Original author: supreet.eth

Original compilation: H.Forest Ventures, Dinzz

Recommended reason:

Recommended reason:We all know that OpenSea is the only one, but how did OpenSea become the most popular NFT market? In the article, the author described how OpenSea made the right choice step by step in the 18-year encryption winter: they predicted the potential track; established the supply and demand relationship in their own way; from the direction of maximizing user experience Polishing products... OpenSea has become a unicorn in the NFT trading market through these, and after that, where will OpenSea go? Let the article tell you.

Let’s go back to the winter of 2018, when the encryption market was close to a collapse, even blue chips like BTC and ETH fell by 90% from their historical highs, and those projects that once had grand visions were shut down one after another. So at Thanksgiving dinner, your uncle might sarcastically ask, "So... how's your Bitcoin investment?"

first level title

First, what are NFTs?

NFTs (Non-Fungible Tokens) are a way to store ownership of assets on the blockchain. It can be digital assets like pictures, music, or even real-world assets like land titles, diplomas, etc. Since blockchains are fully decentralized and censorship resistant (at least Ethereum is), you don't need a third party to maintain this record of ownership.

first level title

Is OpenSea really that popular?

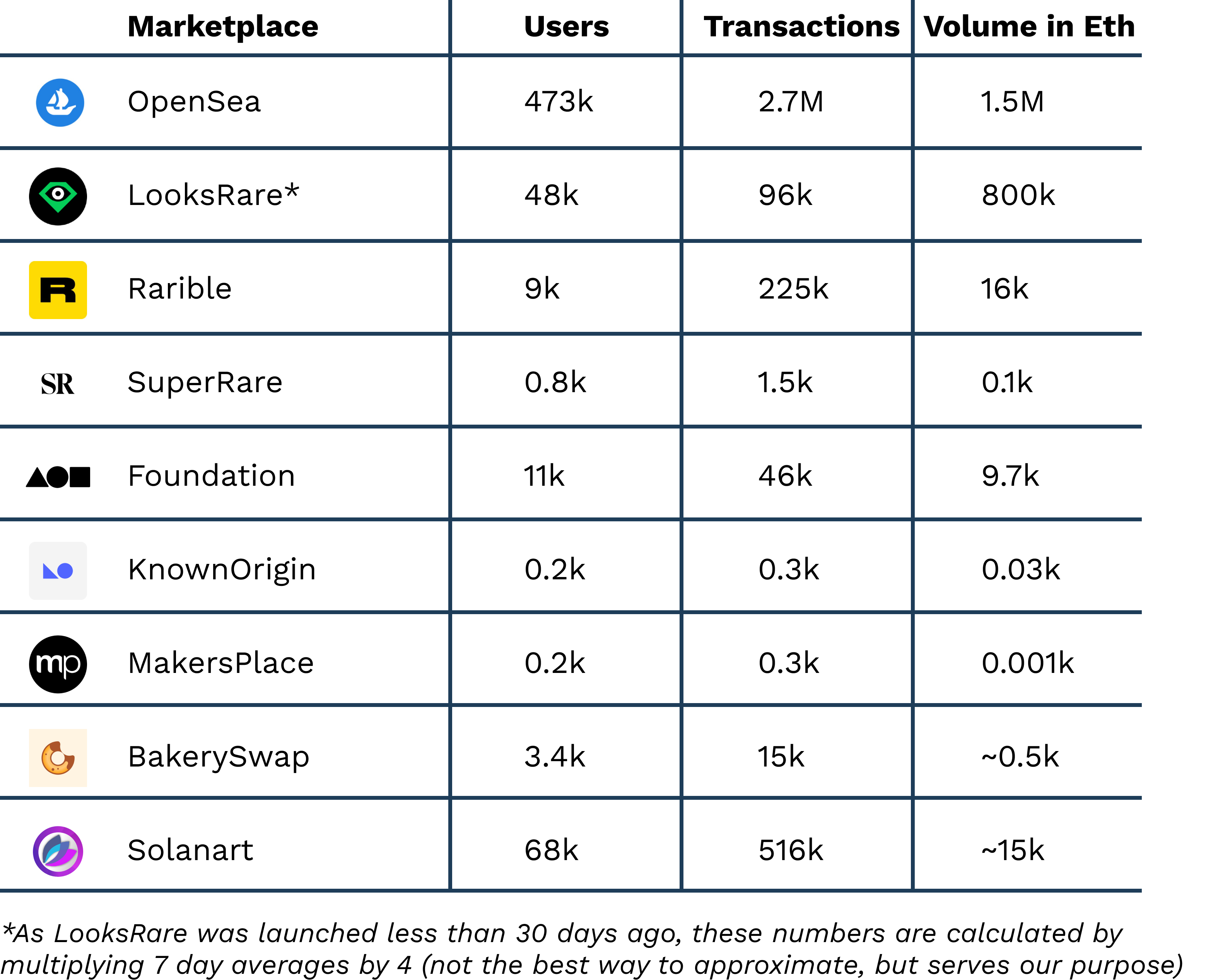

Let's look at the data. The table below compares different NFT markets based on user count, transaction volume, and ETH transaction volume over the past 30 days. These stats come from DappRadar, which tracks various metrics for Ethereum applications by querying Ethereum on-chain data.

first level title

What did they do right?

secondary title

Quickly establish supply and demand relationship

As Lenny Rachitsky (former product manager at Airbnb) discusses in his Newsletter, one of the biggest pain points of launching a marketplace can be described as a “chicken and egg problem”. How do you convince suppliers to rank their items when there are no users on the platform, and if not, how do you get the attention of buyers?

