Original Author: Kevin Tai

This article is an opinion article published by Kevin Tai, the co-founder of Linear Finance, on Cointelegraph. The following is the full text translation.

Are Decentralized Autonomous Organizations (DAOs) Really Decentralized? Let's see why they have trouble achieving this goal.

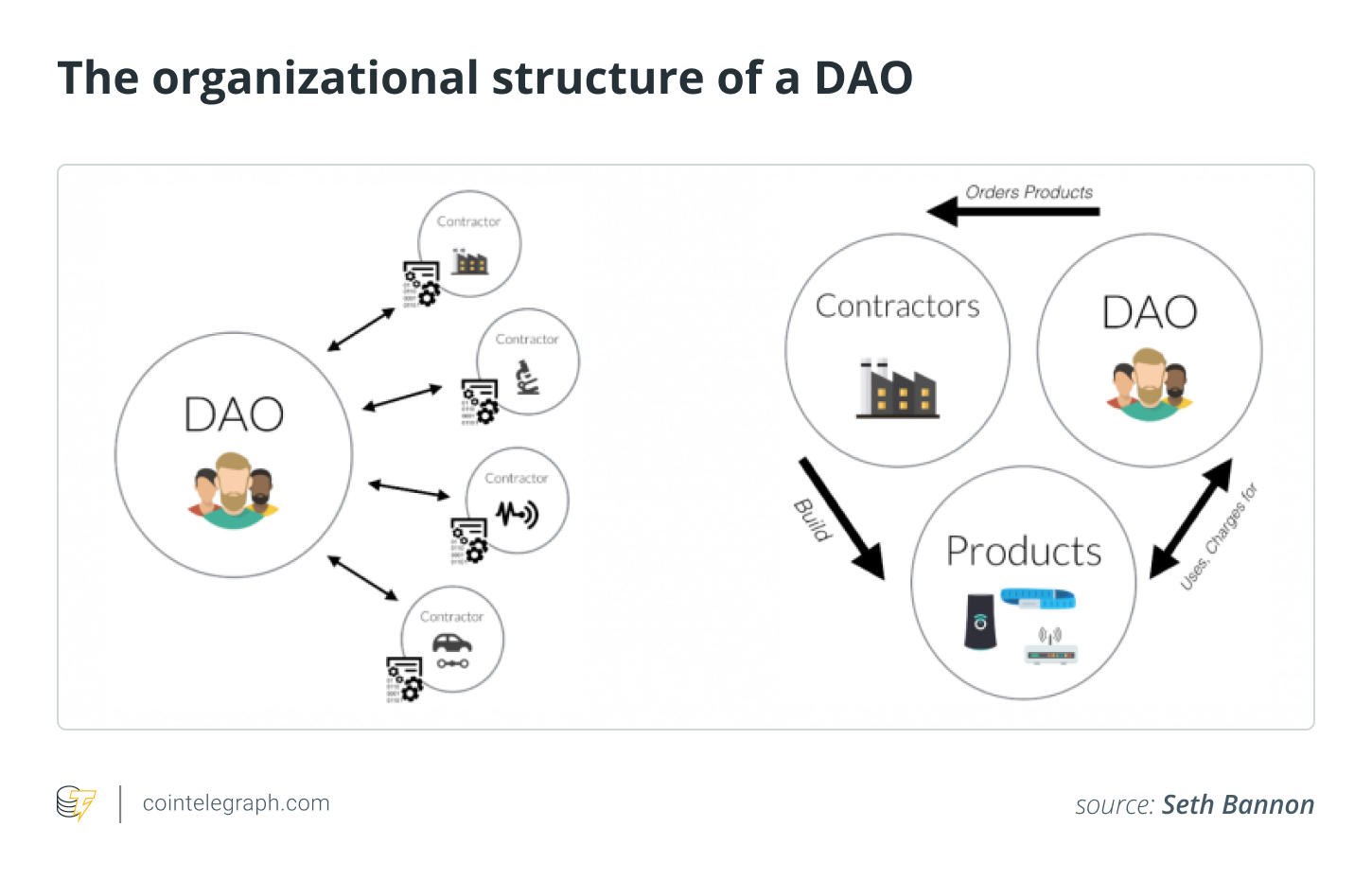

image description

Figure: Organizational structure of DAO

More broadly, DAOs can be compared to how democracies are run. While ideologically the people make decisions for the state, the state is still largely run by a powerful few who hold most of the license to dictate laws and control decision-making. DAOs are similar to large organizations, where shareholders are allowed to vote, but key policies are determined by a board of directors.

