In 2020, the decadent mainstream market underperformed, and DeFi emerged. Among them, Uniswap V2 became the leader in the DEX field with its constant product automatic market maker AMM, and became a new wealth code in the encryption industry.

In the past year, Uniswap V2 has continuously refreshed the records of decentralized exchanges, and the lock-up volume and transaction volume have continuously hit new highs. Now, the Uniwap V3 version has been officially launched, will it become the key to leverage a new round of DeFi boom?

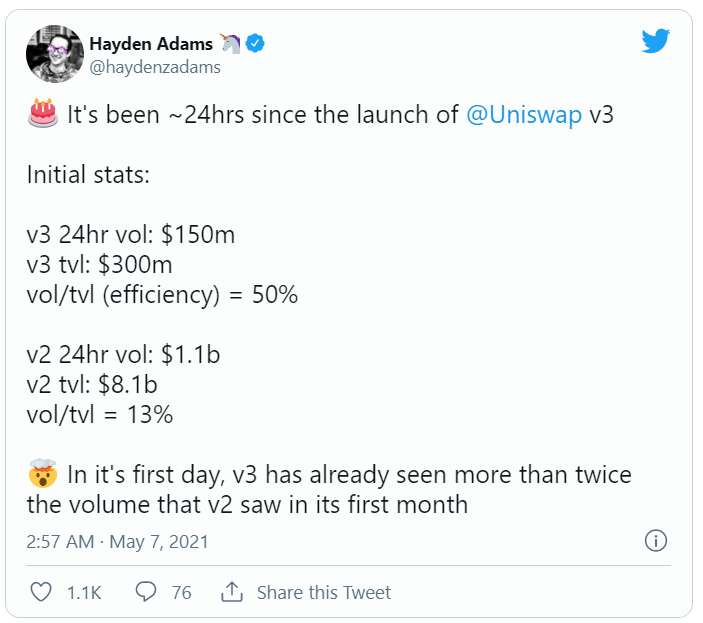

After the first day of Uniswap V3's launch, Uniswap founder Hayden Adams tweeted that its 24-hour trading volume has more than doubled that of V2 in the first month.

