On October 25th, Odaily, DFG and Acala jointly held the "All Things Grow - Polkadot Ecological Theme Meeting" in Shanghai. Representatives of professional investment institutions, project parties who will participate in the front-line bidding, development teams, foundation community leaders and other ecological roles stand together at a new starting point when Polkadot officially enters the application stage, predict the development trend of the ecology, and explore various Prospects for class applications.

Meanwhile, Ziqi, a member of the Bifrost Council, introduced Bifrost's original crowd-lending liquidity solution SALP in his keynote speech on "SALP Liquidity Solution".

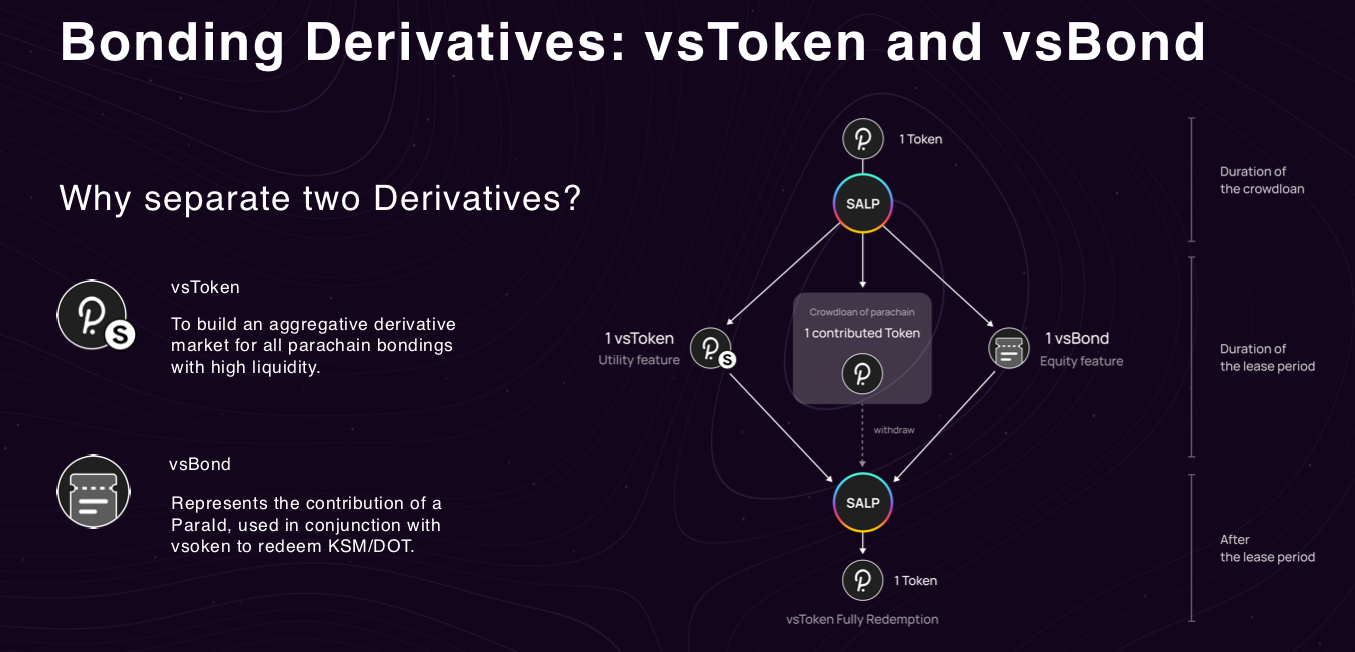

Ziqi said that through the SALP scheme, Bifrost will distribute two derivative tokens vsToken (vsDOT, vsKSM) and vsBond to users. The reason for separating the two types of derivatives is that the slot lease and redemption periods of each project are different, and the incentive strategies for crowd lending cannot be unified, so complete homogeneity cannot be achieved. If a single For derivative tokens, liquidity will be a big problem. Based on this consideration, Bifrost chose to separate and decouple the asset attributes and equity attributes of crowdlending assets, and designed two derivatives for users—homogeneous asset token vsToken and non-homogeneous equity token vsBond.

