This article comes from MediumThis article comes from

, the original author: Haseeb Qureshi, compiled by Odaily translator Katie Ku.

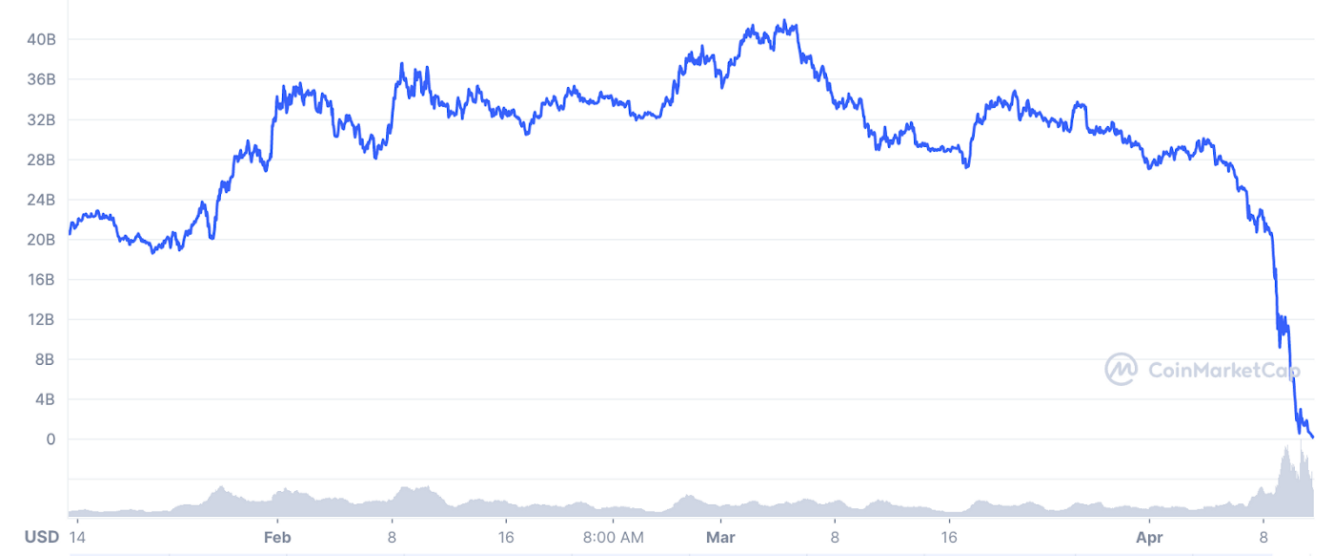

Terra will be forever remembered by the crypto market.Terra The impact of failure will reverberate throughout the industry in the next few years, and people's impression of DeFi and decentralized stablecoins will be "badly discounted".

Source: CoinMarketCap. Terra (LUNA) prices since 2020.

secondary title

Terra empire building

In the early days, Terra only facilitated e-commerce payments in South Korea, and almost all payments were provided through the Chai payment platform. But after the 2020 DeFi Summer, Do Kwon had an idea: by extending the Terra blockchain to support smart contracts, create a native DeFi ecosystem centered on the US dollar-anchored stablecoin UST to increase adoption. (Before then, the largest stablecoin on Terra was KRT, which was pegged to the South Korean won.)

image description

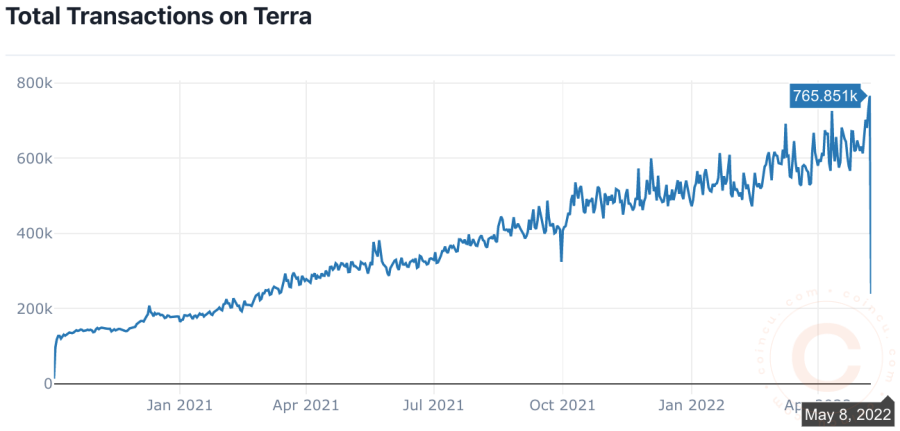

Source: CoincuTotal. Terra's total transaction value since 2021.

