Editor's Note: This article comes fromBabbitt Information (ID: bitcoin8btc), Author: Fang Qinyu, released with authorization.

Editor's Note: This article comes from

Babbitt Information (ID: bitcoin8btc)"Babbitt Information (ID: bitcoin8btc)

, Author: Fang Qinyu, released with authorization.

Poldkadot (Polkadot, DOT), which has been brewing for a long time, broke out in this round of bull market. According to Coingecko data, Polkadot has increased by 280% in the past 30 days, and its market value has jumped to the top four in the market, about 15 billion US dollars, second only to Tether (USDT). It can be said that those who bought DOT from the secondary market last year not only realized their unwinding, but also ushered in rich returns.

Polkadot’s impressive performance has once again attracted the attention of the market. CNBC host Ran Neuner tweeted that buying DOT at $16 is like buying ETH at $90 in 2017. Crypto analyst Michael van de Poppe believes that DOT is in the current round. In the bull market, the target price will reach US$45, and Jiang Zhuoer, a well-known domestic mining industry expert, believes that before the failure of ETH expansion, DOT has only speculative value and no investment value (Note: DOT is also considered to be

Ethereum Killer").

After unlocking 34.208 million tokens this month, Polkadot will have nearly 55 million tokens unlocked within 28 days. Looking vertically, the amount of Polkadot unlocked this month is not small, and the price of Polkadot tokens started to rise two days before the first round of unlocking this month, and fell into shock after the unlocking news."1. Has anyone sold it after unlocking?

After the last round of splitting, the current total amount of DOT is about 1 billion. According to SUBSCAN data, about 25.6% of DOT are in the transferable state, and 74.3% are in the non-transferable state. Non-transferable DOTs are mainly used for staking, election locking and democratic locking. Currently, 5.8% of non-transferable DOTs are being unfrozen, and DOTs used for staking account for nearly half of the total.

This month, DOT has two unlocks with a large amount, and the unlock sources are different. Among them, 34.208 million tokens were unlocked on January 19. The unlocking share came from the previous private placement round, and nearly 55 million tokens were recently unlocked from pledge unlocking, which will continue to be unlocked within one month. There will be a small peak of unlocking on the 4th and 5th of July.

The unlocking of a larger amount will put pressure on the price of DOT. According to Coingecko data, from January 17th to 19th, DOT rose by a maximum of 135%, and after being unlocked on January 19th, DOT experienced a slight decline and has remained sideways since then. It should be pointed out that the recent DOT unlocked by pledge is

"Daily pledged and unbound available balance at maturity" is the daily operation of Polkadot NPoS.

Polkadot's NPoS mechanism requires verifiers to pledge DOT to maintain the operation of the agreement, thereby obtaining rewards or penalties. When the Staking ratio rises to 50%, the inflation rate of DOT will drop to 10%, and the DOT held by validators has a 28-day unbond period.