The following is the full text of Ziqi’s speech, edited by Odaily, enjoy~

I am very happy to be here. Today I would like to share with you the relationship between Bifrost, Polkadot and slot auctions.

The previous guests have introduced some details of Polkadot and the auction, and the explanations are also in place. As for why the project party participates in Polkadot’s parachain slot auction, the main reason is that the parachain has the plug-and-play feature, and the security and interoperability of the entire Polkadot network can be shared by accessing the parachain.

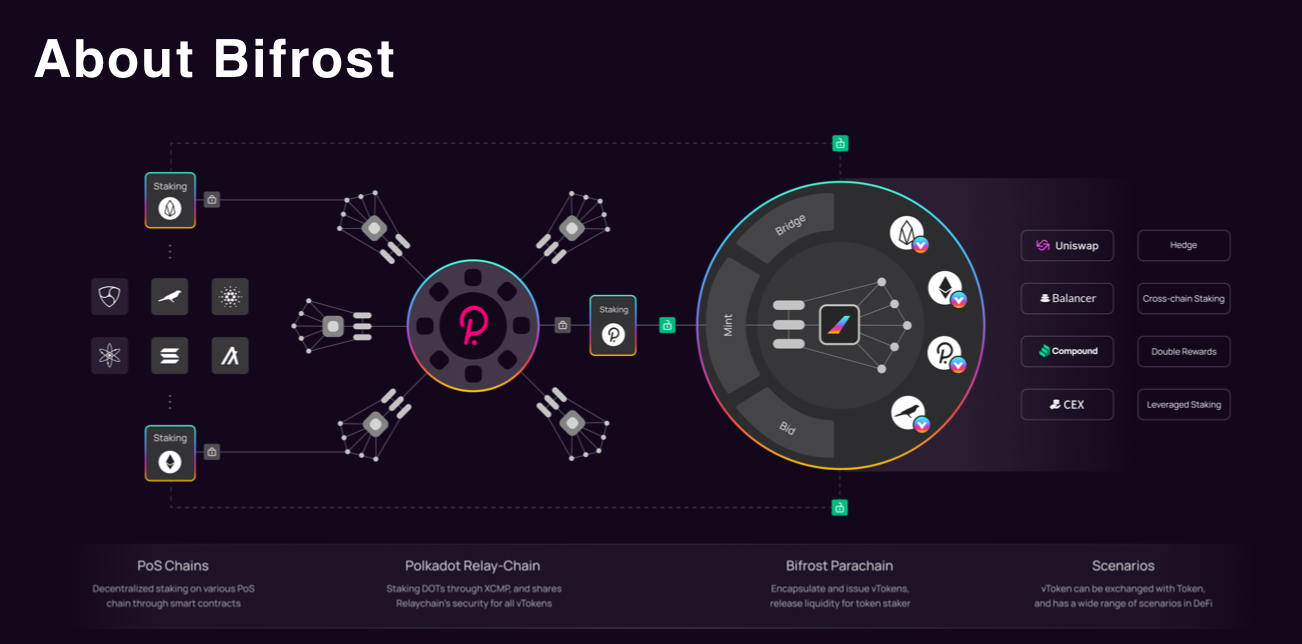

The figure above shows Bifrost's position in the entire DeFi ecological map and the applications that Bifrost can be linked to. In the previous slot auction on Kusama Pioneer Network, we have also successfully won the fifth slot in the first round.

The main thing Bifrost does is to bring some value from other blockchains to parachains or even external heterogeneous chains in the form of derivatives to promote the transfer of value and information. Currently, our main product is SALP, which is also the main content of my speech today.

The full name of SALP is "Slot Auction Liquidity Protocol" (Slot Auction Liquidity Protocol), which is a liquidity solution launched by Bifrost for slot auction scenarios. SALP is somewhat similar to the lcDOT introduced by Acala just now, but the difference is that lcDOT is only applicable to Acala's auctions, while SALP can provide bidding services for other parachain projects.

