The much-anticipated Polkadot parachain slot auction is finally here.

On May 18, Kusama, the first Polkadot network, successfully deployed the first parachain Shell. Although this is just an empty chain that has no practical utility except for upgrades, it paved the way for the official launch of Kusama and the entire Polkadot ecosystem. The first notes sounded.

On the evening of June 3, Shell successfully completed the upgrade and became the first system parachain on the Kusama network. According to Gavin Wood's previous introduction, after ensuring that Statemine can run stably, the Kusama network will officially launch the parachain slot auction. It is expected that there will be 5 auctions at the initial stage, with an interval of 7 days each time. If no major problems are found, more slots will be opened further.

The feast is approaching, and all parties in the ecology are gearing up and ready to go. On the one hand, the project parties who are about to bid in person have recently announced their own Crowdloan incentive plans in order to attract as much external chips as possible; on the other hand, investors who have been waiting for the auction for a long time are also eagerly waiting Wait and see, try to find the most powerful "race horses" among the many auction projects, and earn more profits.

Although the specific shooting time has not yet been determined, intense discussions have begun within the community on the potential ownership of the first batch of slots. Among them, who will win the most iconic first slot is undoubtedly the most attractive people pay attention. Looking around at all the project parties who plan to participate in the auction, it can be said that many projects that have participated in the Rococo V1 network parachain test in the early stage have certain competitiveness.However, considering the volume of community discussions, Karura (Acala plans to connect to Kusama's pioneer network) is undoubtedly the hottest candidate for the top spot.secondary title

Acala, the DeFi center of the Polkadot ecosystem

Why is the voice of Acala so high? What are the advantages of this project? Before answering these two questions, it is necessary to give a brief introduction to the basic information of the project.

Users who are familiar with the Polkadot ecology may have a certain understanding,Acala is positioned as the DeFi center of the entire Polkadot ecosystem. As Acala’s pioneer network for the Kusama network, Karura and Acala use the same set of codes, but the assets and ecology of the service are completely different. In order to avoid confusion, in the following project introduction, we will focus on Acala.

The name Acala is taken from the Buddhist Sanskrit sound "Acalanatha", which means "Fudo Ming King". In the face of difficulties, obstacles can be overcome, and the compassion is so strong that it cannot be shaken. As can be seen from the name, the founding team of Acala has placed great expectations on the project, that is, it hopes that Acala will become the leader of all Polkadot ecological projects and provide safe and stable services for all users.

When it comes to specific product lines, Acala will provide diversified services around the theme of DeFi, covering multiple sectors such as stable currency, lending, trading, and liquidity release.

The first is the over-collateralized stablecoin protocol. This product can be roughly understood as a cross-chain version of MakerDAO.Users can open a collateralized debt warehouse (CDP), deposit their encrypted assets as collateral in the collateralized debt warehouse, obtain the US dollar stable currency aUSD, and send and receive aUSD across chains between any blockchains connected to Polkadot.

The second is Acala Swap, a decentralized exchange. This product can be roughly understood as a cross-chain version of Uniswap.Acala Swap will use the AMM (Automatic Market Maker) mechanism to provide the project's native tokens (ACA, aUSD), tokens in the Polkadot ecosystem (DOT and isomorphic parachain project tokens), and external tokens bridged to Polkadot. Chain tokens (BTC, ETH, etc.) provide a free circulation scenario.

Then there is the release of the decentralized product L-token for the liquidity of the Staking scene.besides,

besides,Acala also created an on-chain decentralized sovereign fund (Acala Treasury), which can be simply understood as the "foreign exchange reserve" of the Acala network, whose significance is to help the Acala network achieve sustainable development. Specifically, Acala will use its network revenue to purchase high-quality encrypted assets (DOT, KSM initially, and expand to other out-of-chain assets after Acala & Karura can bear the cost of a parallel chain) and store them in the Treasury. ACA holds Not only do they jointly own the Acala Treasury, but they can also collectively decide how to spend the funds in it. With the continuous development of the Acala network, Acala Treasury will accumulate more and more high-quality assets, which will directly improve Acala's ability to solve system risks, and will also provide greater value support for ACA.

