Original title: "In-depth analysis of NFTFi——From the current market to see the future development of NFTFi"

Original post by Cobo Ventures team members including Alex Zuo, Ellaine Xu, Walon Lin, Caroline Li, and Yuwei Hou

Original source: Cobo Ventures

background

background

NFT has become an indispensable and important chapter in the encryption world. Since the NFT Summer boom in 2021, the weekly transaction volume of Opensea, the largest NFT platform on Ethereum, has reached the order of one billion US dollars, and the number of independent wallets has remained above 300,000 (Dune Analytics @hildobby, 2022).

However, the non-homogeneity and difficult pricing characteristics of NFT make NFT have problems such as low liquidity, which further leads to excessively high capital thresholds and insufficient capital utilization. In addition to NFT holders can only sell at a lower price when there is a shortage of funds, or cannot participate in some blue-chip projects due to the small amount of funds, they will also suffer liquidity losses due to difficult valuations. In order to solve these problems of NFT, the concept of NFTFi has recently been proposed in the market, trying to increase the liquidity, priceability, utilization and compatibility of NFT in a financial way, in order to create a better NFT player experience.

track size

Based on the valuation of blue-chip NFT, we can estimate the current track size of NFTFi.

At present, the main blue-chip NFT value (refer to the floor price and the ETH price is calculated at 2000 USD): BAYC is about $1.72 billion, Moonbirds is $440 million, Azuki is $237.4 million, Doddles is $237 million, CryptoPunks is $953.2 million, and the total valuation is about 35.87 billion dollars.

secondary title

text

1. Insufficient liquidity

① Barriers to entry are too high

For ordinary collectors or consumers outside the circle, the entry threshold of the current NFT market platform is too high; for players in the circle, there is also the problem of scattered liquidity due to different NFT listing platforms. Therefore, the aggregation agreement between the payment connection system and NFT listing is an important practical application.

②Limited transaction accuracy

The tradable accuracy of homogeneous tokens is usually higher (10-18), but the NFT in the ERC721 format can only be circulated as a whole, and there is a liquidity threshold. On the one hand, since it can only be purchased in its entirety, the minimum transaction threshold may be as high as a few hundred dollars, making it more difficult to make NFT liquid. On the other hand, it is difficult for NFT market makers to make markets without sufficient precision, and because the rarity of NFTs varies, the value of each NFT is different, and the price difference within the same item may be as high as 10 times, and it is not easy to make market, it is difficult to improve the trading experience.

③Low capital utilization

Homogeneous tokens or equity can increase the utilization rate of funds through mortgages, pledges, leverage, etc., but currently the NFT field still lacks the means to increase the utilization rate of funds. Even though the current BAYC series has begun to use airdrops, whitelists, etc., as an extension of the use of NFT funds, most of the investment income of NFT still comes from capital gains from buying low and selling high. There has not yet been a wide range of NFT derivative applications. Investors often Afraid to enter the market or even exit the market because of concerns about "selling out" or mispricing assets, which is not conducive to increasing transaction volume and transaction frequency.

2. Pricing is flawed

① Difficult price consensus

Different from traditional securities pricing methods, NFT has different prices in the eyes of different collectors or investors because of its unique characteristics. The ambiguous pricing situation makes it more difficult for buyers and sellers to reach a consensus at the moment of the transaction, hindering the improvement of liquidity and capital utilization.

②Insufficient price discovery mechanism

The current two price discovery mechanisms in the NFT market (external price feed & built-in oracle) are insufficient in timeliness, accuracy, and versatility. Even if a consensus price is reached on some exchanges or auctions, it is difficult to provide to the market or other exchanges. Some exchanges may even have short-term pricing failures due to insufficient liquidity or manipulation by giant whales, which in turn affects the application of NFT derivatives. Therefore, price discovery mechanisms such as oracle machines are very important NFT liquidity infrastructure. It can not only promote the formation of price consensus, but also make the operation of derivatives more reasonable, including the construction of NFT liquidity pools to achieve large-scale capital utilization .

Currently, ChainLink has a separate oracle machine NFTBank.ai for NFT, which is used to capture the floor price on Opensea.

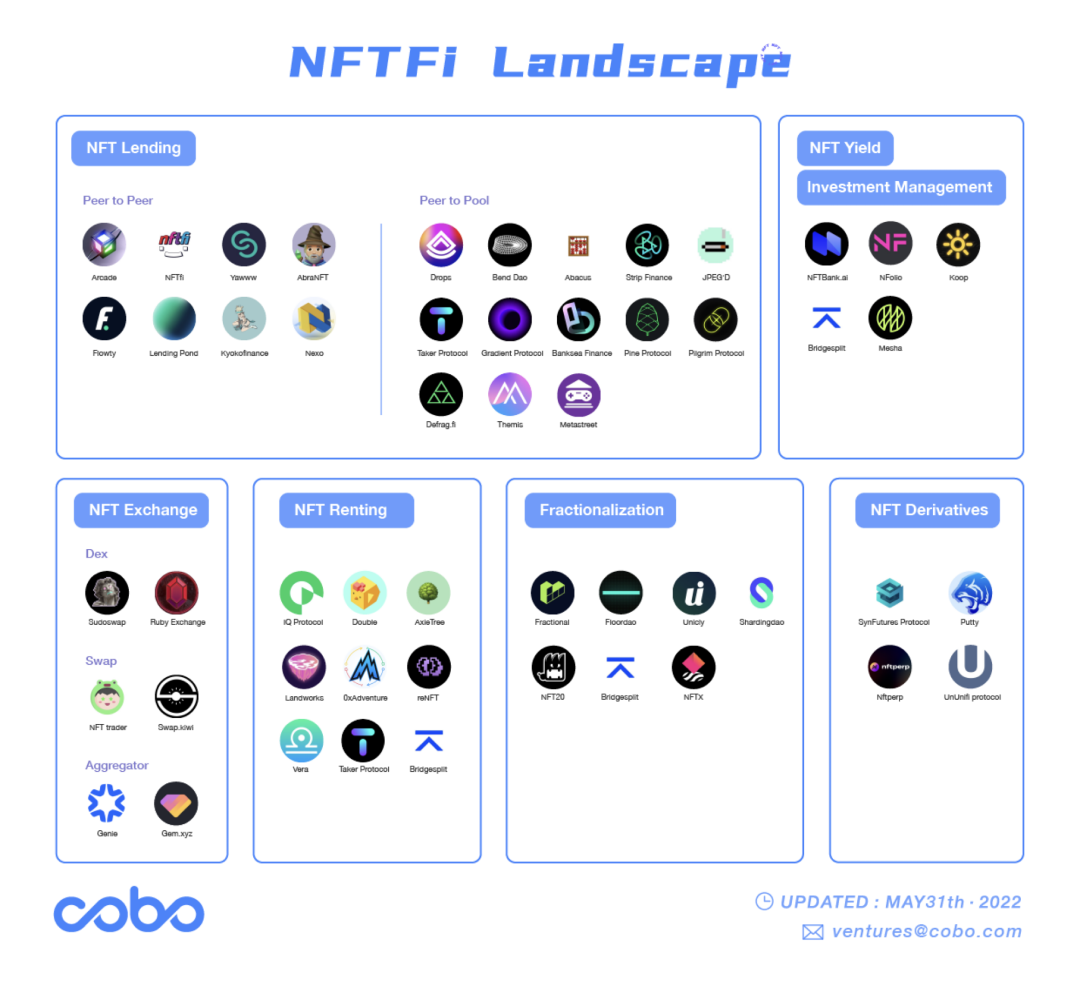

In response to the above problems, this article summarizes the following solutions, and lists some existing cases in the market for further discussion:

The problem of high barriers to entry can be solved by aggregators. There are currently two major NFT market aggregator projects, Genie and Gem, in the market, and the use of wallets can be carried out through intermediaries such as Moonpay.

The problem of low capital utilization can be solved by means of borrowing and leasing. Currently, there are P2P lending agreement NFTfi.com, P2Pool lending agreement DROPS and leasing agreement Doubles.

The accuracy problem can be solved by fragmentation. There are currently NFTx, Fractional and other projects in the market. From the perspective of the demand side, it can also be solved through a secure crowdfunding platform, allowing users to pool funds in a multi-signature environment and jointly manage fund-raising NFTs.

The problems related to pricing ambiguity and oracles require the use of multiple design mechanisms and node data providers to solve them. This article will focus on two projects, Banksea and Abacus.

Finally, on derivatives, this article will introduce the derivatives projects currently on the market that try to improve the utilization rate of funds. However, because the oracle mechanism is not yet mature, NFT derivatives are still in their infancy.