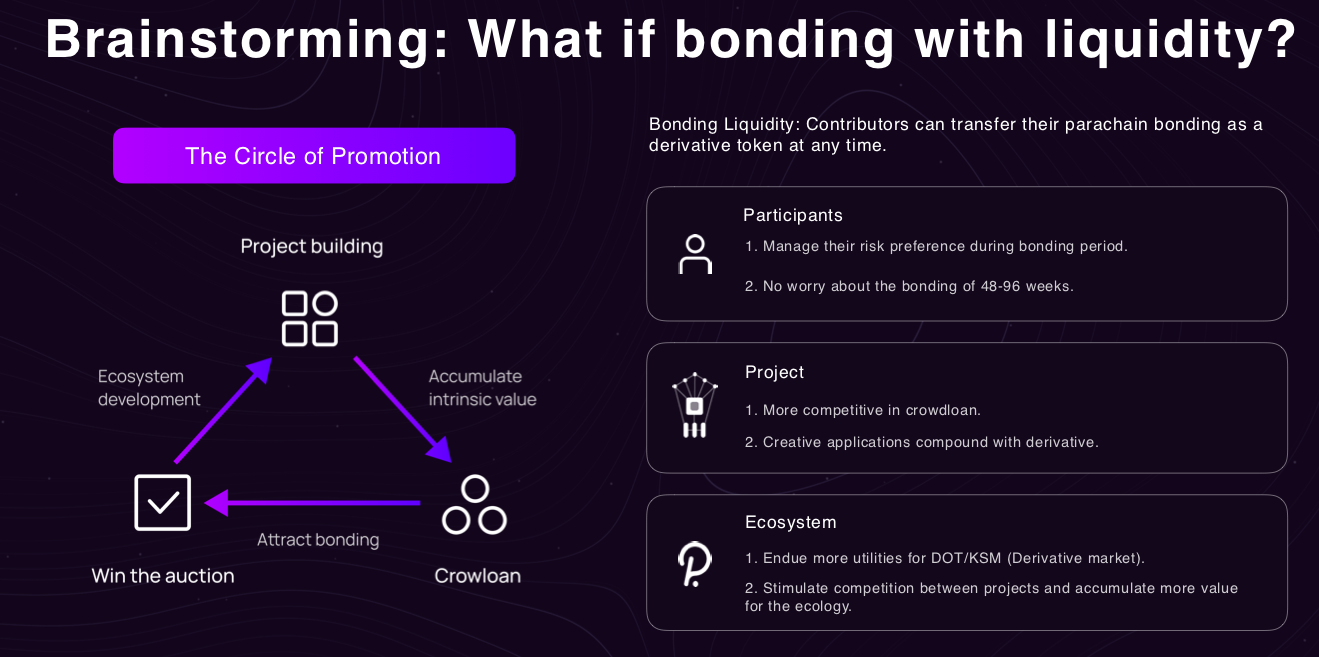

Before introducing SALP, I would like to briefly introduce the special incentive mechanism of parachain auctions - Crowdloan. From a market point of view, the primary significance of crowdlending is to allow projects to get support from the community, attract more DOT and KSM support through certain incentives, and then become a parachain. From another perspective, this also gives DOT and KSM another major new usage scenario outside of Staking.

The picture above shows the role of crowdlending in promoting the ecology. It can be seen that its design is very interesting and can play the role of an "invisible hand" in the entire ecology. The community can help the project to successfully bid for the parachain. In order to maintain competitiveness, all major project parties need to work hard to create and accumulate their own value, which plays a positive role in promoting the entire ecology.

In order to obtain the incentives given by the project party, many users will consider participating in crowd lending. However, there is currently a common concern among users: since participating in crowd lending requires DOT to be completely locked during the entire lease period, this means that within 1-2 years, the user's own DOT will not flow Sexually, this may result in a certain opportunity cost loss. To solve this problem, Bifrost launched the SALP protocol to release the liquidity of assets locked due to auctions.

Briefly introduce the usage process of the SALP protocol. After the user pledges through the SALP protocol, he can obtain two derivatives, vsToken (vsDOT / vsKSM) and vsBond. Among them, vsToken is a completely homogeneous token (Fungible Token), which represents the certificate that users pledge to parachain crowdlending. vsToken can be traded at any time or redeemed 1:1 with vsBond after the lease period of the parachain ends. ; while vsBond is not entirely the same, the vsBond issued for different parachains is different, and its attributes represent the user's support for different parachain slot lease periods and participation in auction rewards, such as supporting Acala and Moonbeam will generate different vsBond-Acala And vs Bond-Moonbeam.