Most traditional markets succeed by establishing supply channels first. The same is true for OpenSea. As The Generalist reports, they went to great lengths to build up the initial supply, which Richard Chen (partner at crypto investment firm 1confirmation) sums it up perfectly in the quote below:

"Devin and Alex (the co-founders of OpenSea) did a great job discovering new NFT projects in Discords, and beat Rare Bits (OpenSea's strong competitor at the time), and successfully got these projects listed and traded on OpenSea instead of Rare Bits .When we invested in April 2018, OpenSea traded about 4x the volume of Rare Bits." --Richard Chen

These efforts led to OpenSea's early collaborations with several projects/artists, including support for Axies (arguably the most popular Ethereum-based game), using its native token MANA to purchase Decentraland (an Ethereum-based virtual game similar to Minecraft). Game), cooperate with Major League Baseball to sell MLB digital collectibles, cooperate with Deadpool official to sell digital collectibles, cooperate with German football club Bayern Munich to list player card NFT, and support the transaction of ENS domain name. This exhaustive list demonstrates the team's passion for establishing stable supply partnerships with as many projects as possible, and a vision to cater to NFTs across a wide range of categories including games, art, sports, entertainment, domains, and more.

OpenSea's full steam ahead is fueled by the platform's user-focused features that make it easy for vendors to get started with OpenSea. The listing of NFT is permissionless, without any approval or complicated approval process. Additionally, OpenSea has created a way to shift the cost of minting new NFTs on Ethereum from the seller to the buyer. Both of these features have significantly lowered the entry barrier for new artists/projects and greatly increased the inventory of NFTs on the platform.

secondary title

Maximize user experience

As Sarah Tavel discusses in her blog post, the market should not only focus on increasing supply, but also need to implement product features to maximize user experience. Much like Uber does with credit card touchless payments, Airbnb is making it easier for them to get customers by building a Premium Host program that rewards hosts who meet the requirements with a special display badge. OpenSea excels here too.

