Author: Ming Xi | Produced by: Benz Finance

Stable currency is a bridge between the real world and the encrypted world. The biggest feature of this bridge is stability.

As a converter between fiat currencies and cryptocurrencies, stablecoins are the only magic weapon for transactions and flows in the encrypted market. Statistics show that more than 86% of the transactions of Bitcoin, the world's largest cryptocurrency, are completed with the assistance of the stable currency USDT.

In an encrypted world that believes in decentralization, people's trust in centralized stablecoins that anchor safe assets is highly uncertain.

A few days ago, the U.S. Department of the Treasury’s Office of the Comptroller of the Currency (OCC), the largest banking regulator in the United States, announced that it will allow U.S. banks to use public blockchains and U.S. dollar stablecoins as settlement infrastructure in the U.S. financial system. This benefit was once called the prelude to a "new chapter in the cryptocurrency industry", but this does not mean that mainstream financial institutions recognize stablecoins or cryptocurrencies. After all, the degree of recognition this time is limited to supporting USDC and other compliant U.S. dollar stablecoins, excluding USDT stablecoins that have not obtained compliance qualifications.

From this point of view, USDT, the stablecoin with the best liquidity and highest utilization rate, is a bit embarrassing. In fact, the industry has always been suspicious of USDT and Tether. When Tether issues 1 USDT, it will retain a reserve of 1 USD. In 2020, the supply of USDT will increase from 4 billion USD to 20 billion USD, an increase of 16 billion USD. The so-called 1:1 peg with USD has been questioned by the industry.

What's more, USDT, whose value is based on the reserves of the centralized company Tether, once the centralized company is thundered, it will be a catastrophe in the encrypted world.

The contradiction between the importance and uncertainty of stablecoins has become a dangerous shoal where cryptocurrency transactions are becoming more and more prosperous, and people are more eager to use decentralized stablecoins.

Stablecoins rebuilt based on the native features of the blockchain—algorithmic stablecoins have attracted attention and expectations.

Get rid of human control, use algorithms to regulate supply, and maintain currency stability. Algorithmic stablecoins have been playing games here since their birth, and they have not yet won.

What are algorithmic stablecoins?

Algorithmic stablecoins are tokens that use algorithms to adjust the supply, aiming to control and stabilize the price of tokens within a reasonable range.

As early as 2014, in the paper "Hayek Money: Cryptocurrency Price Stability Solution" written by Professor Ferdinando Ametrano of the Politecnico di Milano, he proposed: a cryptocurrency based on rules and supply elasticity, which can be rebase according to demand ( Token supply changes).

This should be an earlier theoretical basis. Under the guidance of the theory, the algorithmic stablecoin that appeared in 2018 was not valued by the industry. Until the decentralized financial DeFi trend hit, the algorithmic stablecoin gradually received the attention and attention of the industry .

Let's advance! Algorithmic Stablecoins

In 2020, Ampleforth (AMPL), which brought the algorithmic stable currency to the fire for the first time, is basically consistent with the Hayek currency operating mechanism proposed by Professor Ferdinando Ametrano.

AMPL sets up a price oracle that provides external prices for smart contracts, and its supply is adjusted based on the deterministic rules of the daily time-weighted average price. That is, AMPL has set the equilibrium point of price and supply in advance, and when the price fluctuation reaches the equilibrium point, it will automatically trigger the contract to adjust the supply. When the AMPL price is below $0.96, the supply shrinks, and when the AMPL price is above $1.06, the supply increases. AMPL makes each wallet holding coins change in a certain proportion after the supply of tokens changes.

In theory, this mechanism perfectly controls the price of tokens within a range of no more than 0.05 US dollars, which conforms to the attributes of stable coins and is not subject to human control.

But practice is the only criterion for testing truth. According to qkl123 data, the price fluctuation of AMPL can only be described as "unstable". Some people in the industry said: The reason for being optimistic about algorithmic stablecoins is precisely because of its instability.

The way to stabilize the price of cryptocurrencies with elastic supply depends on the collective demand psychology of the market, not only subject to human greed and panic, but also to expand the market size through financial speculation.

Let's make a simple analysis and explanation below: Assuming that according to the current market price, Xiao Ming bought 1 AMPL with 1 USD, when the market demand increased, the price of AMPL was stimulated, and the price of AMPL became 2 USD (higher than 1.06 U.S. dollars), triggering rebase, according to the ratio, the AMPL in Xiaoming’s wallet becomes 2 pieces, and when the price of AMPL returns to 1 dollar, the balance of Xiaoming’s wallet increases by 1 dollar, but Xiaoming does nothing during this process.

Conversely, when the market demand drops, the price of AMPL drops, and the wallet holdings drop.

When the demand is high, currency holders are rewarded through inflation, and when the demand is low, it affects the vested interests of currency holders. For financial speculators, in order to stimulate market demand to drive up prices and induce more traders to independently promote and participate in AMPL, this kind of financial speculation can only cause more severe fluctuations in the financial market.

How can speculative tools ensure stability?

The market has seen the flaws of Ampleforth (AMPL). The single-currency system stablecoin represented by it cannot meet the stability requirements, so a multi-currency system algorithm stablecoin represented by Basis Cash appeared.