If there are only the first few products, Acala seems to be just a cross-chain version of DeFi application portfolio based on Polkadot, then the last product - the smart contract module - will give Acala a completely different meaning.Acala's smart contract module has good compatibility with the Ethereum Virtual Machine (EVM), allowing DeFi projects built on Ethereum to be easily deployed to the Acala parachain without much adjustment.This feature will make Acala an excellent window for external DeFi projects (such as Ampl) to migrate to the Polkadot ecosystem, making Acala a veritable DeFi base layer for the entire Polkadot ecosystem.

……

secondary title

Karura, the best solution for investors to participate in the auction?

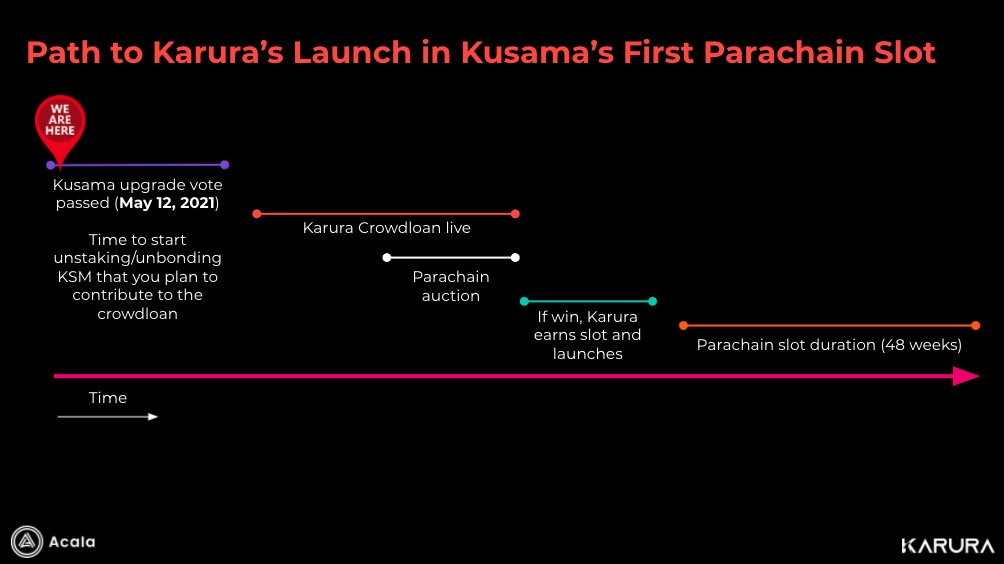

Going back to the upcoming auction, Kusama and subsequent Polkadot mainnet auctions have adopted the "candle" mode in design to reduce bid raids. The auction will be divided into two phases - the security period and the random period. After entering the random period, the random number on the chain may determine the final auction result at any time. Therefore, in order to successfully win the slot, the project party needs to enter the second phase Attract as many chips as possible before.

The project party's strong demand for external chips is the opportunity for investors to participate in the auction and obtain income, and the design of the crowd lending module provides a standardized window for the realization of this opportunity.The slot auction allows the project party to use the crowd lending mechanism to borrow from the outside. Generally speaking, the project party will use incentives such as distributing the project's own tokens to attract external investors to lock more KSM and DOT to themselves for the auction. accumulate stronger competitiveness.

For KSM and DOT investors, the only stable way to use their chips to earn more income is node pledge, although sometimes some centralized exchanges will launch targeted pledge mining while launching Polkadot ecological projects Activities, but the time window often does not last too long, the launch of slot auctions gives all KSM and DOT investors another way to tap the value of their chips.

