Dear friends, welcome to SignalPlus Daily Morning News. SignalPlus Morning News updates macro market information for you every day, and shares our observations and opinions on macro trends. Welcome to track and subscribe, and follow the latest market trends with us.

Dear friends, welcome to SignalPlus Daily Morning News. SignalPlus Morning News updates macro market information for you every day, and shares our observations and opinions on macro trends. Welcome to track and subscribe, and follow the latest market trends with us.

Recent investor sentiment (for regional bank stocks)...

Source: Simon Baker's boardroom scene - from the film Margin Call (2011)

Longtime moviegoers may remember this classic scene from the movie Margin Call (2011) where some "imaginary" bank is debating what to do with their holdings of MBS assets, which will soon be worth far less It is reasonable to think of the shadow of this scene when stock investors see the financial situation and subsequent troubles of Silicon Valley Bank.

As Silvergate's collapse was fairly quick, the market realized and began to focus on the mark-to-market losses in the banks' AFS (Available-for-Sale Securities) portfolios, which refer to the "high quality" assets held by the banks themselves, which they had to hold (Usually) different forms of fixed income bonds to meet regulatory capital requirements. Overall bond values have fallen sharply over the past year as the Federal Reserve has continued to raise interest rates, yet rapid deposit flight and a general loss of market confidence have forced banks to incur significant losses to sell these assets.

Silicon Valley Bank (SVB), which has a balance sheet of over $200 billion and primarily serves fintech startups, just announced yesterday that it sold $21 billion in bonds at a loss of $2 billion (about 10%) to support liquidity. The market was surprised, compared with the bank's net income of only $1.5 billion in 2021; moreover, SVB announced plans to issue $2.3 billion in new shares to cover losses, causing its shares to plunge 60% and dragging regional bank stocks down 8.5%, and the SPX is also down more than 2% from its session high.