At the center of this rapid growth is the Anchor protocol, a deposit protocol built by Terraform Labs. Dragonfly Capital was one of the investors in Anchor's seed round. Anchor receives UST and income-generating assets (usually liquid stock derivatives, such as stETH). Since pledged derivatives passively generate income, these income are captured by the agreement and used as interest rates to subsidize depositors.

image description

Source: Anchor Protocol. Anchor tagline.The most important (and most controversial) feature of Anchor is that the protocol sets a fixed target rate of return for savers, rather than a market rate.

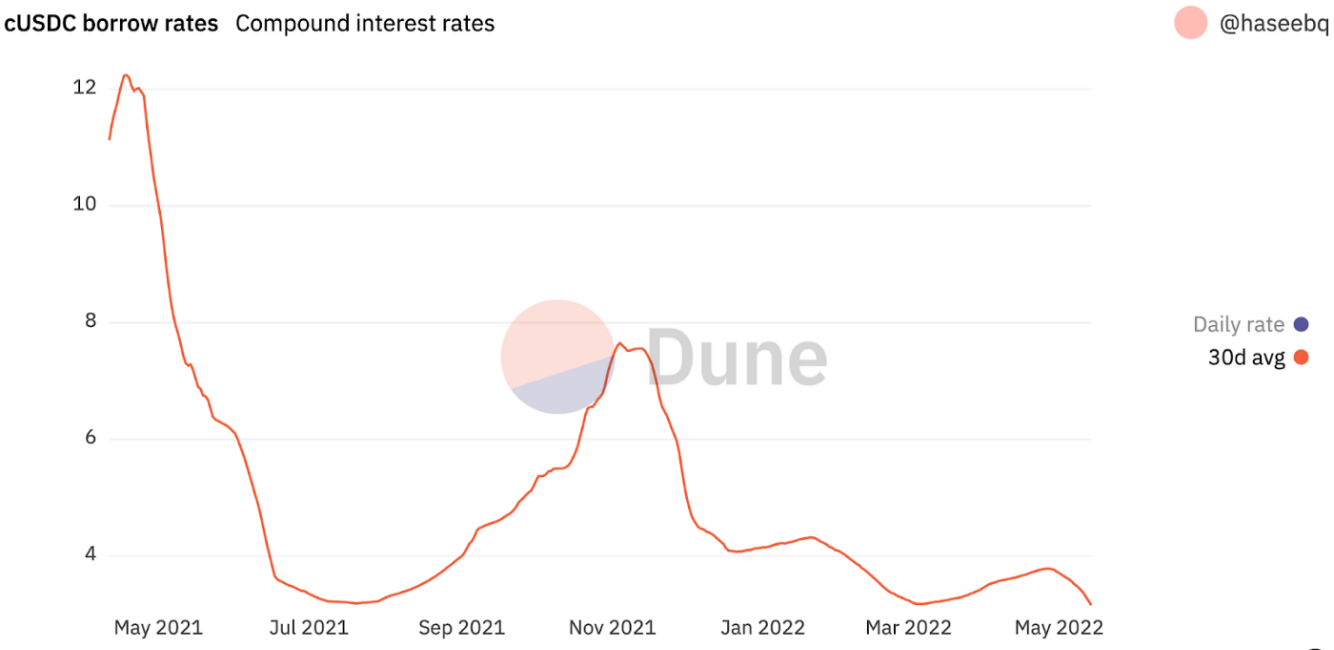

In the early days of Anchor, this rate was basically sustainable, because the overall rate of DeFi is also high. With the yields of most DeFi protocols falling in the summer of 2021, Anchor still refuses to change its target interest rate. This made Anchor's 20% guaranteed yield increasingly attractive, and eventually became the lending protocol with the largest TVL in all of DeFi.

