secondary title

Important market news today

Pantera Capitall, a cryptocurrency fund manager with more than $1 billion in assets, announced today that it is working on launching a new fund aimed at heavyweight institutional investors. Chief executive Dan Morehead said the new fund is expected to launch in the coming months. In addition, Morehead said: "We've had a lot of calls from endowments and other organizations trying to get in on this."

The traditional financial market has begun to pay more and more attention to cryptocurrencies such as Bitcoin, and the market demand has soared. I believe that in the future, more traditional financial institutions will open cryptocurrency portfolio funds. Cryptocurrency fund portfolios will be the most important in the future It is a big hotspot in the domestic traditional financial market.

This collective lawsuit can be described as worse for XRP. Under this round of supervision, XRP may have to pay a large fine. Therefore, in the future, the person in charge of XRP may rely on selling coins for turnover. Under this round of big market, XRP It is estimated that it will be difficult to improve.

Market Index Analysis Today

According to data from feixiaohao.Com, today’s panic and greed index is 78, which is extremely greedy. The market’s correction and decline not only failed to dissuade some investors, but also boldly entered the game. It seems that many investors think that this round of Bitcoin The end of the callback is about to start the rising mode. Today, the long-short ratio of the entire network is -1.4%, which is a weak market. The premium rate of USDT in the market today is -0.2428%, and the outflow of funds in the market is gradually decreasing, and some investors are running into the market. In terms of Grayscale Fund, Grayscale Fund increased its position by 138 bitcoins today, and there is a high probability that Grayscale Fund will operate with small funds tomorrow, and large capital operations may be carried out the day after tomorrow.

Mainstream currency market

BTC

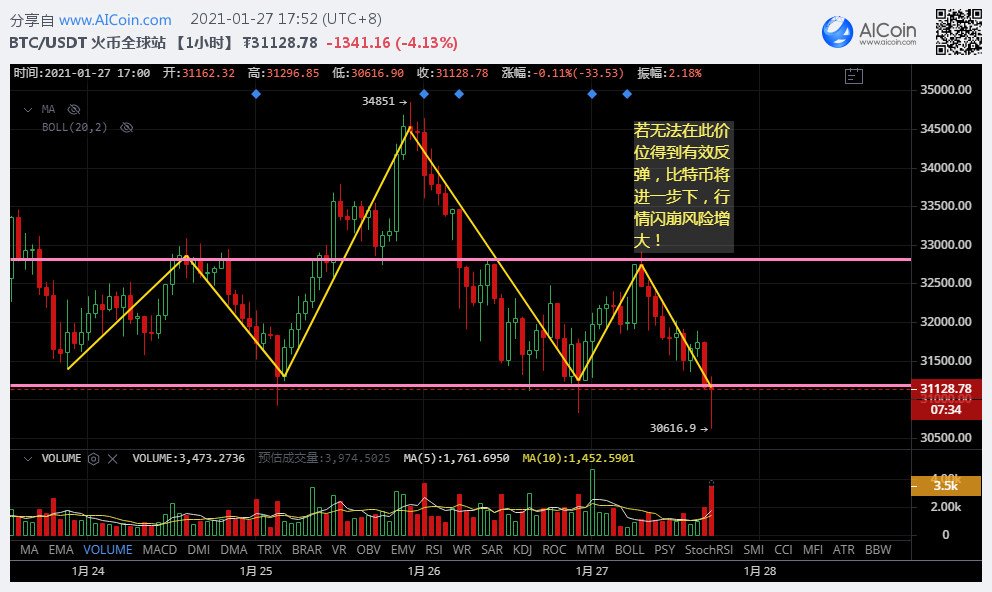

Mainstream currency market

Current Price: $30,921

Risk Factor: High

In terms of operation suggestions, at the 1-hour level, $30,950 will be an important point, and the important support position under this round of shocks is located here. If it can stay above $30,500, then Bitcoin will still be able to maintain the shock state and wait for opportunities to accumulate If there is no effective rebound at this price, the price will further drop to $29,000. At the daily level, Bitcoin has lost all chances of a daily rebound, and the market is gradually weakening. If it cannot get effective support at $30,500, the market may crash at any time.

Upper pressure level: $32,500

Upper pressure level: $32,500

ETH

Current Price: $1265

Risk Factor: Moderate

Risk Factor: Moderate

The trend of ETH is the same as yesterday’s analysis. With the rebound of the market, ETH may have a bright performance, but the general market has fallen, and ETH lacks the courage to go out of the independent market, and it will still follow the linkage of the market.

First stop loss: $1215 Second stop loss: $1170

Layer2 track

LRC

Layer2 track

Current Price: $0.41 Risk Factor: Moderate

After posting the article yesterday, we suggested that $0.39 can be an appropriate entry. In the following market, LRC rebounded relatively sharply after falling to $0.39, with a maximum increase of 15%. During today's rebound, LRC came out of a relatively strong market. At the same time, the main force did a pressure test to the upper position of 0.46 US dollars. It seems that the main force of LRC still does not want to give up this round of market. At present, LRC is still at the upper end of the Bollinger Band at the daily line level, but in the future trend, in view of the trading volume in the past few days, LRC may also follow the market linkage.

OMG

Upper pressure level: $0.43 First stop loss level: $0.39

Current Price: $3.23 Risk Factor: Medium

text

Polkadot series

DOT

Current Price: $15.8 Risk Factor: High

Current Price: $15.8 Risk Factor: High

Upper pressure level: $17.2 First stop loss level: $14.4

KSM

Current Price: $97.3 Risk Factor: Moderate

Current Price: $97.3 Risk Factor: Moderate

Yesterday we analyzed KSM’s trading logic. Today we can see that although the market has generally fallen, KSM has shown a strong rebound around $93.45. Unlike DOT, KSM has no bad news recently. KSM has come out of independence The probability of the market will be greater than that of DOT to a certain extent. Therefore, around $93, KSM can participate with small funds, and it is still not recommended to invest in such currencies with large funds.

Upper resistance level: $102