NFT lending

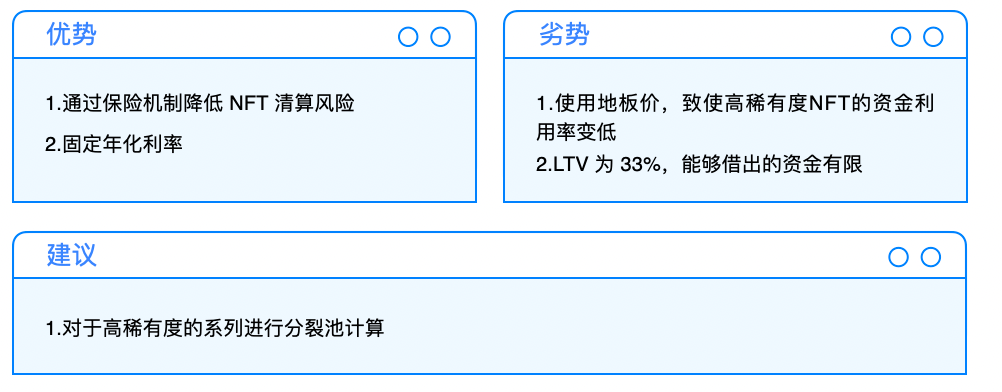

P2P NFT Lending Protocol

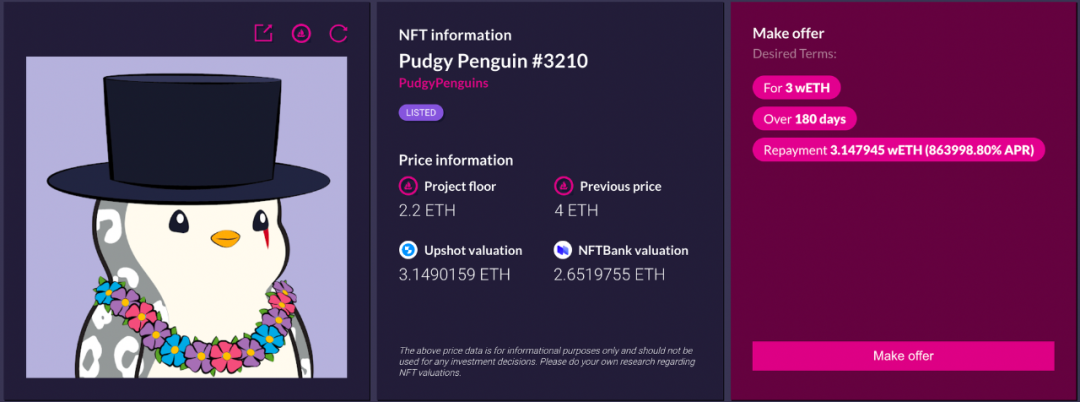

P2Peer is a lending method in which the borrower uses NFT as collateral to borrow money from the lender after the lender and the borrower reach a loan agreement with each other.

The advantage of this is that users can customize the rules and conditions of lending, but the disadvantage is that it is more dependent on professional lending knowledge, and this manual matching method will also take a long time to match transactions, and liquidity cannot be fully released.

In principle, NFT assets will be locked into the NFTFi smart contract until the borrower repays the loan. If the borrower does not repay the loan by the due date, the NFT asset will be transferred to the lender. For lenders, they can provide funds for each NFT by themselves, and set the term and desired repayment amount (or interest rate) for borrowers to choose. This logic is to hope that NFTs with high collection value can have liquidity, but because the borrowers and lenders have different judgments on the value of NFTs, it may lead to a problem of too long decision-making time.

NFTFi.com

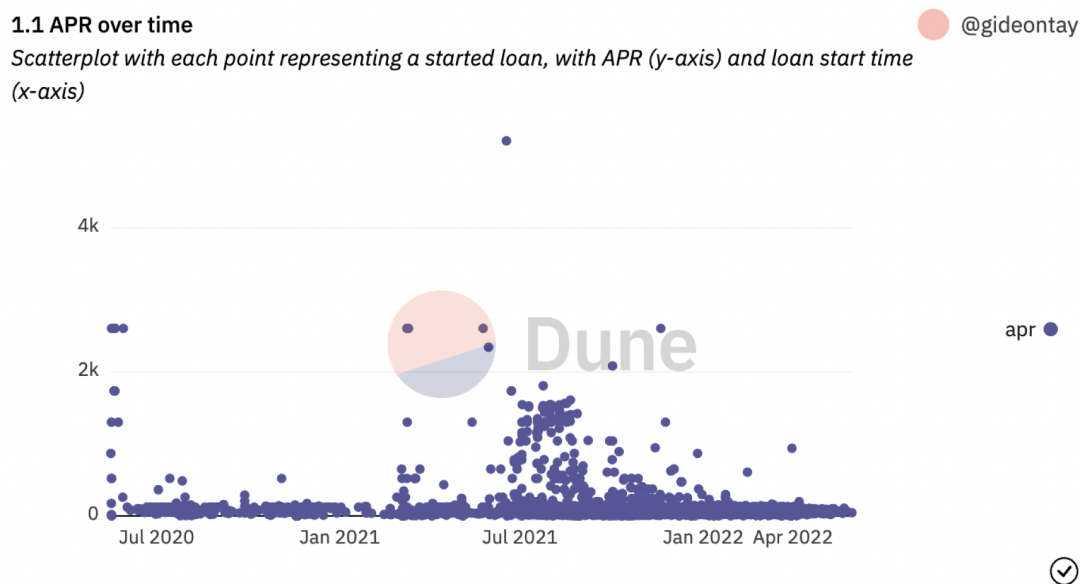

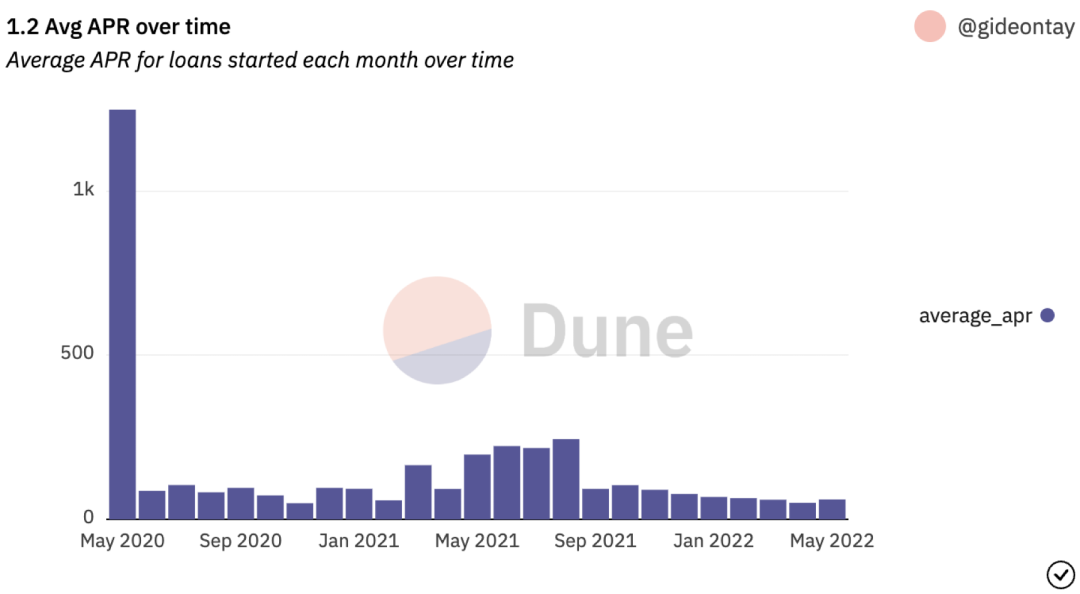

image description

Source: NFTFi.com official website

image description

image description

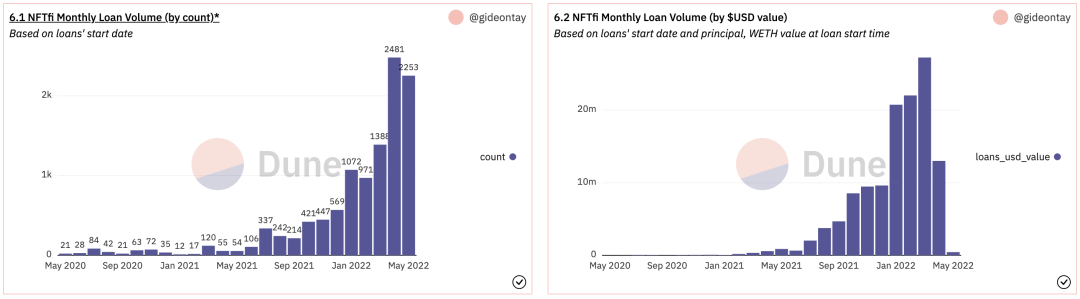

Source: Dune Analytics @gideontay

image description

Source: Dune Analytics @gideontay

The advantage of the P2P model: the price is the equilibrium point between supply and demand, and any form of NFT can be put on the shelves, and will not affect each other due to price fluctuations of a single NFT.

Disadvantages of the P2P model: The utilization rate of NFT is low, because the transaction cycle is relatively long, and the price jointly decided by both parties is not necessarily the intrinsic value of NFT, which may cause NFT holders who need funds to use it too much because they urgently need money. Cheap price to sell. The trade-off between liquidity and price has instead allowed the P2P agreement to enter a market where the buyer (ETH provider) has too much power.