image description

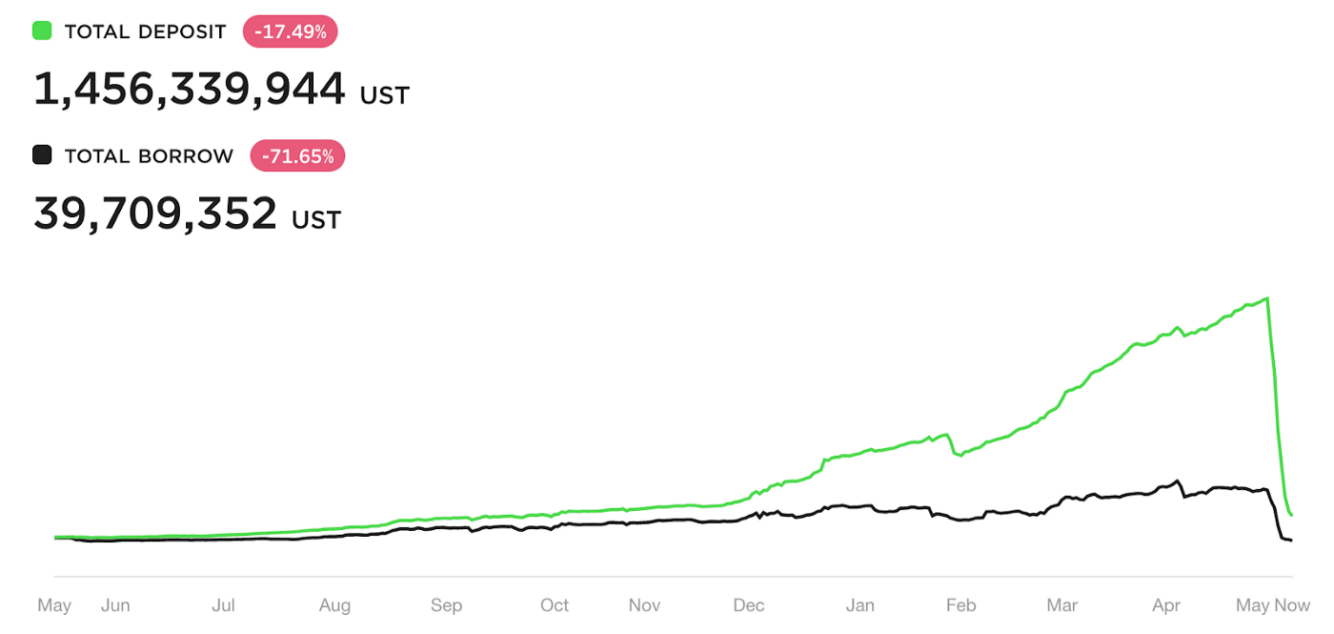

Anchor's deposit volume swelled rapidly and began to be inconsistent with the growth of loan volume.

image description

Source: Anchor Protocol. Anchor deposits and borrows over time (peaking at its crash).