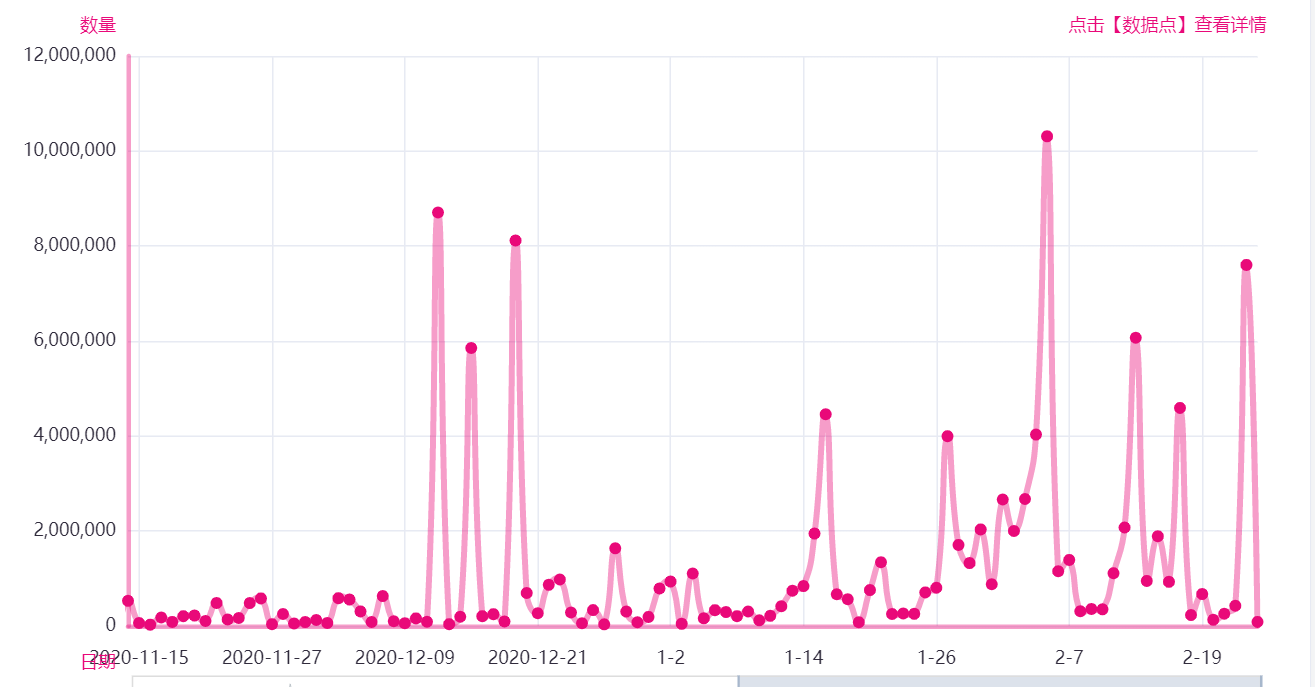

Interestingly, according to SUBSCAN data, after January 27, DOT's daily active accounts and new accounts, daily transaction volume, and daily transaction fee consumption have dropped sharply, which is the same as the private placement round of DOT unlocked on January 19. The situation is different, similar to the performance before and after Polkadot hit a new high within the month on January 17, and after the pledge was released on January 27, DOT once fell by nearly $15 per coin. Coincidentally, on January 16, Polkadot also saw a large amount of pledge unlocking, with an unlocked amount of about 4.46 million DOT.

The resulting contrast may indicate that the investors in the private placement round did not choose to sell after unlocking, but those who participated in the Polkadot pledge conducted cash-out operations. Limited by the pledge lock, Polkadot's real circulation is not large, and the amount of DOT's daily pledge unlocking release should be considered from the total amount of DOT that can be transferred in the current market.

2. Polkadot controversy

Compared with other public chains, Polkadot can be said to be born with a golden spoon in its mouth. Unlike EOS, the founder of Polkadot, Gavin Wood, has a successful entrepreneurial experience in encrypted projects. He was the former CTO of Ethereum and left for unknown reasons before Ethereum was about to achieve remarkable results.

The halo blessing and a large number of pledges make the actual circulation of Polkadot small, making Polkadot one of the scarce targets that can be seen in the market. However, the market's biggest concern about Polkadot is that Polkadot will become the next EOS, which makes some investors stop and wait and see, or refer to EOS to value Polkadot, such as benchmarking the price of the EOS mainnet when it goes online, thinking that DOT It will reach 24 US dollars per piece. Ideally, the market value of Polkadot can reach 1/3-1/2 of Ethereum.

It should be noted that if the project party successfully obtains the right to use the parachain slot, the DOT used by the project party to participate in the auction will be locked for half a year to two years, and if the auction fails, it will be returned after the end.

Encryption analyst Michael van de Poppe believes that in this round of bull market, DOT will break through $25/piece, $29/piece and $45/piece, and the market value of Polkadot corresponding to the price of $45/piece is just close to 1% of the market value of Ethereum. /3.

However, the selling point of having a strong Chinese color and slot auctions still makes Polkadot be criticized as similar to EOS. Pang Xiaojie, co-founder of PolkaWorld, faced doubts with a strong Chinese flavor, and publicly responded that Polkadot’s community is global, with 8% of projects in China, 12% in the United States, and 10% in Russia. But what is subtle is that in some publicly available Polkadot ecological projects, Chinese capital accounts for half of the country, and the EOS community has transformed itself and started to promote Polkadot, which shows the domestic pursuit of Polkadot.

Polkadot's upcoming parachain slot auction is recognized as the biggest "selling point" of Polkadot. According to public information, the market is generally looking forward to the Kusama slot auction in March and the Polkadot slot auction in April. The rules will lock more DOTs, and the circulation of DOTs will be reduced at that time. In order to obtain the right to use a limited number of parallel chain slots, the bidders participating in the project will find ways to collect more DOTs (or buy or sell to market borrowing), so the price of DOT will increase as participants increase and try to obtain parallel chain slots.

It should be noted that if the project party successfully obtains the right to use the parachain slot, the DOT used by the project party to participate in the auction will be locked for half a year to two years, and if the auction fails, it will be returned after the end.

EOS’s super nodes were unprecedentedly prosperous back then, but today’s EOS is in a mess because of the unsatisfactory ecology and the founder’s departure. However, Bifrost, the DeFi project of Polkadot’s ecology, said in a public interview that the two are very different. Polkadot’s parachain card slot auction does not promise to quantify the benefits, and card slot users who do nothing will be eliminated. EOS super nodes attracted Xue Manzi, Li Xiaolai, Lao Mao and other investors to participate in the past, so will Polkadot parachain card slot bidders attract real users to participate? The answer will be revealed when the auction comes.

The big V Jiang Zhuoer in the cryptocurrency circle is a firm short side of Polkadot. Jiang Zhuoer once again sang about Polkadot on Weibo on January 27, pointing out that Polkadot has no users other than speculators. The recent unlocking will lead to a further reduction in the short-term price of DOT. In addition, Jiang Zhuoer once pointed out that unless Ethereum The expansion fails, otherwise cross-chain is a false demand, so DOT has only speculative value and no investment value.

In the face of doubts, Pang Xiaojie, the co-founder of PolkaWorld, said that there is no chain in the blockchain field that can meet all business needs. Liu Yuzhu, an open contributor to the Polkadot ecological project Acala, believes that as long as there is demand for absolute returns, cross-chains will exist.