What would you do if 519 repeated 312? In today's video content, we will review the sharp drop of 312 and 519 to help investors review the history and look forward to the future.

Long-term rating: Overweight

Short Cycle Rating:

Bitcoin accumulation

Lighten up in small-cap cryptocurrencies

Today's point of view

History does not repeat itself, but it is always strikingly similar.

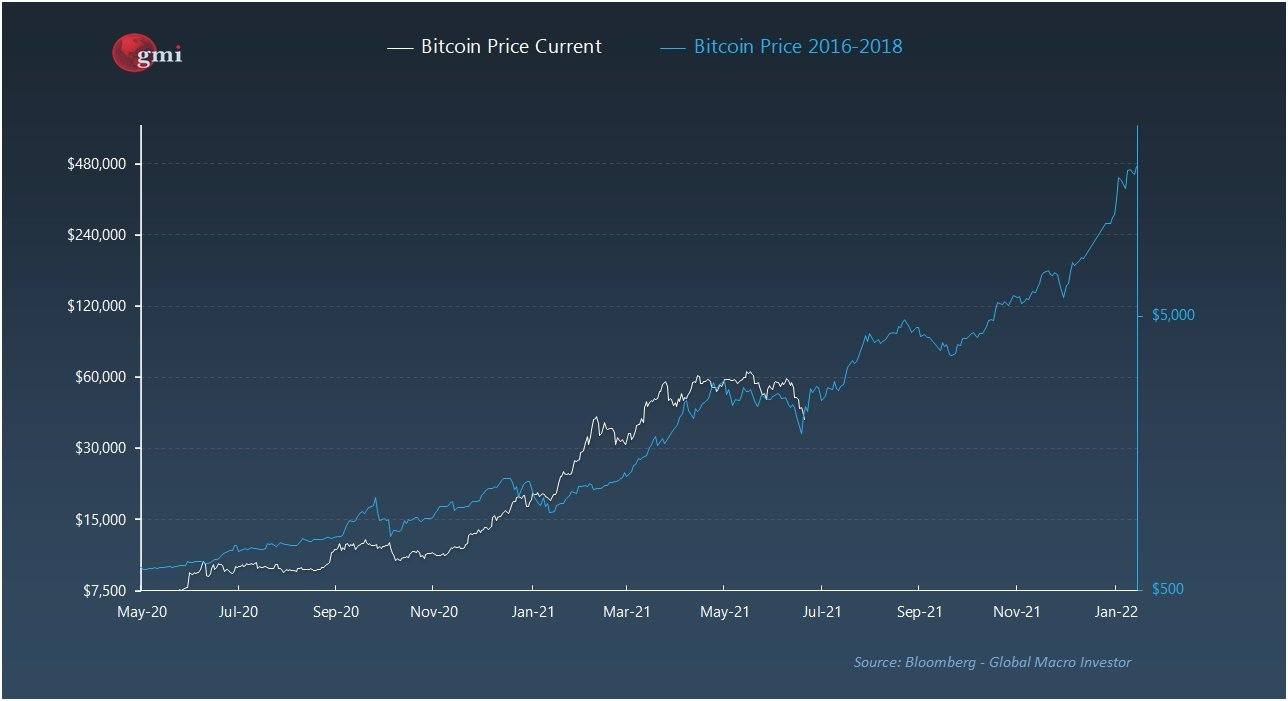

We mark the price of Bitcoin from 2016 to 2018 with a blue trend line, and then represent the price trend of this round of Bitcoin bull market with a white trend line. We can see that the price of Bitcoin was 3 times higher before reaching After that, there was a long-term sideways arrangement, and even the decline after the arrangement was surprisingly consistent.

According to the bull market script from 2016 to 2018, we will soon complete a V-shaped reversal, break through 60,000 US dollars and quickly hit a new high.

We compare the slump of 312 with this round of slump. If the trend after the slump is similar, it means that we will rush to around 55,000 US dollars and then fall back, and finally break through the downward trend line, and confirm on the trend line again Going higher, the price will go sideways after reaching 75,000 US dollars, and after breaking through, it will point to the 100,000 US dollars mark.

Bitcoin has fallen by about 54% since its peak of 65,000 US dollars. The bottom line is that even if we have entered a bear market, the price will not directly drop by 70% or 80%. After a round of 50% decline, there will undoubtedly be a strong rebound and a lower high before falling. The worst-case scenario also points to the fact that we will see more Bitcoin price gains in the next few days.

We believe that the fundamentals of Bitcoin have not changed significantly. The recent strength of gold has actually suppressed the price of Bitcoin. Investors continue to make choices in value storage methods. Gold has been affected by funds due to the end of the long-term decline. Inflows, and after Bitcoin restarts, it will attract capital back again.

From a long-term perspective, both gold and Bitcoin will rise, and the zodiac sign of the alternatives will make them go out of a negative correlation trend in some stages, which is worthy of investors' attention.

The epidemic in India is still going on, and the mutated virus seems to be starting to increase the number of fatal infections. The epidemic is still ongoing, vaccinations have failed, employment is sluggish, and inflation is at risk of rising. What would you do if you were the central bank?

This is the most difficult test of the central bank's monetary policy in history. To save the economy, it is necessary to abandon the currency; to save the currency, it is necessary to sacrifice the economy and enter a period of recession for many years.

Compared with the depreciation of the currency, the economy is undoubtedly more important. This is the choice made by the central bank in the past years. As long as the inflation is not completely out of control, the central bank still hopes to keep the economy.

In this context, quantitative easing and inflation are accompanied. Is there a market environment that is more suitable for the rise of gold and Bitcoin?

If such a market environment is expected to continue to attract capital into these two assets in the future, why should we expect the end of a bull market cycle after the price rises and corrects? As long as capital keeps coming in, the price will keep rising, the bull market for Bitcoin is not over, and time will tell.