Original Author: brookbit.eth, Elaine, Dirk

text

Ethereum founder Vitalik tweeted this on July 8, 2022:The first law of tokenomics is: don’t take advice about tokenomics from someone who uses the word “tokenomics”.This sentence is quite confusing at first glance, but after a thorough study, you will actually understand that what God wants to express is:People who are too obsessed with token economics cannot see the overall situation and ensure the balanced development of the protocol.

Indeed, the token economy is certainly a part that cannot be ignored when building an agreement economic and financial system, but as V God said, it is not the whole of the agreement.Imagine a scenario, if you are the founder of a stablecoin project, on Day 1, what things do you need to consider?First and foremost, consider what is missing in the market. Homogeneous projects abound on the stablecoin track, and those that are truly scarce are those that can solve market pain points. Fully research and find out where the real demand for stablecoins in the current encryption market is. This is an important prerequisite for whether the project can have positive externalities and whether it can create real benefits.Second, consider the business model,Do you want to collateralize the stablecoin with fiat currency? Or a cryptocurrency-collateralized stablecoin? Or an algorithmic stablecoin? So how to determine the pledge rate? Which liquidation mechanism to choose? How to set the liquidation parameters?Then comes the incentive design,Should I issue project tokens, and how should the economic mechanism be designed? Which form of financial incentive to choose? Is it to hold and earn? Or staking rewards? What is the appropriate range for transaction fees and incentive parameters?Finally, governance,therefore,

therefore,Don’t limit yourself to the token economy. This is like the Internet is an innovation of science and technology, but it is the proposal of the "Internet +" model that has had a profound impact on the human social and economic paradigm. same,Today's encryption market is no longer a single competition of token economic mechanism, it has evolved into a comprehensive power game in three aspects of "business & incentive & governance" around positive externalities.Only by cooperating with business, incentives and governance well,Explore a set of logical and self-consistent "token +" new economic paradigm,The project agreement can constantly leverage new attention,Be the one to truly “shape the future”.

secondary title

The encryption market has been trapped in the "token economy" for a long time

From a theoretical perspective, the research perspective of "token economics" is relatively single.It is generally believed that it is a term used to describe all factors that affect the value of Token, including supply and demand mechanisms, incentive mechanisms, consensus mechanisms, role definition, technology determination, target group definition, etc. In this ecosystem, because of transparency Sex, consensus, algorithm mechanism, etc., which make the token economy quite powerful. However, the Token-based economic and financial system is a complex open game system with chaotic and nonlinear characteristics. The inherent emergent characteristics of this type of system must be explained with interdisciplinary knowledge such as mathematics, modeling, and computers. Tokens It is difficult for economics to attribute the complex results emerging from the system only from the perspective of economics.

From a practical perspective, the application of "token economics" is also in its early stages and immature.

On the one hand, everyone focused on token economic mechanisms such as supply and demand and incentives, ignoring the importance of business and governance.Of course, this is also understandable. The immature supervision of the early encryption world, the aggressive staking of capital, and the exaggerated bubble of the Ponzi project have allowed every participant in the encryption market to see the wealth accumulation effect brought about by the token economic mechanism. No one has carefully designed the business and polished the governance, because studying the token economy seems to be easier to create bubbles, which has become the default shortcut for the public to get rich. It is human nature to seek advantages and avoid disadvantages. In front of the huge cake, everyone is scrambling to use the token economy to increase leverage. Fomo emotions, gambler psychology, and herd effect are flooding the sky above this dark forest. The consequences of ignoring business and governance are also obvious. A large number of "hit" encryption projects only focus on economics, and in the end they failed to survive a round of market cycles. In contrast, projects like Compound and Uniswap, which have carefully designed their business and polished their governance, have survived to this day even without the leverage of economic incentives. The results speak for themselves, and business and governance cannot be ignored.

On the other hand, the Token project is one of the most complex economic and financial systems, and the industry is still relying on Excel and experience to judge which is better. In the traditional economic and financial system, these are the fields that rely on mathematicians and computer scientists to model to control risks. In contrast, the Token-based economic and financial system is more complex and chaotic, coupled with its adaptive and nonlinear features, making the game and evolution speed of the system unmatched by traditional financial systems, and such a rapidly evolving The ecosystem is still making judgments and qualitative analysis based on experience and Excel, which is really staggering. If the theoretical guidance in the encryption field still stays in the "token economics" of the last round of bull market, it will undoubtedly cause a huge obstacle to the development of the encryption industry today.

