On August 14, the Polkadot ecological project Acala was suddenly attacked by hackers. Affected by the parameter configuration error of the iBTC/aUSD liquidity pool, more than 1.3 billion aUSD were mistakenly dug out, causing the price of aUSD to be seriously de-anchored, and the price on the chain fell below 0.01 Dollar.

secondary title

1. What was the cause of the incident?

secondary title

2. What is the current situation?

secondary title

3. How to calculate the real loss?

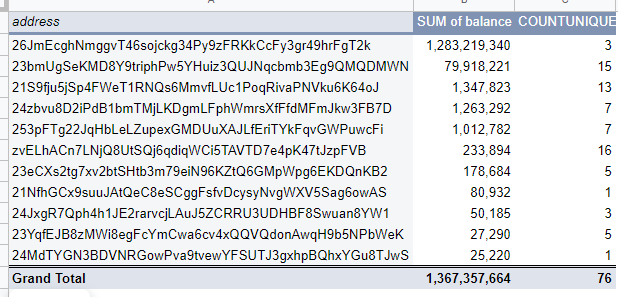

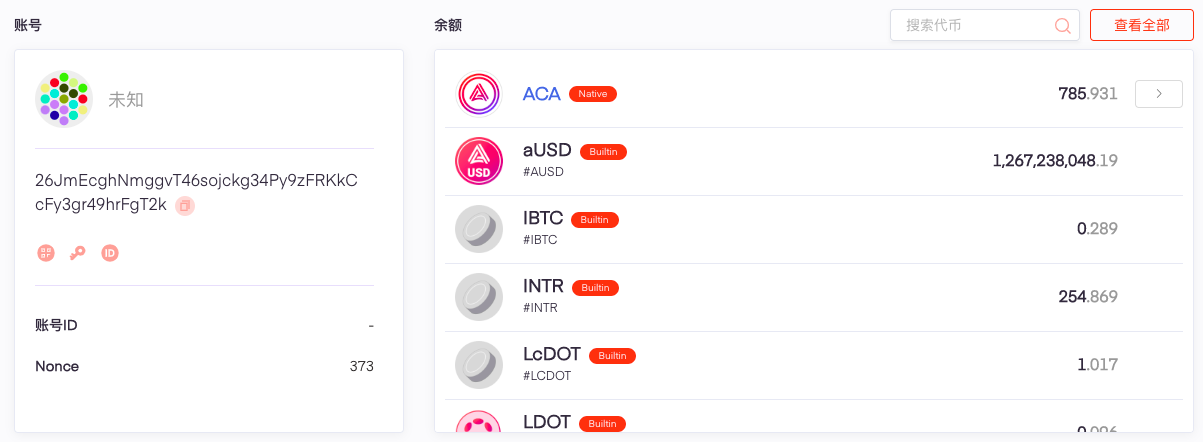

analyzeanalyze。

Although the market attention is basically focused on the super addresses that minted 1.28 billion aUSD, butsecondary title

4. How much money "fleeed"?

Before calculating the amount of "fleeing" funds, let's take a look at the four main ways for funds to "flee":

a. Send aUSD to Moonbeam;

b. Convert aUSD to DOT and transfer to Polkadot;

c. Convert aUSD to iBTC, and then transfer to Interlay;

d. Transfer directly to CEX to cash out.

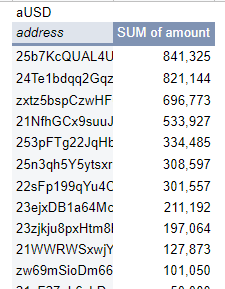

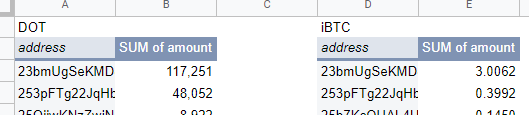

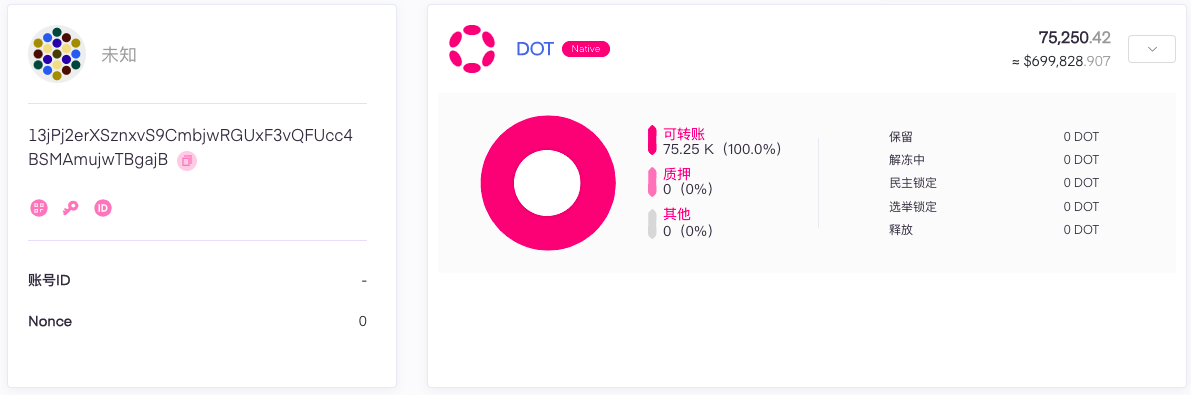

Combined with the statistics on the chain made by Alice and Bob, a total of about 4.6 million aUSD was transferred to Moonbeam; a total of about 1.6 million worth of DOT and iBTC were sent to Polkadot and Interlay. The corresponding main profit addresses of the two methods are 23bmUgSeKMD8Y9triphPw5YHuiz3QUJNqcbmb3Eg9QMQDMWN (165,000 DOTs) and 253pFTg22JqHbLeLZupexGMDUuXAJLfEriTYkFqvGWPuwcFi (3.4 iBTCs); the amount of funds transferred directly to CEX is temporarily unknown.

secondary title

5. Can the outflow funds be recovered?

Currently, Acala is appealing to white hat hackers to return the outflow funds, and has announced the funds recovery addresses on other chains such as Polkado and Moonbeam.

secondary title

6. What is the key to solving the problem?

On the whole, there are actually two problems facing Acala:

One is how to deal with the frozen funds on the Acala chain (aUSD and other exchanged tokens). Considering that this part of funds is in a controllable state, it is not too difficult to solve this problem, but it requires the community to make a collective decision (high probability It is the path of destruction).

The second is how to recover (or fill in) and deal with the "fleeing" funds. Among them, the situation of DOT and iBTC with relatively stable prices is relatively simple. The more complicated issue is how to deal with the funds that have flowed out (such as Moonbeam) and have been traded. aUSD —— If the aUSD issued by mistake on the Acala chain needs to be destroyed, what should be done with this part of aUSD? If it is regarded as 0 value together with other aUSD that needs to be destroyed, how should the incurred transaction loss be calculated?

secondary title

7. Can I buy the bottom of aUSD?

Yesterday, as the price of aUSD fluctuated greatly on CEX, many users began to consider the "risky move" - buying aUSD at the bottom.

simply put,

simply put,Whether you can buy the bottom depends entirely on your expectation of whether Acala can solve the incident, if you believe that Acala can properly handle all the problems, then it is only a matter of time before the recovery of aUSD is anchored, and vice versa, it is just another ending.

Perhaps out of trust in Acala's past word-of-mouth, judging from the current trend of aUSD's gradual re-peg, the market seems to have a relatively positive attitude towards the outcome of the incident.