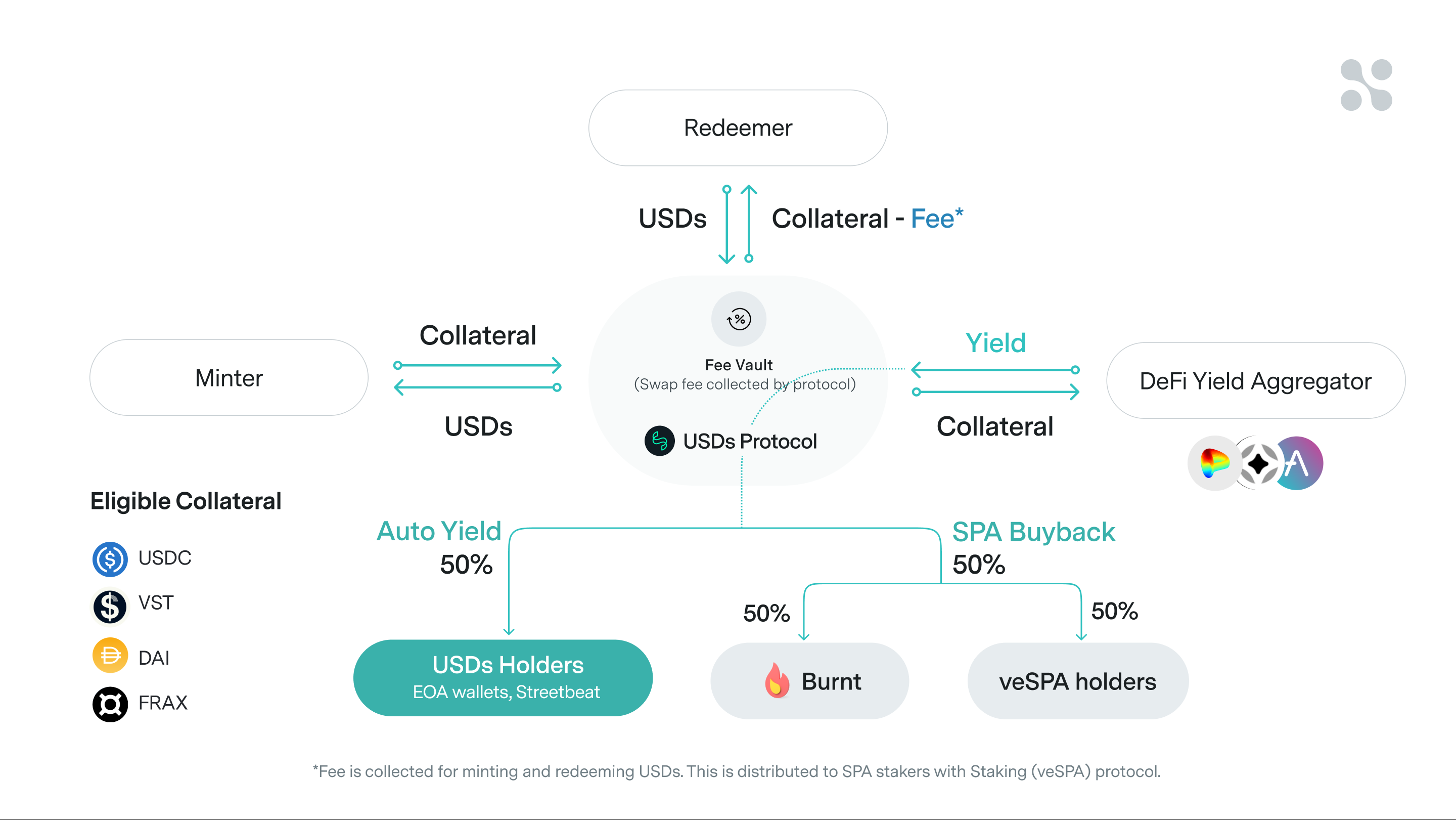

SperaxUSD($SPA)

SperaxUSD is a decentralized protocol for minting stablecoins $USDs, minted 100% collateralized by eligible collateral (including $USDC, $DAI, etc.). Due to the automatic income function of $USDs, users can earn income without collateral.

Where does the benefit come from? When $USDs are minted, collateral is deposited into audited yield aggregators to generate yield. The income strategy is determined by $veSPA holders. 50% of the income generated will be allocated to $USDs holders every week, and the remaining 50% will be used to repurchase $SPA, half will be destroyed, and half will be distributed to $veSPA holders.