This is not to belittle "token economics". We must admit that the development of the token economy has indeed brought about the ICO craze, DEFI Summer, and the "X 2 Earn" carnival. The development of the encryption industry today is inseparable. The power of token economics.However, the industry is developing, and the theory cannot stand still. back to the beginning of the articleVitalik's take: The first law of tokenomics is: don't take advice about tokenomics from someone who uses the word "tokenomics".Essentially, it's notPeople who use the term "token economics",but those: noThere are people who find the positive externalities (creating value) of Token projects and design bad token economics for the projects.

secondary title

Containing the Birth of Risks from the Source——Theoretical Innovation

Token-based economic and financial systems are a complex and rapidly evolving open game system.In the three-body movement, the three subjects interact and interfere with each other, and the emerging nonlinearity, dynamics, and complexity make it impossible for us to give an analytical general solution that accurately describes its dynamic trajectory. And the general three-body problem is often chaotic, that is, if the initial conditions of two three-body systems are only slightly different, in the subsequent evolution process, the dynamic states of the two systems will produce Huge difference. The Token-based economic and financial system involves many different types of subjects such as contracts, agreements, and users.The degree of chaos and evolution speed of the game is much higher than that of the three-body system, so the multi-body system tends to have stronger dynamics, adaptability and emergence. This is certainly not a problem that can be solved by "economics" alone.Symbiosis of single and interdisciplinary research, to conduct integrated research on the system to achieve the breadth and depth consistent with complex nonlinear systems.

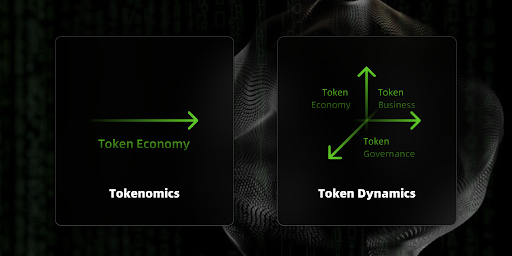

Therefore, we propose the concept of "token dynamics".

Token dynamics, which treats Token-based projects as a complex dynamic system, is a science dedicated to studying the value growth law of Token projects from an overall perspective, and discussing the interactive logic among business, incentives, and governance. relationships and the discipline of studying the various models that a token ecosystem might involve.It will describe all factors that affect the value of the Token project, including but not limited to the business construction logic of the Token project, token incentive mechanism, community governance methods, etc.

Token Dynamics will also integrate research methods in multiple disciplines, opening up a new research perspective on Token-based economic and financial systems.It will consist of industrial and systems engineering, artificial intelligence,optimization and control theory,computer science and cryptography,Economics and Game Theory,Psychology and Decision Sciences, Behavioral Economics (Cognitive Psychology), Political Science and Political Economy,Institutional Economics and Governance,secondary title

The "power" of continuous value growth - self-driven snowball model

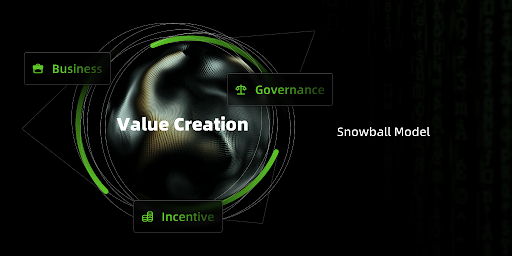

Token Dynamics believes that positive externalities are the core driving force for the value growth of Token projects, otherwise, no matter how big the snowball is, it will be just an empty shell, which will collapse in one blow.

Looking at the previous flash crash projects, we will find that all those that do not have positive externalities will eventually collapse. (However, it does not mean that the collapse is due to the lack of positive externalities. Business, incentives, governance, any link is not properly deployed, and it will eventually collapse. It is just a matter of speed).So what is a positive externality?To put it simply, we regard the project as an independent subsystem. If it provides value to the external system, solves real problems and pain points in the market, meets the actual needs of the market and thus obtains gains from the external system, We think it has positive externalities. However,There are tens of millions of market demands, but it is difficult to find the real pain points.This requires the project party to keep their eyes open, carefully explore the value of the business itself, consider whether the market really needs it, whether the current technology matches, whether the timing of entering the market is appropriate, etc., and even the final ideal realization path must be planned in advance. Many project parties entered the encryption market with a good original intention, but did not seriously examine where the real demand of the market is. They thought that the project had the so-called "positive externality", so they started to make a big fuss about incentives. The "magnification effect" of the currency economy has become even worse.Therefore, exploring positive externalities is the most worthwhile and valuable thing in the current Token project entrepreneurship, and the "project snowball" that is separated from positive externalities will be just "an empty shell".How to find market pain points and lock in positive externalities? This is a profound and grand topic. Its related theories, methods and practices are beyond the scope of this article. We will discuss it with you in the follow-up original series.

In addition to the core power source, a mutually compatible business model, incentive mechanism, and governance system will also greatly reduce the resistance of the "value gear" in the process of advancing, and the "project snowball" can quickly and steadily grow bigger and bigger.