It looks a bit complicated, so why design it this way? Non-homogeneity factors such as uneven slot rental periods, different redemption periods, and inconsistent reward strategies for parachains make derivatives unable to achieve complete homogeneity, and non-homogeneity is an obstacle to liquidity. In contrast, homogeneous derivatives will pool liquidity from crowdlending of different parachains, forming a huge liquidity advantage. Therefore, Bifrost started from the Token attribute of participating in crowd lending, separated and decoupled its asset attribute and equity attribute, and designed two derivatives for users: vsToken and vsBond.

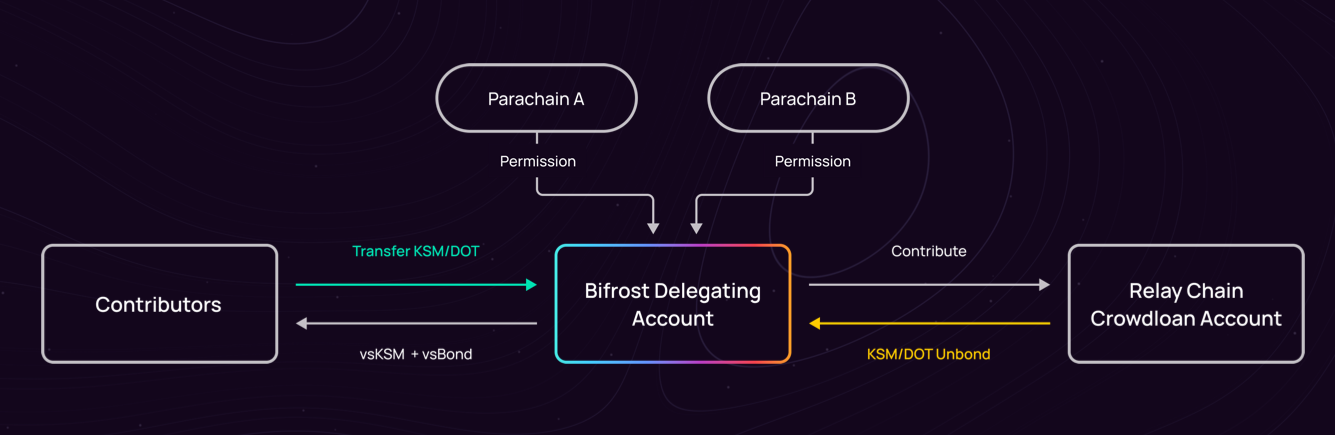

The figure above shows the operation process of the entire SALP protocol. The Bifrost Delegating Account plays a re-coordinating role among crowdlending contributors, parachain projects, and relay chain crowdlending accounts.

