The NFT market began to explode in January last year, and became a hot spot leading the market last year.

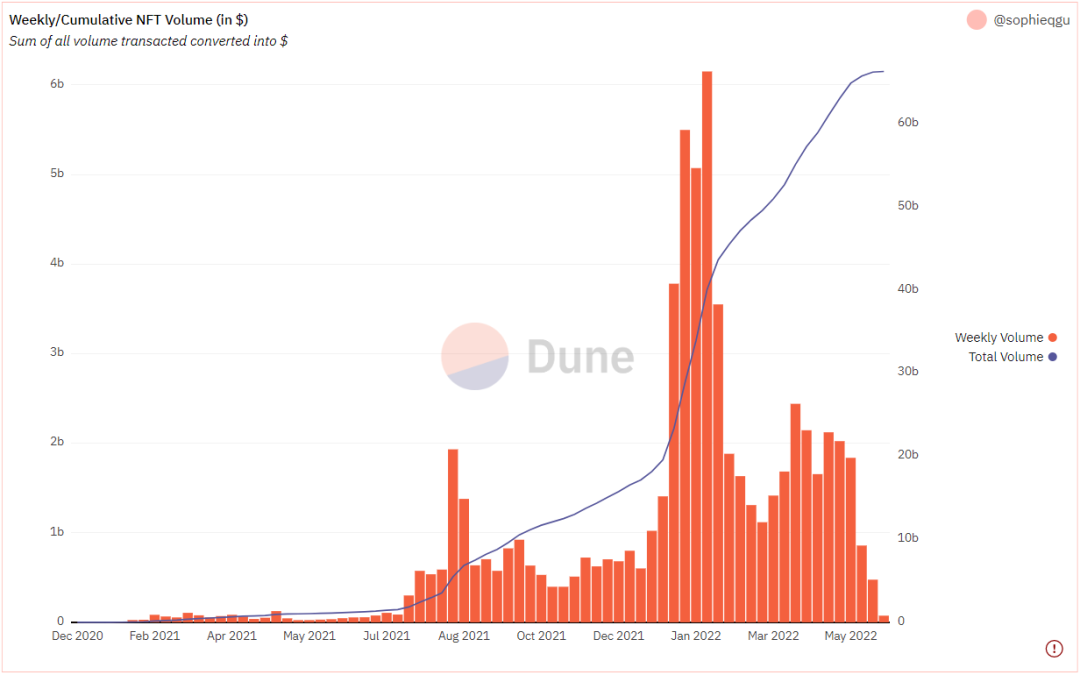

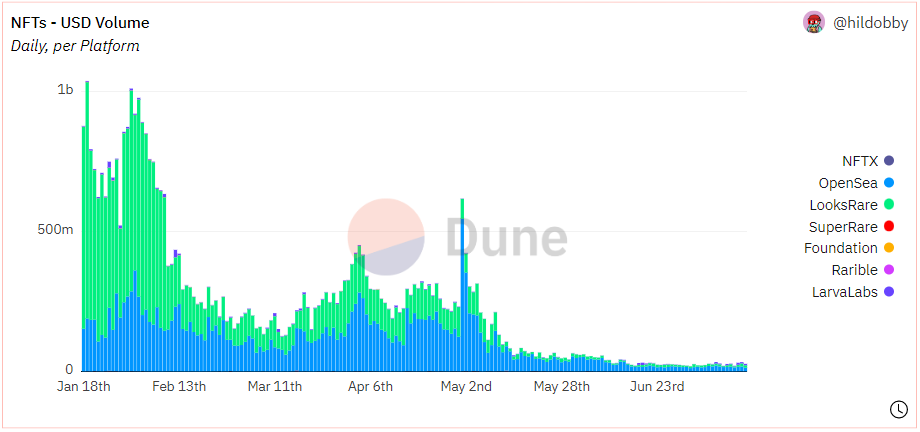

According to data from Dune Analytics, in January this year, the weekly transaction volume of the NFT market reached 6.15 billion US dollars. As of now, the cumulative transaction volume of the NFT market has reached more than 60 billion US dollars. During this time, a large number of popular NFTs have emerged, such as Meebits, CryptoPunk, BAYC, etc. NFT has also led the blockchain industry to break the circle again. We can see that many friends who do not belong to this circle have also changed into NFT avatars, which confirms the popularity of the NFT market.

However, as the entire encryption market began to turn downwards, the NFT market was inevitably affected, and the transaction volume and transaction value began to decline rapidly.