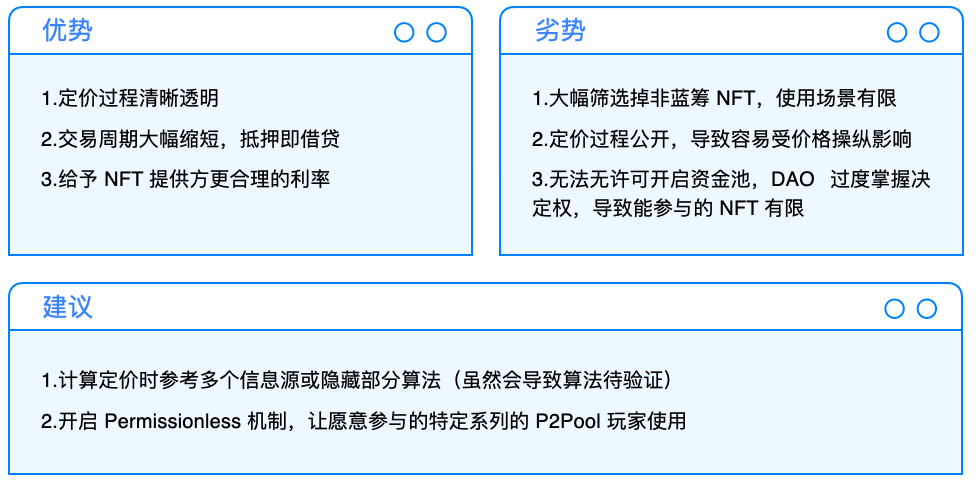

P2Pool NFT Lending Protocol

Another lending model is P2Pool. For the benchmarking DeFi track, similar to AAVE and Compound, its pricing method is usually price feed or time-weighted average. Mechanistically speaking, lenders provide liquidity to the agreement, and distribute these funds to borrowers who use NFT as collateral through the agreement. This model usually needs to be realized by relying on price oracles, and uses algorithms to evaluate the value of NFT, so it is only applicable to NFTs with guaranteed prices, such as CryptoPunks, BAYC, etc., and it is difficult to open the capital pool in an unlicensed way.

The advantage of the P2Pool model is that it can greatly increase the utilization rate of funds, and at the same time give NFT mortgagers more reasonable interest rates, and reduce the occurrence of pricing disorder caused by low-volume NFTs by dividing into pools by series.

However, the risk of P2Pool is that most of the pricing methods are in the public form, and the price feed of the oracle machine will also become a very important link, so it may be liquidated due to price manipulation of NFT (a large number of left-handed for right-handed) or price fluctuations . For example, the price of Azuki fluctuates around 10ETH within a few days.

DROPS

Pricing model for DROPS: pricing using 1) oracles, 2) time weighting, 3) removing outliers and exploiting fragmentation (if any). However, this calculation method will screen out a large number of low-liquidity NFTs, because a large amount of transaction data is required to remove noise, resulting in low-liquidity series not being able to enter the DROPS calculation mode.

Price calculation mode: based on the floor price, 1) Preliminary inspection of the transaction: 25 block confirmations, 1 NFT sold, and the same Token ID has not been sold again within 24 hours; 2) Remove extreme values: After calculating the floor price of 100 transaction data, remove transactions below 5% and above 950% quantile value (ie if the average floor price is 100E, transactions of 5E and 950E will be eliminated); 3) remove the extreme value of possibility : The transaction price with N standard deviations removed; 4) The price feed is recorded every 4 hours; 5) If there is an Index of this series of NFTs, it will be used as a reference.

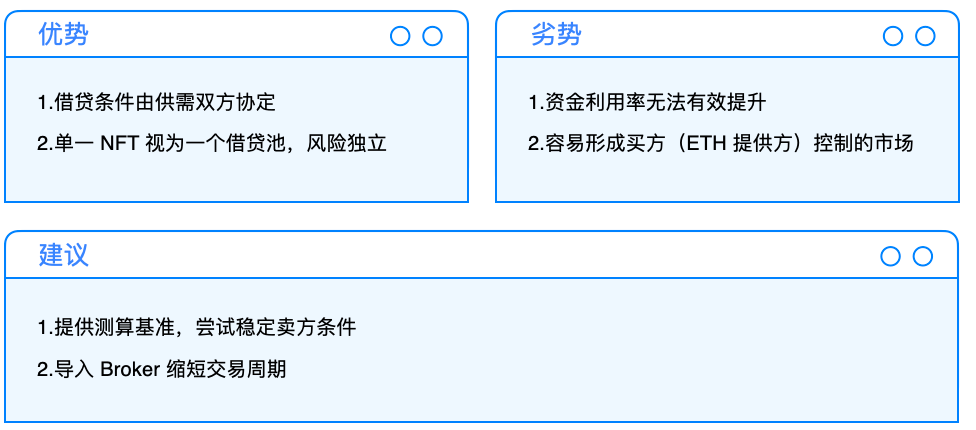

JPEG’d

JPEG'd is an improved loan agreement for NFT P2Pool. The loan interest rate is initially set at an annual interest rate of 2% + 0.5% withdrawal fee, and the loan amount is 33% (Loan to Value). For example: Alice pledges an NFT equivalent to 10,000 PUSD, and can borrow up to 10,000*32% = 3,200 PUSD. After deducting the withdrawal fee of 50 PUSD, she can finally get 3,150 PUSD. When JPEG'd NFT encounters liquidation, consumers can use the insurance mechanism to protect NFT early. Alice needs to pay 1% as an insurance fund plus 25% of the debt value, and the NFT can be redeemed by paying to the treasury.

image description

Source: JPEG'd official website

This design makes the improvement of capital utilization rate limited, and there is still a 32% upper limit of capital utilization rate in loans. Although the annual interest rate is lower than that of NFTFi.com, in the end it is because of the low pricing efficiency, so JPEG'd can only choose It is a blue-chip project to reduce project risk, and it is not friendly to collectors of high-rarity NFTs.

Due to the design of the liquidation mechanism, JPEG'd can purchase CryptoPunks at 1/3 of the price to the treasury and complete the liquidation. On the fierce and turbulent trading day of 2022/05/09, JPEG'd bought 10 CryptoPunks at an average price of around 19ETH, sold them at the current price of 55ETH (2022/05/09), and made a profit of 360ETH.

The liquidation process is as follows:

The price of NFT drops sharply —> the borrower’s LTV is greater than 33%, and liquidation is started —> JPEG’d treasury buys NFT back at the price of debt (Floor Price * 1/3) —> finally DAO disposes of treasury NFT