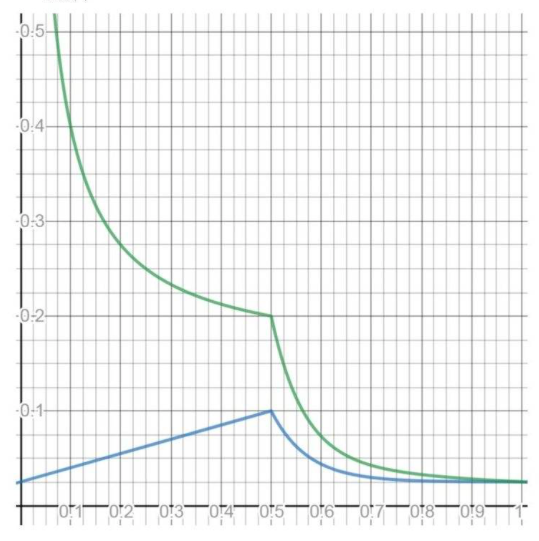

The PoS income mechanism of the Polkadot network determines that when the DOT (KSM) ratio of participating nodes in the entire network exceeds a certain threshold, the overall income will decline (for specific calculations, please refer to "In 2021, how to grasp the maximum benefit of Polkadot ecology?"). Therefore, it is expected that with the launch of slot auctions, many investors who are currently participating in node pledges on the chain will unlock tokens and turn to seek higher returns in slot auctions. This plot is somewhat similar to the choice of users in the Ethereum ecosystem between ETH 2.0 mining or DeFi mining. Considering the current market value of many early DeFi projects in the Ethereum ecosystem, slot auctions were chosen at the initial stage Obviously, there is more room for imagination.

This brings up a new question - how can ordinary investors maximize their returns in slot auctions? This question seems difficult to answer, but if you subtract some minor details and only look at the main body, you can roughly focus on two elements.

One is to pay attention to the specific token incentives provided by major projects.Due to the differences in the competitiveness of the project parties themselves, some relatively weak project parties often use tokens that account for a higher proportion of the total supply as incentives. However, considering the uneven quality of the projects, the incentive strength is the only measure Standards are not desirable.

The second is to focus on the development prospects of the project itself.This is easy to understand. The market value of leading projects in the Ethereum ecosystem is no longer at the same level as that of late-developing projects.

Considering that the number of slots released in the early stage is limited, only a few projects can successfully win the slots. If the auction of the project supported by investors fails, the crowd lending mechanism is designed to return KSM to investors. Although this will not cause No loss, but it will also waste the time window of the current auction round; in addition, the time period of slot auctions is often longer, and in order to avoid "digging and selling" and smashing the market, the project side often designs corresponding lock-ups for token release mechanism, so it is necessary to look at the specific rate of return situation with a long-term perspective.It can be seen that when investors choose which project to support to participate in the auction, the second element "focusing on the development prospects of the project itself" is undoubtedly more important.

At the beginning, we mentioned two questions - why is Karura's voice so high? What are the advantages of this project? The answer to the first question is simple: Acala is one of the projects with the best development prospects in the Polkadot ecosystem. Correspondingly, Karura is also one of the projects with the best development prospects in the Kusama ecosystem. The main reason why stages attract so much attention.

As for the answer to the second question, in our opinion, the advantages of Acala (Karura) can be reflected in the following four aspects:

Capital advantages:Acala has the strongest capital background among Polkadot ecological projects.The list of investors includes Polychain, Coinbase Ventures, Pantera, ParaFi, Hypersphere, Digital Currency Group, CoinFund, 1confirmation, HashKey and many other well-known institutions in the circle.

Track advantage:Acala occupies the DeFi track with the largest capital flow.The scale of DeFi in the Ethereum ecosystem is now approaching 100 billion US dollars. As one of the most powerful public chain systems outside of Ethereum, the scale of DeFi in the Polkadot ecosystem in the future is also worth looking forward to. As the leader of Polkadot-based DeFi, Acala's product line covers almost all mainstream sectors of DeFi. Imagine if MakerDAO, Uniswap, etc. are merged together, coupled with stronger smart contract development support, it will be what happened This is not the end. Acala’s vision is not limited to the encrypted world, but has already invested in a broader traditional financial market. On Tuesday, Acala announced that it has reached an agreement with Current.com, a fintech bank with 3 million users. Collaborate to build a bridge between the traditional financial system and the on-chain DeFi world.

Technical advantages:Acala has long been a technology pioneer within the Polkadot ecosystem.So far, Acala has obtained many official grants from the Web 3 Foundation; in February this year, Acala officially launched the Acala EVM; since then, Acala has jointly tested cross Chain communication (XCMP) transactions have opened up the composability between different flatline chains; recently, Acala has executed the first heterogeneous cross-chain transaction from the Ethereum Kovan network to Acala.

First-mover advantage: Acala started earlier than most projects in the ecosystem,At present, the main products have basically taken shape, and only wait for the official shooting, if you can successfully win the first slot, this advantage will be further amplified. Considering that the current DeFi track presents a certain trend of homomorphism, and the number of initial slots is limited, the speed of landing will become a key factor in project competition. Whoever can land earlier will be able to seize more slots earlier. Market share, occupy a favorable position in advance.