With the shrinking of the overall environment, the NFT market, which originally did not have much liquidity, cooled down rapidly, which put the investors who entered before into a dilemma. The main reasons for poor market liquidity are as follows:

The bar is high. The price of blue-chip NFT, which is relatively popular in the current market, is already very high. The high price threshold makes ordinary investors discouraged, and assets can only be traded and circulated among some users with large amounts of funds. The market that has lost a large number of investors is bound to be insufficiently liquid;

Price discovery is difficult. NFT transactions are currently mainly point-to-point transactions between users. Due to the non-homogeneous nature of NFT, each NFT is unique. Even for the same type of NFT, it is difficult to unify the price.

The current market has not yet formed a good consensus on the price of NFTs, especially the current blue-chip NFTs are mainly pictures, and the pricing is subjective. Different users have very different estimates of prices, and there are no good value discovery tools on the market. , In the absence of fair pricing, it is difficult to facilitate peer-to-peer transactions, and the time for transaction matching is usually relatively long. In addition, the price evaluation systems of blue-chip and non-blue-chip NFTs are also very different, and it is difficult to generalize.

Most NFTs lack practical value. After buying, holders mostly wait for the price to rise before selling, and the lack of application scenarios makes transactions difficult.

These two factors, low liquidity and difficulty in price discovery, interact in turn. The lack of price consensus will affect the transaction frequency of NFT, and if the liquidity of NFT can be improved, the pricing of NFT will be easier after the transaction frequency increases.

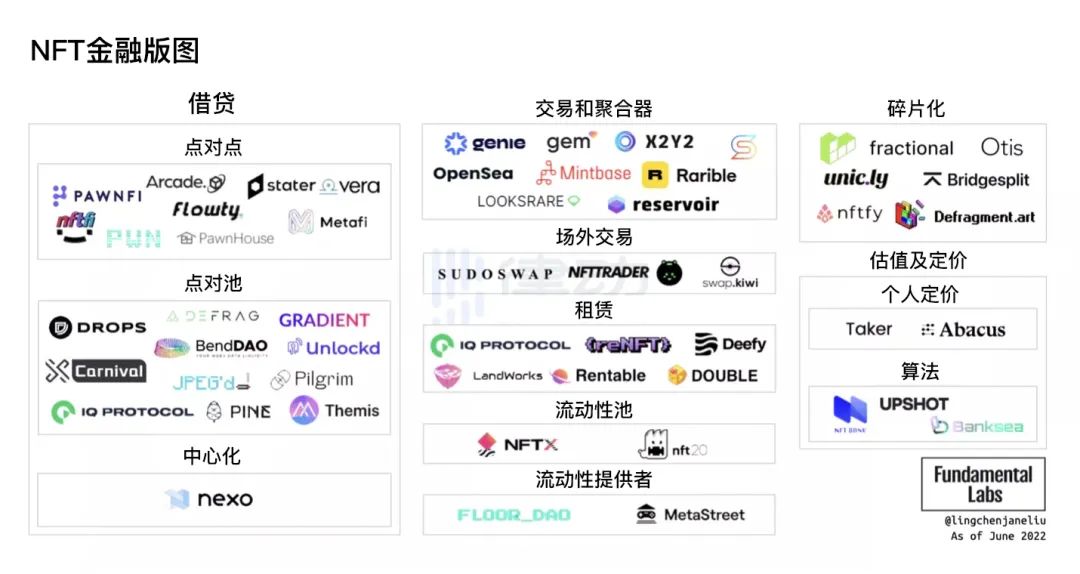

In order to improve the liquidity of the NFT market and revitalize the NFT held by investors, the NFT financial circuit came into being.

Financialization gives liquidity to illiquid assets by converting them into securities-like products. The market began to think that we have experienced the development of the traditional financial industry and witnessed the rise of the Defi industry, so can the NFT industry replicate the path of these industries? For holders of NFT, how to obtain greater value and higher capital efficiency?

