Text︱Esens

The fiery central bank digital currency (CBDC) research and development has opened up a new track for competition between countries, and the smoke of a new round of currency wars has quietly risen.

Last week, against the backdrop of global financial market turmoil and Bitcoin’s plunge, Federal Reserve Chairman Jerome Powell and U.S. Treasury Secretary Janet Yellen frequently spoke out to “stand” for the digital dollar , has become a hot topic of discussion for a while.

"This year will be the year the Federal Reserve engages with the public on the digital dollar." On February 23, Jerome Powell said that the digital dollar is a "high priority" project. Compared with the previous situation of staying in the digital dollar white paper, this seems to indicate that it has entered an acceleration stage.

The day before, Janet Yellen believed in an interview with the New York Times that it makes sense for the Federal Reserve to study the issuance of a digital dollar. A digital dollar maintained by the Federal Reserve and based on a blockchain may lead to faster, safer and more Cheap payment method.

first level title

New Positive Signals for the Digital Dollar

In May 2020, the Digital Dollar Foundation, a non-profit organization founded by Christopher Giancarlo, former chairman of the U.S. Commodity Futures Trading Commission (CFTC), released its Digital Dollar Project. ’s first white paper.

In May 2020, the Digital Dollar Foundation, a non-profit organization founded by Christopher Giancarlo, former chairman of the U.S. Commodity Futures Trading Commission (CFTC), released its Digital Dollar Project. ’s first white paper.

Overall, the white paper provides the Federal Reserve with a logical framework for the high-priced CCTV digital currency, lists the design requirements and existing problems, and recommends the layout of domestic and international payment scenarios as soon as possible, so as to maintain and consolidate the global reserve of US dollars currency hegemony.

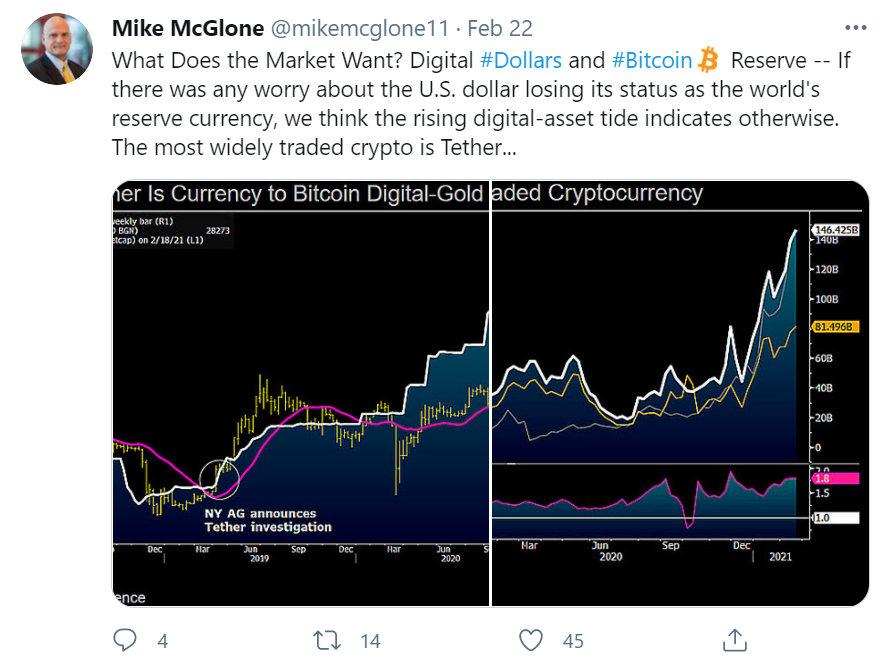

Bloomberg strategist Mike McGlone tweeted that the market wants digital dollars and Bitcoin to be reserve currencies. If anyone is worried about the US dollar losing its status as the world's reserve currency, we think the opposite will be the case with the rising wave of digital assets, the most widely traded cryptocurrency being Tether.

"The current financial system is outdated." Christopher Giancarlo once said that in recent years we have seen a new wave of digitalization in the world, and the Federal Reserve must issue a digital currency to compete with China's digital renminbi. At the same time, he believes that innovative products such as Bitcoin and Libra have their own "value proposition."

Even so, Randal Quarles, the Fed’s vice chairman for supervision, believes that the Fed’s stance on digital currencies is still in the formative stages. He said the Fed has been interested in the possibility of a central bank digital currency, in response to the rise of government-backed payment systems around the world, prompting the Fed to further study possible U.S. payment systems. Now, though, the Fed is weighing the pros and cons.

Last week, Jerome Powell said that he is carefully studying whether the Federal Reserve should issue a digital dollar, and this year will be the year when the Fed engages with the public on a digital dollar. Currently, the Boston Fed is cooperating with the Massachusetts Institute of Technology on digital currency research.

first level title

Five preconditions "constraints"

Last Wednesday, a new paper published by the Federal Reserve explained some of the prerequisites for the Federal Reserve to consider launching a digital dollar. This substantive discussion has attracted widespread attention.

