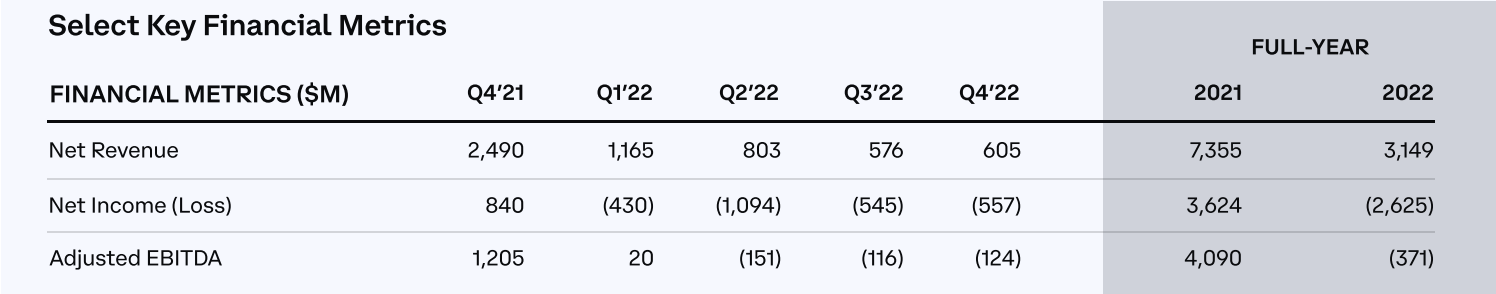

Recently, Coinbase announced its financial report for the fourth quarter of 2022, with revenue for the quarter of $605 million, compared with Wall Street analysts' forecast of $589 million.

Although the financial report data performance exceeded market expectations, in the context of the bear market, its data performance has declined compared with the past few quarters, and the transaction volume has decreased by 12% compared with the previous quarter.

In the fourth quarter of 2022, Coinbase suffered a loss of $557 million, and for the full year of 2022, it will lose $2.6 billion, while generating a profit of $3.6 billion in 2021. This comparison also reflects the difficult dilemma that Coinbase is in as a representative of a compliant exchange.

Coinbase shares fell 4.8 percent intraday following the news, before rising more than 2 percent after hours.

secondary title

The overall revenue declines, and the proportion of service revenue increases significantly