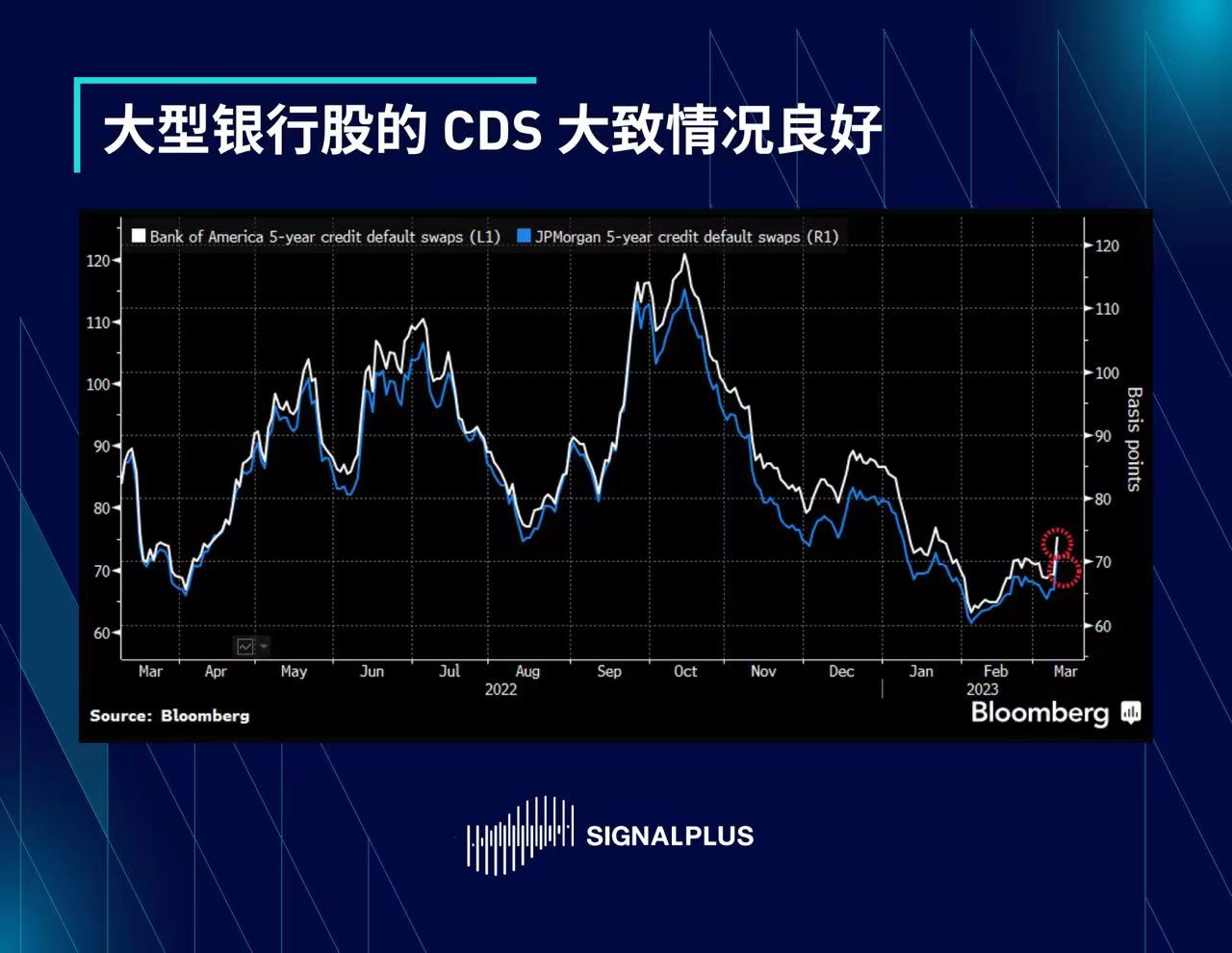

SVB has a good liquidity structure with a 15% Tier 1 capital coverage ratio, a manageable 40% LTV ratio and a 100% deposit liquidity coverage ratio, as well as $120 billion in liquid assets, which is significantly higher than the global financial crisis The previous bank was in a much better situation in the Lehman/MBS/CDO era. In some respects, the overall operation of the bank is still in line with the established rules of the system. The asset portfolio is hit by a 10% loss and is compensated by capital injection. Small Deposits are fully insured by the FDIC, so damage should not spread system-wide.

However, in the post-Lehman, FTX, Silvergate period, investors were hypersensitive to signs of bank runs, and in fact Peter Thield, a prominent investor and co-founder of Founders Fund, a venture capital fund, has advised all his portfolio companies to move from SVB's divestment sent SVB shares down 22% after hours after plunging 60%.

Again, while we haven't seen a widespread credit crunch event across the U.S. banking sector, we believe banks will continue to be diluted and suffer losses, and many banks will be forced to raise capital to shore up their balance sheets and restore investor confidence . In a post-GFC world, regulated banks need to hold a certain amount of eligible assets to meet capital requirements, most of which are longer-dated bonds, as banks desperately need yield under ZRP/QE and These positions are now in the hundreds of billions of dollars in unrealized losses across the U.S. due to rapid rate hikes by the Fed (yields rising and prices falling); The Bank of England's quantitative easing repeated and led to losses in its Liability Driven Investments (LDI), which is basically the same concept, just now happening in a different form in the US market