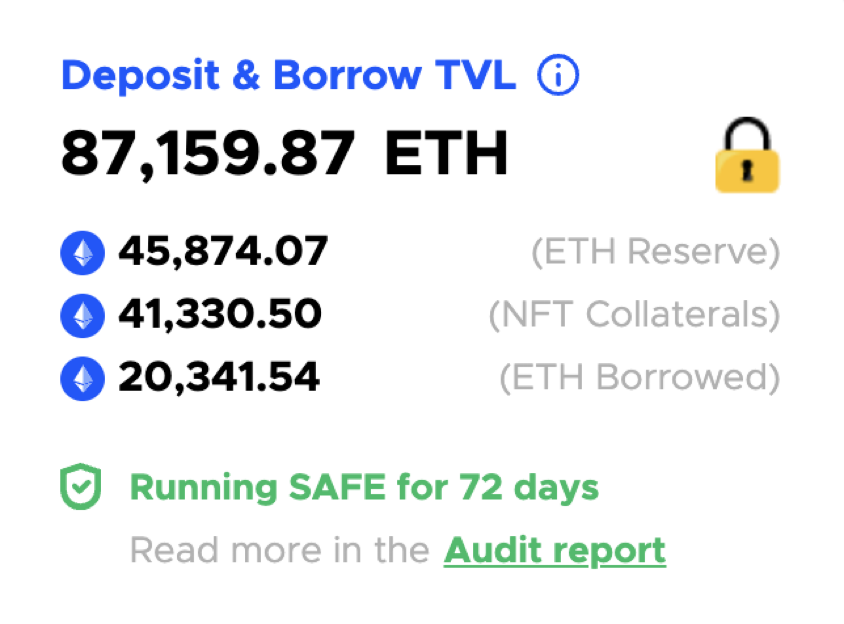

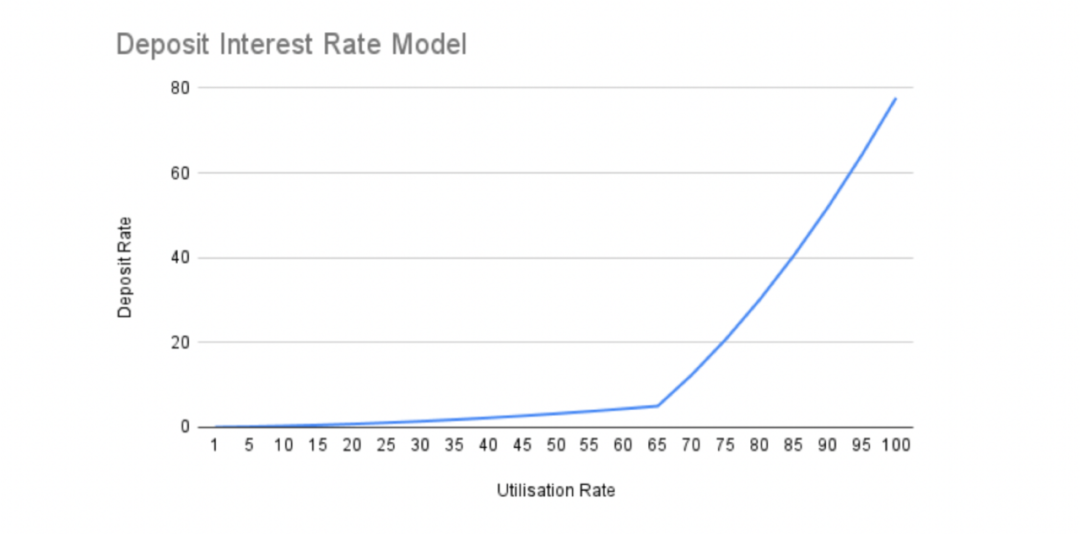

BendDAO

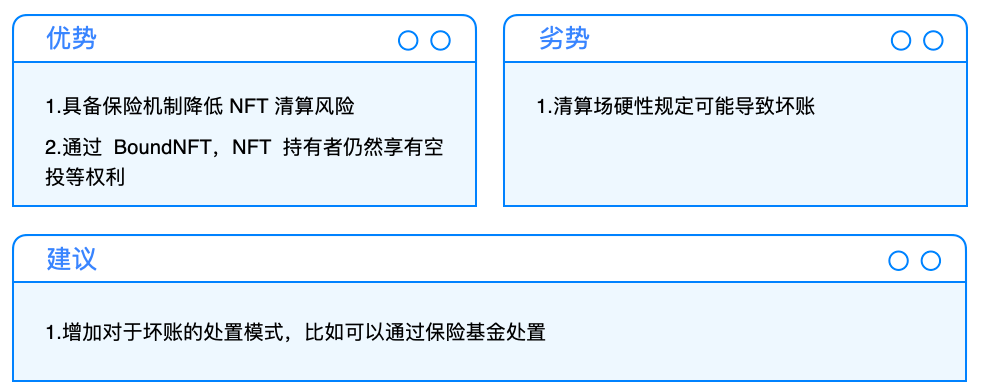

BendDao is also a non-custodial NFT lending pool. When the mortgaged NFT enters the contract, it will get the mapped BoundNFT as an IOU. At the same time, it has the same metadata, so that investors can still use BoundNFT as PFP.

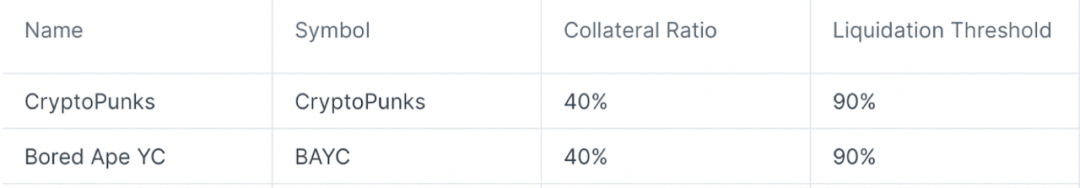

Investors and users can exchange ETH by mortgage NFT to the lending pool. As of 2022/04/27, BendDao is almost the NFT mortgage agreement with the most BAYC. However, like most P2Pool protocols, currently only blue-chip NFTs can be mortgaged (BAYC, Azuki, CryptoPunks, MAYC, CloneX and Doodles), and veBend holders need to vote to increase the range of NFT mortgages.

Similar to JPEG'd, BendDao also has an insurance mechanism that allows the mortgagee to have the opportunity to buy back the collateral after being liquidated. A 48-hour buffer period is provided in BendDao to allow debtors to redeem. If the debtor does not redeem it, the NFT will enter the auction house.

The price source of BendDao itself is the floor price of Opensea (the data source may be changed after DAO). However, the biggest problem that BendDao will encounter is that the liquidation price is less than the debt price and cannot be liquidated, and it is in a dilemma that no one is willing to buy back NFT when the liquidation price is greater than the debt price. Therefore, the NFT category can only include blue-chip projects in the end.

image description

Source: BendDAO official website

image description

Source: BendDAO Whitepaper

image description

summary

summary

Although the P2Pool model can improve the utilization rate of funds, it is often forced to enter the auction market due to the liquidation of positions due to oracle machines, pricing models or unilateral market conditions. Problems leading to distribution of liquidation funds. According to the current operating logic, the P2Pool model requires strict screening of NFT participating in lending, so the audience is relatively limited.

For the P2P model, although there is a problem of NFT utilization rate, because the conditions are coordinated by both parties, even if there is a problem of buyer’s market tendency, it can solve the complex problem of pricing and liquidation at one time, and the audience is almost Infinite, so P2P may be a more long-term solution in the NFT market in the short term.

However, in the long run, as the oracle machine and quotation model gradually mature and the accuracy gradually improves, P2Pool, a model with high capital utilization, will become the mainstream of the market. The key variable is the maturity of the oracle machine.

NFT Liquidity Solutions

NFT rental agreement

The leasing agreement is an agreement that provides users to rent NFT to other users or rent other people's NFT. This allows users to lease idle NFTs to others to earn income without giving up their ownership of NFTs. For lessors, they can also obtain the right to use NFTs with a lower amount, thereby increasing liquidity and capital utilization. .

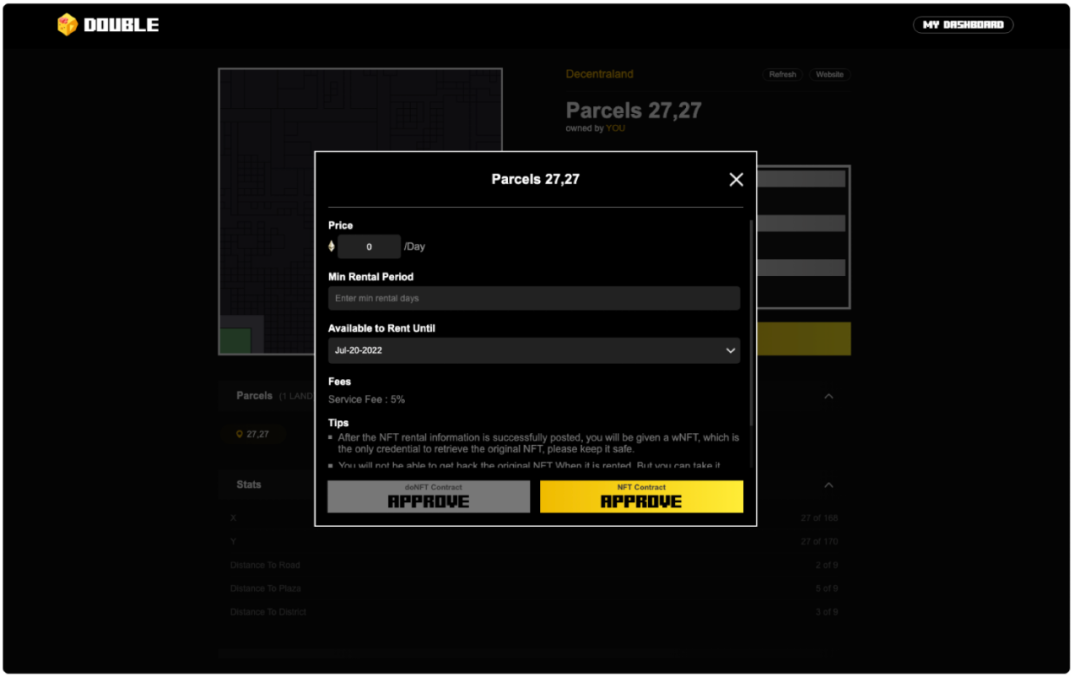

Double

Double is a leasing protocol that attempts to solve the separation of usage and ownership schemes. Different from the mechanism of similar agreements that stake NFT in smart contracts for lenders to restrict use, Double can map a doNFT type, and set the time and price at the beginning of the loan, and the doNFT will be automatically destroyed when it expires. In this way, Double only needs to lock one-way for NFT providers, and the lender restrictions for doNFT are minimized.

image description

Source: Double official website

NFT Liquidity Pool Protocol

The liquidity pool means that users deposit their NFTs in a liquidity pool in exchange for n homogeneous tokens (vTokens), and users will be able to use these vTokens to trade in the secondary market, and those who are interested can also buy them back, etc. Amount of vToken to redeem any NFT in the pool. This approach is to put the same series of NFTs into the same pool, so that users can choose the NFTs to be redeemed or mortgaged, and if they find that the price is higher than the average NFT in the pool, there is room for arbitrage, which is also the price discovery of the liquidity pool. one of the means. The trading method of the liquidity pool provides a faster transaction method for users who want to purchase the same series of NFTs without going through bidding or auction.