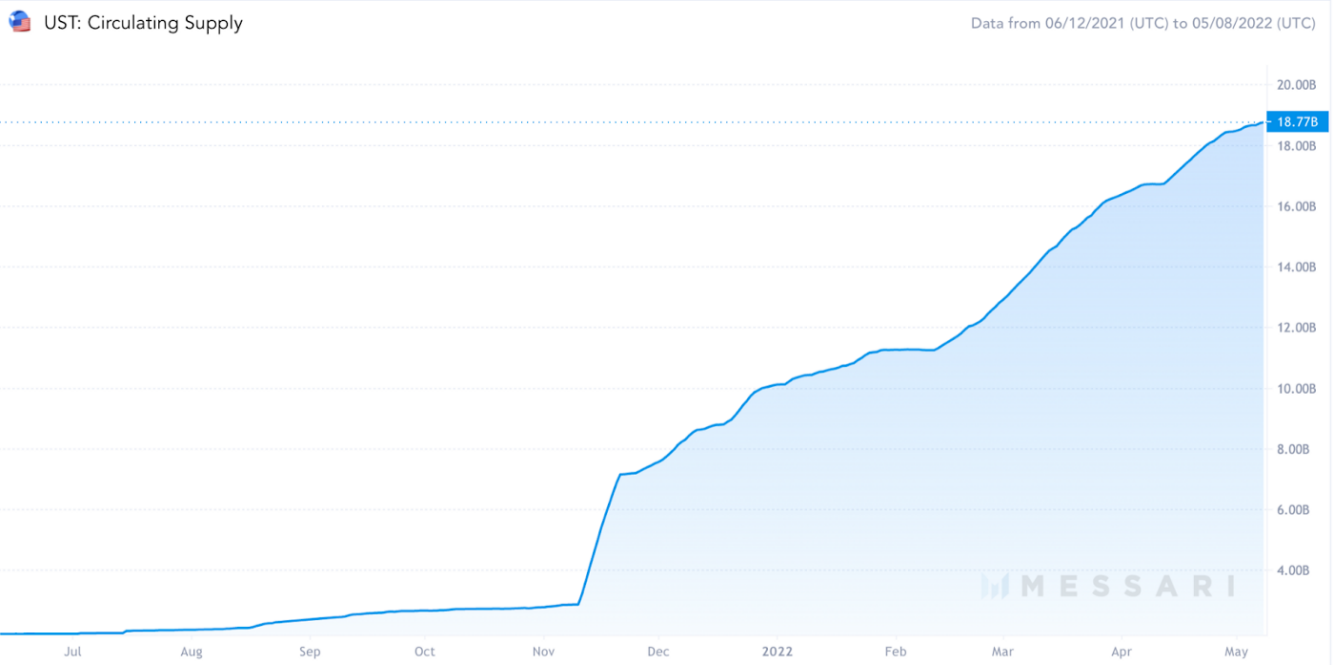

More and more UST began to be minted just to be deposited into Anchor. At its peak, Anchor held over $14 billion in UST, making UST the third largest stablecoin in the world.

Source: Messari. Availability until May 8th UST.

secondary title

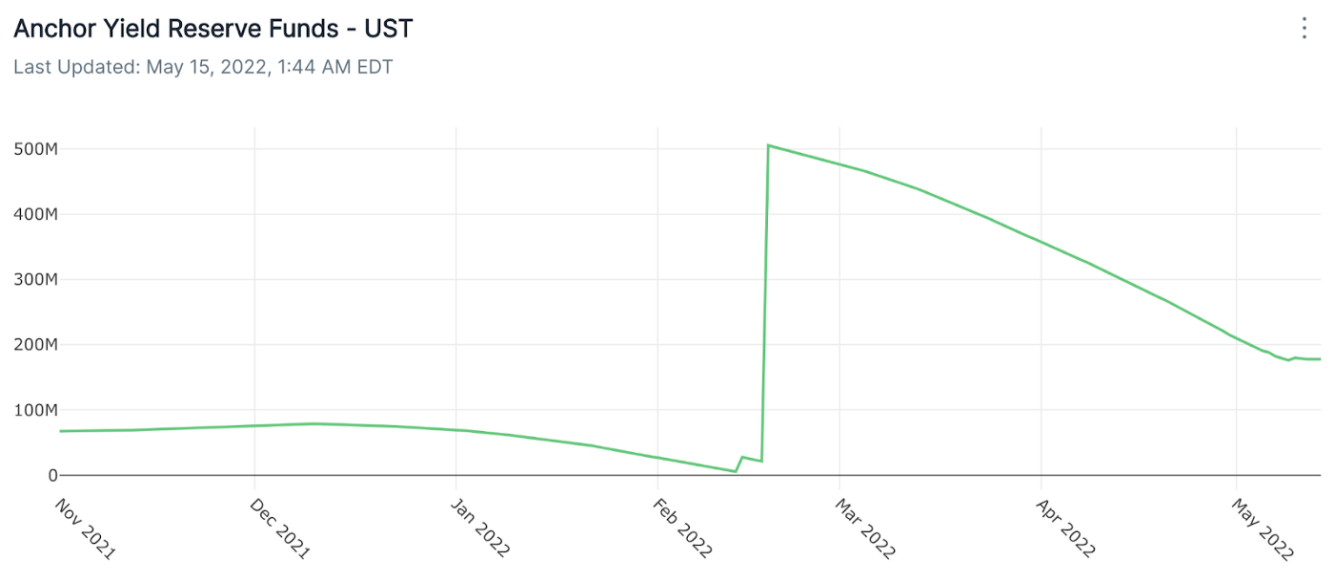

When over $10 billion in UST promises a 20% yield, pays over $2 billion a year in interest, and can't be paid with only the interest paid by borrowers, reserves can obviously dry up quickly.