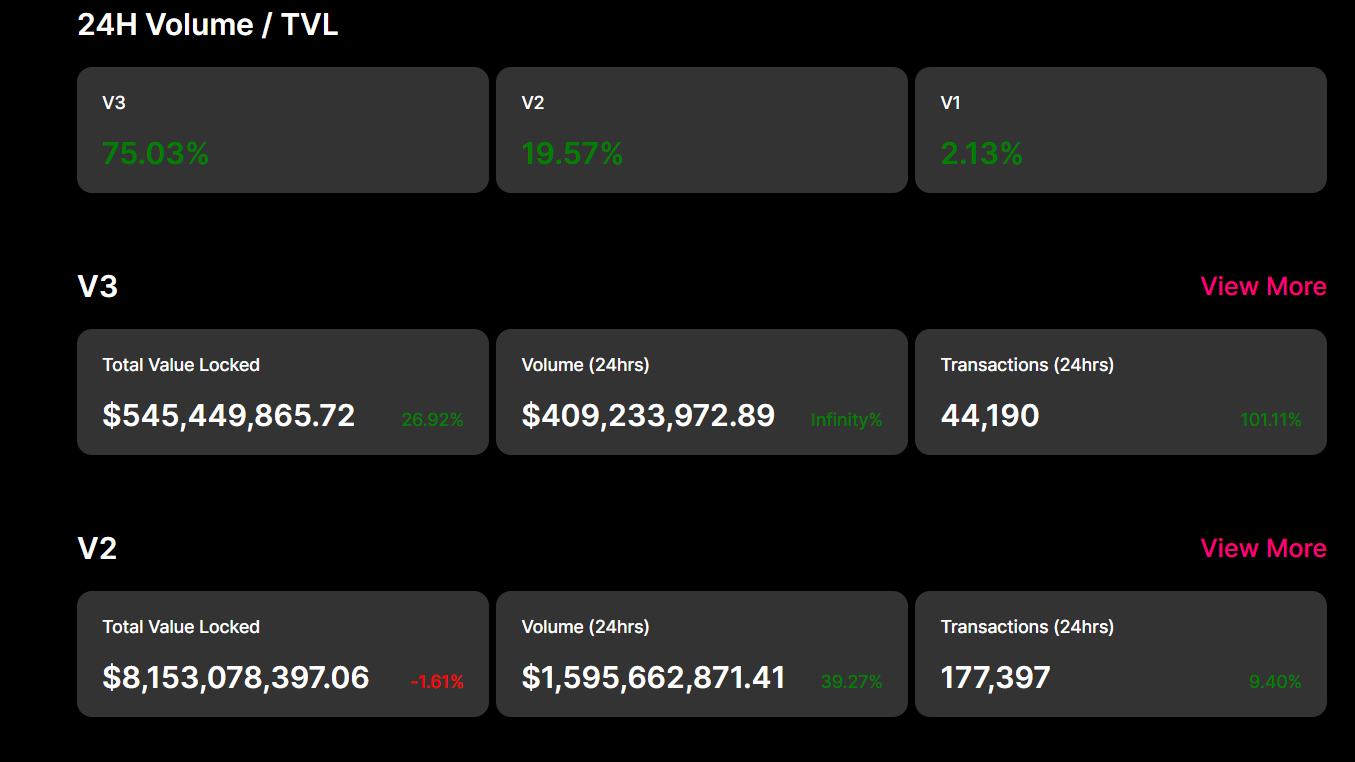

As of the press time of Benz Finance, the total lock-up volume of Uniswap has exceeded 500 million US dollars (546.25 million US dollars), and the 24-hour trading volume has reached 409.4 million US dollars. In addition, according to the official data of Uniswap Info, the 24-hour trading volume and lock-up volume ratio of Uniswap V3 reached 75.03%, far exceeding V2’s 19.57%.

Judging from the current lock-up volume and transaction data of Uniswap V3, the core measure of the new version, "concentrated liquidity", is more successful, and the higher capital efficiency provides stronger execution for transactions. It is foreseeable that for a long time to come, Uniswap will firmly sit on the top spot of DEX. Just ask, will it trigger a new round of DeFi boom?

The DeFi Boom of 2020

Looking back at the development of DeFi in 2020, the number of active wallets has increased from 58,000 to 200,000; the transaction volume has increased from US$21 billion to US$270 billion, and the total locked-in amount of the Ethereum DeFi ecosystem has reached a record high of US$13 billion.

The reason for the DeFi boom is "liquidity mining" and "yield farming".

The prosperity of the world is all for Lilai. When the market is not good and the global economy is developing slowly, liquidity mining projects have attracted a large influx of funds through "providing liquidity-obtaining token income". At this time, the DeFi market is growing wildly and overgrown with weeds. With many problems such as no code audit, hacker attacks, frequent security issues, etc., DeFi has become a casino.

In this wave of short-term popularity, the 48-hour crash at the peak of YAM’s debut has brought more and more people back to rationality. The transparency and security of decentralized finance behind the popularity of DeFi have made people see the possibility of upgrading and developing the financial industry in the future sex.

Different types of decentralized financial applications such as decentralized exchanges (DEX), decentralized lending, stable coins, and payments have begun to enter a healthy development track.

Among them, DEX, as an important part of the DeFi ecosystem, is also accumulating energy for the new round of DeFi boom through continuous innovation.

The ecological pattern of DEX

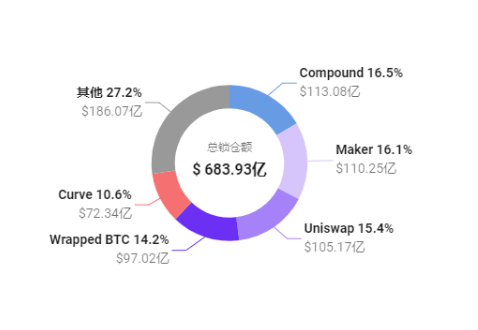

According to QKL123 data, the total lock-up volume of DeFi is 68.393 billion US dollars, of which the lending platforms Compound and Maker account for 16.5% and 16.1% of the total lock-up volume, respectively, and the DEX platforms Uniswap and Curve account for 15.4% and 10.6% of the total lock-up volume, respectively. %.

With the continuous development of the DeFi ecosystem and the continuous expansion of the business sector under the market demand, DEX is facing the dilemma of being unable to meet more specific needs of users, such as low capital efficiency, impermanent losses, high slippage, high handling fees, and insufficient incentives. Prompted the birth of some innovative forms of DEX.

