In the FTX thunderstorm incident we just experienced, many analysts and researchers tried to gain a better understanding of the whole picture of the incident by analyzing the on-chain assets of FTX and alameda and the capital transactions between them and other entities .

The development history of Web2 tells us that data has become one of the most important means of production.

On-chain data analysis has always been an indispensable and important tool in the blockchain industry. In the early days when public chains were not abundant, data analysis tools were mainly used to analyze simple indicators such as the number of addresses on Bitcoin and Ethereum, the number of coins held, the time of holding coins, and the number of transactions.

With the rise of many public chains, the gradual development of defi, the skyrocketing transaction volume of NFT breaking circles, and the enrichment of social activities on the chain, users have more demand for data analysis on the chain, and the dimensions of analysis have become more complex.

As we all know, the data on the chain is open and transparent, and everyone is equal in front of these data. But this does not mean that everyone has the same amount of information. Differences in the level of data analysis lead to differences in understanding the market, and ultimately lead to different trading behaviors.

How to dig out valuable information from public data is a question that every trader in this industry will think about. Whether it is a small trading fund or a large institution, it is increasingly relying on various analytical tools to make its own investment decisions.

In recent years, many excellent products have emerged in the field of on-chain data analysis, which can easily reach valuations of hundreds of millions or even billions in the primary investment market.

secondary title

Nansen

Nansen focuses on tracking on-chain activities to"Label the address on the chain"And famous, the most famous label is "smart money" - smart money. The smart money labels are the wallet addresses of the elites in the crypto world. Their trading behavior can usually bring a lot of money, and other traders naturally want to follow their trading behavior.

Nansen has strong rapid iteration capabilities. For example, after the rise of the NFT market, it quickly launched a series of NFT-related products and services, such as NFT Paradise, NFT God Mode, NFT Wallet Profiler, etc.

【The main function】

The functions provided by Nansen mainly include portfolio, smart alerts, watchlist, etc. On the main interface of Nansen, you can view the macro data of major public chains, defi data, stablecoin data and the basic situation of the NFT market, including the market value, floor price, transaction volume, transaction value and number of wallets of major NFTs.

