Want to ask what is the hottest in the industry in 2021? Many people may mention Layer2.

Indeed, there are more than 2,000 DApps running on the Ethereum network. Behind the ecological prosperity, the problems of network congestion and high transaction fees have not been well resolved.

secondary title

Know Layer2

In recent years, there have been many technical attempts to improve the state of the Ethereum network.

There are technical solutions for Layer 1, such as ETH2.0's sharding technology. By modifying or optimizing the consensus network of the blockchain, the network's block generation efficiency is improved, thereby speeding up the block confirmation time and achieving the purpose of fast transactions on the chain. Scaling within Ethereum;

There is also a technical solution for Layer 2. On the premise of keeping the functions of Layer 1 simple enough, powerful and stable, some calculations and operations that were originally performed on Layer 1 are placed off-chain and expanded outside the Ethereum blockchain.

The origin of the idea of Layer2 can be traced back to 2015. Layer is mentioned in the Lightning Network white paper, which means "layer". Public chains such as Bitcoin and Ethereum are collectively referred to as Layer1, "one-layer network". The main function is to ensure Security, decentralization, and final state determination, achieve state consensus, and act as an "encrypted court" to conduct arbitration through rules designed by smart contracts, and transfer trust to Layer 2 in the form of economic incentives;

Layer2 pursues the ultimate performance. As a "two-layer network", it can undertake most of the computing work for Layer1, such as separating Ethereum transactions from the main chain, reducing the burden on the layer-1 network, improving business processing efficiency, and achieving expansion. Layer2 can only achieve partial consensus, but it can meet the needs of various scenarios.