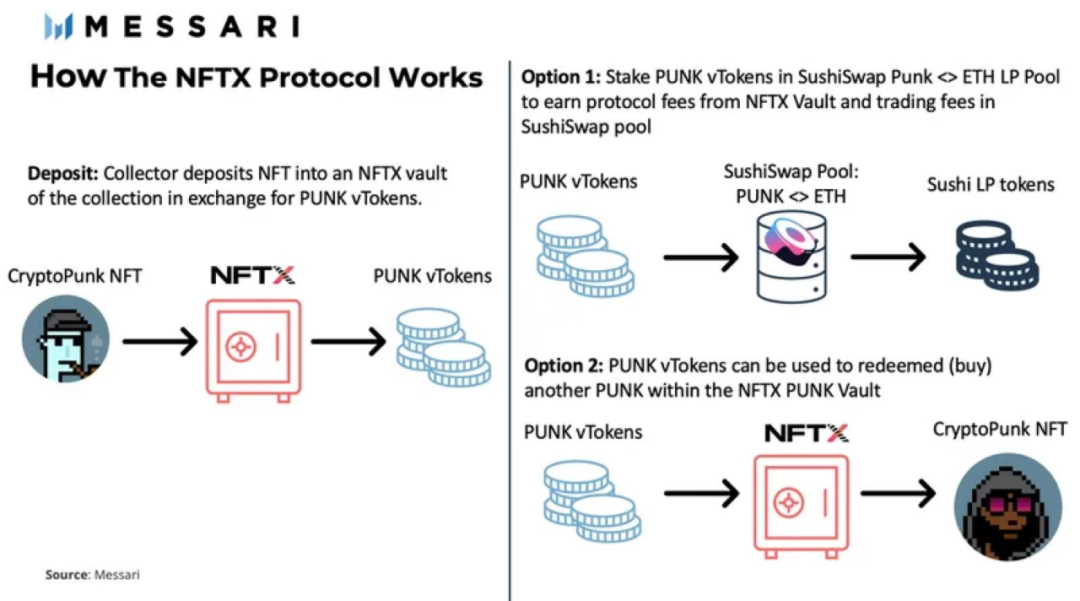

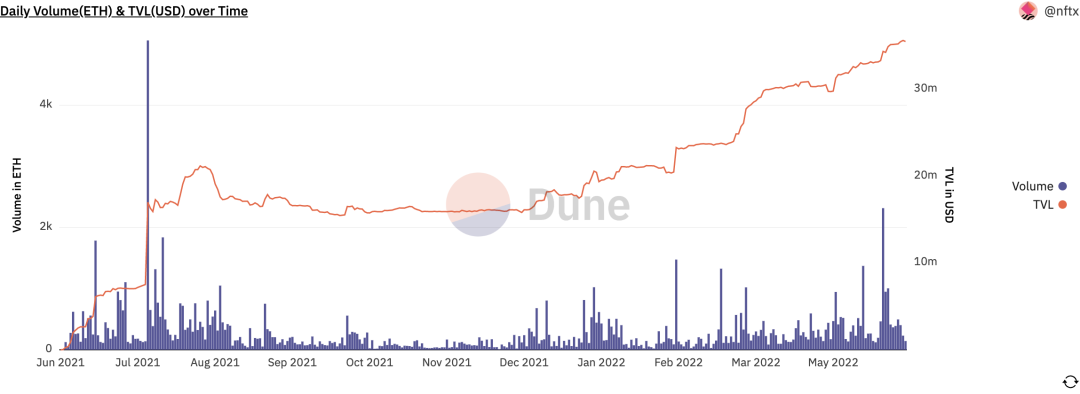

NFTX

NFTX is a project that focuses on the floor NFT track, allowing users to deposit the floor NFT into the project treasury and exchange it for an equivalent vToken (ERC20), allowing others to invest in part of the floor NFT. For the same series of NFTs with medium and high prices, due to the difficulty in value positioning and the difficulty in calculating the equivalent vToken, NFTX decided to abandon this market and focus on NFT projects that can directly match the target.

Source: Messari

Source: Messari

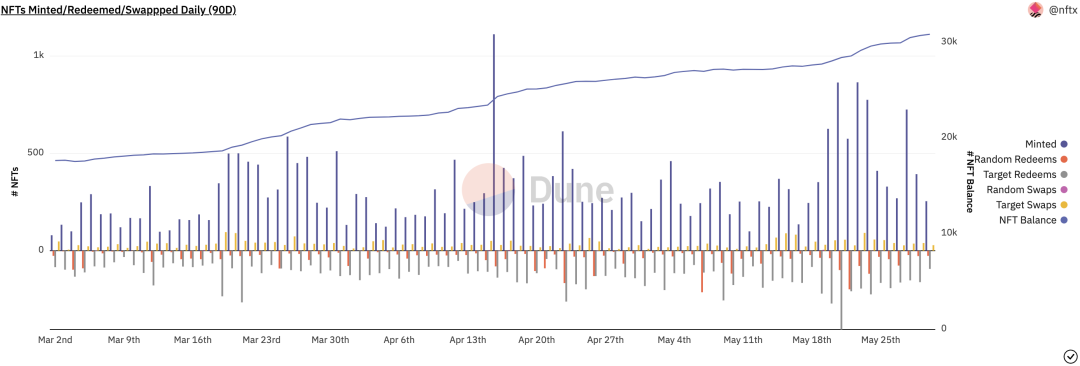

image description

Source: Dune Analytics @nftx

image description

Source: Dune Analytics @nftx

secondary title

NFT Funding Crowdfunding Protocol

The capital crowdfunding agreement is to pool funds and provide an agreement to securely purchase the NFT environment. It aims to solve the characteristic that NFT cannot divide ownership, so that investors can not only diversify risks, but also enter the market with smaller funds.

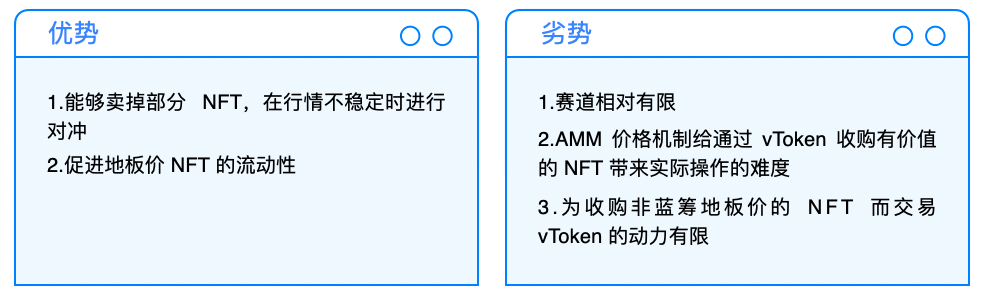

Mesha

Mesha not only allows investors to jointly hold NFT, but also can receive airdrop tokens through an agent or sell NFT under a joint resolution, thereby increasing liquidity. Now it has access to Opensea, Looksrare and gem.xyz. to use. At the same time, Mesha also provides chat and discussion functions, combined with the characteristics of some communities, allowing NFT collectors of the same team to complete discussions in one stop. The most important thing is that due to the cooperation between Mesha and Moonpay, credit card consumption can be used on the site, bringing a more complete user environment.

Currently, Mesha is still in the early stage, and XP tokens can be obtained through task activities, which can be exchanged for $MESHA in a 1:1 manner in the future, and a 50% reduction in handling fees can be obtained after staking.

NFT aggregator

Strictly speaking, the aggregator does not belong to the category of NFTFi, but it is an important infrastructure that can greatly increase the liquidity and visibility of NFT in the early stage, so it is proposed here.