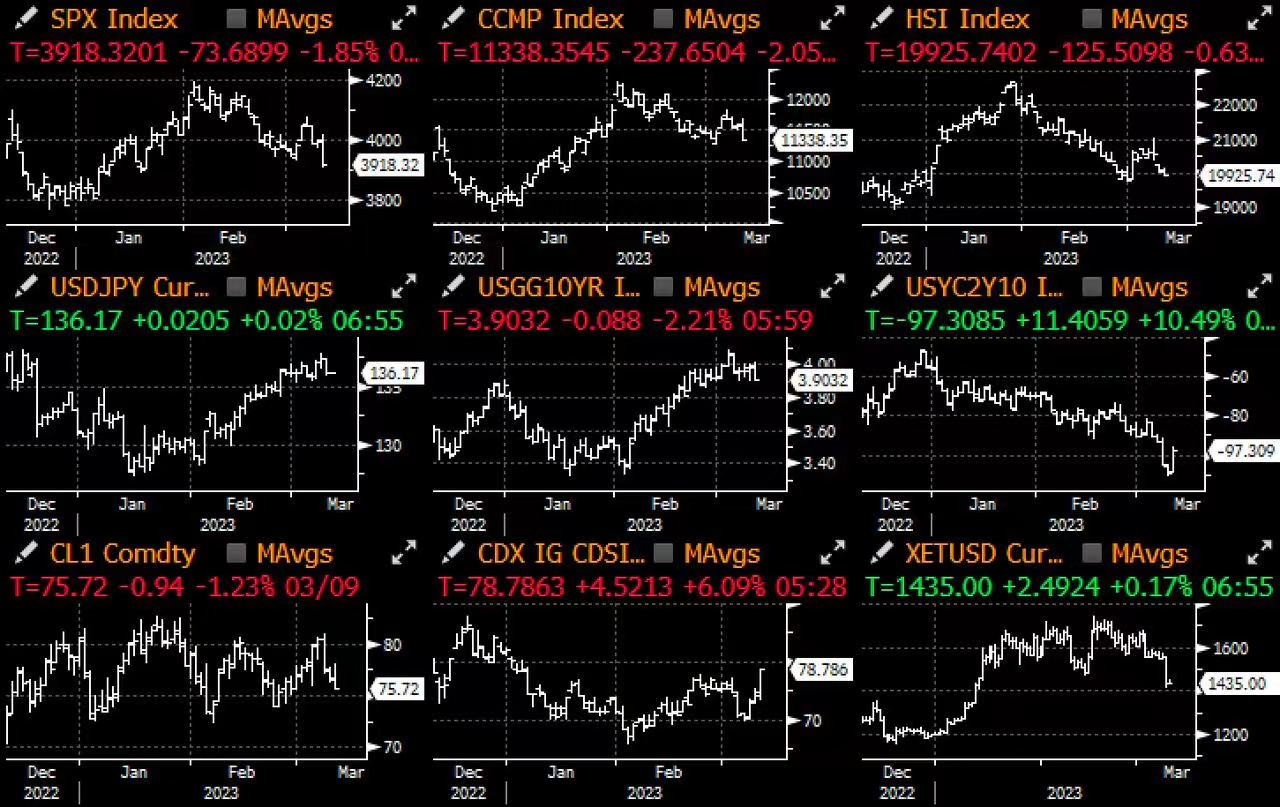

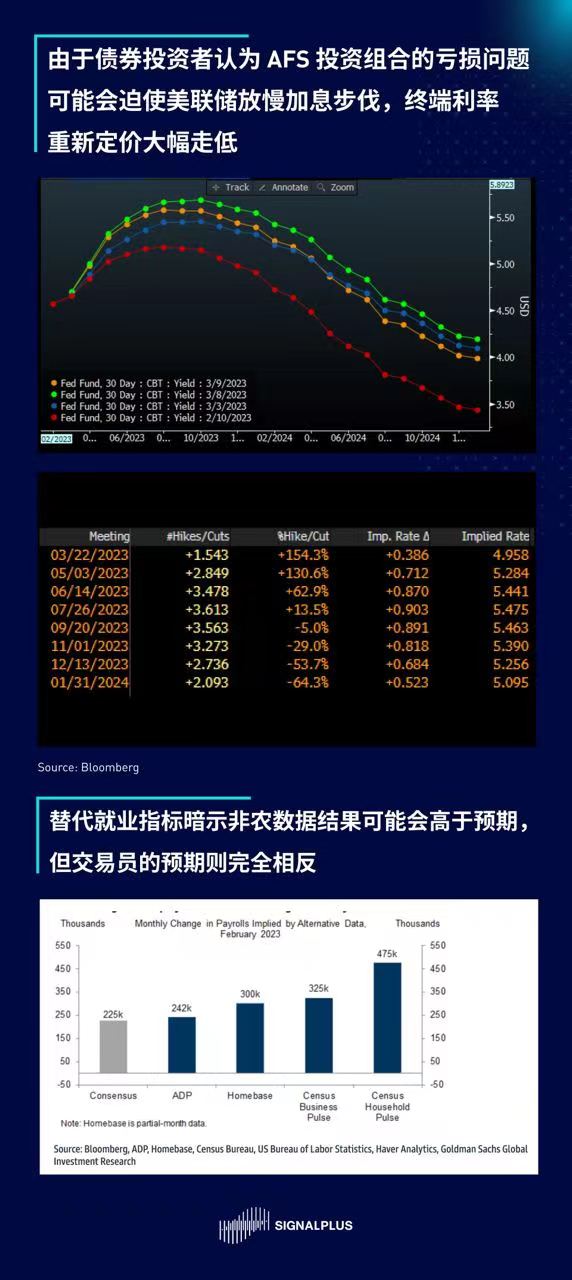

Proving once again that the unintended consequences are always worst, the Federal Reserve's unprecedented aggressive rate hikes to combat inflation could lead to huge capital gaps on the balance sheets of well-capitalized banks, and due to the US SEC's scrutiny of cryptocurrencies The balance sheets of these banks are now under scrutiny due to the crackdown from the crisis and the impact of the Silvergate liquidation. Also, as always, fixed income markets are keenly aware of the first signs that may finally force the Fed to be less hawkish, with terminal rates down 22 basis points and markets pricing in a 50 basis point rate hike in March as unlikely as before A one-day high of 65% fell to around 50%.

On the data front, Challenger's companies announced the largest 2-month increase in layoffs since 2009, initial jobless claims of 211,000 (over 200,000 for the first time in nearly 2 months), construction worker vacancies in JOLTS data These data results have interest rate traders suddenly becoming wary of the possibility of a surprise downside in today's non-farm payrolls data; however, Wall Street economists seem to see the opposite, seeing the data The result will be slightly higher than market expectations. This could be one of the most important NFP 50/50 bets ever, especially after a very hawkish Powell Fed on Tuesday/Wednesday and now the focus is on the AFS issue.