The Federal Reserve believes that issuing a central bank digital currency is not an easy task, and many basic elements are required for its realization. According to the paper, if the United States decides to support a general-purpose central bank digital currency, it must meet five necessary prerequisites, clear policy goals, a wide range of stakeholders, a sound legal framework, strong technical support, and a sound market Prepare.

The paper explained that, first, clear policy goals are the key to guiding the design of the central bank's digital currency; second, to establish broad stakeholder support to complete the necessary social and legal changes, thereby improving society's perception of currency and Americans' The method of currency use; third, a strong legal framework needs to provide a legal basis for the issuance, distribution, use and destruction of the central bank's digital currency; fourth, the central bank's digital currency must have strong technical support to ensure its safety and efficiency; fifth, it needs Be market ready for widespread acceptance and adoption.

They argue that these prerequisites, and the efforts to achieve them, are interconnected, each taking a significant amount of time to achieve. Thus, the development of one prerequisite condition may lead to the development of another condition. And these developments could strengthen or weaken the shift to issuing a universal central bank digital currency.

In fact, the report is positioned as a starting point for further discussions rather than a clear bellwether for the Fed's future actions. Engaging with a broad range of stakeholders and monitoring market readiness can inform clear policy objectives, the paper argues, without intending to prescribe how these preconditions will be addressed. Its purpose is to inspire further research. Much work remains to be done before the Fed can decide whether and how to move forward with a central bank digital currency.

"This is a new digital form of the U.S. dollar. Along with traditional legal tender, banknotes and reserves, the digital dollar enjoys the full faith and credibility of the U.S. government like central bank money." Christopher Giancarlo pointed out last year, The Digital Dollar Project aims to support retail, wholesale, and international payments while ensuring scalability, security, and privacy.

He believes that the digital dollar not only provides financial inclusion, but also involves a changing financial architecture. It will also promote economic growth and must be implemented carefully, thoughtfully and leisurely. Therefore, the United States must make policy choices as it explores this new form of currency, the digital dollar. Congress and policymakers play a crucial role here.

first level title

CBDC advances prudently and aggressively

All over the world, countries are intensively deploying central bank digital currencies. Industry analysts believe that in the future digital economy society, the field of digital currency is full of new opportunities.

On January 17, the Central Bank Digital Currency Research Report released by the Bank for International Settlements (BIS) showed that in the third annual central bank digital currency survey, 86% of the central banks indicated that they were at least considering the pros and cons of issuing digital legal currency, with a high 80% from last year.

The research report pointed out that 60% of central banks are currently conducting central bank digital currency experiments or proof-of-concepts, while this figure was only 42% in 2019. The Bank for International Settlements also stated that within the next three years, central banks representing one-fifth of the world's population are likely to issue a common central bank digital currency.

On February 14, Li Lihui, the former president of the Bank of China, issued a document stating that the policy attitudes and specific actions of most countries in the world show that the issuance of the central bank's digital currency is no longer a question of "whether or not", but a credible technological innovation and a feasible solution. The issue of the length of time required for institutional innovation. While people are full of expectations, they pay special attention to four changes that may occur in the central bank's digital currency: first, change the pattern of the payment market; second, change the pattern of competition in the banking industry; third, change the pattern of money market supervision; fourth , changing the pattern of the global monetary system.

However, although research on central bank digital currency is gradually emerging in various countries, it may still take several years before the global adoption of central bank digital currency. According to the BIS 2019 survey data, half of the central banks said that they are "likely" to issue a central bank digital currency in the short term, and in the 2020 survey, they downgraded this sentiment to "likely" or "unlikely". ".

Meanwhile, among the central banks surveyed, the BIS also noted that the legality of central bank digital currencies remains an open question.

Still, the Federal Reserve has become one of the countries actively researching central bank digital currencies against the backdrop of other countries developing their own digital currencies, with economists at the Fed exploring the so-called "intrinsic value" of a digital dollar. Jerome Powell pointed out that the digital dollar will not affect the implementation of monetary policy, but there are still many problems to be solved in terms of technology and related policy formulation of the digital dollar, and there are also certain risks. This is why the implementation of the digital dollar cannot urgent reason.

Analysts believe that the positive signal from the United States will act like a catalyst to accelerate the research and development of central bank digital currencies around the world.

On the other hand, after Shenzhen, Suzhou, Beijing and other places, Chengdu has become the fourth city in China to carry out special digital RMB test activities. Judging from the information disclosed in many places recently, the second batch of pilot cities may add six new cities including Shanghai, Changsha, Hainan, Qingdao, Dalian, and Xi'an.

This shows that with the promotion of many countries, the global development of central bank digital currency is becoming clearer. As stated in the Economic Reference News article "Digital RMB Optimizes my country's Currency Payment System", this is not only an inevitable trend in the evolution of currency forms, but also an inherent demand for the development of the digital economy.