V0.1 Mar 8, 2021 J.QU@LatticeX Foundation

secondary title

1. Goal

The public chain is an open and decentralized world, and at the same time it is a "discrete" world with block generation as the time dimension and distributed storage as the physical mirror. Based on its open source and sharing characteristics, innovation iterations are rapid, especially in the financial field DeFi is in full swing. At the same time, fraud and false transactions are rampant, exposing serious problems such as lack of supervision and lack of investor protection.

The effective decoupling of basic capabilities and services, and the protocolization of interfaces will promote ecological prosperity, and ultimately provide a variety of compliant financial services in various forms, breaking through the limits of existing financial services.

secondary title

2. Background: current exchange issues and regulatory trends

2.1 Regulatory Trends

In January 2021, the U.S. Office of the Comptroller of the Currency (OCC) stated in Interpretation Letter No. 1174 that federally registered banks and federal savings associations can act as nodes on the Independent Node Verification Network (INVN) to verify, store, and record stablecoins. payment transactions. OCC did not specify whether INVN refers to the public chain or the alliance chain, but the wording is inclined to the public chain.

2.2 Problems faced by current exchanges

Traditional exchanges maintain large and complex systems with high operating costs.

– Transaction verification costs include system development, operation and maintenance costs and asset delay turnover costs

• Non-compliant exchanges are over-dispersed and mixed with good and bad, and there are more systemic risks. For example, security loopholes lead to theft of assets, poor management leads to self-stealing, there are a large number of robots self-directed and self-acting false market prices, deliberate delays in withdrawal and recharge, illegal arbitrage and malicious market making and other behaviors.

3. Basic design of compliant crypto exchange

text

3.1 Discussion on design concepts - minimalist design, protocol-based design

Through the KYC and access control mechanism, the transaction is settlement system is improved. Simplify and mitigate counterparty risk, operational risk, and liquidity risk. Reduce or even cancel excess pledge, etc., to reduce transaction costs.

image description

Figure 3.1 Schematic diagram of three major services

3.2 Customer Service: KYC Authorization Interface Protocol -- Alaya Qualified Client Protocol

In view of the open nature of the public chain and the diversity of laws and regulations of different regimes, we decouple the KYC process, identity authentication, and specific authorization here. It is broken down into semi-centralized KYC, on-chain identity login process, and application and authorization process. Establishment of a new PlatON Licensing Framework Agreement (details to be published separately).

3.2.1 Customer Classification

The Alaya ecosystem is roughly composed of three types of customers

Official seed authority: Provide KYC for other customers and manage various authorizations, that is, authority management, issuance (lease), recycling (destruction), etc.

Business service provider: After being certified and authorized by the official seed authority, it provides financial services for ecological compliance. The holder of the service class permission.

Service recipient: After being certified and authorized by the official seed authority, it accepts ecological financial services in compliance. The holder of the client authority.

3.2.2 Official Seed Authority

The setting of the seed authority is the basis of the compliance ecology. The financial regulatory authority of a certain country permits Alaya's compliant transactions as an example. Assuming that the agency of the Financial Supervision Bureau is X, Alaya will first conduct offline KYC certification for it and grant it the authority of the seed authority.

The agency X further authorizes Bank Y, etc., including KYC authority. In this way, Bank Y can exercise offline KYC for other qualified investors and authorize qualified investors in accordance with its existing procedures approved by the Financial Supervisory Authority.

3.2.3 Business service providerDBS Digital Exchange,

Business service providers who have been certified by the official seed authority KYC and have obtained the corresponding service authorization, still take the example of a country’s financial regulatory bureau permitting Alaya’s compliant transactions, and Bank Y can provide services within the scope of authorization. For example, DBS is approved by the Monetary Authority of Singapore (MAS) to provide digital asset trading platform services for two types of membership users

– Institutional Investor

– Accredited Investor

user category

– STO (Security Token Offerings)

– DCE (Digital Currency Exchange)

– DCS (Digital Custody Services)

service type

3.2.4 Service recipient

Customers who have been verified by the KYC audit authority can obtain the ACT of the corresponding equity domain and conduct corresponding transactions