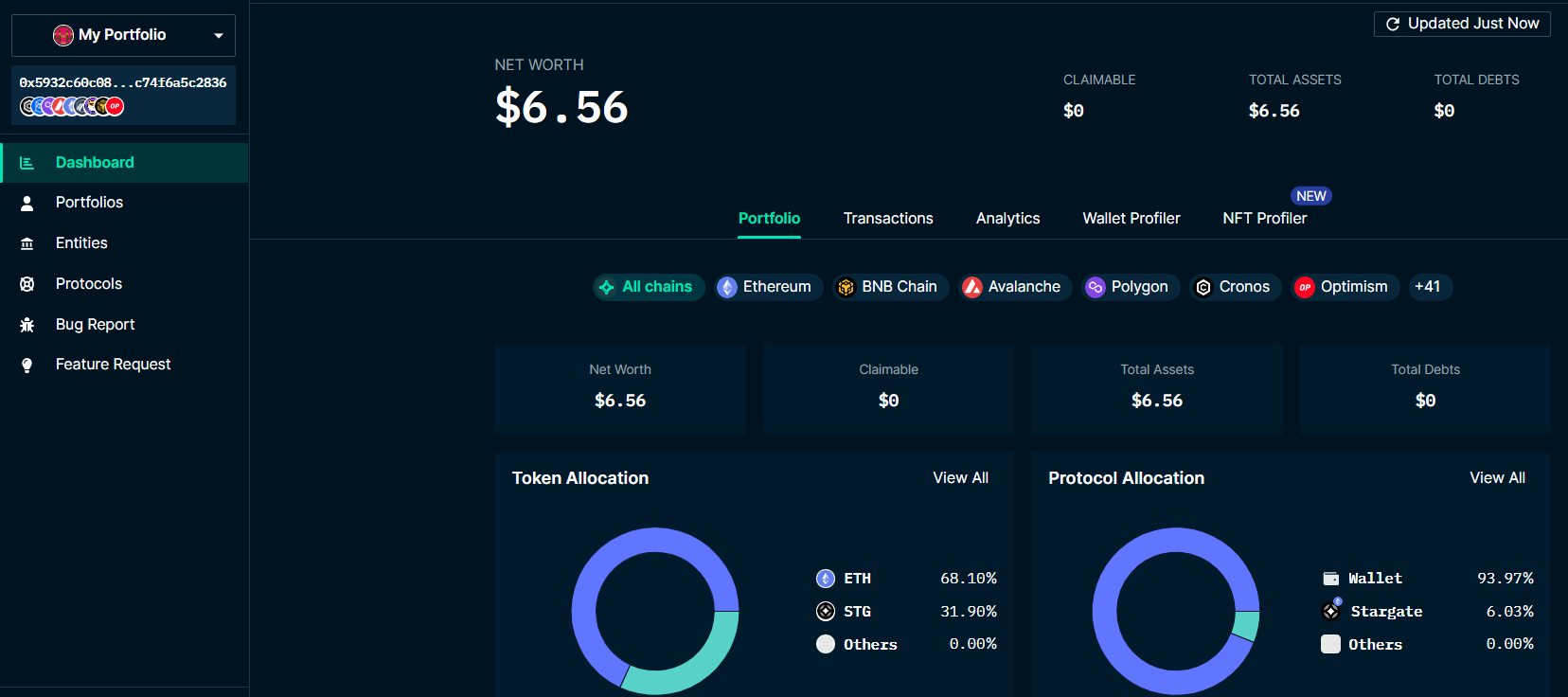

Portfolio: Nansen users can use their wallet address to log in to their website. After logging in, they can view all assets, transaction records, asset analysis, etc. under the wallet address on the page.

smart alerts: Nansen allows users to subscribe to smart alerts, where they will be notified when there is activity at the addresses they are subscribed to.

watchlist: Users can add the wallet address they want to monitor to the watchlist to monitor the movement of the address at any time.

At present, Nansen provides some free functions, but most of the functions need to be paid for, which is also Nansen's main source of income.

[Whether custom data is supported]

At present, the data provided by Nansen are all processed by them, and user-defined data analysis is not supported. Since they are mainly aimed at institutional investors who need highly available data, the data provided are basically finished product data that have been modeled and processed.

【Overlay Blockchain】

Nansen has already supported data on 41 public chains including Layer 2.

【Data Delay】

Minute level delay.

【Research Report】

secondary title

glassnode

Glassnode mainly provides on-chain data of Bitcoin, Ethereum, DEFI tokens, exchange tokens, and some stablecoin data. Their feature is that their attention is relatively vertical, and they only focus on the data on the BTC, ETH, and LTC chains, but for These three chains, especially the Bitcoin chain, provide a variety of rich data indicators that can help users judge where they are in the current encryption cycle.

【The main function】

Provide various modeled data indicators, such as addresses, token distribution, currency holders, fees, derivative interest rates and leverage, exchange funds, miners, markets, profit and loss, supply, transaction numbers, etc., to help users comprehensively analyze the global Market positions and make trading decisions.

[Whether custom data is supported]

Most of the data provided by glassnode are official modeling analysis data, but currently, the dashboard and workbench modules also provide user-defined functions, users can define the indicators they need, and generate charts on glassnode.

【Overlay Blockchain】

Glassnode mainly focuses on the data on the BTC, ETH, and LTC chains, including these three main currencies and mainstream ERC-20 tokens, stable coins, mainstream defi tokens and exchange tokens.

【Data Delay】

Minute level delay.

【Research Report】

secondary title

Token Terminal

Token Terminal focuses on the income of each chain project, including total income, expenses, TVL, and estimated price-to-sales and price-earnings ratios based on income, providing reliable reference data for projects to be valued with reference to traditional companies.

【The main function】

Token Terminal mainly provides income data charts of many on-chain protocols, and also provides data on major exchanges and mainstream chains in the market.