The business and governance of encrypted tokens are as important as the design of the underlying token economy (incentives). Maybe you can start the project by carefully designing a Token incentive mechanism, butWithout a long-term profitable business model and maintaining a stable governance system to optimize the system, your project will quickly fall into a "death spiral".The Token project is neither a sprint nor a marathon. It is more like a directional exercise: through trial and error, the expected goal is gradually achieved. The core of its success is whether it can create continuous value and revenue growth.That is to say, "creating value" is the goal or core of the Token project. Business, incentives, and governance are the basic elements for the project to create value, or they are the three pillars of trust that make up the Token project, and none of them can be separated.

For the Token project:A well-planned business plan can prevent the project from becoming a "castle in the sky".A good business layer design can create a new type of attention black hole, and its positive externalities can ensure that the project will truly take root in the encrypted world;A properly designed incentive mechanism can help the project shape the future to the greatest extent.A good incentive layer design can provide a stable supply and demand mechanism for Token, which will help the community to actively hold and use Token, maximizingbuild consensus, to amplify the influence of the project;A well-crafted governance method can continuously optimize anti-fragility.A good governance layer design can enable the project to continuously evolve independently,Continuously optimized business layer and incentive layer can make the project have stronger "resilience",In this way, it can adapt to the unpredictable market environment and travel through longer market cycles.

Therefore, token dynamics believes that projects with positive externalities can grow rapidly like a "snowball" under the protection of business, incentives and governance.secondary title

Token dynamics - empty talk or full of dry goods?

As we mentioned earlier, the Token-based economic and financial system is a dynamic open game chaotic system that requires interdisciplinary fields to jointly solve its emerging economic security issues. Therefore, we propose the "token dynamics" from the perspective of multi-field integration Learning", which makes the three levels of business, incentives, and governance have professional and mature disciplines to provide specific guidance:

Sound Business Logic - Optimization and Cybernetics in Guidance

Business logic (or business scenario) is the basis for the existence of a Token project incentive mechanism and governance method.Only when the business logic is established, the profit model has a prospect, and the system mechanism is stable and reliable, can there be continuous users, which is also the basis for the project to avoid Ponzi.We need to ensure that business logic can support project development throughout the project life cycle.

In the process of business operation, the parameters and mechanisms of the smart contract of the project are involved.For example, MakerDAO is an over-collateralized stablecoin, lending, storage, user-co-governance and development project running on the Ethereum blockchain. In the selection of the liquidation auction mechanism, MakerDAO mainly considers the English auction and the Dutch auction. English-style auction is also called increasing price auction. The starting price of the lot is the lowest expected price. From low price to high price, multiple bids can be made, and the highest price before the countdown ends. The price is the highest expected price, from high to low, and the first bidder to respond wins and pays the price that was called at that time. For MakerDAO, the rules of the English auction are simple, and there may be super high auction prices. The Dutch auction can be traded in real time, and will not lock up a large amount of funds of users for a long time. The two auction methods have their own advantages and disadvantages, and different mechanisms choose corresponding Different project ecologies have a real impact on MakerDAO's ultimate value realization path. In terms of liquidation parameters, there are key liquidation variable parameters such as step, cut, buf, cusp, tail, etc. How to adjust and adapt is also crucial to the value capture of MakerDAO.

Therefore, it is urgent to introduce optimization and control theory.Optimization and cybernetics is an interdisciplinary study that focuses on the iteration and optimization of systems, involving cutting-edge concepts such as learning, cognition, adaptation, social control, emergence, aggregation, communication, efficiency, effectiveness, and connectivity.For projects like MakerDAO, it can provide a set of scientific design verification methods for the improvement of business logic and the analysis and adjustment of internal mechanism parameters. Compared with the "head-slapping" decision-making, the iterative business plan under the guidance of optimization and cybernetics is theoretically less risky, more logical, and more likely to be recognized by the community.

Effective Incentive Mechanism——Game Theory Guidance

In addition to looking at the white paper, founding team, roadmap and community development, the incentive mechanism is also an important part of evaluating the future prospects of the Token project.Token projects design token incentives around their business and governance frameworks to encourage or discourage various user behaviors.Different users have different target expectations, so the same incentive parameters may produce hugely different incentive results between different user groups, so it must beThe position with the highest cumulative incentive utility finds the balance,It's a bit like a central bank that prints money and implements monetary policy to encourage or discourage spending, borrowing, saving, and money flows, thereby regulating the macroeconomy.

