This article comes fromanchain.aiThis article comes from

For encrypted companies/teams, the tightening of supervision may lead to severe penalties, including fines, restrictions, etc. To avoid this, timely adjustments must be made to comply with FATF (Financial Action Task Force on Money Laundering) regulations. In order for companies or individuals to make appropriate compliance adjustments, we must first understand the scope of VASP (Virtual Asset Service Providers, Virtual Asset Service Providers) defined by FATF. Below, we will bring the latest interpretation of the spirit of FATF cryptocurrency compliance.

secondary title

Any digital form of value (formed on the blockchain), including:

cryptocurrency

utility token

utility token

NFT

stable currency

stable currency

Digital currency issued by the central bank

secondary title

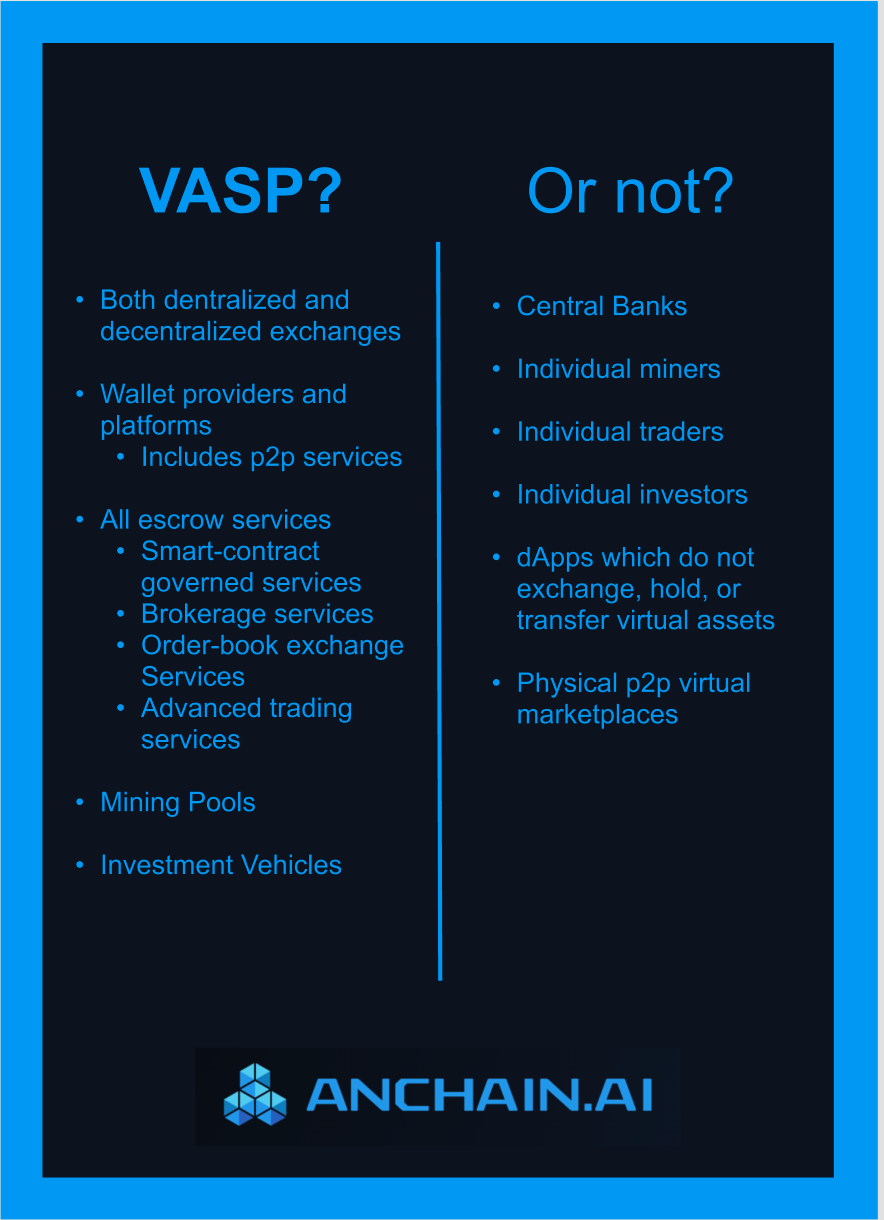

Centralized exchange

Centralized exchange

decentralized exchange

decentralized exchange

Wallet provider or platform

Managed services include, but are not limited to:

Smart Contract Driven Services

Brokerage

Order Book Trading Services

hosting provider

mining pool

mining pool

investment vehicle

The 2018 update had serious and lasting effects on the crypto space, “traditional” financial services and new related technologies. The FATF has been updating its guidance in the cryptocurrency space over the past decade, but the clarification and integration of this new term provides a strong reference for how countries should properly establish regulations on cryptocurrencies.