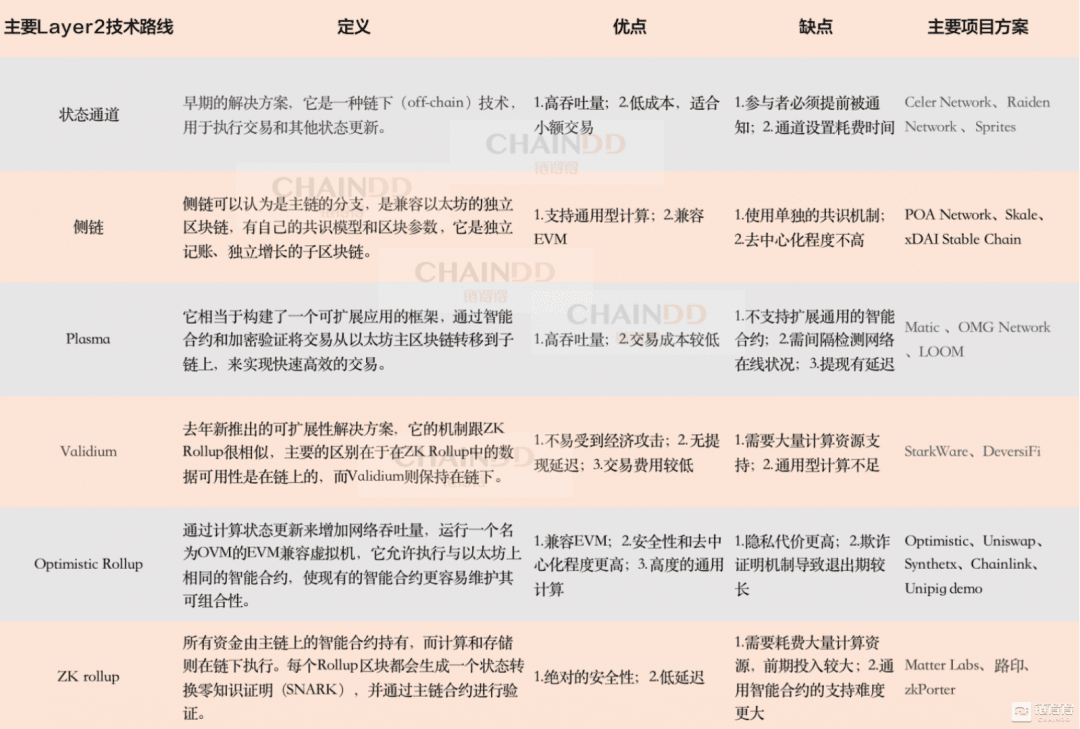

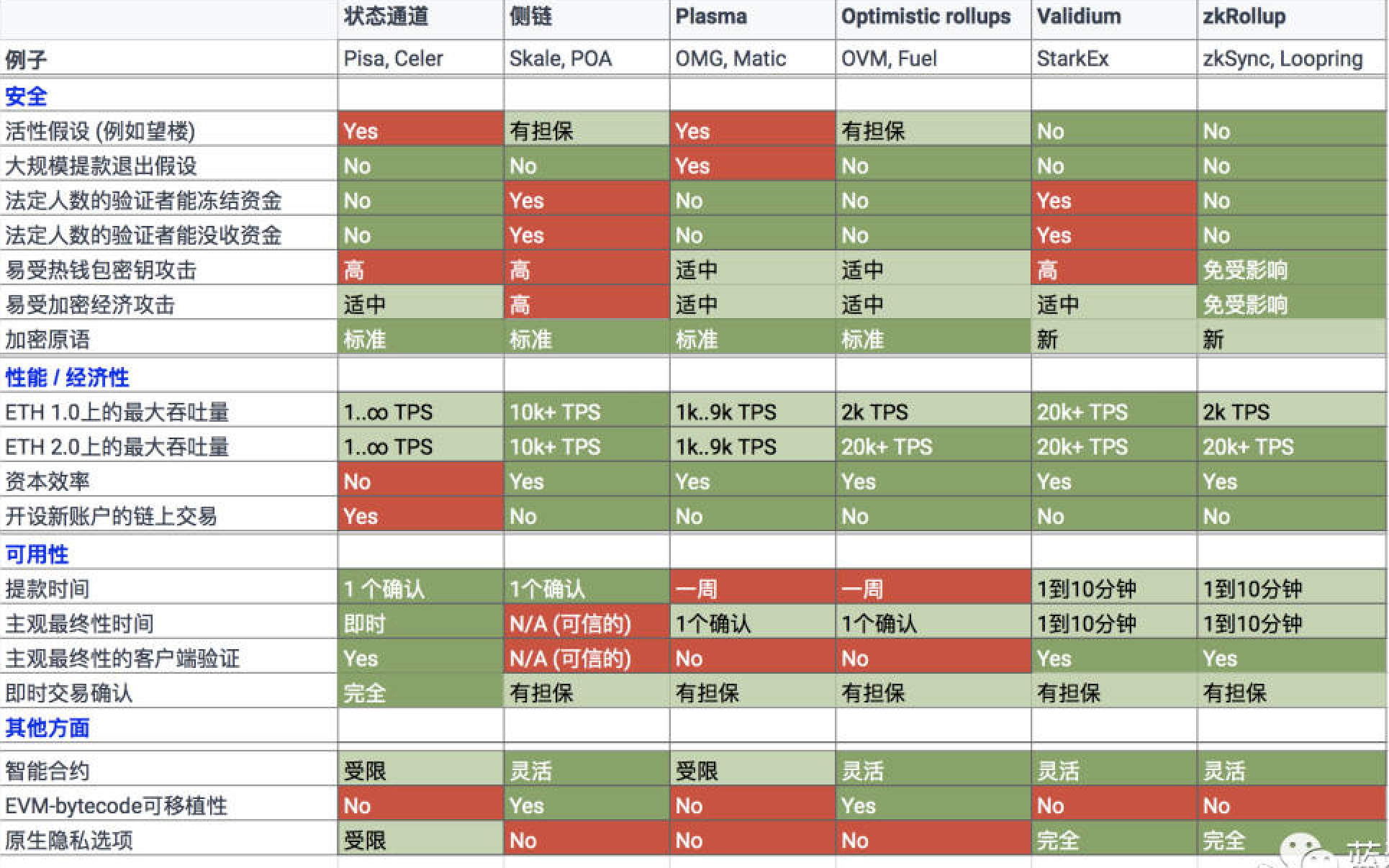

Layer2 has several solutions, including State channels, Sidechains, Plasma, Rollup (ZK Rollup, Optimistic Rollup), Validium, Hybrid solutions, etc.

Currently the most discussed ZK Rollup, Optimistic Rollup, Validium and Plasma.

image description

Original image: Matter Labs, translation: Blue Fox Notes

Image source: Lianwen

call to the ground

The gas fee spent on ethereum exceeds 100 knives a day, and layer2 is eagerly called for to be implemented soon.