image description

Source: Flipside Crypto. The Anchor Income Reserve Fund was recapitalized in mid-February for $450 million.In February 2022, facing dwindling on-chain reserves, Do Kwon was forced to quickly recapitalize the reserves with $450 million in UST.

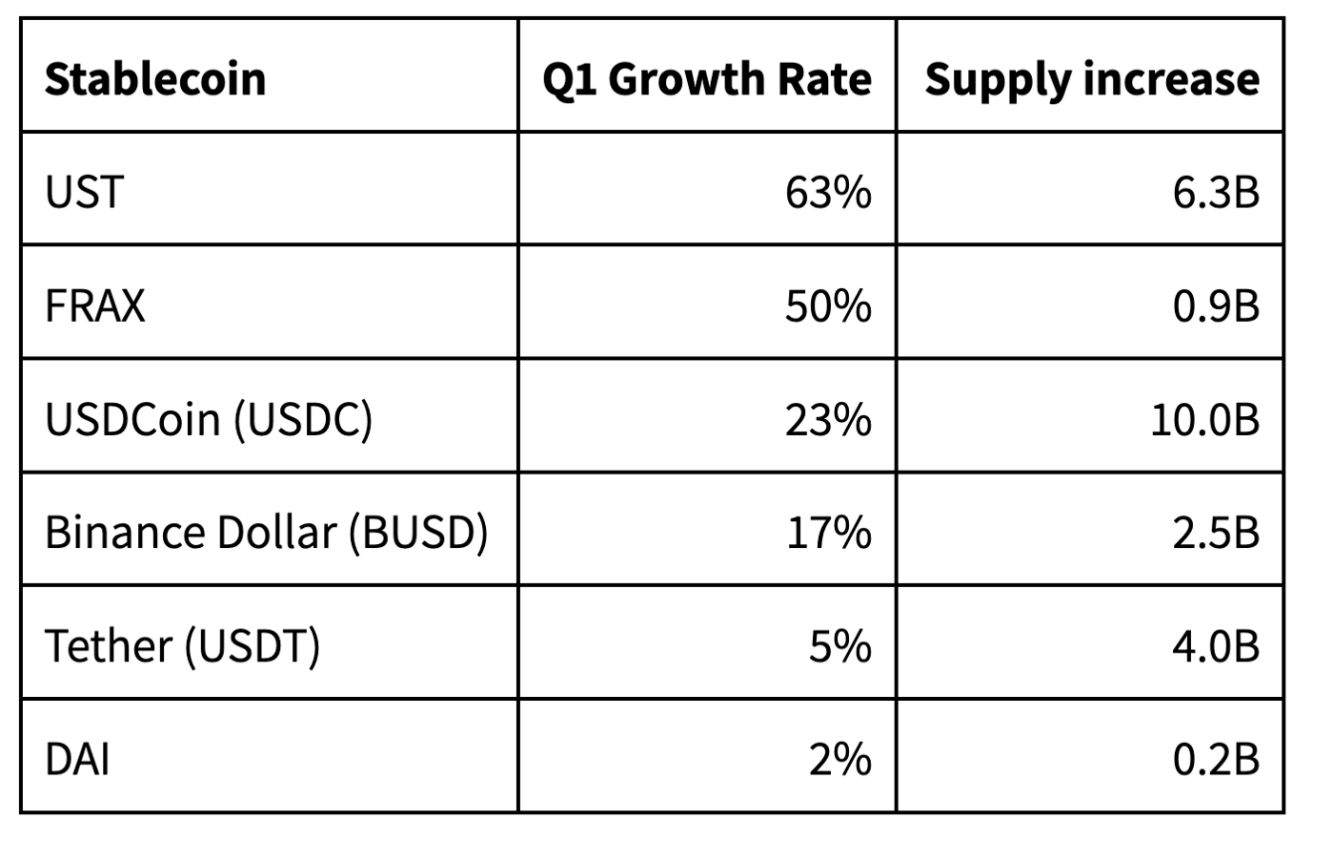

Anchor, as a "cancer" in the center of Terra, needs to be fed. Its voracious appetite has also made UST the fastest growing stablecoin in the entire industry.