text

image description

Image credit: Fundamental Labs

secondary title

1. Transactions and Aggregators

image description

secondary title

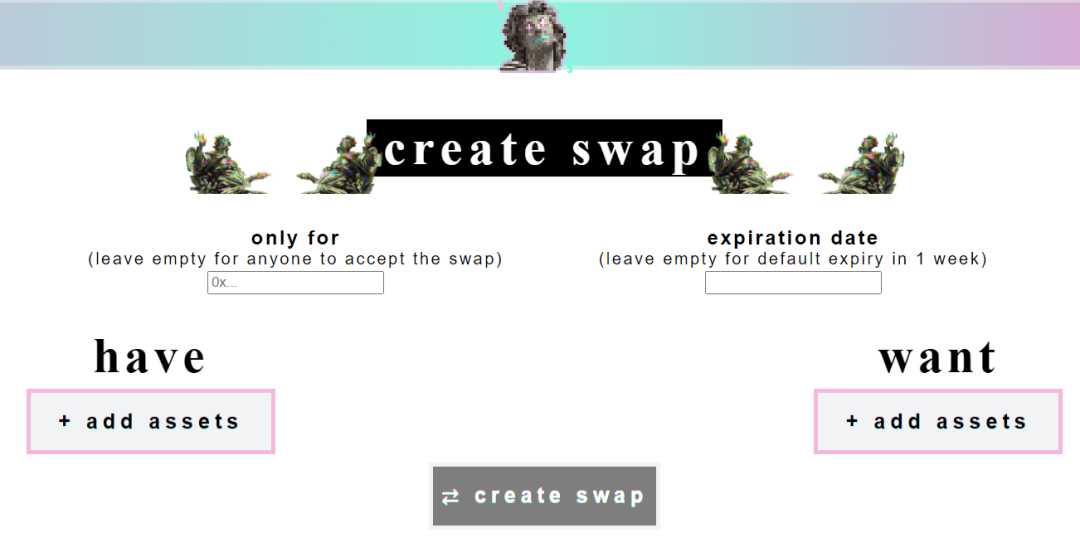

2. OTC transactions

Over-the-counter trading (OTC) refers to the direct transaction between the two parties without going through a third-party platform. Users can create a trade request on the platform and wait for other traders to accept the request or negotiate a price. Users can also create trader-specific deals to sell assets to a trader that has been agreed upon in advance. Participants in the transaction can agree on the details of the transaction through the chat section. When the transaction is confirmed, both parties need to send their assets to a guarantee contract, which will automatically execute the transaction without the participation of a third party. Representative projects in this field include Sudoswap, X2Y2, tader.xyz, etc.

Sudoswap

Sudoswap is a non-custodial trading platform that has no platform transaction fees, optimized gas fees, and can trade ERC-20 and ERC-721 assets at the same time.

Users can create an exchange transaction for a specific object (wallet address) on Sudoswap, add the assets they hold and the assets they want to exchange, and then send the exchange code to the transaction object to complete the exchange.

secondary title

3. NFT lending

Lending products are one of the earliest and most popular types in Defi. Lending products, as the infrastructure of the financial market, will have relatively broad development prospects in the foreseeable future.

NFT loans use NFT as collateral to obtain encrypted funds loans through over-collateralization.

To become collateral, the market requires a certain consensus on the value of NFT. On the one hand, everyone recognizes the value of NFT, and on the other hand, the price of NFT is generally accepted by the market. For these reasons, the NFTs currently accepted as collateral are mainly some blue-chip NFTs, such as CryptoPunk.

The lending business relies on the Loan to Value (LTV) ratio for risk control. When the value of the NFT falls below the value of the loan, the collateral needs to be liquidated, so the valuation and pricing of the NFT has become the basis for mortgage lending. Base. Now there is a common problem of pricing difficulties in the NFT market, which has become an important factor restricting the development of NFT lending.

There are currently three main modes of NFT lending:

1) Peer to peer mode;

2) Peer to pool mode;

3) Centralized mode.

Representative projects include NFTFi.com, DropsDao, Nexo, etc.

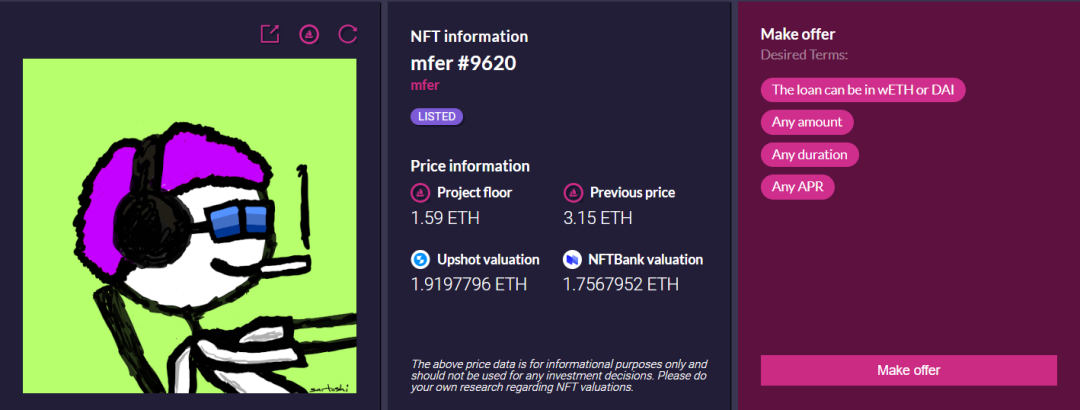

1) Peer to Peer

In the peer-to-peer lending model, borrowers need to place an order to show their borrowing needs, and then find a matching lender.

