On April 20, Gavin Wood, the founder of Polkadot, released the Kusama parachain launch list. The list shows that the launch of XCM, Shell chain, and Statemint public welfare parachain will be completed before the official auction.

According to the latest news, Statemint has been launched on the parachain test network Rococo and has begun to test asset issuance. Statemint provides the function of deploying assets in Polkadot and Kusama networks, allowing anyone to deploy assets, and only needs to pledge a certain amount of DOT or KSM. The public welfare parachain is a parachain that provides basic services for the network. If some important basic functions are not launched, the slot auction is meaningless.

Before Polkadot was officially launched on the mainnet, Gavin Wood also released an online list. The interval from the release of the list to the official launch was about a month. Using this as a comparison to speculate, the Kusama slot auction time should be in late May.

The parachain auction is a major event that Polkadot ecological project parties and ecological users are looking forward to. On the one hand, the auction means that the Polkadot network will officially set sail to establish an ecology. On the other hand, it also means that users can obtain ecological tokens from the auction.However, the DOT and KSM participating in the slot auction need to be locked for a long time. For users, this part of assets loses liquidity, which will hinder users' willingness to participate.

So is it possible to solve the liquidity problem by issuing derivative tokens like ETH 2.0 Staking?

From the current point of view, there are several channels for users to participate in slot auctions, such as the entrance, exchange, wallet and liquidity release platform built by the project party. Referring to the situation of ETH 2.0 Staking, exchanges and liquidity release platforms have the conditions and willingness to provide users with bidding liquidity release.

Exchanges such as Binance and Huobi have already provided users with ETH 2.0 Staking services, and issued derivative tokens to solve the liquidity problem after users pledge. According to recent news, Coinbase will also provide users with ETH 2.0 Staking services, and will also issue derivative tokens.

Liquidity staking platforms Bifrost, Lido and other liquidity release platforms also provide users with services to participate in ETH 2.0 Staking in a decentralized way, and provide users with derivative tokens to solve liquidity problems, and they all perform well.

At present, trading exchanges such as Binance and Ouyi OKEx have stated that they will support Polkadot parachain auctions. The most intuitive performance is to provide users with channels to participate in the auction. As for whether they will provide users with derivative tokens to solve liquidity problems, it is currently unknown Without relevant information, we have no way of knowing.

Compared with ETH 2.0 Staking, it is much more complicated to provide liquidity release services for slot auction users.Because there are many projects participating in the slot auction, the bidding cycle and bidding rewards of each project are different, which cannot be solved simply by issuing a derivative token.

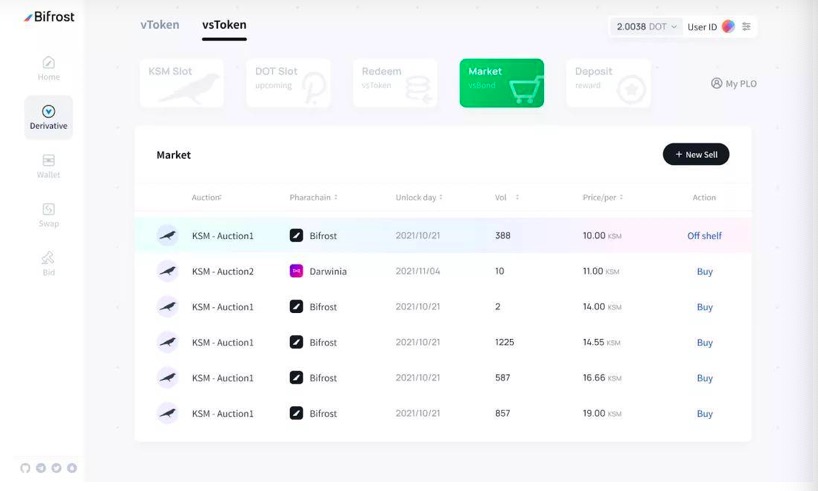

Because different project bidding cycles and rewards are different, the rights and interests represented by derivative tokens are different. In summary, there will be tokens with different rights and interests as follows:The rights and interests of derivative tokens between different projects are different; the rights and interests of derivative tokens of the same project on Kusama and Polkadot are different; the rights and interests of derivative tokens of the same project on different lease periods on Kusama are also different.

For example, based on the 6-24-month lease cycle on Polkadot, every 6 months is an interval, users can choose different lock-up periods when participating in the auction, 6-month intervals, and different lock-up periods correspond to different rewards. soA project will have four derivative tokens with different rights and interests on only one Polkadot chain. And we know that there will be many projects taking pictures of parachains, and the existence of the Kusama advanced network, so there will be a lot of different tokens.