The S&P 500 saw a 2% back-and-forth yesterday, with a short squeeze due to weak jobless claims, and the index broke upwards to 4016, with a chance to clear most of the shorts ahead of Friday's non-farm payrolls release, however, the market then traded in It was down more than 100 points on the day and ended at a 7-week low in a puzzlingly delayed reaction to SVB's news as it surfaced early in the morning session, but it wasn't the first time stocks have reacted to the Slow response to macro inflection points. In the end, 95% of the S&P 500 constituent stocks fell, led by financial stocks by 4%, and the stock market VIX index finally woke up, soaring about 4 points after a month-long hibernation period; as the market has been very bullish in the past few weeks , the CBOE put/call ratio hit its lowest level in 3 years, which is a very dangerous situation ahead of the release of the non-farm payrolls data. .

As the risk sentiment of TradFi cooled down, the price of cryptocurrency also fell sharply. BTC dropped to the level of 20,000 US dollars, and ETH was close to 1,400. single-day scale. Implied volatility and RV momentum have also soared, while the underlying fundamentals of cryptocurrencies are still quite fragile, and there are many headwinds in terms of regulation and TradFi risk sentiment, once again proving that building downside protection strategies through options is currently a better choice.

Finally, we believe that many markets are currently in a particularly fragile state, and we recommend that readers manage risks carefully during the days when non-agricultural data and CPI are released. Good luck!

If you want to receive our updates immediately, welcome to follow our Twitter account @SignalPlus_Web 3 , or join our WeChat group (add a small assistant WeChat: chillywzq), Telegram group and Discord community to communicate and interact with more friends.

Website: https://www. signalplus. com/