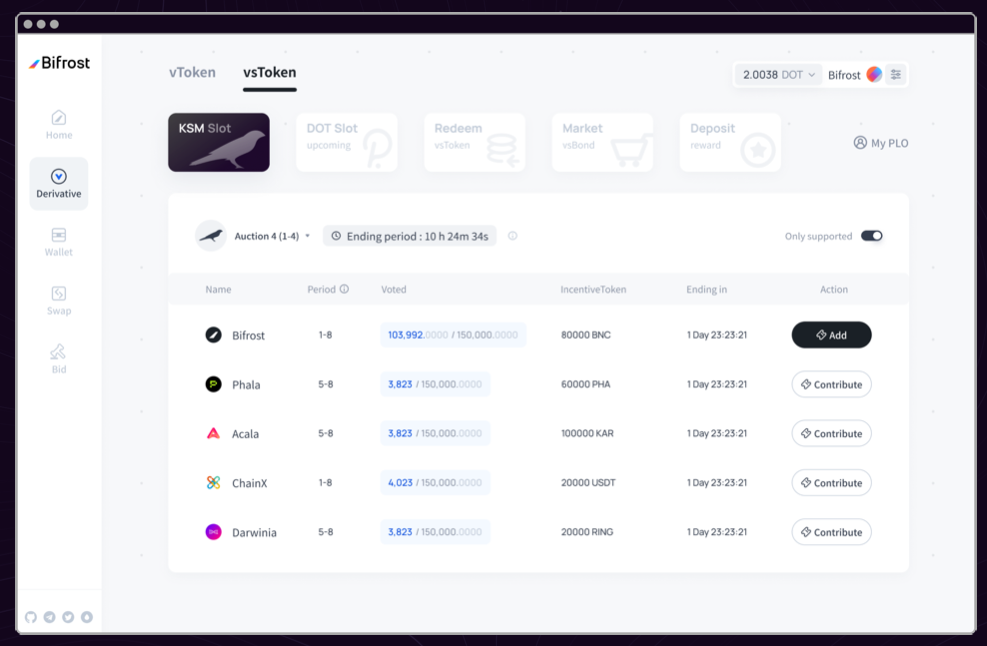

SLAP products have actually landed, and the picture below is our UI. This page will display all the parachain auction information, and you can see the amount of tokens raised, rewards and other information of different projects. You can also choose the project you want to support on this interface, lock DOT, and exchange for vsToken and vsBond.

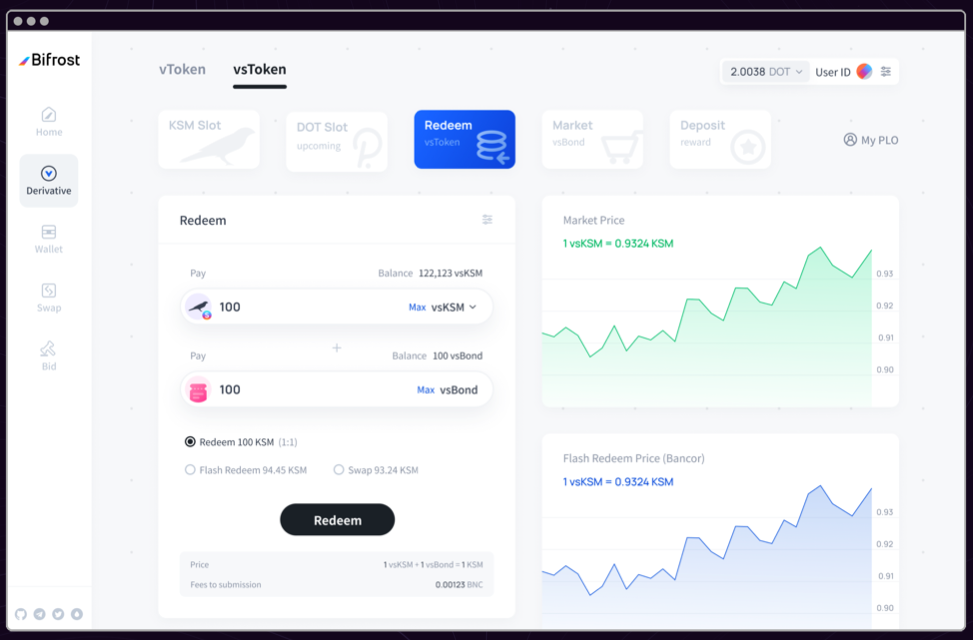

How to redeem your KSM with vsKSM and vsBond? After the parachain lease expires, users can use vsKSM + vsBond 1:1 to redeem the original assets, and within the lease period, users can also freely sell or buy derivatives through the corresponding liquidity pool, but It should be noted that derivatives have a certain discount rate compared with the original assets.

There are two reasons for the discount. One is that it depends on the crowd loan incentive given by the project party. It will give users a psychological expectation that the derivatives during the pledge period will be affected by the fluctuation of the specific incentive value. The other is that it will be affected by the unlocking of the pledged assets. Time impact, for example, if the unlocking period is one year, its discount cost may be relatively high, and the closer to the redemption period, the discount cost will be smaller and smaller.

In the previous second round of slot auctions on the Kusama network, SALP provided bidding support for four parachains including Basilisk, Altair, Parallel, and Kintsugi. A total of 15,164.4 vsKSM were minted, with an average of 11.4190 KSM minted by a single address. With the official start of the Polkadot mainnet auction, SALP will soon launch services for the mainnet auction.

thank you all! Bifrost also has some themed activities in the past few days, everyone is welcome to participate, and you can also visit our official website (Bifrost.Finance) to learn more about Bifrost.