Author: HELEN PARTZ

Compilation of the original text: Grain

Bitcoin's experience in 2022cruelest everA drop in price, which fell below $20,000 in June this year after peaking at $68,000 in 2021.

June 2022 Be Bitcoin Since September 2011worst month, The monthly decline reached 40%, and the entire second quarter was the worst quarter in the past 11 years.

However, this sell-off did not cause Bitcoin to crash, and the bear market is not limited to 2022. In fact, Bitcoin has survived multiple rounds of crypto winter since the genesis block was mined in January 2009. Let's zoom in on Bitcoin's price chart and see how the cryptocurrency has historicallyfirst level title

Bear No. 1

In 2011, plummeted from $32 to $0.01

Time to return to previous high:20 months(June 2011-February 2013)

At the end of April 2011, Bitcoin broke through for the first time$ 1The psychological threshold for the first major rally in history was reached on June 8, 2011$32. However, this joy did not last long, because then Bitcoin began to plummet,It dropped to $0.01 within a few days.

Sharp sell-off largely attributed to safety concerns at now-defunct Mt. Gox, a Japanese cryptocurrency exchange that handles most of the bitcoin trades. The exchange had 850,000 bitcoins stolen due to a security breach on its platform, raising concerns about the security of bitcoins stored on the exchange.

The June 2011 flash crash became an important part of Bitcoin's history as it lost roughly 99% of its value in a matter of days. This incident started a long recovery period, and it was not until February 2013 that the price returned to its previous high of $32.

first level title

Bear 2

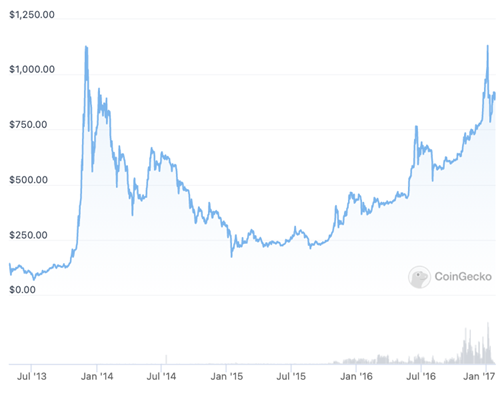

Dropped from $1,000 to under $200 in 2015

Time to return to previous high:37 months(November 2013-January 2017)

According to price data collected by Cointelegraph, Bitcoin hit $100 in mid-April 2013 before continuing to soar, briefly reaching $1,000 in November 2013.

Shortly after breaking above $1,000 for the first time in history, Bitcoin entered a massive bear market. A month later, the price of BTC fell below $700. The main reason for the decline wasDomestically, local financial institutions are prohibited from conducting BTC transactions.

Over the next two years, Bitcoin continued to fall, falling to $360 in April 2014 before hitting a low of $170 in January 2015.

The long crypto winter of 2014 was associated with the hacked Mt. Gox, which stopped all Bitcoin withdrawals in early February 2014. The platform then suspended all trading and eventually filed for bankruptcy in Tokyo and the United States.

Some major financial institutions have also raised concerns about Bitcoin, with the U.S. Commodity Futures Trading Commission claiming in late 2014,"We have the power to control bitcoin price manipulation"。

Prior to August 2015, perceptions of Bitcoin were generally negative. After that, in a strong bull market, Bitcoin finally returned to the $1,000 mark in January 2017,first level title

Bear 3

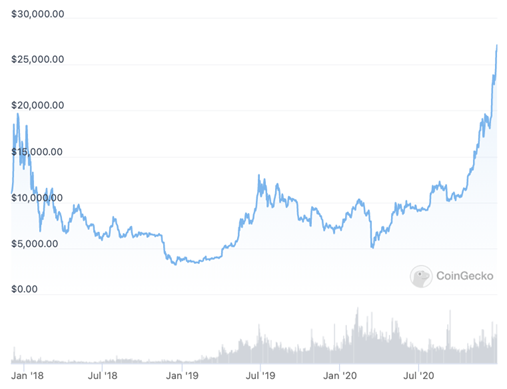

After hitting $20,000 in December 2017, it plummeted below $3,200

Time to return to previous high:36 months(December 2017-December 2020)

After recovering to $1,000 in January 2017, Bitcoin continued to rally, reaching as high as $20,000 by the end of the year.

However, similar to Bitcoin’s previous all-time peak of $1,000, the $20,000 victory was short-lived as Bitcoin then fell,Lost over 60% of its value in a few months.

As the market continues to shrink, 2018 will soon be called"Crypto Winter", in December 2018, BTC bottomed out at around $3,200.

The security issue of Coincheck, another Japanese cryptocurrency exchange, kicked off the crypto winter. In January 2018, Coincheck suffered a huge hacker attack, resulting in a loss of about $530 million in NEM (XEM) cryptocurrency.

The bear market escalated further as tech giants such as Facebook and Google banned ICO and token advertisements on their platforms in March and June 2018, respectively.Global cryptocurrency regulation also fuels bear marketfirst level title

Bear 4

In 2021, drop from $64,000 to $29,000

Time to return to previous high:6 months(April 2021-October 2021)

Bearish sentiment dominated the cryptocurrency market until 2020, when Bitcoin not only returned to $20,000, but entered a massive bull market, reaching a high of $64,000 in April 2021.

Although 2021 is one of the most important years for the development of Bitcoin, and the market value of cryptocurrency has exceeded 1 trillion US dollars, Bitcoin still encountered a small bump.

Shortly after breaching its all-time high in mid-April, Bitcoin began to retrace, with its price eventually falling to $29,000 within three months.

As the mini-bear market in 2021 emerges, more and more media believe thatThere are environmental, social and governance (ESG) related issues with Bitcoin mining.

As Elon Musk's electric car company TeslaAbandoning Bitcoin as a payment method in May, the global doubts surrounding Bitcoin ESG have further intensified. Just three months later, Musk admitted that roughly 50 percent of Bitcoin mining is powered by renewable energy.

first level title

Bear 5

In 2022, plunge from $68,000 to below $20,000

Time to return to previous highs: To be determined.

Bitcoin failed to break through $70,000 and began to decline towards the end of 2021. The cryptocurrency market has been in a bear market since November last year,Making 2022 the biggest drop in history.

In June, BTC plummeted below $20,000 for the first time since 2020, fueling extreme fear in the market.

Ongoing bear market largely due to algorithmic stablecoin crisis, the TerraUSD Classic (USTC) stablecoin - its purpose is to support a 1:1 stable peg to the US dollar through a blockchain algorithm, rather than an equivalent cash reserve.

USTC, once a mainstream algorithmic stablecoin, was completely pegged to the U.S. dollar in May, causing massive panic in the broader cryptocurrency market as the stablecoin managed to become the third-largest stablecoin before collapsing.

Terra's crash takes its toll on other cryptocurrency marketsdomino effect, as massive liquidations and uncertainty fuel a cryptocurrency lending crisis. Some global crypto lenders like Celsius had to suspend withdrawals as they were unable to maintain liquidity amid brutal market conditions.

Historically, Bitcoin prices have been below their previous highs for more than 3 years. The last peak of $68,000 occurred seven months ago, and it remains to be seen if and when Bitcoin will return to new heights.

Note: The above content is for communication only and does not constitute any investment advice. The currency market is risky, so you need to be cautious when entering the market.