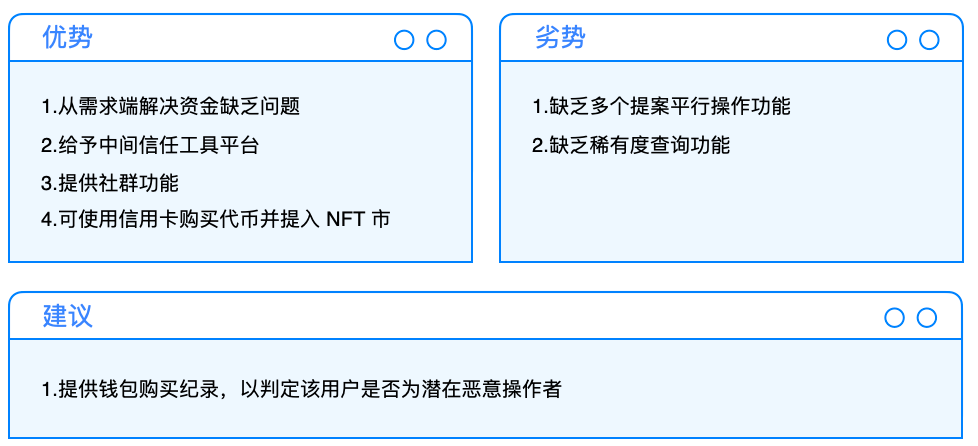

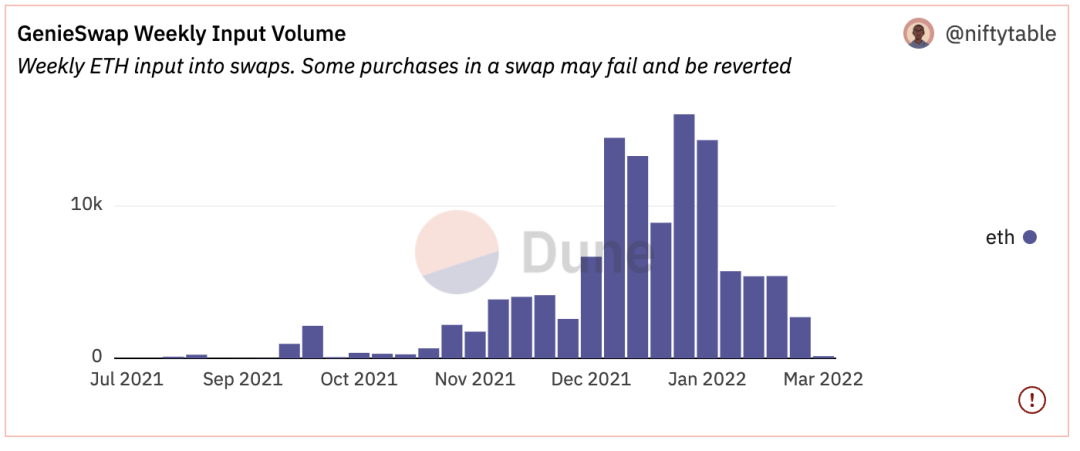

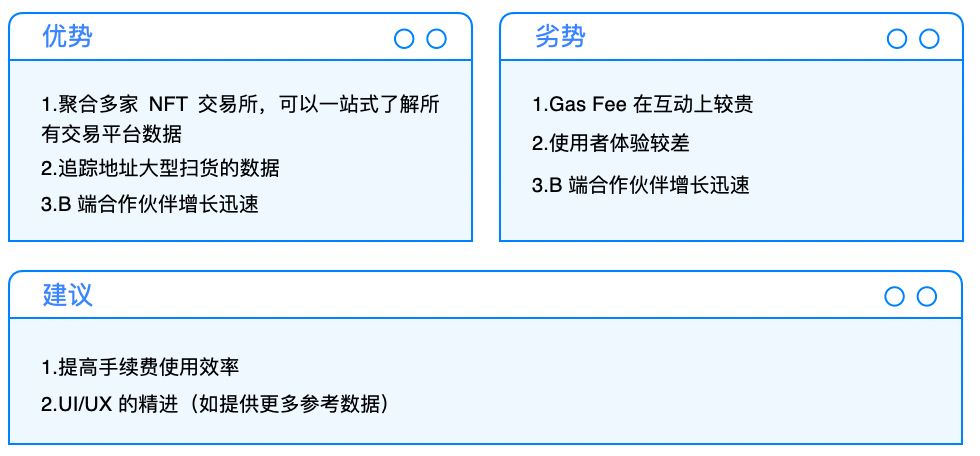

Genie

image description

Source: Dune Analytics @niftytable

Gem.xyz

Over time, gem.xyz, an aggregator protocol that can save Gas Fee, came out. With a significant reduction in Gas Fee and a more friendly UI design, Gem.xyz quickly swallowed Genie's first-mover advantage and gained a substantial lead in the NFT aggregation battle. The current daily usage is almost 5 times that of Genie (Dune Analytics @sohwak, 2022), and with the design of listing analysis and payment of handling fees with any ERC20 token, it will continue to improve user stickiness. Although Genie has cooperated with Looksrare and others in succession, users have become accustomed to using Gem.xyz.

In the NFT aggregation track, Gem.xyz has the advantages of simple and easy-to-understand UI design and a large reduction in Gas Fee, making it difficult for Genie to keep up with the number of users and transaction volume, and the emergence of this track has also made the fragmented NFT market With a unified trading environment, the search cost for users to purchase NFT is reduced.

NFT special pricing mechanism and oracle

NFT Game Theory Pricing Model

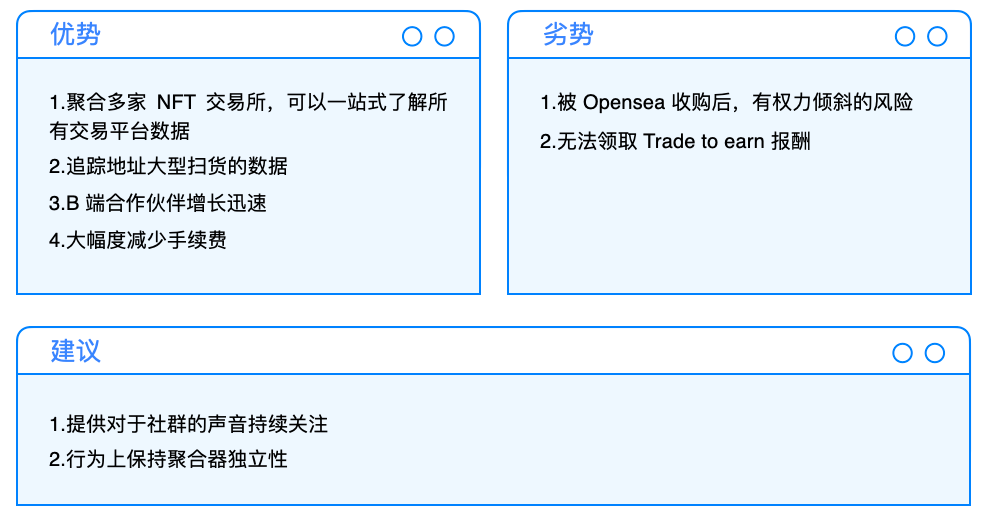

Abacus

There are two pricing methods adopted by Abacus, the first is peer incentive pricing, and the second is Spot Market pricing.

Peer incentive pricing is that the user first pays the review fee (0.9%), so that the person who pledges the tokens can discover the value, and the weight of the value discovery will be based on the number of pledges/the minimum number of pledges as the weighted number. If the final submitted price is within 5% of the submitted price, the right to income can be obtained. Through this incentive method, let everyone participate in value capture.

The second is the pricing model of Spot Market, which has pool holders and traders respectively. The pool holder is the person who basically opens the NFT pricing pool, and can set the initial price and quantity. For example, now Bob has a CryptoPunks that he thinks is worth 100ETH. When he sets up 1000 xPunk tokens, the initial price of each xPunk is 0.1ETH, and then opens the Dutch transaction. The Dutch Auction will end after the last xPunk is sold, and the final selling price multiplied by the total number of tokens is the price at which the market believes that Bob holds CryptoPunks. The way to close the pool can be through auction. If the auction price is higher than the price in the pool, the founder of the pool can recover the principal, and the remaining ETH will be distributed to traders, otherwise the holder will record a loss. In addition, pool holders can redeem NFT by exiting, and the founder of the pool has to pay 5% of the market anchor price to traders.

Under the establishment of these two mechanisms, traders will have incentives to push the price of NFT as close as possible to liquid pricing, and at the same time use this AMM mechanism for arbitrage. In addition, because traders do not know which method the pool owner will use to close the pool, it is difficult for traders to earn value by depressing the value in the pool, because in this way, the pool owner will choose to withdraw from the redemption of NFT, instead Get less income. This game-like approach can push the price of P2Pool to the value recognition point of the market under the premise of sufficient traders.

NFT autonomous computing oracle

Banksea

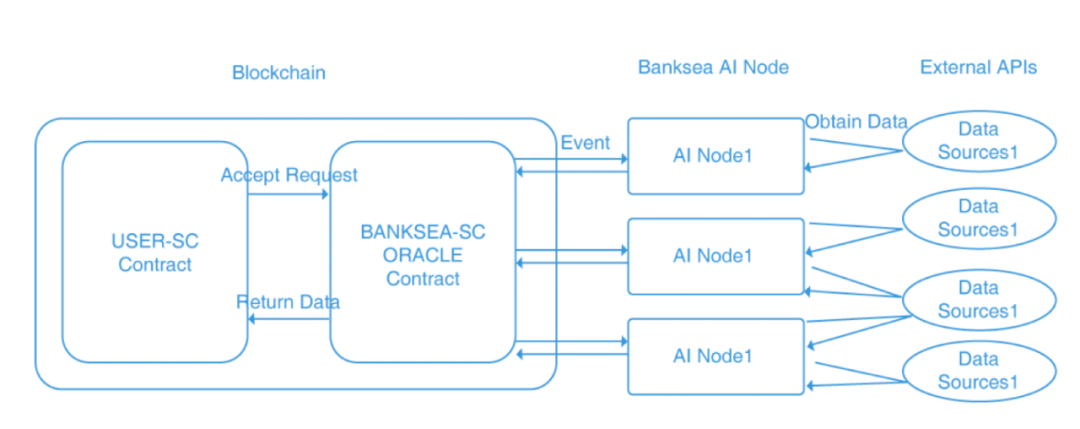

image description

Source: Banksea Whitepaper

Banksea's oracle machine architecture is divided into three parts: node data provider, AI computing node and end user. When the user puts forward a request for quotation, Banksea AI Node will apply for information from external nodes, and after obtaining the information, calculate it through its own algorithm and report the price and risk index to Banksea's SC, and finally return it to the user.