The current peer-to-peer model has a relatively high interest rate, about 30%-100%, and the loan-to-value ratio is about 50%, that is, an NFT with a mortgage price of 100ETH can obtain funds worth 50ETH.

The disadvantage of this model is that it takes a long time to match borrowers and lenders and match loan needs, and when the borrower is in urgent need of funds, the lender has far more say than the borrower. The representative platform of the peer-to-peer model is NFTFi.com.

NFTFi.com

NFTFi.com is a lending platform launched in 2020. The borrower mortgages the NFT they hold on the platform and shows their borrowing needs, mainly including the loan amount, loan period, interest rate, and the currency in which funds are accepted. Lenders can browse all borrowing needs on the platform, then choose the order they are interested in, and provide loan funds after agreeing on the interest rate and deadline with the borrower. When the loan is due, if the borrower can repay it on time, the NFT will return to the borrower, and if it cannot be repaid, the NFT will be transferred to the lender.

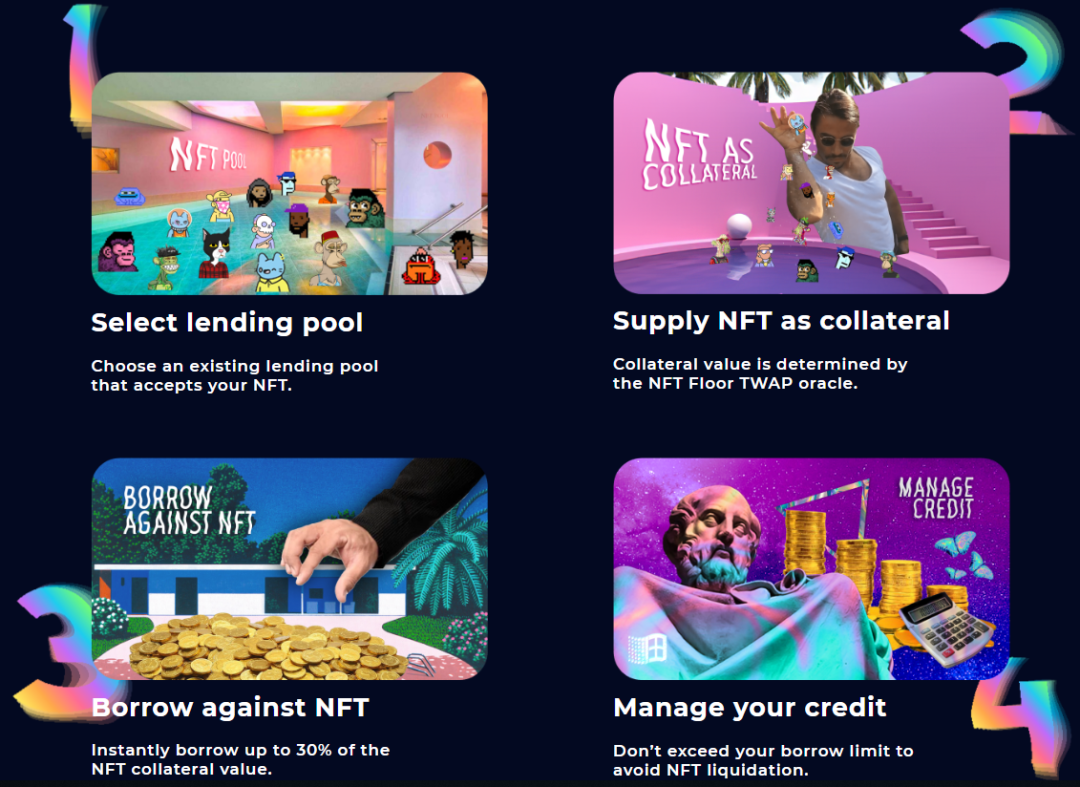

2) Peer to Pool

The peer-to-pool model is that NFT holders mortgage NFT to the NFT pool to obtain loans. In this model, the borrower does not need to wait for a successful match with the lender, the time to obtain a loan is shortened, and the capital efficiency is higher. The point-to-pool model usually also adopts over-collateralization, and the pricing of NFT is based on the floor price data of the series in the market in the most recent period. This model is very dependent on the pricing accuracy of the NFT oracle machine, because the pricing of NFT determines the amount of loans that can be obtained by mortgage NFT, which directly affects the capital risk control of the platform.