Additionally, SperaxUSD released the DEX Liquidity Manager Protocol (Demeter Protocol), which DAOs can use to launch liquidity pools on Uniswap v3.

secondary title

TridentDAO($PSI)

TridentDAO is a Web3 game enterprise aiming to change the encrypted game industry. They replaced the Play-to-Earn concept with Risk-to-Earn, where players stake tokens to earn rewards while watching matches in-game.

secondary title

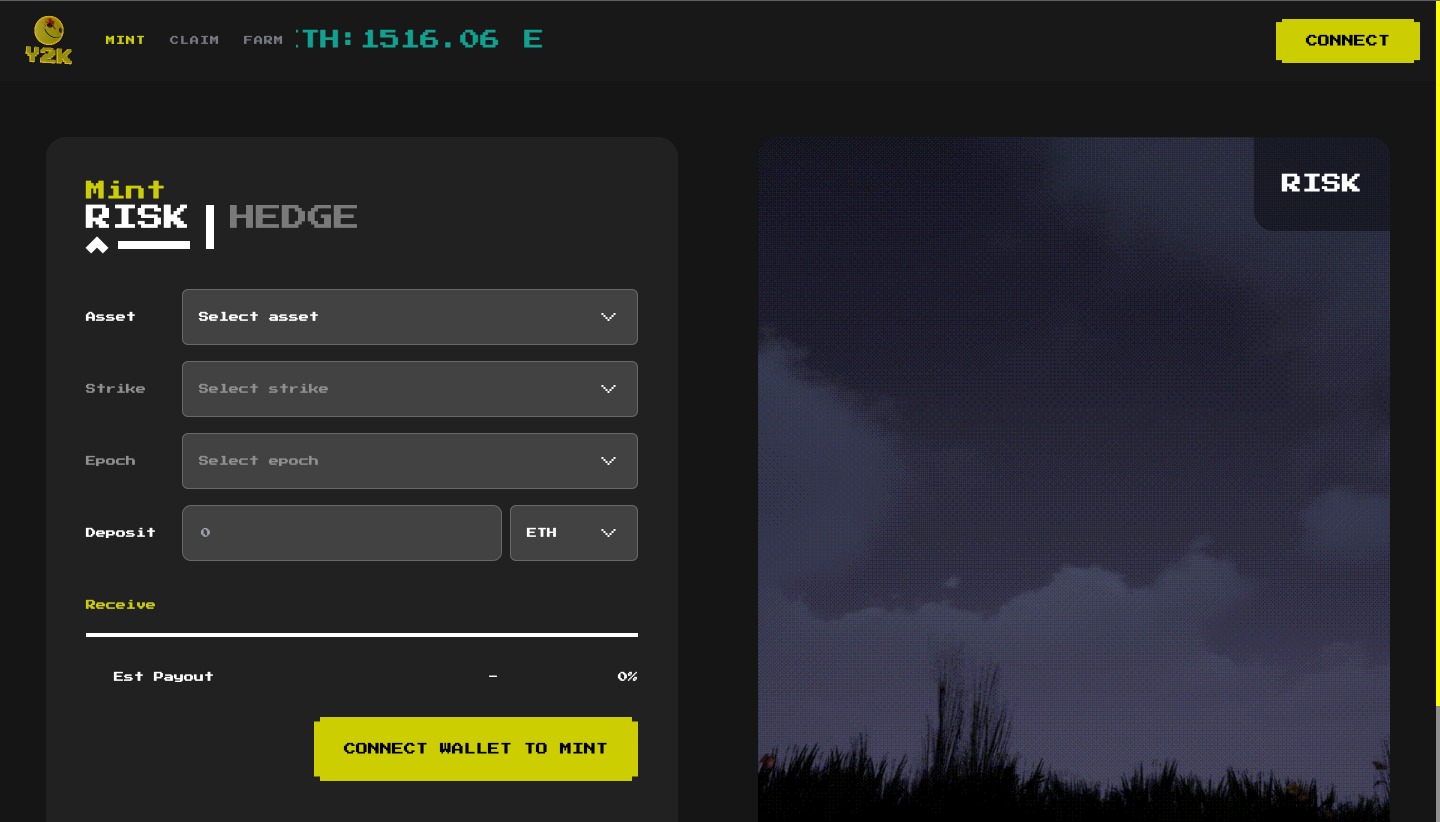

Y 2 K Finance($Y 2 K)