Basis Cash is a multi-token protocol, which consists of three tokens: stable currency BAC (Basis Cash), tightening purchase BAB (Basis Bond), and inflation income BAS (Basis Share).

The stablecoin BAC is essentially the same as AMPL, and is still a cryptocurrency with elastic supply, but the difference is that when the market is inflated and deflated, the rewards and pressure are transferred to other tokens in the system, thereby stabilizing the price of BAC. This seems to be an adjustment method of the traditional financial market. For example, the central bank will withdraw money by selling bonds to solve the situation of excess capital in the market.

The operating mechanism of Basis Cash is:

When BAC<1, currency holders can use BAC to buy BAB at a discount to achieve the purpose of returning BAC supply and callback BAC price. When the deflation phase ends, participants who hold BAB can exchange BAB for BAC;

When BAC>1, the supply of BAC will be released by repurchasing BAB, and BAS will be rewarded to holders as inflationary income.

Therefore, whether it is a single-currency system or a multi-currency system, essentially no mortgage is required, but an algorithm is used to adjust the currency supply and stabilize the currency price. The difference is: the single-currency system AMPL will solely undertake the supply adjustments brought about by inflation and contraction, triggering speculation, while the multi-currency system finds a pressure sharer for the stable currency inflation and contraction, thereby inhibiting speculation to a certain extent.

However, under the verification of the market, the stability of BAC price is not reliable. It has been falling all the way since December 7, 2020, and there is still no upward trend.

It is a natural paradox to automatically adjust the currency price to ensure its stability based on market buying psychology. However, the market demand for tokens that are not subject to human control and have stable value still exists. In order to meet this demand, research and exploration will not stop.

At present, the semi-collateralized algorithmic stablecoin represented by FRAX is approaching people's needs to some extent.

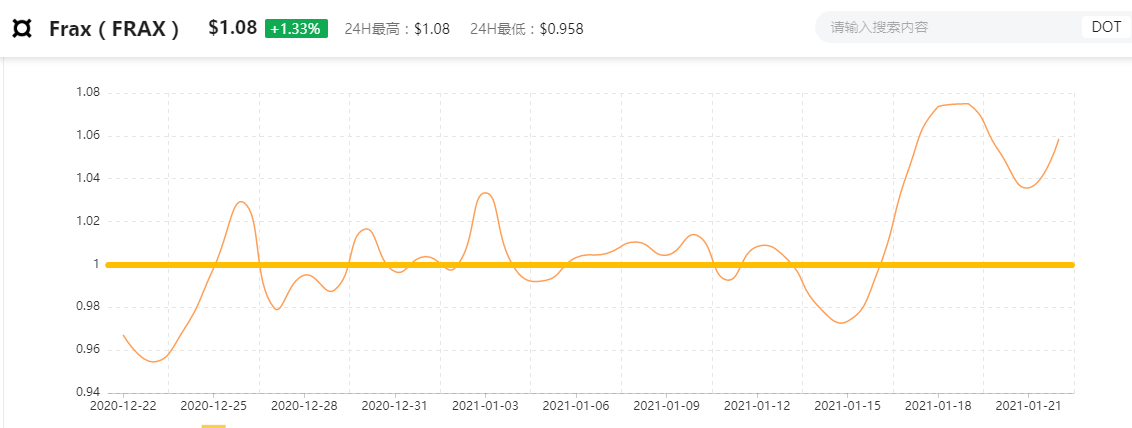

According to qkl123 data, from December 22, 2020 to now, the price of FRAX is fluctuating around $1, and the daily volatility is controllable.

Frax is a combination of MakerDAO's stable currency DAI and Basis Cash, which requires pledge to generate value, as well as "reward recipients" and "debt bearers".

According to the official introduction, the mortgage rate of Frax starts from 100% and is adjusted every hour. In the first 1 hour, a collateral of USD 1 is required to mint one Frax. After every hour from now on:

When Frax>1, the mortgage rate will be reduced by 0.25%. At this time, a collateral of 0.975 US dollars and 0.025 US dollars of FXS are required to mint 1 Frax, and the FXS will be destroyed;

When Frax<1, arbitrageurs need to deposit a certain amount of USD collateral to obtain FXS as a reward, and the Frax mortgage rate increases, thereby increasing the price of Frax.

The superiority of FRAX is that each token has invested "real money" and injected real value, which is also the root of its stability. However, after further expanding the market size, all market instability risks will be transferred to FXS. In the future, Frax's overall system will be a game between real value and market risk.

Through the comparative analysis of Ampleforth, Basis Cash, and Frax, we found that the decentralized algorithmic stable currency is a spiral game between being free from human control and maintaining stability. Slowly produce the opposite force, this force comes from the greed and panic of human nature. Striving to ensure stability at the unit of account level will lack the stability of value storage, leading to Ponzi-like speculation.

You can't have your cake and eat it too, but that's all.

The decentralized financial DeFi is being proven by time and practice that its future can be expected. As a payment and settlement tool that decentralized finance relies on, stablecoins are the basic elements of the closed loop of DeFi ecological value. Algorithmic stablecoins are introduced from the old to the new, and generations of attempts and innovations have been made to convince more people that they are decentralized and stable. The encrypted world needs value consensus.

The world is bustling, and it is all about profit. The current popularity of algorithmic stablecoins stems from the speculation and interests that exist in instability; bridge.