secondary title

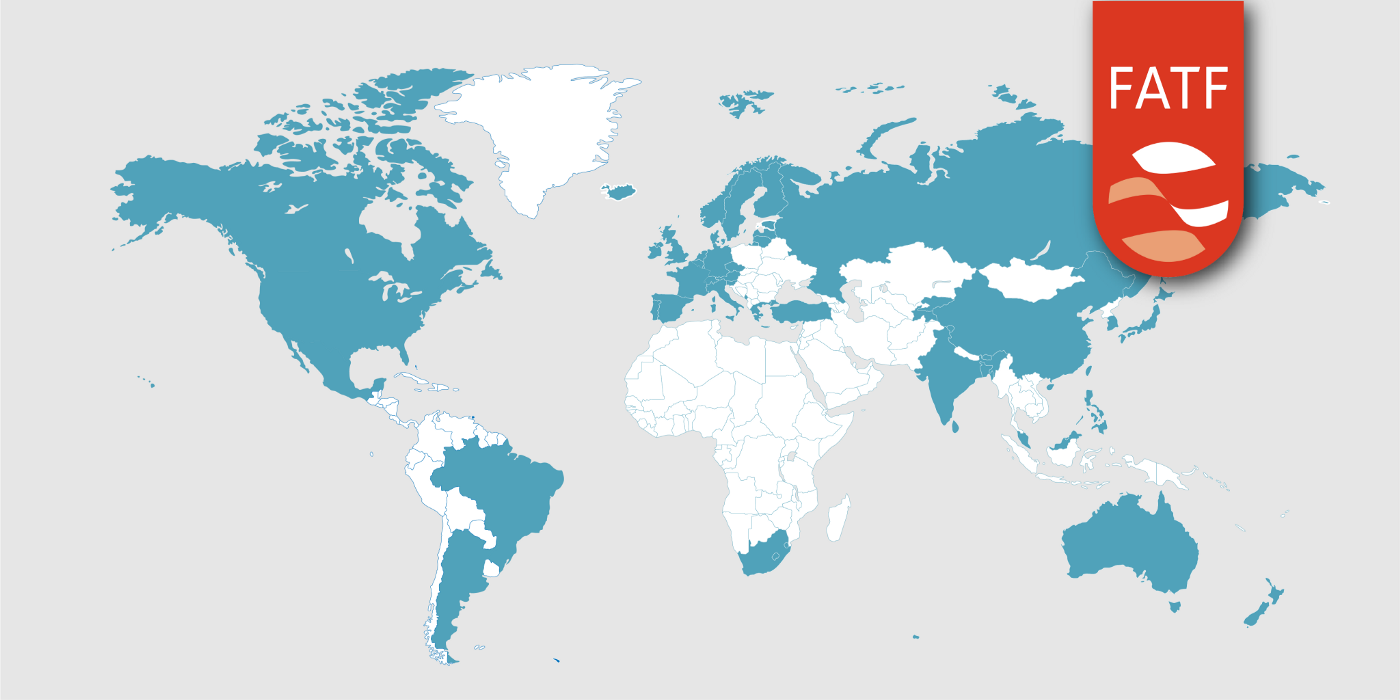

FATF (Financial Action Task Force on Money Laundering)

FATF is a powerful non-governmental organization tasked with helping the international financial system eliminate criminal activity in anti-money laundering (AML) and countering the financing of terrorism (CFT).

These policies often come in the form of KYC requirements, which dictate the amount of information that individuals and businesses must share in order to legally transact with each other. This KYC information is an important tool for law enforcement to carry out their duties in the investigation of financial crimes, especially money laundering and terrorist financing.

secondary title

Virtual Assets (VA) and Virtual Asset Service Providers (VASPs)

VA:

In other words, VAs and VASPs must follow FATF guidelines. Next, it is critical to understand what constitutes a VA or VASP, which a company or individual is to both regulate and comply with. The 2018 proposal leaves us with the following criteria for defining VAs and VASPs:

Is a digital form of value that can be traded or transferred digitally.

Can be used for payment or investment purposes.

Digital forms of fiat currency are not included.

VASP:

Excludes digital forms of securities.

Can be a legal or natural person or business entity and, as a business, carries out one or more of the following activities on behalf of another natural or legal person or business:

Transactions between VAs and fiat currencies.

One or more forms of transactions between VAs.

Facilitate asset transfers for VAs.

Custody and/or management of VAs or tools capable of controlling VAs.

Participate in and provide financial services related to the issuer's offering and/or sale of virtual assets.

This is the measure of whether an individual or entity falls under the FATF-recommended regulation in the blockchain space.

Notably, this content expansion update further clarifies the definitions of VA and VASP. At the same time, in 2020 and the previous few years, the application of various blockchain technologies is also increasing.

image description

39 member countries of FATF

In particular, FATF specifies the following:

Most NFTs should be considered VA.

Stablecoins should be considered VA.

Digital currencies issued by central banks should not be considered VA.

Decentralized exchanges should be considered VASPs.

Decentralized platforms or DAPPs are considered VASPs (as of now, relevant smart contract developers are considered VASPs because the code they write to perform operations falls under the definition of VASP stipulated in 2018)

VA hosting services are all VASPs.

Any platform that facilitates P2P transactions between individuals is a VASP.