Y 2 K Finance is a protocol for building derivatives around pegs to "stable" assets. Their main product allows users to hedge against the unpegging of stablecoins, such as the recent USDC event. More products are coming soon.

secondary title

Crypto Volatility Index($GOVI)

Crypto Volatility Index is an index protocol for building cryptocurrency volatility, or a decentralized market fear index for cryptocurrencies. CVI allows users to bet on market fluctuations without choosing the direction of up or down.

secondary title

FactorDAO($FCTR)

FactorDAO is a protocol that allows users to create tokenized baskets of multiple assets that can also replicate other portfolios, market-neutral strategies, and more.

secondary title

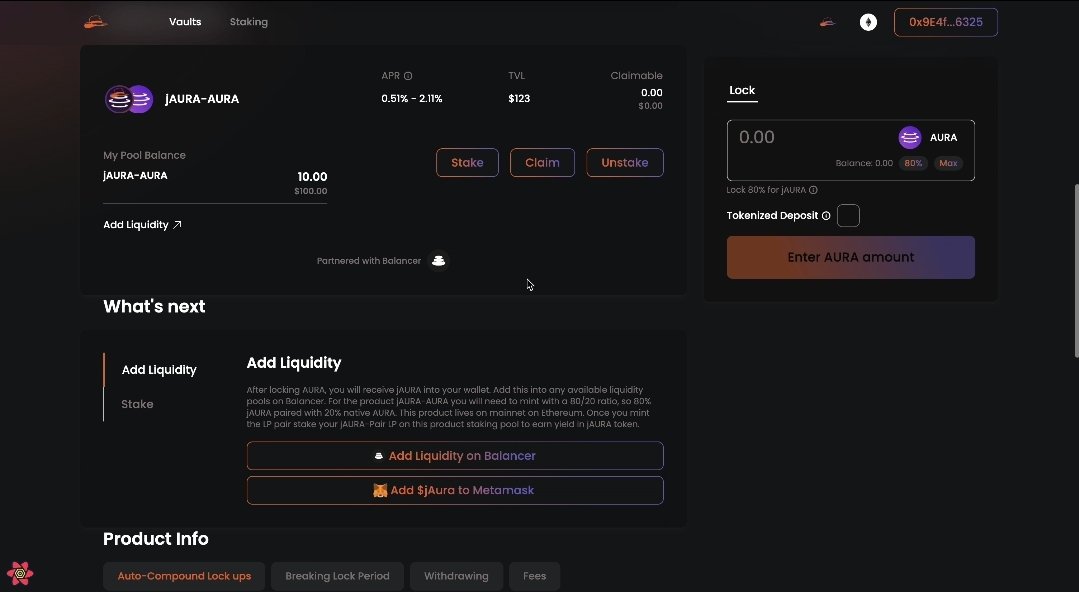

PlutusDAO($PLS)

PlutusDAO is a veTokens governance aggregator protocol on Arbitrum.

secondary title

Ipro Protocol($IPRO)

Ipro Protocol is a protocol that allows users to speculate and hedge on DeFi rates, earn stablecoin yields, and receive retroactive rewards.

secondary title

Vesta Finance($VSTA)

Vesta Finance, a lending protocol, has now also launched its own stablecoin $VST. Users can lend $VST with ETH, gOHM, GMX, GLP or DPX.

secondary title

Kromatika DEX($KROM)

Kromatika DEX is a DEX aggregator with no price slippage, no front-running robots, and no gas fee model. It also offers perpetual contract trading with up to 100x leverage, more than 70 cryptocurrency pairs, and low transaction fees.

secondary title

WINR Protocol($WINR)

WINR is an infrastructure for building GameFi, P2E games, and its core is a liquidity pool (WLP).

