Even though more and more institutions have adopted cryptocurrencies in this bull market, with the plunge of encrypted assets, there are more and more voices questioning that cryptocurrencies and blockchain are just hype. FTX CEO SBF also shared his views on potential application scenarios of cryptocurrencies on Twitter, including payment, market structure, and social media.

FTX CEO Sam Bankman-Fried (hereinafter referred to as SBF) recently shared on Twitter the potential application scenarios of cryptocurrencies, including payment, market structure (referring to the structure of the financial transaction market), and social media.

first level title

Domestic and foreign payments

SBF pointed out that thanks to the development of the Internet, payment methods have changed from cash transactions in the past to credit cards or electronic payments, but he believes that the daily payment fees are still too expensive. The data he gave here is 1%, but the data pointed out that the current "cash flow handling fee" of mobile payment operators in Taiwan is about 2.2-3%. Of course, the industry also has corresponding discounts, such as point rewards and so on.

If the handling fee for domestic payments is a minor problem, the current dilemma of overseas payments is as obvious as the elephant in the room.

SBF said that the dilemma of overseas remittances is obvious, in addition to high fees, it is also time-consuming:

"A US business wants to send $100 million to a European business, let's say the chosen method is a wire transfer, one day later, your bank executes the transfer, and within the next week, the funds have appointments with 3 or so banks Handling, sometimes the funds are even stuck in a certain bank, and you need to use a certain method to unfreeze them.

Oh, and you also pay 1% for foreign exchange, plus a wire transfer fee of around $50. "

Wire transfers usually also require payment of "FX fees" and "wire transfer fees".

Overseas remittances will involve currency conversion, and foreign exchange charges are surcharges that will occur when customers purchase currencies other than US dollars through foreign banks, usually 1% to 3% of the transaction amount.

The wire transfer fee is the handling fee charged for the transfer.

In addition to handling fees, the current clearing system is not real-time.

SBF said that the clearing of interbank transfer systems and credit card transactions can take as little as one day, and it can take as long as a month. For example, it may take four days for employees to receive salaries remitted by companies; cash.

“These examples are to show that payments are hard. There are many reasons for this, but they all revolve around a core question: What does it really mean to send money to someone? What does ‘settlement’ mean?”

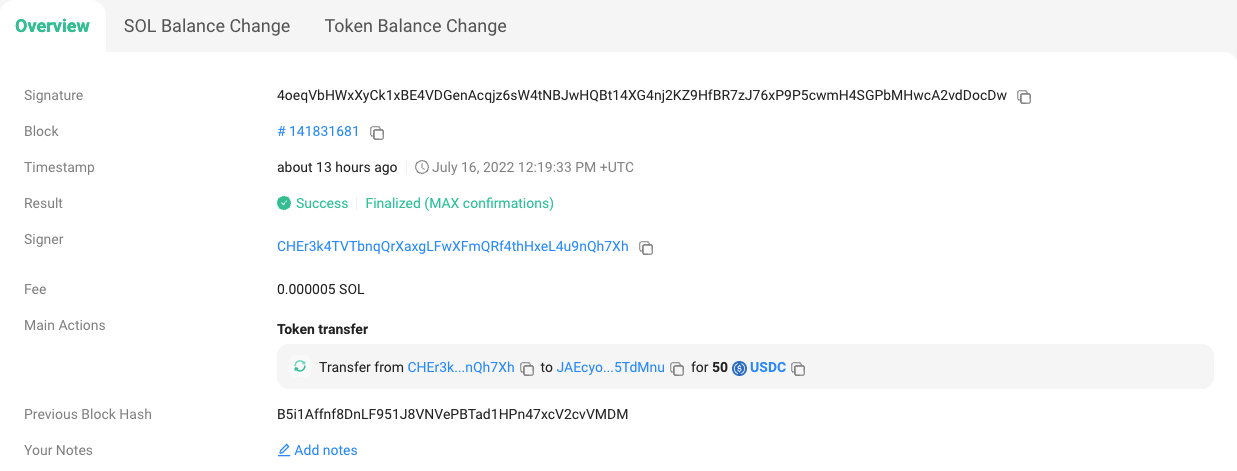

experimentexperiment, created two addresses and transferred $50, the cryptocurrency fee is only $0.0002.