-Bancor

Bancor is the earliest AMM proposer. Its V1 version is similar to Uniswap V1. It needs to use its platform BNT token as an exchange medium to conduct transactions. Bancor V2 uses the elastic supply model to mortgage unilateral assets, removes the requirement for double-sided liquidity deposits, uses fixed liquidity reserves, dynamically adjusts the weight of the AMM pool through the oracle, and maintains the unity of the internal and external market prices of the fund pool , to ensure that liquidity providers earn income with complete impermanence loss protection. In addition, Bancor provides liquidity insurance for users. In addition to enjoying liquidity benefits, users can also enjoy compensation for impermanent losses.

-Curve

Curve is a hybrid AMM that combines constant sum and constant product functions, minimizing slippage for relatively stable assets. Curve's asset swaps are through packaged versions of tokenized assets such as sUSD and sETH. Through Synthetix's mortgage synthetic asset model, there is no slippage between the two exchanges, and then the exchange of packaged version tokens and target tokens is completed based on Curve's own AMM model.

-SushiSwap

It basically continues the core design of Uniswap. Unlike Uniswap's in-depth exploration of AMM, SushiSwap's development direction is to develop into a diversified financial platform. It includes trading, lending, options, futures; single treasury; token issuance platform; NFT issuance platform and other financial product lines will be jointly promoted. At the same time, the incentive policy based on Onsen will help SushiSwap obtain long-term positive liquidity.

-PancakeSwap

PancakeSwap is a decentralized trading platform based on Binance Smart Chain BSC. Compared with Uniswap, Bancor, Curve and ShshiSwap, PancakeSwap users enjoy lower Gas fees and high efficiency on BSC. Moreover, PancakeSwap has a complete liquidity incentive policy, and maintains the enthusiasm of liquidity providers through the deflation mechanism of its platform's native tokens, thereby ensuring a good depth of AMM. In addition, PancakeSwap's diverse product ecology has allowed it to obtain a high degree of user attention and participation.

Diversified financial trends of Uniswap V3

As the leading project of DEX, the launch of Uniswap V3 will undoubtedly have a great impact on the ecological development of the entire DEX field.

As mentioned above, the biggest innovation of Uniswap V3 is "concentrated liquidity", which is its core strategy to solve the problem of low capital efficiency. Its specific features are as follows:

- Increased granularity control, allowing liquidity providers to deploy funds in the most frequently traded range, improve capital utilization, reduce transaction slippage, and obtain the most benefits.

Granularity control means increased transaction complexity, which will inevitably lead to an increase in Gas fees.

After the V3 version was launched, many people complained about the high operating cost of V3. The developer of CPlusPlus said on Reddit: "The reduction of gas fees promised by Uniswap V3 has failed. The cost of processing transactions in the Uniswap V3 main network is much higher than that of V2, and the average consumption cost is 102% higher than that of V2."

Although it seems that the entire network is complaining about the high handling fee of Uniswap V3, judging from the performance of the transaction volume on the first day, Uniswap V3's innovative measures of "centralized liquidity" still brought it a good market response.

-Liquidity providers in Uniswap v3 can set multiple ranges of liquidity combinations in the same pool and aggregate them into one order book. For example, an LP in an ETH/DAI pool could choose to allocate $100 to the $1,000-$2,000 price range and another $50 to the $1,500-$1,750 price range.

- Concentrated liquidity can provide greater trading depth, and Uniswap V3 supports a minimum range setting of 0.02%. But the corresponding is to pay more Gas.

-Active liquidity, if the price of assets traded in a specific liquidity pool moves outside the price range of the LP, the liquidity of the LP will be effectively removed from the pool and stop earning fees. When this happens, the LP's liquidity is completely shifted to one of the assets, and they end up holding only one of the assets.

On the one hand, active liquidity is conducive to making up for impermanent losses, but on the other hand, it also means that traders need more flexible and changeable trading strategies, which undoubtedly raises the entry threshold for participating in transactions.

As of the press time of Benz Finance, the top four pools of Uniswap V3 lock-up volume are USDC/ETH, UNI/ETH, ETH/USDT and WBTH/ETN.

It can be seen that the corresponding rate is displayed after each transaction pair, which is another new function of the V3 upgrade - multiple rates.

Compared with the fixed fee rate of V2, V3 allows LPs to choose different fee rates when adding liquidity to assets of different attributes, which are 0.05%, 0.3% and 1% respectively. Low-risk trading pairs such as stable coins can choose lower rates, and high-risk trading pairs of non-stable coins can choose higher rates. Compared with the fixed rate of V2, V3 provides liquidity providers with higher risks. More rewards. At the same time, for currencies with high price volatility, a 1% fee rate can also achieve the purpose of reducing impermanent losses.