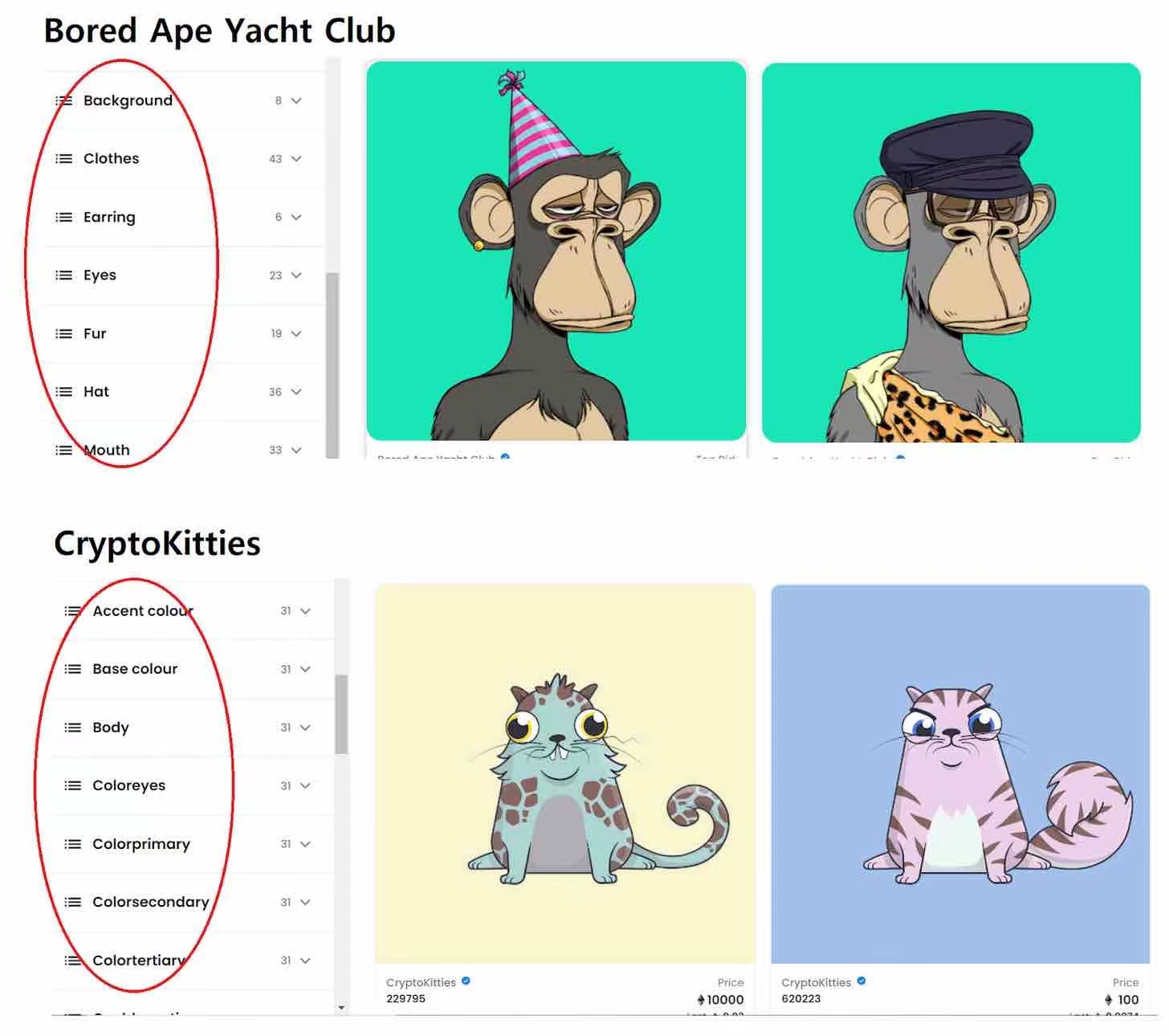

image description

Different filters for different collections

Next, they took concrete steps to address the biggest problem plaguing NFT enthusiasts and Ethereum users in general — prohibitively high gas fees. Gas is a fee charged for each transaction on the Ethereum network, paid to individuals who run the network, that is, miners. However, due to the ridiculously high demand for Ethereum and the relatively low capacity of the current network, the fee per NFT transaction can range from tens to hundreds of dollars (depending on network congestion). While OpenSea has no control over the underlying gas fees of the Ethereum network, they have implemented several features that reduce these costs, at least to some extent.