“The blockchain allows anyone to create a wallet that can be used to transfer or receive tokens, including USD stablecoins. These payments take seconds to settle and the fee is less than a dime. No long waits, no account balances settlement uncertainty.”

image description

first level title

Change the structure of financial commodity transactions

Another blockchain application is "changing market structure".

SBF refers to changing the way traditional brokerages operate through blockchain liquidation and "securities tokenization" to simplify the transaction process instead of building a stack of houses.

The current process for retail investors to buy stocks is also quite complicated.

First of all, retail investors will place orders through platforms such as brokers or Robinhood, these orders will not be sent directly to the exchange, but will be sent to PFOF companies¹ (order flow payment), such as Citadel or Virtu .

Some of these PFOF companies may place orders from ATS ², and then the ATS exchange will in turn pass the order to another PFOF company. However, these orders are ultimately placed on the stock exchange and then settled through the DTCC (Depository Trust Company) two days later.

[Note*1]: Order Flow Payment is the compensation a stockbroker receives from a marketer in exchange for the broker sending its client's trades to that marketer.

[Note*2]: ATS can trade listed stocks like an exchange, but does not need to bear regulatory responsibilities.

Assuming that the customer purchases the stock successfully, the stock transfer from the stock exchange to the broker/platform is the following process:

NASDAQ → Clearing Corporation (DTCC) for No. 2 PFOF #2 → ATS → DTCC for No. 1 PFOF #1 → Broker's DTCC.

So, to buy one share of AAPL, there were 10 or so mutual settlements between 11 different entities over the next few days. In theory, each of these liquidations could fail.

The most obvious example was the short squeeze triggered by GME last January.

"On January 28, 2021, most securities brokers were closed. Users were unable to buy and sometimes sell stocks. Even on some platforms, some users who clearly did not have leverage were also liquidated.

It wasn't because the stock was "out of stock" or anything, it was simply a system crash. "

At that time, short-selling institutions aggressively shorted GameStop stock (GME). Seeing this opportunity, retail investors bought a large number of spot and options, causing a short squeeze and causing institutional losses. At that time, many securities brokerage companies urgently suspended trading of the stock.

“On January 28, 2021, retail investors saw heavy stock trading volumes, meaning dozens of counterparties would take days to settle billions in settlements. As GME shares rose, so did potential losses if settlements failed.

In the end, this risk is too great for the broker, so only some trading pairs can be closed. "

So how does cryptocurrency solve the problem?

SBF said that on the FTX exchange, everyone can send orders directly to the exchange, so when securities are tokenized, the purchase cost and time for stock delivery are almost zero.

first level title

Application of social media

SBF believes that the biggest problem with social media at present is "the lack of interoperability".

In short, if you tweet, your friends won't see it on Facebook. In the past, this isolated model could be established because the life circles of different groups were different, but in the age of Web3, it has entered the era of borderless, and the inability to integrate between social platforms has become a major problem.

“Social media networks are siled and there is no interoperability. This means that everyone has to manage 10 different social apps at the same time, which makes our conversations with other people fragmented.”

In addition, the current social network still has "pseudo-monopolies", and social giants can use huge network effects to attack competitors. Another problem is the issue of censorship.

SBF pointed out that if we publish articles/posts on the blockchain, assuming it is Blockchain Twitter (Blockchain-Twitter, BT), then when you post on BT, use Blockchain-Facebook (Blockchain-Facebook , BF) friends can also see this message, because BF can automatically integrate the data of the blockchain.

"By passing messages (meaning posting) through the underlying public chain, we can integrate different social networks. You can use any single platform, but you can still communicate with friends who use other platforms. In addition, you have these messages and Ownership of the network, porting platform A's data to platform B if you want."

This has the added benefit of enabling real competition. Because switching platforms is almost painless, it will promote competition between platforms, which also includes the development of review mechanisms.

SBF said that the potential applications he has seen so far are for payment, market structure, and social media, but this does not mean that the application of blockchain is the only one. He believes that there are many areas that can be innovated, including DeFi or Web3 games.

In the end, he believes that although there are many potential applications and have begun to have some impact, these fields have not yet had a real encryption revolution, so the real question is how to implement it:

"Take a step back and think, how many areas have the crypto revolution happened so far? I think the answer is "not yet."

While cryptography is starting to have an impact, it’s not comprehensive enough, so the real question is: How do we go from a little impact to a really large scale application? "

1) To what end?

Some potential use-cases for crypto.

— SBF (@SBF_FTX)July 16, 2022