Based on the above four points, in the upcoming Kusama network parachain slot auction, Acala's leading network Karura will be particularly competitive, and it is not surprising that the community has such high expectations.secondary title

Support Karura auction, what is the return on investment?

As mentioned earlier, Acala wants to become the DeFi center of the entire Polkadot ecosystem. Correspondingly, Karura also hopes to become the DeFi center of the Kusama network.

Last week, Karura has officially disclosed the details of the Kusama network parachain slot auction.Crowd Loan Incentive Program. According to the plan, the lease period chosen by Karura this time is 48 weeks. All investors who intend to support Karura’s bidding need to lock their own KSM to Karura for 48 weeks in the crowd lending module. After the lease period ends, all KSM will be automatically released refunded to supporters.

In return, Karura will take out the native token KAR, which accounts for 11%+ of the total supply, as an incentive. Each KSM token that supports Karura will receive at least 12 KAR rewards (total supply 100 million), and this number may be further increased due to the intensity of the trial auction.

If the slot can be successfully bought, 30% of the KAR incentives that investors can obtain will be released immediately after Karura goes online, can be freely circulated and traded, and can also be used for Karura’s DeFi products and ecology. The remaining 70% of the rewards will be Linear release over 48 week lease term.

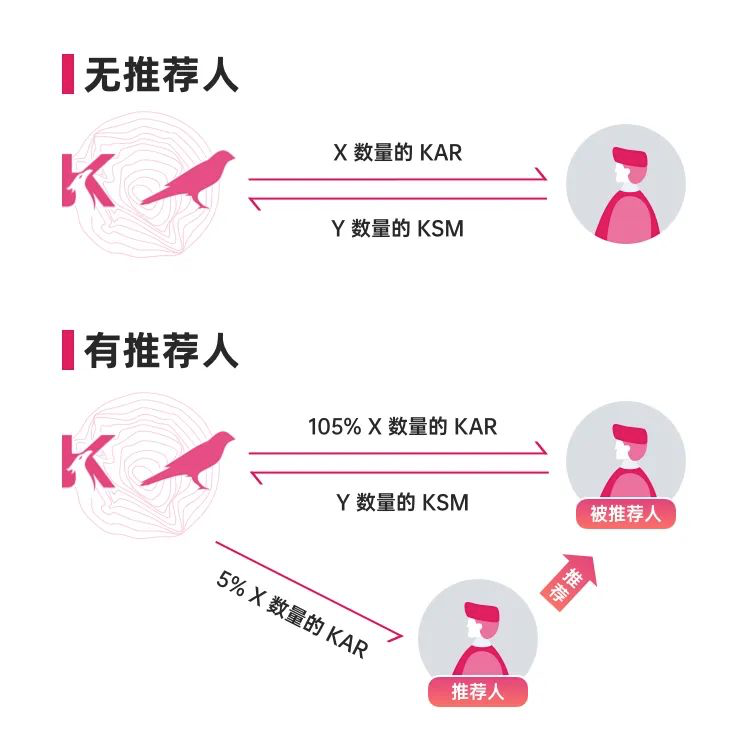

In addition, Karura also introduced in this auctionRecommended Incentive Mechanism, if you successfully recommend others to support the Karura auction, both parties will receive an additional 5% KAR reward.

At present, Karura has started the preliminary warm-up for the auction, and the specific participation methods will not be detailed here. Interested friends can go to "Parachain auction is coming soon, Karura crowd loan pre-registration officially openedsecondary title

Sail into the era of Web 3.0

As Polkadot's leading network, Kusama has similar code logic and a more flexible operating environment. With the accumulation of consensus, today's Kusama network is no longer a test field for testing, but has formed a platform independent of Polkadot. The card's ecological value system and the circulation market value of billions of dollars are the best proof.

Today, the launch of the Kusama network parachain auction means that the giant ship sailing into the Web 3.0 era has officially opened the door for project parties who have worked hard in the ecology for a long time. Whoever wins the first boarding ticket will be regarded as a Milestone events are remembered by the entire community.

The launch of Karura (Acala) will announce that the DeFi story of the Ethereum era is still sustainable in the Web 3.0 era. Positioned as the "DeFi center" of the new ecology, the components of Karura (Acala) and the smart contract carrying capacity will become the infrastructure serving the entire ecology, helping the rise of the Kusama (Polkadot) ecosystem.