secondary title

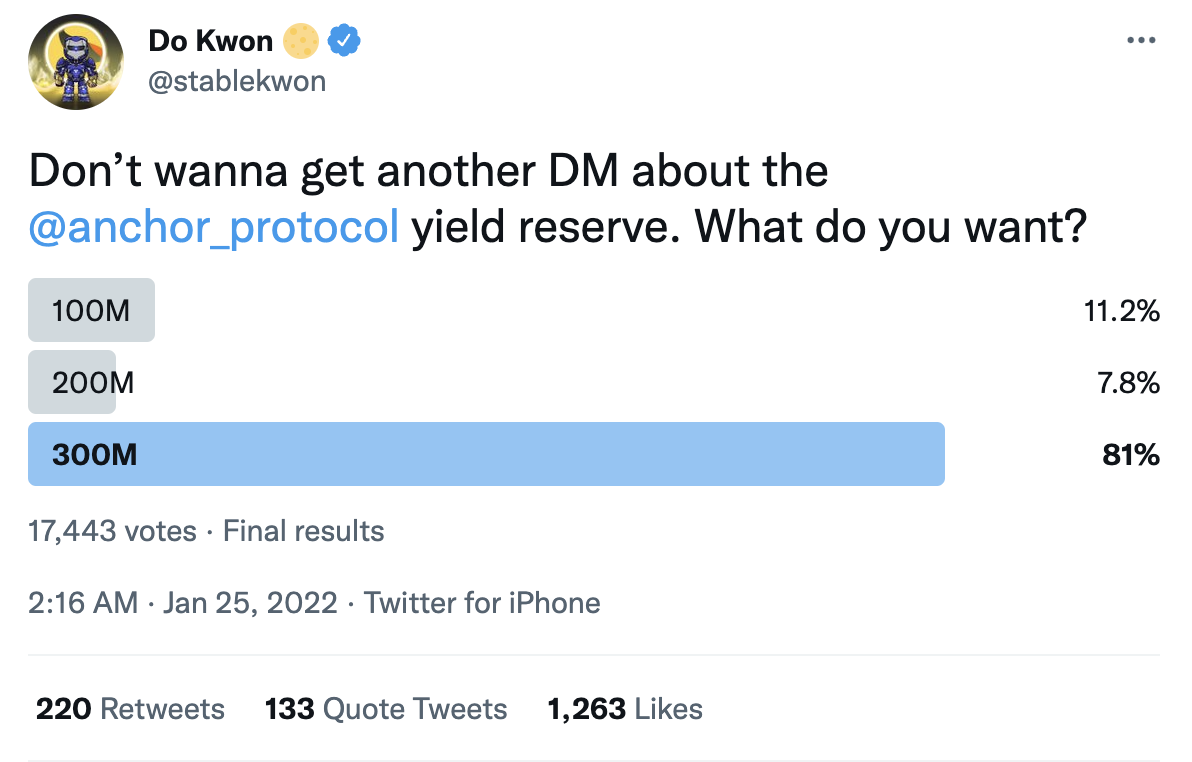

Since high returns are unsustainable, why not stop them earlier?They argue that yield is simply a customer acquisition cost that must be paid before UST becomes the dominant stablecoin among cryptocurrencies.

