The Fed finished its interest rate meeting in the early hours of this morning and released a hawkish signal. The market seemed to react flatly, and some pessimists’ previous worries disappeared.

There is a view that: After the Federal Reserve released the hawkish signal, the reason for the stable market reaction is probably because the previous inflation expectations have been included in the price of Bitcoin. Therefore, after the Federal Reserve made a statement, the market stability is a kind of "hedging phenomenon".

However, we believe that this view is slightly one-sided, and the current price performance of Bitcoin is affected by many factors. In addition, the impact of the Fed's interest rate hike on the encryption market does not stop there. So, what signals did the Fed's interest rate meeting release? Before and after the interest rate meeting, what are the reasons that affect the price of Bitcoin? What impact will the Fed's future interest rate hike have on Bitcoin? The following will explain it one by one for everyone.

Highlights from the Fed's June rate meeting

In order to discuss more specifically the impact of the Fed’s interest rate hike on Bitcoin prices, let’s first focus on interpreting some important changes before and after the Fed’s June interest rate meeting.

Before the June interest rate meeting, the Federal Reserve frequently stated that high inflation is temporary, and that the Fed cares more about employment than inflation, and the US job market has yet to form a stable recovery expectation. However, with the explosion of inflation data, the dot plot in the Fed's June interest rate meeting shows that by the end of 2023, the Fed will raise interest rates twice. officials said,A rate hike could come as early as 2023, after saying in March that no rate hikes would take until at least 2024. According to the dot plot, more than half of the members gave the expectation of raising interest rates in advance. However, the Fed also stated thatWill continue to add at least $80 billion in Treasury securities and at least $40 billion in mortgage-backed securities each month until substantial progress is made on the Committee's goals for full employment and price stability.

In addition, the Fed's statement also softened some of the language of previous statements since the new crown crisis.

Since last year, the Federal Open Market Committee has said that the new crown epidemic "is causing enormous human and economic hardship in the United States and around the world." Wednesday's statement instead pointed to progress in vaccinations against the outbreak, noting that "indicators of economic activity and employment have strengthened, with sectors most adversely affected by the outbreak remaining weak but showing improvement."

That is to say, with vaccinations and the easing of the epidemic, as the economy begins to recover, employment indicators strengthen, and inflation picks up,The Fed is likely to continue to adjust the rate hike schedule. In March this year, the Federal Reserve also expected to raise interest rates in 2024. In the past three months, the timetable for raising interest rates has been advanced by one year. If inflation continues, the time for the Fed to raise interest rates will be further advanced. Can the inflation data be stabilized within a reasonable range? I'm afraid it will be difficult, because the Fed has not yet scaled back its aggressive bond-buying program, and there is no timetable for a reduction.

After the Federal Reserve released a hawkish signal, why did Bitcoin not fluctuate violently?

Judging from the statement of the June interest rate meeting, the Fed’s interest rate hike seems to be a little far away; but does the hawkish signal released by the Fed have little impact on Bitcoin?

Of course not, although Bitcoin has not fluctuated violently, it is not without movement. According to the OKEx market, Bitcoin rose as high as $41,324 yesterday, and fell as low as $38,108 today, with a maximum shock of 7.8%. It can be said that the Fed's hawkish signals have already had a great influence, but on the whole, BTC has stabilized the situation. We believe that,Reasons for the relative strength of BTCThere are four points:

The Federal Reserve issued a hawkish signal, but did not propose a timetable for reducing the bond purchase plan. The previous market forecast was more pessimistic, and it is still slightly better than expected. In addition, the Fed continues to purchase bonds, and short-term market liquidity is still very abundant. This will cause some funds to continue to flow into Bitcoin.

Since late May, Bitcoin has experienced multiple rounds of sharp falls, and a large part of the panic has been washed out, and the current valuation of Bitcoin is close to the cost of holding positions of many large institutions. Against this background, MicroStrategy, Large institutions such as Ark Investment Management Co., Ltd. have recently increased their holdings further.

Since El Salvador regarded Bitcoin as a legal currency, Latin America and underdeveloped African countries have followed suit, and have successively promoted the legalization of Bitcoin in the local area, or proposed to follow El Salvador, which has greatly expanded the usage scenarios and market confidence of Bitcoin.