I just made a fund transfer from product v1 to v2, and the gasfee cost 125 usdt in total. I feel heartbroken...... I really can't stand the high gasfee, and I appeal to layer2 to popularize it quickly. …

——Daying Space-Time 2020/12

Ethereum is $1,000, and I am not very happy, not because I do not hold coins, but now Uniswap has to pay $50+ gas fees every time, which is very uncomfortable. 2.0 and layer2 need to speed up their pace. In this round of bull market, after all, Ethereum has a chance to reach $4,000.

——Blockchain female doctor 2021/1

Under the current high gas fee, most ordinary defi players can no longer afford to play, and Layer2 is imperative.

secondary title

Optimistic about the prospects

If there is a Layer 2-based AMM dex in the Ethereum system, other public chains will basically have nothing to do. Those public chains that claim to be ultra-high-speed and free DPOS mechanism will be dumbfounded. It is said that Uniswap is in action, wait and see.

——bruce_big head 2020/9

ETH2.0 may not be popularized on a large scale until 2023, and Layer 2 is a transitional product and a major opportunity in the last three years.

——BlockArk Block Ark 2020/10

The ETH locked in Defi has already accounted for 7.5% of the total. The next step is to wait for Layer 2 to come out. Defi’s speed increase and fee reduction, and lockup will explode. In addition, after the upgrade of ETH2.0, lockup mining will wait for the amount of lockup. When it reaches 20%, 30%, won't the price explode?

——Blockchain Fortune 2020/10

The realization of Layer 2 will greatly increase the transaction speed of the Ethereum network, reduce Gas fees and alleviate block congestion problems, which is of great significance to the future development of defi.

——OneSwap 2021/1

Optimism is the theme song of 2021. A small step for Layer2, a big step for expansion.

——Yang Mindao 2021/1

The more blocked Ethereum is, the more it shows that Ethereum is valuable, and the more valuable it is to expand layer2.