Banksea's algorithm for price calculation is to use the price fluctuation in a certain range as a variable to calculate the optimal range, and then calculate beta according to the correlation coefficient of the project with the market and other indicators, and calculate the mortgage rate as a risk factor. The detailed algorithm content has not been disclosed, so whether it can reflect the real market reaction still needs to wait for the later market verification.

At present, there are about four Banksea oracle nodes, which include Trading Data (Opensea, Rarible, etc.), Social Data (DC and Twitter), Chain Data (Etherscan and Solscan) and the current Banksea mortgage rate for price feed conditions It may become a widely used exclusive NFT oracle machine in the future.

NFTBank.ai

NFTBank.ai adopts a common fund management method, allowing users to manage their own NFT in one stop, and estimate the price through floor prices or machine learning programs, and carry out portfolio tracking management. At the same time, the feature of being able to capture the floor prices of various exchanges also made NFTBank.ai a data source for ChainLink in February this year, providing more accurate quotations for other NFT projects, thereby optimizing the P2Pool function.

NFT derivatives

NFT options platform

Putty

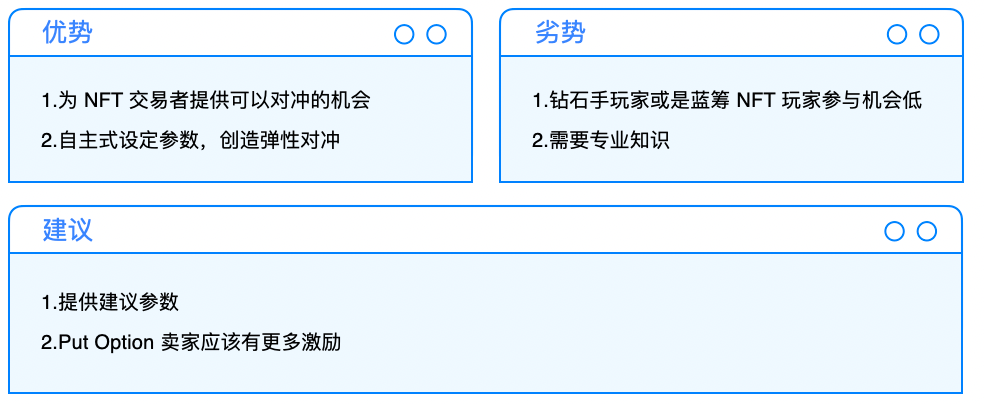

Putty is a platform for hedging NFT risks. In the V1 version, it belongs to the P2P Put Option platform, allowing investors and users to package ERC721 into Put Option for trading in the market.

For example, if it is believed that CyptoPunks#0001 will fall below 100ETH in the next 10 days, and 100ETH is the lowest acceptable price, investors can set the strike price of a Put Option to 100ETH and Put Premium to 10ETH. When someone is willing to sell this Put Option, the investor will pay 10ETH to the seller. If CryptoPunks#0001 falls below 100ETH in the last 10 days, the investor can exercise the option to get back 100ETH, and at the same time, CryptoPunks#0001 will be transferred to the seller. On the contrary, if it does not fall below, investors can continue to hold NFT, and 10ETH will be regarded as insurance money.

However, this model will cause most NFT users of diamond hands to be afraid to use it. Even if the price fluctuation is hedged, it will cause the loss of NFT (Underlying Assets). In general financial products, it is convenient to make up at a point in time in the future, but the particularity of NFT will cause the state that the right should be exercised but not exercised because of concerns about the loss of NFT, which is contrary to the original intention of the project design. Therefore, NFTs that should be more hyped in terms of usage scenarios have the opportunity to circulate in this market.

NFT Perpetual Contract Platform

NFTprep

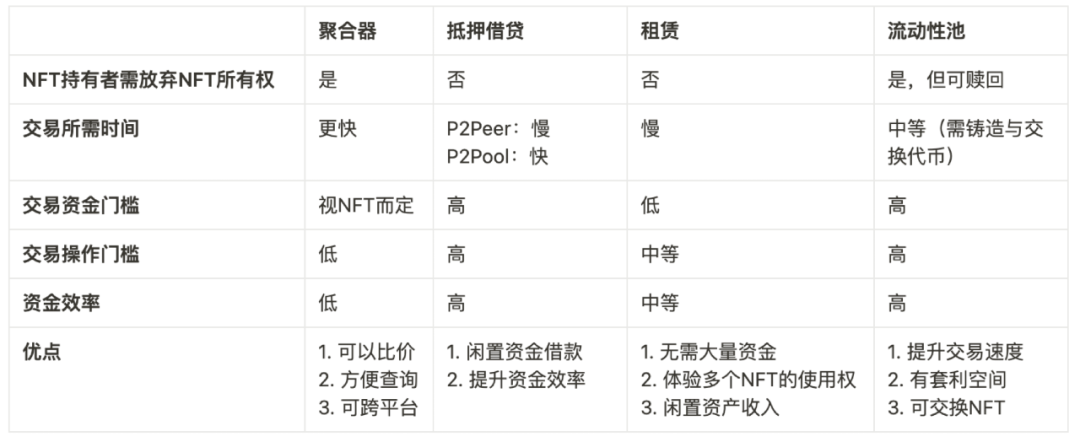

NFTperp is a perpetual contract system specially designed for NFT floor prices. It adopts the vAMM mechanism and is deployed on Arbitrum. In view of the large fluctuations of NFT in the current market, and the threshold of blue-chip NFT is too high, it is difficult for ordinary people to enter, NFTperp provides a behavior of hedging the floor price and indexing blue-chip NFT. Under this design, although it is not so meaningful for the same series of products with mid-to-high prices, it can at least offset the drop in the floor price and slow down the loss when the series prices go down together. In the indexed blue-chip part, users can be allowed to do long blue-chip NFTs in the form of 5-10USD, so as to achieve the result of partial participation and profit.

In the price feeding mechanism, NFTperp uses multiple reference sources, not only using ChainLink’s quotations, but also calculating the prices of upshot, Banksea, NFTBank.ai and DROPS, etc., and using TWAP (every 5 minutes to record data, 8 hours to calculate the average price) price) to reduce the risk of single-source oracle being manipulated.

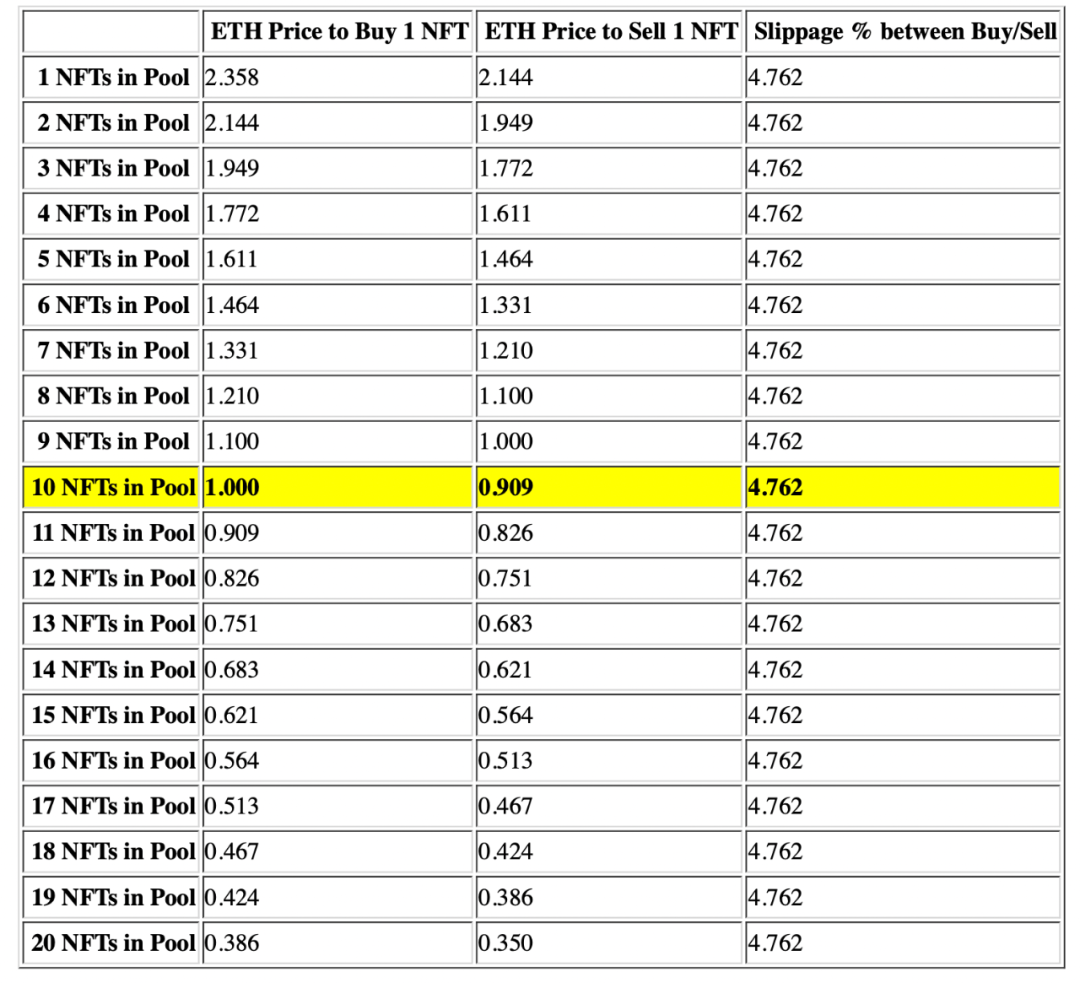

In the design of keeping the price of derivatives close to the spot price, NFTperp not only refers to the Funding Rate mechanism, but also introduces a dynamic transaction fee mechanism. When the forward premium is higher, the handling fee for the long side will be gradually adjusted from 0.3% to the highest 5%, and the short side will be gradually reduced from 0.3% to the lowest 0.1%, and vice versa. In terms of design, it not only increases the insurance premium and project income, but also increases the cost of active trampling.