DropsDao

DropsDao provides instant loans to borrowers in the model of NFT pool.

NFT holders mortgage their NFTs into the pool of this category. The price of the collateral is determined by the floor price of the category collected by the platform in the market, and then obtain a loan of about 30% of the collateral value. The platform pays a certain amount of interest.

Lenders get interest rewards in the pool by injecting mainstream encrypted assets or stable coins into the pool.

3) Centralization

The centralized NFT lending platform mainly targets institutions, and only provides financial services to large customers holding blue-chip NFTs. A more representative platform is Nexo.io.

Nexo

secondary title

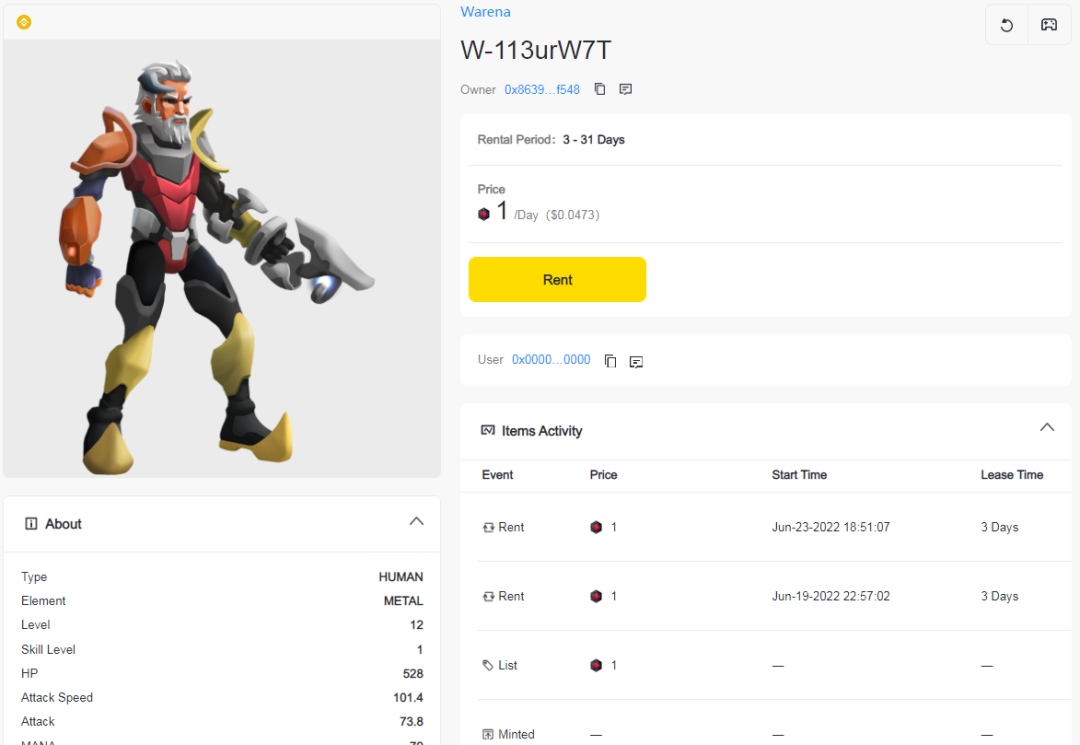

4. NFT leasing

By retaining the ownership of NFT and only transferring the right to use, the lease of NFT is realized, so that idle NFT can generate greater value.

Currently popular NFT types mainly include avatar pictures, domain names, metaverse virtual land, game equipment, etc. Although these types of NFTs have poor transaction liquidity due to high prices, short-term leasing has become another optional value flow method because of their certain use value. For the lessor, they can obtain working capital without transferring the ownership of NFT. For the lessee, they can still obtain the right to use NFT for a period of time without paying a high price.

Representative projects include IQ Protocol, Double Protocol, etc.

Double Protocol

Double Protocol is a leasing agreement mainly for game NFT.