image description

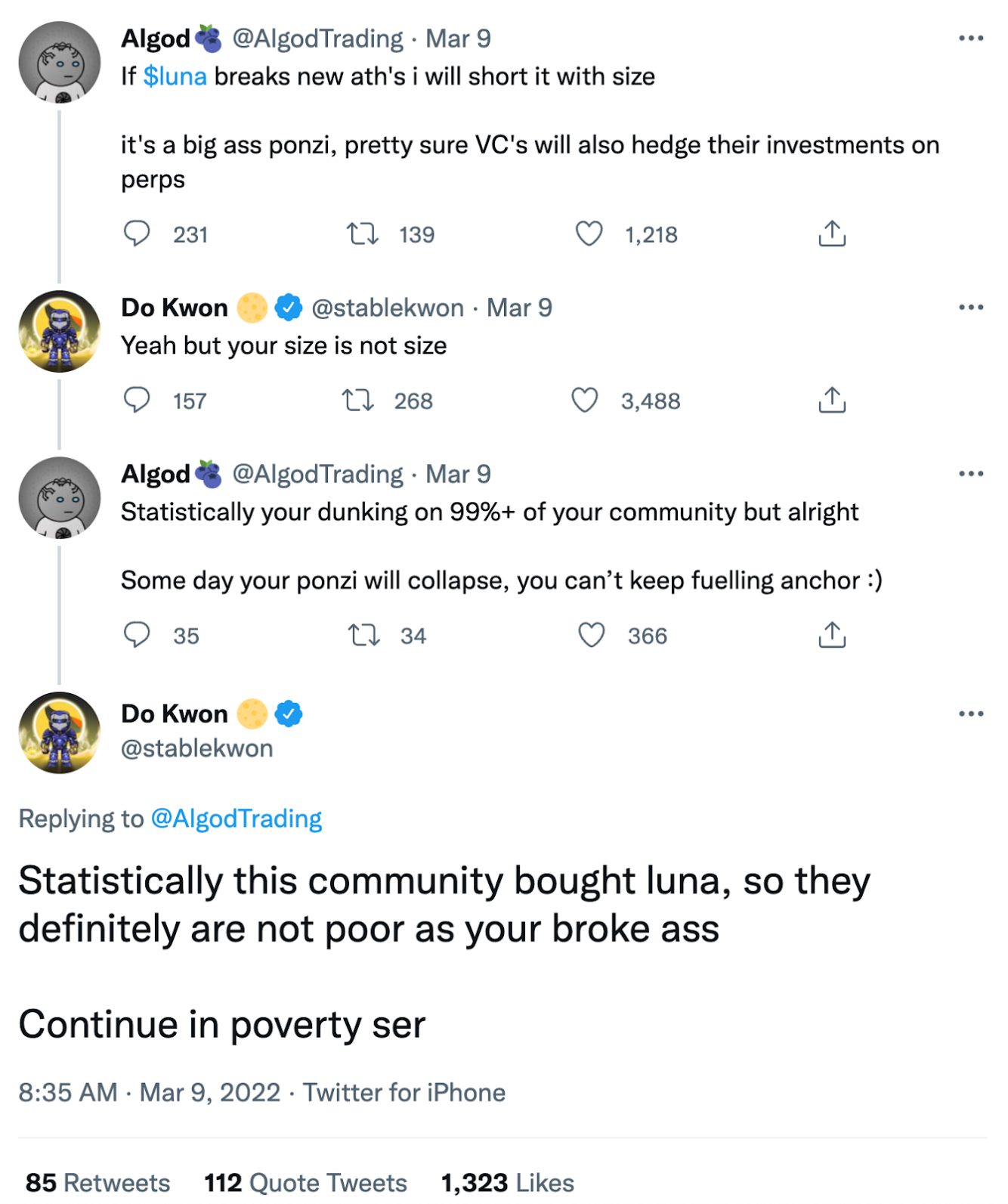

We, like many others, have publicly commented on the unsustainability of UST and Terra, but Terra has rejected those comments. Do Kwon has cultivated a cult of personality around himself, publicly attacking naysayers and dismissing claims of "unsustainability".

image description

Source: Twitter. Do Kwon publicly bet $1 million on Terra’s future solvency against Algod, who publicly denounced Terra as a Ponzi scheme. Do Kwon publicly bet against other critics for a total of $11 million.

The Terra community relies heavily on Anchor right now. Ultimately, the market capitalization of LUNA was more than 2 times the value of outstanding UST. At this time, it was also argued that, even at this level of growth, UST was a safe overcollateralization.