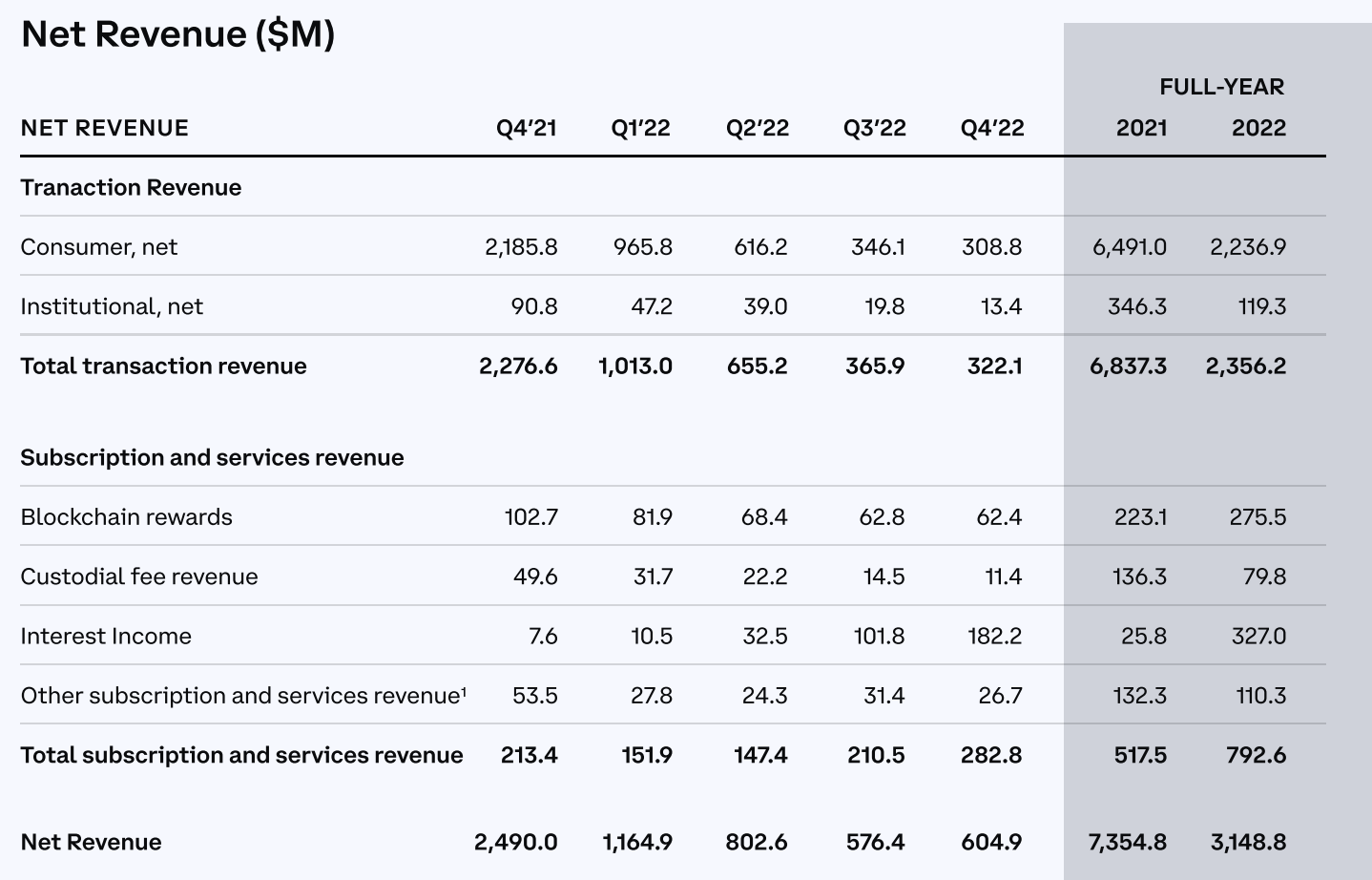

The financial report shows that Coinbase’s trading revenue in Q4 was US$320 million, a year-on-year decrease of 68% and a quarter-on-quarter decrease of 10%.

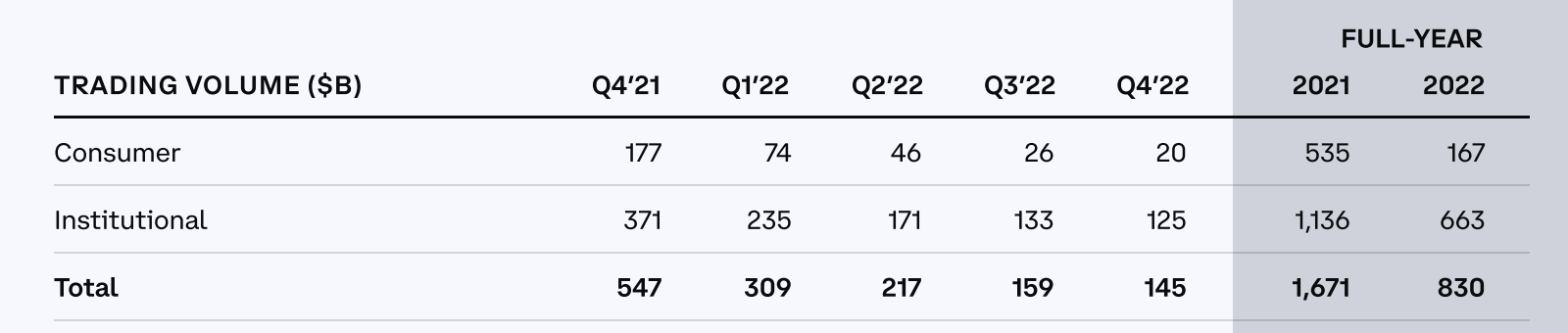

Meanwhile, Coinbase’s trading volumes are also down, falling to $145 billion quarterly from $547 billion a year ago. Q4 volumes for retail clients fell 23% quarter-on-quarter and institutional clients fell 6%.