Double's technical team proposed Ethereum's 4907 proposal, which finally passed the review and became the ERC-4907 protocol. This agreement stipulates some lease-related attributes in NFT, such as users, lease period, etc. Through this agreement, the separation of NFT ownership and use rights can be realized, so that NFT leasing has a unified and reliable standard. This is the 30th ERC standard currently adopted on Ethereum. Before this standard was passed, there was no NFT leasing agreement that could be widely used on Ethereum, and leasing-related businesses could only be realized through the development of smart contracts by each project.

secondary title

5. Liquidity pool

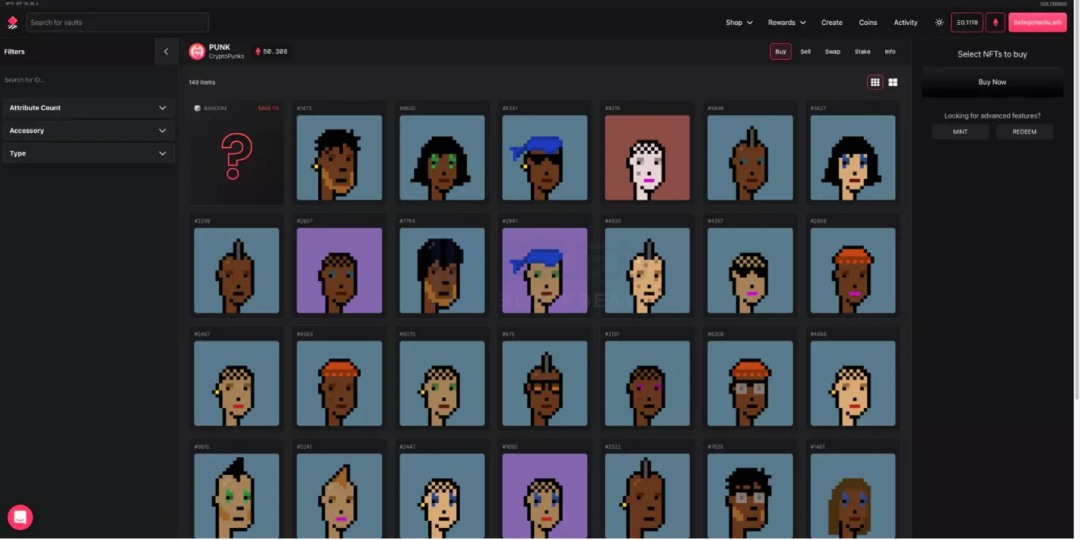

Users can create an NFT vault and obtain transaction fees generated by NFT transactions in the vault by providing NFT liquidity (depositing NFT) to the vault. Representative projects include NFTX, nft20, etc.

NFTX

NFTX can help users convert NFTs that are not convenient for transactions into ERC-20 tokens that are easier to trade.

Users can deposit NFT into NFTX's vault and obtain a homogeneous ERC-20 vToken. Holding vToken can be exchanged for NFT in the vault at 1:1. The exchange of NFT is random or can be Pay an additional 5% service fee to redeem specific NFTs.

image description

NFTX's PUNK Vault

When vToken is traded in the liquidity pool of Dex, it enters the price discovery stage. At the same time, since vToken can be exchanged for NFT in the vault at a ratio of 1:1, it is equal to the value of vToken being endorsed by NFT, and it can also achieve a similar value The effect of bringing together NFTs. For example, if a user thinks that the price of a cypherpunk NFT is lower than the price of PUNK on the market, the user will tend to store the NFT in the library to exchange for PUNK and sell it on the market. In this transaction process, you can gradually discover the floor price of a certain type of NFT.

secondary title

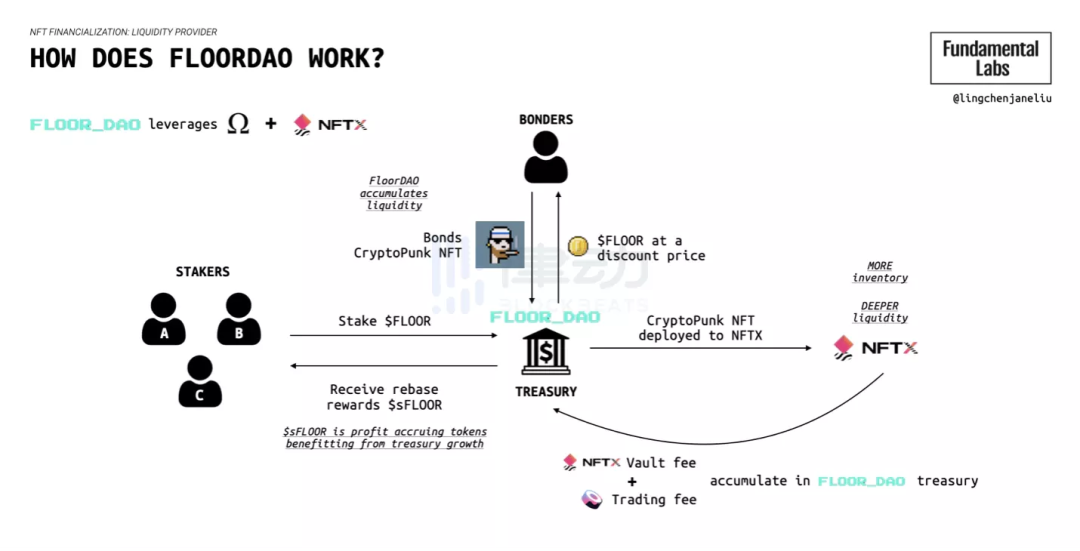

6. Liquidity Providers

image description

FLOOR.DAO

Image credit: Fundamental Labs

FloorDao mainly includes three roles:

a) Creditors

Provide NFT to Floor users, and users can obtain $FLOOR tokens at a discounted price after providing NFT to the agreement.

b) Pledger

After pledgers pledge $FLOOR to the treasury, they can get rewards denominated in $sFLOOR.

c) Treasury

secondary title

7. Fragmentation

As a non-homogeneous token, each NFT is unique and cannot be divided like FT. This feature also limits the liquidity of NFT to a certain extent. But the ownership represented by NFT is divisible.

Fragmentation is to create fragments/fragments of a single NFT, divide the ownership of NFT into multiple shares, and trade them as replaceable tokens, for example, convert 1 NFT into 10,000 FT. This approach improves liquidity by lowering the barrier to purchase. NFT fragmentation is similar to the "share split" in traditional financial markets, by splitting a stock with a higher denomination into several shares with a lower denomination. Similar to Robinhood's case of fragmenting the stock, so that instead of buying a whole Tesla stock, buyers can buy multiple Tesla stock fragments. Representative projects include Fractional.art and Unic.ly.

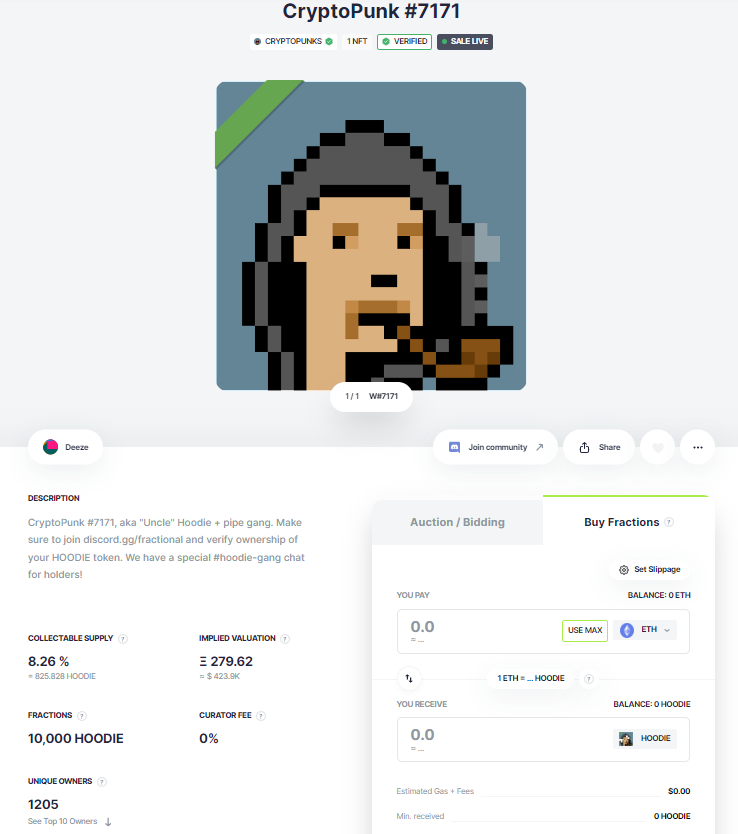

Fractional.art

Fractional.art is built on the Ethereum network and supports NFT collectors to lock NFT assets in smart contracts, and then issue ERC-20 homogeneous tokens. These fungible tokens represent the holder's ownership of the NFT.

Users can set how many FT tokens to divide NFT into on Fractional, and set a reserve price for the deposited NFT. After depositing NFT to VAULT, they will receive the corresponding amount of FT. Deposit a CryptoPunk#7171 in the HOODIE Vault on Fractional, and then receive 10,000 HOODIE. Users can donate these 10,000 HOODIE to others or keep them for themselves. Those who hold these FTs own part of the ownership of NFTs, and all these FT tokens can be used to redeem the deposited NFTs.