In addition, Uniswap V3 also joins the NFTization of LPs, whose centralized liquidity, range orders, and elastic fees are all tokenized in NFT. Currently, the NFT of Uniswap V3 has been listed on OpenSea.

Uniswap v2 revolves around the "x*y=k" constant market maker model, and each user must follow a "passive market-making strategy", which means that they will bear a certain degree of "impermanent loss".

Uniswap V3 provides users with "irreplaceable liquidity" through Visor vaults by tokenizing liquidity positions in NFTs. Users can try to obtain different income rewards based on LP NFT, including: obtaining rewards from liquidity mining, trading to others to obtain income-generating assets, and locking deposits to obtain loan rewards.

On the whole, the centralized liquidity at the core of Uniswap V3 is essentially an innovative form of customized AMM, which tends to be more diversified financial services.

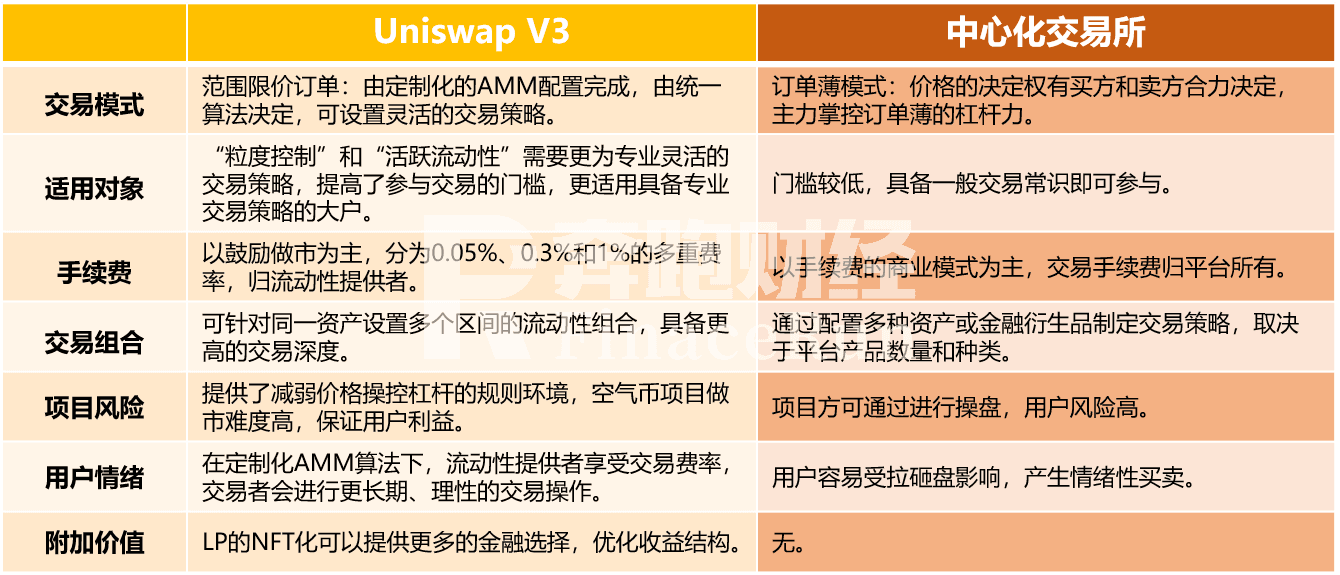

Uniswap V3 VS CEX

The launch of the Uniswap V3 version is not only a subversive innovation in the DEX field, but also has a certain degree of impact on traditional centralized exchanges.

epilogue

epilogue

The essence of finance is the financing of funds. DeFi decentralized finance has characteristics such as openness and security that centralized finance does not have, but it cannot be separated from the fundamental needs of financial integration.

The high capital utilization rate brought by Uniswap V3 is the best performance of capital integration in the DeFi field at this stage. At the same time, it is not limited to transactions, but endows a more diversified financial form, which is extremely important for the development of the DeFi field. Influence. However, operations based on the chain need to match the underlying technical facilities of the corresponding configuration, transaction congestion, and Gas fees have become key issues that urgently need to be resolved. We can fully see more possibilities for future financial development from the many innovative features of Uniswap V3. The time for Uniswap V3 to detonate the next round of DeFi boom is believed to be after the completion of Layer 2 deployment.