They enable auctions to be held off-chain so that the gas fee is only used once during the final sale, allow auction prices to be lowered off-chain so that price changes do not require gas fees to be paid each time, introduce "lazy one-click minting", So that artists can mint NFT for free, and the gas fee is borne by the buyer. OpenSea is integrated with Polygon, which is a side chain of Ethereum, and its interaction cost is lower.

secondary title

make the right choice

A good product is only one of the key elements of success, but not the only one. Every project faces a myriad of choices during their lifecycle, and the choices they make determine whether they ride the waves or capsize and sink. OpenSea made many right choices on its way to the top.

The first is that they have faith in their mission. According to The Generalist, their firm belief is something called ERC-721. This is a standard built by Ethereum core developers to regulate the creation and transfer of NFTs on Ethereum. The creation of this standard means that this area is important enough to attract the attention of Ethereum developers, and that all future NFT projects will adhere to this standard. So they created a marketplace on top of the ERC-721 standard, which could then support all future NFTs. By doing so, OpenSea provides buyers with a more convenient experience by aggregating NFT supply. Before this, each project had to create its own marketplace, for example, CryptoPunks and Axies had their own NFT marketplaces (and still do).

This belief in NFTs is also what allowed them to survive the 2018 crypto winter. When the cryptocurrency market was down and not many projects could survive, OpenSea ran a lean team of only 7 employees, relied on constant transaction fees to maintain the company's operations, and continued to cultivate in the industry.

first level title

What's next for OpenSea

What will you do after conquering the world? It's up to you to crush every competitor who dares to overthrow you and continue your dominance. This can be done by either becoming number one in your field by a wide margin, expanding into other fields or tracks, or both.

OpenSea is already a dominant force in the NFT market. However, they face a real and powerful threat from the newcomer to the market, LooksRare. This recently launched NFT marketplace has a lot of advantages for them: fees are lower than OpenSea, have a native token which greatly increases its appeal to crypto-natives, and share all of its fees with token holders. As can be seen from the previous table, LooksRare has surpassed all other platforms and is approaching OpenSea's volume and value.

So will OpenSea launch its own token? It's not that simple. As a U.S. company, OpenSea gets along well with U.S. regulators and cannot risk launching a token that would only draw the wrath of the regulators, hindering their operations. Therefore, the path forward for OpenSea is to maximize user experience and possibly expand to other tracks. Here are some potential options:

Expand mobile. OpenSea already has a mobile app, but it's very limited and doesn't even allow trading NFTs. The application needs to abstract away the process of creating wallets, storing mnemonic phrases (which can be done for advanced users), and complex gas estimation. Basically, it allows encryption novices to seamlessly access and use it.

Explore the fragmentation of NFTs, where the original owner of the NFT can split ownership into multiple smaller tokens, which can then be purchased by others to share ownership of the NFT. Now that most people can’t afford blue-chip NFTs like BYAC and CryptoPunks, such ownership will become a new demand. Original owners can benefit from increased liquidity and potential "curator" fees from selling fragmented NFTs. Win-win!

Consider partnering with a DeFi protocol (or creating your own) to allow borrowing money using NFTs as collateral, starting with blue-chip NFTs of course. This cross-cutting collaboration can unlock entirely new user bases and demands for OpenSea.

Vitalik recently spoke about non-transferable NFTs that have potential uses such as awarding college degrees, land titles, and more. While there are many considerations that have yet to be addressed (for example, if the owner wants to transfer to their own other wallet due to security concerns), OpenSea could lead the community's discussions, and possibly even write an ERC standard for it! They could even explore the potential of creating a B2B solution, offering non-transferable NFT solutions to businesses that might want to use it.

Translator's note:

Translator's note:

Official account: H Forest

Follow us:

Our Twitter: @Forest_Ventures

Our mirrors:H.Forest

Official account: H Forest