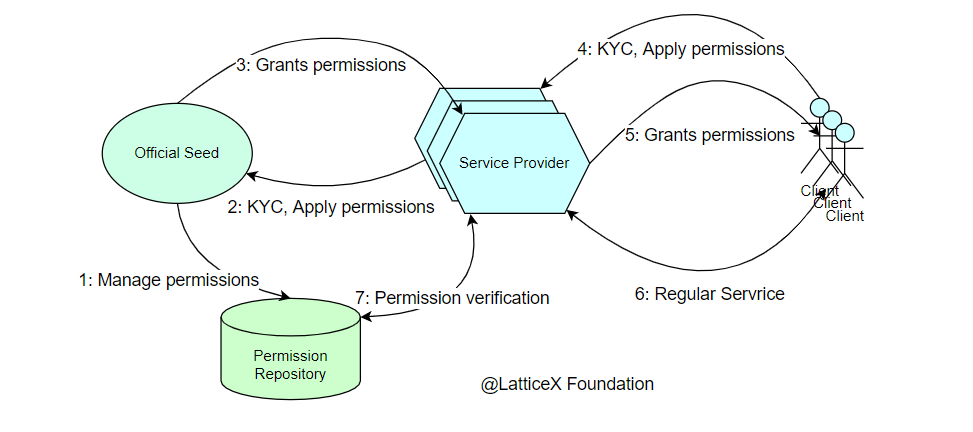

3.2.5 Conceptual flow of license agreement

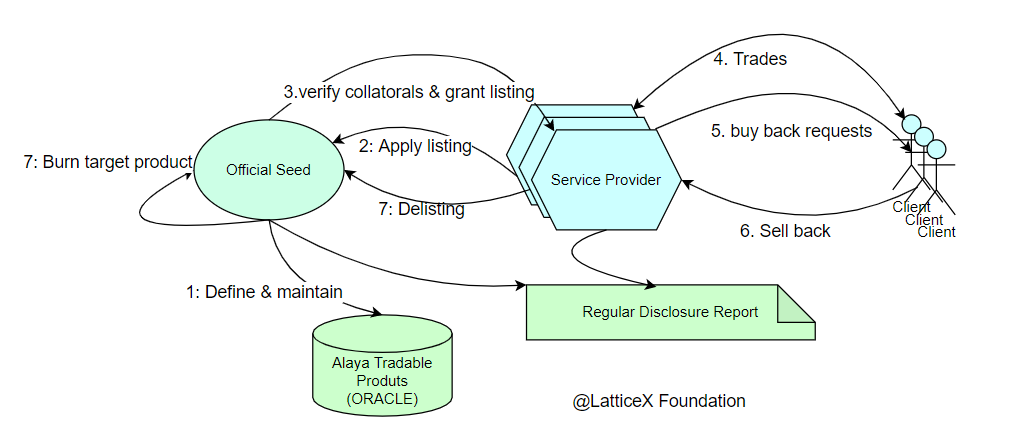

image description

Figure 3.2.5 Conceptual diagram of authorization agreement

Note: In practical applications, multiple seeds can form different authorization systems at the same time.

3.3 Asset Service: On/Off Shelf Protocol for Tradable Currency Pairs - Alaya Standard Asset Protocol & Protocol Governance

3.3.1 List of tradable financial products - Alaya Tradable Product List

Defined by an authorized service agency, or defined by an official seed authority, and provided as an ORACLE service. For example: At the beginning of the service, only mainstream compliant spot currency pairs are available. BTC, ETH, etc., while derivative products such as Future/Options are suspended.

Suggestions for judging the list of tradable financial products:

Compliant assets that can be held above a certain scale

Institutions have certain investment needs and assets with a certain scale of liquidity

3.3.2 On/Off Shelf Protocol and Protocol Governance of Tradable Currency Pairs - Alaya Standard Asset Protocol & Protocol Governance

Offline asset mortgage certification, online asset issuance

Native issuance, offline asset mortgage process, offline qualified and compliant asset initial pledge audit certificate, regular publicity, incidental insurance and other related processes.

ARC20 release, the offline process is similar to Native release.

The cross-chain lock-up issue is essentially exercising the customer asset trust business. Before the implementation of asset cross-chain, it is necessary to complete customer asset custody business qualification, business management, etc.

Full redemption and partial redemption of issued assets

3.3.3 Asset Service Conceptual Process

image description

3.4 Matching Model Agreement

to be continued