The bull market is here, everything is recovering, and everything is active. Blockchain project parties, cryptocurrency funds, individual and institutional investors, etc. have entered the market to "sweep goods". In order to take advantage of the opportunity to quickly deploy, the "consortium" not only invests in individual projects, but also invests in funds. They neither miss projects nor miss the high expected returns brought by fund investment projects.

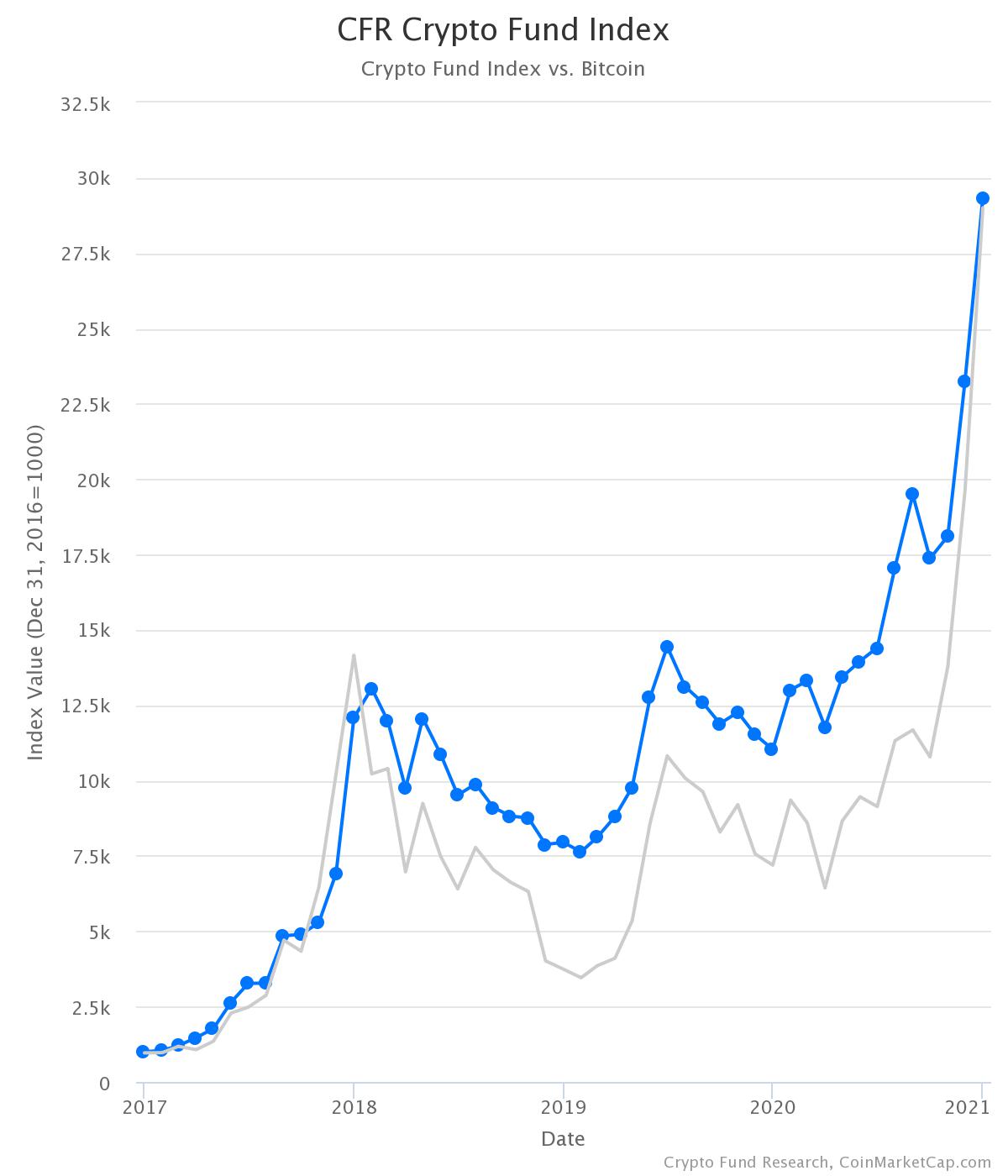

This gave birth to the "predatory" model in which the strong unite and the weak have no share. Therefore, before the end of the bull market, in order to race against time, individual investors began to rely on relationships to find resources. The secondary market can no longer meet the expected returns, and participating in the primary market is the "kingly way." Therefore, the number of cryptocurrency funds, the size of funds under management, activity, and rate of return have all risen again. According to the statistics of Crypto Fund Research (as shown in the figure below), since September 2020, the performance of funds has been almost at the same frequency as Bitcoin or even higher.

In the ecological chain of the weak and the strong, although all the signs are so "attractive", what does it matter to you not to participate in the bull market? Or participate in unreliable funds in the mixed encryption market, maybe you have lost your principal and there is nowhere to find it!In the past few years, the unprecedented advantages of blockchain technology, such as transparency, traceability, and verifiable rights, seem to have not been released to transform the venture capital industry.Is there an innovative model that can activate individual strengths with a more open attitude, and be more friendly to individual investors, so as to achieve a win-win goal of mutual benefit for funds, investors, and project parties?

This goes back to what is needed at the core of a new project. Excellent new projects generally have strong technical capabilities,What they need is to find two forces from the market: investors and community participants. Regrettably, so far, these two things have been handled separately. After the financing is completed, they wait for growth, and those who are in the market don’t know where to find accurate users. In the Internet industry, everyone knows that public domain traffic is expensive and imprecise, which is why private domain dividends are born. However, in the investment industry, it seems that there is no large-scale deactivation of individual value. It not only provides funds, but also active and accurate community users, so that the project can focus on research and development and iteration.