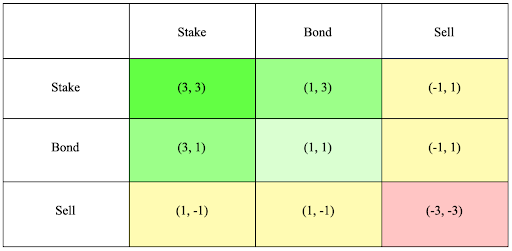

At present, the incentives of the Token project still mainly rely on tokens,game theoryEntered the field of token economy very early. For example, Olympus DAO (OHM) is trying to create a global stablecoin asset backed by encryption rather than US dollars. It uses pledge as the main way to increase the value of its Token OHM to achieve the state of value storage. This strategy is called (3, 3), Its inspiration also comes from game theory.

In the Olympus system, you can Stake, Bond, Sell or combine these strategies. These numbers on the graph are just a visual representation of how beneficial each strategy is to the Olympus protocol, Stake is +3, Bond is +1, and Sell is -1. ( 3, 3) means that Olympus regards pure pledge as the most beneficial strategy for the project, so users use this strategy to earn the most. Combinations of Stake and Bond ( 3, 1) or Sell and Bond (-1, 1) are generally less profitable.

( 3,3) The introduction of game theory played a huge role.Currently, 91.5% of the OHM supply is collateralized - a figure that is probably one of the highest of any cryptocurrency. Game theory is an economic concept that assumes that traders are rational actors who will eventually make optimal choices under certain incentives, such as staking to obtain high returns, mining Bitcoin, etc. The case of OHM allows us to see:Game theory provides a more scientific and complete methodology for the design of incentive mechanisms, making the system goals and Nash equilibrium tend to be consistent. Token dynamics will also further explore more application scenarios of game theory and tap its greater potential in combination with tokens.

A Complete Governance Plan—Institutional Economics Guiding

In most Token projects, Token holders can already vote to change the rules of the Token project. DAO can passVote to change the number of token incentives for pledgers, or modify risk parameters in business logic, etc.For example, 1 HiveDAO, which is committed to developing public products, decided to decide whether to distribute HNY tokens to motivate tool development contributors who can bring value to the community through belief voting. Conviction voting is a novel decision-making process. Voters pledge Token to support the proposal they want to be approved, and continuously express their preferences. As time goes by, the collective belief continues to accumulate until it reaches the threshold set according to the proposal requirements. When the accumulation of belief exceeds a threshold, the proposal passes and the funds are released. It can be seen that the setting of the governance parameter-threshold has a huge impact on whether the proposal can be passed, and even determines the next development trend of the project and the community. Facing a community network with complex relationships, the community needs to better perceive and respond to the belief voting network in order to make more scientific decisions.

In this situation,Institutional economics can play its strengths.It is the branch of economics concerned with the role of institutions, formal or informal, governed by a set of rules, norms, procedures, conventions, arrangements, traditions, or customs to guide socioeconomic interactions in order to incorporate individual decision-making into organizational decision-making , enabling systems to coordinate toward a common purpose.This is highly consistent with the governance paradigm of the Token project. It can be said that the introduction of institutional economics is the only way to optimize the governance model.

Various disciplines are like "Eight Immortals crossing the sea, each showing their magical powers", laying a more universal and diverse theoretical foundation for token dynamics。

However, the theoretical upgrade is only the first step. To usher in a healthier, freer, and more active encryption world, two problems still need to be resolved.

First, data open source in the encrypted world is not really "open source"."Code is law" is the basic law of the encryption world. The project party will open the actual running code on GitHub, but except for hackers and some professional developers, no one will spend a lot of time and energy to study the running code, which is It has caused a huge "information asymmetry" and is also the main reason why users are unwilling to easily deliver trust. If you can use tools to convert the code logic into a visual model, and display the macro data and laws emerging from the code operation in the form of graphs,Change "Code is law" to "Model is law",Then, all projects will be publicReadable, usable, verifiableThis is the real "open source world" coming.

second, under normal circumstances, the project party will design aI thinkA relatively complete token-based economic and financial system, but a large amount of market evidence shows thatThe real behavior of users is often far from the expected behavior of the project side.This is because, on the one hand,on the other hand,on the other hand,The participation of "people" brings a high degree of uncertainty to the token-based economic and financial system.at last

at last

"Token Dynamics" is committed to providing profound theoretical guidance for the value growth of encryption projects. Only when the public's cognitive foundation is improved, can a more solid step be taken in practice.To solve the problems of Token projects such as "opacity" and "high uncertainty", and truly realize the technical and economic goals of the project, we also need to introduce more reliable practical methods and applications in the stages of conception, design, development and deployment tool.We will continue to introduce you in detail in the follow-up tweets“ Model is law ” And related concepts such as token engineering, in order to contribute to the good development of the encryption market.

TEDAO (Public Account: TEDAO): For reprinting/content cooperation/seeking reports, please add WeChat: tedaoo_ 0 for authorization and indicate the source. In addition, if you have any questions, you are also welcome to consult, communicate and discuss.