NFTperp is designed to serve floor price customers, and at the same time, it also allows Xiaosan to meet blue-chip NFT bulls, which can promote ecological flow in the current NFT market.

NFT Automated Market Maker

SudoSwap

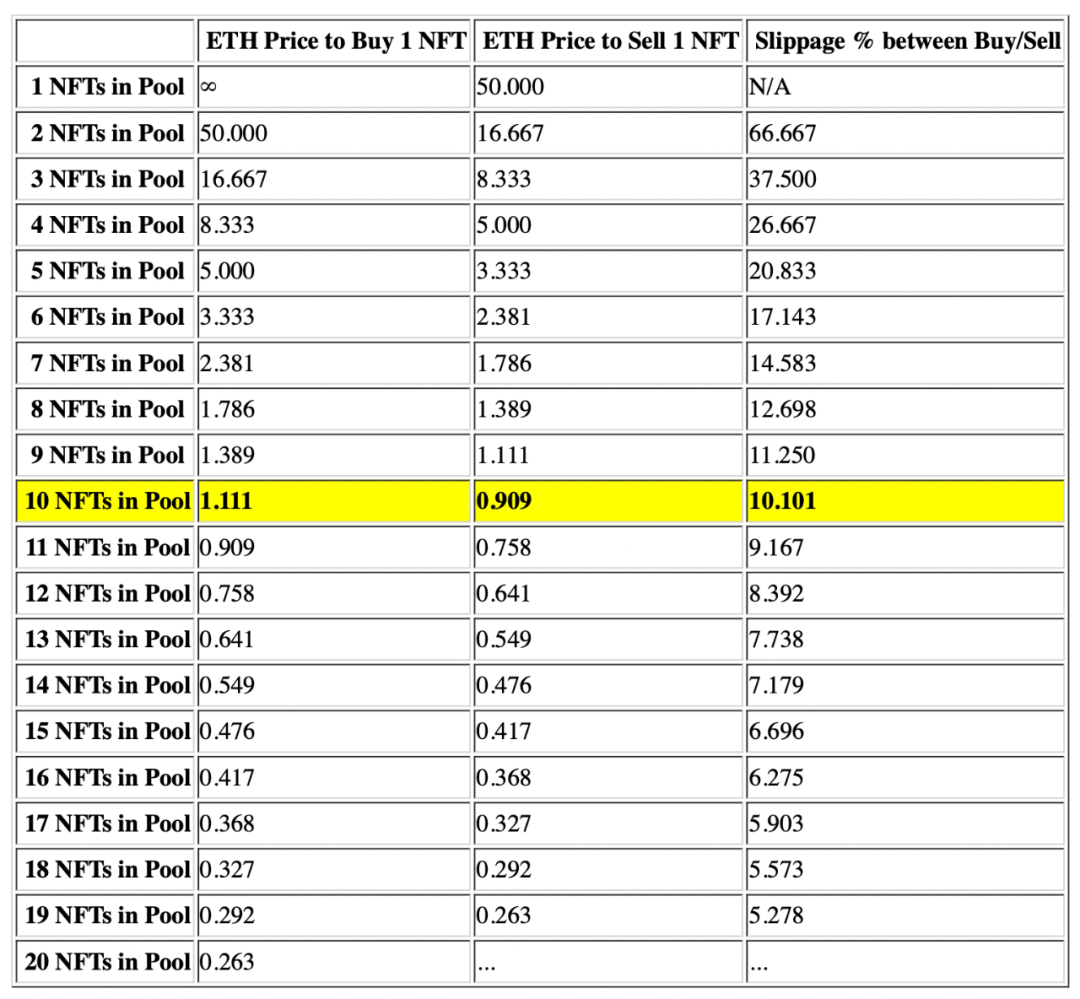

NFT and ETH are currently exchanged in a 1:1 manner. For the common DeFi model, AMM is currently difficult to use in the NFT market. At the same time, since NFT is sold as a whole, the exchange will be due to X*Y=K The formula design causes a large slippage.

image description

Source: blog.sudoswap.xyz

in conclusion

in conclusion

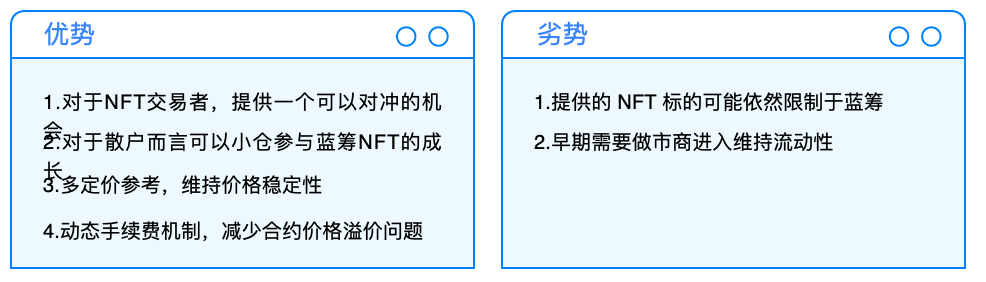

The following table lists the differences and advantages of each solution.

At present, most users are concentrated in the market and aggregator fields with the lowest operating threshold, but these two fields have not fully demonstrated the greatest capital efficiency. From the analysis of the operating threshold, when more users join the NFT field, it can be predicted that the next round of market hotspots will focus on the NFT leasing field. Although lending and liquidity pool projects with high operating thresholds can effectively improve capital efficiency, how to attract users' attention and make users feel the importance of these functions is a direction that projects need to carefully consider.

In the battle between P2P and P2Pool, the improvement of oracle machine and clearing mechanism will make P2Pool stand out. However, whether it is ChainLink or Banksea, which has built its own oracle machine, due to NFT liquidity problems, even if the quotation is accurate, it is difficult to ensure that the liquidation is completed at an accurate price in the auction house. To better reflect the market value consensus, NFT's liquidity combing and the use of oracle machines will also significantly affect the development of the derivatives market and the index market.

Therefore, although there will be many breakthrough projects in NFTFi in the near future, issues such as how to independently rate different NFTs and establish liquidity will develop in the direction of market consensus and centralized auction venues. At the same time, the biggest tipping point of lending and liquidity usually comes from the high-risk operation of loan items, which leads to a gradual increase in scenarios that require precision and accurate pricing. Therefore, the author also recommends paying attention to risk control when using NFT for derivatives operations. Under the premise of the current limited infrastructure, there will be a large number of liquidations, just like the recent (05/07-05/10) Azuki plunge.

Finally, the author believes that with more and more NFT empowerment, the use of NFTFi should not be limited to the main body of NFT. In the foreseeable future, NFTFi is very likely to focus on the extended use of empowerment and the transfer of rights. exciting.

About Cobo

Cobo is the largest cryptocurrency custody institution in the Asia-Pacific region. Since its establishment, it has provided excellent services to more than 300 industry top institutions and high-net-worth individuals. On the premise of ensuring the safe storage of encrypted assets, it has also realized the steady gains of encrypted assets. Trusted by users around the world. Cobo focuses on building scalable infrastructure, providing organizations with multiple solutions for managing multiple types of assets, such as safe custody, asset value-added, chain interaction, and cross-chain and cross-layer, providing the most powerful technology for organizations to transform towards Web 3.0 Underlying support and empowerment. Cobo includes Cobo Custody, Cobo DaaS, Cobo MaaS, Cobo StaaS, Cobo Ventures, Cobo DeFi Yield Fund and other business sectors to meet your various needs.

Intellectual Property and Disclaimer

This article was written and provided by Cobo Ventures for informational purposes only. Cobo Ventures does not warrant (whether express or implied) that the content provided is accurate, complete, reliable or reasonable.

The content of this article is not intended to guide readers to invest in related companies or products or provide any advice. Cobo Ventures shall not be liable for any loss or expense arising from reading the content of this article or being involved in the content provided.

Original link