In 2021, Coinbase's transaction volume will soar from $193 billion in 2020 to $1.67 trillion, before plummeting to $830 billion in 2022. For the full year 2022, the total transaction volume in 2021 is down 51%.

CryptoCompare data shows that Coinbase’s market share has been declining recently, from 5.9% in November last year to 4.1% in February this year. Some researchers pointed out that Binance’s market share has increased during this period, reaching nearly 60% in February this year.

Despite the decline in trading volume, Coinbase's revenue not only did not decline in Q4, but also increased quarter-on-quarter.

As a trading platform, the single income structure has long been one of the main reasons why Coinbase has been criticized. This quarter, however, this phenomenon has improved. Total revenue still rose in the quarter, thanks to a 34% increase in subscription and service revenue. Compared with previous quarters, the proportion of this revenue in total revenue is increasing.

In Q1 of 2022, subscription and service revenue accounted for 12% of total net revenue, 18.3% and 36.4% in Q2 and Q3, respectively, and have grown to 46% in this quarter. The growth of this data is quite important for Coinbase, which means that many investors are "consuming" on Coinbase, which allows Coinbase to earn income even in the context of an uncertain market.

In mid-2022, the market begins to gradually weaken, and so does Coinbasedownsizingcourse. existtwo roundsFollowing the layoffs, Coinbase reduced its workforce by about 35%. Coinbase noted in an investor letter on Tuesday that 2023 will be “a year of regulatory focus, and we believe our strong fundamentals will position us as a net beneficiary of this new environment.” Coinbase said its operating goal is to improve Adjusted EBITDA, which measures profitability before deducting certain costs.

Coinbase CEO Brian Armstrong said on an earnings call that the company has evolved to aim to generate adjusted EBITDA “under all market conditions” rather than operating roughly at breakeven across cycles.

secondary title

Being "targeted" by regulation, but the pledge business only accounts for 3% of revenue

Staking revenue was down from the previous quarter, despite Coinbase reaffirming its belief that its staking products are not securities.

Blockchain rewards revenue fell to $62 million in the quarter, or 10% of net revenue. But much of that revenue was passed on to customers, with blockchain rewards accounting for about 3% of fourth-quarter net revenue when adjusted for spending. Currently, the product with the largest amount of collateral is ETH 2 , with approximately $3 billion as of December 31.

What worries investors more is the regulatory investigation and potential shutdown risks. Coinbase's staking service is under investigation by the SEC. Previously, Kraken faced regulatory pressure, eventually shut down its staking business, and paid $30 million to reach a settlement, which Odaily madeDetailed interpretation。

The token pledge service currently provided by Coinbase involves currencies, which completely overlap with Kraken, and there are five in total: ETH, ADA, ATOM, SOL, and XTZ. Coinbase Chief Legal Officer Paul Grewal emphasized that Coinbase's staking program is not affected by Kraken's termination of US staking services. He said that Kraken is essentially providing income products, while Coinbase's on-chain pledge service is fundamentally different from it, not securities.

secondary title

NFT business blocked, loss amount unknown

Coinbase answered a series of questions about the company's health in its latest earnings call with investors and analysts after releasing its new quarterly earnings report, including how much money the Coinbase NFT platform has lost, whether it has plans to reduce losses, and Coinbase NFT market share, etc. In addition, the cryptocurrency exchange Coinbase stated that it will not withdraw from its NFT project.

According to Dune Analytics data, in the past week, there were only 41 Coinbase NFT sales, and the transaction volume was less than 3 ETH (about $4,900).

Emilie Choi, President and Chief Operating Officer of Coinbase, did not disclose any specific project loss figures, but said that the company will continue to view Coinbase NFT as a valuable project and explore medium and long-term opportunities, but she admitted that Coinbase is now devoting resources to the NFT project Less than in the past, "(We) will not throw in the towel in any way, and the Coinbase NFT team has already started realigning resources."

secondary title

Has the market picked up?