When the liquidity pool of HOODIE and ETH is established on DEX such as Uniswap, users can sell HOODIE on it.

secondary title

8. Pricing Valuation

It can be seen from the above that the valuation and pricing of NFT is an important infrastructure of the entire NFT financial industry. Whether it is NFT transactions or loans, it depends on this service. Accurate pricing is crucial to improving the liquidity of the NFT market. role. A sound pricing system can shorten the time for matching buyers and sellers, and can also promote the development of the lending market. At present, many projects are exploring the field of NFT pricing. The main valuation methods are as follows.

a) Oracle

In the Defi project, Oracle is an important link in the operation of the entire system, and it is a relatively common practice to use the oracle as a price reference. Oracle is also widely used in the NFT financial field to realize price links with external markets.

A well-run oracle requires a reliable data source and a reasonable data aggregation method. Currently, the two most used data sources in the NFT field are Opensea's API and NFTX's floor price. Opensea is the most commonly used trading platform in the NFT field, and its price has great reference value, but the way Opensea sellers bid also creates some room for price manipulation; NFTX's floor price discovery mechanism is also mentioned above , relying on the mechanism of homogeneous aggregation, under the action of arbitrage activities, it is easier to eliminate price deviations in NFTX transactions and find a fair floor price for a certain series.

The agreement aggregates the prices from Opensea and NFTX as well as prices from other sources and uses the final result as a pricing reference, which is a common mode at present.

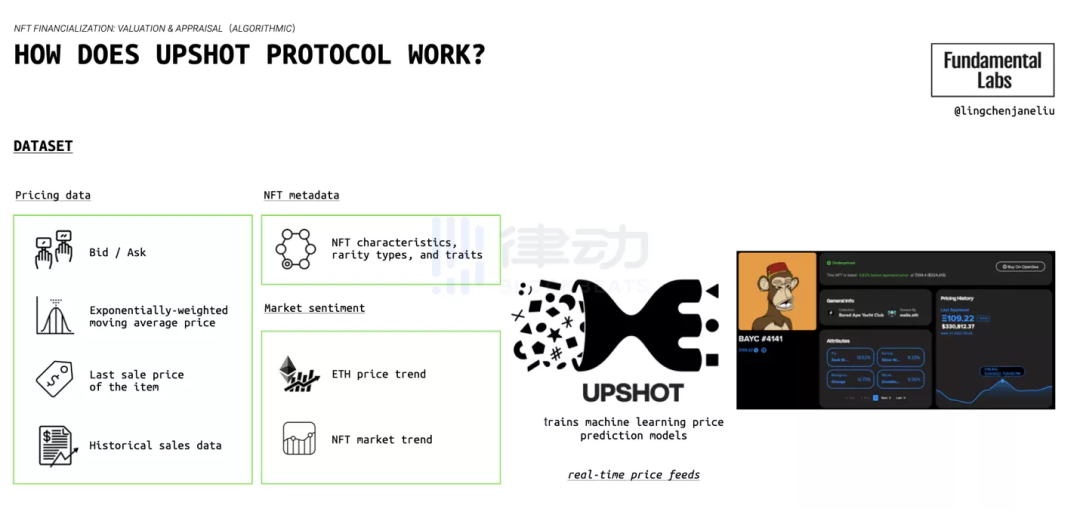

b) machine learning

Some protocols use Machine Learning algorithms to build models, and use past transaction data as input to make valuation predictions. More representative projects include NFTbank, UPShot and Banksea.

image description

Image credit: Fundamental Labs

c) P2P

The P2P model is to conduct NFT price discovery in P2P lending activities.

In the lending activities, the borrower and the lender need to reach a consensus on the price of NFT to complete a match, so the lending platform can also act as a market.

In this market, there is a lot of freedom in price assessment, and it will also be affected by the urgency of the borrower's need for funds, which will lead to a certain price deviation. In addition, the pricing in the lending market is finalized. Once the pricing is completed, it will not change dynamically in a short period of time.

d) rational agent

The Abacus protocol determines the valuation of NFTs through rational actors that maximize profits.

epilogue

epilogue

Due to the lack of liquidity in the NFT market, the need for financialization was born. The market has tried and explored NFT financialization from several directions such as trading, lending, leasing, liquidity pools, and fragmentation. However, due to problems such as difficulty in valuation and pricing, lack of price consensus, and insufficient practicability, these explorations and attempts are still in the preliminary stage.

The NFT market itself is developing and growing, and has also achieved initial breakthroughs. Looking back at the development path of Defi and traditional finance, we believe that NFT finance is a track with great potential. With the continuous improvement of infrastructure and industry innovation, it is believed that more complete solutions will emerge in the future to empower the entire NFT industry.