secondary title

Impact of Fed rate hike on Bitcoin

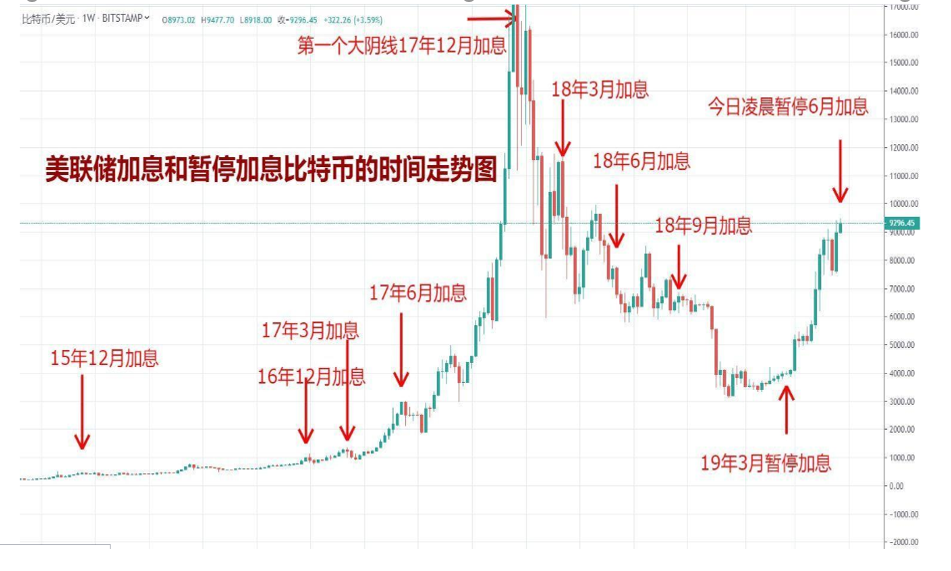

image description

Rate hikes tend to correspond to Bitcoin price drops

In addition to the intuitive connection above, more and more studies have also noticed the correlation between US stocks and Bitcoin.Bloomberg in the Bloomberg Crypto OutlookResearch in the report found that the 260-day correlation indicator between Bitcoin and the stock market is usually negative, but reached 0.34 in early March, which is the highest value so far.A recent report by DBS Bank of Singapore (DBS)It pointed out that the volatility correlation between Bitcoin and US index futures is increasing, and Bitcoin is no longer a fringe asset class. The study showed that Bitcoin and the S&P 500 were more positively correlated after large crypto trades, at 0.26 in the abnormal case, compared with 0.19 in the normal case.

According to the correlation research above, we can roughly infer that when the Fed’s quantitative easing policy changes, it will directly affect the U.S. stock market; Large fluctuations due to interest rate hikes. This connection, as more and more US listed companies increase their holdings of Bitcoin, will undoubtedly become closer and closer.

Finally, whether it is an intuitive data impression or a correlation study,We all have reasons to believe that major changes in the Fed's policies in the future will have a profound impact on the encryption market (especially in the current process of the traditional financial market in the United States gradually taking over the leadership of Bitcoin).

How to prepare for the Fed to raise interest rates?

Through the above interpretation of the Federal Reserve’s June interest rate meeting, we can see that,The liquidity of short-term funds in the financial market is still sufficient, but the time for the Fed to tighten funds is also greatly accelerating.

In addition, it can be seen from the interpretation of the Fed's interest rate meeting above that the Fed said in March that it would not raise interest rates until at least 2024, and now the June rate meeting said that the rate hike may come as early as 2023. That is to sayWhen the Fed will raise interest rates depends on the market and data performance, current expectations are not accurate. As the Federal Reserve said, "full employment and price stability" are the main considerations, and the most important factors affecting these two are naturallyPandemic and Economic Recovery. According to estimates, by October in the United States, the vaccination rate can reach about 70%, which means that herd immunity can be achieved. Morgan Stanley CEO Gore Man James had previously predicted that the Fed would start raising interest rates as early as early next year, and would start tapering its quantitative easing program by the end of this year.

After anticipating the timing of the Fed's rate hike, what preparations do you need to make?JPMorgan Chase & Co. Chief Executive Jamie Dimon said at a conference on Monday (June 14) that JPMorgan has been "effectively hoarding" cash instead of using it to buy U.S. Treasury bonds or other investments because of higher Inflation could force the Fed to raise interest rates. The practice of traditional financial tycoons is to keep hoarding cash now, and then wait for the Fed to raise interest rates before "buying the bottom" of low-priced assets.

So is the approach of the American financial tycoon a reference for investors in the encryption market? We think there are still.

Summarize

Summarize

In the short term, the Fed will continue to "release water", and the result of continuing to "release large amounts of water" is that inflation will continue to rise, and inflation will continue to rise, which will undoubtedly have a positive impact on Bitcoin in the short term.The total amount of bitcoin is limited. When the dollar is flooded, more and more people begin to recognize the deflationary nature of bitcoin. Bridgewater Fund Dalio said in an interview, "The U.S. dollar is on the verge of depreciation. The last time a similar situation was in 1971. In such a general environment, Bitcoin, which has similar properties to gold, is used as a kind of savings. Instruments are increasingly attractive. I would personally prefer to buy bitcoin over bonds in an inflationary context.”

In the medium term, the Federal Reserve's interest rate hike schedule is constantly being pushed forward, and the risk of the encryption market after October may gradually increase. At the beginning of next year, if the Federal Reserve raises interest rates, Bitcoin may be greatly affected, and investors should pay attention and make appropriate preparations.