This adds a lot of complexity. Personally, I feel that the exchange may not necessarily do such a thankless thing. Of course, if the exchange finds a simple method, it may do it. From the current point of view, it is relatively smooth for liquidity release platforms to do this, such as Bifrost, Acala, etc.

secondary title

1. Separation of asset attributes and equity attributes

so

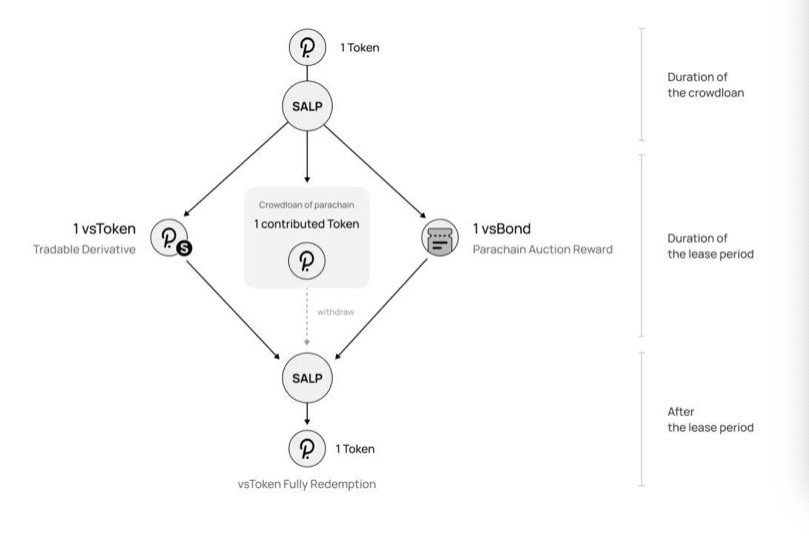

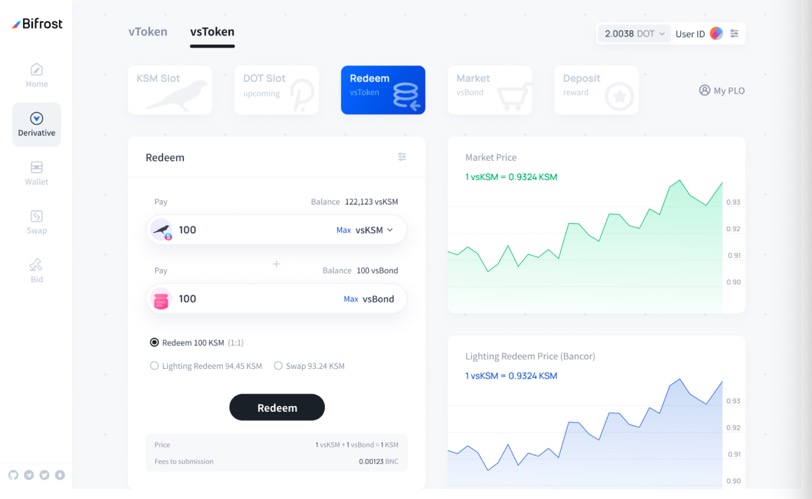

soBifrost separates and decouples asset attributes from equity attributes, and designs two derivatives: vsToken (Voucher Slot Token) and vsBond (Voucher Slot Bond).

Among them, vsToken (vsDOT/vsKSM) is a homogeneous token, which is also the pledge certificate of the user, representing the asset attribute of the user participating in the parachain auction token. vsBond is a non-homogeneous token, which represents the user's support for the slot lease cycle and auction rewards of the parachain, and represents the equity attribute.

vsToken can be traded at any time or redeemed 1:1 with vsBond after the parachain lease ends.

From the above we can seevsBond represents the redemption right of native tokens, and vsDOT/vsKSM can be sold at any time without affecting the acquisition of parachain rewards.

secondary title

2. Important liquidity issues

There are many types of vsBond, and some tokens have a very short life cycle. The lease cycle of the Kusama parachain is 6-48 weeks, which means that the life cycle of the equity token with the shortest life is only 6 weeks. It no longer has equity value.

Therefore, in this case, it is inappropriate to establish an exchange pool for each equity token. It is more appropriate to directly use the current general form of non-homogeneous token transactions, that is, the pending order transaction commonly used by NFT.

secondary title

3. Significance of liquidity release

In my opinion, the most important significance of slot liquidity release is to reduce the psychological barrier for users to participate in the auction. After all, it is a big psychological threshold to lock in at least 6 months, and the liquidity release business can weaken the psychological barrier for users to participate., improve user participation enthusiasm.For projects using liquidity release solutions, this will increase the probability of successful bidding.

The second is to release a large amount of liquid assets for the Polkadot ecosystem. The most important assets in the Polkadot ecosystem are DOT and KSM. Most of them will be used for staking to protect the network security. If a large part of the tokens are locked in the auction , there will be fewer negotiable assets in the ecology.

For the DeFi ecology that everyone values very much, the amount of participating funds is very important. At present, the market value of DOT and KSM is not high. If a large number of negotiable assets are locked due to slot auctions, it will be even more detrimental to the DeFi ecology development of. Therefore, the release of slot circulation is very necessary for the Polkadot ecology, and the tradable funds released by it are more important for the development of the Polkadot DeFi ecology.

At present, the slot auction liquidity release schemes of platforms such as Acala and exchanges have not yet been launched, and we look forward to them coming up with wonderful solutions to better support the development of Polkadot’s ecosystem.