How can such a cryptocurrency fund fulfill this one-stop need?The traditional fund framework is impossible, and it is destined to separate funds and users, but the blockchain DAO architecture can do itAt present, everyone is not used to and familiar with the operation mode of DAO and the way of participation, so the value has not been fully activated, but the changes it can bring cannot be ignored.

How does the DAO architecture work?This model allows anyone to participate in the fund ecology, and is divided into DAO committee, due diligence committee, and basic members according to the degree of member participation. Funds built with this technical architecture as the bottom layer do not need to set a minimum subscription threshold. As long as you have ETH, you can put it into the fund and let the fund invest in early blockchain projects. The core change is that because of the DAO mechanism, all investors have become active community members and deep participants in the blockchain ecosystem. They can use their strengths to participate in product testing, marketing, In the process of project development such as community operation, it promotes and benefits from the growth of the project. More importantly, it can grasp the dynamics of the project in time, and will not be ignorant when the project has declined. The mode of individual investors has also changed from passive acceptance For active promotion.

actually,Enterprises and funds that make good use of individual strengths have begun to emerge and have gained early first-mover advantages.China has Xiaomi & Lei Jun, who have also created a community model of "participation". Foreign countries have Tesla & Musk, who release news through Twitter, interact directly with fans, and even cut off the public relations department. Looking at the fund industry, the representative of the cryptocurrency fund industry is Stacker Ventures, the first new-generation venture capital fund that introduces individual strength through the DAO structure. According to reports, it will officially launch external investment on May 1. The representative of traditional finance is Stacker Ventures. Cathy Wood, the founder of the Ark Invest fund, records videos every week and shares and discusses investment ideas with fans on social media. In her own words: Let everyone have the opportunity to correct their mistakes.

This is exactly the idea we mentioned above,Blockchain technology gives the fund industry a tool, can make the ideal come true. The emergence of new funds like Stacker Ventures is a great benefit for project parties and investors. In the past, strategic investors gave resources to the industry at most, but they could not give seed users and communities. In this era, anyone can be an expert in a subdivided field, and there are many top talents in the blockchain industry, including technical Experienced people, products, markets, etc. New cryptocurrency funds may wish to give it a try. The DAO structure may be an opportunity to overtake at a corner.