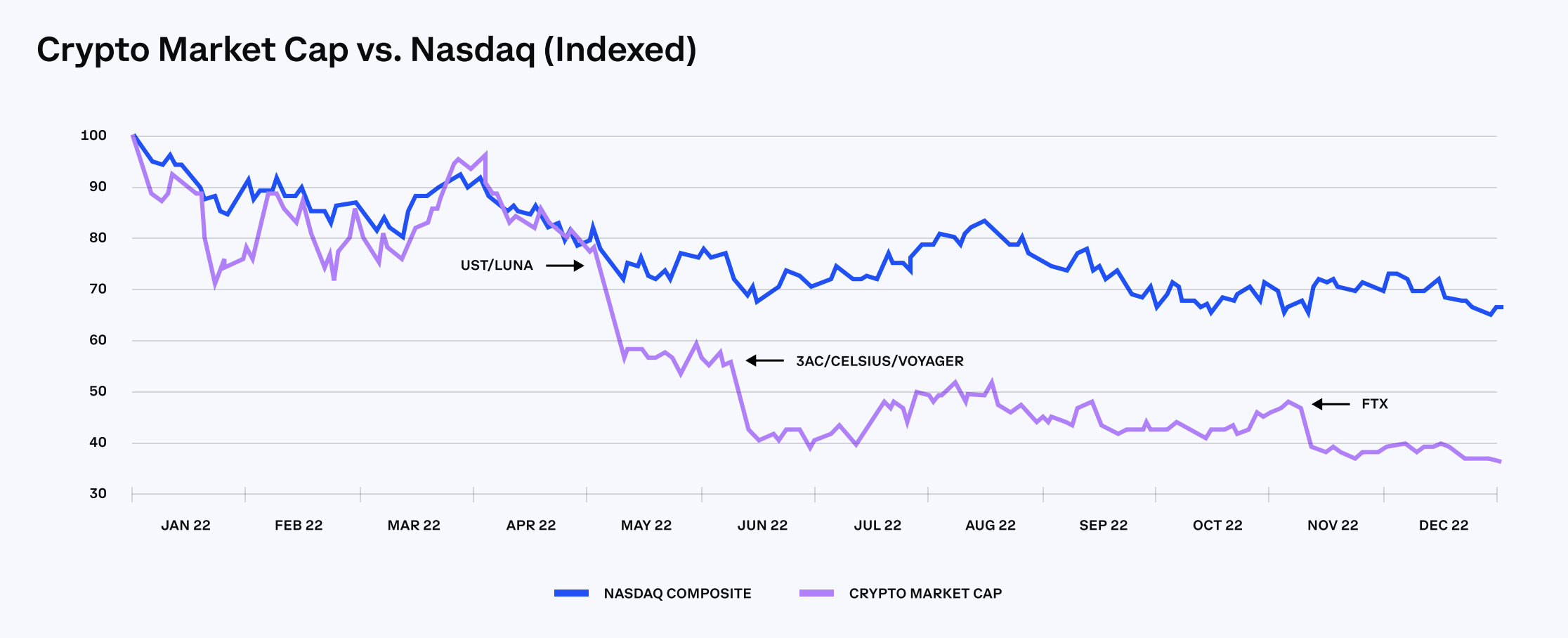

In the financial report, Coinbase compared the total market capitalization of encryption with Nasdaq, and drew the following line chart. It is not difficult to see that every "thunderstorm" event in the encryption world is hitting the market, and Coinbase is also conveying the chill of the entire market to investors.

Things seem to be looking up for Coinbase, though, as the overall market picks up. CFO Alesia Haas said the market has bounced back this quarter compared to the fourth quarter of 2022, and that "market conditions have really changed, even in a single month." Coinbase generated $120 million in transactions in January Fee income, retail clients have returned to the market. We are seeing what we have been seeing in the crypto space. It is overall volatility and market conditions that are driving transaction activity, and these particular events have changed the long-term dynamics that we have seen.”