What makes DAOs different is that they possess more attractive qualities than traditional organizations. For example, if anyone has an idea in a traditional organization, the idea has to go through a manager before it reaches the top. In a DAO, due to the flat structure, there is no hierarchy and everyone can act on proposals.

Community members come together to vote on proposals that will help the future functioning of the protocol, and once a proposal is agreed to, it is enforced in a smart contract. With this kind of community cooperation, it is in everyone's best interest within the DAO to agree to proposals that benefit the protocol due to incentives. A protocol that attracts more users drives up the value of the token, which is what token holders want.

Although it seems that complete decentralization has been achieved, the reality is that it is very difficult to achieve complete decentralization.

Why DAO projects are still struggling to achieve full autonomy

The DAO protocol is on the difficult road to full autonomy because achieving full decentralization is challenging, and for good reasons.

The decision-maker does not take enough responsibility, which makes the core founding team unable to fully trust a system where anyone can control decision-making. Relying on a large community that bears no immediate consequences creates tension within the collective, leading to a slow decision-making process that in turn affects the entire company.

Today, almost all traditional early-stage startups have very few decision makers. This is mainly because in the initial growth stage, a wrong decision can greatly affect the growth of a company, which also makes many early-stage founders extremely careful about the selection of core team members. In this case, founders can make quick decisions and act quickly. However, DAO goes against this principle by emphasizing the importance of consensus and community voting.

secondary title

Decentralization needs to be done in stages

Decentralization will need to happen in stages if DAOs are to retain their essence, where the community can make decisions equally. Still, giving some level of control is necessary so that the organization can sustain shared prosperity. While engaged communities should be empowered to make recommendations and make decisions, gatekeepers or councils that can effectively uphold the company's core values may be needed.

Most successful DAOs like Uniswap, MakerDAO, PieDAO, Decred, etc. have different gatekeeping systems where proposals go through different stages before being accepted. For example, in Uniswap’s governance protocol, there are multiple execution stages before any proposal is accepted. In its final phase, a group of voted-in users has the power to terminate any suggestion they deem malicious or unnecessary. In contrast, MakerDAO has a more open community where people do not need to hold their tokens to participate in off-chain voting. Still, its proposals are subject to rigorous scrutiny.

The community is the foundation of the DAO, and it is crucial that the DAO develops towards a structure that does not rely entirely on the core team. Currently, voting is an important part of interacting with community members. However, future protocols must pay more attention to the participation of community members and collaboration with developers.

secondary title

Build common prosperity

Most DAO protocols are still in the early stages of building more mature DAOs. A good example is Shapeshift, a cryptocurrency platform for global transactions that has “broken down” its structure to become more decentralized.

The idea of building shared prosperity where everyone can actively participate in the running of an organization is far from reality. Nonetheless, DAOs represent a revolution in which control is decentralized. DAO also represents a platform where people can achieve mutual prosperity in a transparent and efficient manner. More work still needs to be done to realize this romantic idea, but by continually learning and taking new steps along the way, DAOs can achieve full decentralization.

This article does not contain investment advice or advice. Every investment and trading action involves risk and readers should do their own research when making a decision.

The views, ideas and opinions expressed here are solely those of the author and do not necessarily reflect or represent the views and opinions of Cointelegraph.

Kevin Tai is the co-founder of Linear Finance and has more than 13 years of experience in the financial services industry. During the Internet bubble, he worked at Broadview International, a boutique investment bank in Silicon Valley, focusing on M&A transactions in the field of enterprise/CRM software and mobile applications. He has also worked for a number of well-known banks, including Standard Chartered, BNP Paribas and Credit Suisse, in charge of lending and alternative asset products. He holds a BA in Finance from the Haas School of Business at the University of California, Berkeley, and an MBA from Harvard Business School.