——Xiaofeifei bitcoin 2021/2

secondary title

——CoinVoice 2021/2

project evaluation

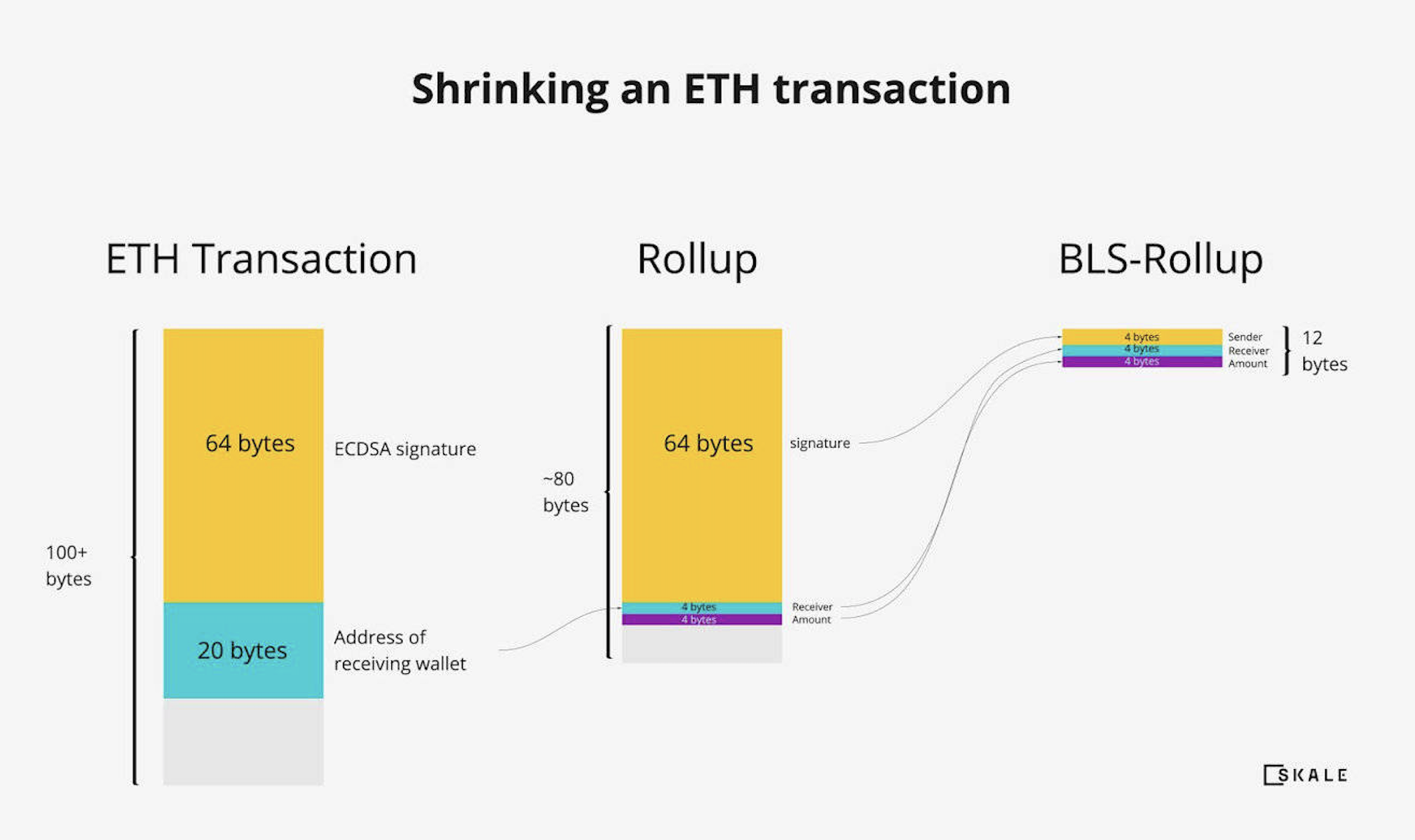

Skale Network, an Ethereum Layer 2 project invested by Consensys, can compress Ethereum transactions to 12 bytes. Is it really so awesome?

——RealSatoshi 2020/1

——DeFi He Taiji 2020/9

The ecological result of Ethereum Layer 2 is very clear, and technical ability is no longer the threshold. Now is the time to compete for resources. Whoever can bring projects with their own traffic to their own platforms will win. So I guess it's the op. Although the OP has the disadvantage of a long withdrawal period, these can be solved in another way. If I remember correctly, there should be a new project doing similar services, doing work similar to acceptance, and helping you quickly get the OP on the OP. Funds are transferred from layer2 to layer1.

——Blockchain Three Swords 2020/11

With the skyrocketing of Ethereum, the problem of high gas costs has become more and more obvious. From a certain point of view, the skyrocketing of LRC can be regarded as a low-gas concept currency, so the layer2 track can be paid attention to.

The green ticks are projects that are progressing quickly. The red ones can’t be done at all and can be ignored, and the yellow ones can be ignored if the progress is extremely slow. Picture 2 still lacks dung beetle SKL.

—— Hanamaki bitcoin 2021/01

The Optimistic Ethereum Network launched a soft release, and synthetix was started, which is another important progress in the scalability of Ethereum layer2. 2021 will be the busiest year for DeFi application layer2. In the end, only a few layer2 stand out, but in the long run, there may be only one winner.

——Blue Fox Notes 2021/1

The battle between UNI and sushi is not only a battle for dex, but also a battle for layer2.

——A certain circle of gourd baby 2021/1

If UNI can’t do a good job in layer2 plan to reduce the transaction fee, it will be left behind by BNB so that the taillights can’t be seen.

——Chain Expert 2021/1

Only uniswap can save ether. In defi, it is used the most frequently and has the largest proportion of users. Only it has the appeal to let everyone gradually try the second-layer network. What is difficult about the Layer 2 network now is not technology or user experience, but the lack of sufficient reasons for everyone to migrate to it.

