Bitcoin is a decentralized blockchain currency proposed by Satoshi Nakamoto out of distrust of the defects of the centralized currency dollar after the financial crisis. It has been 12 years since 2009. As the mainstream financial institution Wells Fargo said, a 12-year phenomenon like Bitcoin cannot be considered a bubble.

Bitcoin's value consensus is gaining popularity, and Bitcoin has received a lot of attention over the past few months. On January 8, Bitcoin broke through $40,000 and hit an all-time high of $41,940, more than doubling in value in just over a month. On January 15, Bitcoin touched $40,000 again, and Bitcoin's repeated record highs became the biggest stimulant in the currency circle.

secondary title

1. The entry of institutions into the market has become a factor for the stability of Bitcoin

Compared with the bull market of Bitcoin in 2017 and the new round that started at the end of 2020, the biggest difference is that in 2017 it was retail FOMO, this time it is institutional FOMO.

According to the data monitored by Whale Alert on January 12, there were two transfers of hundreds of millions of dollars, the two amounts were 9060 BTC (about 327 million U.S. dollars) and 17283 BTC (about 616 million U.S. dollars). The two transfers brought a flow of 26,000 bitcoins, and this is the epitome of large bitcoin transfers since January. From January 11th to 15th, Whale Alert alone monitored 65 large transfers of Bitcoin, 19 of which were transfers between anonymous wallet addresses. For these 19 transfers alone, the total amount of transferred bitcoins reached 92,201, with a market value of about 3.5 billion U.S. dollars.

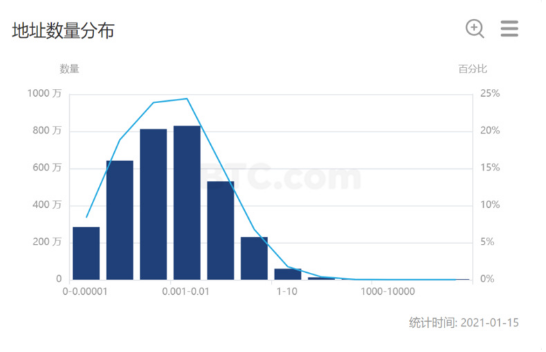

According to the BTC.com blockchain browser on January 15, 2021, there are currently 100 Bitcoin addresses with a balance of more than 10,000 BTC, and these 100 addresses hold 13.6% of the Bitcoin circulation. If the number of 1000-10000 BTC addresses is added, then 0.00695% of the Bitcoin addresses in the world own 42.5% of the Bitcoins.

secondary title

2. The essential attributes of Bitcoin determine its vitality

1. Security

The design of Bitcoin, whether it is the underlying logic "transaction" or a series of components such as blocks, timestamps, and local hashes, is nothing more than strengthening the trust mechanism. Only 51% of the computing power in the theoretical sense can be cracked. The development of two years has been attacked countless times, which is the most powerful evidence to verify the security of Bitcoin. However, the preservation of the private key has become the weakest link.

exchangeexchangedigital currencydigital currency$41 million was stolen overnight from the exchange. Fortunately, Binance said that it has enough financial capacity to bear it, and it will not cause losses to any users. However, this also shows from the side that the security performance of Bitcoin is worthy of recognition. After all, you can only unlock the stolen coins by stealing the key, which also verifies the value of the lock.

2. Scarcity and irreproducibility

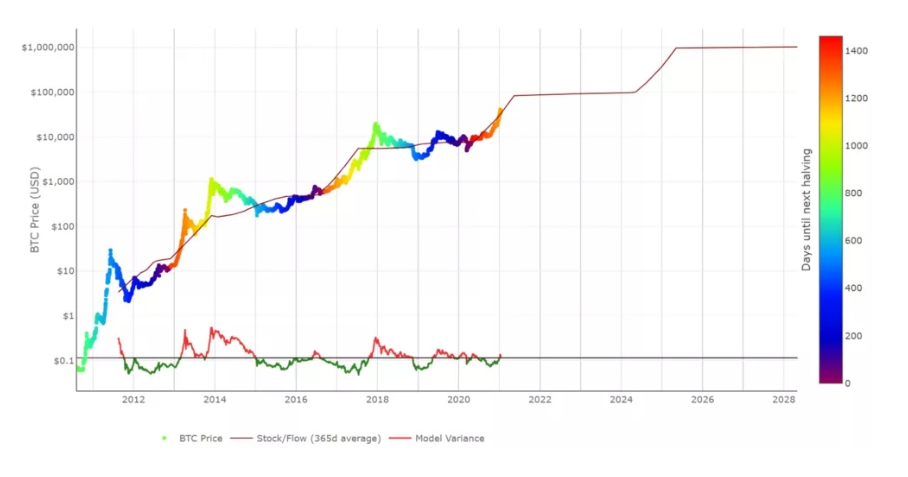

The biggest feature of Bitcoin and other virtual currencies is that their total quantity is very limited and extremely scarce. The currency system used to have no more than 10.5 million in 4 years, and the total number after that was limited to 21 million. The number of bitcoins will cease to be mined by 2140.

3. Conclusion

3. Conclusion

The anonymity of bitcoin transactions is a feature of decentralization. The bitcoin market is also a free market determined by real economic factors, unlike stock exchanges that have fluctuation restrictions or circuit breakers. These factors are also responsible for the high volatility of Bitcoin.

At present, the views of mainstream financial institutions on Bitcoin have begun to diverge strongly, and their stance on Bitcoin is currently at a very controversial stage. It can be said that these views on Bitcoin are on a continuum. One extreme is strongly opposed, and the other extreme is strongly supported. It can only be said that each has its own arguments, but some views are still worthy of discussion. Whether it is proposed that the regulatory authorities will determine the fate of Bitcoin, or that stablecoins will replace Bitcoin and other reasons.

Bitcoin has existed for twelve years, and time is the best verification. For the impact of factors, I think it can only be the gray rhino event. The impact on Bitcoin can be huge, but not absolute. It will only highlight the value of Bitcoin from the side, but cannot decide whether Bitcoin will return to zero.