In order to alleviate the debt pressure brought about by rapid growth, Terraform Labs established the Luna Foundation Guard (LFG) to support the UST peg. Some of the most notable members include Jump Capital, the venture capital arm of Jump Trading, and Delphi Digital. Jump is one of the most profitable market makers in all of cryptocurrencies, reportedly raking in billions of dollars in profits last year, much of it from massive bets on the Terra ecosystem.

The Terra community once believed that its central bank is now so deep and unbreakable.

secondary title

At the beginning of the second quarter, the ratio of LUNA to UST market capitalization dropped rapidly as some holders began to sell due to concerns about inflation, risk assets and the cryptocurrency market.

image description

Source: CoinMarketCap. LUNA market capitalization after mid-January.

The decline peaked on May 9. In order to deal with a larger sell-off in advance, some giant whales withdrew a large number of positions from Anchor and sold UST through Curve, the largest DEX in UST. The continuous selling of hundreds of millions of dollars in a short period of time finally decoupled UST.

This caused UST to suddenly not be warranted enough.

image description

The market reacted violently. Anchor depositors scrambled to exit before UST and Anchor burned completely, and runs ensued.

image description

Source: Anchor Protocol. Total Anchor deposits plummeted in May as users scrambled to withdraw their money.Armed with billions of dollars in LUNA and BTC assets, LFG desperately tried to buy up the UST that was being sold, but the sell-off couldn't be stopped.

When on-chain “sleuths” discovered that LFG had moved $1.4 billion of its Bitcoin holdings to Binance, the entire market panicked amid fears of Bitcoin being sold off in an already chaotic environment. In the end, Bitcoin did nothing to distract from the market panic, as many have warned. During times of panic, crypto assets have a correlation of 1. Bitcoin's plunge caused LUNA to fall further.

But over the next few hours and days, UST's peg gradually fell along with the price of LUNA.

image description

Source: CoinMarketCap. UST/USD exchange rate since May 8.

Rumor has it that there were massive margin calls and that funds and market makers exposed to LUNA and UST had to do fire sales. The entire market fell in tandem.Terra's algorithmic minting has led it into a hyperinflationary spiral, like a third world country frantically printing devalued currency to pay its debtors.

image description

Source: TerraScope. Vicious inflation of LUNA supply.

Three days later, the supply of LUNA surged from 345 million to 6.5 trillion, and the supply expanded by about 18840 times. On May 12, LUNA was delisted from many major exchanges, and the price dropped from more than $60 to less than a tenth of a cent. The Terra blockchain paused block production as the cost of a governance attack has dropped to a few million dollars, allowing anyone to take over the chain and wreak havoc.

But we are left with two questions.

secondary title

First, what else can Terra do?

According to rumors, LFG still holds more than $1 billion in unspent Bitcoin, and Terra is still an L1 with an emerging ecosystem. When L1's central bank's liabilities exceed its assets, there is only one responsible thing to do: default on its debts, and negotiate with creditors.If Terra negotiates a compensation plan for UST holders that is acceptable to all parties, then maybe the Terra chain can survive.

(Odaily Note: Now, Do Kwon has proposed "Terra Ecological Reconstruction Plan 2", proposing to fork the Terra chain into a new chain of Terra Classic and non-algorithmic stablecoins.)

secondary title

Second, what are the long-term consequences of Terra's failure?

Most obviously, algorithmic stablecoins like UST will no longer be taken seriously. The possibility of a stablecoin death spiral has been known since the release of the stablecoin’s original algorithm, the Basis white paper. Terra's failure seared it into the collective memory of Crypto participants. Every major algorithmic stablecoin has either utterly failed or lost significant value in the last week.This is the largest experiment ever,

The collapse of Terra could be the death knell for algorithmic stablecoins.The second consequence of Terra's bankruptcy is increased regulation.

Stablecoin and DeFi regulation is likely to come soon and be more punitive than ever. The last time we saw such an egregious public failure by a large crypto asset was the 2018 debacle of the Ponzi scheme BitConnect. Its promoters have been sued by the SEC. For a failure of this magnitude, people have to be punished. We’ve seen US Treasury Secretary Yellen call for regulation of stablecoins and hold congressional hearings on the risks of DeFi.