——Blockchain Three Swords 2021/2

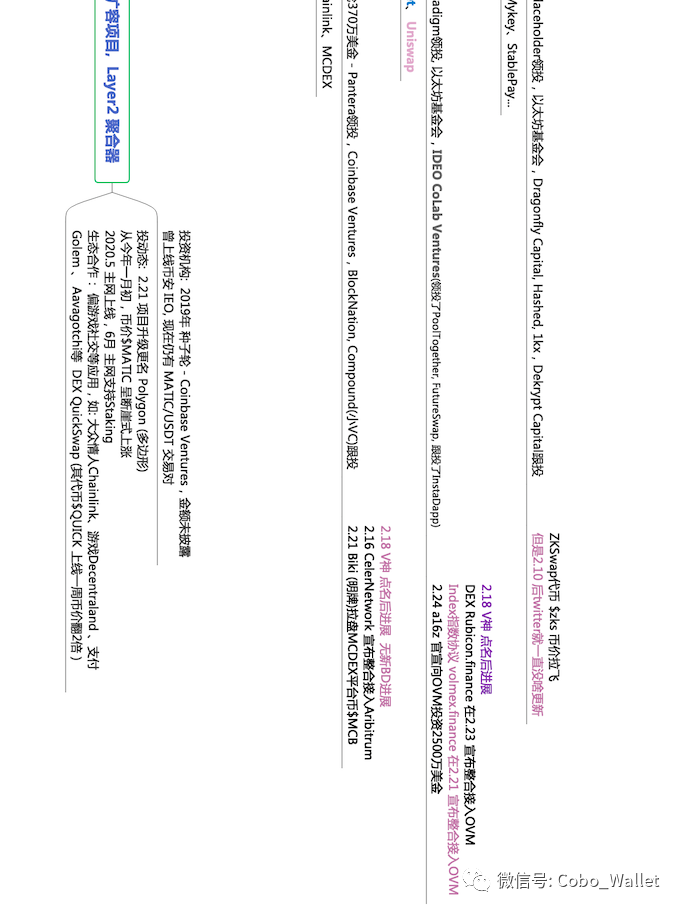

The second-tier network will be ready soon. Recently, I have tried most of the layer2. Some trading experience is indeed better than the Ethereum mainnet. There should be many related products coming out in the near future. You can see the quickswap made on matic. Currency quick has increased by 10 times in a few days.

Exchanges are all building their own public chains. Except for coinbase and bitfinex, other cex seem to not take the initiative to support layer2 deposits and withdrawals, and can only rely on dex and wallets to promote them.

——The old man in the currency circle 2021/2

layer2 is definitely winner-take-all too. Which second-layer ecology the head defi is in, that ecology the user is in.

It is certain that optimism will take the lead in landing, and uniswap, aave, etc. all use this plan. It seems that it can be met when it comes out first, and it will take more time for other plans to come out later.

In addition, if the op does not issue coins, it is better to continue to use eth as the fuel of the second layer.

secondary title

Questions and Challenges

Layer2 is a beautifully packaged rotten fruit!

The reason is that Ethereum 2.0 cannot be done, and the Layer 2 plan has become a life-saving straw, but the Layer 2 plan is far from smooth as imagined. The development of Layer 2 needs to upgrade the original Ethereum chain through EIP, but due to the governance and decision-making mechanism of Ethereum, it cannot support the development of Layer 2 at all. Moreover, the advantage of DeFi lies in composability, but the current Layer2 solution needs to give up this composability...

——Some voices from the source community 2020/11

I just listened to AC's interview, about Ethereum gas fee and layer2, AC's point of view, the excerpt is as follows:

1. The high gas fee means that someone is willing to pay, and Ethereum still has a high utilization rate, but the users are the "wealthy people" of Ethereum, and Cross out (deprives) the right to use of the general population. This creates opportunities for public chains with low gas fees. Binance Smart Chain has recently developed rapidly, similar to Ethereum's Test Net.

2. Pessimistic about layer2 solutions: First, there are different types of layer2 solutions, and different solutions will cause isolation; compared with the ghost chain a few years ago, l2 has not developed well; the gas cost of upper and lower l2 is also high, which is messy.

——Distributed Finance DeFi 2021/2

The current core advantage of Ethereum is: the degree of decentralization is higher than those of smart chains and layer2. If you lose everything, you will be finished.

——No currency speculation 2021/2

For transactions, transaction depth is the core indicator, followed by speed and cost, so even if layer2 is used, the core problem is not solved.

——defi A Fei 2021/2

The story of Layer 2 has been told many times on BTC. The small block party has great expectations for the Lightning Network, but they all failed completely. The same story will happen on ETH, we don't need Layer2, we need a powerful Layer1.

secondary title

Collision of views

When we turn our attention to Layer 2, the problem will be much more complicated. As more and more DeFi adopt Layer 2 solutions in the future, can the composability of DeFi still exist?