[Whether custom data is supported]

Token terminal now supports the download of all data charts, and also provides an API interface, users can use these data to create their own charts.

【Overlay Blockchain】

Currently, it supports querying data of more than 20 mainstream chains and more than 150 protocols.

【Data Delay】

two days. Since the analysis is mainly income data, which needs to be measured in days, the data delay time is relatively longer.

【Research Report】

secondary title

Eigenphi

This is a tool mainly for data analysis of MEV behavior for DEFi activities. Their feature is to provide real-time token flow, filter out redundant information, connect traders' trading behavior scattered in various Defi protocols, and facilitate users to identify their trading strategies.

【The main function】

Eigenphi provides sandwich attack monitoring, lending and real-time liquidation data monitoring, flash loan behavior monitoring, and MEV real-time token flow display. It also provides tools to monitor current hottest liquidity pools, hottest tokens, and tokens with malicious behavior.

[Whether custom data is supported]

User-defined data analysis is not currently supported.

【Overlay Blockchain】

It mainly supports the data on Ethereum, and there is also some data coverage on the BSC chain, mainly because the Defi infrastructure on Ethereum is more complete, and MEV arbitrage activities are relatively more abundant.

【Data Delay】

Quasi real time.

【Research Report】

secondary title

Dune analytics

The characteristic of Dune is that they are an open UGC community, open the original chain data query to users, allow users to use SQL code for custom data analysis and generate their own customized data visualization dashboard for other users to view, but for those who want to For users who customize data indicators, there is a certain code usage threshold. 【The main function】

Provide raw data on multiple chains to users, and users can use SQL language to analyze and publish analysis results according to their own needs.

At the same time, Abstraction is open to project parties, who can process the data of their own agreements and generate customized data analysis charts for users to view.

[Whether custom data is supported]

support. All display data is user-defined data.

【Overlay Blockchain】

Supports data on the six chains of Ethereum, BSC, Optimism, Polygon, Gnosis Chain, and Solana.

【Data Delay】

minute delay.

【Research Report】

secondary title

Footprint analytics

Footprint has similarities to Dune, but also differences. Footprint also opens data to users, allowing users to customize their own data analysis charts, but the data provided by Footprint includes both raw data on the chain and processed data that is easier to analyze and use.

Footprint divides data into gold, silver, and copper categories. Bronze-level data is unprocessed raw on-chain transactions, transfers, activities, logs, etc. data, and silver-level data is NFT, GameFi, and Defi data on multiple chains. , to extract and mark transactions, addresses, etc., while gold-level data is aggregated business-level data, including user portraits, market value, TVL and other data, which can be used directly.

Footprint also provides users with simple charting tools to customize their own data panels without using code.

【The main function】

Provide raw and processed data and charting tools for users to customize their own data analysis panels, and the Dashboard generated by users can also be viewed by other users.

[Whether custom data is supported]

support. There are not only user-defined charts for data analysis, but also official dashboards.

【Overlay Blockchain】

Support data on 16 chains including Ethereum, BSC, Polygon, Fantom, Hive, Avalanche, Arbitrum, Harmony, Boba, Celo, DFK, HSC, IoTeX, Moonbeam, Moonriver and ThunderCore.

【Data Delay】

The delay time of different data ranges from tens of seconds to several hours.

【Research Report】

epilogue

Compared

epilogue

With the formation of a multi-chain pattern (including Layer 1 and Layer 2), the field of on-chain data analysis will be a huge cake in the foreseeable future, and there will be a lot of room for development in the future in terms of depth and breadth.

The current on-chain data analysis products each have their own areas of focus, showing a trend of vertical development. Although there have been several leading products, but if you can find a suitable entry point, it is still possible to kill a dark horse.

Since the data on the blockchain is all open and transparent, the data source does not have a moat like Web2 enterprises, so data analysis tools can only continuously polish their products, perform rapid update iterations, and provide more and better indicators. , to attract users to use.

This track contains great potential and can also bring great value to traders. We are still looking forward to the development of this track in the future.