secondary title

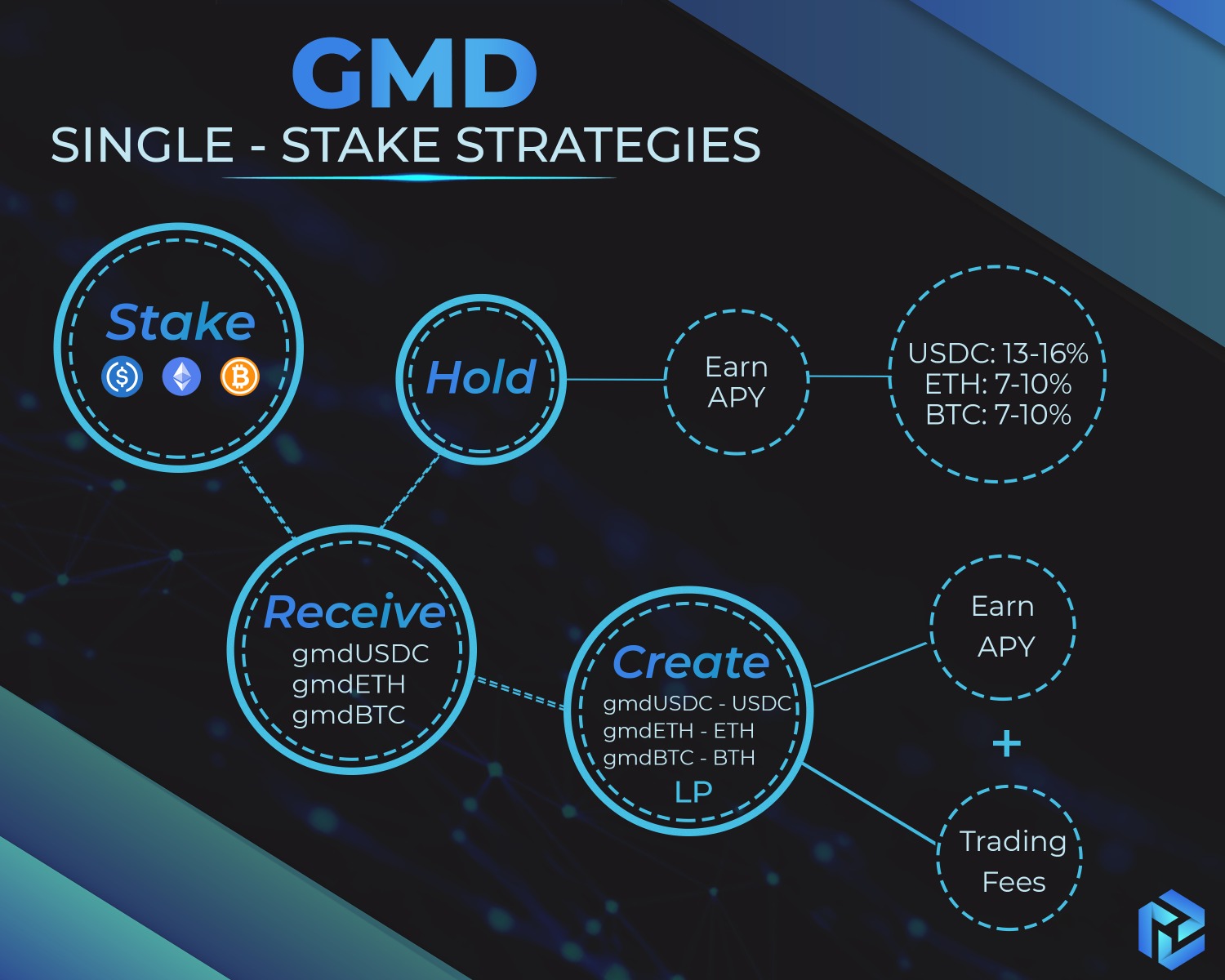

GMD Protocol($GMD)

GMD offers a Delta-Neutrail single asset vault built on top of $GMX and $BFR, allowing LPs to profit from fees incurred by integration agreements while hedging other risks.

secondary title

BetSwirl($BETS)

BetSwirl is a GambleFi protocol that provides its users with fair odds via Chainlink's randomness. It is currently live on Avalanche, Polygon, BSC and will soon be deployed on Arbitrum. With more than $1 million in bets on the protocol last week, it's clearly getting more attention.

According to the "Notice on Further Preventing and Dealing with the Risk of Hype in Virtual Currency Transactions" issued by the central bank and other departments, the content of this article is only for information sharing, and does not promote or endorse any operation and investment behavior. Participate in any illegal financial practice.

risk warning:

According to the "Notice on Further Preventing and Dealing with the Risk of Hype in Virtual Currency Transactions" issued by the central bank and other departments, the content of this article is only for information sharing, and does not promote or endorse any operation and investment behavior. Participate in any illegal financial practice.