——Blockchain Research Institute 2020/10

Layer2 will eventually solve the island problem. From this point of view, in the long run, only one or two layer2 may develop and grow, and the rest will evolve over time, which is just a waste of developer manpower (of course, exploration deserves support, telling people that there are some roads to go) nowhere). In this sense, layer2 is also a very large track.

——Blue Fox Notes 2020/10

layer2 can be like the current exchange, with fewer heads and more tails. You can play with more than 100,000 ETH at the end.

—— ebit coins 2021/1

It only takes 5 minutes from Layer1 to Layer2, and it takes an hour and a half from Layer2 to Layer1. Is it good on average? Can we not be so realistic. . .

——Blockchain Robin 2021/2

Security and boundaries are two ends of the seesaw. It is a logical paradox for ETH to pursue these two indicators at the same time, and security is the lowest indicator. This is the primary pursuit of ETH, and uni is to meet the current industry's requirements for convenience.

If technology giants also join in, each of them will be no less than uni in size, and exist at the same level as uni. Then uni's advantage may be zero access.

The vast majority of transactions are processed in layer2, and the transaction requests submitted to the main chain are not high. Maybe ten transactions per second are enough, but each gas may be 1,000 U. The standard of showing off wealth at that time is to show off your main chain gas fee.

secondary title

Technical Discussion

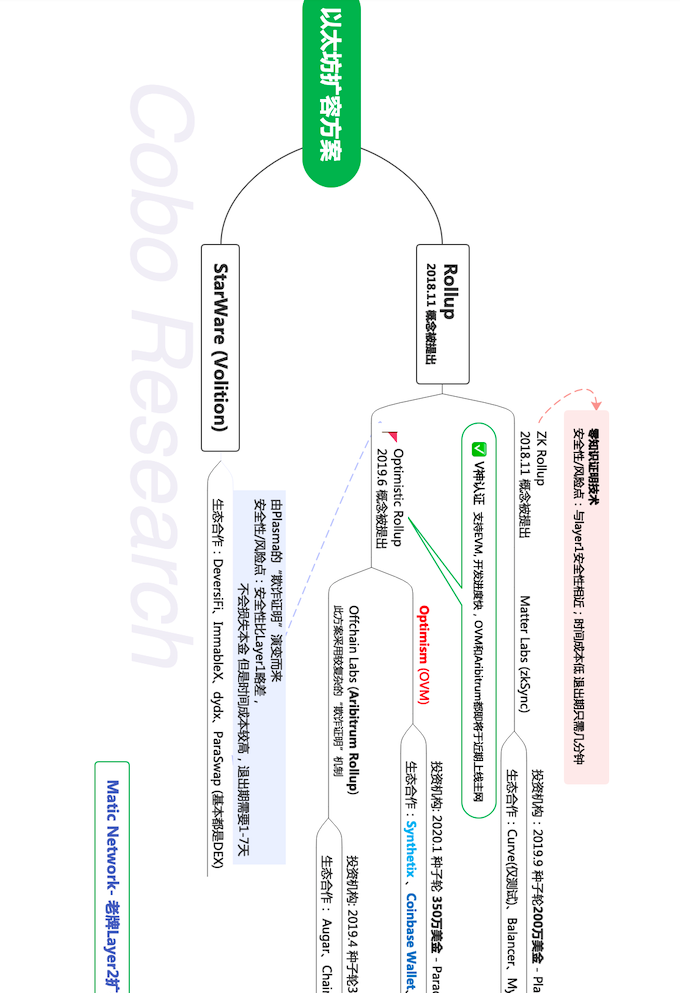

Regarding the recent hot layer2 rollup scheme, one is zk rollup, adopted by Loopring, and LRC has been pulling it out very hard recently; the other is optimistic rollup, the first experiment is SNX, time is January 15th, SNX also started to pull up. In addition, Uniswap and Chainlink also publicly stated that they will integrate Optimistic, but the time has not been set.

Rollups should be the layer2 solution most likely to succeed at present.

——Bitcoin Female Doctor 2021/01

Composability barriers will lead to different types of DeFi applications choosing different Layer 2 solutions. Decentralized exchanges choose ZK Rollup, and lending and synthetic asset projects gather to Optimistic Rollup. The two types of projects realize composability within the two networks respectively.

——D1 Ventures 2020/8

The opinions extracted in this article come from various channels such as media reports and community discussions. They are only for discussion and research and do not constitute investment advice.